Very Small Businesses Dominate in California

Small businesses power the U.S. economy. According to the U.S. Chamber of Commerce, 99.9% of U.S. businesses are small ones, and they generate nearly half of our nation’s gross domestic product (GDP).

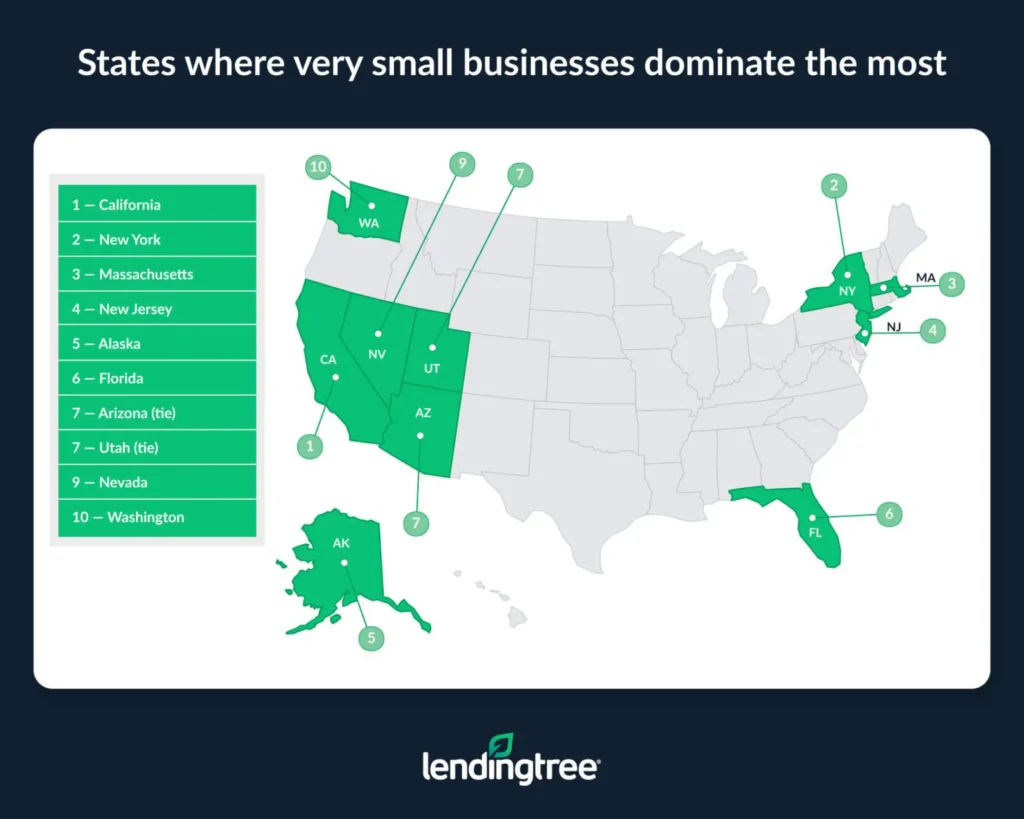

But very small businesses (those with fewer than five employees) are on the rise — perhaps thanks to their lean, agile profile, which makes it relatively easy for them to start up and operate. LendingTree’s latest study found that 58.6% of businesses in the U.S. fit into this category. Below, see our full analysis of very small businesses by state.

Key findings

- Nearly 3 in 5 businesses across the U.S. are very small. An average of 58.6% of businesses across the 50 states and the District of Columbia employed fewer than five workers in 2021, up 0.6 percentage points from 2020 (58.0%) and 1.1 percentage points from 2017 (57.5%).

- Very small businesses are most dominant in California. 64.5% of Golden State businesses employ fewer than five workers — the fourth-highest in the U.S. But that percentage saw significant growth year over year (2.0 percentage points) and over five years (3.1 percentage points), carrying the state to the top. New York, Massachusetts and New Jersey are next.

- Very small businesses are least dominant in North Dakota. Just 53.4% of Peace Garden State businesses employ fewer than five workers — the seventh-worst in the U.S. But it’s seen the most significant one- and five-year declines, securing its last-place finish. Kentucky, New Mexico and New Hampshire join at the bottom.

