Cheapest Car Insurance in Idaho (2026)

State Farm has the cheapest car insurance for most Idaho drivers. Its rates average $61 a month for full coverage and $18 a month for liability insurance.

Best cheap Idaho car insurance

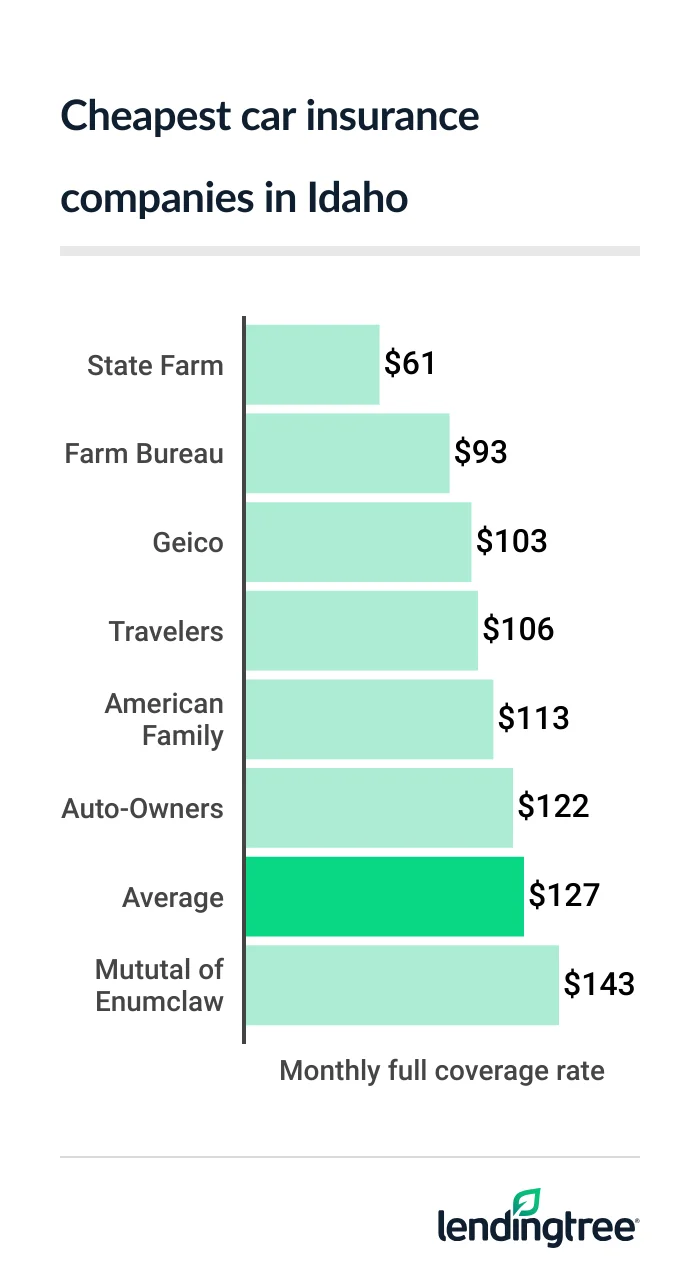

Cheapest full coverage car insurance in Idaho: State Farm

State Farm has the cheapest full coverage car insurance in Idaho, at $61 a month.

Full coverage auto insurance rates by company

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $61 | |

| Farm Bureau | $93 | |

| Geico | $103 | |

| Travelers | $106 | |

| American Family | $113 | |

| Auto-Owners | $122 | |

| Mutual of Enumclaw | $143 | |

| Allstate | $171 | |

| Sentry | Sentry | $227 | Not rated |

Full coverage

Each company treats these factors differently and has different car insurance discounts. This makes it good to compare car insurance quotes to find the cheapest rate.

Idaho’s cheapest liability insurance: State Farm

At $18 a month, State Farm has Idaho’s cheapest liability insurance. However, Geico offers a few more discounts than State Farm. These include discounts for federal employees and military service members. If you qualify, Geico may have the cheapest liability-only insurance

Liability-only insurance rates

| Company | Monthly rate |

|---|---|

| State Farm | $18 |

| American Family | $32 |

| Geico | $35 |

| Farm Bureau | $38 |

| Auto-Owners | $40 |

| Travelers | $41 |

| Allstate | $67 |

| Mutual of Enumclaw | $68 |

| Sentry | $70 |

Cheap car insurance for Idaho teens: State Farm

Idahoans can get the cheapest car insurance for teens from State Farm. The company’s liability rates for young drivers average $62 a month. This is 27% less than the next-cheapest rate of $85 a month from the Farm Bureau.

