74% of Small Business Owners Took On Debt to Offset COVID-19 Financial Losses

Nearly three-quarters of small business owners have taken on debt to make up for financial losses amid the COVID-19 crisis, up 57% from March. And few businesses are again fully operational, according to the most recent LendingTree survey of almost 1,400 small business owners.

“Only 13% of our respondents have been able to completely resume operations, which means that almost 9 out of 10 aren’t there yet,” said Hunter Stunzi, senior vice president of small business and investments at LendingTree. “That’s a real drag on revenue and on their ability to keep and pay their employees.”

But it isn’t all doom and gloom, the survey found. The majority of small business owners still feel optimistic about their future beyond the pandemic. Here’s what else we learned.

Key findings

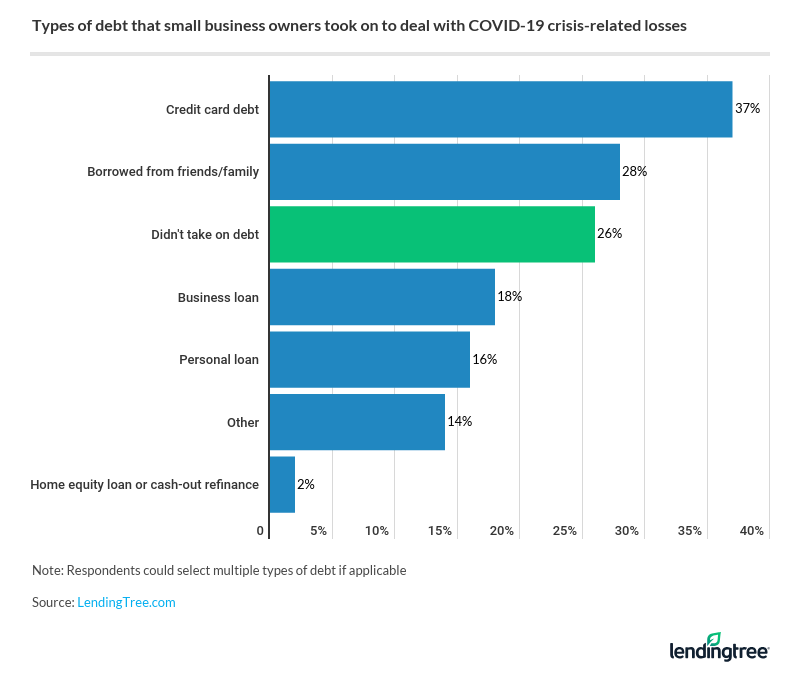

- 74% of small business owners have taken on debt to cope with the financial losses due to the coronavirus crisis. Most notably, 37% took on credit card debt and 28% borrowed from friends or family.

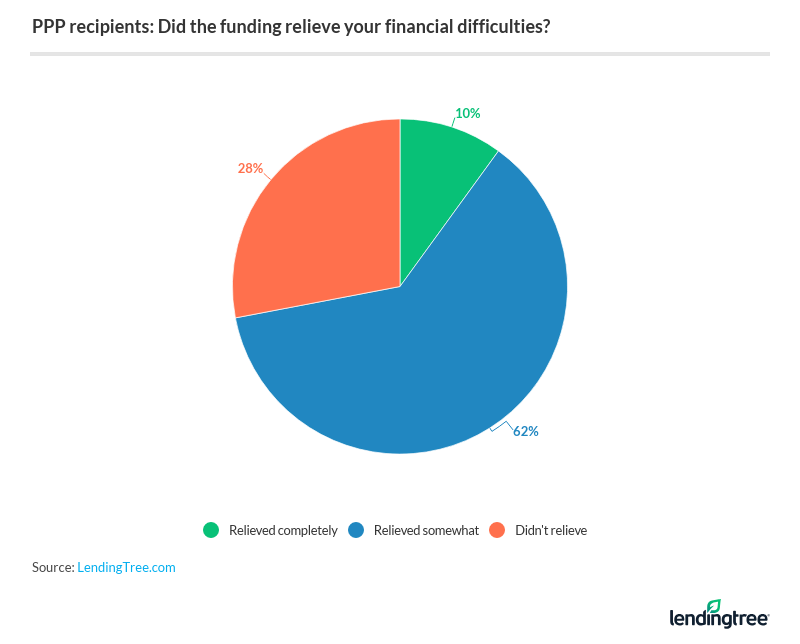

- Only 10% of small business owners who received Paycheck Protection Program (PPP) funding said it relieved all the financial difficulties they’re facing. The majority (62%) said the funds helped somewhat, but 28% said the PPP funds didn’t relieve their difficulties at all.