- Florida is the only state where more than 7 in 10 businesses are very small. In the Sunshine State, 70.7% of businesses employ fewer than five. But its middle-of-the-pack one-year change kept it out of our top five. Conversely, West Virginia has the worst rate of very small businesses — 50.4% — but its one-year growth (1.4 percentage points) kept it from the overall bottom.

Nearly 3 in 5 businesses across U.S. are very small

In 2021 — the latest year for which data is available — an average of 58.6% of U.S. businesses had fewer than five workers. That’s almost 3 in 5. (Note: This figure includes all 50 states and the District of Columbia.)

While that may seem like a lot at first blush, LendingTree chief consumer finance analyst Matt Schulz says he’s not surprised at how common the very small business model has become.

“It’s never been easier to create a little business than today,” Schulz points out. A solo entrepreneur taking on freelance work — which a 2023 Upwork study found a historical high of 38% of the U.S. workforce did in that year — or a tiny enterprising team “can have something set up online in an afternoon and without a whole lot of upfront cost.”

Thanks to the proliferation of third-party sales platforms (think Etsy and eBay) and easy-to-use website building (think Squarespace and Wix), almost anyone of legal age can easily start an online business or advertise an offline one.

And, yes, offline businesses are part of the picture, too. Along with common 21st-century laptop-in-coffee-shop gigs like freelance writing or web design, some very small businesses still offer more traditional, tangible services like yard work or child care.

To wit, the average percentage of very small businesses is on the rise — although incrementally so. From 2020 to 2021, the average national rate of very small businesses rose 0.6 percentage points, and over the five-year period from 2017 to 2021, it rose 1.1 percentage points.

Average percentage of businesses that are very small (nationally)

| Year | Avg. across U.S. |

|---|---|

| 2017 | 57.5% |

| 2020 | 58.0% |

| 2021 | 58.6% |

While these increases are small, Schulz suggests some recent cultural shifts may be at play.

“There’s no question that the pandemic, and the Great Recession before it, changed something in Americans in a major way,” Schulz says. “I think the economic carnage that came with those two events was so profound that it drove many people to no longer be satisfied with working for one company and relying on one paycheck that could be gone tomorrow.”

As a result, he thinks, many Americans — especially younger ones — have turned to small businesses and side hustles in an effort to protect themselves from future economic uncertainty.

Very small businesses most dominant in California

Though popular throughout the U.S., the prevalence of very small businesses varies geographically — and per our study, these micro-companies dominate in the Golden State.

Based on an equal weighting of the state’s percentage of very small businesses, the one-year percentage-point change in such businesses between 2020 and 2021 and the five-year percentage-point change between 2017 and 2021, California ranked first on our list of very small business dominance.

(Overall, based on sheer percentage of very small businesses in 2021, California comes in fourth behind Florida, New York and Colorado.)

California’s share of very small businesses — 64.5% — is substantially higher than the national average, and the Golden State is also seeing a faster increase in such firms, especially in recent years. The prevalence of such firms in the state grew 2.0 percentage points between 2020 and 2021, and 3.1 between 2017 and 2021.

California also headquarters, by far, the largest number of zero-employee small businesses (i.e., incorporated freelancers) in the country: 121,348 such firms call the state home. Florida, the state with the second-highest number, comes in almost 40% lower at 75,609.

One might surmise that California offers an attractive business tax structure or other economic incentives. But, on the contrary, California’s corporate tax rate is one of the highest in the country: 8.84%, regardless of how much a business makes.

The same can be said of the runners-up (which we’ll discuss in more depth momentarily): All three of them have corporate taxes that climb above 7.0%, a trend suggesting there must be some other factor driving the proliferation of very small businesses in these states.

Schulz hypothesizes that these states benefit from relatively high populations and median income levels: “There’s definitely truth to the old saying that it takes money to make money,” he says. Even though it’s cheaper than ever to start a small business, “having an extra cushion of funding at the start brings some real significant advantages,” he explains.

