More Than Half of Small Business Owners Don’t Think PPP Funds Are Helping the Right People, but Newly Announced Changes May Be a Step in Right Direction

The rollout of the Paycheck Protection Program (PPP) has been met with widespread criticism, as many small business owners believe they didn’t get the support they needed.

In fact, a new LendingTree survey of nearly 600 small business owners showed that more than half don’t believe the PPP funds have gone to the hardest-hit businesses. Their voices might have been heard, though, as the Biden administration announced this week that small businesses with fewer than 20 employees will get exclusive access to PPP loans for two weeks starting Wednesday, Feb. 24.

Keep reading for small business owner insight into the PPP program, its application process and more.

Key findings

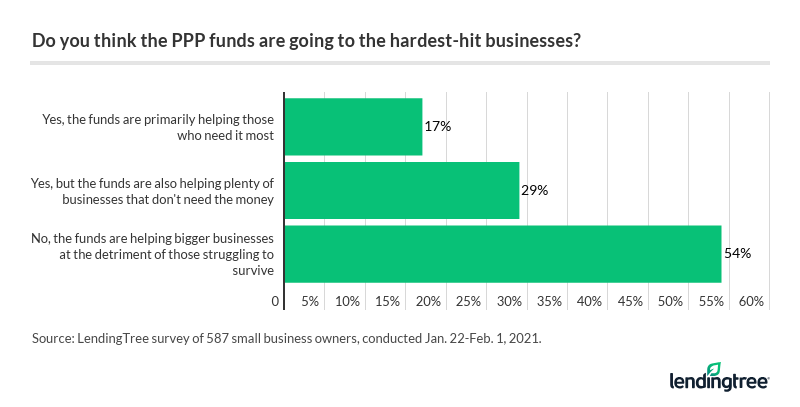

- 54% of small business owners don’t think PPP funds are going to the hardest-hit businesses, noting that the program helps bigger businesses at the detriment of those struggling to survive. An additional 29% of small business owners say they believe the funds are going to those who need the money — while also helping plenty of businesses that don’t.

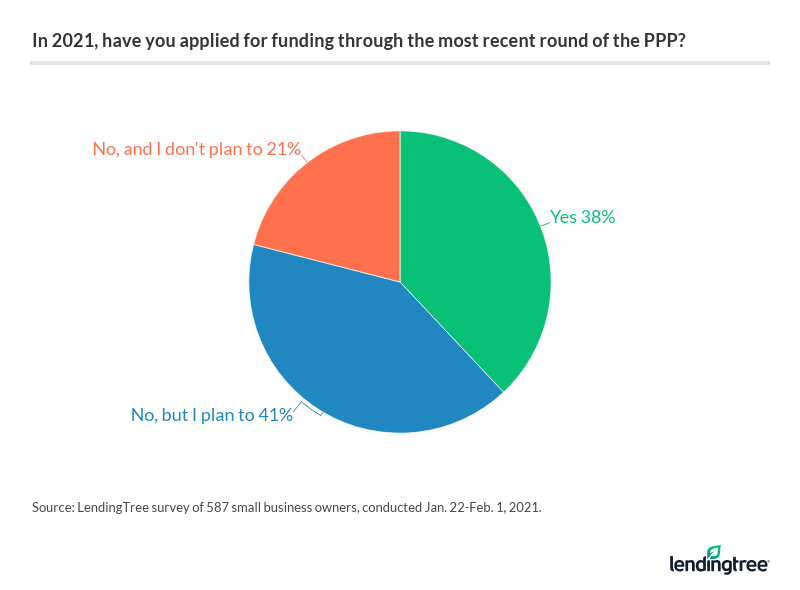

- Nearly 40% of surveyed small business owners have applied for funding through the most recent PPP funding round in 2021. As for those who have no plans to apply, their main reason was not meeting the eligibility criteria (53%).

