The SBA Provides Tens of Billions in Funding Each Fiscal Year — Here Are the States That Benefit the Most Per Loan

Loans can be essential for businesses navigating uncertainty and pursuing growth. In fiscal year 2024, the U.S. Small Business Administration (SBA) provided $37.8 billion in 7(a) and 504 funding, up from 2023 and 2022.

Here’s a look at where companies received the largest loans and which industries received the highest share of funding.

Key findings

- The U.S. Small Business Administration (SBA) provided $37.8 billion in 7(a) and 504 funding in fiscal year 2024. That’s an increase from $33.9 billion in fiscal year 2023 and $34.9 billion in fiscal year 2022. In fiscal year 2024, the average 7(a) loan was $443,097, while the average 504 loan was $1.1 million.

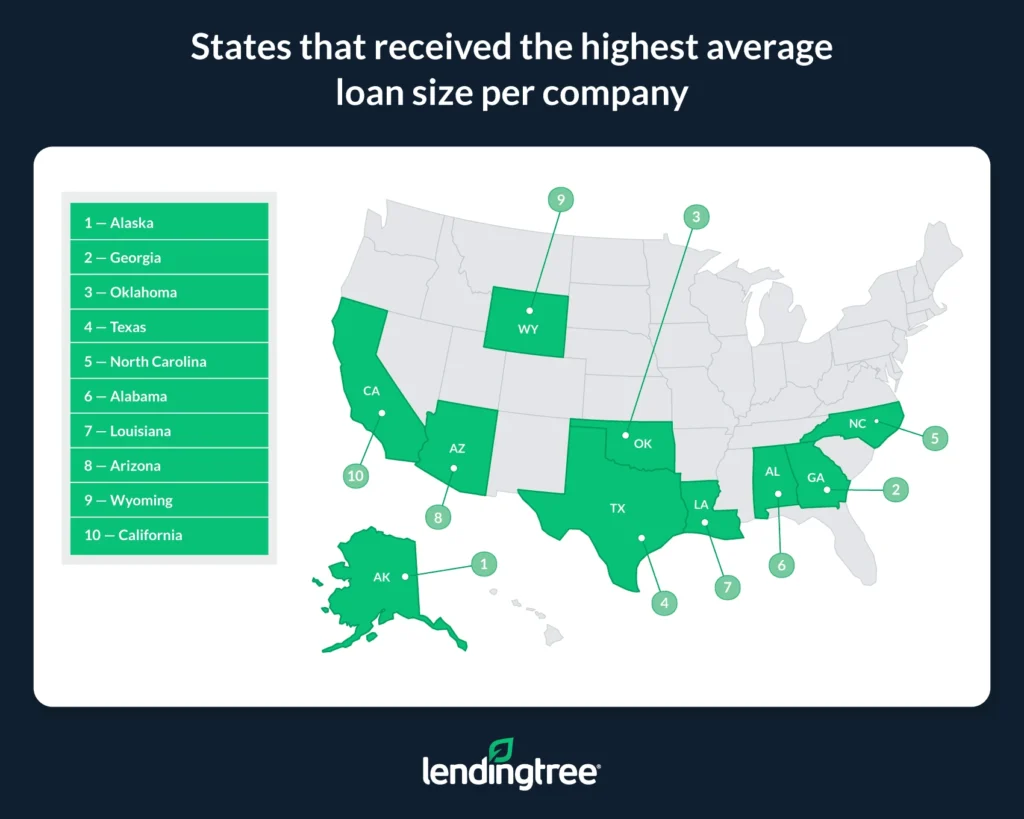

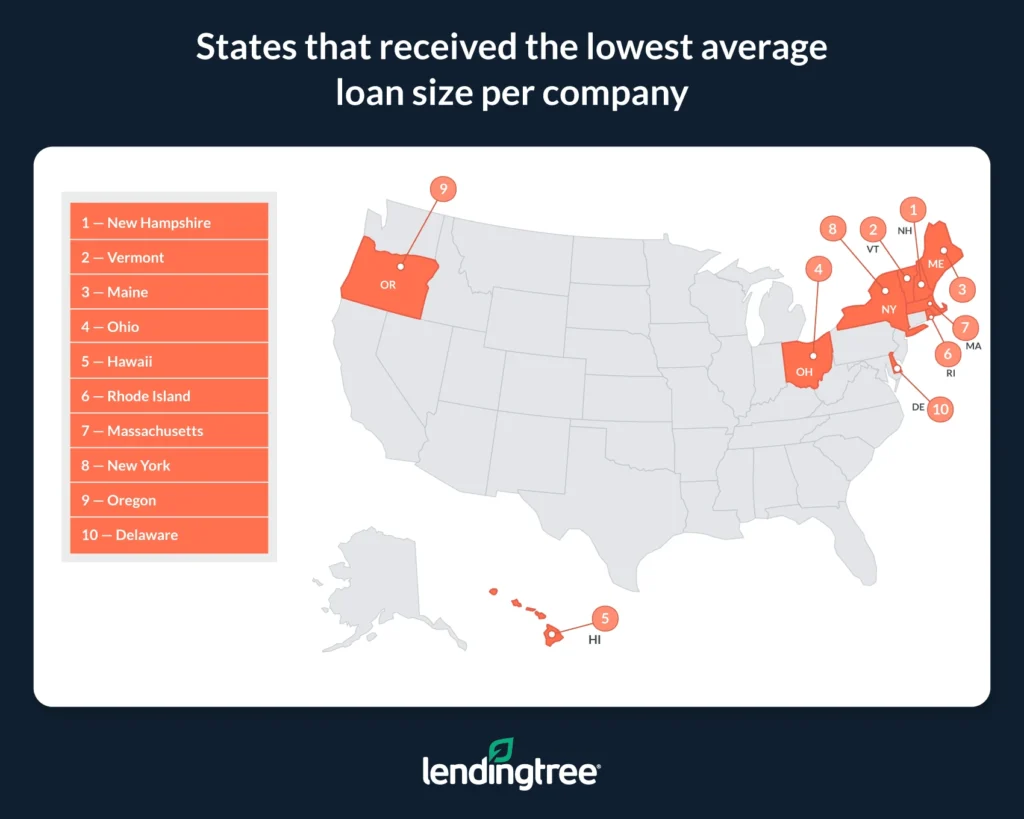

- Alaska companies that received 7(a) and 504 loans in fiscal year 2024 received the most funding per loan at $766,809. Georgia ($708,610) and Oklahoma ($669,944) followed. Meanwhile, New Hampshire companies received the least funding per loan at $244,889. Vermont ($276,960) and Maine ($281,577) were the next closest.

- Accommodation and food services was the industry that received the highest share of SBA 7(a) and 504 loan amounts. The industry received 16.7% of 7(a) and 22.1% of 504 funding in fiscal year 2024 — the highest across both loan types. Retail trade and health care and social assistance were the next two across both loan types, switching orders.

- Companies owned by men received 73.8% of 7(a) and 71.2% of 504 loan funding. That translates to $23.0 billion and $4.7 billion in fiscal year 2024 funding, respectively.

A 7(a) loan covers working capital, equipment or other expenses, while a 504 loan covers equipment costs or commercial real estate. A 504 loan is generally bigger than a 7(a) loan, with lower interest rates.

The SBA data is available by fiscal year rather than calendar year. The fiscal year is Oct. 1 through Sept. 30.

Businesses received $37.8 billion in SBA funding in 2024

In fiscal year 2024 (Oct. 1, 2023, through Sept. 30, 2024), the SBA provided $37.8 billion in 7(a) and 504 funding. Broken down, that’s $31.1 billion in 7(a) and $6.7 billion in 504 loans.

