Cheapest Car Insurance in Nebraska (2026)

FMNE has Nebraska’s cheapest full coverage car insurance at $99 a month. It also has the state’s cheapest liability insurance rate of $21 a month.

Best cheap Nebraska car insurance

Nebraska’s cheapest full coverage car insurance: FMNE

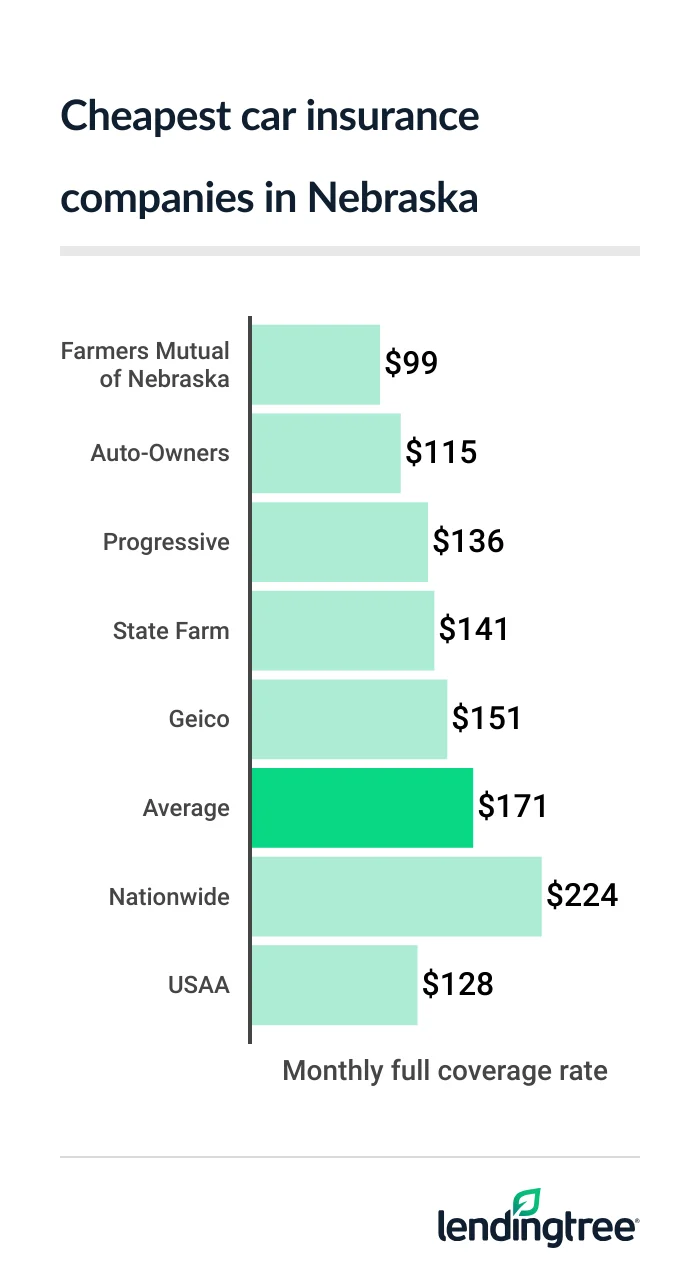

FMNE has Nebraska’s cheapest full coverage car insurance at $99 a month. Auto-Owners’ rate is 16% higher at $115 a month.

Auto-Owers is a better choice for full coverage

Full coverage costs an average of $171 a month in Nebraska. The actual price you pay depends on things like your driving record, vehicle and credit history.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| FMNE | $99 | |

| Auto-Owners | $115 | |

| Progressive | $136 | |

| State Farm | $141 | |

| Geico | $151 | |

| Nationwide | $224 | |

| Allstate | $240 | |

| Farm Bureau | $306 | |

| USAA* | $128 | |

Each company treats these factors differently and has different car insurance discounts. This makes it good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheapest Nebraska liability insurance: FMNE

At $21 a month, FMNE has Nebraska’s cheapest liability insurance, or minimum coverage. USAA has the next-cheapest rate, but it’s only available to the military community.