- Of the 79% of small business owners who suspended or reduced operations, only 13% have since been able to completely resume operations. Most (63%) have been able to somewhat resume, while 23% haven’t been able to resume operations at all.

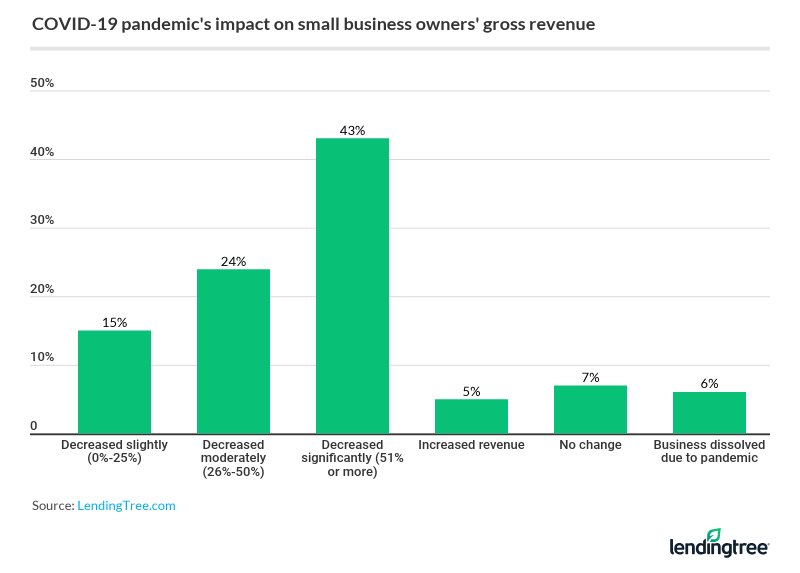

- 43% of small business owners said their gross revenue has decreased by 51% or more due to the pandemic.

Almost three-quarters of small business owners have taken on debt to offset losses

Those who took on debt to deal with crisis-related losses did so in a variety of ways. More than a third of small business owners (37%) turned to credit cards, while 28% borrowed from friends or family. Others have leveraged business loans, personal loans or home equity to see them through.

“I think it’s encouraging that people have been able to access debt during this time, and I think it diminishes the negative connotation of borrowing,” Stunzi said. “It’s a critical, necessary thing. It’s also encouraging that there are programs for businesses to be able to borrow inexpensively.”

The number of small business owners who’ve taken on debt to cope with the COVID-19 pandemic is up significantly (57%) from a March LendingTree survey. At that point, just 47% had done so. An additional 34% had also tried to secure financing at that time but weren’t approved.

36% not approved for the PPP funds they needed

The PPP was rolled out in the Coronavirus Aid, Relief and Economic Security (CARES) Act at the end of March to offer financial relief to small business owners affected by the coronavirus crisis. It provided forgivable loans up to $10 million through the U.S. Small Business Administration (SBA). This money could be used to cover:

- Rent payments on mortgages or leases

- Utilities

- Payroll expenses, such as employee salaries and paid leave

The program stopped accepting applications in early August.

More than one-third (36%) weren’t approved for the funds they needed, and 9% are still waiting to hear back. More than half (55%) did receive the funds they were seeking, which is far better than the 5% who received financial relief during the first round in early April. Be that as it may, Stunzi likened the program to a temporary Band-Aid.

“It was really sort of a one-time shot in the arm for a few months of payroll, utilities or rent,” he said. “But now that they’ve worked through that and the government has not been able to get its act together and provide more stimulus to these Main Street businesses, many are never going to return and are simply going to go out of business.”

As for how PPP funding is relieving financial difficulties, the results are mixed, with only just 1 in 10 relieved completely.

41% have had to lay off employees due to the pandemic

With so many small business owners feeling the financial pinch brought on by the coronavirus crisis, many have been forced to lay off a portion of their workforce. Here’s how the numbers shake out:

- 26% laid off employees and haven’t been able to bring anyone back yet

- 10% laid off employees but have since brought some back

- 5% laid off employees but have since brought everyone back

One bright spot is that 59% of small business owners didn’t lay off any employees at all, but that was primarily driven by those businesses who have fewer than 10 employees. Stunzi also pointed to the fact that there are some industries that have been booming during the pandemic, thanks to increased demand. This is especially true for essential businesses.

