Cheapest Car Insurance in Maine (2026)

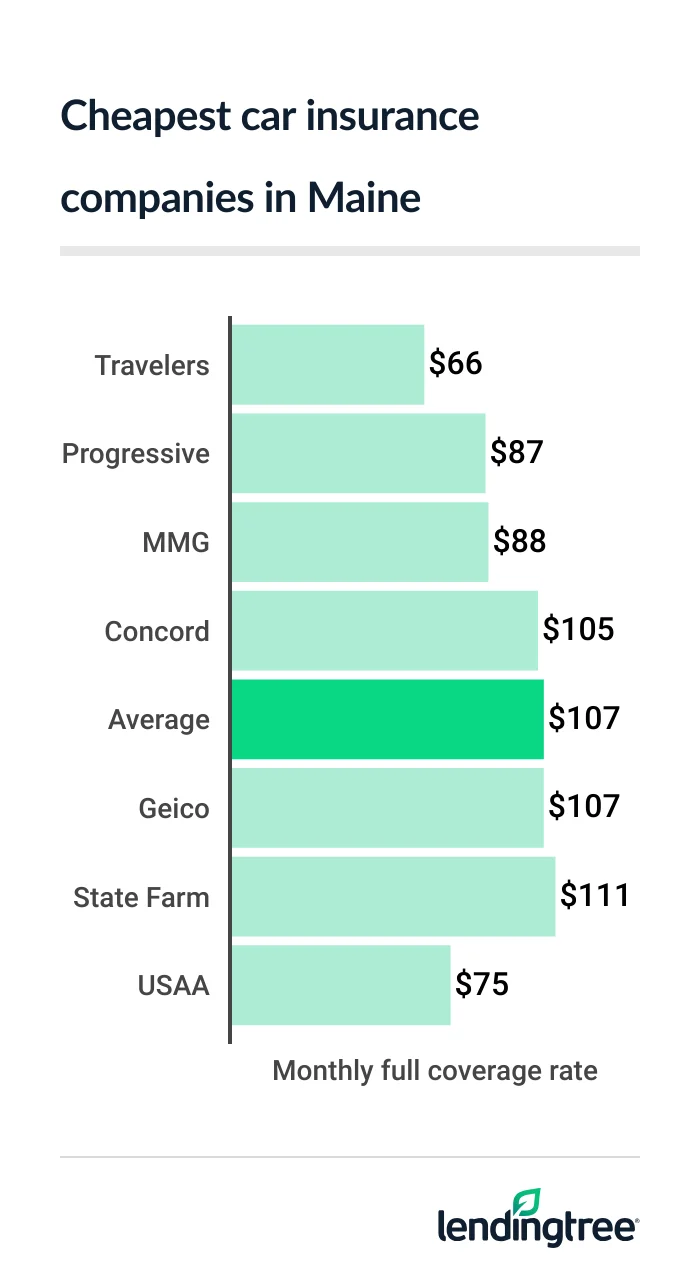

Travelers has Maine’s cheapest car insurance, charging about $66 per month for full coverage and $32 per month for minimum coverage.

Best cheap car insurance in Maine

Maine’s cheapest full coverage car insurance: Travelers

At $66 per month, Travelers has the cheapest full coverage car insurance in Maine. This is 38% cheaper than the state average of $107 per month.

USAA has the state’s second-cheapest rates of around $75 per month for full coverage

- USAA has the best J.D. Power customer satisfaction score of these companies, which generally means it has the happiest customers. If you can, definitely get a quote from USAA.

- Travelers and Progressive’s J.D. Power scores are worse than average, with Progressive’s being the slightly better of the two companies.

Cheapest full coverage insurance companies

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $66 | |

| Progressive | $87 | |

| MMG | $88 | |

| Concord | $105 | |

| Geico | $107 | |

| State Farm | $111 | |

| Allstate | $131 | |

| Sentry | Sentry | $146 | Not rated |

| Farmers | $150 | |

| USAA* | $75 | |

Progressive and MMG are the second-cheapest companies for most Maine drivers who want full coverage. Each has an average rate of just under $90 per month.