Minimum coverage includes liability

Cheap auto liability insurance

| Company | Monthly rate |

|---|---|

| FMNE | $21 |

| Geico | $32 |

| State Farm | $32 |

| Progressive | $36 |

| Auto-Owners | $42 |

| Nationwide | $71 |

| Farm Bureau | $83 |

| Allstate | $86 |

| USAA* | $31 |

Geico charges $11 more per month for liability insurance than FMNE. However, GEICO also offers a lot more discounts than FMNE. You can save with Geico if you:

- Serve in the military

- Work for the federal government

- Belong to a participating professional or alumni group

- Own your home

- Have a clean driving record

Discounts like these could make Geico your cheapest option if you qualify for enough of them. FMNE only offers a handful of discounts.

Best Nebraska car insurance rates for teens: FMNE

Nebraskans get the cheapest car insurance for teens from FMNE. The company charges young drivers an average of $59 a month for minimum coverage. Geico is the next-cheapest company for most teens at $91 a month, which is 53% higher than FMNE’s rate.

At $182 a month, FMNE also has the cheapest full coverage for young Nebraska drivers. This is 45% less than the next-cheapest rate of $332 a month from Auto-Owners.

Cheapest teen auto insurance

| Company | Minimum coverage | Full coverage |

|---|---|---|

| FMNE | $59 | $182 |

| Geico | $91 | $372 |

| State Farm | $104 | $356 |

| Auto-Owners | $152 | $332 |

| Progressive | $183 | $577 |

| Allstate | $212 | $451 |

| Nationwide | $236 | $688 |

| Farm Bureau | $265 | $691 |

| USAA* | $80 | $290 |

A lack of driving experience makes teens more likely to crash than older drivers. This leads to high auto insurance costs for young drivers. Teens usually get cheaper car insurance on a parent’s policy than they do on their own.

Usage-based insurance (UBI) programs also help make car insurance affordable for teens. These programs typically use a smartphone app to monitor your driving. You get discounts based on how safely you drive. The apps also provide feedback you can use to improve your driving.

Most large companies, including Geico, State Farm and Progressive, have UBI. The programs are available to drivers of all ages, but teens may benefit the most. FMNE does not offer UBI.

Cheap Nebraska auto insurance with a speeding ticket: Auto-Owners

Auto-Owners and FMNE have Nebraska’s cheapest auto insurance after a speeding ticket. Auto-Owners has the cheapest rate at $115 a month. FMNE is only slightly more expensive at $117 a month. Auto-Owners also has a few more discounts than FMNE, which could make it an even cheaper option.

Insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Auto-Owners | $115 |

| FMNE | $117 |

| State Farm | $148 |

| Geico | $185 |

| Progressive | $208 |

| Allstate | $262 |

| Nationwide | $298 |

| Farm Bureau | $367 |

| USAA* | $160 |

Auto-Owners and FMNE make their quotes available through independent insurance agents

Nebraska’s cheapest car insurance after an accident: FMNE

At $122 a month, FMNE has Nebraska’s cheapest car insurance after an at-fault accident. This is 54% less than the average rate of $265 a month after an accident. State Farm is the next-cheapest company after an accident at $141 a month.

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| FMNE | $122 |

| State Farm | $141 |

| Auto-Owners | $167 |

| Progressive | $241 |

| Geico | $306 |

| Nationwide | $358 |

| Allstate | $380 |

| Farm Bureau | $486 |

| USAA* | $182 |

An at-fault accident raises the average cost of full coverage by 55% to $265 a month. However, some companies raise their rates by smaller amounts. Shopping around for car insurance with a bad driving record helps you avoid overpaying.

