Best Cheap Car Insurance in Hawaii (2026)

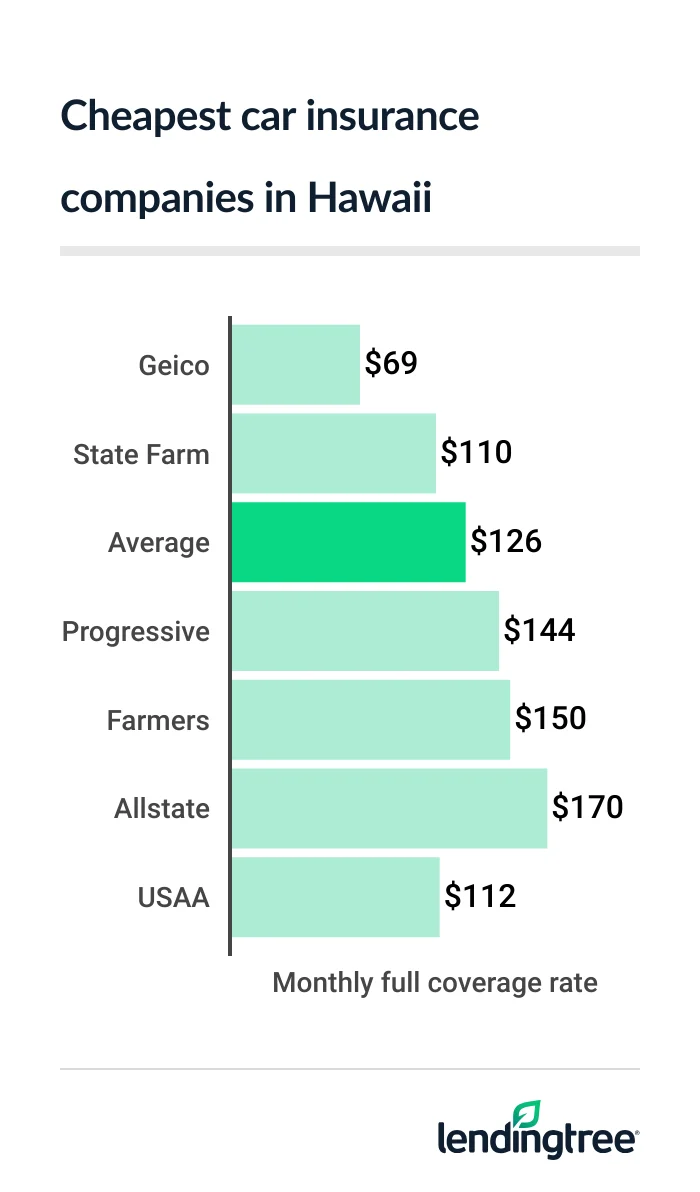

Geico has Hawaii’s cheapest car insurance for most drivers, at $69 a month for full coverage. This is $57 less than the state average of $126 a month.

Cheap Hawaii car insurance

Hawaii’s cheapest full coverage car insurance: Geico

At $69 a month, Geico has the cheapest full coverage car insurance in Hawaii. This is 37% less than the next-cheapest rate of $110 a month from State Farm.

Geico has a few more discounts than State Farm, which can make it even cheaper for full coverage insurance

In Hawaii, drivers pay an average of $126 a month for full coverage. Your actual rate depends on factors like your driving record and the type of car you drive.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Geico | $69 | |

| State Farm | $110 |  |

| Progressive | $144 | |

| Farmers | $150 | |

| Allstate | $170 | |

| USAA* | $112 | |

Each company treats these factors differently and offers different car insurance discounts. Comparing car insurance quotes from multiple companies helps you find the cheapest rate.

Cheap minimum coverage car insurance in Hawaii: Geico

Geico has Hawaii’s cheapest liability insurance, or minimum coverage, at $24 a month. This is 48% less than the state average of $46 a month. USAA has the next-cheapest rate at $31 a month, but it’s only available to the military community.

Minimum coverage in Hawaii includes liability insurance

Minimum coverage auto insurance rates

| Company | Monthly rate |

|---|---|

| Geico | $24 |

| State Farm | $41 |

| Farmers | $49 |

| Progressive | $62 |

| Allstate | $67 |

| USAA | $31 |

Geico and USAA are both military friendly companies.