State Farm charges teens an average $179 a month for full coverage. This is 12% less than Farm Bureau’s rate of $203 a month.

Auto insurance rates for teens

| Company | Liability coverage | Full coverage |

|---|---|---|

| State Farm | $62 | $179 |

| Farm Bureau | $85 | $203 |

| Auto-Owners | $124 | $284 |

| Travelers | $128 | $290 |

| Geico | $136 | $361 |

| Sentry | $169 | $433 |

| Mutual of Enumclaw | $177 | $320 |

| Allstate | $201 | $562 |

| American Family | $216 | $650 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why they get charged so much for car insurance. Teens usually get charged less on a parent’s policy than they do on their own.

Most companies give young drivers a good student discount for getting good grades. State Farm, Geico and Travelers also give teens a discount for completing a driver training program. Farm Bureau does not offer this discount.

Best car insurance rates after a ticket: State Farm

Idaho drivers with a speeding ticket get the best car insurance rates from State Farm. The company charges drivers with a ticket $65 a month for full coverage. Farm Bureau has the next-cheapest rate at $93 a month.

| Company | Monthly rate |

|---|---|

| State Farm | $65 |

| Farm Bureau | $93 |

| Auto-Owners | $122 |

| Travelers | $127 |

| Geico | $134 |

| American Family | $135 |

| Mutual of Enumclaw | $197 |

| Allstate | $198 |

| Sentry | $362 |

A speeding ticket raises car insurance rates by an average of 26% to $159 a month in Idaho. However, some companies increase their rates by lower amounts. Shopping around can help you save money on car insurance with a bad driving record.

Cheap Idaho car insurance after an accident: State Farm

At $70 a month, State Farm has Idaho’s cheapest auto insurance after an at-fault accident. This is 65% less than the state average of $202 a month with an accident. Farm Bureau has the next-cheapest rate, at $122 a month.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $70 |

| Farm Bureau | $122 |

| Travelers | $141 |

| Auto-Owners | $176 |

| Geico | $195 |

| American Family | $214 |

| Mutual of Enumclaw | $237 |

| Allstate | $275 |

| Sentry | $390 |

Best for Idaho teens with a bad driving record: State Farm

Idaho teens with a bad driving record can get the best car insurance rates from State Farm. The company charges young drivers with a speeding ticket an average of $68 a month. Its rates for young drivers with an accident average $74 a month.

Teen rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $68 | $74 |

| Farm Bureau | $85 | $111 |

| Auto-Owners | $144 | $198 |

| Travelers | $158 | $187 |

| Geico | $158 | $176 |

| Sentry | $223 | $230 |

| American Family | $239 | $252 |

| Allstate | $241 | $364 |

| Mutual of Enumclaw | $267 | $318 |

Cheapest for Idaho drivers with a DUI: Travelers

At $145 a month. Travelers has Idaho’s cheapest car insurance for drivers with a DUI (driving under the influence). State Farm has the next-cheapest DUI insurance, at $190 a month.

Car insurance costs an average of $242 a month after a DUI in Idaho. Farm Bureau, Allstate and American Family also charge less than this average.

Car insurance rates with a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $145 |

| State Farm | $190 |

| Farm Bureau | $207 |

| Allstate | $229 |

| American Family | $229 |

| Mutual of Enumclaw | $257 |

| Auto-Owners | $262 |

| Sentry | $296 |

| Geico | $360 |

Idaho’s best car insurance for bad credit: State Farm

State Farm has Idaho’s cheapest car insurance for bad credit, at $121 a month. This is 14% less than the next-cheapest rate of $141 a month from Farm Bureau.

State Farm also offers a few more discounts than Farm Bureau, which can make it an even cheaper option.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| State Farm | $121 |

| Farm Bureau | $141 |

| Geico | $148 |

| Travelers | $156 |

| American Family | $173 |

| Auto-Owners | $188 |

| Mutual of Enumclaw | $205 |

| Allstate | $249 |

| Sentry | $294 |

Best car insurance companies in Idaho

State Farm is the best car insurance company to contact for quotes in Idaho. Along with low rates, it also has a good satisfaction rating from J.D. Power. This means its customers are generally happy with its prices, coverage options and service.