Cheapest liability car insurance in Maine: Travelers

Travelers, Progressive and MMG have the cheapest liability insurance for most Maine drivers, each with an average rate of $35 per month or less. This is well below the state average of $43 per month for liability coverage

Cheapest companies for minimum coverage

| Company | Monthly rate |

|---|---|

| Travelers | $32 |

| Progressive | $33 |

| MMG | $35 |

| State Farm | $40 |

| Concord | $43 |

| Geico | $46 |

| Farmers | $52 |

| Allstate | $60 |

| Sentry | $61 |

| USAA* | $26 |

Both Travelers and Progressive offer several car insurance discounts that could help you save money. Only Travelers has discounts for customers with new cars and hybrid or electric vehicles, however. But Progressive has discounts for signing your documents online and receiving docs through email.

Unlike a lot of states, Maine requires drivers to have more than just liability car insurance. It also requires uninsured and underinsured motorist

Best cheap auto insurance for Maine teens: Travelers

For the cheapest teen car insurance in Maine, get a quote from Travelers while you shop for coverage. The company’s average rate for teen minimum coverage is $87 per month. For full coverage, it’s $178 per month. Both are the cheapest rates in the state for most teen drivers.

Cheapest insurance companies for teens

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Travelers | $87 | $178 |

| Concord | $96 | $201 |

| MMG | $126 | $284 |

| State Farm | $132 | $325 |

| Allstate | $144 | $350 |

| Geico | $162 | $356 |

| Sentry | $181 | $384 |

| Farmers | $190 | $537 |

| Progressive | $199 | $452 |

| USAA* | $69 | $188 |

Concord has the second-cheapest car insurance for teens in Maine. It charges around $96 per month for minimum coverage, and $201 per month for full coverage.

How to save money on teen car insurance

In Maine, teen drivers pay three times what the average adult driver pays for car insurance. This is mostly because, statistically, teens get into more accidents than older drivers.

Discounts can help make teen car insurance more affordable.

- Both Travelers and Concord offer discounts to students who get good grades.

- Travelers also has discounts for students who take a driver education course and those who go away to school without a car.

Cheap Maine car insurance rates after a speeding ticket: Travelers

Travelers has the cheapest car insurance in Maine for drivers with a speeding ticket on their records, at $86 per month. This is 36% lower than the state average of $135 per month.

Geico and MMG are the next-cheapest companies for Maine drivers with a ticket. Geico’s average rate is $112 per month, while MMG’s is $115 per month.

Cheapest companies after a ticket

| Company | Monthly rate |

|---|---|

| Travelers | $86 |

| Geico | $112 |

| MMG | $115 |

| State Farm | $119 |

| Progressive | $122 |

| Concord | $136 |

| Sentry | $171 |

| Allstate | $171 |

| Farmers | $235 |

| USAA* | $85 |

Although Geico is 30% more expensive than Travelers for drivers with a ticket on their records, it also has many more discount options. You can get discounts from Geico for:

- Insuring more than one vehicle

- Having more than one policy with the company

- Driving a car with certain safety devices or systems

- Being a homeowner

Most drivers in Maine see their car insurance premium go up by about 26% after a speeding ticket.

Maine’s cheapest car insurance quotes after an accident: Travelers

With an average rate of $95 per month, Travelers has Maine’s cheapest car insurance for drivers with an accident on their records. That’s 43% cheaper than the state average of $167 per month.

MMG and State Farm come in second and third for these drivers. Both companies offer rates of around $110 per month.

Cheapest companies after an accident

| Company | Monthly rate |

|---|---|

| Travelers | $95 |

| MMG | $108 |

| State Farm | $111 |

| Progressive | $141 |

| Concord | $163 |

| Geico | $192 |

| Sentry | $202 |

| Allstate | $236 |

| Farmers | $310 |

| USAA* | $112 |

One reason to choose State Farm over Travelers, even though Travelers is a bit cheaper, is that State Farm scores better for customer satisfaction. It also offers enough discounts that getting a few of them could make it the cheapest for you, too.