Loan amounts have increased from previous years, with the total reaching $33.9 billion in fiscal year 2023 and $34.9 billion in fiscal year 2022.

One reason for this growth? Since 2020, the SBA has prioritized increasing small-dollar loans of less than $150,000. In fiscal year 2024, according to the Associated Press, over 38,000 7(a) loans were under $150,000, totaling $2.7 billion.

SBA loan approvals by fiscal year and loan type

| 7(a) loans | |||

| Fiscal year | # of loans approved | Approval amount | Avg. loan amount per company |

| 2022 | 47,678 | $25.7 billion | $538,903 |

| 2023 | 57,362 | $27.5 billion | $479,685 |

| 2024 | 70,242 | $31.1 billion | $443,097 |

| 504 loans | |||

| Fiscal year | # of loans approved | Approval amount | Avg. loan amount per company |

| 2022 | 9,254 | $9.2 billion | $995,029 |

| 2023 | 5,924 | $6.4 billion | $1,083,622 |

| 2024 | 5,993 | $6.7 billion | $1,112,115 |

In fiscal year 2024, the average 7(a) loan size was $443,097, down from $479,685 in 2023 and $538,903 in 2022. Meanwhile, the average 504 loan size was $1.1 million, similar to 2023 and up from $995,029 in 2022.

While the number of approved 7(a) loans has grown significantly between 2022 and 2024, the number of approved 504 loans has fallen.

Alaska companies received biggest loans

By state, Alaska companies that received 7(a) and 504 loans in fiscal year 2024 got the most funding per loan. These companies received an average of $766,809. Georgia ($708,610) and Oklahoma ($669,944) followed.

States that received the biggest average loans per company

| Rank | State | # of loans approved | Approval amount | Avg. loan amount per business | Avg. loan amount per company |

|---|---|---|---|---|---|

| 1 | Alaska | 131 | $100.5 million | $3,956 | $766,809 |

| 2 | Georgia | 2,224 | $1.6 billion | $4,019 | $708,610 |

| 3 | Oklahoma | 500 | $335.0 million | $2,591 | $669,944 |

Conversely, New Hampshire companies approved for SBA loans received the least funding, averaging $244,889. Vermont ($276,960) and Maine ($281,577) followed.

When averaging approval amounts across all businesses in a state rather than across approved companies, Utah businesses saw the biggest average loans at $5,230. Washington ($4,664) and Texas ($4,387) followed. Hawaii ($1,197), Vermont ($1,469) and the District of Columbia ($1,482) businesses received the smallest average loans.

Full rankings

States that received the highest/lowest average loan size per company

| Rank | State | # of loans approved | Approval amount | Avg. loan amount per business | Avg. loan amount per company |