Cheap Nebraska car insurance for teens with bad driving records: FMNE

Teens with a bad driving record can get the cheapest car insurance quotes from FMNE in Nebraska. The company charges young drivers with a speeding ticket $76 a month. This is 34% less than the next-cheapest rate of $116 a month from Geico.

FMNE’s rates for teens with an accident average $84 a month, which is 20% less than State Farm’s rate.

Rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| FMNE | $76 | $84 |

| State Farm | $116 | $104 |

| Geico | $124 | $153 |

| Auto-Owners | $169 | $225 |

| Progressive | $213 | $232 |

| Allstate | $242 | $419 |

| Nationwide | $255 | $258 |

| Farm Bureau | $331 | $435 |

| USAA* | $126 | $139 |

Nebraska’s cheapest car insurance with a DUI: Progressive

At $175 a month, Progressive has Nebraska’s cheapest car insurance after a DUI (driving under the influence). FMNE also has cheap DUI insurance at $187 a month

Cheapest DUI insurance rates

| Company | Monthly rate |

|---|---|

| Progressive | $175 |

| FMNE | $187 |

| Auto-Owners | $211 |

| State Farm | $259 |

| Allstate | $309 |

| Farm Bureau | $367 |

| Nationwide | $488 |

| Geico | $521 |

| USAA* | $265 |

Progressive offers a few discounts that FMNE doesn’t have. You can save by:

- Getting an online quote

- Signing up for your policy online

- Going paperless

- Setting up automatic payments

Discounts like these can help make car insurance more affordable after a DUI.

Best Nebraska car insurance for bad credit: FMNE

FMNE has Nebraska’s cheapest bad credit car insurance at $149 a month. This is 27% less than the next-cheapest rate of $205 a month from Geico.

Cheap bad credit car insurance

| Company | Monthly rate |

|---|---|

| FMNE | $149 |

| Geico | $205 |

| Progressive | $220 |

| Nationwide | $316 |

| Auto-Owners | $342 |

| Allstate | $369 |

| Farm Bureau | $567 |

| State Farm | $699 |

| USAA* | $221 |

Nebraska drivers with bad credit pay an average of $343 a month for full coverage. This is about twice as much as the average with good credit.

Insurance companies believe your borrowing habits show how likely you are to have a claim. You can improve your credit rating and get cheaper car insurance by:

- Avoiding late payments

- Paying down debts

Nebraska’s best car insurance companies

FMNE and Auto-Owners are Nebraska’s best car insurance companies.

FMNE has the best rates for most drivers, including teens and drivers with bad credit. It offers all the basic coverages like liability, collision

Auto-Owners has the best combination of low rates and coverage. It’s slightly more expensive than FMNE for most drivers. However, it also offers a few more optional coverages. These include gap insurance

Neither of these coverages are required by law, and both cost extra. However, they can save you money in certain situations after an accident.

- Gap insurance can come in handy if you financed your car with a low down payment. If you total your car in this situation, your normal insurance check may not be large enough to pay off your loan. Gap insurance covers the shortfall.

- Accident forgiveness protects you from a rate increase after your first at-fault accident.

Insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| FMNE | Not rated | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Nebraska car insurance rates by city

Lincoln and York have the cheapest car insurance among Nebraska’s cities and towns. Drivers in both areas pay an average of $156 a month for full coverage. This is only barely less than the rate of $157 a month in both Bradshaw and Aurora.