Car insurance rates go up about 56% after an accident in Maine, based on our research. If you have a policy with Travelers, your rate increase may be smaller. We found Travelers only raises rates 44% after an accident, on average.

Best cheap insurance for Maine teens with bad driving records: Travelers

Most people in Maine get the cheapest teen car insurance quotes from Travelers. The company’s average rate for teens with a speeding ticket on their records is $112 per month. Its average rate for teens after an accident is $132 per month.

Cheapest companies for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Travelers | $112 | $132 |

| Concord | $125 | $154 |

| State Farm | $144 | $132 |

| MMG | $159 | $163 |

| Geico | $179 | $245 |

| Allstate | $195 | $284 |

| Sentry | $220 | $268 |

| Progressive | $222 | $232 |

| Farmers | $260 | $319 |

| USAA* | $103 | $149 |

Concord has the second-cheapest rates for teens with a ticket on their records, at $125 per month. State Farm is second for those with an accident, at $132 per month.

Cheapest car insurance after an OUI in Maine: Travelers

At $99 per month, Travelers has Maine’s cheapest DUI insurance. This is less than half the state average of $249 per month for drivers with a DUI — or OUI

Progressive also offers affordable car insurance for Maine drivers with an OUI conviction. Its rates average $112 per month. MMG is worth a look, too, thanks to its rates of around $148 per month.

Cheapest insurance companies after a OUI

| Company | Monthly rate |

|---|---|

| Travelers | $99 |

| Progressive | $112 |

| MMG | $148 |

| Concord | $177 |

| Allstate | $179 |

| State Farm | $265 |

| Geico | $323 |

| Farmers | $351 |

| Sentry | $691 |

| USAA* | $151 |

Something else to consider besides rates and discounts when comparing car insurance companies is the add-on coverages they offer. These are important if you want to customize your policy.

Travelers and Progressive offer more add-on coverages than most top car insurance companies. Both have accident forgiveness

If you’re convicted of an OUI in Maine, your car insurance rates are likely to more than double, our data shows.

Maine’s cheapest car insurance for drivers with bad credit: Travelers

Travelers has the cheapest car insurance for drivers with bad credit in Maine, with rates of about $105 per month. The state average for these drivers is $222 per month, or more than twice Travelers’ rate.

Second-place MMG also has an average rate well below the state average, at $141 per month.

Cheapest insurance companies for poor credit

| Company | Monthly rate |

|---|---|

| Travelers | $105 |

| MMG | $141 |

| Progressive | $142 |

| Geico | $161 |

| Concord | $184 |

| Allstate | $197 |

| Sentry | $221 |

| State Farm | $469 |

| Farmers | $476 |

| USAA* | $124 |

Drivers in Maine with poor credit pay more than double what drivers with good credit pay for car insurance. You can usually improve your credit by paying down debt and avoiding late payments.

Best car insurance in Maine

Travelers is the best car insurance company in Maine overall because of its low rates for most drivers and its good selection of discounts and coverage options.

Maine car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Sentry | Not rated | Not rated | A+ |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| Concord | Not rated | A+ | |

| USAA* | 735 | A++ | |

| MMG | Not rated | A | |

| Progressive | 621 | A+ | |

| Geico | 645 | A++ | |

| Allstate | 635 | A+ | |

| Farmers | 622 | A |

Geico and Progressive are also worth a look. Their rates aren’t as low as Travelers’, but both offer many discounts that could help make them cheaper for you. Geico has the most discounts of the three companies, or the most chances to save money.

Progressive also has several optional coverages that let you customize your policy. And its J.D. Power customer satisfaction score is the best of these companies.

Maine insurance rates by city

Chebeague Island and Cousins Island have the cheapest car insurance rates among Maine’s many cities and towns. Drivers there pay $99 per month, on average, for full coverage.

