Cheapest Car Insurance in Kentucky (2026)

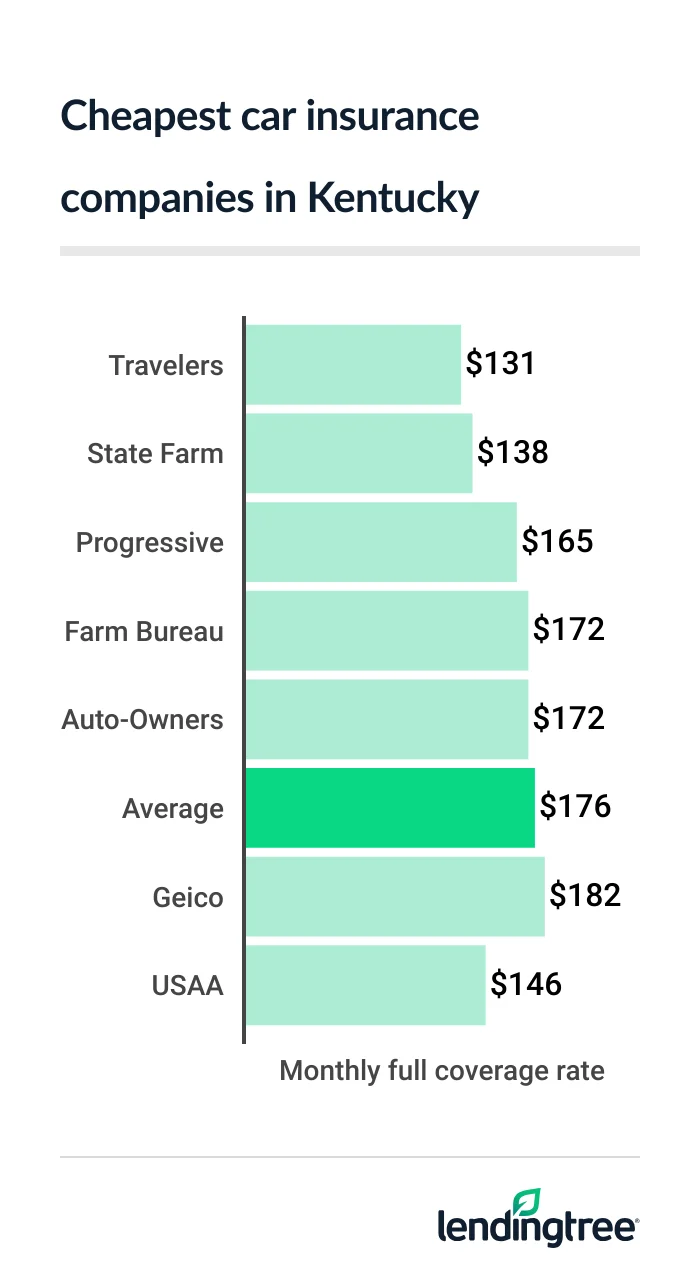

Travelers has the cheapest car insurance in Kentucky for full coverage, at $131 a month. Farm Bureau has the state’s cheapest liability insurance, at $39 a month.

Best cheap car insurance in Kentucky

Cheapest full coverage car insurance in Kentucky: Travelers

Travelers has Kentucky’s cheapest full coverage car insurance, offering an average rate of $131 per month.

State Farm is right behind at $138 per month. Both companies are well below the state average of $176 per month for full coverage

State Farm has a much better customer satisfaction score from J.D. Power than Travelers. That suggests State Farm has happier customers.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $131 |  |

| State Farm | $138 |  |

| Progressive | $165 | |

| Farm Bureau | $172 | |

| Auto-Owners | $172 | |

| Geico | $182 | |

| Shelter | $208 | |

| Nationwide | $266 | |

| USAA* | $146 | |

Because these two companies are so close in cost, you should compare car insurance quotes from both to find out which is the best and cheapest for you.

Kentucky’s cheapest liability car insurance: Farm Bureau

For the cheapest liability car insurance in Kentucky, go to Farm Bureau. Its average rate is $39 per month, or half the state average of $84 per month.

Travelers has the second-cheapest liability insurance

Liability auto insurance rates

| Company | Monthly rate |

|---|---|

| Farm Bureau | $39 |

| Travelers | $54 |

| Geico | $76 |

| Auto-Owners | $77 |

| Shelter | $87 |

| Progressive | $89 |

| Nationwide | $95 |

| State Farm | $185 |

| USAA* | $50 |

Travelers has the most car insurance discounts of these companies, and some are easy to get.

You can save money with Travelers for getting a quote before your current policy expires, or for paying your premium with electronic funds transfer or payroll deduction. Travelers also has discounts for new, hybrid and electric vehicles, as well as for home or condo owners.

Best cheap car insurance for teen drivers in Kentucky: Farm Bureau

At $111 per month, Farm Bureau has the cheapest teen car insurance rates in Kentucky for those who only want liability coverage.

Travelers has the state’s cheapest car insurance rates for teens who want full coverage, at $325 per month.

Car insurance rates for teen drivers

| Company | Liability-only coverage | Full coverage |

|---|---|---|

| Farm Bureau | $111 | $446 |

| Travelers | $142 | $325 |

| State Farm | $154 | $370 |

| Shelter | $222 | $516 |

| Auto-Owners | $254 | $464 |

| Progressive | $284 | $645 |

| Nationwide | $306 | $866 |

| Geico | $328 | $696 |

| USAA* | $128 | $380 |

Teen and other young drivers pay a lot for car insurance, even if they have clean driving records. In fact, they often pay the highest rates of any age group. This is mainly because they tend to get into the most accidents.