Palisade drivers have the state’s most expensive car insurance at $200 a month. This is 17% higher than the state average. Omaha drivers pay $179 a month, or 4% more than the average.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abie | $163 | -5% |

| Albion | $170 | 0% |

| Alda | $160 | -6% |

| Alexandria | $163 | -5% |

| Allen | $163 | -5% |

| Alliance | $180 | 5% |

| Alvo | $169 | -1% |

| Amelia | $176 | 3% |

| Ames | $166 | -3% |

| Amherst | $163 | -5% |

| Angora | $184 | 8% |

| Anselmo | $185 | 8% |

| Ansley | $189 | 11% |

| Arapahoe | $177 | 3% |

| Arcadia | $184 | 8% |

| Archer | $162 | -5% |

| Arlington | $168 | -2% |

| Ashby | $186 | 9% |

| Ashland | $173 | 1% |

| Ashton | $181 | 6% |

| Atkinson | $181 | 6% |

| Atlanta | $163 | -4% |

| Auburn | $164 | -4% |

| Aurora | $157 | -8% |

| Axtell | $159 | -7% |

| Ayr | $162 | -5% |

| Barneston | $170 | -1% |

| Bartlett | $181 | 6% |

| Bartley | $195 | 14% |

| Bassett | $186 | 9% |

| Battle Creek | $164 | -4% |

| Bayard | $187 | 9% |

| Beatrice | $167 | -2% |

| Beaver Crossing | $162 | -5% |

| Bee | $164 | -4% |

| Beemer | $166 | -3% |

| Belden | $166 | -3% |

| Belgrade | $171 | 0% |

| Bellevue | $164 | -4% |

| Bellwood | $160 | -6% |

| Belvidere | $162 | -5% |

| Benedict | $160 | -7% |

| Benkelman | $199 | 16% |

| Bennet | $169 | -1% |

| Bennington | $165 | -3% |

| Bertrand | $167 | -3% |

| Bingham | $186 | 9% |

| Bladen | $162 | -5% |

| Blair | $177 | 4% |

| Bloomfield | $167 | -3% |

| Bloomington | $163 | -5% |

| Blue Hill | $161 | -6% |

| Blue Springs | $173 | 1% |

| Boelus | $165 | -4% |

| Boys Town | $165 | -3% |

| Bradshaw | $157 | -8% |

| Brady | $185 | 8% |

| Brainard | $162 | -5% |

| Brewster | $188 | 10% |

| Bridgeport | $187 | 9% |

| Bristow | $178 | 4% |

| Broadwater | $186 | 9% |

| Brock | $165 | -3% |

| Broken Bow | $182 | 6% |

| Brule | $187 | 10% |

| Bruno | $161 | -6% |

| Brunswick | $167 | -2% |

| Burchard | $173 | 1% |

| Burr | $167 | -2% |

| Burwell | $192 | 12% |

| Bushnell | $186 | 9% |

| Butte | $181 | 6% |

| Byron | $162 | -5% |

| Cairo | $162 | -6% |

| Callaway | $187 | 9% |

| Cambridge | $178 | 4% |

| Campbell | $162 | -5% |

| Carleton | $166 | -3% |

| Carroll | $163 | -5% |

| Cedar Bluffs | $162 | -5% |

| Cedar Creek | $170 | -1% |

| Cedar Rapids | $178 | 4% |

| Center | $170 | -1% |

| Central City | $162 | -5% |

| Ceresco | $167 | -2% |

| Chadron | $186 | 9% |

| Chambers | $173 | 1% |

| Champion | $191 | 12% |

| Chappell | $189 | 11% |

| Chester | $164 | -4% |

| Clarks | $161 | -6% |

| Clarkson | $164 | -4% |

| Clatonia | $172 | 0% |

| Clay Center | $160 | -6% |

| Coleridge | $161 | -6% |

| Colon | $166 | -3% |

| Columbus | $159 | -7% |

| Comstock | $185 | 8% |

| Cook | $170 | -1% |

| Cordova | $165 | -3% |

| Cortland | $174 | 2% |

| Cozad | $170 | -1% |

