Cheapest Car Insurance in Montana (2026)

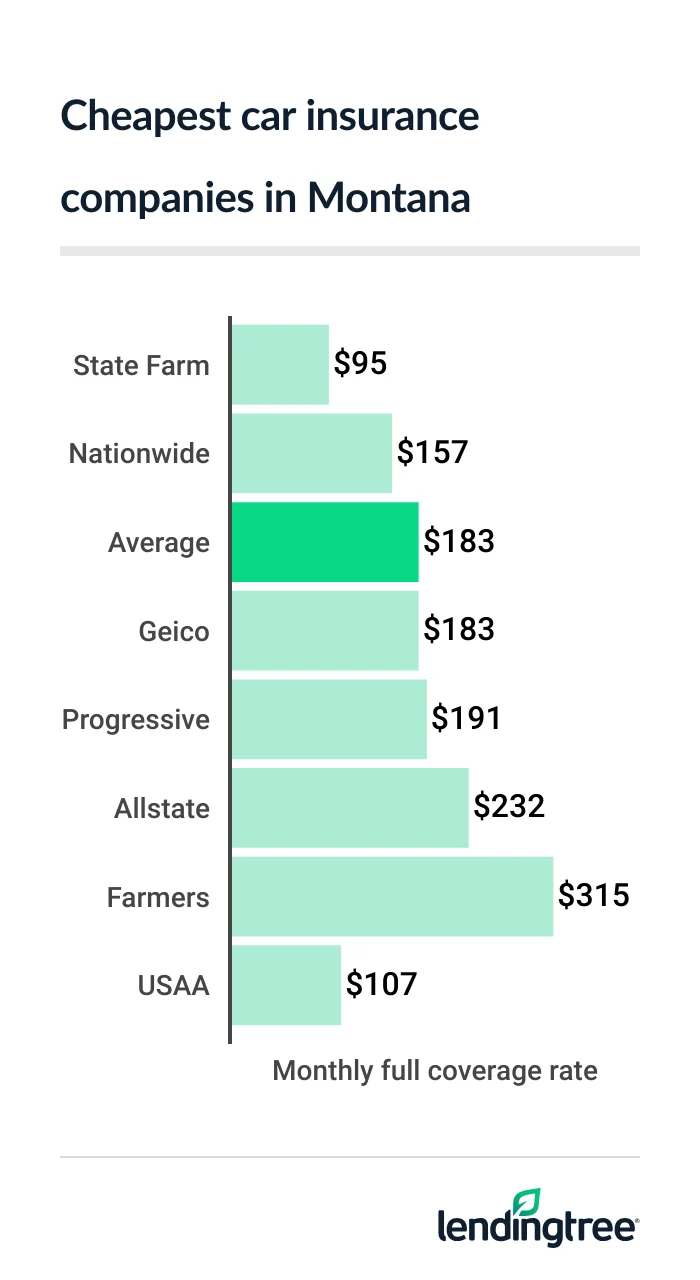

State Farm is the best company for cheap car insurance in Montana, at $95 a month for full coverage. That’s just over half the state average of $183 a month.

Best cheap car insurance in Montana

Cheapest full coverage car insurance in Montana: State Farm

State Farm has Montana’s cheapest full coverage car insurance, with an average rate of $95 per month.

USAA has the state’s second-cheapest rates for full coverage

Nationwide and Geico also offer car insurance to Montana drivers that is at or below the state average rate of $183 per month.

Nationwide’s average rate is $157 per month, while Geico’s is $183.

MT full coverage car insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $95 | |

| Nationwide | $157 | |

| Geico | $183 | |

| Progressive | $191 | |

| Allstate | $232 | |

| Farmers | $315 | |

| USAA* | $107 | |

Although all four of these companies have good J.D. Power customer satisfaction scores

Montana’s best cheap liability insurance: State Farm

With an average quote of $17 per month, State Farm also has the cheapest liability insurance in Montana. This is $29 less than the state average of $46 per month.

Geico is the next-cheapest company for most Montana drivers, at $37 per month for liability-only

MT liability insurance rates

| Company | Monthly rate |

|---|---|

| State Farm | $17 |

| Geico | $37 |

| Nationwide | $49 |

| Progressive | $55 |

| Farmers | $66 |

| Allstate | $79 |

| USAA* | $20 |

With Geico, you may get discounts for having a newer vehicle or driving a car with certain safety features. Geico also has discounts for getting a quote before you buy a policy, going paperless and signing up for autopay.