Castine is the state’s most expensive city for car insurance. Rates there average $119 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abbot | $110 | 4% |

| Acton | $115 | 8% |

| Addison | $115 | 8% |

| Albion | $111 | 4% |

| Alfred | $108 | 1% |

| Alna | $113 | 6% |

| Andover | $113 | 6% |

| Anson | $116 | 9% |

| Ashland | $106 | -1% |

| Athens | $118 | 11% |

| Auburn | $112 | 5% |

| Augusta | $111 | 5% |

| Aurora | $114 | 7% |

| Bailey Island | $104 | -3% |

| Bangor | $107 | 0% |

| Bar Harbor | $111 | 4% |

| Bar Mills | $110 | 3% |

| Bass Harbor | $112 | 5% |

| Bath | $106 | 0% |

| Beals | $114 | 7% |

| Belfast | $112 | 5% |

| Belgrade | $118 | 11% |

| Belgrade Lakes | $117 | 10% |

| Benedicta | $106 | 0% |

| Bernard | $114 | 7% |

| Berwick | $112 | 5% |

| Bethel | $111 | 4% |

| Biddeford | $103 | -3% |

| Biddeford Pool | $106 | 0% |

| Bingham | $113 | 6% |

| Birch Harbor | $114 | 7% |

| Blaine | $103 | -4% |

| Blue Hill | $118 | 11% |

| Boothbay | $111 | 4% |

| Boothbay Harbor | $111 | 4% |

| Bowdoin | $109 | 2% |

| Bowdoinham | $108 | 1% |

| Bradford | $111 | 4% |

| Bradley | $107 | 1% |

| Bremen | $115 | 8% |

| Brewer | $107 | 1% |

| Bridgewater | $102 | -5% |

| Bridgton | $114 | 7% |

| Bristol | $115 | 8% |

| Brooklin | $117 | 10% |

| Brooks | $114 | 7% |

| Brooksville | $117 | 10% |

| Brookton | $113 | 6% |

| Brownfield | $116 | 8% |

| Brownville | $107 | 0% |

| Brownville Junction | $111 | 4% |

| Brunswick | $102 | -5% |

| Brunswick Station | $102 | -5% |

| Bryant Pond | $112 | 5% |

| Buckfield | $115 | 8% |

| Bucksport | $117 | 9% |

| Burlington | $108 | 2% |

| Burnham | $111 | 4% |

| Bustins Island | $104 | -3% |

| Buxton | $107 | 0% |

| Calais | $113 | 6% |

| Cambridge | $113 | 6% |

| Camden | $106 | -1% |

| Canaan | $113 | 6% |

| Canton | $116 | 8% |

| Cape Elizabeth | $101 | -5% |

| Cape Neddick | $109 | 2% |

| Cape Porpoise | $109 | 2% |

| Caratunk | $113 | 6% |

| Caribou | $104 | -2% |

| Carmel | $111 | 4% |

| Casco | $113 | 6% |

| Castine | $119 | 11% |

| Center Lovell | $118 | 11% |

| Chamberlain | $114 | 7% |

| Charleston | $111 | 4% |

| Chebeague Island | $99 | -7% |

| Cherryfield | $117 | 9% |

| China Village | $114 | 7% |

| Chisholm | $114 | 7% |

| Clayton Lake | $105 | -1% |

| Cliff Island | $104 | -2% |

| Clinton | $111 | 4% |

| Columbia Falls | $117 | 10% |

| Coopers Mills | $114 | 7% |

| Corea | $115 | 8% |

| Corinna | $111 | 5% |

| Corinth | $112 | 5% |

| Cornish | $114 | 7% |

| Cousins Island | $99 | -7% |

| Cranberry Isles | $113 | 6% |

| Crouseville | $106 | 0% |

| Cumberland Center | $101 | -5% |

| Cumberland Foreside | $100 | -6% |

| Cushing | $110 | 3% |

| Cutler | $117 | 10% |

| Damariscotta | $116 | 9% |

| Danforth | $115 | 7% |

| Danville | $111 | 4% |

| Deer Isle | $115 | 8% |

| Denmark | $116 | 9% |

| Dennysville | $117 | 9% |

| Detroit | $112 | 5% |

| Dexter | $111 | 4% |