| Crab Orchard | $169 | -1% |

| Crawford | $193 | 13% |

| Creston | $159 | -7% |

| Crete | $168 | -2% |

| Crofton | $171 | 0% |

| Crookston | $188 | 10% |

| Culbertson | $193 | 13% |

| Curtis | $198 | 16% |

| Dakota City | $169 | -1% |

| Dalton | $183 | 7% |

| Danbury | $189 | 11% |

| Davenport | $162 | -5% |

| Davey | $169 | -1% |

| David City | $161 | -6% |

| Dawson | $168 | -2% |

| Daykin | $163 | -5% |

| De Witt | $173 | 1% |

| Deweese | $162 | -6% |

| Dickens | $192 | 12% |

| Diller | $163 | -5% |

| Dix | $184 | 7% |

| Dixon | $163 | -5% |

| Dodge | $166 | -3% |

| Douglas | $175 | 2% |

| Du Bois | $167 | -2% |

| Dunbar | $167 | -2% |

| Duncan | $159 | -7% |

| Dunning | $188 | 10% |

| Dwight | $161 | -6% |

| Eagle | $169 | -1% |

| Eddyville | $173 | 1% |

| Edison | $167 | -2% |

| Elgin | $174 | 2% |

| Elk Creek | $167 | -2% |

| Ellsworth | $186 | 9% |

| Elm Creek | $162 | -5% |

| Elmwood | $170 | 0% |

| Elsie | $189 | 10% |

| Elsmere | $187 | 9% |

| Elwood | $171 | 0% |

| Elyria | $184 | 8% |

| Emerson | $165 | -4% |

| Emmet | $174 | 2% |

| Enders | $193 | 13% |

| Ericson | $184 | 7% |

| Eustis | $183 | 7% |

| Ewing | $176 | 3% |

| Exeter | $161 | -6% |

| Fairbury | $170 | 0% |

| Fairfield | $161 | -6% |

| Fairmont | $159 | -7% |

| Falls City | $163 | -4% |

| Farnam | $173 | 1% |

| Farwell | $163 | -5% |

| Firth | $178 | 4% |

| Fontanelle | $168 | -2% |

| Fordyce | $168 | -2% |

| Fort Calhoun | $183 | 7% |

| Franklin | $166 | -3% |

| Fremont | $158 | -7% |

| Friend | $161 | -6% |

| Fullerton | $170 | 0% |

| Funk | $162 | -5% |

| Garland | $167 | -2% |

| Geneva | $161 | -6% |

| Genoa | $168 | -2% |

| Gering | $185 | 8% |

| Gibbon | $160 | -7% |

| Gilead | $161 | -6% |

| Giltner | $159 | -7% |

| Glenvil | $161 | -6% |

| Goehner | $163 | -4% |

| Gordon | $192 | 12% |

| Gothenburg | $172 | 1% |

| Grafton | $161 | -6% |

| Grand Island | $160 | -6% |

| Grant | $184 | 8% |

| Greeley | $169 | -1% |

| Greenwood | $168 | -2% |

| Gresham | $162 | -5% |

| Gretna | $163 | -4% |

| Gross | $178 | 4% |

| Guide Rock | $163 | -5% |

| Hadar | $166 | -3% |

| Haigler | $188 | 10% |

| Hallam | $176 | 3% |

| Halsey | $188 | 10% |

| Hampton | $158 | -7% |

| Hardy | $164 | -4% |

| Harrisburg | $186 | 9% |

| Harrison | $190 | 11% |

| Hartington | $164 | -4% |

| Hastings | $160 | -7% |

| Hay Springs | $187 | 9% |

| Hazard | $179 | 5% |

| Heartwell | $162 | -6% |

| Hebron | $165 | -4% |

| Hemingford | $186 | 9% |

| Henderson | $158 | -7% |

| Hendley | $170 | -1% |

| Herman | $172 | 0% |

| Hershey | $186 | 9% |

| Hickman | $173 | 1% |

| Hildreth | $162 | -5% |

| Holbrook | $169 | -1% |

| Holdrege | $160 | -6% |

| Holstein | $161 | -6% |

| Homer | $172 | 0% |

| Hooper | $165 | -4% |

| Hordville | $158 | -7% |

| Howells | $164 | -4% |

