Best Car Loans for Bad Credit in February 2026

Qualify with a score as low as 460 when you shop car loans with LendingTree

Learn more about how we made our picks for the best auto loans for bad credit.

Best auto loan lenders for bad credit

Best for: Stretching out payments – Autopay

- Starting APR

- 4.65%

- Rated 4.6/5 stars by LendingTree users who use Autopay

- Some of the longest repayment terms on the market

- Check rates without affecting your credit

- Allows you to apply with a co-borrower for better approval odds

- Highest credit score requirement on our list

- Loan requirements and fees vary by partner lenders

If you need to stretch out your car payments, check out the auto marketplace Autopay. In addition to extra-long car loan repayment terms, Autopay also offers prequalification. This allows you to see your potential rates with no impact on your credit score. Plus, Autopay lenders offer loans for private party purchases.

Autopay won’t directly fund your car loan — it partners with lenders who offer car loans. And some of those lenders charge fees of up to $400, so you may need to shell out some extra cash.

Autopay connects borrowers to partner lenders and financial institutions. These partners all have different eligibility requirements.

To use the marketplace, you and the vehicle you’re financing must meet the requirements below:

- Credit score: 580+

- Income: At least $2,500 per month

- Vehicle restrictions: Car must be less than 10 years old and have no more than 150,000 miles

- Administrative: You must provide your driver’s license, insurance, proof of income and residence and a payoff letter if you’re refinancing

Best for: Dealership loans for bad credit – Capital One

- Starting APR

- 5.12%

Capital One auto loans APR and loan term disclosure: Please note that your starting APR depends on the type of car loan you get and the length of your loan term. Capital One new auto loans: Starting at 5.12% APR for 60-month loan terms and starting at 5.33% APR for 72-month loan terms. Capital One used auto loans: Starting at 5.59% APR for 60-month loan terms and starting at 5.99% APR for 72-month loan terms.

- Rated 4.4/5 stars by LendingTree users who use Capital One

- See rates without hurting credit

- Shop for your car and prequalify for your loan at the same time

- Can manage loan online and via mobile app

- No private party car loans (for cars from an individual seller)

- Limited to Capital One partner dealerships

Not sure if you can qualify for a loan at a traditional dealership? Think again. Capital One approves scores as low as 500, and you can use Capital One’s Auto Navigator tool to check your rates and find cars at local dealerships at the same time.

Capital One car loans aren’t for everyone — you can only use a Capital One auto loan at select partner dealers. If you have a non-partner dealership in mind or want to buy a car from a private seller, consider other lenders.

Capital One requires a credit score of at least 500. The following vehicles are ineligible for financing:

- Cars worth less than $4,000

- Oldsmobiles, Daewoos, Saabs, Isuzus

- Cars with branded titles

- Cars that are older than 10 years and have more than 120,000 miles (in most cases)

Best for: Convenient used car loans – CarMax

- Starting APR

- 5.24%

- One-stop shop for cars and loans

- Back out if you find a better rate within three days

- Free car delivery (depending on location)

- Increase approval odds by adding a co-borrower to your loan

- See rates without hurting credit

- Can only use CarMax loan on CarMax car

- Expect a rate as high as 28.00% if you have bad credit

- Not available in all states

With CarMax, you can buy a car and get your loan entirely online or with a trip to one of more than 250 CarMax locations. CarMax lets you check your rates without risking your credit, and if you don’t like what you see, you can add a car loan co-borrower for better approval odds and lower rates.

Worried about qualifying? CarMax doesn’t have a minimum credit score requirement, so you could get a loan even with bad credit.

But if you’ve got your eye on a new car or a used one outside of CarMax’s inventory, you’re out of luck. You can only use a CarMax loan on a CarMax car.

CarMax does not have a minimum credit score requirement. You can only use a CarMax loan to buy a car from a CarMax store.

CarMax does business in 42 states. There are no CarMax stores in:

- Alaska

- District of Columbia

- Hawaii

- Montana

- North Dakota

- South Dakota

- Vermont

- West Virginia

- Wyoming

Best for: Car loan refinancing for bad credit – OpenRoad Lending

- Starting APR

- 5.49%

- Rated 4.5/5 stars by LendingTree users who refinance with OpenRoad

- One of the lowest credit score requirements on the market

- Allows you to apply with another person for better approval odds

- Doesn’t offer loans for car purchases

- Can take seven to 10 business days to pay your current lender

- May charge an origination fee (up to $299)

If you want to refinance your car loan with bad credit, consider OpenRoad Lending. OpenRoad’s credit requirements are some of the lowest you’ll find, and you can boost your odds of approval by applying with a co-borrower. Plus, borrowers on the LendingTree marketplace give OpenRoad high marks for customer satisfaction.

