Cheapest Car Insurance for 18-Year-Olds (2026)

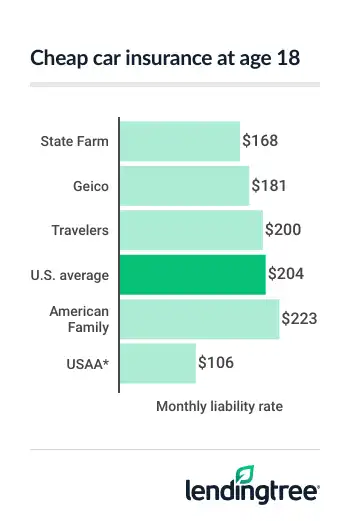

State Farm has the cheapest car insurance for most 18-year-olds. Its rates average $168 a month for liability only, and $396 a month for full coverage.

Best cheap car insurance for 18-year-olds

How much is car insurance for 18-year-olds?

Eighteen-year-olds pay an average of $204 a month for liability

You usually get cheaper rates on a parent’s policy when you’re 18 than you do on your own. For example, liability coverage only costs $182 a month on a parent’s car insurance. This is 20% less than you’re charged on your own.

Full coverage costs 27% less on a parent’s policy.

Insurance rates for 18-year-olds

| Policy type | Monthly liability | Monthly full coverage |

|---|---|---|

| Own policy | $204 | $482 |

| On a parent’s policy | $163 | $353 |

Your actual rate depends on factors like your driving record, vehicle and location. Each company treats these factors differently, and their rates vary by customer. This makes it good to compare car insurance quotes from a few companies to find the cheapest rate.

Does an 18-year-old need their own car insurance?

You usually need your own car insurance if you live on your own at age 18, but there are exceptions. Some companies let you stay on a parent’s car insurance if they are listed on your vehicle’s registration.

You can usually stay on a parent’s policy if you’re 18 years old and you:

- Live with your parents

- Are away at college or another facility for higher education

The rules on this differ among insurance companies and states. It’s good to discuss your options with your insurance agent, or the ones you contact for quotes.

Car insurance costs for 18-year-olds by gender

Car insurance costs 4% to 6% less for 18-year-old females than it does for males. This is mainly because young men have higher crash rates than young women.

Insurance rates for 18-year-olds by gender

| Driver | Females | Males | % difference |

|---|---|---|---|

| Minimum coverage | $199 | $208 | 4% |

| Full coverage | $467 | $497 | 6% |

Cheapest car insurance companies for 18-year-olds

State Farm has the cheapest car insurance for most 18-year-old drivers. It charges an average of $168 a month for liability policies and $396 a month for full coverage. USAA is cheaper, but it’s only available to the military community and their families.

Best auto rates for 18-year-olds

| Company | Monthly liability | Monthly full coverage | LendingTree score | |

|---|---|---|---|---|

| State Farm | $168 | $396 | ||

| Geico | $181 | $444 | ||

| Travelers | $200 | $441 | |

| American Family | $223 | $569 | |

| Progressive | $241 | $601 | ||

| AAA | $248 | $551 | |

| Nationwide | $264 | $602 | |

| Allstate | $297 | $679 | ||

| Farmers | $364 | $827 | |

| USAA* | $106 | $307 |

Cheapest car insurance by state for 18-year-olds

The companies with the cheapest car insurance for 18-year-olds vary by state. Major auto insurance companies like State Farm and Geico are the cheapest in several states. However, smaller ones like Erie and the Farm Bureau have the cheapest rates in many others.

This is why it’s good to get quotes from big and small car insurance companies when you shop.

Your state’s cheapest car insurance

| State | Cheapest liability | Monthly rate | Cheapest full coverage | Monthly rate |

|---|---|---|---|---|

| Alabama | Country Financial | $98 | Country Financial | $220 |

| Alaska | Allstate | $107 | Geico | $307 |

| Arizona | Travelers | $175 | Travelers | $374 |

| Arkansas | Alfa | $80 | Farm Bureau | $298 |

| California | Geico | $128 | Geico | $327 |

| Colorado | State Farm | $177 | Geico | $469 |

| Connecticut | Geico | $266 | Amica | $552 |

| Delaware | Geico | $236 | State Farm | $471 |

| Florida | Geico | $86 | State Farm | $434 |

| Georgia | Farm Bureau | $182 | Farm Bureau | $379 |

| Hawaii | Geico | $27 | Geico | $78 |

| Idaho | State Farm | $62 | State Farm | $179 |

| Illinois | Erie | $81 | Country Financial | $255 |

| Indiana | Travelers | $109 | Travelers | $255 |

| Iowa | IMT | $59 | IMT | $218 |

| Kansas | Travelers | $93 | Travelers | $260 |

| Kentucky | Farm Bureau | $111 | Travelers | $325 |

| Louisiana | Allstate | $211 | Allstate | $624 |

| Maine | Travelers | $87 | Travelers | $178 |

| Maryland | Erie | $149 | Erie | $349 |

| Massachusetts | Plymouth Rock | $115 | Plymouth Rock | $261 |

| Michigan | Auto-Owners | $102 | Auto-Owners | $331 |

| Minnesota | North Star Mutual | $108 | Travelers | $250 |

| Mississippi | State Farm | $97 | Farm Bureau | $278 |

| Missouri | Farm Bureau | $85 | Travelers | $284 |

| Montana | State Farm | $58 | State Farm | $249 |

| Nebraska | Farmers Mutual of Nebraska | $59 | Farmers Mutual of Nebraska | $182 |