One of the best ways to find out which company is the best for you is to compare car insurance quotes from several of them before you buy or renew your policy.

Cheap car insurance in Montana for teen drivers: State Farm

To get the cheapest teen car insurance in Montana, make sure you get a quote from State Farm as you shop for a policy.

State Farm has the state’s lowest teen liability rates, at an average of $58 per month. It also has the cheapest full coverage rates for teen drivers, at $249 per month.

Teen car insurance rates in MT

| Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $58 | $249 |

| Geico | $123 | $589 |

| Progressive | $143 | $535 |

| Nationwide | $156 | $387 |

| Allstate | $168 | $437 |

| Farmers | $233 | $914 |

| USAA* | $75 | $324 |

Geico is the second-cheapest company for most Montana drivers who want cheap teen liability coverage, at $123 per month. Nationwide has the second-cheapest full coverage for most teens, at $387 per month.

Discounts are one of the best and easiest ways to save money on car insurance for teen drivers.

State Farm, Geico and many other companies offer discounts for teens and young adults who:

- Complete a driver’s education program

- Get good grades

- Go away to college without a vehicle

Cheapest Montana auto insurance after a speeding ticket: State Farm

State Farm is Montana’s cheapest car insurance company for drivers with a speeding ticket on their records. Its average rate for these drivers is $99 per month.

Cheapest MT insurance after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $99 |

| Nationwide | $220 |

| Geico | $236 |

| Allstate | $246 |

| Progressive | $252 |

| Farmers | $423 |

| USAA* | $141 |

The average cost of car insurance after a speeding ticket is $231 per month in Montana. Nationwide also comes in below that amount, with an average rate of $220 per month.

You can expect your car insurance premium to go up about $50 per month after getting a speeding ticket in Montana.

Best auto insurance quotes after an accident in Montana: State Farm

At $95 per month, State Farm has Montana’s cheapest car insurance after an accident. This is less than half the state average of $267 per month.

Nationwide is the state’s next-cheapest company after an accident, but its average rate is quite a bit higher than State Farm’s, at $260 per month.

Cheapest MT insurance after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $95 |

| Nationwide | $260 |

| Progressive | $282 |

| Geico | $314 |

| Allstate | $347 |

| Farmers | $429 |

| USAA* | $141 |

The average driver in Montana sees their car insurance go up around $85 per month after an accident.

Montana’s cheapest car insurance for teens with bad driving records: State Farm

Teens in Montana with a speeding ticket or accident on their driving records usually get the cheapest car insurance from State Farm.

State Farm’s average quote for teens with a speeding ticket is $64 per month. For teens with an accident, the company’s quotes average $58 per month.

MT car insurance quotes for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $64 | $58 |

| Geico | $143 | $165 |

| Progressive | $154 | $165 |

| Nationwide | $168 | $170 |

| Allstate | $183 | $280 |

| Farmers | $287 | $287 |

| USAA* | $87 | $89 |

If you have ties to the military, don’t ignore USAA. It has the next-cheapest car insurance quotes for young drivers in Montana with a ticket, at $87 per month. USAA also comes in second for young drivers after an accident, at $89 per month.

For families not affiliated with the military, Geico is the second-cheapest option for most Montana teens with bad driving records.

Cheap Montana car insurance quotes after a DUI: State Farm

State Farm offers the cheapest DUI insurance in Montana, with an average quote of $184 per month.

Progressive, Allstate and Nationwide are next, all with average quotes that are under $350 per month for drivers with DUI (driving under the influence) convictions.

MT car insurance quotes after a DUI

| Company | Monthly rate |

|---|---|

| State Farm | $184 |

| Progressive | $223 |

| Allstate | $312 |

| Nationwide | $347 |

| Farmers | $413 |

| Geico | $583 |

| USAA* | $208 |

Although Progressive is more expensive than State Farm, you can customize your policy more with Progressive. It offers accident forgiveness

The average Montana driver pays $324 per month for car insurance after a DUI. This is just over $140 per month more than what drivers with clean records pay for the same amount of coverage.

Cheapest car insurance for bad credit in Montana: Nationwide

Nationwide has Montana’s cheapest car insurance for drivers with bad credit, at $251 per month.

