Laws of Buying a Used Car From a Dealer

- Check the Buyers Guide before purchasing, which includes what kinds of protections you have if there are issues with the car.

- The dealer is legally required to have a posted Buyers Guide.

- Many states have implied warranties that can help protect you, even if they aren’t explicitly stated in the Buyers Guide.

- It’s best to get an independent inspection of a used car before buying it, especially if you’re buying it “as is.”

Used car dealers have something of a shady reputation, and many buyers get antsy thinking about having to negotiate with one.

But the good news is that federal and state governments realize this and have put laws in place to protect consumers. But being forewarned is being forearmed, so the more you know about your own rights, the more you can force a dealer to comply with them.

To help you out, here’s a look at the laws governing used car transactions and how you can protect yourself as a buyer, including steps you can take if you feel a dealer has taken advantage of you.

Federal laws about buying a used car from a dealer

Federal laws about buying a used car only apply to dealers, so you should be aware of who you’re buying your car from. A dealer is any entity that sells more than five cars in a 12-month period. Anyone selling fewer than five cars a year is simply a seller.

Perhaps the most important rule that used car dealers must follow is that they must post a Buyers Guide before they display a vehicle for sale or let potential buyers inspect it.

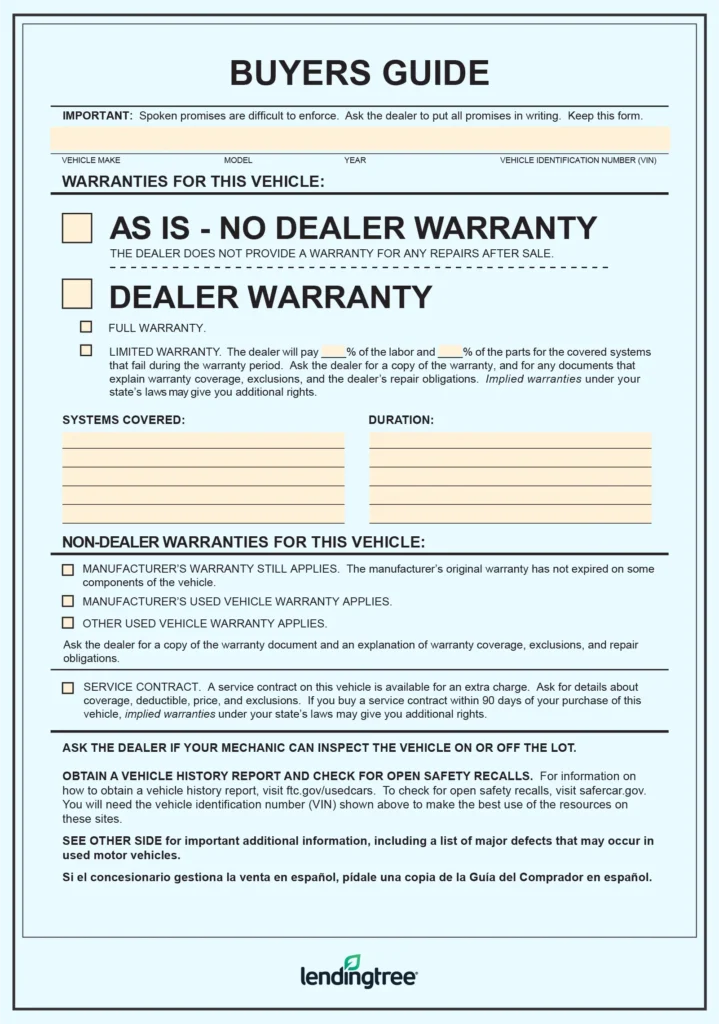

Buyers Guide

The Buyers Guide must be posted in a spot that’s easily visible to potential buyers, typically on the window or dashboard of a car that’s for sale.

It’s not a multi-page document, like its name might imply. Rather, it’s essentially a long sheet that covers specific, important information about the protections that come (or don’t come) with the vehicle.

Specifically, the Buyers Guide must include:

- The vehicle’s make, model, year and vehicle identification number (VIN)

- Any issues with a car’s major mechanical and electrical systems, or problems the buyer should be aware of

- Whether the vehicle has a warranty or is being sold as is

- What percentage of repair costs that a warranty will cover

- A warning to the buyer about the difficulty to enforce oral promises

- That a buyer should get all promises in writing

- That a buyer should have an independent mechanic inspect the vehicle before they buy

- Information on how to get a vehicle history report and to visit ftc.gov/usedcars for additional information regarding safety recalls and other vehicle topics

- The option to ask for a Spanish Buyers Guide for sales conducted in Spanish

- The option to retain the Buyers Guide as a reference after the sale

Important to note is that dealers in Maine and Wisconsin are exempt from the FTC Used Car Rule. However, this is because those two states each have their own laws regarding posting used car disclosures.