OpenRoad only offers car loan refinancing, so you can’t use an OpenRoad loan to buy a car. And if you need to refinance fast, consider other car loan refinancing lenders — it can take OpenRoad up to 10 business days to pay your current lender, which is on the slow side.

To refinance your car loan with OpenRoad, you must meet the following requirements:

- Credit score: 460+

- Income: $1,500+ monthly (income from ride-sharing services doesn’t qualify)

- Car requirements: Must be eight model years old or newer, have 140,000 miles or less. Can’t be a commercial car, motorcycle, recreational vehicle (RV), Oldsmobile, Daewoo, Smart Car, Isuzu or truck larger than 3/4 ton. The car must still be manufactured.

How LendingTree works

Shopping around for an auto loan on LendingTree can save you $1,424 in total interest on average with a credit score below 620. Here’s how it works.

Tell us what you need

Take two minutes to tell us who you are and how much money you’ll need. We’ll take care of the rest. It’s free, simple and secure.

Shop your offers

We’ll send you offers from up to five trusted lenders. Compare your offers side by side to see which one will save you the most money.

Get your money

Finalize your loan with your lender, and you’ll be on the road in no time. — you could see money in your account in as soon as 24 hours.

Estimate your car loan payment — even with bad credit

What to know about bad credit car loans

You can still get a loan. If you’re struggling with bad credit, you’re not alone — and it doesn’t mean you won’t qualify for a car loan. Some reputable car loan companies offer loans for credit scores 580 and below.

But it’ll be expensive. Bad credit means more expensive auto loans. Improving your credit before you apply for a car loan is like writing yourself a check — potentially for thousands.

Here’s how to save. Even if you need a new car right away, taking a few minutes to shop around can save you an average of $1,424. With LendingTree, you don’t have to take the first offer — multiple lenders could compete for your business, even with bad credit.

What’s next? After you’ve taken out your loan, work to improve your credit, then refinance. You could still cut thousands from your loan costs.

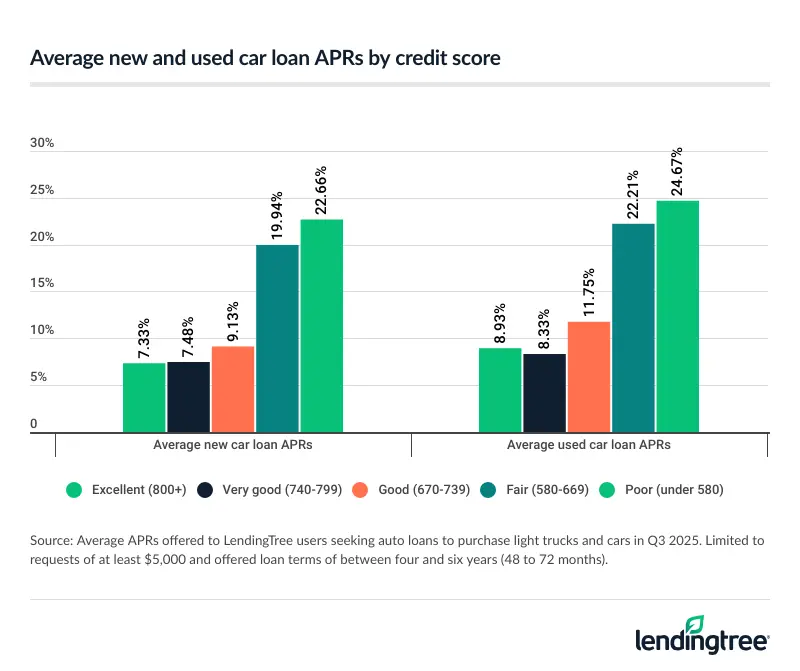

New and used auto loan rates by credit score

Lenders use your credit history to decide what car loan rates to offer you. Here are average rate offers for car loans in the LendingTree marketplace.

| Credit score range | Average new car APR | Average used car APR |

|---|---|---|

| Excellent (800+) | 7.33% | 8.93% |

| Very good (740-799) | 7.48% | 8.33% |

| Good (670-739) | 9.13% | 11.75% |

| Fair (580-669) | 19.94% | 22.21% |

| Poor (under 580) | 22.66% | 24.67% |

That’s a lot of data — here’s what it means for you:

- The worse your credit, the higher your rates. But how much more does bad credit actually cost? Our data shows that on a $30,000 car loan, a borrower with bad credit could pay over $14,000 more in interest than someone with excellent credit.

- Used cars come with higher rates. The average used car APR is around 1 – 3% higher than the average new car APR, depending on the credit band. But that doesn’t mean buying a new car will be cheaper — cars depreciate, so you’ll borrow a lot less for a used car than a new one. That will likely more than offset a difference in rates.