- Geico offers car insurance discounts to active duty and retired service members, reservists and guardsmen. It gives you an additional discount during emergency deployments.

- USAA is available to these groups, plus honorably discharged veterans and their families.

Of the two companies, USAA has a higher satisfaction rating from J.D. Power

Best car insurance rates for Hawaii teens: Geico

Geico has Hawaii’s cheapest car insurance for teens. Its young driver rates average $27 a month for minimum coverage and $78 a month for full coverage.

State Farm has the next-cheapest minimum coverage for most teens at $41 a month. Its full coverage rates average $110 a month.

Young driver insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Geico | $27 | $78 |

| State Farm | $41 | $110 |

| Farmers | $49 | $150 |

| Allstate | $67 | $170 |

| Progressive | $80 | $186 |

| USAA* | $31 | $112 |

Geico and State Farm both offer discounts to young drivers who:

- Get good grades

- Complete an approved driving training program

- Go off to college without a car

State Farm’s Drive Safe & Save program can be particularly useful for teens in Hawaii. The program’s app monitors your driving and gives you a discount for driving safely. It also provides feedback you can use to improve your driving skills.

Geico does not offer a similar usage-based insurance program in Hawaii.

Cheap auto insurance with a speeding ticket: Geico

Hawaii drivers with a speeding ticket get the cheapest auto insurance quotes from Geico. The company’s full coverage rates average $69 a month after a ticket. State Farm is the next-cheapest company for most drivers at $121 a month.

Car insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| Geico | $69 |

| State Farm | $121 |

| Farmers | $150 |

| Progressive | $197 |

| Allstate | $243 |

| USAA* | $117 |

A speeding ticket raises insurance rates in Hawaii by an average of 19% to $149 a month. However, some companies raise their rates by lower amounts. Shopping around can help you save on car insurance with a bad driving record.

Best auto insurance rates after an accident: Geico

Geico has Hawaii’s cheapest auto insurance after an at-fault accident at $101 a month. This is 23% less than the next-cheapest rate of $131 a month from State Farm. An at-fault accident raises the average cost of car insurance in Hawaii by 39% to $175 a month.

Insurance rates with an at-fault accident

| Company | Monthly rate |

|---|---|

| Geico | $101 |

| State Farm | $131 |

| Farmers | $198 |

| Progressive | $216 |

| Allstate | $264 |

| USAA* | $138 |

Cheap car insurance for teens with a ticket or accident: Geico

Hawaii teens with a bad driving record can get the cheapest car insurance from Geico. The company charges $27 a month after a ticket and $36 a month after an accident.

State Farm is the next-cheapest company for most teens. Its rates average $45 a month after a ticket at $50 a month after an accident.

Insurance rates for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Geico | $27 | $36 |

| State Farm | $45 | $50 |

| Farmers | $49 | $66 |

| Progressive | $101 | $112 |

| Allstate | $105 | $108 |

| USAA* | $32 | $39 |

Cheapest Hawaii car insurance after a DUI: Farmers

At $211 a month, Farmers has the cheapest car insurance for Hawaii drivers with a DUI (driving under the influence). Progressive has the next-cheapest DUI insurance at $244 a month. At $266 a month, State Farm’s rate is also lower than the state average of $329 a month.

DUI car insurance rates

| Company | Monthly rate |

|---|---|

| Farmers | $211 |

| Progressive | $244 |

| State Farm | $266 |

| Geico | $487 |

| Allstate | $536 |

| USAA* | $229 |

Hawaii’s best car insurance companies

Geico is Hawaii’s best car insurance company for cheap rates. It charges 45% less than the state average for full coverage. It also offers several discounts that make its rates even more affordable. These include discounts for:

- Homeowners

- Drivers with no tickets or violations

- Federal employees

- Active duty or retired military service members

Progressive, on the other hand, has the state’s best coverage options. It offers a form of gap insurance

Progressive also offers accident forgiveness

USAA is the best choice if you or a family member are or have been in the military. Along with low rates, USAA has the best satisfaction score from J.D. Power. This means its customers generally like its combination of price, coverage and service.

