Auto Loan Calculator

See your car payment and compare offers to save

How to use the LendingTree car loan calculator

-

Enter your numbers

Don’t know how to find your loan amount, interest rate or loan term? We’ll walk you through it. -

See what you’ll pay

We’ll show you your estimated monthly car payments, but pay attention to your total interest, too. That’s how much you’ll pay to borrow money for your car. -

Play with the numbers

Change the numbers to see how your payment shifts, or plug in offers you already have to compare.

Ready to compare real offers? Enter a few details to see top lender options — no impact to your credit.

Car loan rates, amounts and terms

Loan amount

This is how much you borrow after making a down payment. If your car costs $40,000 and you put $5,000 down, your loan amount is $35,000. Most buyers put down 10%-20%.

Average loan amount: $28,657 for new cars, $29,147 for used

Interest rate

Your APR is the cost of your car loan, including interest and fees. You’ll typically get a better (lower) APR with a high credit score and a new car instead of a used one. Use the table below to estimate your interest rate.

Average car loan rates: 13.80% new, 16.20% used

Loan term

This is how long you have to pay back your car loan. Save money on interest by choosing the shortest loan term with monthly payments you can afford.

Average loan term: 63 months

Remember to account for taxes and dealer fees, which can add up to 8 – 10% to the cost of your car, depending on your state and dealership. Our calculator doesn’t include these.

What to know about car loans

Car loans help you spread out the cost of your car over time. The two factors that matter most are your car loan rate and loan term — together, they determine how much you’ll pay.

Here’s how to save:

- Get a lower rate. Improve your credit and shop around for a car loan to get the best offer.

- Pick the right term. Choose the shortest term that fits in your budget. Shorter loans come with higher monthly payments, but you’ll pay less money in interest.

Car loan rates in 2026: Is now the right time to finance your vehicle?

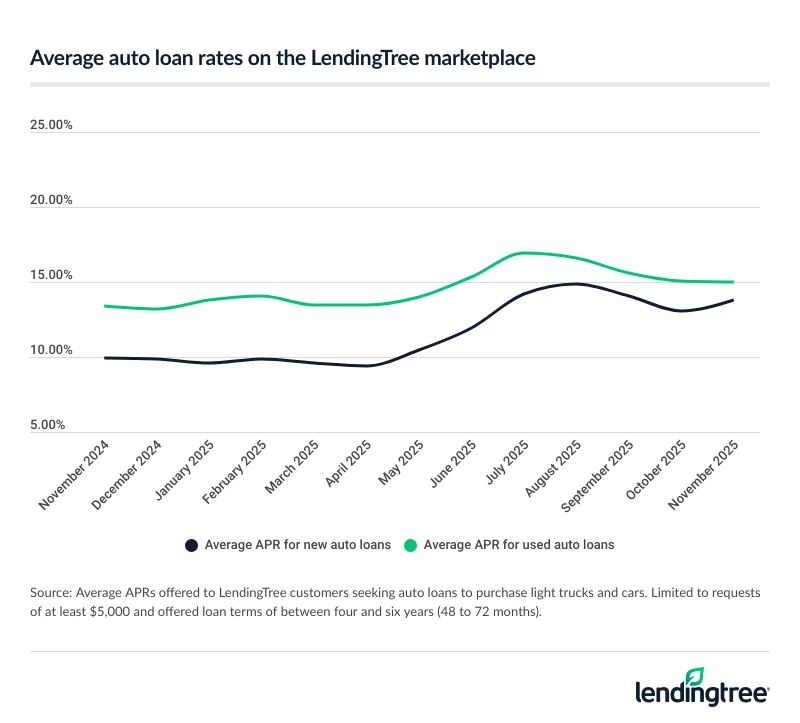

Car loan rates rose over the summer, but the latest LendingTree data shows that used auto rates are starting to plateau while new auto loan rates continue to be a bit of a rollercoaster.

If you’re looking for a used car now, take advantage of this pause in rate hikes. But if you can afford to wait, see if the Fed continues to cut rates — this might eventually mean lower rates for your car loan and more savings in your pocket.