| Dixfield | $116 | 9% |

| Dixmont | $115 | 8% |

| Dover-Foxcroft | $108 | 1% |

| Dresden | $113 | 6% |

| Dryden | $116 | 9% |

| Durham | $110 | 3% |

| Eagle Lake | $108 | 1% |

| East Andover | $115 | 8% |

| East Baldwin | $116 | 9% |

| East Blue Hill | $116 | 9% |

| East Boothbay | $112 | 5% |

| East Dixfield | $117 | 10% |

| East Livermore | $114 | 7% |

| East Machias | $116 | 9% |

| East Millinocket | $104 | -2% |

| East Newport | $114 | 7% |

| East Orland | $112 | 5% |

| East Parsonsfield | $117 | 9% |

| East Poland | $116 | 9% |

| East Vassalboro | $113 | 6% |

| East Waterboro | $110 | 3% |

| East Wilton | $117 | 10% |

| East Winthrop | $116 | 9% |

| Easton | $101 | -5% |

| Eastport | $115 | 8% |

| Eddington | $111 | 4% |

| Edgecomb | $113 | 6% |

| Eliot | $107 | 0% |

| Ellsworth | $113 | 6% |

| Estcourt Station | $109 | 2% |

| Etna | $111 | 4% |

| Eustis | $114 | 7% |

| Exeter | $112 | 5% |

| Fairfield | $110 | 3% |

| Falmouth | $103 | -4% |

| Falmouth Foreside | $102 | -5% |

| Farmingdale | $110 | 3% |

| Farmington | $114 | 7% |

| Farmington Falls | $113 | 6% |

| Fort Fairfield | $104 | -2% |

| Fort Kent | $104 | -3% |

| Fort Kent Mills | $108 | 2% |

| Frankfort | $114 | 7% |

| Franklin | $118 | 10% |

| Freedom | $116 | 9% |

| Freeport | $104 | -2% |

| Frenchboro | $112 | 5% |

| Frenchville | $106 | 0% |

| Friendship | $113 | 6% |

| Fryeburg | $116 | 9% |

| Gardiner | $112 | 5% |

| Garland | $110 | 3% |

| Georgetown | $107 | 0% |

| Gorham | $105 | -1% |

| Gouldsboro | $115 | 8% |

| Grand Isle | $106 | -1% |

| Grand Lake Stream | $116 | 9% |

| Gray | $105 | -1% |

| Greenbush | $110 | 3% |

| Greene | $114 | 7% |

| Greenville | $108 | 1% |

| Greenville Junction | $109 | 2% |

| Greenwood | $113 | 6% |

| Guilford | $110 | 3% |

| Hallowell | $111 | 4% |

| Hampden | $107 | 1% |

| Hancock | $114 | 7% |

| Hanover | $113 | 6% |

| Harborside | $114 | 7% |

| Harmony | $114 | 7% |

| Harpswell | $102 | -5% |

| Harrington | $116 | 9% |

| Harrison | $112 | 5% |

| Hartland | $114 | 7% |

| Hebron | $114 | 7% |

| Hinckley | $114 | 7% |

| Hiram | $117 | 10% |

| Holden | $112 | 5% |

| Hollis Center | $109 | 2% |

| Hope | $107 | 0% |

| Houlton | $104 | -3% |

| Howland | $104 | -2% |

| Hudson | $111 | 4% |

| Hulls Cove | $114 | 7% |

| Island Falls | $107 | 1% |

| Isle Au Haut | $111 | 4% |

| Isle of Springs | $114 | 6% |

| Islesboro | $109 | 2% |

| Islesford | $114 | 6% |

| Jackman | $109 | 3% |

| Jay | $114 | 7% |

| Jefferson | $116 | 9% |

| Jonesboro | $117 | 10% |

| Jonesport | $115 | 8% |

| Kenduskeag | $110 | 3% |

| Kennebunk | $102 | -5% |

| Kennebunkport | $106 | -1% |

| Kents Hill | $115 | 8% |

| Kingfield | $115 | 8% |

| Kingman | $110 | 4% |

| Kittery | $107 | 0% |

| Kittery Point | $106 | 0% |

| Lagrange | $109 | 2% |

| Lake Arrowhead | $111 | 4% |

| Lambert Lake | $115 | 8% |

| Lebanon | $112 | 5% |

| Lee | $108 | 2% |

| Leeds | $114 | 7% |