Although it’s more expensive, Travelers has better coverage options than State Farm. It offers accident forgiveness and new car replacement, which State Farm doesn’t have.

- Accident forgiveness protects you from a rate increase after your first at-fault accident.

- New car replacement protects your investment in a new vehicle. If your car is totaled, you only have to pay your deductible to get a new one. Without it, your car is only covered at its depreciated value, after age and wear. This can be a lot less than the price of a new model.

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 3.2 | 635 | A+ |

| American Family | 4.1 | 640 | A |

| Auto-Owners | 4.8 | 638 | A+ |

| Farm Bureau | 4.0 | 645 | A |

| Geico | 3.7 | 645 | A++ |

| Mutual of Enumclaw | 4.1 | Not rated | Not rated |

| Sentry | Not rated | Not rated | A+ |

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

Idaho car insurance rates by city

At $113 a month for full coverage, Mountain Home has the cheapest car insurance among Idaho’s cities and towns. Glenns Ferry has the next-cheapest rate, at $115 a month.

On the flip side, Kootenai has Idaho’s most expensive car insurance, at $137 a month. This is 8% higher than the state average. Colburn has the next-highest rate, at $135 a month.

Boise drivers pay an average of $121 a month, or 5% less than the state average.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $128 | 1% |

| Ahsahka | $132 | 4% |

| Albion | $125 | -2% |

| Almo | $123 | -3% |

| American Falls | $125 | -2% |

| Ammon | $133 | 5% |

| Arbon | $127 | 0% |

| Arbon Valley | $127 | 0% |

| Arco | $131 | 3% |

| Arimo | $129 | 2% |

| Ashton | $128 | 1% |

| Athol | $132 | 4% |

| Atomic City | $133 | 5% |

| Avery | $125 | -1% |

| Bancroft | $127 | 0% |

| Banks | $121 | -4% |

| Basalt | $132 | 4% |

| Bayview | $132 | 5% |

| Bellevue | $121 | -4% |

| Bern | $125 | -1% |

| Blackfoot | $133 | 5% |

| Blanchard | $128 | 1% |

| Bliss | $119 | -6% |

| Bloomington | $125 | -1% |

| Boise City | $121 | -5% |

| Bonners Ferry | $131 | 4% |

| Bovill | $122 | -4% |

| Bruneau | $126 | -1% |

| Buhl | $122 | -4% |

| Burley | $125 | -1% |

| Calder | $126 | 0% |

| Caldwell | $133 | 5% |

| Cambridge | $123 | -3% |

| Carey | $123 | -3% |

| Careywood | $132 | 4% |

| Carmen | $133 | 5% |

| Cascade | $120 | -5% |

| Castleford | $121 | -4% |

| Cataldo | $127 | 0% |

| Challis | $126 | -1% |

| Chester | $126 | 0% |

| Chubbuck | $129 | 2% |

| Clark Fork | $131 | 3% |

| Clarkia | $128 | 1% |

| Clayton | $125 | -2% |

| Clifton | $128 | 1% |

| Cobalt | $131 | 3% |

| Cocolalla | $132 | 4% |

| Coeur d’Alene | $128 | 1% |

| Colburn | $135 | 6% |

| Conda | $129 | 1% |

| Coolin | $130 | 3% |

| Corral | $122 | -4% |

| Cottonwood | $128 | 1% |

| Council | $124 | -2% |

| Craigmont | $132 | 4% |

| Culdesac | $127 | 0% |

| Dalton Gardens | $127 | 1% |

| Dayton | $129 | 2% |

| Deary | $122 | -4% |

| Declo | $124 | -2% |

| Desmet | $128 | 1% |

| Dietrich | $125 | -1% |

| Dingle | $130 | 2% |

| Donnelly | $120 | -5% |

| Dover | $131 | 3% |

| Downey | $130 | 3% |

| Driggs | $130 | 2% |

| Dubois | $127 | 0% |

| Eagle | $124 | -2% |

| Eastport | $130 | 3% |

| Eden | $121 | -4% |

| Elk City | $128 | 1% |

| Elk River | $127 | 0% |

| Ellis | $126 | -1% |

| Emmett | $121 | -5% |

| Fairfield | $122 | -4% |

| Felt | $130 | 2% |