You can usually get cheaper car insurance for teens if:

- The teen child joins their parent’s policy

- You shop around before you buy or renew a policy and compare quotes from several companies

- You look for discounts aimed at teen drivers, such as ones for getting good grades or taking a driver education course

Farm Bureau, Travelers and State Farm all offer teen car insurance discounts. State Farm stands out for letting teen drivers with good grades save up to 25%.

Cheap Kentucky car insurance after a speeding ticket: State Farm

State Farm is Kentucky’s cheapest car insurance company for drivers with a speeding ticket on their records. Its average rate is $146 per month.

Travelers and Farm Bureau are next, with rates of around $170 per month. All three companies are much cheaper than the state average of $202 per month.

Car insurance rates after a speeding ticket

| Company | Monthly rate |

|---|---|

| State Farm | $146 |

| Travelers | $167 |

| Farm Bureau | $172 |

| Auto-Owners | $180 |

| Progressive | $228 |

| Geico | $234 |

| Shelter | $236 |

| Nationwide | $266 |

| USAA* | $186 |

State Farm and Farm Bureau score better for customer service than Travelers, based on their J.D. Power ratings.

The average Kentucky driver sees their car insurance go up by 15% after getting a speeding ticket. However, State Farm only raises its rates by about 6% after a ticket.

Best insurance rates for Kentucky drivers with an accident: State Farm

With an average rate of $155 per month, State Farm also has Kentucky’s cheapest car insurance for drivers with an accident.

Farm Bureau and Travelers come in second and third, with each offering an average rate of about $177 per month.

Car insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $155 |

| Farm Bureau | $172 |

| Travelers | $183 |

| Auto-Owners | $238 |

| Progressive | $253 |

| Shelter | $262 |

| Nationwide | $399 |

| Geico | $429 |

| USAA* | $220 |

The average cost of car insurance with an accident is $257 per month in Kentucky. Most of the state’s drivers see their car insurance costs increase 46% after an accident. State Farm’s rates go up only 12%, on average.

Kentucky’s best teen car insurance rates after a ticket or accident: Farm Bureau

Teen drivers in Kentucky with a speeding ticket or accident on their records usually find the cheapest car insurance with Farm Bureau.

Farm Bureau’s average rate for teens with a speeding ticket is $111 per month. For teens with an accident, its rates average $134 per month.

Monthly teen rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $111 | $134 |

| State Farm | $168 | $185 |

| Travelers | $180 | $210 |

| Auto-Owners | $254 | $364 |

| Shelter | $262 | $300 |

| Nationwide | $306 | $338 |

| Progressive | $322 | $330 |

| Geico | $424 | $524 |

| USAA* | $200 | $223 |

State Farm has the second-cheapest car insurance rates for these young drivers. The company’s rates average $168 per month for teens with a ticket, and $185 per month with an accident.

You can get more car insurance discounts from State Farm than you can from Farm Bureau. If you can get enough of them from State Farm, it could be the cheapest company for you.

Cheapest Kentucky car insurance after a DUI: Travelers

Travelers is the cheapest car insurance company in Kentucky for drivers with a driving under the influence (DUI) conviction. Its average rate for these drivers is $192 per month.

Progressive is close behind for the state’s cheapest DUI insurance rates, at $210 per month. Both companies are much cheaper than the state average of $346 per month.

Auto insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $192 |

| Progressive | $210 |

| State Farm | $267 |

| Shelter | $299 |

| Auto-Owners | $388 |

| Farm Bureau | $404 |

| Nationwide | $516 |

| Geico | $537 |

| USAA* | $297 |

Travelers and Progressive are similar in terms of how many discounts they offer and how they score on customer service.

You can get more optional car insurance coverages from Progressive, however. Both companies have accident forgiveness, roadside assistance and gap insurance. But only Progressive offers custom parts, trip interruption and rideshare coverage.

You should expect your car insurance premium

Cheap car insurance for Kentucky drivers with bad credit: Travelers

At $250 per month, Travelers has Kentucky’s cheapest car insurance for drivers with bad credit. Progressive is next, with rates of about $261 per month.

Insurance rates for drivers with bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $250 |

| Progressive | $261 |

| Geico | $372 |

| Nationwide | $417 |

| Auto-Owners | $489 |

| Farm Bureau | $527 |

| Shelter | $548 |

| State Farm | $616 |

| USAA* | $255 |

The average cost of car insurance with poor credit in Kentucky is $415 per month. Drivers in Kentucky with bad credit pay more than twice what the state’s drivers with good credit pay for car insurance.

To improve your credit and get cheaper car insurance, avoid late payments and pay down your debt.

Kentucky’s best car insurance companies

Travelers, State Farm and Farm Bureau are the best car insurance companies in Kentucky for different reasons.

Kentucky car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| Shelter | 669 | A | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Travelers is Kentucky’s best car insurance company overall. It has the cheapest full coverage insurance rates in the state for drivers with clean records. It’s also cheapest for drivers with a DUI or bad credit. And it’s often among the cheapest companies for other driver and coverage types.

State Farm is the best company for Kentucky residents with a traffic incident on their records. Along with that, it has the best J.D. Power customer satisfaction score of the companies we surveyed, besides USAA.

Farm Bureau is the best insurance company for Kentucky teens. It also has the state’s cheapest liability coverage rates. And it scores well for customer service, too.