|---|---|---|---|---|---|

| 1 | Alaska | 131 | $100.5 million | $3,956 | $766,809 |

| 2 | Georgia | 2,224 | $1.6 billion | $4,019 | $708,610 |

| 3 | Oklahoma | 500 | $335.0 million | $2,591 | $669,944 |

| 4 | Texas | 5,530 | $3.7 billion | $4,387 | $667,136 |

| 5 | North Carolina | 1,680 | $1.1 billion | $2,866 | $647,455 |

| 6 | Alabama | 562 | $361.1 million | $2,217 | $642,613 |

| 7 | Louisiana | 596 | $360.3 million | $2,311 | $604,473 |

| 8 | Arizona | 1,533 | $913.0 million | $4,126 | $595,553 |

| 9 | Wyoming | 120 | $70.2 million | $2,266 | $584,965 |

| 10 | California | 9,487 | $5.5 billion | $2,950 | $584,094 |

| 11 | Kansas | 500 | $290.2 million | $2,878 | $580,496 |

| 12 | South Carolina | 843 | $487.6 million | $2,588 | $578,396 |

| 13 | Colorado | 1,955 | $1.1 billion | $4,092 | $562,925 |

| 14 | Wisconsin | 1,272 | $712.9 million | $3,420 | $560,441 |

| 15 | Nevada | 838 | $464.4 million | $4,277 | $554,164 |

| 16 | Washington | 1,975 | $1.1 billion | $4,664 | $554,149 |

| 17 | Tennessee | 844 | $462.8 million | $1,970 | $548,312 |

| 18 | Utah | 1,334 | $723.0 million | $5,230 | $541,962 |

| 19 | Florida | 6,560 | $3.6 billion | $3,933 | $541,630 |

| 20 | Arkansas | 301 | $162.2 million | $1,596 | $539,029 |

| 21 | Montana | 258 | $138.6 million | $2,192 | $537,368 |

| 22 | South Dakota | 223 | $119.4 million | $2,968 | $535,444 |

| 23 | Illinois | 2,737 | $1.5 billion | $3,569 | $534,932 |

| 24 | New Mexico | 283 | $150.0 million | $2,192 | $529,933 |

| 25 | District of Columbia | 154 | $77.5 million | $1,482 | $503,492 |

| 26 | Mississippi | 367 | $183.9 million | $2,048 | $501,220 |

| 27 | Nebraska | 391 | $195.8 million | $2,540 | $500,649 |

| 28 | Missouri | 1,124 | $554.6 million | $2,261 | $493,457 |

| 29 | Indiana | 1,425 | $700.9 million | $3,640 | $491,847 |

| 30 | Virginia | 1,310 | $639.0 million | $1,997 | $487,812 |

| 31 | Minnesota | 1,811 | $846.7 million | $3,989 | $467,515 |

| 32 | North Dakota | 172 | $78.0 million | $2,137 | $453,531 |

| 33 | Kentucky | 549 | $240.9 million | $1,533 | $438,714 |

| 34 | West Virginia | 215 | $94.3 million | $1,528 | $438,667 |

| 35 | Iowa | 476 | $195.9 million | $1,761 | $411,616 |

| 36 | New Jersey | 2,595 | $1.0 billion | $3,049 | $397,679 |

| 37 | Pennsylvania | 2,539 | $1.0 billion | $2,564 | $397,495 |

| 38 | Connecticut | 975 | $381.7 million | $2,521 | $391,533 |

| 39 | Michigan | 2,838 | $1.1 billion | $3,201 | $389,264 |

| 40 | Idaho | 715 | $277.2 million | $2,744 | $387,741 |

| 41 | Maryland | 1,272 | $492.9 million | $2,341 | $387,504 |

| 42 | Delaware | 249 | $91.6 million | $2,090 | $367,977 |

| 43 | Oregon | 1,105 | $398.1 million | $2,030 | $360,290 |

| 44 | New York | 5,011 | $1.7 billion | $2,362 | $336,024 |

| 45 | Massachusetts | 2,142 | $698.7 million | $2,430 | $326,208 |

| 46 | Rhode Island | 295 | $93.9 million | $1,925 | $318,248 |

| 47 | Hawaii | 233 | $71.3 million | $1,197 | $306,143 |

| 48 | Ohio | 3,965 | $1.2 billion | $3,510 | $302,012 |

| 49 | Maine | 419 | $118.0 million | $1,796 | $281,577 |

| 50 | Vermont | 174 | $48.2 million | $1,469 | $276,960 |

| 51 | New Hampshire | 667 | $163.3 million | $2,448 | $244,889 |

Accommodation and food services got highest share of funding

By industry, accommodation and food services (which includes hotels, restaurants, food service contractors such as caterers and more) received the highest share of SBA 7(a) and 504 loan amounts in fiscal year 2024.

Businesses within this industry received 16.7% of 7(a) and 22.1% of 504 funding in fiscal year 2024. That’s largely due to this industry having significant and ongoing upfront costs.