| Fenn | $128 | 1% |

| Ferdinand | $132 | 4% |

| Fernwood | $128 | 1% |

| Filer | $126 | -1% |

| Firth | $133 | 5% |

| Fish Haven | $126 | 0% |

| Fort Hall | $130 | 3% |

| Franklin | $130 | 3% |

| Fruitland | $120 | -5% |

| Garden City | $122 | -4% |

| Garden Valley | $121 | -4% |

| Genesee | $121 | -4% |

| Geneva | $127 | 1% |

| Georgetown | $126 | 0% |

| Gibbonsville | $132 | 4% |

| Glenns Ferry | $115 | -9% |

| Gooding | $119 | -6% |

| Grace | $127 | 0% |

| Grand View | $125 | -1% |

| Grangeville | $125 | -2% |

| Greencreek | $127 | 0% |

| Greenleaf | $129 | 2% |

| Groveland | $133 | 5% |

| Hagerman | $120 | -5% |

| Hailey | $121 | -4% |

| Hamer | $127 | 1% |

| Hammett | $116 | -8% |

| Hansen | $123 | -3% |

| Harrison | $129 | 2% |

| Harvard | $120 | -5% |

| Hayden | $129 | 2% |

| Hazelton | $121 | -5% |

| Heyburn | $123 | -3% |

| Hill City | $122 | -4% |

| Holbrook | $128 | 1% |

| Homedale | $128 | 1% |

| Hope | $129 | 2% |

| Horseshoe Bend | $122 | -3% |

| Howe | $131 | 4% |

| Idaho City | $123 | -3% |

| Idaho Falls | $133 | 5% |

| Indian Valley | $121 | -5% |

| Inkom | $128 | 1% |

| Iona | $134 | 6% |

| Irwin | $129 | 1% |

| Island Park | $128 | 1% |

| Jerome | $122 | -4% |

| Juliaetta | $124 | -2% |

| Kamiah | $130 | 2% |

| Kellogg | $127 | 0% |

| Kendrick | $126 | -1% |

| Ketchum | $120 | -6% |

| Kimberly | $126 | -1% |

| King Hill | $117 | -7% |

| Kingston | $126 | -1% |

| Kooskia | $128 | 1% |

| Kootenai | $137 | 8% |

| Kuna | $123 | -3% |

| Laclede | $131 | 4% |

| Lake Fork | $131 | 4% |

| Lapwai | $124 | -2% |

| Lava Hot Springs | $127 | 0% |

| Leadore | $134 | 6% |

| Lemhi | $133 | 5% |

| Lenore | $128 | 1% |

| Letha | $130 | 2% |

| Lewiston | $123 | -3% |

| Lewisville | $131 | 3% |

| Lincoln | $133 | 5% |

| Lowman | $121 | -4% |

| Lucile | $126 | -1% |

| Mackay | $125 | -2% |

| Macks Inn | $128 | 1% |

| Malad City | $127 | 0% |

| Malta | $125 | -1% |

| Marsing | $129 | 2% |

| May | $131 | 4% |

| McCall | $118 | -7% |

| McCammon | $128 | 1% |

| Medimont | $129 | 2% |

| Melba | $125 | -1% |

| Menan | $130 | 3% |

| Meridian | $122 | -4% |

| Mesa | $122 | -4% |

| Middleton | $130 | 3% |

| Midvale | $120 | -5% |

| Monteview | $127 | 0% |

| Montpelier | $125 | -1% |

| Moore | $128 | 1% |

| Moreland | $133 | 5% |

| Moscow | $125 | -1% |

| Mountain Home | $113 | -11% |

| Mountain Home AFB | $116 | -8% |

| Moyie Springs | $132 | 4% |

| Mullan | $125 | -2% |

| Murphy | $127 | 0% |

| Murray | $128 | 1% |

| Murtaugh | $124 | -2% |

| Nampa | $131 | 4% |

| Naples | $131 | 4% |

| New Meadows | $122 | -4% |

| New Plymouth | $121 | -4% |

| Newdale | $128 | 1% |

| Nezperce | $132 | 4% |

| Nordman | $130 | 3% |

| North Fork | $132 | 4% |

| Oakley | $122 | -4% |

| Ola | $119 | -6% |

| Oldtown | $131 | 3% |

| Orofino | $132 | 4% |

| Osburn | $126 | 0% |

| Parker | $132 | 4% |

| Parma | $122 | -4% |

| Paul | $122 | -3% |

| Payette | $119 | -6% |

| Peck | $126 | -1% |

| Picabo | $122 | -4% |

| Pierce | $133 | 5% |

| Pinehurst | $126 | -1% |

| Pingree | $132 | 4% |

| Placerville | $121 | -5% |

| Plummer | $131 | 4% |

| Pocatello | $130 | 3% |

| Pollock | $130 | 2% |

| Ponderay | $132 | 4% |

| Porthill | $133 | 5% |

| Post Falls | $129 | 1% |

| Potlatch | $121 | -5% |

| Preston | $129 | 2% |

| Priest River | $132 | 4% |

| Princeton | $121 | -5% |