While the proliferation of online business makes a large local population less critical, Schulz says, it can still be a boon: “Bigger populations mean more people to sell to.”

4 states where very small businesses dominate

| Rank | State | % of business with fewer than 5 employees | 1-year % point change | 5-year % point change | Score |

|---|---|---|---|---|---|

| 1 | California | 64.5% | 2.0 | 3.1 | 100.00 |

| 2 | New York | 67.5% | 1.6 | 2.7 | 94.07 |

| 3 | Massachusetts | 59.7% | 2.1 | 3.2 | 90.37 |

| 4 | New Jersey | 62.2% | 1.9 | 2.4 | 89.63 |

After California, New York is the state we rank second-highest for dominance of very small businesses: About two-thirds (67.5%) of the state’s businesses have fewer than five employees, and the rate increased by 1.6 percentage points year over year between 2020 and 2021. Eager go-getters who call the Big Apple home are likely impacting those trends.

Massachusetts comes in third even with its relatively low overall percentage of very small businesses relative to the other three at the top of our list (59.7%), thanks in part to its skyrocketing increase: 2.1 percentage points between 2020 and 2021, and 3.2 between 2017 and 2021.

Although its reputation isn’t quite Silicon Valley’s (which may partially explain California’s winning stance in this regard), Massachusetts, too, is a major tech hub — and home to some of the nation’s most prestigious (and STEM-focused) colleges. It’s possible that enterprising grads (and maybe even some undergrads) could be helping nudge the Bay State’s proportion of very small businesses upward.

Finally, New Jersey — where many residents work in major cities like New York and Philadelphia — ranks fourth, with 62.2% of its businesses classified as very small and steady increases in such small businesses during both periods analyzed.

Very small businesses least dominant in North Dakota

At the other end of the spectrum, some states are seeing an active decrease in very small businesses — though the percentage of businesses with under five employees is more than 50% in every single state as well as D.C.

At the bottom of our ranking is North Dakota, where a relatively low 53.4% of businesses qualify as “very small.” Between 2020 and 2021, the share of such companies dropped 2.6 percentage points — and panning out to the five-year view brings the drop to 4.7.

While, again, firm whys can be hard to get a handle on, it’s interesting to note that the states toward the bottom of the list are “generally lower-income, lower-population states,” as Schulz puts it — factors “that can present real challenges for small businesses trying to get off the ground.”

During the 2020 census, the majority of counties in North Dakota had fewer than 5,000 residents, making for a sparse population base that can be difficult to market to. Further, the Peace Garden State is home to only 19,111 companies altogether — one of the lowest totals in the country. Even fewer firms of any size are headquartered in Wyoming (18,281), Vermont (16,764), Alaska (16,440) and D.C. (15,600).

4 states where very small businesses dominate the least

| Rank | State | % of business with fewer than 5 employees | 1-year % point change | 5-year % point change | Score |

|---|---|---|---|---|---|

| 1 | North Dakota | 53.4% | -2.6 | -4.7 | 0.00 |

| 2 | Kentucky | 53.1% | -0.4 | -2.2 | 4.44 |

| 3 | New Mexico | 52.9% | -1.4 | -0.9 | 5.19 |

| 3 | New Hampshire | 52.9% | -1.4 | -0.7 | 5.19 |

After North Dakota, the states with the lowest dominance of very small businesses are Kentucky (where only 53.1% of businesses have fewer than five workers, down 2.2 percentage points from 2017) and New Mexico and New Hampshire, which tie for third place. In both the Land of Enchantment and the Granite State, only 52.9% of businesses qualify as very small, and both have seen a 1.4 percentage point drop in such businesses between 2020 and 2021.

New Hampshire is a notable exception from Schulz’s theory: “It’s decidedly not a low-income state,” he admits, “though it does have a small population.”

Florida has highest rate of businesses with under 5 employees

While we ranked dominance based on the three variables described above, when states are ranked solely by the share of businesses that qualify as very small, the Sunshine State surges to the front.