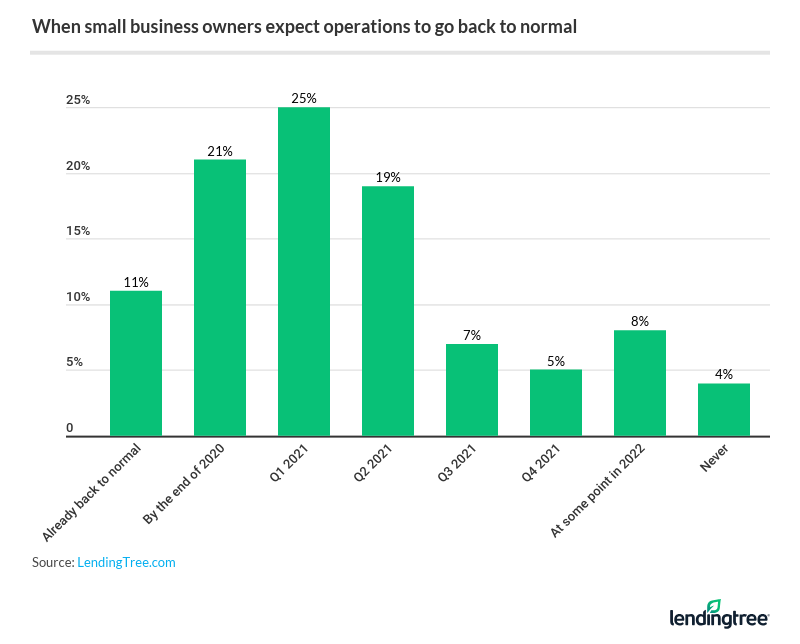

Nearly one-third of businesses expect they’ll be back to normal by end of 2020

Virtually all states are still imposing coronavirus-related restrictions on nonessential businesses. This includes occupancy caps that limit the number of customers that can be served at any given time. While necessary for public health and safety, it’s something that’s thrown a wrench in business operations. The survey found that 28% of small business owners had to shut down completely amid the crisis, and 52% had to reduce operations while remaining open.

However, the majority of small business owners do feel confident that they’ll be able to get back to business as usual at some point in the near future.

“Essentially one-third of businesses feel like they’ll be back to normal before the end of the year,” Stunzi said. “Plus, another 25% feel like they’ll get there by the end of the first quarter of 2021. I’d say that’s pretty optimistic.”

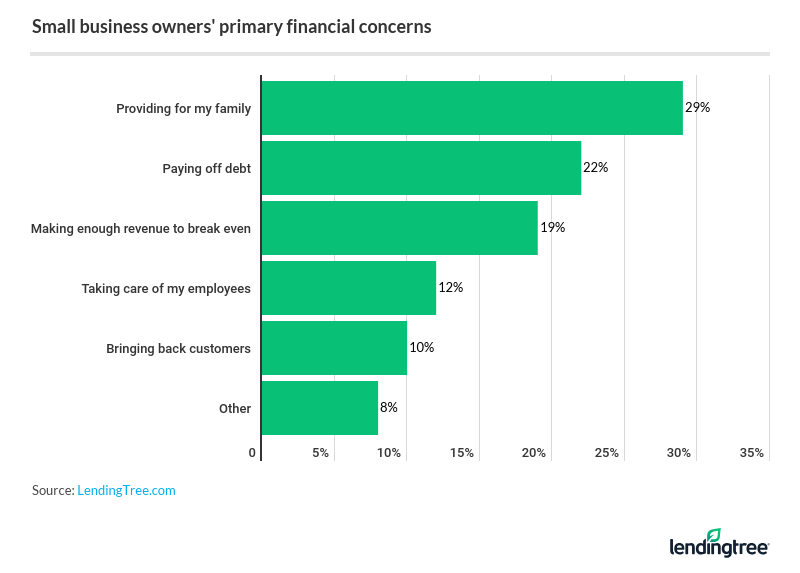

Small business owners most concerned about providing for families

Even with so many small business owners feeling good about the future, many are still financially struggling in the short term. A good number of small business owners (29%) are most concerned about being able to provide for their families.

This has everything to do with operating restrictions and contracting revenue. Stunzi used restaurants and retail stores as a prime example.

“If they’re allowed to open up at 25% of their pre-COVID-19 capacity, that equates to a 75% cut on revenue,” he said. “You can’t have a thriving business when you aren’t able to serve clients.”

Our survey highlighted the tough reality that 43% of small business owners have seen their gross revenue shrink by at least half during the pandemic.

These are certainly challenging times for small business owners, but 45% say they have no doubts that they’ll still be in business one year from now.

“Only 5% said that they’re unlikely to be around, so there seems to be a good measure of confidence that they’ll be able to get through this,” Stunzi said. “As a result of this, I think we’re going to have healthier businesses that are more resilient.”

Methodology

LendingTree conducted an online survey of 1,397 small business owners who had previously applied for funding through LendingTree’s small business lending database. Participants were emailed a link to participate in the survey, which was fielded using Qualtrics from Sept. 4-11, 2020.

Compare business loan offers