| Hubbard | $172 | 1% |

| Hubbell | $164 | -4% |

| Humboldt | $168 | -2% |

| Humphrey | $159 | -7% |

| Huntley | $163 | -4% |

| Imperial | $187 | 9% |

| Inavale | $162 | -5% |

| Indianola | $192 | 12% |

| Inland | $162 | -5% |

| Inman | $172 | 1% |

| Ithaca | $168 | -2% |

| Jackson | $168 | -1% |

| Jansen | $162 | -5% |

| Johnson | $167 | -3% |

| Johnstown | $187 | 9% |

| Julian | $167 | -2% |

| Juniata | $158 | -8% |

| Kearney | $158 | -8% |

| Kennard | $173 | 1% |

| Keystone | $188 | 10% |

| Kilgore | $187 | 10% |

| Kimball | $185 | 8% |

| La Vista | $160 | -6% |

| Lakeside | $190 | 11% |

| Lamar | $191 | 12% |

| Laurel | $159 | -7% |

| Lawrence | $166 | -3% |

| Lebanon | $188 | 10% |

| Leigh | $163 | -5% |

| Lemoyne | $185 | 8% |

| Lewellen | $187 | 9% |

| Lewiston | $169 | -1% |

| Lexington | $170 | 0% |

| Liberty | $170 | 0% |

| Lincoln | $156 | -9% |

| Lindsay | $162 | -5% |

| Linwood | $164 | -4% |

| Lisco | $189 | 10% |

| Litchfield | $187 | 9% |

| Long Pine | $187 | 9% |

| Loomis | $163 | -5% |

| Lorton | $167 | -2% |

| Louisville | $176 | 3% |

| Loup City | $189 | 10% |

| Lyman | $186 | 9% |

| Lynch | $175 | 2% |

| Lyons | $171 | 0% |

| Macy | $176 | 3% |

| Madison | $164 | -4% |

| Madrid | $188 | 10% |

| Magnet | $168 | -2% |

| Malcolm | $168 | -2% |

| Malmo | $168 | -2% |

| Manley | $167 | -2% |

| Marquette | $161 | -6% |

| Marsland | $185 | 8% |

| Martell | $173 | 1% |

| Maskell | $166 | -3% |

| Mason City | $184 | 8% |

| Max | $193 | 13% |

| Maywood | $189 | 11% |

| McCook | $191 | 11% |

| McCool Junction | $158 | -8% |

| McGrew | $182 | 6% |

| McLean | $164 | -4% |

| Mead | $168 | -2% |

| Meadow Grove | $166 | -3% |

| Melbeta | $188 | 10% |

| Memphis | $169 | -1% |

| Merna | $183 | 7% |

| Merriman | $188 | 10% |

| Milburn | $185 | 8% |

| Milford | $165 | -4% |

| Miller | $166 | -3% |

| Milligan | $161 | -6% |

| Mills | $189 | 10% |

| Minatare | $186 | 9% |

| Minden | $160 | -6% |

| Mitchell | $182 | 6% |

| Monowi | $175 | 2% |

| Monroe | $161 | -6% |

| Moorefield | $188 | 10% |

| Morrill | $185 | 8% |

| Morse Bluff | $167 | -2% |

| Murdock | $172 | 1% |

| Murray | $171 | 0% |

| Naper | $179 | 5% |

| Naponee | $166 | -3% |

| Nebraska City | $162 | -5% |

| Nehawka | $168 | -2% |

| Neligh | $175 | 2% |

| Nemaha | $165 | -3% |

| Nenzel | $195 | 14% |

| Newman Grove | $165 | -3% |

| Newport | $189 | 10% |

| Nickerson | $168 | -2% |

| Niobrara | $176 | 3% |

| Norfolk | $162 | -5% |

| North Bend | $163 | -5% |

| North Platte | $179 | 5% |

| O’Neill | $174 | 2% |

| Oak | $161 | -6% |

| Oakdale | $170 | -1% |

| Oakland | $167 | -3% |

| Oconto | $183 | 7% |

| Odell | $175 | 2% |

| Odessa | $162 | -5% |

| Offutt AFB | $165 | -4% |

| Ogallala | $186 | 9% |

| Ohiowa | $164 | -4% |

| Omaha | $179 | 4% |

| Ong | $161 | -6% |