Kentucky car insurance rates by city

The cheapest city for car insurance in Kentucky is Fort Thomas, where rates average $131 per month. Saul is the state’s most expensive city for car insurance. Its rates average $243 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $176 | 0% |

| Adairville | $146 | -17% |

| Adams | $195 | 11% |

| Adolphus | $153 | -13% |

| Ages Brookside | $205 | 17% |

| Albany | $164 | -7% |

| Alexandria | $137 | -22% |

| Allen | $214 | 22% |

| Allensville | $156 | -11% |

| Almo | $157 | -11% |

| Alpha | $163 | -7% |

| Alvaton | $139 | -21% |

| Anchorage | $160 | -9% |

| Annville | $210 | 20% |

| Argillite | $157 | -11% |

| Arjay | $184 | 5% |

| Arlington | $166 | -5% |

| Artemus | $179 | 2% |

| Ary | $228 | 30% |

| Ashcamp | $223 | 27% |

| Asher | $215 | 22% |

| Ashland | $151 | -14% |

| Auburn | $147 | -16% |

| Audubon Park | $187 | 7% |

| Augusta | $174 | -1% |

| Austin | $154 | -12% |

| Auxier | $214 | 22% |

| Avawam | $234 | 33% |

| Bagdad | $160 | -9% |

| Bandana | $169 | -4% |

| Banner | $218 | 24% |

| Barbourville | $182 | 4% |

| Bardstown | $166 | -5% |

| Bardwell | $164 | -7% |

| Barlow | $169 | -4% |

| Baskett | $176 | 0% |

| Battletown | $168 | -4% |

| Baxter | $204 | 16% |

| Bays | $215 | 22% |

| Bear Branch | $226 | 29% |

| Beattyville | $205 | 17% |

| Beaumont | $160 | -9% |

| Beauty | $218 | 24% |

| Beaver | $221 | 26% |

| Beaver Dam | $155 | -12% |

| Bedford | $179 | 2% |

| Bee Spring | $160 | -9% |

| Beech Creek | $162 | -8% |

| Beech Grove | $163 | -7% |

| Beechmont | $161 | -8% |

| Beechwood Village | $159 | -10% |

| Belcher | $223 | 27% |

| Belfry | $223 | 27% |

| Bellefonte | $154 | -12% |

| Bellemeade | $159 | -9% |

| Bellevue | $134 | -24% |

| Bellewood | $159 | -9% |

| Belton | $163 | -7% |

| Benham | $204 | 16% |

| Benton | $159 | -10% |

| Berea | $146 | -17% |

| Berry | $151 | -14% |

| Bethelridge | $167 | -5% |

| Bethlehem | $166 | -5% |

| Betsy Layne | $219 | 24% |

| Beverly | $185 | 5% |

| Bevinsville | $222 | 26% |

| Big Clifty | $166 | -5% |

| Big Creek | $224 | 27% |

| Big Laurel | $206 | 17% |

| Bighill | $168 | -5% |

| Bimble | $182 | 4% |

| Blackey | $215 | 22% |

| Blaine | $196 | 11% |

| Bledsoe | $209 | 19% |

| Bloomfield | $170 | -3% |

| Blue Ridge Manor | $160 | -9% |

| Blue River | $217 | 23% |

| Boaz | $162 | -8% |

| Bonnieville | $167 | -5% |

| Bonnyman | $232 | 32% |

| Booneville | $221 | 26% |

| Boons Camp | $220 | 25% |

| Boston | $166 | -5% |

| Bowling Green | $142 | -19% |

| Bradfordsville | $175 | 0% |

| Brandenburg | $165 | -6% |

| Breckinridge Center | $157 | -10% |

| Breeding | $161 | -8% |

| Bremen | $161 | -8% |

| Briarwood | $159 | -9% |

| Brodhead | $156 | -11% |

| Bronston | $171 | -3% |

| Brooks | $172 | -2% |

| Brooksville | $178 | 1% |

| Browder | $164 | -6% |

| Brownsboro Farm | $159 | -9% |

| Brownsville | $159 | -10% |

| Bryants Store | $183 | 4% |

| Buckhorn | $236 | 34% |

| Buckner | $159 | -9% |

| Buffalo | $163 | -7% |

| Bulan | $227 | 29% |

| Burdine | $205 | 17% |

| Burgin | $147 | -16% |

| Burkesville | $168 | -4% |

| Burlington | $136 | -23% |

| Burna | $178 | 1% |

| Burnside | $173 | -2% |

| Busy | $233 | 33% |

| Butler | $171 | -2% |

| Bypro | $218 | 24% |

| Cadiz | $160 | -9% |

| Calhoun | $163 | -7% |

| California | $139 | -21% |

| Calvert City | $159 | -9% |

| Calvin | $182 | 4% |

| Camargo | $150 | -15% |

| Cambridge | $161 | -8% |

| Campbellsburg | $164 | -6% |

| Campbellsville | $162 | -8% |

| Campton | $217 | 23% |

| Canada | $223 | 27% |

| Caneyville | $165 | -6% |

| Canmer | $167 | -5% |

| Cannel City | $191 | 9% |

| Cannon | $181 | 3% |

| Carlisle | $155 | -12% |

| Carrie | $214 | 22% |

| Carrollton | $165 | -6% |

| Catlettsburg | $157 | -11% |

| Cave City | $148 | -16% |

| Cawood | $209 | 19% |

| Cecilia | $154 | -12% |

| Center | $162 | -8% |

| Centertown | $159 | -10% |

| Central City | $162 | -8% |

| Cerulean | $162 | -8% |

| Chaplin | $171 | -3% |

| Chappell | $219 | 25% |

| Chavies | $229 | 30% |

| Clarkson | $166 | -6% |

| Claryville | $137 | -22% |

| Clay | $175 | 0% |

| Clay City | $176 | 0% |

| Clayhole | $213 | 21% |

| Clearfield | $154 | -12% |

| Cleaton | $163 | -7% |

| Clermont | $177 | 1% |

