Cheapest Car Insurance in Delaware (2026)

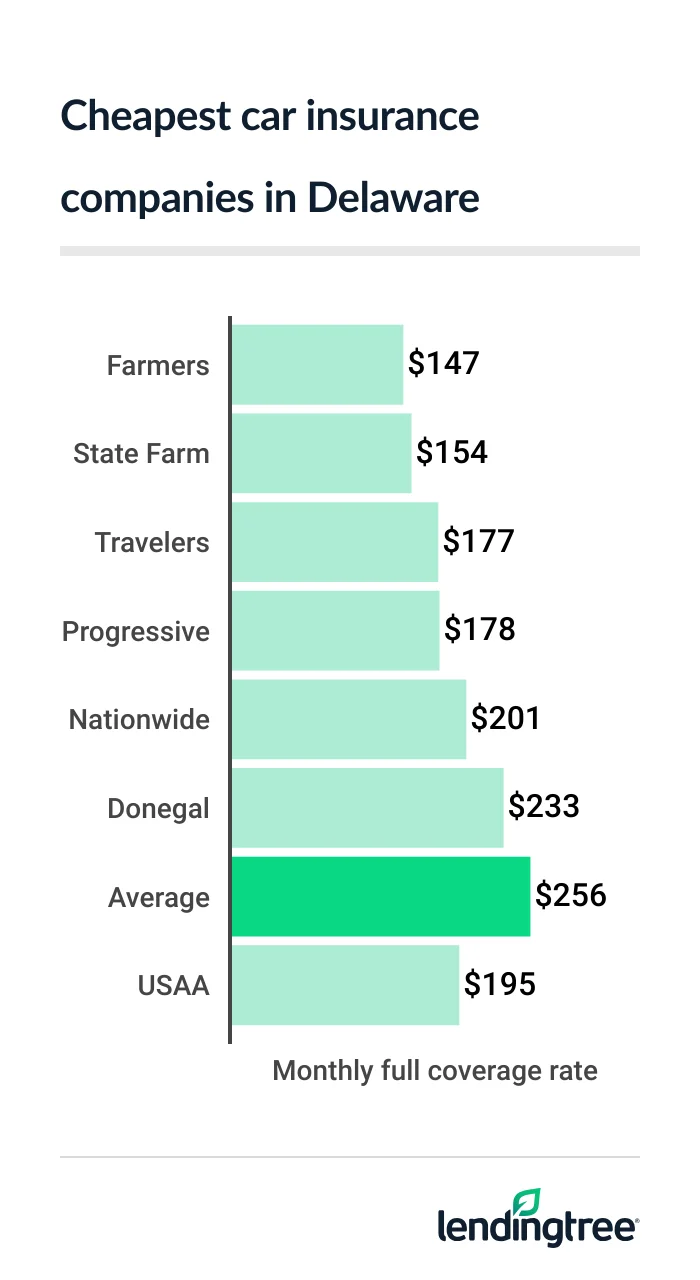

Farmers has Delaware’s cheapest full coverage car insurance, at $147 a month. This is $109 less than the state average of $256 per month.

Best cheap car insurance in Delaware

Cheapest full coverage car insurance in Delaware: Farmers

Farmers has Delaware’s cheapest full coverage car insurance, with rates that average $147 per month.

State Farm is close behind, at $154 per month. Travelers and Progressive are next at just under $180 per month.

The average rate for full coverage insurance in Delaware is $256 per month.

Because the state’s cheapest companies for full coverage are so close in price, discounts could make a big difference for you.

Still, Farmers offers more discounts than Progressive, State Farm or Travelers, so it’s a good place to start for most Delaware drivers.

Full coverage car insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Farmers | $147 | |

| State Farm | $154 | |

| Travelers | $177 | |

| Progressive | $178 | |

| Nationwide | $201 | |

| Donegal | $233 | |

| Geico | $250 | |

| Allstate | $402 | |

| Sentry | Sentry | $627 | Not rated |

| USAA* | $195 | |

Compare car insurance quotes from Farmers, Travelers, State Farm and Progressive. Use the same coverage amounts and deductibles

Delaware’s cheapest liability car insurance: Farmers

At $66 per month, Farmers has the cheapest liability car insurance quotes in Delaware.