Industries that received the highest share of 7(a) loan amounts

| Industry | # of loans approved | % of loans approved | Approval amount | % of approval amount |

|---|---|---|---|---|

| Accommodation and food services | 8,402 | 12.0% | $5.2 billion | 16.7% |

| Retail trade | 7,981 | 11.4% | $4.0 billion | 12.9% |

| Health care and social assistance | 6,719 | 9.6% | $3.4 billion | 11.0% |

| Construction | 9,873 | 14.1% | $3.3 billion | 10.5% |

| Other services (except public administration) | 6,943 | 9.9% | $2.6 billion | 8.4% |

| Professional, scientific and technical services | 7,222 | 10.3% | $2.6 billion | 8.4% |

| Manufacturing | 4,141 | 5.9% | $2.4 billion | 7.7% |

| Wholesale trade | 3,219 | 4.6% | $1.7 billion | 5.5% |

| Administrative and support and waste management and remediation services | 4,166 | 5.9% | $1.4 billion | 4.4% |

| Arts, entertainment and recreation | 2,536 | 3.6% | $1.1 billion | 3.7% |

| Transportation and warehousing | 3,802 | 5.4% | $1.0 billion | 3.3% |

| Real estate and rental and leasing | 1,492 | 2.1% | $658.2 million | 2.1% |

| Finance and insurance | 1,079 | 1.5% | $459.5 million | 1.5% |

| Educational services | 1,095 | 1.6% | $403.0 million | 1.3% |

| Agriculture, forestry, fishing and hunting | 611 | 0.9% | $328.5 million | 1.1% |

| Information | 713 | 1.0% | $275.7 million | 0.9% |

| Mining, quarrying, and oil and gas extraction | 88 | 0.1% | $62.0 million | 0.2% |

| Utilities | 95 | 0.1% | $64.2 million | 0.2% |

| Management of companies and enterprises | 32 | 0.0% | $36.3 million | 0.1% |

| Public administration | 33 | 0.0% | $11.5 million | 0.0% |

Retail trade (merchandise stores) received the second-highest share of 7(a) funding at 12.9%, while health care and social assistance (like medical practices, outpatient facilities, ambulance services and more) received the second-largest share of 504 funding at 12.1%.

Conversely, public administration (0.0%) received the least across both loan amounts.

Industries that received the highest share of 504 loan amounts

| Industry | # of loans approved | % of loans approved | Approval amount | % of approval amount |

|---|---|---|---|---|

| Accommodation and food services | 1,033 | 17.2% | $1.5 billion | 22.1% |

| Health care and social assistance | 861 | 14.4% | $807.5 million | 12.1% |

| Retail trade | 671 | 11.2% | $728.7 million | 10.9% |

| Manufacturing | 512 | 8.5% | $718.3 million | 10.8% |

| Other services (except public administration) | 676 | 11.3% | $533.3 million | 8.0% |

| Wholesale trade | 311 | 5.2% | $505.8 million | 7.6% |

| Construction | 588 | 9.8% | $467.6 million | 7.0% |

| Professional, scientific and technical services | 381 | 6.4% | $333.0 million | 5.0% |

| Arts, entertainment and recreation | 222 | 3.7% | $268.8 million | 4.0% |

| Real estate and rental and leasing | 162 | 2.7% | $214.3 million | 3.2% |

| Transportation and warehousing | 134 | 2.2% | $197.5 million | 3.0% |

| Educational services | 129 | 2.2% | $172.1 million | 2.6% |

| Administrative and support and waste management and remediation services | 148 | 2.5% | $119.6 million | 1.8% |

| Finance and insurance | 82 | 1.4% | $46.0 million | 0.7% |

| Agriculture, forestry, fishing and hunting | 33 | 0.6% | $28.8 million | 0.4% |

| Information | 29 | 0.5% | $25.7 million | 0.4% |

| Management of companies and enterprises | 3 | 0.1% | $7.8 million | 0.1% |

| Mining, quarrying, and oil and gas extraction | 7 | 0.1% | $9.3 million | 0.1% |

| Utilities | 8 | 0.1% | $6.5 million | 0.1% |

| Public administration | 3 | 0.1% | $1.1 million | 0.0% |

Male-owned companies received most of funding

Companies owned by men received the majority of SBA loan funding, at 73.8% (or $23.0 billion) of 7(a) and 71.2% (or $4.7 billion) of 504 loan funding. In contrast, companies with more than 50% female ownership received the least, at 15.6% (or $4.9 billion) of 7(a) and 11.0% (or $733.8 million) of 504 loan funding.