| Clifty | $184 | 5% |

| Clinton | $170 | -3% |

| Closplint | $207 | 18% |

| Cloverport | $164 | -7% |

| Coalgood | $202 | 15% |

| Cold Spring | $133 | -24% |

| Coldiron | $204 | 16% |

| Coldstream | $169 | -4% |

| Columbia | $157 | -10% |

| Columbus | $169 | -4% |

| Combs | $229 | 30% |

| Corbin | $180 | 2% |

| Corinth | $169 | -4% |

| Cornettsville | $230 | 31% |

| Corydon | $153 | -13% |

| Covington | $139 | -21% |

| Coxs Creek | $167 | -5% |

| Crab Orchard | $161 | -8% |

| Cranks | $206 | 17% |

| Crayne | $180 | 2% |

| Crestview | $133 | -24% |

| Crestview Hills | $136 | -23% |

| Crestwood | $159 | -9% |

| Crittenden | $167 | -5% |

| Crockett | $206 | 17% |

| Crofton | $154 | -12% |

| Cromona | $218 | 24% |

| Cromwell | $160 | -9% |

| Cub Run | $166 | -5% |

| Cumberland | $206 | 17% |

| Cunningham | $164 | -7% |

| Curdsville | $168 | -4% |

| Custer | $168 | -4% |

| Cynthiana | $148 | -15% |

| Dana | $218 | 24% |

| Danville | $149 | -15% |

| David | $218 | 24% |

| Dawson Springs | $164 | -7% |

| Dayhoit | $202 | 15% |

| Dayton | $134 | -24% |

| De Mossville | $169 | -4% |

| Deane | $208 | 18% |

| Debord | $217 | 24% |

| Delphia | $227 | 29% |

| Dema | $219 | 25% |

| Denniston | $186 | 6% |

| Denton | $166 | -6% |

| Dexter | $157 | -11% |

| Dixon | $174 | -1% |

| Doe Valley | $164 | -7% |

| Douglass Hills | $160 | -9% |

| Dover | $157 | -11% |

| Drake | $168 | -5% |

| Drakesboro | $161 | -9% |

| Drift | $218 | 24% |

| Druid Hills | $160 | -9% |

| Dry Ridge | $169 | -4% |

| Dubre | $177 | 1% |

| Dunbar | $167 | -5% |

| Dundee | $161 | -8% |

| Dunmor | $165 | -6% |

| Dunnville | $168 | -4% |

| Dwale | $214 | 22% |

| Dwarf | $226 | 29% |

| Dycusburg | $192 | 9% |

| Earlington | $159 | -10% |

| East Bernstadt | $180 | 3% |

| East Point | $218 | 24% |

| Eastern | $215 | 22% |

| Eastview | $157 | -10% |

| Eastwood | $199 | 13% |

| Eddyville | $162 | -8% |

| Edgewood | $136 | -22% |

| Edmonton | $160 | -9% |

| Eighty Eight | $153 | -13% |

| Ekron | $163 | -7% |

| Elizabethtown | $148 | -15% |

| Elizaville | $174 | -1% |

| Elk Creek | $169 | -4% |

| Elk Horn | $164 | -7% |

| Elkfork | $186 | 6% |

| Elkhorn City | $223 | 27% |

| Elkton | $153 | -13% |

| Elliottville | $178 | 2% |

| Elsmere | $136 | -23% |

| Emerson | $153 | -13% |

| Eminence | $163 | -7% |

| Emlyn | $180 | 3% |

| Emmalena | $214 | 22% |

| Eolia | $213 | 21% |

| Erlanger | $135 | -23% |

| Ermine | $210 | 19% |

| Essie | $215 | 23% |

| Etoile | $156 | -11% |

| Eubank | $163 | -7% |

| Evarts | $205 | 17% |

| Ewing | $152 | -14% |

| Ezel | $189 | 8% |

| Fairdale | $190 | 8% |

| Fairfield | $169 | -4% |

| Fairview | $185 | 5% |

| Falcon | $221 | 26% |

| Fall Rock | $230 | 31% |

| Falls Of Rough | $166 | -5% |

| Falmouth | $172 | -2% |

| Fancy Farm | $164 | -6% |

| Farley | $161 | -8% |

| Farmers | $179 | 2% |

| Farmington | $161 | -8% |

| Fedscreek | $227 | 29% |

| Ferguson | $172 | -2% |

| Fincastle | $160 | -9% |

| Finchville | $162 | -8% |

| Fisherville | $170 | -3% |

| Fisty | $225 | 28% |

| Flat Lick | $185 | 5% |

| Flatgap | $220 | 25% |

| Flatwoods | $153 | -13% |

| Flemingsburg | $148 | -16% |

| Florence | $136 | -23% |

| Fords Branch | $227 | 29% |

| Fordsville | $162 | -8% |

| Forest Hills | $222 | 26% |

| Fort Campbell North | $147 | -16% |

| Fort Knox | $153 | -13% |

| Fort Mitchell | $135 | -23% |

| Fort Thomas | $131 | -25% |

| Fort Wright | $136 | -23% |

| Foster | $176 | 0% |

| Fountain Run | $158 | -10% |

| Fourmile | $180 | 2% |

| Fox Chase | $161 | -8% |

| Frakes | $182 | 4% |

| Francisville | $137 | -22% |

| Frankfort | $146 | -17% |

| Franklin | $145 | -18% |

| Fredonia | $170 | -3% |

| Freeburn | $228 | 30% |

| Frenchburg | $185 | 5% |

| Fulton | $166 | -6% |

| Gamaliel | $159 | -9% |

| Garfield | $169 | -4% |

| Garner | $217 | 23% |

| Garrard | $223 | 27% |

| Garrett | $217 | 24% |

| Garrison | $155 | -12% |

| Gays Creek | $229 | 31% |

| Georgetown | $144 | -18% |

| Germantown | $175 | 0% |

| Ghent | $175 | -1% |

| Gilbertsville | $160 | -9% |

| Girdler | $185 | 6% |

| Glasgow | $149 | -15% |

| Glencoe | $173 | -1% |

| Glendale | $158 | -10% |

| Glens Fork | $160 | -9% |

| Glenview | $176 | 0% |

| Goose Creek | $160 | -9% |