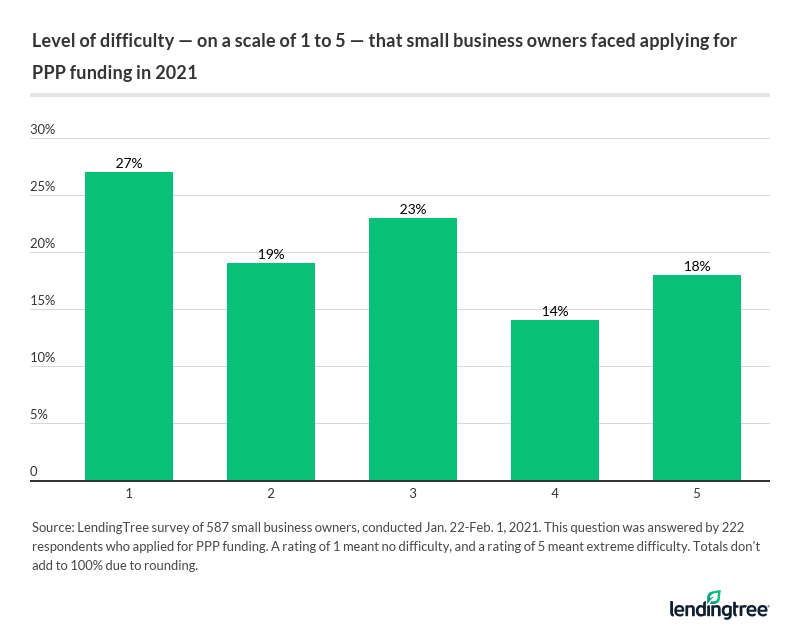

- 65% of small business owners who applied for PPP funding in 2021 have had issues doing so. The most common problems include confusion about funding being denied (20%), difficulty finding the necessary paperwork (19%) and trouble finding a financial institution to help with the application (16%).

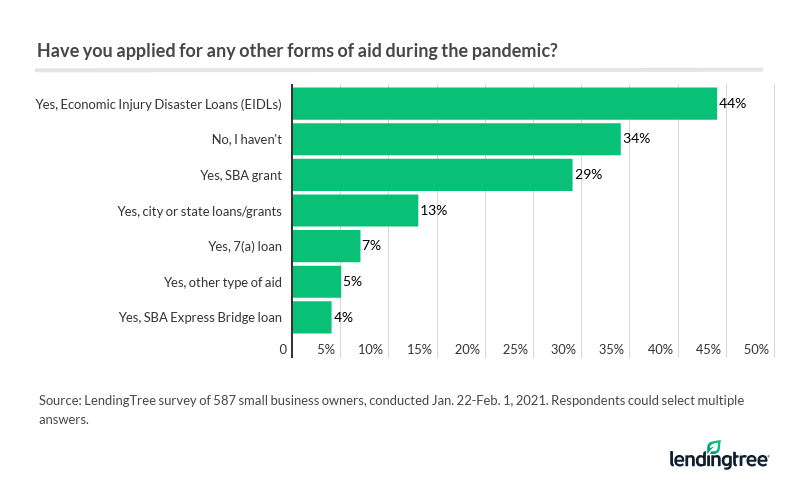

- Two-thirds of surveyed small business owners applied for other forms of business aid during the pandemic. Most notably, 44% applied for Economic Injury Disaster Loans (EIDLs), 29% applied for Small Business Administration (SBA) grants and 13% applied for loans or grants from their city or state.

- 74% of small business owners took on debt during the pandemic — the same percentage who cited this in a September 2020 LendingTree survey — and credit card debt is most common. Of those who have taken on debt, small business owners owe an average of $40,733.

54% of small business owners say PPP funds aren’t going to the right businesses, but more help could be on the way

More than half of small business owners don’t believe that PPP funds are going to the hardest-hit businesses, so it’s easy to see how some business owners may feel frustrated or let down.