State Farm and Travelers are the state’s next-cheapest companies for liability insurance

Liability car insurance rates

| Company | Monthly rate |

|---|---|

| Farmers | $66 |

| State Farm | $74 |

| Travelers | $75 |

| Geico | $85 |

| Nationwide | $97 |

| Progressive | $111 |

| Donegal | $117 |

| Allstate | $226 |

| Sentry | $237 |

| USAA* | $75 |

One reason to consider State Farm over Farmers is that State Farm earned a much better customer satisfaction score from the J.D. Power

Liability car insurance costs $116 per month in Delaware, on average. Farmers’ average rate is 43% cheaper, while State Farm and Travelers are both about 35% cheaper.

Best cheap car insurance for Delaware teens: Geico and State Farm

Most teen drivers in Delaware can get the cheapest car insurance from Geico and State Farm.

Geico has the state’s cheapest car insurance for teens who only want liability coverage, with rates of about $236 per month.

For Delaware teens who want full coverage, State Farm has the cheapest rates of around $471 per month.

Monthly car insurance rates for teen drivers

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Geico | $236 | $565 |

| State Farm | $255 | $471 |

| Farmers | $318 | $599 |

| Donegal | $335 | $638 |

| Nationwide | $371 | $789 |

| Progressive | $406 | $802 |

| Sentry | $466 | $1,040 |

| Travelers | $680 | $1,607 |

| Allstate | $792 | $1,513 |

| USAA* | $165 | $398 |

USAA’s average teen car insurance rates are even cheaper for both coverage types, but it’s only available to members of the military and their families.

If that includes you, make sure you get a quote from USAA. The company’s average rate for teen liability insurance is $165 per month, and its average full coverage rate for teens is $398.

The average cost of liability car insurance for Delaware teens is $403 per month. For full coverage, the state average is $842.

Cheap auto insurance in Delaware after a speeding ticket: Farmers

Farmers and State Farm have the cheapest car insurance in Delaware for drivers with a speeding ticket on their records. Both companies have an average rate of around $167 per month for these drivers. That’s half the state average of $348 per month.

Insurance rates after a speeding ticket

| Company | Monthly rate |

|---|---|

| Farmers | $166 |

| State Farm | $168 |

| Progressive | $233 |

| Donegal | $233 |

| Nationwide | $244 |

| Geico | $320 |

| Travelers | $423 |

| Allstate | $445 |

| Sentry | $995 |

| USAA* | $254 |

Although Farmers and State Farm both offer several car insurance discounts, Farmers has more. With Farmers, you could save money by bundling auto and home insurance policies with the company, paying on time and avoiding accidents.

You should expect your car insurance premium

Delaware’s cheapest insurance quotes after an accident: State Farm

With rates of around $154 per month, State Farm has the cheapest car insurance for drivers with an accident in Delaware. This is less than half the state average rate for these drivers, which is $378 per month.

Farmers is the second-cheapest company for drivers after an accident. Its rates average $194 per month.

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $154 |

| Farmers | $194 |

| Progressive | $223 |

| Donegal | $256 |

| Travelers | $284 |

| Nationwide | $300 |

| Geico | $423 |

| Allstate | $679 |

| Sentry | $1,075 |

| USAA* | $195 |

If you can get a few discounts from Farmers, it could be the cheapest company for you. Optional coverages could also make a difference.

Farmers and State Farm both offer car rental reimbursement and rideshare driver coverage, but only Farmers sells add-on coverage for new original parts

The average driver in Delaware sees their car insurance rate go up by 48% after an at-fault accident.

Best car insurance for teens with bad driving records in DE: State Farm

State Farm has Delaware’s cheapest auto insurance for teens with a speeding ticket or accident on their records. The company’s average rate for teens with a ticket is $284 per month. For teens with an accident, its rates average $255 per month.

Geico is second for teens with a ticket, $291 per month, and Donegal is second for teens with an accident, $352 per month.

Monthly rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $284 | $255 |

| Geico | $291 | $381 |

| Donegal | $335 | $352 |

| Farmers | $356 | $412 |

| Nationwide | $396 | $404 |

| Progressive | $424 | $478 |

| Sentry | $619 | $639 |

| Allstate | $905 | $1,158 |

| Travelers | $1,912 | $1,232 |

| USAA* | $267 | $165 |

Delaware teens who have family members in the military should get a quote from USAA, as its rates are even cheaper.

Teen and other young drivers pay a lot more for car insurance than older drivers, even if they have clean driving records. This is mostly because they get into more accidents.