Geico is close behind, with an average quote of $262 per month. Progressive also comes in under the state average, at $301 per month.

MT car insurance quotes with poor credit

| Company | Monthly rate |

|---|---|

| Nationwide | $251 |

| Geico | $262 |

| Progressive | $301 |

| Allstate | $344 |

| State Farm | $492 |

| Farmers | $518 |

| USAA* | $221 |

The state average cost of car insurance with poor credit is $341 per month. This is nearly $160 per month more than what a typical Montana driver with good credit pays for the same policy.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance companies in Montana

State Farm is the best car insurance company in Montana, based on our data and research.

State Farm has the cheapest car insurance rates in the state for most drivers, and its many discounts could make it even more affordable.

It also has a great J.D. Power customer satisfaction score, which means its customers are generally happy about how the company handles things like price, coverage options and service.

Montana car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Montana insurance rates by city

The cheapest city for car insurance in Montana is Fort Harrison, where rates average $154 per month.

Drivers in Lodge Grass pay the state’s highest car insurance rates of $198 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Absarokee | $184 | 1% |

| Acton | $181 | -1% |

| Alberton | $166 | -9% |

| Alder | $165 | -10% |

| Alzada | $182 | -1% |

| Anaconda-Deer Lodge County | $161 | -12% |

| Angela | $182 | -1% |

| Antelope | $175 | -5% |

| Arlee | $171 | -7% |

| Ashland | $181 | -1% |

| Augusta | $170 | -7% |

| Avon | $160 | -12% |

| Babb | $183 | 0% |

| Bainville | $179 | -2% |

| Baker | $180 | -1% |

| Ballantine | $182 | 0% |

| Basin | $164 | -10% |

| Bearcreek | $182 | -1% |

| Belfry | $182 | 0% |

| Belgrade | $163 | -11% |

| Belt | $175 | -4% |

| Biddle | $185 | 1% |

| Big Arm | $180 | -1% |

| Big Sandy | $183 | 0% |

| Big Sky | $168 | -8% |

| Big Timber | $180 | -2% |

| Bigfork | $185 | 1% |

| Bighorn | $180 | -1% |

| Billings | $178 | -3% |

| Birney | $181 | -1% |

| Black Eagle | $171 | -6% |

| Bloomfield | $177 | -3% |

| Bonner | $160 | -13% |

| Bonner-West Riverside | $154 | -16% |

| Boulder | $160 | -12% |

| Box Elder | $183 | 0% |

| Boyd | $183 | 0% |

| Boyes | $180 | -2% |

| Bozeman | $164 | -10% |

| Brady | $176 | -4% |

| Bridger | $184 | 0% |

| Broadus | $188 | 3% |

| Broadview | $181 | -1% |

| Brockton | $180 | -2% |

| Brockway | $175 | -4% |

| Browning | $185 | 1% |

| Brusett | $185 | 1% |

| Buffalo | $179 | -2% |

| Busby | $191 | 4% |

| Butte | $167 | -9% |

| Bynum | $178 | -3% |

| Cameron | $165 | -10% |

| Canyon Creek | $166 | -9% |

| Capitol | $189 | 3% |

| Cardwell | $161 | -12% |

| Carter | $177 | -3% |

| Cascade | $171 | -7% |

| Charlo | $173 | -6% |

| Chester | $177 | -3% |

| Chinook | $182 | 0% |

| Choteau | $177 | -3% |

| Circle | $177 | -3% |

| Clancy | $166 | -9% |

| Clinton | $161 | -12% |

| Clyde Park | $171 | -7% |

| Coffee Creek | $178 | -3% |

| Cohagen | $182 | 0% |

| Colstrip | $180 | -2% |

| Columbia Falls | $180 | -1% |

| Columbus | $183 | 0% |

| Condon | $170 | -7% |

| Conner | $164 | -10% |

| Conrad | $173 | -5% |