The Coronavirus Aid, Relief and Economic Security (CARES) Act introduced PPP loans to businesses in which the loans can be forgiven if at least 60% of the funds are used for payroll over eight or 24 weeks.

Whatever amount remains (up to 40%) can be used for specified business expenses, such as mortgage, rent, utilities or pandemic related-expenses.

The PPP program expired Aug. 8, 2020, but was reopened Jan. 11, 2021.

According to Dan LaFayette, LendingTree director of product management for small business, many business owners may be feeling that PPP funds aren’t going to the right businesses because of mismanagement during the first round of funding last year. In that first round, numerous multimillion-dollar corporations took advantage of the program, while many small business owners couldn’t get aid.

Biden administration to grant exclusive PPP window to small businesses

The Biden administration announced that small businesses with fewer than 20 employees can exclusively apply for PPP funding for two weeks starting Wednesday, Feb. 24. That means bigger businesses will be blocked from submitting applications through March 9.

LendingTree’s survey was conducted in late January and early February before the Biden administration’s announcement, but it seems like a decision that would be cheered by many respondents, based on their prior responses.

Nearly 4 in 10 small biz owners have applied for PPP funds in latest round, but application issues remain

Almost 40% of small business owners applied for funding during the most recent release of PPP funding in 2021.

Difficulty surrounding the application process was fairly common, with about 1 in 5 PPP applicants reporting they had “extreme difficulty” applying for funds.

Not to mention that getting through the application may not equate to funds — 65% of small business owners who applied for PPP funding in 2021 had issues during the process.

The most common reported problems included:

- Confusion about being denied for funding (20%)

- Difficulty finding all the required paperwork for the application (19%)

- Trouble finding a financial institution to help with the application (16%)

The hardest parts of the application process for many have been supplying the right information and delays in the approval process, LaFayette said.

Any hiccups or roadblocks in the process may lead to a longer wait period for the applicant, which can justifiably lead to frustration. Being as thorough as possible during the application process can help avoid delays, LaFayette said, but he thinks some applicants may start considering other options if the wait for a response is too long.

“The delays are causing confusion with small business owners, and they don’t know whether they should continue with the PPP path or attempt to get money from traditional business financing sources,” LaFayette said.

Less than 1 in 10 have been approved for 2021 PPP funding so far

Of those who applied for funding in this latest round, only 9% were approved for 2021 PPP funding. Luckily, there’s still hope to be had for many applicants: 67% were waiting to hear back at the time of our survey on whether they’ll receive funds.

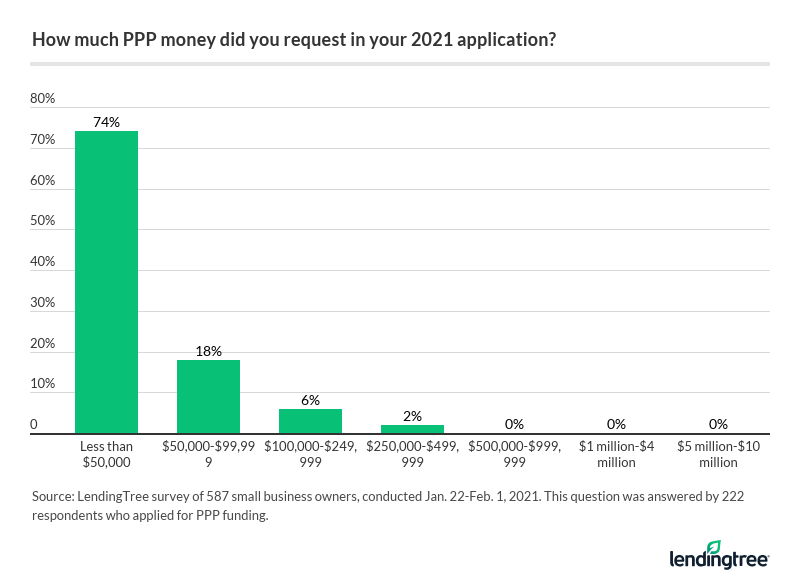

Business owners are generally being modest in their requests for aid. The vast majority of small business owners (74%) applied for less than $50,000 in PPP funding with their 2021 application — not a single respondent asked for $500,000 or more.