| Goose Rock | $242 | 38% |

| Gordon | $214 | 22% |

| Goshen | $163 | -7% |

| Gracey | $159 | -10% |

| Gradyville | $161 | -8% |

| Graham | $164 | -7% |

| Grand Rivers | $179 | 2% |

| Gravel Switch | $174 | -1% |

| Gray | $180 | 3% |

| Gray Hawk | $234 | 33% |

| Graymoor-Devondale | $159 | -10% |

| Grays Knob | $214 | 22% |

| Grayson | $162 | -8% |

| Green Road | $185 | 5% |

| Greensburg | $167 | -5% |

| Greenup | $156 | -11% |

| Greenville | $162 | -8% |

| Grethel | $221 | 26% |

| Gulston | $207 | 18% |

| Gunlock | $218 | 24% |

| Guston | $161 | -9% |

| Guthrie | $149 | -15% |

| Hagerhill | $216 | 23% |

| Hallie | $214 | 22% |

| Hampton | $181 | 3% |

| Hanson | $160 | -9% |

| Happy | $233 | 32% |

| Hardin | $159 | -10% |

| Hardinsburg | $165 | -6% |

| Hardy | $225 | 28% |

| Hardyville | $166 | -5% |

| Harlan | $203 | 16% |

| Harned | $166 | -6% |

| Harold | $219 | 25% |

| Harrods Creek | $191 | 9% |

| Harrodsburg | $146 | -17% |

| Hartford | $157 | -11% |

| Hawesville | $159 | -9% |

| Hazard | $227 | 29% |

| Hazel | $157 | -10% |

| Hazel Green | $211 | 20% |

| Hebron | $137 | -22% |

| Hebron Estates | $161 | -8% |

| Heidrick | $183 | 4% |

| Hellier | $219 | 24% |

| Helton | $213 | 21% |

| Henderson | $149 | -15% |

| Hendron | $160 | -9% |

| Heritage Creek | $186 | 6% |

| Herndon | $152 | -13% |

| Hestand | $158 | -10% |

| Hi Hat | $224 | 28% |

| Hickman | $167 | -5% |

| Hickory | $162 | -8% |

| Highland Heights | $133 | -24% |

| Hillsboro | $152 | -13% |

| Hillview | $175 | 0% |

| Hima | $230 | 31% |

| Hindman | $217 | 23% |

| Hinkle | $187 | 6% |

| Hitchins | $165 | -6% |

| Hodgenville | $163 | -7% |

| Holland | $154 | -12% |

| Holmes Mill | $211 | 20% |

| Hope | $152 | -14% |

| Hopkinsville | $152 | -14% |

| Horse Branch | $160 | -9% |

| Horse Cave | $161 | -8% |

| Hoskinston | $230 | 31% |

| Houston Acres | $161 | -8% |

| Huddy | $220 | 25% |

| Hudson | $167 | -5% |

| Hueysville | $218 | 24% |

| Hulen | $182 | 4% |

| Hurstbourne | $159 | -9% |

| Hurstbourne Acres | $161 | -9% |

| Hustonville | $163 | -7% |

| Hyden | $224 | 28% |

| Independence | $138 | -22% |

| Inez | $222 | 27% |

| Ingram | $189 | 8% |

| Irvine | $172 | -2% |

| Irvington | $166 | -5% |

| Island | $161 | -8% |

| Isom | $206 | 17% |

| Isonville | $195 | 11% |

| Ivel | $218 | 24% |

| Jackhorn | $210 | 19% |

| Jackson | $215 | 23% |

| Jamestown | $160 | -9% |

| Jeff | $227 | 29% |

| Jeffersontown | $160 | -9% |

| Jeffersonville | $152 | -13% |

| Jenkins | $216 | 23% |

| Jeremiah | $213 | 21% |

| Jetson | $168 | -4% |

| Jonancy | $216 | 23% |

| Jonesville | $171 | -3% |

| Junction City | $148 | -16% |

| Keaton | $215 | 23% |

| Keavy | $179 | 2% |

| Kenton | $169 | -4% |

| Kenvir | $205 | 17% |

| Kettle Island | $183 | 4% |

| Kevil | $164 | -7% |

| Kimper | $227 | 29% |

| Kings Mountain | $162 | -8% |

| Kirksey | $160 | -9% |

| Kite | $222 | 26% |

| Knifley | $159 | -10% |

| Knob Lick | $160 | -9% |

| Krypton | $226 | 28% |

| Kuttawa | $162 | -8% |

| La Center | $167 | -5% |

| La Fayette | $157 | -11% |

| La Grange | $159 | -10% |

| Lackey | $213 | 21% |

| Lakeside Park | $135 | -23% |

| Lancaster | $148 | -16% |

| Langdon Place | $159 | -9% |

| Langley | $219 | 25% |

| Latonia | $140 | -20% |

| Lawrenceburg | $149 | -15% |

| Lebanon | $172 | -2% |

| Lebanon Junction | $162 | -8% |

| Leburn | $214 | 22% |

| Ledbetter | $178 | 1% |

| Leitchfield | $163 | -7% |

| Lejunior | $219 | 24% |

| Letcher | $212 | 21% |

| Lewisburg | $158 | -10% |

| Lewisport | $145 | -18% |

| Lexington | $145 | -17% |

| Liberty | $168 | -4% |

| Lick Creek | $222 | 26% |

| Lily | $179 | 2% |

| Linefork | $208 | 19% |

| Littcarr | $222 | 26% |

| Livermore | $158 | -10% |

| Livingston | $166 | -6% |

| Lockport | $168 | -4% |

| London | $178 | 2% |

| Lone | $220 | 25% |

| Lookout | $239 | 36% |

| Loretto | $173 | -2% |

| Lost Creek | $219 | 25% |

| Louisa | $191 | 9% |

| Louisville | $194 | 11% |

| Lovelaceville | $169 | -4% |

| Lovely | $223 | 27% |

| Lowes | $183 | 4% |

| Lowmansville | $191 | 9% |

| Loyall | $205 | 17% |

| Lucas | $155 | -12% |

| Ludlow | $138 | -21% |

| Lynch | $210 | 19% |

| Lyndon | $159 | -10% |

| Lynnview | $190 | 8% |

| Lynnville | $192 | 9% |

