53% of Americans Expect to Shop on Small Business Saturday This Year

Nov. 30, 2024, is Small Business Saturday, when consumers across the U.S. will pour into local shops and restaurants — and click online — to support small businesses. This year marks the 15th annual Small Business Saturday since American Express founded the initiative in 2010.

In honor of Small Business Saturday, Lending Tree surveyed nearly 2,050 consumers about the occasion. More than half say they’ll definitely or probably shop small on Nov. 30. Even more — 76% — say they’ll purchase holiday gifts at small businesses this year, invaluable support as mom-and-pop shops compete with online retailers and national chains.

Key findings

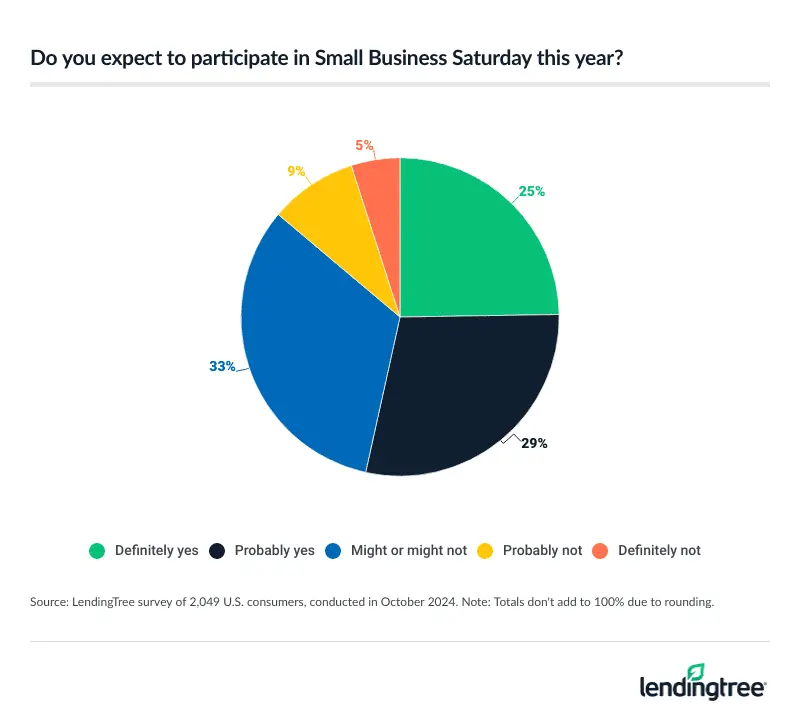

- More than half of Americans expect to participate in Small Business Saturday this year. 53% of Americans say they definitely or probably will shop small on Saturday, Nov. 30, led generationally by millennials (60%) and Gen Zers (58%). In fact, 34% only shop at small businesses on that day.

- More than three-quarters will shop small for holiday gifts. 76% of Americans say they’ll purchase holiday gifts at small businesses this year, with 28% of them saying they’ll get 50% or more of their presents from them.

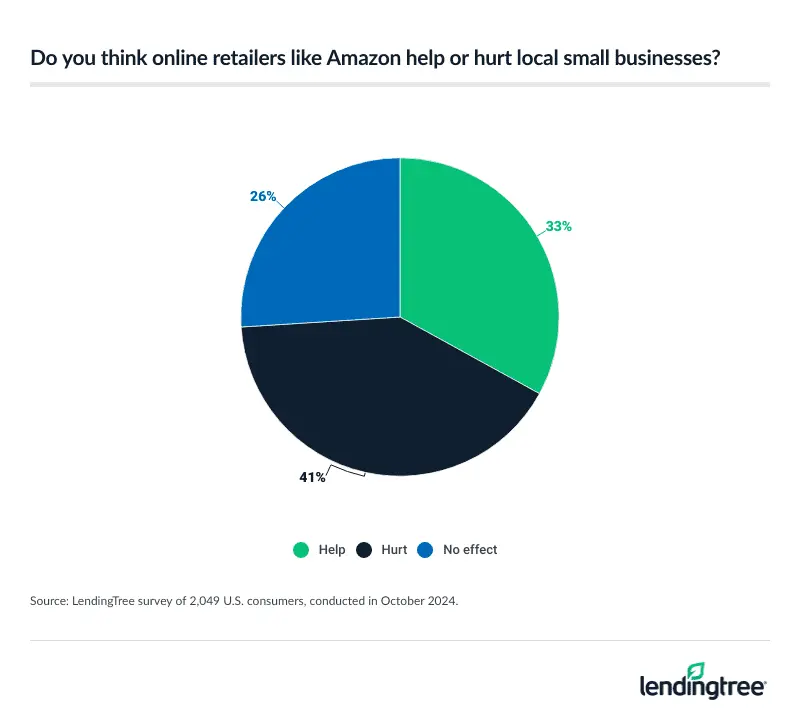

- Many Americans intentionally shop small. 60% of Americans chose small businesses over chain stores or large retailers at least half the time when shopping or ordering food online in the past month. In fact, 47% say they try to go out of their way to shop at small businesses. Additionally, 41% think online retailers like Amazon hurt small businesses.