As is — no dealer warranty

If a car is being sold as is, it means that it carries no warranty, either implied or written. This means that buyers are responsible for any problems that arise as soon as they buy the car. This isn’t necessarily a red flag, but it does mean that you’ll need to take extra steps to protect yourself.

You’ll want to have a third-party mechanic inspect a vehicle before you buy it on an as-is basis. If a dealer has implied in any way that it will take care of specific problems if they arise, be sure to get those promises in writing.

Note that some states won’t even allow as-is sales. Seven jurisdictions, including the District of Columbia, don’t allow as-is sales at all, while another 26 require additional protections on as-is sales.

Pennsylvania, for example, carries an implied warranty that a car is roadworthy if it is sold on an as-is basis. If a car is allowed to be sold on an as-is basis, that box must be checked in the Buyers Guide attached to the vehicle.

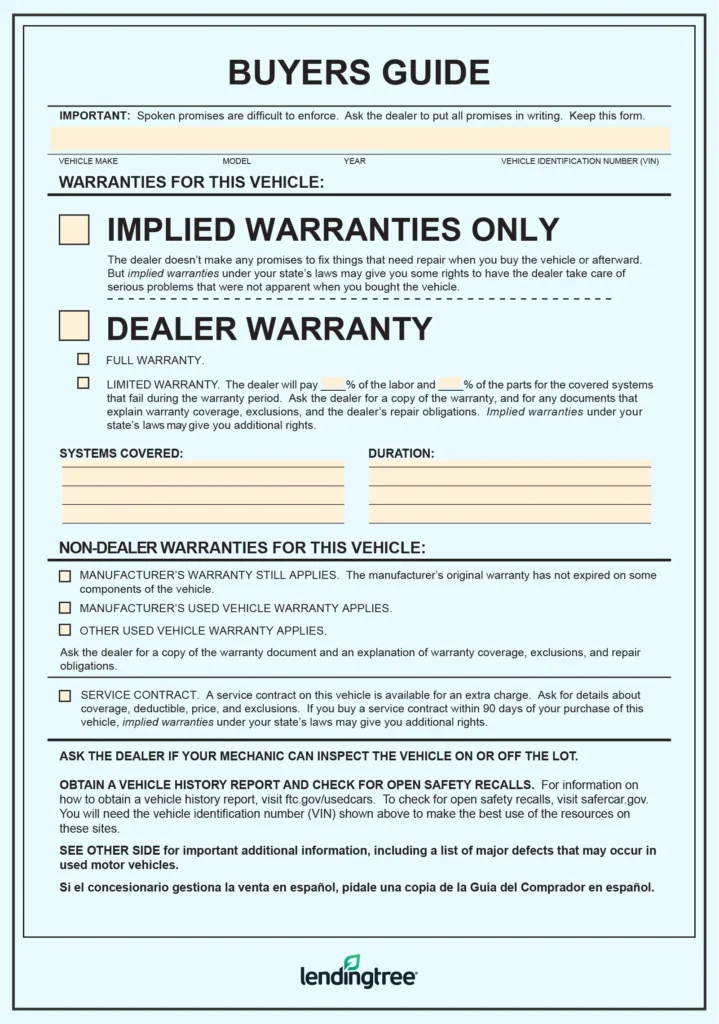

Implied warranties

An implied warranty is a warranty that is in place and enforceable by a state even if it isn’t specifically itemized in the Buyers Guide. In fact, the Buyers Guide includes language stating “implied warranties under your state’s laws may give you some rights to have the dealer take care of serious problems that were not apparent when you bought the vehicle.”

Implied warranty of merchantability

An implied warranty of merchantability is an unwritten and unspoken promise that a used car will function as intended — meaning, you will be able to drive it off the lot.

However, you’d still have to be able to prove that any defect existed at the time of sale. Note that this implied warranty is attached to all vehicle sales except for as-is sales, unless specific state laws, such as those in Pennsylvania, override the as-is provision.

Implied warranty of fitness for a particular purpose

The implied warranty of fitness for a particular purpose is a specific legal provision that can get quite technical. However, the gist of the provision is that when a buyer has an expectation that something will be used for a certain purpose — in this case, a vehicle — the seller must provide a product that meets that need.

Stated warranties

Unless you’re buying a car as is, there’s typically some type of warranty. A stated warranty is a written guarantee issued by the dealer or even the manufacturer. If there is one, the federal Magnuson-Moss Warranty Act requires dealers to provide the warranty information to consumers. This information must be disclosed on the Buyers Guide.

When you decide whether or not to buy a car, you should understand the differences between limited and full warranties, as well as what a manufacturer’s warranty is.

- A full warranty should cover the entire vehicle for a specified period of time, regardless of how many owners there are during the warranty period. Repairs should be free of charge. If a dealer can’t provide the required service, you could opt for replacement or return of your entire vehicle.

- A limited warranty typically only applies to specific systems or portions of a car.