- Use our data to calculate your payments. You can estimate your monthly payments by finding the average APR for your credit band and entering it into the LendingTree car loan calculator.

4 mistakes to avoid with a bad credit auto loan

- Focusing on minimum rates: When you see a range of possible rates, pay attention to the maximum APR, not the minimum. You’ll likely qualify for rates on the high end of the range if you have bad credit.

- Ignoring total overall interest: Remember to consider both your monthly payment and the total interest you’ll pay. Even with a high rate, you can save money on interest when you pay off your car loan fast.

-

Only considering expensive cars: According to LendingTree data, borrowers with bad credit receive auto loan offers that average $9,488 smaller than offers made across all credit bands. That doesn’t mean larger loans aren’t possible, but smaller offers appear more common.

If a lender isn’t willing to offer you a big loan, consider buying a used car instead of new. - Overlooking fees: Bad credit car loans often come with high documentation (or doc) fees that aren’t included in the sticker price. Before you start to negotiate, ask for the out-the-door price to spot any hidden fees.

Expert advice from LendingTree on shopping for a bad credit car loan

Don’t take the first car loan offer you find. Even with bad credit, you can benefit from comparing offers from multiple lenders. Temper your expectations around those loans, of course. With crummy credit, you’re not going to get that sweetheart deal you’re hoping for. However, shopping around can still help you save money.

Want more expert advice? Here’s what to do next:

- Make sure your new ride fits in your budget. Use the LendingTree auto loan calculator to calculate the true cost of your loan, including interest and fees.

- Negotiate. Most people know they can negotiate, but few people know how. Prepare yourself before you set foot in a dealership by reading about how to negotiate car prices.

- Read your loan contract. Yes, really. Mistakes happen, and sometimes lenders or dealers tack on products like GAP insurance. Avoid balloon payments that make your monthly payments cheap at first but expensive at the end of the loan.

- Come prepared. Bring your preapproved car loan offer and know your rights when buying a used car from a dealership. Don’t show your salesperson how much you need a new car. Play it cool, and be ready to walk away if you’re feeling pressured.

- Improve your credit and refinance. You’re not stuck with high car payments forever. It’ll take time and effort, but improving your credit score and refinancing your car loan later could save you thousands of dollars.

If you’re worried about getting approved for a car loan with bad credit, it makes sense that you’d turn to buy here, pay here car lots. But in exchange for easy approval, you’ll pay predatory rates that make you more likely to join the 5.1% of Americans delinquent on an auto loan.

Tips to improve your chances of being approved for a car loan

Just because you have poor credit doesn’t mean a lender won’t offer you a loan. Here’s how to boost your odds:

-

Getting a cosigner

Adding a cosigner with solid credit can make it much easier for you to qualify for a car loan. -

Making a big down payment

A larger down payment can make it easier to get approved and save you money on interest. Steer clear of zero-down bad credit car loans — they can trap you in a cycle of debt. -

Improving your credit score

You can save money and boost your approval odds by improving your credit first. In fact, raising your credit score from fair to very good could save you $2,316 on your car loan on average, according to a recent LendingTree study.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best bad credit car loans

We reviewed nearly 50 auto lenders to determine the overall best four bad credit car loan lenders. To make our list, lenders must offer auto loans to borrowers with credit scores 580 and below.

Accessibility. We look for lenders with fewer barriers to approval and award points for lower credit requirements, nationwide access, fast funding and simple applications.

Rates and terms. We prioritize lenders that offer low starting rates, minimal fees, flexible terms and APR discount opportunities.

Repayment experience. We choose lenders with strong reputations, convenient self-service tools, responsive support and borrower-friendly perks.

According to our systematic rating and review process, the best bad credit car loans come from CarMax, OpenRoad, Capital One and Autopay. LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Why trust our methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.”

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

Frequently asked questions

It’s possible to get a car loan with a 500 credit score, but the lender might have other requirements, too. You might also need to earn a certain amount of money or have been at your job for a specific length of time.

The best way to see if you qualify for an auto loan is to prequalify. It doesn’t require a hard credit hit, so prequalifying won’t negatively impact your credit.

Most approved borrowers have credit scores of 661 or higher, but there is no standard credit score for buying a car. Some lenders don’t require a specific credit score at all. Keep in mind that the easier it is to get a loan, the more expensive that loan will probably be. Even if you have bad credit, shop around and compare offers to find the loan that’s best for you.

Yes, zero-down bad-credit car loans exist, but they come with the risk of going upside-down on your car loan, or owing more on your car than it’s worth. If you can afford to wait, take the time to build up your credit and save up for a down payment instead.