In Florida, 70.7% of businesses had five workers or fewer in 2021 — the highest rate in the U.S. However, its respective increases over the one- and five-year periods studied (0.9 and 2.6 percentage points, respectively) are relatively shallow compared to states further up in our dominance ranking.

As mentioned, Florida also has the second-highest rank of zero-employee companies (i.e., solopreneurs and incorporated freelancers) in the nation. One reason behind this trend might be the state’s lack of individual income tax, which, on top of corporate taxes and self-employment taxes, can be a heavy burden on those forging a road of their own. Incorporating in Florida and avoiding personal income taxes could save freelancers a substantial amount of money.

At the bottom of the list, we find West Virginia — another low-population, low-income state, Schulz points out, shoring up his overall premise. The Mountain State has the lowest share of very small businesses in the country, with just 50.4% of its companies qualifying.

However, despite the state’s 1.5 percentage point drop in very small businesses between 2017 and 2021, their prevalence grew 1.4 percentage points between 2020 and 2021 — perhaps thanks to outdoor-loving entrepreneurs moving into the state after being cut loose from their desks during the pandemic. West Virginia saw a positive net migration in both 2021 and 2022.

Full rankings

States where very small businesses dominate the most/least

| Rank | State | % of business with fewer than 5 employees | 1-year % point change | 5-year % point change | Score |

