Cheapest Car Insurance in New Hampshire (2026)

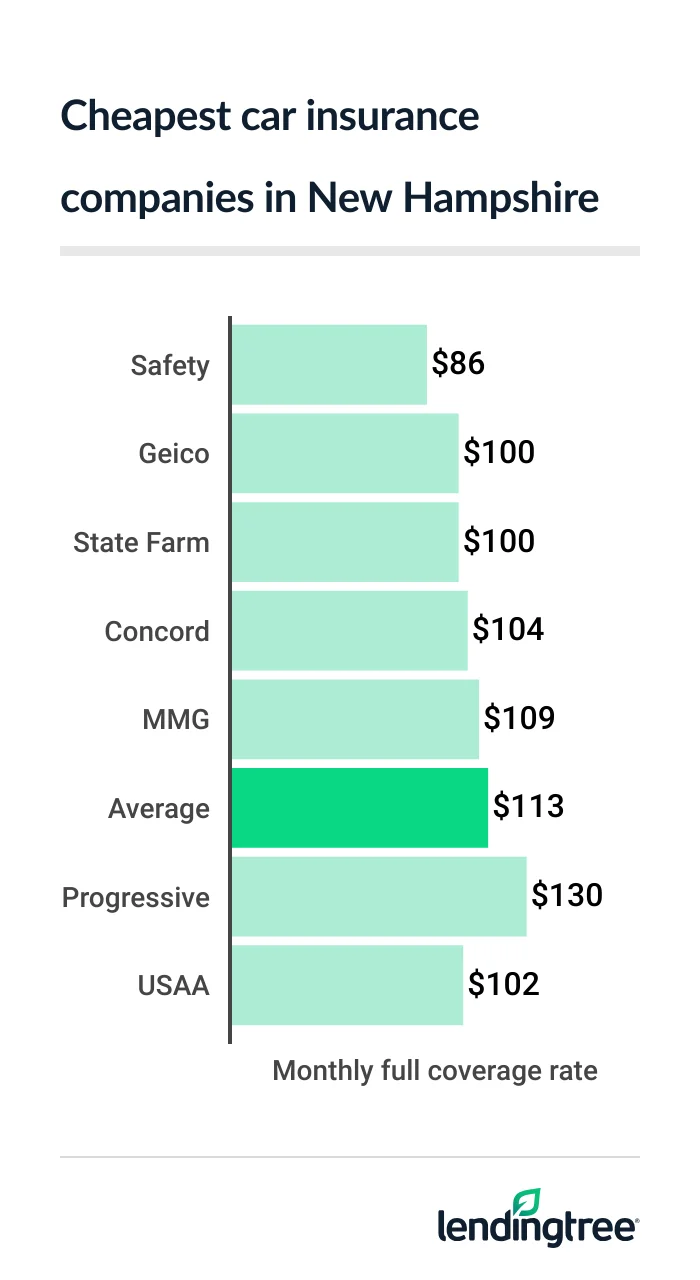

Safety has the cheapest full coverage car insurance in New Hampshire, with an average quote of $86 per month. This is $27 less than the state average.

Cheapest car insurance quotes in New Hampshire

New Hampshire’s cheapest full coverage insurance: Safety

Safety has the cheapest full coverage car insurance in New Hampshire, with an average rate of $86 per month.

Geico and State Farm are next, each with an average rate of $100 per month for full coverage

Full coverage car insurance rates in NH

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Safety | $86 | |

| Geico | $100 | |

| State Farm | $100 | |

| Concord Group | $104 | |

| MMG | $109 | |

| Progressive | $130 | |

| Allstate | $176 | |

| USAA* | $102 | |

Both Geico and State Farm offer many more car insurance discounts than Safety. Depending on how many you can get, either of these companies could be the cheapest for you.

Another reason to consider Geico and State Farm over Safety is that they have much better J.D. Power customer satisfaction scores

One of the best ways to see which company is the best and cheapest for you is to compare car insurance quotes from a handful of them before you buy or renew a policy.

Best cheap liability insurance in New Hampshire: Safety

At $37 per month, Safety also has the cheapest liability insurance for most drivers in New Hampshire.