| Levant | $110 | 3% |

| Lewiston | $115 | 7% |

| Liberty | $115 | 8% |

| Limerick | $114 | 7% |

| Limestone | $105 | -2% |

| Limington | $112 | 5% |

| Lincoln | $103 | -3% |

| Lincolnville | $109 | 3% |

| Lincolnville Center | $113 | 6% |

| Lisbon | $111 | 4% |

| Lisbon Falls | $109 | 2% |

| Litchfield | $117 | 10% |

| Little Deer Isle | $115 | 8% |

| Little Falls | $105 | -1% |

| Livermore | $113 | 6% |

| Livermore Falls | $117 | 10% |

| Long Island | $102 | -4% |

| Lovell | $115 | 8% |

| Lubec | $118 | 11% |

| Machias | $115 | 8% |

| Machiasport | $117 | 9% |

| Madawaska | $105 | -2% |

| Madison | $115 | 8% |

| Manchester | $112 | 5% |

| Mapleton | $105 | -2% |

| Mars Hill | $102 | -5% |

| Matinicus | $112 | 5% |

| Mattawamkeag | $106 | 0% |

| Mechanic Falls | $110 | 4% |

| Meddybemps | $116 | 9% |

| Medway | $104 | -2% |

| Mexico | $112 | 5% |

| Milbridge | $115 | 8% |

| Milford | $107 | 0% |

| Millinocket | $105 | -2% |

| Milo | $110 | 3% |

| Minot | $114 | 7% |

| Monhegan | $113 | 6% |

| Monmouth | $116 | 9% |

| Monroe | $115 | 8% |

| Monson | $109 | 2% |

| Monticello | $104 | -3% |

| Moody | $108 | 1% |

| Morrill | $111 | 4% |

| Mount Desert | $112 | 5% |

| Mount Vernon | $118 | 11% |

| Naples | $114 | 7% |

| New Gloucester | $111 | 4% |

| New Harbor | $112 | 5% |

| New Limerick | $107 | 0% |

| New Portland | $116 | 9% |

| New Sharon | $114 | 7% |

| New Sweden | $105 | -1% |

| New Vineyard | $116 | 9% |

| Newcastle | $116 | 9% |

| Newport | $110 | 3% |

| Newry | $110 | 3% |

| Nobleboro | $118 | 11% |

| Norridgewock | $114 | 7% |

| North Anson | $115 | 8% |

| North Berwick | $107 | 1% |

| North Bridgton | $112 | 5% |

| North Haven | $106 | 0% |

| North Jay | $115 | 8% |

| North Monmouth | $115 | 8% |

| North Turner | $118 | 11% |

| North Vassalboro | $114 | 7% |

| North Waterboro | $110 | 3% |

| North Waterford | $112 | 5% |

| North Windham | $106 | 0% |

| North Yarmouth | $104 | -3% |

| Northeast Harbor | $113 | 6% |

| Norway | $112 | 5% |

| Oakfield | $106 | -1% |

| Oakland | $113 | 6% |

| Ocean Park | $107 | 0% |

| Ogunquit | $107 | 0% |

| Old Orchard Beach | $105 | -2% |

| Old Town | $106 | -1% |

| Oquossoc | $115 | 8% |

| Orient | $107 | 0% |

| Orland | $117 | 10% |

| Orono | $108 | 1% |

| Orrington | $107 | 1% |

| Orrs Island | $102 | -5% |

| Owls Head | $107 | 0% |

| Oxbow | $107 | 0% |

| Oxford | $112 | 5% |

| Palermo | $111 | 4% |

| Palmyra | $112 | 6% |

| Parsonsfield | $116 | 9% |

| Passadumkeag | $109 | 2% |

| Patten | $105 | -2% |

| Peaks Island | $102 | -4% |

| Pemaquid | $114 | 7% |

| Pembroke | $114 | 7% |

| Penobscot | $116 | 9% |

| Perham | $106 | 0% |

| Perry | $118 | 11% |

| Peru | $113 | 6% |

| Phillips | $115 | 8% |

| Phippsburg | $107 | 1% |

| Pittsfield | $111 | 4% |

| Plymouth | $111 | 4% |

| Poland | $112 | 5% |

| Port Clyde | $110 | 3% |

| Portage | $104 | -3% |

| Porter | $117 | 10% |