|---|---|---|---|---|---|

| 1 | California | 64.5% | 2.0 | 3.1 | 100.00 |

| 2 | New York | 67.5% | 1.6 | 2.7 | 94.07 |

| 3 | Massachusetts | 59.7% | 2.1 | 3.2 | 90.37 |

| 4 | New Jersey | 62.2% | 1.9 | 2.4 | 89.63 |

| 5 | Alaska | 62.8% | 1.4 | 2.9 | 87.41 |

| 6 | Florida | 70.7% | 0.9 | 2.6 | 84.44 |

| 7 | Arizona | 61.9% | 1.1 | 2.4 | 77.78 |

| 7 | Utah | 61.9% | 0.6 | 2.8 | 77.78 |

| 9 | Nevada | 58.9% | 1.6 | 2.1 | 75.56 |

| 10 | Washington | 61.3% | 1.0 | 1.9 | 69.63 |

| 11 | Arkansas | 58.5% | 1.5 | 2.2 | 68.89 |

| 11 | Oregon | 58.5% | 2.3 | 1.0 | 68.89 |

| 13 | District of Columbia | 52.4% | 1.7 | 7.3 | 66.67 |

| 14 | Virginia | 58.9% | 1.2 | 2.0 | 65.93 |

| 15 | Maine | 61.9% | 1.3 | 1.1 | 65.19 |

| 16 | Illinois | 63.6% | 0.3 | 1.7 | 62.96 |

| 17 | Texas | 59.7% | 0.2 | 2.3 | 61.48 |

| 18 | Colorado | 64.6% | 0.1 | 1.4 | 60.74 |

| 18 | Maryland | 64.6% | 1.1 | 2.0 | 60.74 |

| 20 | Hawaii | 57.0% | 0.7 | 3.0 | 59.26 |

| 21 | Georgia | 62.4% | -0.2 | 1.5 | 57.04 |

| 21 | North Carolina | 62.4% | 0.7 | 1.2 | 57.04 |

| 23 | Pennsylvania | 57.3% | 1.5 | 1.2 | 55.56 |

| 24 | Kansas | 57.1% | 2.2 | 0.4 | 54.81 |

| 24 | Nebraska | 57.1% | 1.6 | -0.6 | 54.81 |

| 24 | South Carolina | 57.1% | 0.6 | 2.0 | 54.81 |

| 24 | Wyoming | 57.1% | -0.4 | 1.7 | 54.81 |

| 28 | Delaware | 57.7% | -0.3 | 4.0 | 54.07 |

| 28 | Vermont | 57.7% | 0.7 | 1.7 | 54.07 |

| 30 | South Dakota | 58.1% | 1.8 | -1.0 | 47.41 |

| 31 | Connecticut | 56.3% | 0.7 | 1.4 | 45.93 |

| 31 | Iowa | 56.3% | 0.1 | 1.1 | 45.93 |

| 33 | Minnesota | 59.7% | 0.5 | 0.3 | 43.70 |

| 34 | Ohio | 54.7% | 0.9 | 1.2 | 40.74 |

| 35 | Alabama | 53.7% | 1.2 | 1.0 | 40.00 |

| 36 | Montana | 62.8% | -1.3 | -0.1 | 39.26 |

| 37 | Tennessee | 52.4% | 1.6 | 0.9 | 38.52 |

| 38 | Idaho | 60.5% | -0.8 | 0.2 | 36.30 |

| 38 | Michigan | 60.5% | 0.5 | 1.0 | 36.30 |

| 40 | Wisconsin | 54.9% | 0.5 | 1.1 | 34.81 |

| 41 | Indiana | 55.2% | 0.5 | 0.7 | 29.63 |

| 41 | Mississippi | 55.2% | 1.0 | -0.4 | 29.63 |

| 43 | West Virginia | 50.4% | 1.4 | -1.5 | 25.19 |

| 44 | Oklahoma | 58.8% | -1.2 | -0.5 | 23.70 |

| 45 | Missouri | 58.9% | -0.4 | -2.0 | 22.96 |

| 46 | Louisiana | 54.1% | -0.3 | 0.1 | 18.52 |

| 47 | Rhode Island | 55.3% | -1.6 | -1.3 | 8.89 |

| 48 | New Hampshire | 52.9% | -1.4 | -0.7 | 5.19 |

| 48 | New Mexico | 52.9% | -1.4 | -0.9 | 5.19 |

| 50 | Kentucky | 53.1% | -0.4 | -2.2 | 4.44 |

| 51 | North Dakota | 53.4% | -2.6 | -4.7 | 0.00 |

3 challenges that very small businesses face

As the very small business model becomes increasingly popular, the fabric of our economy will continue to evolve, too. States with especially high concentrations of very small businesses might see hard-to-predict impacts on job stability, wages, state GDP and more.

And in the meantime, very small business owners and solopreneurs face their own set of challenges. Here are a few of the most common — and some solutions to consider.

- Funding. As Schulz pointed out, it takes money to make money — and diversifying your pool of funding can be a change-maker. “While a small business credit card can be a useful way to get a quick start for your business,” Schulz says, “it’s important to also leverage other resources that might be available. For example, many government agencies as well as nonprofits and other organizations can help provide grants and loans that can make a huge difference. These organizations can also help with things beyond funding, including training, marketing and other vital functions of business.” Not sure where to start? Try a quick Google search for “small business resources near me,” Schulz suggests.

- Taxes. Although there are plenty of small business tax deductions not available to W-2 employees, freelancers and small businesses have to pay upfront for their supplies and keep track of all deductible expenses for the IRS. They also have to make quarterly tax payments to the IRS instead of having taxes automatically deducted from their paycheck. It can mean a much more complicated tax filing process. In addition, W-2 employees only have to pay half of their Social Security and Medicare (FICA) taxes, and their employer covers the other half. Solo entrepreneurs need to cover the full 15.3% self-employment tax themselves.

- Benefits. Another perk of working for someone else: Someone else footing at least some of the bill for benefits like health insurance coverage. Large companies can have more leverage to bargain with health insurance plans and score lower prices on both the employer and employee side. Business owners with no employees can turn to the health care marketplace to search for a plan that works for them, and small employers can enroll in the Small Business Health Options Program (SHOP) if they choose to provide employee coverage.

Methodology

LendingTree researchers analyzed U.S. Census Bureau Annual Business Survey data to find the states where very small businesses dominate.

Researchers found the number of businesses in each state that employed fewer than five workers in 2021, 2020 and 2017. We ranked the states by the:

- Percentage of businesses that employed fewer than five people in 2021

- Percentage point change from 2020 to 2021 (one-year)

- Percentage point change from 2017 to 2021 (five-year)

We then created a score using each state’s average rank across these three metrics.

Compare business loan offers