| Rathdrum | $132 | 4% |

| Reubens | $128 | 1% |

| Rexburg | $130 | 3% |

| Richfield | $125 | -2% |

| Rigby | $131 | 3% |

| Riggins | $125 | -1% |

| Ririe | $129 | 2% |

| Riverside | $133 | 5% |

| Roberts | $129 | 2% |

| Robie Creek | $121 | -5% |

| Rockland | $125 | -1% |

| Rogerson | $122 | -4% |

| Rupert | $123 | -3% |

| Sagle | $131 | 4% |

| Salmon | $133 | 5% |

| Sandpoint | $131 | 3% |

| Santa | $130 | 3% |

| Shelley | $133 | 5% |

| Shoshone | $123 | -3% |

| Shoup | $128 | 1% |

| Silverton | $128 | 1% |

| Smelterville | $127 | 0% |

| Soda Springs | $124 | -2% |

| Spencer | $130 | 3% |

| Spirit Lake | $129 | 2% |

| Springfield | $129 | 2% |

| St. Anthony | $126 | 0% |

| St. Charles | $126 | -1% |

| St. Maries | $132 | 4% |

| Stanley | $125 | -2% |

| Star | $123 | -3% |

| Stites | $125 | -2% |

| Sugar City | $126 | -1% |

| Sun Valley | $122 | -4% |

| Swan Valley | $127 | 0% |

| Swanlake | $125 | -1% |

| Sweet | $122 | -4% |

| Sweetwater | $124 | -2% |

| Tendoy | $132 | 4% |

| Tensed | $132 | 4% |

| Terreton | $127 | 0% |

| Teton | $127 | 0% |

| Tetonia | $130 | 2% |

| Thatcher | $128 | 1% |

| Troy | $122 | -4% |

| Twin Falls | $125 | -1% |

| Victor | $132 | 4% |

| Viola | $122 | -4% |

| Wallace | $124 | -2% |

| Warren | $127 | 0% |

| Wayan | $125 | -1% |

| Weippe | $133 | 5% |

| Weiser | $118 | -7% |

| Wendell | $120 | -5% |

| Weston | $127 | 1% |

| White Bird | $126 | -1% |

| Wilder | $127 | 1% |

| Winchester | $132 | 4% |

| Worley | $128 | 1% |

| Yellow Pine | $116 | -8% |

Idaho car insurance requirements

Idaho requires all registered vehicles to have liability car insurance. The state’s minimum car insurance requirements include:

-

Bodily injury liability

: $25,000 per person, $50,000 per accidentBodily injury liability helps cover the medical bills of other people you injure in a car accident.

-

Property damage liability

: $15,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

Insurance agents are also required to offer uninsured motorist

You usually have to add collision

How does SR-22 insurance work in Idaho?

You usually need to get SR-22 insurance in Idaho to reinstate your license after certain violations. These range from DUI and reckless driving to insurance and registration violations. An SR-22 is a certificate your insurance company files with the state to show you have insurance.

Most Idaho companies insure drivers with an SR-22 requirement, but some don’t. It’s good to be upfront about your SR-22 requirement with the companies you contact. This lets you get accurate quotes. Many companies add a filing fee of about $25 to your rate.

Your overall rate for SR-22 insurance depends largely on your driving record. Rates average $242 a month after a serious violation like DUI. Costs are closer to $152 a month after a lesser offense, like driving without insurance.

Frequently asked questions

Car insurance costs an average of $127 a month in Idaho for full coverage for a typical driver. Minimum coverage rates average $45 a month.

State Farm has the cheapest car insurance for most Idaho drivers. Its full coverage rates average $61 a month, which is 52% less than the state average.

How we selected the cheapest car insurance companies in Idaho

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Idaho

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.