- A manufacturer’s warranty or factory warranty is a promise from the car’s maker that if you have problems within a specified period of time, it will repair them free of charge. New car warranties typically last for three years or 36,000 miles, but each manufacturer has its own version. Some manufacturer warranties are full and some are limited, so it pays to read the fine print.

Extended warranties

An extended warranty adds additional months or years to a car’s original manufacturer’s warranty. It’s basically an add-on service you pay for in exchange for additional protection. You can get an extended warranty either from a dealer or through a third-party service.

The availability of an extended warranty may be included in the Buyers Guide, or it may be offered in a separate document, depending on how your state regulates it. As an extended warranty is technically an insurance policy, your individual state might have different requirements for how it is disclosed to you.

An extended warranty can be a good idea if you’re buying a used car that is at or near the end of the original manufacturer’s warranty, as this is a time when used cars tend to start having problems.

What to do if you have problems

Lemon laws exist to protect consumers from persistent, unrepairable car problems. They allow you to return your vehicle for a full refund under certain conditions.

But while all 50 states and the District of Columbia have some type of lemon law on their books, only a few states, including California, Texas and New York, provide the same consumer protections for used vehicles. But if applicable, a lemon law can help you get your money back if a manufacturer problem cannot be rectified in a sufficient amount of time.

If you’re buying a used car and lemon laws don’t apply in your state, you still have some options in case you have problems with your purchase. In some cases, the original manufacturer’s warranty may still apply, or you may be able to purchase an extended service contract.

Barring those options, you can always file a complaint with your state’s consumer protection agency or attorney general’s office, depending on the nature of your problem.

How to buy a used car

Anyone can buy a used car by simply walking onto a dealer’s lot or finding a listing on the internet. But to ensure that you get the best deal and protect yourself from dealer shenanigans, you should take some specific steps first.

Determine your budget

To make sure you buy a car you can truly afford, you’ll have to do some math first. Lending Tree’s auto affordability calculator can help you determine a realistic budget as you begin the buying process. This can protect you from overspending once you start actually shopping for a car.

Check your credit score

It’s simple math — the higher your credit score, the lower the interest rate you will get when you finance a used car purchase. You can check your credit score by visiting LendingTree Spring.

Find the right car

Even if you have a particular car in mind, shop around to see if there is an even better car out there that meets your needs and might even be more affordable. Check out reputable sites like Kelley Blue Book and Edmunds to get user and professional reviews and to check the fair market value of your future vehicle.

Find the right financing

Used car lending is a competitive business. You can use this to your advantage by shopping around to compare the rates that various lenders are willing to offer you. If you use Lending Tree’s main auto loan page, you can compare multiple offers from up to five lenders.

Narrow down your choices

Once you’ve got a selection of potential cars in mind, it’s time to dig deep into the research and figure out the pros and cons of each of them. Then, it’s time to go for test drives. While the printed word can give you an idea about how a car performs or feels, nothing compares with actually being in the vehicle yourself.

Get an independent inspection

When buying a used car, it’s especially important to get an independent inspection of the vehicle, particularly if it’s an as-is sale. By definition, used cars are more likely to have mechanical or electrical issues, so it’s essential that you know the condition of the car you’re buying. Your options will become much more limited after the sale is completed.

Complete the transaction

Before you sign and complete the transaction, ensure that the paper you’re signing doesn’t include any last-minute or hidden fees and provides you with all of the written protections you are expecting. Even if a contract has an innocent error, it can be hard or even impossible to change once you sign it.

Is buying a used car from a dealer worth it?

The average used car value in 2024 is $25,513, far below the average new car price of $41,963. This alone makes looking at a used car a worthwhile endeavor. Similarly, used car loan rates are much lower, at an average of $26,248 versus $40,927 for new cars.

The choice you have to make as a used-car buyer is whether you want to work with a dealer or a private seller. Often, you can negotiate a better price from a private seller, as they don’t have to deal with any overhead. But a used car dealer may offer you more in terms of warranties, add-ons or financing options. Just be sure to understand your rights when buying a used car from a dealer.

Frequently asked questions

Generally speaking, you cannot return a car if you simply change your mind, unless your dealer has a return policy. If you’re worried you may change your mind, ask the dealer about its return policy before buying.

However, if there’s a major mechanical issue, you may be able to get the car repaired or ultimately returned under your state’s lemon law provisions.

Your rights on returning a used car, outside of a major failure that triggers lemon law provisions, are slim, and you usually have to get them in writing before the deal closes.

In California, for example, you can buy a “cancellation option agreement” that gives you up to two days to return a car you bought at a dealership for $40,000 or less.

Other dealers may provide their own return policies, such as the 10 days offered by CarMax and the seven days offered by Carvana.

It’s generally safer to buy a used car from a dealership rather than a private seller.

For starters, dealers rely on their reputations and word-of-mouth, whereas an individual seller can just unload a junk car and then vanish in the wind.

You’re also more likely to get some type of warranty, a broader range of vehicles to choose from and options for financing.

Get auto loan offers from up to 5 lenders in minutes