| Cooke City | $169 | -8% |

| Coram | $179 | -2% |

| Corvallis | $161 | -12% |

| Crane | $174 | -5% |

| Crow Agency | $192 | 5% |

| Culbertson | $175 | -4% |

| Custer | $173 | -5% |

| Cut Bank | $183 | 0% |

| Dagmar | $174 | -5% |

| Darby | $161 | -12% |

| Dayton | $184 | 1% |

| De Borgia | $172 | -6% |

| Decker | $185 | 1% |

| Deer Lodge | $159 | -13% |

| Dell | $161 | -12% |

| Denton | $176 | -4% |

| Dillon | $159 | -13% |

| Divide | $163 | -11% |

| Dixon | $173 | -6% |

| Dodson | $185 | 1% |

| Drummond | $161 | -12% |

| Dupuyer | $179 | -2% |

| Dutton | $177 | -3% |

| East Glacier Park | $185 | 1% |

| East Helena | $159 | -13% |

| East Missoula | $154 | -16% |

| Edgar | $182 | 0% |

| Ekalaka | $182 | -1% |

| Elliston | $162 | -12% |

| Elmo | $182 | -1% |

| Emigrant | $166 | -9% |

| Ennis | $163 | -11% |

| Essex | $182 | -1% |

| Ethridge | $178 | -3% |

| Eureka | $182 | 0% |

| Evaro | $165 | -10% |

| Evergreen | $181 | -1% |

| Fairfield | $174 | -5% |

| Fairview | $177 | -3% |

| Fallon | $180 | -2% |

| Fishtail | $183 | 0% |

| Flaxville | $174 | -5% |

| Florence | $160 | -12% |

| Floweree | $175 | -5% |

| Forest Grove | $179 | -2% |

| Forsyth | $180 | -2% |

| Fort Belknap Agency | $186 | 2% |

| Fort Benton | $177 | -3% |

| Fort Harrison | $154 | -16% |

| Fort Peck | $180 | -2% |

| Fort Shaw | $172 | -6% |

| Fort Smith | $195 | 7% |

| Fortine | $181 | -1% |

| Four Corners | $167 | -9% |

| Frazer | $180 | -2% |

| Frenchtown | $159 | -13% |

| Froid | $174 | -5% |

| Fromberg | $184 | 0% |

| Galata | $179 | -2% |

| Gallatin Gateway | $168 | -8% |

| Gardiner | $172 | -6% |

| Garrison | $160 | -12% |

| Garryowen | $189 | 3% |

| Geraldine | $178 | -3% |

| Geyser | $177 | -3% |

| Gildford | $181 | -1% |

| Glasgow | $180 | -2% |

| Glen | $160 | -13% |

| Glendive | $175 | -4% |

| Glentana | $179 | -2% |

| Gold Creek | $160 | -12% |

| Grantsdale | $161 | -12% |

| Grass Range | $175 | -4% |

| Great Falls | $170 | -7% |

| Greycliff | $183 | 0% |

| Hall | $160 | -12% |

| Hamilton | $162 | -11% |

| Hammond | $182 | 0% |

| Hardin | $188 | 3% |

| Harlem | $186 | 2% |

| Harlowton | $180 | -2% |

| Harrison | $163 | -11% |

| Hathaway | $180 | -2% |

| Haugan | $172 | -6% |

| Havre | $179 | -2% |

| Havre North | $179 | -2% |

| Hays | $188 | 3% |

| Heart Butte | $188 | 3% |

| Helena | $158 | -13% |

| Helena Flats | $181 | -1% |

| Helena Valley Northeast | $157 | -14% |

| Helena Valley Northwest | $157 | -14% |

| Helena Valley Southeast | $158 | -14% |

| Helena Valley West Central | $157 | -14% |

| Helena West Side | $159 | -13% |

| Helmville | $162 | -12% |

| Heron | $186 | 2% |

| Highwood | $180 | -2% |

| Hilger | $177 | -3% |

| Hingham | $181 | -1% |

| Hinsdale | $178 | -3% |

| Hobson | $177 | -3% |

| Hogeland | $186 | 2% |

| Homestead | $174 | -5% |

| Hot Springs | $178 | -3% |

| Hungry Horse | $179 | -2% |

| Huntley | $181 | -1% |

| Huson | $159 | -13% |

| Hysham | $181 | -1% |

| Ingomar | $181 | -1% |

| Inverness | $179 | -2% |

| Ismay | $181 | -1% |

| Jackson | $161 | -12% |

| Jefferson City | $164 | -10% |

| Joliet | $181 | -1% |

| Joplin | $175 | -4% |

| Jordan | $182 | 0% |

| Judith Gap | $175 | -4% |

| Kalispell | $181 | -1% |