| Maceo | $138 | -22% |

| Mackville | $173 | -2% |

| Madisonville | $159 | -10% |

| Magnolia | $168 | -4% |

| Majestic | $223 | 27% |

| Mallie | $213 | 21% |

| Malone | $213 | 21% |

| Mammoth Cave National Park | $159 | -9% |

| Manchester | $229 | 30% |

| Manitou | $160 | -9% |

| Maple Mount | $151 | -14% |

| Marion | $175 | -1% |

| Marrowbone | $165 | -6% |

| Marshes Siding | $182 | 4% |

| Martha | $191 | 9% |

| Martin | $217 | 24% |

| Mary Alice | $208 | 19% |

| Mason | $191 | 9% |

| Masonic Home | $176 | 0% |

| Masonville | $138 | -21% |

| Massac | $161 | -8% |

| Mayfield | $159 | -9% |

| Mayking | $210 | 19% |

| Mayslick | $154 | -12% |

| Maysville | $151 | -14% |

| Mazie | $188 | 7% |

| Mc Andrews | $227 | 29% |

| Mc Carr | $227 | 29% |

| Mc Daniels | $165 | -6% |

| Mc Dowell | $222 | 26% |

| Mc Henry | $158 | -10% |

| Mc Kee | $208 | 19% |

| Mc Kinney | $160 | -9% |

| Mc Quady | $175 | -1% |

| McRoberts | $210 | 20% |

| Meadow Vale | $160 | -9% |

| Meally | $213 | 21% |

| Means | $173 | -2% |

| Melber | $166 | -5% |

| Melbourne | $137 | -22% |

| Melvin | $215 | 22% |

| Middleburg | $169 | -4% |

| Middlesborough | $177 | 1% |

| Middletown | $161 | -9% |

| Midway | $142 | -19% |

| Milburn | $187 | 6% |

| Milford | $193 | 10% |

| Millersburg | $145 | -17% |

| Millstone | $210 | 20% |

| Millwood | $164 | -7% |

| Milton | $177 | 1% |

| Minerva | $176 | 0% |

| Minnie | $216 | 23% |

| Miracle | $183 | 4% |

| Mistletoe | $217 | 24% |

| Mitchellsburg | $173 | -1% |

| Mize | $185 | 5% |

| Monticello | $171 | -3% |

| Moorefield | $155 | -12% |

| Moorland | $159 | -9% |

| Morehead | $152 | -13% |

| Morganfield | $157 | -10% |

| Morgantown | $165 | -6% |

| Morning View | $141 | -20% |

| Mortons Gap | $159 | -10% |

| Mount Eden | $169 | -4% |

| Mount Hermon | $159 | -9% |

| Mount Olivet | $162 | -8% |

| Mount Sherman | $165 | -6% |

| Mount Sterling | $150 | -15% |

| Mount Vernon | $157 | -11% |

| Mount Washington | $168 | -4% |

| Mousie | $223 | 27% |

| Mouthcard | $226 | 29% |

| Mozelle | $219 | 24% |

| Muldraugh | $152 | -13% |

| Munfordville | $165 | -6% |

| Murray | $155 | -12% |

| Muses Mills | $166 | -6% |

| Myra | $217 | 24% |

| Nancy | $172 | -2% |

| Nazareth | $179 | 2% |

| Nebo | $164 | -7% |

| Neon | $205 | 17% |

| Nerinx | $185 | 5% |

| New Castle | $162 | -8% |

| New Concord | $160 | -9% |

| New Haven | $164 | -7% |

| New Hope | $168 | -4% |

| New Liberty | $175 | 0% |

| Newport | $139 | -21% |

| Nicholasville | $143 | -19% |

| Norbourne Estates | $159 | -10% |

| North Corbin | $180 | 3% |

| North Middletown | $143 | -19% |

| Northfield | $160 | -9% |

| Nortonville | $158 | -10% |

| Oak Grove | $149 | -15% |

| Oakbrook | $133 | -24% |

| Oakland | $143 | -19% |

| Oil Springs | $214 | 22% |

| Olaton | $160 | -9% |

| Old Brownsboro Place | $160 | -9% |

| Olive Hill | $167 | -5% |

| Olmstead | $145 | -18% |

| Olympia | $154 | -12% |

| Oneida | $230 | 31% |

| Orchard Grass Hills | $161 | -8% |

| Orlando | $161 | -8% |

| Owensboro | $135 | -23% |

| Owenton | $180 | 2% |

| Owingsville | $150 | -15% |

| Paducah | $161 | -8% |

| Paint Lick | $145 | -18% |

| Paintsville | $218 | 24% |

| Paris | $144 | -18% |

| Park City | $155 | -12% |

| Park Hills | $136 | -22% |

| Parkers Lake | $187 | 6% |

| Parksville | $149 | -15% |

| Parkway Village | $179 | 2% |

| Partridge | $211 | 20% |

| Pathfork | $208 | 18% |

| Payneville | $165 | -6% |

| Pembroke | $154 | -12% |

| Pendleton | $165 | -6% |

| Perry Park | $176 | 0% |

| Perryville | $148 | -16% |

| Petersburg | $136 | -23% |

| Pewee Valley | $160 | -9% |

| Phelps | $229 | 30% |

| Philpot | $138 | -21% |

| Phyllis | $234 | 33% |

| Pikeville | $222 | 26% |

| Pilgrim | $226 | 29% |

| Pine Knot | $186 | 6% |

| Pine Ridge | $208 | 18% |

| Pine Top | $218 | 24% |

| Pineville | $182 | 4% |

| Pinsonfork | $229 | 30% |

| Pioneer Village | $162 | -8% |

| Pippa Passes | $220 | 25% |

| Pittsburg | $202 | 15% |

| Plano | $138 | -21% |

| Pleasureville | $166 | -5% |

| Plummers Landing | $177 | 1% |

| Poole | $171 | -3% |

| Port Royal | $170 | -3% |

| Powderly | $161 | -8% |

| Premium | $212 | 20% |

| Preston | $177 | 1% |

| Prestonsburg | $216 | 23% |

| Princeton | $166 | -5% |

| Printer | $220 | 25% |