USAA is $3 cheaper than Safety, at $34 per month for minimum coverage

Liability car insurance rates in NH

| Company | Monthly rate |

|---|---|

| Allstate | $37 |

| Concord Group | $42 |

| Geico | $45 |

| MMG | $46 |

| Progressive | $49 |

| Safety | $61 |

| State Farm | $84 |

| USAA* | $34 |

State Farm is only $5 more than Safety, with an average rate of $42 per month. But if you can get some of the company’s several discounts, State Farm could be your cheapest option.

With State Farm, you can save money by having certain vehicle safety features, insuring more than one car and paying for your entire policy period upfront. It also offers discounts for loyal customers, low-mileage drivers and good students.

The average cost of minimum car insurance is $50 per month in New Hampshire.

Cheapest car insurance quotes for New Hampshire teens: The Concord Group

The Concord Group offers the cheapest teen car insurance in New Hampshire, at $95 per month for minimum coverage. Its full coverage rates are the lowest in the state, too, at $197 per month.

MMG and Geico are the next-cheapest companies for both coverage types. Although Geico is the most expensive of the three insurers, it has many discounts that can make it more affordable.

Monthly insurance rates for teen drivers

| Company | Minimum | Full |

|---|---|---|

| Concord Group | $95 | $197 |

| MMG | $122 | $204 |

| Geico | $129 | $270 |

| Safety | $147 | $345 |

| State Farm | $147 | $325 |

| Allstate | $168 | $319 |

| Progressive | $215 | $561 |

| USAA* | $136 | $385 |

Like most insurance companies, Geico offers discounts to teens and young adults who:

- Get good grades

- Go to college without a vehicle

- Complete a driver’s education program

You may also get a discount from Geico for having a car with air bags, antilock brakes, an anti-theft system or daytime running lights. Some of the company’s other discounts are for federal employees, military personnel and members of certain groups.

Best New Hampshire auto insurance quotes after a speeding ticket: Safety

With an average quote of $86 per month, Safety has New Hampshire’s cheapest auto insurance company for drivers with a speeding ticket on their records.

State Farm comes in second, at $100 per month. The $14 difference between State Farm and Safety isn’t much. A few discounts could make State Farm cheaper for you, especially because some discounts are easy to get.

Auto insurance rates with a speeding ticket

| Company | Monthly rate |

|---|---|

| Safety | $86 |

| State Farm | $100 |

| Geico | $137 |

| Concord Group | $140 |

| MMG | $156 |

| Progressive | $184 |

| Allstate | $209 |

| USAA* | $118 |

The average New Hampshire driver pays $141 per month after getting a speeding ticket. That’s $28 per month more than what drivers with a clean record pay for the same coverage.

New Hampshire’s cheapest car insurance after an accident: State Farm

Drivers in New Hampshire get the cheapest car insurance after an accident from State Farm. Its average quote is $116 per month.

This is $43 less than the second-cheapest company, The Concord Group. And it’s $63 less than the state average of $179 per month.

Car insurance rates after an at-fault accident

| Company | Monthly rate |

|---|---|

| State Farm | $116 |

| Concord Group | $159 |

| MMG | $163 |

| Safety | $168 |

| Progressive | $192 |

| Geico | $197 |

| Allstate | $293 |

| USAA* | $144 |

Most New Hampshire drivers pay about $65 per month more for car insurance after an at-fault accident, or an accident they cause.

Best car insurance for NH teens with a bad driving record: The Concord Group

Teen drivers in New Hampshire with tickets or accidents on their records can find the cheapest auto insurance with The Concord Group.

The company has the state’s lowest quotes for teens with a speeding ticket, at $128 per month. It also has the most affordable quotes for teen drivers with an accident, at $148 per month.

Monthly rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Concord Group | $128 | $148 |

| Safety | $147 | $203 |

| State Farm | $147 | $154 |

| Geico | $158 | $200 |

| MMG | $172 | $181 |

| Allstate | $200 | $294 |

| Progressive | $254 | $242 |

| USAA* | $181 | $234 |

Compare quotes from State Farm and Safety as well if you’re looking for cheap teen car insurance after a speeding ticket. Their average quotes aren’t much higher than The Concord Group’s prices, and discounts could make them your best and cheapest option.