More than half of small business owners say they didn’t meet eligibility criteria

There were many reasons why business owners reported they weren’t planning to apply for PPP funds in this latest round, with the main one being eligibility concerns (53%). Another 15% said the program is too confusing and 13% aren’t confident the loan will be forgiven.

Other reasons included:

- I tried to apply during the initial round but was denied (11%)

- My business is financially stable (8%)

- I don’t think the funds will help (3%)

- My bank or financial advisor told me not to (3%)

For those who may want to change their minds and still apply, the SBA is accepting both first-draw and second-draw PPP loan applications from participating lenders until March 31, 2021 (though you should be aware of the exclusive application window for the smallest businesses when you decide to apply).

Still, 3 in 10 applicants did receive 2020 funding, so this very well may be a fruitful path worth pursuing for many small business owners.

2 in 3 small business owners have sought other business aid amid coronavirus pandemic, with debt averaging $40,733

PPP loans aren’t the only business aid option available at the moment. Two-thirds of small business owners reported having applied for other forms of business aid during the pandemic, including EIDLs (44%), SBA grants (29%) or city- or state-based loans or grants (13%).

Melissa Wylie, LendingTree small business analyst, noted these other forms of aid can have a big impact on small business owners, especially EIDLs.

“These loans come in large amounts and have low interest rates and long repayment terms,” Wylie said. “If a business owner is unable to get a PPP loan, an EIDL may be the next best option for them.”

Another option worth pursuing, Wylie said, is a local grant that wouldn’t need to be repaid. However, it may be difficult to obtain, especially if the number of local programs is limited. Business owners should have a backup plan if they’re not selected as a recipient, she said.

How small business debt now compares to September 2020

Small business owners who want to avoid debt may be extra eager to seek out aid. This is fair when you consider that 74% of small business owners have taken on debt during the pandemic — the same percentage who cited this in a September LendingTree survey — with credit card debt being the most common.

You can see how small business debt has changed since:

- 41% have taken on credit card debt (up from 37% in September)

- 32% have borrowed from friends or family (up from 28% in September)

- 18% have taken out a personal loan (up from 16% in September)

- 17% have taken out out a business loan (down from 18% in September)

- 5% have taken out a 401(k) loan (we didn’t ask about this in September)

Of those who have taken on debt, small business owners owe an average of $40,733.

A look back at PPP funding in 2020: More than 1 in 5 small business owners were denied

Almost a third (30%) of surveyed small business owners applied for and were approved for PPP funding in 2020, but an additional 21% applied but were denied. For those small business owners who applied for PPP funding in both 2020 and 2021, 72% worked with the same financial institution both times.

Of those who applied for PPP funding in 2020, 38% have applied for forgiveness. Only 67 of our survey respondents have applied for forgiveness, but 82% of that group received full forgiveness, 15% partial forgiveness and just 3% said their application for forgiveness was denied.

An additional 60% haven’t applied for their 2020 PPP loan to be forgiven, but plan on doing so.

Overall, LaFayette feels the PPP program has been successful in providing aid to many small business owners.

“The government is trying to do things to help small business owners survive,” LaFayette said. “Certainly, this is helpful, and forgiveness is a strong possibility for most borrowers.”

Methodology

LendingTree conducted an online survey of 587 small business owners who had previously applied for funding through LendingTree’s small business lending database. Participants were emailed a link to participate in the survey, which was fielded using Qualtrics from Jan. 22 to Feb. 1, 2021.

Compare business loan offers

Recommended Articles