Car insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Hawaii car insurance rates by city

Car insurance rates range from $116 a month to $142 a month in Hawaii’s cities and towns.

Poipu, Princeville and 20 other areas have the cheapest rates of $116 a month. This is 8% less than the state average.

Drivers in Hilo, Waikoloa and 43 other areas pay $142 a month, or 13% more than average.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Ahuimanu | $134 | 7% |

| Aiea | $134 | 7% |

| Ainaloa | $142 | 13% |

| Anahola | $116 | -8% |

| Camp H M Smith | $134 | 6% |

| Captain Cook | $142 | 13% |

| Eleele | $116 | -8% |

| Ewa Beach | $135 | 7% |

| Ewa Gentry | $135 | 7% |

| Ewa Villages | $135 | 7% |

| Fern Acres | $142 | 13% |

| Fort Shafter | $134 | 6% |

| Haiku | $128 | 2% |

| Haiku-Pauwela | $128 | 2% |

| Hakalau | $142 | 13% |

| Halaula | $142 | 13% |

| Halawa | $134 | 7% |

| Haleiwa | $134 | 7% |

| Haliimaile | $128 | 2% |

| Hana | $128 | 2% |

| Hanalei | $116 | -8% |

| Hanamaulu | $116 | -8% |

| Hanapepe | $116 | -8% |

| Hauula | $134 | 7% |

| Hawaii National Park | $142 | 13% |

| Hawaiian Acres | $142 | 13% |

| Hawaiian Beaches | $142 | 13% |

| Hawaiian Ocean View | $142 | 13% |

| Hawaiian Paradise Park | $142 | 13% |

| Hawi | $142 | 13% |

| Heeia | $134 | 7% |

| Hickam Housing | $134 | 6% |

| Hilo | $142 | 13% |

| Holualoa | $142 | 13% |

| Honalo | $142 | 13% |

| Honaunau | $142 | 13% |

| Honaunau-Napoopoo | $142 | 13% |

| Honokaa | $142 | 13% |

| Honolulu | $134 | 7% |

| Honomu | $142 | 13% |

| Hoolehua | $124 | -1% |

| Iroquois Point | $135 | 7% |

| JBPHH | $134 | 6% |

| Kaaawa | $134 | 7% |

| Kaanapali | $128 | 2% |

| Kahaluu | $134 | 7% |

| Kahaluu-Keauhou | $142 | 13% |

| Kahuku | $134 | 7% |

| Kahului | $128 | 2% |

| Kailua | $138 | 10% |

| Kailua Kona | $142 | 13% |

| Kalaheo | $116 | -8% |

| Kalaoa | $142 | 13% |

| Kalaupapa | $125 | 0% |

| Kamuela | $142 | 13% |

| Kaneohe | $134 | 7% |

| Kaneohe Station | $134 | 7% |

| Kapaa | $116 | -8% |

| Kapaau | $142 | 13% |

| Kapalua | $128 | 2% |

| Kapolei | $134 | 7% |

| Kaumakani | $116 | -8% |

| Kaunakakai | $124 | -1% |

| Keaau | $142 | 13% |

| Kealakekua | $142 | 13% |

| Kealia | $116 | -8% |

| Keauhou | $142 | 13% |

| Kekaha | $116 | -8% |

| Keokea | $128 | 2% |

| Kihei | $128 | 2% |

| Kilauea | $116 | -8% |

| Ko Olina | $134 | 7% |

| Koloa | $116 | -8% |

| Kualapuu | $124 | -1% |

| Kula | $128 | 2% |

| Kunia | $134 | 7% |

| Kurtistown | $142 | 13% |

| Lahaina | $128 | 2% |

| Laie | $134 | 7% |

| Lanai City | $120 | -4% |

| Launiupoko | $128 | 2% |

| Laupahoehoe | $142 | 13% |

| Lawai | $116 | -8% |

| Lihue | $116 | -8% |

| MCBH Kaneohe Bay | $134 | 6% |

| Maalaea | $128 | 2% |

| Mahinahina | $128 | 2% |

| Maili | $134 | 7% |

| Makaha | $134 | 7% |

| Makakilo | $135 | 8% |

| Makawao | $128 | 2% |

| Makaweli | $116 | -8% |

| Maunaloa | $124 | -1% |

| Maunawili | $134 | 7% |

| Mililani | $134 | 7% |

| Mililani Mauka | $134 | 7% |

| Mililani Town | $134 | 7% |

| Mokuleia | $134 | 7% |

| Mountain View | $142 | 13% |

| Naalehu | $142 | 13% |

| Nanakuli | $134 | 7% |

| Nanawale Estates | $142 | 13% |

| Napili-Honokowai | $128 | 2% |

| Ninole | $142 | 13% |

| Ocean Pointe | $135 | 7% |

| Ocean View | $142 | 13% |

| Olinda | $128 | 2% |