You should also get a quote from State Farm if you or a teen you want to insure has been in an at-fault accident. Its average quote is only $6 more than The Concord Group’s.

Cheapest car insurance quotes in New Hampshire after a DUI: Progressive

Progressive has the cheapest DUI insurance in New Hampshire, with an average quote of $153 per month.

The Concord Group, MMG and Safety are next, all with average quotes that are under the state average of $195 per month.

Auto insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $153 |

| Concord Group | $183 |

| MMG | $185 |

| Safety | $188 |

| Geico | $212 |

| State Farm | $217 |

| Allstate | $222 |

| USAA* | $203 |

Though discounts could make up the difference between The Concord Group, MMG, Safety and Progressive, the fact is that Progressive offers many more than the other three companies.

Another reason Progressive is likely to be your best and cheapest option for DUI insurance is that it offers many ways to customize your policy. Progressive customers can get accident forgiveness

Cheap car insurance quotes for NH drivers with bad credit: Safety

At $144 per month, Safety has the cheapest car insurance for drivers with bad credit in New Hampshire.

Geico and The Concord Group are nearly as cheap, however, with average quotes that are just $2 and $6 more than Safety’s, respectively.

Auto insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Safety | $144 |

| Geico | $146 |

| Concord Group | $150 |

| Progressive | $210 |

| Allstate | $239 |

| MMG | $247 |

| State Farm | $459 |

| USAA* | $205 |

A typical New Hampshire driver with poor credit pays $225 per month for car insurance. This is nearly double what a typical driver with good credit pays.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance in New Hampshire

Safety, State Farm and USAA are the best car insurance companies in New Hampshire, depending on your needs and situation.

NH’s best-rated car insurance companies

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Concord Group | Not rated | A+ | |

| Geico | 645 | A++ | |

| MMG | Not rated | A | |

| Progressive | 621 | A+ | |

| Safety | 617 | A | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Safety has the cheapest rates for most of the state’s drivers before discounts — especially those with clean records. It doesn’t offer many ways to save or customize your policy, however. Also, its J.D. Power customer satisfaction score is poor.

State Farm doesn’t often have the state’s lowest rates, but it’s usually close enough that its many discounts could make it the cheapest for you. It also has the best customer satisfaction score of any company besides USAA.

USAA has a reputation for customer service that outshines pretty much every other insurance company around. Its rates aren’t the cheapest, however. Even more importantly, you or a close relative must be an active-duty or retired military member to get a policy from USAA.

New Hampshire car insurance quotes by city

West Lebanon is the cheapest city in New Hampshire for car insurance, with an average rate of $110 per month.

The state’s most expensive city for car insurance is Manchester, where rates average $143 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Alton Bay | $119 | 5% |