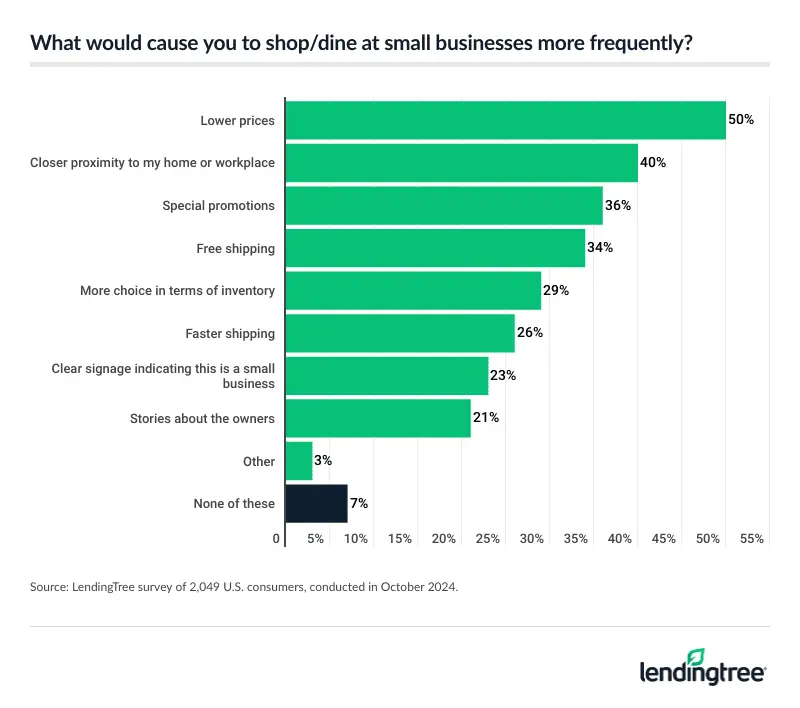

- Avoiding chains can come with higher prices. 57% say they expect to spend more when shopping at small businesses over chain stores. When asked what would get them to shop or dine at small businesses more frequently, 50% said lower prices, 40% said closer proximity to home or work and 36% said special promotions.

More than half expect to participate in Small Business Saturday

Just less than half — 46% — of American consumers are familiar with Small Business Saturday. After learning that the annual tradition, which occurs on the Saturday after Thanksgiving, is meant to encourage shopping at small businesses, more than half (53%) of Americans say they’ll participate in this year’s event.

Younger generations plan to shop small at a higher rate than their older counterparts — 60% of millennials (ages 28 to 43) and 58% of Gen Zers (ages 18 to 27) say they’ll patronize small businesses on Nov. 30, compared with 52% of Gen Xers (ages 44 to 59) and 43% of baby boomers (ages 60 to 78).

Other demographics most likely to participate include consumers with household incomes of $100,000 or more (69%), parents of children younger than 18 (66%), those with incomes of $50,000 to $99,999 (62%) and men (57%, compared with 50% of women). Meanwhile, 14% of consumers say they definitely or probably won’t participate in Small Business Saturday.

More than a third of consumers will shop exclusively at small businesses

A sizable share of consumers plan to lean into Small Business Saturday by only shopping small that day — 34% — with higher rates among several groups:

- Consumers with household incomes of $100,000 or more: 53%

- Parents of children younger than 18: 47%

- Millennials: 42%

- Men: 39%

- Consumers with household incomes of $50,000 to $99,999: 38%

- Gen Zers: 36%

Every year, small businesses nationwide look forward to the kickoff of the holiday shopping season and the boost Small Business Saturday provides. Many independent retailers leverage Small Business Saturday by offering promotions and deals. In 2023, consumers spent an estimated $17 billion, according to American Express.

“Small businesses in this country need as much help as they can get,” LendingTree chief consumer finance analyst Matt Schulz says. “They’re an enormously important part of any community, and they often struggle to compete against giant online sellers or big-box retailers. The fact that Small Business Saturday helps keep these businesses front of mind for more people, even for a day once a year, matters.”

Most will shop small for holiday gifts this year

Most Americans plan to “go small” for the holiday shopping season, with 76% saying they’ll purchase holiday gifts at independent retailers this year. Six-figure earners will look to small businesses for holiday shopping to a much greater extent (88%), as will consumers with household incomes of $50,000 to $99,999 (83%) and parents of children younger than 18 (83%).

Among those consumers who say they’ll buy holiday gifts at small businesses, 28% expect to do at least half of their holiday shopping with them.

Our survey also reveals that consumers are likelier to purchase gifts, clothing and groceries from independent retailers. Consumers are least likely to shop small for cosmetics, electronics and home improvement goods.