| Kevin | $178 | -3% |

| Kila | $183 | 0% |

| Kinsey | $183 | 0% |

| Kremlin | $181 | -1% |

| Lake Mc Donald | $181 | -1% |

| Lakeside | $185 | 1% |

| Lambert | $176 | -4% |

| Lame Deer | $184 | 1% |

| Larslan | $184 | 0% |

| Laurel | $177 | -3% |

| Lavina | $182 | 0% |

| Ledger | $176 | -4% |

| Lewistown | $173 | -6% |

| Libby | $182 | 0% |

| Lima | $160 | -12% |

| Lincoln | $169 | -8% |

| Lindsay | $177 | -3% |

| Livingston | $170 | -7% |

| Lloyd | $184 | 0% |

| Lockwood | $178 | -3% |

| Lodge Grass | $198 | 8% |

| Lolo | $159 | -13% |

| Loma | $180 | -1% |

| Lonepine | $177 | -3% |

| Loring | $180 | -2% |

| Lothair | $177 | -3% |

| Malmstrom AFB | $169 | -8% |

| Malta | $181 | -1% |

| Manhattan | $167 | -9% |

| Marion | $183 | 0% |

| Martin City | $181 | -1% |

| Martinsdale | $162 | -12% |

| Marysville | $169 | -7% |

| Mc Allister | $161 | -12% |

| Mc Leod | $181 | -1% |

| Medicine Lake | $173 | -6% |

| Melrose | $164 | -11% |

| Melstone | $184 | 0% |

| Melville | $183 | 0% |

| Mildred | $181 | -1% |

| Miles City | $180 | -1% |

| Milltown | $155 | -15% |

| Missoula | $156 | -15% |

| Moccasin | $176 | -4% |

| Molt | $182 | 0% |

| Monarch | $169 | -8% |

| Montana City | $167 | -9% |

| Moore | $178 | -3% |

| Mosby | $183 | 0% |

| Musselshell | $180 | -2% |

| Nashua | $180 | -1% |

| Neihart | $174 | -5% |

| Niarada | $179 | -2% |

| Norris | $164 | -10% |

| North Browning | $185 | 1% |

| Noxon | $186 | 2% |

| Nye | $182 | -1% |

| Oilmont | $179 | -2% |

| Olive | $181 | -1% |

| Olney | $181 | -1% |

| Opheim | $179 | -2% |

| Orchard Homes | $155 | -15% |

| Otter | $184 | 0% |

| Outlook | $177 | -3% |

| Ovando | $168 | -8% |

| Pablo | $173 | -5% |

| Paradise | $174 | -5% |

| Park City | $184 | 1% |

| Peerless | $179 | -2% |

| Pendroy | $177 | -3% |

| Philipsburg | $163 | -11% |

| Pinesdale | $161 | -12% |

| Plains | $175 | -4% |

| Plentywood | $172 | -6% |

| Plevna | $180 | -1% |

| Polaris | $160 | -13% |

| Polebridge | $180 | -2% |

| Polson | $178 | -2% |

| Pompeys Pillar | $184 | 1% |

| Pony | $162 | -12% |

| Poplar | $178 | -3% |

| Powderville | $181 | -1% |

| Power | $181 | -1% |

| Pray | $169 | -7% |

| Proctor | $181 | -1% |

| Pryor | $191 | 4% |

| Radersburg | $167 | -9% |

| Ramsay | $165 | -10% |

| Rapelje | $182 | 0% |

| Ravalli | $174 | -5% |

| Raymond | $177 | -3% |

| Raynesford | $178 | -3% |

| Red Lodge | $185 | 1% |

| Redstone | $177 | -3% |

| Reed Point | $184 | 0% |

| Reserve | $175 | -5% |

| Rexford | $181 | -1% |

| Richey | $180 | -2% |

| Richland | $179 | -2% |

| Ringling | $165 | -10% |

| Riverbend | $168 | -8% |

| Roberts | $185 | 1% |

| Rocky Boy’s Agency | $183 | 0% |

| Rocky Point | $179 | -2% |

| Rollins | $185 | 1% |

| Ronan | $173 | -5% |

| Roscoe | $184 | 1% |

| Rosebud | $180 | -2% |

| Roundup | $177 | -3% |

| Roy | $177 | -3% |

| Rudyard | $180 | -2% |

| Ryegate | $183 | 0% |

| Saco | $178 | -3% |

| Saltese | $173 | -5% |

| Sand Coulee | $171 | -6% |

| Sand Springs | $186 | 2% |

| Sanders | $181 | -1% |

| Sangrey | $182 | 0% |

| Savage | $175 | -4% |

| Scobey | $177 | -3% |

| Seeley Lake | $166 | -9% |

| Shawmut | $179 | -2% |

| Shelby | $175 | -4% |

| Shepherd | $183 | 0% |

| Sheridan | $167 | -8% |