How to save money on teen car insurance

Discounts are one of the best ways to save money on car insurance for teen drivers. While shopping for coverage, look for companies that offer discounts for:

- Getting good grades

- Taking a driver’s education or training program

- Leaving your car at home while you’re at college

Cheap Delaware car insurance after a DUI: Progressive

Delaware drivers looking for the cheapest DUI insurance should get a quote from Progressive, which has the state’s lowest rate of $217 per month. That’s less than half the state average of $452 per month for drivers with DUI (driving under the influence) convictions.

Nationwide and Donegal are the next-cheapest car insurance companies for drivers with a DUI on their records. The average rate for these companies is just under $390 per month.

DUI insurance rates by company

| Company | Monthly rate |

|---|---|

| Progressive | $217 |

| Nationwide | $387 |

| Donegal | $389 |

| Farmers | $410 |

| State Farm | $436 |

| Geico | $463 |

| Travelers | $500 |

| Allstate | $530 |

| Sentry | $831 |

| USAA* | $359 |

If you’re convicted of DUI in Delaware, you can expect your car insurance rates to go up by around 77%. However, Progressive customers only see their rates go up 22%, on average, after a DUI.

Cheapest car insurance in Delaware for bad credit: Progressive

Progressive and Nationwide have the cheapest car insurance for drivers with bad credit in Delaware, with average rates that are just under $280 per month.

Farmers is next, with rates that average $336 per month for drivers with poor credit.

Bad credit car insurance rates by company

| Company | Monthly rate |

|---|---|

| Progressive | $271 |

| Nationwide | $278 |

| Farmers | $336 |

| Travelers | $358 |

| Geico | $375 |

| State Farm | $400 |

| Donegal | $453 |

| Allstate | $638 |

| Sentry | $807 |

| USAA* | $343 |

On average, Delaware drivers with bad credit pay $426 per year for full coverage car insurance. You should pay less if you improve your credit score.

Two ways you can improve your credit and pay lower car insurance rates are to avoid late payments and to pay down your debt.

Best car insurance companies in Delaware

State Farm is the best car insurance company overall in Delaware.

Not only are the company’s car insurance rates among the cheapest in the state for most coverage and driver types, but it also scores well with customers. In fact, State Farm’s J.D. Power rating is the best of the companies we surveyed, after USAA.

Delaware car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Donegal | Not rated | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| Sentry | Not rated | A+ | Not rated |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Farmers is often cheaper than State Farm for Delaware residents with clean driving records, but its J.D. Power customer satisfaction score is not as good. Its AM Best financial strength rating also is worse than State Farm’s.

Delaware car insurance rates by city

The cheapest city for car insurance in Delaware is Fenwick Island, where rates average $204 per month. Elsmere is the state’s most expensive city for car insurance. Rates there average $310 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Arden | $260 | 1% |