| Prospect | $167 | -5% |

| Providence | $173 | -1% |

| Putney | $205 | 16% |

| Quincy | $155 | -12% |

| Raccoon | $223 | 27% |

| Raceland | $153 | -13% |

| Radcliff | $151 | -14% |

| Ransom | $234 | 33% |

| Raven | $218 | 24% |

| Ravenna | $174 | -1% |

| Raywick | $174 | -1% |

| Redfox | $221 | 26% |

| Reed | $149 | -15% |

| Regina | $218 | 24% |

| Reidland | $162 | -8% |

| Renfro Valley | $185 | 5% |

| Revelo | $182 | 4% |

| Reynolds Station | $161 | -9% |

| Rhodelia | $166 | -5% |

| Ricetown | $219 | 24% |

| Richlawn | $159 | -10% |

| Richmond | $139 | -21% |

| Rineyville | $151 | -14% |

| River | $211 | 20% |

| Riverwood | $160 | -9% |

| Roark | $214 | 22% |

| Robards | $153 | -13% |

| Robinson Creek | $222 | 26% |

| Rochester | $166 | -6% |

| Rockfield | $140 | -20% |

| Rockholds | $179 | 2% |

| Rockhouse | $227 | 29% |

| Rockport | $159 | -9% |

| Rocky Hill | $159 | -10% |

| Rogers | $215 | 23% |

| Rolling Fields | $161 | -9% |

| Rolling Hills | $159 | -9% |

| Rosine | $162 | -8% |

| Roundhill | $160 | -9% |

| Rousseau | $211 | 20% |

| Rowdy | $224 | 28% |

| Roxana | $209 | 19% |

| Royalton | $217 | 24% |

| Rumsey | $163 | -7% |

| Rush | $152 | -13% |

| Russell | $153 | -13% |

| Russell Springs | $160 | -9% |

| Russellville | $147 | -16% |

| Ryland Heights | $142 | -19% |

| Sacramento | $162 | -8% |

| Sadieville | $153 | -13% |

| Salem | $181 | 3% |

| Salt Lick | $155 | -12% |

| Salvisa | $147 | -17% |

| Salyersville | $226 | 29% |

| Sanders | $174 | -1% |

| Sandgap | $203 | 16% |

| Sandy Hook | $194 | 10% |

| Sassafras | $217 | 24% |

| Saul | $243 | 38% |

| Scalf | $183 | 4% |

| Science Hill | $170 | -3% |

| Scottsville | $153 | -13% |

| Scuddy | $227 | 29% |

| Sebree | $171 | -3% |

| Seco | $211 | 20% |

| Sedalia | $163 | -7% |

| Seneca Gardens | $165 | -6% |

| Sextons Creek | $228 | 30% |

| Sharon Grove | $155 | -12% |

| Sharpsburg | $155 | -12% |

| Shelbiana | $224 | 28% |

| Shelby Gap | $217 | 23% |

| Shelbyville | $159 | -9% |

| Shepherdsville | $162 | -8% |

| Shively | $206 | 17% |

| Sidney | $219 | 25% |

| Siler | $184 | 5% |

| Silver Grove | $135 | -23% |

| Simpsonville | $161 | -8% |

| Sitka | $218 | 24% |

| Sizerock | $218 | 24% |

| Slade | $180 | 2% |

| Slaughters | $172 | -2% |

| Slemp | $234 | 33% |

| Smilax | $225 | 28% |

| Smith Mills | $153 | -13% |

| Smithfield | $162 | -8% |

| Smithland | $181 | 3% |

| Smiths Grove | $151 | -14% |

| Soldier | $186 | 6% |

| Somerset | $171 | -3% |

| Sonora | $158 | -10% |

| South Carrollton | $161 | -8% |

| South Portsmouth | $155 | -12% |

| South Shore | $157 | -10% |

| South Wallins | $205 | 17% |

| South Williamson | $222 | 26% |

| Southgate | $136 | -23% |

| Sparta | $176 | 0% |

| Spottsville | $150 | -15% |

| Springfield | $171 | -2% |

| St. Catharine | $182 | 4% |

| St. Charles | $162 | -8% |

| St. Francis | $174 | -1% |

| St. Helens | $222 | 26% |

| St. Mary | $199 | 13% |

| St. Matthews | $160 | -9% |

| Staffordsville | $216 | 23% |

| Stambaugh | $213 | 21% |

| Stamping Ground | $148 | -16% |

| Stanford | $159 | -9% |

| Stanton | $177 | 0% |

| Stanville | $213 | 21% |

| Stearns | $184 | 5% |

| Steele | $233 | 33% |

| Stephensport | $168 | -4% |

| Stinnett | $215 | 22% |

| Stone | $226 | 29% |

| Stoney Fork | $184 | 5% |

| Stopover | $234 | 33% |

| Strathmoor Village | $166 | -6% |

| Strunk | $188 | 7% |

| Sturgis | $160 | -9% |

| Sullivan | $185 | 5% |

| Sulphur | $168 | -4% |

| Summer Shade | $161 | -9% |

| Summersville | $170 | -4% |

| Sweeden | $163 | -7% |

| Symsonia | $160 | -9% |

| Tateville | $180 | 3% |

| Taylor Mill | $141 | -20% |

| Taylorsville | $167 | -5% |

| Teaberry | $219 | 25% |

| Ten Broeck | $160 | -9% |

| Thelma | $216 | 23% |

| Thornton | $206 | 17% |

| Thousandsticks | $224 | 27% |

| Tiline | $177 | 0% |

| Tollesboro | $152 | -13% |

| Tomahawk | $222 | 26% |

| Tompkinsville | $160 | -9% |

| Topmost | $224 | 28% |

| Totz | $205 | 17% |

| Tram | $215 | 22% |

| Trenton | $150 | -15% |

| Trosper | $184 | 5% |

| Turners Station | $165 | -6% |

| Tutor Key | $215 | 23% |

| Tyner | $212 | 21% |

| Ulysses | $194 | 10% |

| Union | $140 | -20% |

| Union Star | $167 | -5% |

| Uniontown | $157 | -10% |

| Upton | $165 | -6% |