| Sidney | $171 | -6% |

| Silver Gate | $167 | -9% |

| Silver Star | $165 | -10% |

| Simms | $171 | -7% |

| Somers | $183 | 0% |

| South Browning | $185 | 1% |

| Springdale | $166 | -9% |

| St. Ignatius | $172 | -6% |

| St. Marie | $180 | -2% |

| St. Regis | $174 | -5% |

| St. Xavier | $192 | 5% |

| Stanford | $178 | -3% |

| Stevensville | $161 | -12% |

| Stockett | $175 | -4% |

| Stryker | $181 | -1% |

| Sula | $159 | -13% |

| Sumatra | $182 | 0% |

| Sun Prairie | $169 | -8% |

| Sun River | $173 | -6% |

| Sunburst | $180 | -2% |

| Superior | $168 | -8% |

| Sweet Grass | $180 | -2% |

| Teigen | $175 | -4% |

| Terry | $183 | 0% |

| Thompson Falls | $179 | -2% |

| Three Forks | $164 | -10% |

| Toston | $164 | -11% |

| Townsend | $164 | -10% |

| Trego | $181 | -1% |

| Trout Creek | $181 | -1% |

| Troy | $188 | 3% |

| Turner | $185 | 1% |

| Twin Bridges | $164 | -10% |

| Two Dot | $178 | -3% |

| Ulm | $171 | -7% |

| Valier | $183 | 0% |

| Vandalia | $177 | -3% |

| Vaughn | $171 | -7% |

| Victor | $160 | -13% |

| Vida | $176 | -4% |

| Virginia City | $162 | -11% |

| Volborg | $180 | -2% |

| Walkerville | $166 | -9% |

| West Glacier | $177 | -3% |

| West Glendive | $175 | -4% |

| West Yellowstone | $167 | -9% |

| Westby | $175 | -4% |

| White Haven | $182 | 0% |

| White Sulphur Springs | $161 | -12% |

| Whitefish | $181 | -1% |

| Whitehall | $161 | -12% |

| Whitetail | $180 | -1% |

| Whitewater | $180 | -2% |

| Whitlash | $179 | -2% |

| Wibaux | $176 | -4% |

| Willard | $180 | -2% |

| Willow Creek | $163 | -11% |

| Wilsall | $170 | -7% |

| Winifred | $176 | -4% |

| Winnett | $183 | 0% |

| Winston | $164 | -11% |

| Wisdom | $160 | -12% |

| Wise River | $158 | -14% |

| Wolf Creek | $168 | -8% |

| Wolf Point | $179 | -2% |

| Worden | $181 | -1% |

| Wyola | $197 | 8% |

| Zortman | $184 | 0% |

| Zurich | $183 | 0% |

The average cost of car insurance in Montana’s largest cities:

- Billings, $178 per month

- Bozeman, $164 per month

- Great Falls, $170 per month

- Missoula, $156 per month

Minimum coverage for car insurance in Montana

Montana drivers are required to have at least 25/50/20 car insurance. This means they need to buy, at a minimum:

- $25,000 of bodily injury liability coverage per person

- $50,000 of bodily injury liability coverage per accident

- $20,000 of property damage coverage

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you cause to someone else’s property, including their vehicles.

Montana law doesn’t require full coverage, which usually includes collision

Frequently asked questions

Car insurance in Montana costs $46 a month, on average, if you only buy liability coverage. If you buy a full coverage policy, the state average cost is $183 a month.

The cheapest car insurance in Montana comes from State Farm. The company has the lowest average rate for liability coverage, at $17 a month. It also has the state’s lowest full coverage rate of $95 a month.

Montana is an at-fault car insurance state. This means the driver who causes the accident pays for injuries and damages.

How we selected the cheapest car insurance companies in Montana

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Montana

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.