| Bear | $286 | 12% |

| Bellefonte | $275 | 7% |

| Bethany Beach | $204 | -20% |

| Bethel | $226 | -12% |

| Bridgeville | $224 | -13% |

| Brookside | $271 | 6% |

| Camden | $229 | -11% |

| Camden Wyoming | $229 | -11% |

| Cheswold | $234 | -9% |

| Claymont | $276 | 8% |

| Clayton | $239 | -7% |

| Dagsboro | $214 | -16% |

| Delaware City | $302 | 18% |

| Delmar | $225 | -12% |

| Dewey Beach | $206 | -20% |

| Dover | $235 | -8% |

| Dover Air Force Base | $230 | -10% |

| Dover Base Housing | $235 | -8% |

| Edgemoor | $302 | 18% |

| Ellendale | $226 | -12% |

| Elsmere | $310 | 21% |

| Felton | $229 | -11% |

| Fenwick Island | $204 | -20% |

| Frankford | $214 | -17% |

| Frederica | $230 | -10% |

| Georgetown | $224 | -13% |

| Glasgow | $283 | 11% |

| Greenville | $252 | -2% |

| Greenwood | $221 | -14% |

| Harbeson | $218 | -15% |

| Harrington | $222 | -13% |

| Hartly | $233 | -9% |

| Henlopen Acres | $206 | -20% |

| Highland Acres | $235 | -9% |

| Hockessin | $259 | 1% |

| Houston | $229 | -11% |

| Kent Acres | $235 | -8% |

| Kirkwood | $281 | 10% |

| Laurel | $228 | -11% |

| Lewes | $207 | -19% |

| Lincoln | $227 | -11% |

| Little Creek | $250 | -2% |

| Long Neck | $216 | -16% |

| Magnolia | $229 | -11% |

| Marydel | $230 | -10% |

| Middletown | $249 | -3% |

| Milford | $225 | -12% |

| Millsboro | $218 | -15% |

| Millville | $211 | -18% |

| Milton | $212 | -17% |

| Montchanin | $266 | 4% |

| Nassau | $238 | -7% |

| New Castle | $301 | 17% |

| Newark | $275 | 7% |

| Newport | $278 | 9% |

| North Star | $259 | 1% |

| Ocean View | $205 | -20% |

| Odessa | $258 | 1% |

| Pike Creek | $257 | 0% |

| Pike Creek Valley | $258 | 1% |

| Port Penn | $263 | 3% |

| Rehoboth Beach | $206 | -20% |

| Rising Sun-Lebanon | $228 | -11% |

| Riverview | $229 | -11% |

| Rockland | $269 | 5% |

| Rodney Village | $234 | -9% |

| Seaford | $228 | -11% |

| Selbyville | $209 | -18% |

| Smyrna | $241 | -6% |

| South Bethany | $204 | -20% |

| St. Georges | $292 | 14% |

| Townsend | $245 | -4% |

| Viola | $228 | -11% |

| Wilmington | $307 | 20% |

| Wilmington Manor | $302 | 18% |

| Winterthur | $257 | 0% |

| Woodside | $248 | -3% |

| Woodside East | $229 | -11% |

| Wyoming | $229 | -11% |

| Yorklyn | $255 | -1% |

Where you live isn’t the only factor that impacts what you pay for car insurance. Companies also consider your age, gender, insurance history and the car you drive when coming up with your rate.

This is why you should compare car insurance quotes from several companies before you renew or buy a policy. It’s one of the best ways to get the cheapest rate for the coverage you need.

Minimum coverage for car insurance in Delaware

You need to have at least 25/50/10 car insurance to drive legally in Delaware. This means you must buy, at a minimum:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $10,000

- Personal injury protection (PIP): $15,000 per person, $30,000 per accident

Bodily injury and property damage liability covers injuries and damage you cause to other people and their property.

PIP covers injuries to you and your passengers, no matter who causes the accident.

Optional car insurance coverage in Delaware

Delaware state law doesn’t require you to get collision

Uninsured motorist is another optional coverage that’s often worth getting. It covers you and your passengers for injuries caused by a driver without insurance.

Frequently asked questions

The average cost of car insurance in Delaware is $256 per month for drivers who get full coverage. If you only get liability coverage, the state average cost is $116 per month.

The average cost of car insurance in Wilmington is $307 per month. This is 20% higher than the state average of $256 per month.

Also, these average rates are for full coverage car insurance. If you only get liability coverage, your rate should be lower.

The cheapest car insurance in Delaware comes from Farmers if you have a clean driving record. The company’s average rate is $66 per month for liability-only coverage.

For full coverage car insurance, Farmers’ average rate is $147 per month. That’s also the state’s cheapest for drivers with clean records.

State Farm has Delaware’s cheapest car insurance if you have an at-fault accident on your record. Progressive is the cheapest with a DUI.

Some of the best ways to save money on car insurance in Delaware or anywhere else are to look for discounts, raise your deductible, drop coverage you don’t need and compare quotes from several companies.

Farmers offers more car insurance discounts than any other company we surveyed in Delaware. Some are easy to get, too, like Farmers’ discounts for homeowners, going paperless, paying on time or in full and cars with anti-theft devices.

State Farm has the best customer service of the car insurance companies we surveyed in Delaware. This is mostly because of the company’s great customer satisfaction score from J.D. Power.

USAA’s J.D. Power score is even better, but only members of the military and their families qualify. If you have these military ties, though, consider USAA if customer service is important to you.

Your car insurance rate is based on several different factors. These include your age, gender, marital status and where you live. The car you drive and your driving and insurance histories also play a role in what you pay for car insurance.

If you are convicted of driving without car insurance in Delaware, you could be fined and lose your license.

You may be fined at least $1,500 for a first offense of driving without insurance in Delaware, and $3,000 for every time after that within the next three years.

The state also might suspend your driver’s license or driving privileges for six months.

No. Delaware has at-fault car accident laws. If you cause an accident, you or your insurance company has to pay for each victim’s medical treatment and car repairs. The amounts you owe may be reduced if the victim or another driver is partially responsible for the accident.

How we selected the cheapest car insurance companies in Delaware

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $15,000 per person, $30,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Delaware

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.