| Portland | $106 | 0% |

| Pownal | $109 | 2% |

| Presque Isle | $101 | -5% |

| Princeton | $113 | 6% |

| Prospect Harbor | $115 | 8% |

| Randolph | $110 | 3% |

| Rangeley | $113 | 6% |

| Raymond | $110 | 3% |

| Readfield | $115 | 8% |

| Richmond | $108 | 1% |

| Robbinston | $114 | 7% |

| Rockland | $106 | 0% |

| Rockport | $105 | -1% |

| Rockwood | $110 | 4% |

| Round Pond | $113 | 6% |

| Roxbury | $114 | 7% |

| Rumford | $112 | 5% |

| Sabattus | $110 | 3% |

| Saco | $104 | -2% |

| Salsbury Cove | $111 | 5% |

| Sandy Point | $113 | 6% |

| Sanford | $109 | 2% |

| Sangerville | $109 | 3% |

| Sargentville | $115 | 8% |

| Scarborough | $102 | -4% |

| Seal Cove | $114 | 7% |

| Seal Harbor | $112 | 5% |

| Searsmont | $114 | 7% |

| Searsport | $112 | 5% |

| Sebago | $115 | 8% |

| Sebasco Estates | $110 | 4% |

| Sebec | $107 | 1% |

| Sedgwick | $118 | 10% |

| Shapleigh | $114 | 7% |

| Shawmut | $114 | 7% |

| Sheridan | $108 | 1% |

| Sherman | $107 | 1% |

| Shirley Mills | $113 | 6% |

| Sinclair | $106 | 0% |

| Skowhegan | $114 | 7% |

| Smithfield | $116 | 9% |

| Smyrna Mills | $105 | -1% |

| Solon | $116 | 9% |

| Sorrento | $115 | 8% |

| South Berwick | $110 | 3% |

| South Bristol | $113 | 6% |

| South Casco | $111 | 4% |

| South China | $113 | 6% |

| South Eliot | $107 | 0% |

| South Freeport | $108 | 1% |

| South Gardiner | $114 | 7% |

| South Paris | $112 | 5% |

| South Portland | $104 | -3% |

| South Sanford | $108 | 2% |

| South Thomaston | $109 | 2% |

| South Windham | $107 | 0% |

| Southport | $111 | 4% |

| Southwest Harbor | $113 | 6% |

| Springfield | $109 | 2% |

| Springvale | $109 | 2% |

| Spruce Head | $110 | 3% |

| Squirrel Island | $116 | 9% |

| St. Agatha | $106 | 0% |

| St. Albans | $114 | 7% |

| St. David | $106 | -1% |

| St. Francis | $107 | 1% |

| Stacyville | $107 | 0% |

| Standish | $108 | 1% |

| Steep Falls | $110 | 3% |

| Stetson | $110 | 3% |

| Steuben | $117 | 10% |

| Stillwater | $111 | 4% |

| Stockholm | $106 | -1% |

| Stockton Springs | $113 | 6% |

| Stoneham | $115 | 8% |

| Stonington | $115 | 8% |

| Stratton | $113 | 6% |

| Strong | $117 | 10% |

| Sullivan | $115 | 8% |

| Sumner | $117 | 10% |

| Sunset | $112 | 5% |

| Surry | $115 | 8% |

| Swans Island | $113 | 6% |

| Temple | $114 | 7% |

| Tenants Harbor | $108 | 1% |

| Thomaston | $107 | 0% |

| Thorndike | $115 | 8% |

| Topsfield | $114 | 6% |

| Topsham | $105 | -1% |

| Trevett | $114 | 7% |

| Troy | $113 | 6% |

| Turner | $115 | 8% |

| Union | $110 | 4% |

| Unity | $113 | 6% |

| Van Buren | $106 | -1% |

| Vanceboro | $116 | 9% |

| Vassalboro | $112 | 5% |

| Vienna | $117 | 10% |

| Vinalhaven | $107 | 0% |

| Waite | $115 | 7% |

| Waldoboro | $118 | 11% |

| Wallagrass | $107 | 1% |

| Walpole | $111 | 4% |

| Warren | $112 | 5% |

| Washburn | $104 | -2% |

| Washington | $113 | 6% |

| Waterboro | $112 | 5% |

| Waterford | $111 | 4% |

| Waterville | $111 | 4% |