| Orchard | $174 | 2% |

| Ord | $187 | 10% |

| Orleans | $169 | -1% |

| Osceola | $163 | -5% |

| Oshkosh | $194 | 13% |

| Osmond | $167 | -3% |

| Otoe | $166 | -3% |

| Oxford | $174 | 2% |

| Page | $170 | -1% |

| Palisade | $200 | 17% |

| Palmer | $163 | -5% |

| Palmyra | $171 | 0% |

| Panama | $167 | -2% |

| Papillion | $160 | -7% |

| Parks | $191 | 12% |

| Pawnee City | $170 | 0% |

| Pender | $166 | -3% |

| Peru | $165 | -4% |

| Petersburg | $172 | 1% |

| Phillips | $160 | -6% |

| Pickrell | $169 | -1% |

| Pierce | $163 | -5% |

| Pilger | $165 | -4% |

| Plainview | $170 | -1% |

| Platte Center | $160 | -7% |

| Plattsmouth | $163 | -5% |

| Pleasant Dale | $165 | -4% |

| Pleasanton | $162 | -5% |

| Plymouth | $167 | -2% |

| Polk | $160 | -7% |

| Ponca | $166 | -3% |

| Prague | $167 | -2% |

| Primrose | $168 | -2% |

| Purdum | $188 | 10% |

| Ragan | $162 | -5% |

| Ralston | $167 | -2% |

| Randolph | $166 | -3% |

| Ravenna | $163 | -5% |

| Raymond | $170 | -1% |

| Red Cloud | $168 | -2% |

| Republican City | $163 | -4% |

| Reynolds | $163 | -5% |

| Richfield | $163 | -5% |

| Rising City | $162 | -5% |

| Riverdale | $162 | -5% |

| Riverton | $164 | -4% |

| Roca | $167 | -2% |

| Rockville | $180 | 6% |

| Rogers | $165 | -3% |

| Rosalie | $168 | -2% |

| Royal | $168 | -2% |

| Rulo | $164 | -4% |

| Rushville | $188 | 10% |

| Ruskin | $166 | -3% |

| Salem | $165 | -3% |

| Sargent | $192 | 13% |

| Saronville | $161 | -6% |

| Schuyler | $164 | -4% |

| Scotia | $176 | 3% |

| Scottsbluff | $183 | 7% |

| Scribner | $165 | -4% |

| Seneca | $188 | 10% |

| Seward | $164 | -4% |

| Shelby | $161 | -6% |

| Shelton | $160 | -7% |

| Shickley | $161 | -6% |

| Shubert | $164 | -4% |

| Sidney | $180 | 5% |

| Smithfield | $171 | 0% |

| Snyder | $170 | -1% |

| South Sioux City | $171 | 0% |

| Sparks | $187 | 9% |

| Spencer | $180 | 5% |

| Sprague | $168 | -2% |

| Springfield | $162 | -6% |

| Springview | $192 | 13% |

| St Columbans | $174 | 2% |

| St. Edward | $169 | -1% |

| St. Helena | $166 | -3% |

| St. Paul | $165 | -4% |

| Stamford | $166 | -3% |

| Stanton | $165 | -4% |

| Staplehurst | $166 | -3% |

| Stapleton | $186 | 9% |

| Steele City | $165 | -4% |

| Steinauer | $168 | -2% |

| Stella | $167 | -3% |

| Stockville | $187 | 10% |

| Strang | $162 | -5% |

| Stratton | $198 | 16% |

| Stromsburg | $159 | -7% |

| Sumner | $171 | 0% |

| Superior | $167 | -2% |

| Surprise | $161 | -6% |

| Sutton | $160 | -7% |

| Swanton | $167 | -3% |

| Syracuse | $167 | -2% |

| Table Rock | $172 | 0% |

| Talmage | $166 | -3% |

| Taylor | $194 | 14% |

| Tecumseh | $171 | 0% |

| Tekamah | $172 | 1% |

| Terrytown | $185 | 8% |

| Thedford | $188 | 10% |

| Thurston | $165 | -3% |

| Tilden | $166 | -3% |

| Tobias | $165 | -4% |

| Trenton | $197 | 15% |

| Trumbull | $161 | -6% |