| Nevada | Travelers | $242 | Travelers | $436 |

| New Hampshire | Concord | $95 | Concord | $197 |

| New Jersey | Geico | $97 | Geico | $179 |

| New Mexico | State Farm | $118 | Geico | $257 |

| New York | NYCM | $71 | Progressive | $251 |

| North Carolina | State Farm | $82 | Progressive | $140 |

| North Dakota | North Star Mutual | $44 | North Star Mutual | $173 |

| Ohio | Erie | $68 | Geico | $204 |

| Oklahoma | State Farm | $121 | State Farm | $363 |

| Oregon | Country Financial | $135 | State Farm | $266 |

| Pennsylvania | Erie | $64 | Travelers | $270 |

| Rhode Island | Progressive | $245 | Progressive | $554 |

| South Carolina | Farm Bureau | $160 | Farm Bureau | $270 |

| South Dakota | Farmers Mutual of Nebraska | $38 | Farmers Mutual of Nebraska | $153 |

| Tennessee | Erie | $93 | Travelers | $281 |

| Texas | State Farm | $125 | State Farm | $272 |

| Utah | Farm Bureau | $215 | Geico | $411 |

| Vermont | Co-Op | $40 | Co-Op | $128 |

| Virginia | Farm Bureau | $94 | Farm Bureau | $218 |

| Washington | Mutual of Enumclaw | $120 | Mutual of Enumclaw | $264 |

| Washington, D.C. | Geico | $196 | Geico | $387 |

| West Virginia | Erie | $68 | Erie | $269 |

| Wisconsin | Erie | $55 | American Family | $259 |

| Wyoming | American National | $36 | American National | $154 |

Best car insurance companies for 18-year-olds

State Farm has the best car insurance for 18-year-olds among large companies. Along with low rates, it has a good customer satisfaction rating from J.D Power

Erie is the best regional car insurance company for 18-year-olds. It’s cheaper than State Farm in some states, and it has a better satisfaction score. Unfortunately, it’s only available in 12 states

USAA is the best choice if you meet its military eligibility requirements

Best car insurance for 18-year-olds

| Company | Monthly liability rate | J.D. Power | LendingTree score |

|---|---|---|---|

| State Farm | $168 | 650 | |

| Erie | $97 | 703 | |

| USAA | $106 | 735 |

Best car insurance discounts for 18-year-olds

Car insurance discounts can help make your rates more affordable at any age. Some of the best ones to look for when you’re 18-years-old are good student, driver training and usage-based discounts.

Usage-based insurance

Most large companies have usage-based insurance (UBI), and several smaller ones do too. These plans usually use a smartphone app to monitor your driving. You get a discount just for signing up. If you drive safely enough, you get another discount each time you renew your policy.

It may feel weird to be monitored while you drive, but the savings can add up. You can save up to 30% with State Farm’s Drive Safe & Save app. Nationwide says you can save up to 40% with its SmartRide program.

Good student

Getting good grades can often score you a good student discount on car insurance. Companies that offer this discount usually require you to maintain a B average or better. Some companies, including Allstate, extend the discounts to students with a B- average.

Keep a copy of your school transcripts handy. You won’t need them for quotes, but you usually have to send a copy to your insurance company after you buy your policy.

Driver training

Passing a driver’s training or education course can also often help you save on car insurance at age 18. State Farm, Erie and Geico are among the companies that have this discount. The amount you can save varies by company and state.

Payment discounts

Several companies give you discounts based on how you shop and pay for insurance. Geico and Progressive give you a discount for getting your quotes online. Several companies also give you a discount for setting up automatic payments and going paperless.

Paying in full for your policy up front may place a short-term strain on your budget. However, doing so can often also help you save money on car insurance.

How much car insurance does an 18-year-old need?

The amount of car insurance you need at age 18 depends on your vehicle and financial situation.

Your state’s minimum car insurance requirements are a good start. Most states require liability insurance. Some states also require uninsured motorist

If you have a car loan, your lender will make you add collision

Why is car insurance so expensive for 18-year-olds?

Crash risks are the main reason why car insurance is expensive for 18-year-olds. A lack of driving experience makes young drivers more likely to get into accidents than older drivers (this includes 18- to 20-year-olds).

The good news is that your rates will become more affordable if you avoid tickets and accidents. For example, a 30-year-old with a good driving record pays an average of $177 a month for full coverage. This is 63% less than the average rate of $482 a month for 18-year-olds.

How we obtained car insurance rates for 18-year-olds

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical 18-year-old driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for an 18-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.