| Wayne | $114 | 7% |

| Weld | $113 | 6% |

| Wells | $104 | -2% |

| Wesley | $115 | 8% |

| West Baldwin | $116 | 9% |

| West Bethel | $116 | 8% |

| West Boothbay Harbor | $114 | 7% |

| West Enfield | $106 | -1% |

| West Farmington | $115 | 8% |

| West Forks | $112 | 5% |

| West Kennebunk | $102 | -4% |

| West Minot | $118 | 11% |

| West Newfield | $117 | 10% |

| West Paris | $116 | 9% |

| West Poland | $117 | 10% |

| West Rockport | $110 | 4% |

| Westbrook | $104 | -2% |

| Westfield | $104 | -2% |

| Whitefield | $111 | 4% |

| Whiting | $116 | 9% |

| Wilton | $116 | 9% |

| Windham | $107 | 0% |

| Windsor | $112 | 5% |

| Winn | $109 | 2% |

| Winslow | $110 | 3% |

| Winter Harbor | $114 | 7% |

| Winterport | $111 | 4% |

| Winthrop | $113 | 6% |

| Wiscasset | $113 | 6% |

| Woodland Washington County | $114 | 7% |

| Woolwich | $109 | 3% |

| Wytopitlock | $109 | 2% |

| Yarmouth | $100 | -7% |

| York | $108 | 1% |

| York Beach | $112 | 5% |

| York Harbor | $108 | 1% |

The average monthly cost of car insurance in Maine’s biggest cities:

- Portland, $106

- Lewiston, $115

- Bangor, $107

- South Portland, $104

- Auburn, $112

Minimum coverage for car insurance in Maine

To meet Maine’s car insurance requirements, you need to buy a minimum amount of liability, uninsured and underinsured motorist, and medical payments coverages.

- Liability (bodily injury): $50,000 per person, $100,000 per accident

- Liability (property damage): $25,000 per accident

- Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

- Medical payments: $2,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

State law doesn’t require full coverage car insurance

SR-22 insurance in Maine

If your driver’s license is suspended in Maine, you must file an SR-22 to get it reinstated.

An SR-22 proves you carry the minimum amount of car insurance the state requires. Your insurance company should file the SR-22 with the Bureau of Motor Vehicles (BMV) for you.

Frequently asked questions

Car insurance in Maine costs around $107 per month if you get full coverage. If you only get minimum coverage, the state average cost is $43 per month.

The cheapest car insurance in Maine comes from Travelers, which charges $32 per month for minimum coverage. It also has the state’s cheapest full coverage car insurance, at $66 per month.

Maine car insurance is cheap for several reasons. One is that the state’s residents are fairly spread out. Another is that it has few uninsured drivers. Maine also has a low rate of traffic incidents like speeding and accidents.

No, Maine is an at-fault car insurance state. This means the person who causes the accident pays for any injuries and vehicle damage.

How we selected the cheapest car insurance companies in Maine

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $2,000 per person

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Maine

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.