| Tryon | $191 | 11% |

| Uehling | $171 | 0% |

| Ulysses | $161 | -6% |

| Unadilla | $167 | -2% |

| Union | $169 | -1% |

| Upland | $164 | -4% |

| Utica | $162 | -5% |

| Valentine | $191 | 12% |

| Valley | $166 | -3% |

| Valparaiso | $169 | -1% |

| Venango | $188 | 10% |

| Verdigre | $177 | 4% |

| Verdon | $164 | -4% |

| Virginia | $170 | 0% |

| Wahoo | $166 | -3% |

| Wakefield | $162 | -5% |

| Wallace | $190 | 11% |

| Walthill | $171 | 0% |

| Walton | $169 | -1% |

| Washington | $175 | 2% |

| Waterbury | $165 | -3% |

| Wauneta | $192 | 12% |

| Wausa | $166 | -3% |

| Waverly | $166 | -3% |

| Wayne | $164 | -4% |

| Weeping Water | $173 | 1% |

| Wellfleet | $190 | 11% |

| West Point | $165 | -4% |

| Western | $169 | -1% |

| Westerville | $190 | 11% |

| Weston | $165 | -4% |

| Whiteclay | $188 | 10% |

| Whitman | $188 | 10% |

| Whitney | $186 | 9% |

| Wilcox | $161 | -6% |

| Willow Island | $167 | -3% |

| Wilsonville | $172 | 0% |

| Winnetoon | $169 | -1% |

| Winside | $164 | -4% |

| Winslow | $173 | 1% |

| Wisner | $163 | -5% |

| Wolbach | $169 | -1% |

| Wood Lake | $186 | 9% |

| Wood River | $159 | -7% |

| Woodland Park | $163 | -5% |

| Wymore | $173 | 1% |

| Wynot | $168 | -2% |

| York | $156 | -9% |

| Yutan | $171 | 0% |

Nebraska auto insurance laws

You need proof of financial responsibility to drive legally in Nebraska. Most drivers choose auto insurance, but the alternatives include a bond or certificate of deposit.

The state’s minimum car insurance requirements include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

- Uninsured motorist coverage: $25,000 per person, $50,000 per accident

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you cause to other people’s vehicles and property like fences and light posts.

Collision

You need to show your insurance certificate to your country treasurer’s office to register your vehicle. You also need to keep the certificate in your vehicle. An electronic copy on a device like your smartphone will suffice.

SR-22 insurance in Nebraska

You need SR-22 insurance to reinstate your driving privileges after certain violations in Nebraska. These range from driving without insurance to DUI.

An SR-22 is a certificate that shows you have car insurance. Your insurance company sends it to the DMV for you. Most car insurance companies offer SR-22s. They usually add a filing fee of about $25 to your rate.

The actual price you pay for car insurance with an SR-22 depends on your driving record. The average cost of SR-22 insurance after a DUI is about $300 a month. The average is closer to about $200 a month after a lesser offense like driving without insurance.

How we selected the cheapest car insurance companies in Nebraska

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Nebraska

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.