| Omao | $116 | -8% |

| Ookala | $142 | 13% |

| Orchidlands Estates | $142 | 13% |

| Paauilo | $142 | 13% |

| Pahala | $142 | 13% |

| Pahoa | $142 | 13% |

| Paia | $128 | 2% |

| Papaaloa | $142 | 13% |

| Papaikou | $142 | 13% |

| Pearl City | $134 | 7% |

| Pepeekeo | $142 | 13% |

| Poipu | $116 | -8% |

| Princeville | $116 | -8% |

| Puako | $142 | 13% |

| Puhi | $116 | -8% |

| Pukalani | $128 | 2% |

| Punaluu | $134 | 7% |

| Pupukea | $134 | 7% |

| Puunene | $128 | 2% |

| Royal Kunia | $135 | 7% |

| Schofield Barracks | $134 | 7% |

| Tripler Army Medical Center | $134 | 6% |

| Volcano | $139 | 11% |

| Wahiawa | $134 | 7% |

| Waialua | $134 | 7% |

| Waianae | $134 | 7% |

| Waihee-Waiehu | $128 | 2% |

| Waikane | $134 | 7% |

| Waikapu | $128 | 2% |

| Waikele | $135 | 7% |

| Waikoloa | $142 | 13% |

| Waikoloa Village | $142 | 13% |

| Wailea | $128 | 2% |

| Wailua | $116 | -8% |

| Wailua Homesteads | $116 | -8% |

| Wailuku | $128 | 2% |

| Waimalu | $134 | 7% |

| Waimanalo | $137 | 9% |

| Waimanalo Beach | $137 | 9% |

| Waimea | $129 | 3% |

| Wainaku | $142 | 13% |

| Wainiha | $116 | -8% |

| Waipahu | $135 | 7% |

| Waipio | $135 | 7% |

| Waipio Acres | $134 | 7% |

| Wake Island | $134 | 6% |

| West Loch Estate | $135 | 7% |

| Wheeler AFB | $134 | 7% |

| Wheeler Army Airfield | $134 | 6% |

| Whitmore Village | $134 | 7% |

Auto insurance requirements in Hawaii

Hawaii requires auto insurance with personal injury protection (PIP) and liability coverage. The state’s minimum car insurance requirements include:

-

Bodily injury liability

: $20,000 per person, $40,000 per accidentBodily injury liability helps cover the medical bills of anyone you injure in a car accident.

-

Property damage liability

: $10,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

-

Personal injury protection

: $10,000PIP covers injuries to you and your passengers, whether you or another driver causes the accident. It also covers lost wages and certain other expenses.

You usually need to add collision

Under the state’s no-fault laws, your own PIP covers injuries to you and your passengers. If you severely injure someone, you may have to cover some of their costs. Your policy’s bodily injury liability covers these expenses.

The state’s no-fault laws do not apply to property damage. If you cause an accident, you have to pay for your victim’s car repairs. This is what your property damage liability covers.

Frequently asked questions

The average price of car insurance in Hawaii is $126 a month for full coverage. Minimum no-fault coverage costs an average of $69 a month.

Yes. Hawaii is a no-fault state for car insurance. Your own insurance covers your initial medical treatment for car accident injuries, no matter who caused the crash.

If you cause an accident, you still have to pay for other people’s car repairs. You may also have to cover portions of your victim’s costs if their injuries are severe. Your liability coverage protects you from expenses like these.

Geico has the cheapest car insurance in Hawaii. Its rates average $69 a month for full coverage and only $24 a month for minimum coverage.

How we selected the cheapest car insurance companies in Hawaii

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Hawaii

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.