That resembles small business demographics. According to a LendingTree study on business owners, 61% of businesses are owned by men.

Companies that received the highest share of loan amounts (by gender)

| Ownership demographics | # of loans approved | % of loans approved | Approval amount | % of approval amount |

|---|---|---|---|---|

| 7(a) loans | ||||

| 50%+ owned by women | 14,595 | 20.8% | $4.9 billion | 15.6% |

| 50% or less owned by women | 6,733 | 9.6% | $3.3 billion | 10.6% |

| Male-owned | 48,910 | 69.6% | $23.0 billion | 73.8% |

| 504 loans | ||||

| 50%+ owned by women | 899 | 15.0% | $733.8 million | 11.0% |

| 50% or less owned by women | 1,263 | 21.1% | $1.2 million | 17.8% |

| Male-owned | 3,831 | 63.9% | $4.7 billion | 71.2% |

Turning to race, white business owners received the biggest share of both loan amounts, at 39.1% of 7(a) and 44.8% of 504 funding. That translates to $12.2 billion and $3.0 billion, respectively. Asian business owners followed, receiving 18.4% (or $5.7 billion) of 7(a) and 22.8% (or $1.5 billion) of 504 funding.

Loan size, business age and more: Business demographics that received the highest share of loan amounts

Businesses that received between $500,001 and $2 million received the highest share of 7(a) and 504 loan amounts, at 36.4% and 45.5%, respectively. Businesses that received loans greater than $2 million followed, at 35.9% of 7(a) and 45.1% of 504 loan funding.

By business age, those in business longer than two years received the highest share of both loan amounts, at 46.5% of 7(a) and 73.5% of 504 funding. Those reporting a change of ownership had the next highest share of 7(a) loan amounts (21.5%), while startups intending to use loan funds to open their business received the next biggest slice of 504 funding (19.6%).

Meanwhile, urban businesses received the biggest share of both loan amounts by a wide margin, at 83.8% of 7(a) and 85.5% of 504 funding. By type, limited liability companies (LLCs) received 62.3% of 7(a) and 82.0% of 504 loan amounts.

Finally, by employee count, the smallest businesses received the highest share of loan amounts, with those with five or fewer employees at 43.6% of 7(a) and 31.6% of 504 loan amounts. Businesses with 11 to 25 employees followed, receiving 22.2% of 7(a) and 24.7% of 504 loan amounts.

Applying for loan in new year: Top expert tips

For small businesses looking to apply for SBA loans in fiscal year 2025, we offer the following advice:

- Understand how much you can afford. Use a business loan calculator to determine your borrowing potential and how much your monthly payments would be.

- Determine your eligibility. Both 7(a) and 504 loans have specific criteria, like size, credit history and operations. Understanding each loan’s unique requirements can help save effort and ensure you meet basic qualifications.

Methodology

LendingTree researchers analyzed U.S. Small Business Administration (SBA) data to determine the states where the federal government offers the most small business support.

Specifically, we ranked the states by average 7(a) and 504 loan amounts per company (across approved companies) in fiscal year 2024, which covers Oct. 1, 2023, through Sept. 30, 2024. We also ranked the states by average loan amount per business (across all businesses in a state as of June 2024, via the Bureau of Labor Statistics).

We also analyzed SBA loan data by industry, gender, race, loan size, business age, rural/urban status, business type and employee count.

Compare business loan offers

Recommended Articles