Items consumers are more likely to buy at a small business rather than a large chain

| Items | Share of consumers |

|---|---|

| Gifts | 53% |

| Clothing, accessories or jewelry | 46% |

| Groceries | 38% |

| Home decor | 38% |

| Toys | 29% |

| Home improvement items | 23% |

| Technology or electronics | 21% |

| Makeup or cosmetics | 19% |

Many intentionally shop small, but do online retailers hurt?

Three in 5 (60%) consumers say they chose small businesses over chain stores or large retailers at least half the time when shopping or ordering food online in the past month. Some demographics prioritized shopping small to a greater degree:

- Parents of children younger than 18: 72%

- Consumers with household incomes of $100,000 or more: 71%

- Millennials: 70%

- Gen Zers: 67%

- Consumers with incomes of $50,000 to $99,999: 66%

- Men: 63%

Close to half of American consumers (47%) say they try to go out of their way to shop at small businesses, with parents of children younger than 18 (61%), six-figure earners (59%), millennials (55%), Gen Zers (54%), consumers with household incomes of $50,000 to $99,999 (54%) and men (51%) doing so even more.

Some consumers say online retailers hurt small businesses

A sizable share of consumers (41%) think online retailers like Amazon hurt small companies, while 33% say online retailers help them and 26% say they have no impact.

Gen Zers and millennials are more likely to say online retailers help small businesses, while baby boomers and Gen Xers are more likely to say they hurt.

“Online retailers can certainly hurt small businesses,” says Schulz, author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” “Decades ago, a small business only had to worry about competing with other businesses in its area. Today, small businesses have online-only retailers to contend with as well.

“Those online retailers may be able to undercut the small brick-and-mortar businesses on price because their overhead may be significantly lower as an online-only business.”

Avoiding chains can come with higher prices

Americans lean more toward independent retailers when shopping in person. In fact, 67% of consumers say they chose a small business over a chain at least half the time when shopping and dining in person in the last month. Some groups prioritize local shops at a higher rate:

- Parents of children younger than 18: 78%

- Consumers with household incomes of $100,000 or more: 78%

- Millennials: 76%

- Gen Zers: 73%

- Consumers with incomes of $50,000 to $99,999: 72%

- Men: 71%

Most Americans say shopping small comes at a price — 57% of consumers expect to spend more when patronizing small businesses over chains.

What would get consumers to shop and dine at small businesses more?

When asked what would incentivize them to shop small more frequently, consumers cited lower prices, closer proximity to home or work and special promotions as the top priorities. However, other factors were important for some groups.

For example, either free or faster shipping was a top-three incentive for women, Gen Zers, Gen Xers, consumers with no children and those with household incomes below $30,000.

Most Americans say they can spot when a company is a small business versus a chain; only 41% say it’s difficult. Notably, more Gen Zers (55%) say they have trouble identifying small businesses over chains, as do consumers with household incomes of $100,000 or more (54%), parents of children younger than 18 (52%) and those with incomes of $50,000 to $99,999 (42%).

4 ways to support small businesses

Small businesses and entrepreneurship have surged in recent years, playing a vital role in the country’s economy and pandemic recovery. The U.S. currently averages 430,000 new business applications per month, 50% more than in 2019, according to the U.S. Department of the Treasury.

However, small businesses continue to face multiple challenges in the aftermath of the pandemic. Many have had to pivot directions to meet shifting demands, navigate hiring challenges, battle the impacts of inflation, face tighter lending requirements and embrace new technology to stay afloat.

Many consumers are aware of the roadblocks small business owners face, and some have shifted their spending habits as a result. In fact, 49% of consumers say they have felt more compelled to support local independent retailers, restaurants and service providers since the pandemic.

Helping small businesses thrive

Consider these steps to support new and existing small businesses in your area.

- Shop small throughout the year. Patronizing small businesses for goods, food and services is the most obvious and direct way to support them. However, going beyond shopping can help them further. Become a raving fan. Join their rewards programs. Turn to them for gift-giving throughout the year. Help expand their reach by giving gift cards to friends and family. Remember that many small businesses offer e-commerce, so become intentional about patronizing them when shopping online.

- Spread the word. “There are so many ways to support small businesses that don’t cost a cent,” Schulz says. “Tell your friends and family about them, either in person or via social media. Write a great review for them. All of these things can be invaluable.”

- Network and share resources. Schulz suggests connecting small business owners to potential business contacts and helpful resources. Broadening their network can have a significant impact.

- Offer moral and practical support. “Running a small business can be a brutal, never-ending grind that can wear on you,” Schulz says. “Sometimes being there for your entrepreneur friend as a sounding board, shoulder to cry on or person to vent to can make a huge difference.” Additionally, providing practical support, like volunteering, participating in crowdfunding and attending events, can boost small businesses. “It’s tough being an entrepreneur, but knowing that you have a team of people rooting you on can help a lot,” Schulz says.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from Oct. 14 to 15, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Compare business loan offers