| Utica | $145 | -18% |

| Van Lear | $215 | 22% |

| Vanceburg | $152 | -13% |

| Vancleve | $218 | 24% |

| Varney | $227 | 29% |

| Verona | $152 | -14% |

| Versailles | $141 | -20% |

| Vest | $217 | 24% |

| Vicco | $230 | 31% |

| Villa Hills | $135 | -23% |

| Vincent | $218 | 24% |

| Vine Grove | $154 | -12% |

| Viper | $234 | 33% |

| Virgie | $219 | 25% |

| Waco | $140 | -20% |

| Waddy | $161 | -9% |

| Walker | $185 | 6% |

| Wallingford | $151 | -14% |

| Wallins Creek | $205 | 17% |

| Walton | $140 | -20% |

| Waneta | $217 | 23% |

| Warbranch | $223 | 27% |

| Warfield | $222 | 26% |

| Warsaw | $175 | -1% |

| Washington | $178 | 1% |

| Water Valley | $165 | -6% |

| Watterson Park | $195 | 11% |

| Waverly | $156 | -11% |

| Wayland | $219 | 25% |

| Waynesburg | $161 | -8% |

| Webbville | $173 | -1% |

| Webster | $168 | -4% |

| Weeksbury | $220 | 25% |

| Wellington | $186 | 6% |

| Wendover | $219 | 25% |

| West Buechel | $196 | 12% |

| West Liberty | $188 | 7% |

| West Louisville | $167 | -5% |

| West Paducah | $161 | -8% |

| West Point | $156 | -11% |

| West Somerset | $196 | 11% |

| West Van Lear | $214 | 22% |

| Westport | $164 | -7% |

| Westview | $166 | -5% |

| Westwood | $150 | -15% |

| Wheatcroft | $175 | -1% |

| Wheelwright | $223 | 27% |

| Whick | $214 | 22% |

| White Mills | $157 | -11% |

| White Plains | $161 | -8% |

| Whitesburg | $211 | 20% |

| Whitesville | $145 | -17% |

| Whitley City | $186 | 6% |

| Wickliffe | $169 | -4% |

| Wilder | $135 | -23% |

| Wildie | $183 | 4% |

| Williamsburg | $180 | 3% |

| Williamsport | $213 | 21% |

| Williamstown | $169 | -4% |

| Willisburg | $173 | -1% |

| Wilmore | $142 | -19% |

| Winchester | $144 | -18% |

| Windsor | $169 | -4% |

| Windy Hills | $159 | -10% |

| Wingo | $163 | -7% |

| Wittensville | $213 | 21% |

| Woodbine | $183 | 4% |

| Woodburn | $148 | -16% |

| Woodbury | $188 | 7% |

| Woodland Hills | $161 | -9% |

| Wooton | $226 | 29% |

| Worthington | $155 | -12% |

| Worthville | $177 | 1% |

| Wurtland | $155 | -12% |

| Yeaddiss | $224 | 27% |

| Yerkes | $228 | 30% |

| Yosemite | $168 | -5% |

| Zoe | $199 | 13% |

Where you live isn’t the only factor that impacts what you pay for car insurance. Companies also consider your age, gender, insurance history and the car you drive when coming up with your car insurance rate.

Minimum coverage for car insurance in Kentucky

You need to meet Kentucky’s car insurance requirements to drive legally in the state. These requirements include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

Personal injury protection

State law doesn’t require full coverage, which usually includes collision

Kentucky’s no-fault car insurance law

Kentucky’s no-fault car insurance law limits your ability to get a driver who injures you to cover your medical bills. It also limits your ability to sue an at-fault driver for causing pain and suffering.

If you keep PIP, you can only go after an at-fault driver if you have more than $1,000 in medical bills or your injuries are severe. If you reject PIP, these restrictions won’t apply.

The state’s no-fault law does not apply to property damage. If you cause an accident, you have to cover other people’s car repairs.

This is where your property damage liability coverage would kick in. In a situation like this, your collision coverage, if you have it, covers your own car repairs.

Frequently asked questions

The average cost of car insurance in Kentucky is $176 per month if you get full coverage. If you only get liability coverage, the state average cost is $84 per month.

Farm Bureau has Kentucky’s cheapest car insurance if you only want liability coverage, at an average rate of $39 per month.

Travelers has the cheapest car insurance for Kentucky drivers who want full coverage, at $131 per month.

These average rates are for typical 30-year-old drivers with clean records. You will likely pay more if you are older or younger, or if you have any traffic incidents on your record.

Possibly. The penalties for driving without insurance in Kentucky include a fine and up to 90 days in jail.

How we selected the cheapest car insurance companies in Kentucky

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Kentucky

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.