How your credit score affects your car payment

It’s hard to know if you’re getting a good deal on your car loan, so we’ve made it easy. Compare the rates in your offers to the average rate for your credit band in the table below.

| Credit score range | Average new car APR | Average used car APR |

|---|---|---|

| Excellent (800 and above) | 7.33% | 8.93% |

| Very good (740-799) | 7.48% | 8.33% |

| Good (670-739) | 9.13% | 11.75% |

| Fair (580-669) | 19.94% | 22.21% |

| Poor (Under 580) | 22.66% | 24.67% |

But the best way to know if you’re getting a good deal is to compare quotes from different lenders before choosing one. You can save $2,346 on average by shopping for your car loan with LendingTree and choosing your best offer.

How much can you afford to borrow?

Buying a car is exciting, but it’s also a big financial decision. We’ll walk you through how to calculate what you can afford before you fall in love with a particular car that could stretch your budget too far.

1. Check your budget. Subtract your monthly expenses from your income to see how much car payment you can afford, and leave a cushion to avoid stretching your budget too far. You can use a personal finance app like Monarch Money or YNAB to make this easy and quick.

What this looks like: Let’s say you make $5,000 a month and spend $3,500 on living expenses and essentials. This leaves you with $1,500, but that doesn’t mean you can afford a monthly payment worth $1,500. In fact, if you use the 20/4/10 rule as a benchmark by spending 10% or less of your monthly income on transportation, you’d want to keep your payment under $500.

2. Use a car affordability calculator. The LendingTree car affordability calculator doesn’t just crunch numbers. It lets you start with the monthly payment you want (the number you calculated in step 1) to show you how much you can afford to spend on your car.

3. Plug in real offers. Once you have a few car loan offers, plug them into the LendingTree auto loan calculator to make sure the monthly payment and total cost of interest fit in your budget.

Remember that owning a car costs money, too. Between fuel, insurance, taxes and repairs, car ownership costs $4,507.11 every year on average. Include these costs in your car budget to make sure your car payment is affordable.

Shop around for your car loan

You’d shop around for flights. Why not your auto loan? LendingTree makes it easy. Fill out one form and get lenders from the country’s largest network to compete for your business.

Tell us what you need

Take two minutes to tell us who you are and how much money you need for your vehicle — we’ll take care of the rest. It’s free, simple and secure.

Shop your offers

We’ll send you offers from up to five trusted lenders. Compare your offers side by side to see which one will save you the most money.

How to save money on a car loan

Buy used or certified pre-owned

Potential savings: Thousands of dollars

Since new cars lose around 20% of their value in the first year alone, you can save thousands on the purchase price by buying a used car instead. If you’re worried you’ll end up with a lemon, consider getting a certified pre-owned car from the manufacturer. These cars are thoroughly inspected and often come with extended warranties.

Want a new car without a long-term commitment? Consider leasing a car for many of the same benefits you get with buying. Lease payments tend to be cheaper than new car payments, and you won’t have to deal with the hassle of selling your leased car or trading it in.

Improve your credit

Potential savings: $2,316 on average (as of publication)

When you improve your credit score from fair to very good, you’ll save an average of $2,316 on your car loan and over $39,000 across different types of credit, like credit cards, personal loans and mortgages. Lenders offer lower rates to borrowers with high scores and a history of on-time payments, which could translate to thousands of dollars of savings across your lifetime.

Look for rebates and deals

Potential savings: Several thousand dollars

Manufacturers sometimes offer special car rebates or discounts to encourage people to buy their cars. Rebates are typically discounts on particular car models or for a specific group of people, like college grads or teachers.

If you have excellent credit, you may be able to snag a 0% APR deal, meaning you won’t have to pay interest on your car loan. It’s unlikely that you’ll be able to combine 0% financing with a rebate, so use our car loan calculator to see which option will help you save more money.

Make a bigger down payment

Potential savings: Hundreds of dollars

It may seem counterintuitive to spend more upfront to save money. But the more you put down for your car, the less you’ll have to borrow — and the less money you’ll pay in interest. Plus, making a larger down payment can help you qualify for a car loan with bad credit.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.