| Antrim | $120 | 6% |

| Ashland | $114 | 1% |

| Ashuelot | $114 | 0% |

| Barnstead | $121 | 7% |

| Belmont | $116 | 2% |

| Berlin | $117 | 3% |

| Bretton Woods | $116 | 2% |

| Bristol | $118 | 4% |

| Center Barnstead | $122 | 8% |

| Center Conway | $115 | 2% |

| Center Ossipee | $118 | 4% |

| Center Sandwich | $114 | 1% |

| Center Strafford | $120 | 6% |

| Center Tuftonboro | $116 | 2% |

| Charlestown | $114 | 0% |

| Chesterfield | $113 | 0% |

| Chocorua | $116 | 2% |

| Claremont | $114 | 0% |

| Colebrook | $118 | 4% |

| Concord | $118 | 4% |

| Contoocook | $117 | 3% |

| Conway | $113 | 0% |

| Cornish Flat | $113 | -1% |

| Derry | $134 | 18% |

| Dover | $119 | 5% |

| Drewsville | $115 | 1% |

| Durham | $120 | 6% |

| East Andover | $116 | 2% |

| East Candia | $124 | 9% |

| East Hampstead | $135 | 19% |

| East Hebron | $113 | -1% |

| East Merrimack | $123 | 8% |

| East Wakefield | $119 | 5% |

| Eaton Center | $115 | 2% |

| Elkins | $117 | 3% |

| Enfield | $111 | -2% |

| Enfield Center | $111 | -2% |

| Epping | $122 | 8% |

| Etna | $110 | -3% |

| Exeter | $122 | 8% |

| Farmington | $122 | 8% |

| Franklin | $116 | 2% |

| Georges Mills | $112 | -1% |

| Gilmanton Iron Works | $121 | 7% |

| Glen | $113 | 0% |

| Glencliff | $115 | 2% |

| Goffstown | $129 | 14% |

| Greenville | $120 | 6% |

| Groveton | $116 | 2% |

| Guild | $112 | -1% |

| Hampton | $123 | 8% |

| Hampton Beach | $123 | 9% |

| Hanover | $111 | -2% |

| Haverhill | $113 | 0% |

| Hebron | $113 | -1% |

| Henniker | $120 | 6% |

| Hillsborough | $121 | 7% |

| Hooksett | $128 | 13% |

| Hudson | $133 | 17% |

| Intervale | $113 | 0% |

| Jaffrey | $114 | 1% |

| Kearsarge | $114 | 0% |

| Keene | $110 | -3% |

| Laconia | $117 | 3% |

| Lancaster | $116 | 2% |

| Lebanon | $111 | -2% |

| Lincoln | $113 | -1% |

| Lisbon | $114 | 1% |

| Littleton | $114 | 0% |

| Lochmere | $116 | 2% |

| Londonderry | $129 | 14% |

| Lyme Center | $113 | 0% |

| Manchester | $143 | 26% |

| Melvin Village | $116 | 2% |

| Meredith | $114 | 1% |

| Meriden | $112 | -1% |

| Milford | $122 | 7% |

| Milton Mills | $119 | 5% |

| Mirror Lake | $114 | 1% |

| Monroe | $115 | 1% |

| Mount Washington | $114 | 1% |

| Munsonville | $113 | 0% |

| Nashua | $132 | 16% |

| Nelson | $113 | 0% |

| Newmarket | $119 | 5% |

| Newport | $114 | 0% |

| Newton Junction | $132 | 16% |

| North Conway | $115 | 1% |

| North Haverhill | $113 | 0% |

| North Sandwich | $114 | 1% |

| North Stratford | $116 | 2% |

| North Sutton | $115 | 1% |

| North Walpole | $115 | 1% |

| North Woodstock | $113 | 0% |

| Peterborough | $118 | 4% |

| Piermont | $114 | 0% |

| Pike | $114 | 0% |

| Pinardville | $135 | 19% |

| Plymouth | $114 | 0% |

| Portsmouth | $117 | 3% |

| Randolph | $115 | 2% |

| Raymond | $123 | 9% |

| Rochester | $117 | 3% |

| Rye Beach | $120 | 6% |

| Sanbornville | $118 | 4% |

| Seabrook Beach | $129 | 14% |

| Silver Lake | $115 | 1% |

| Somersworth | $116 | 2% |

| South Acworth | $113 | 0% |

| South Hooksett | $129 | 13% |

| South Newbury | $119 | 5% |

| South Sutton | $119 | 5% |

| South Tamworth | $114 | 1% |

| Spofford | $112 | -1% |

| Stinson Lake | $117 | 3% |

| Sugar Hill | $114 | 1% |

| Suncook | $120 | 6% |

| Tilton Northfield | $117 | 3% |

| Troy | $114 | 0% |

| Twin Mountain | $115 | 1% |

| Union | $117 | 3% |

| Waterville Valley | $114 | 0% |

| West Chesterfield | $112 | -1% |

| West Lebanon | $110 | -3% |

| West Nottingham | $122 | 8% |

| West Ossipee | $116 | 2% |

| West Peterborough | $118 | 4% |

| West Stewartstown | $114 | 0% |

| West Swanzey | $111 | -2% |

| Winchester | $115 | 1% |

| Winnisquam | $117 | 3% |

| Wolfeboro | $117 | 3% |

| Wolfeboro Falls | $116 | 2% |

| Wonalancet | $115 | 2% |

| Woodsville | $114 | 1% |

The average cost of car insurance in New Hampshire’s other largest cities:

- Nashua, $132 per month

- Concord, $118 per month

- Derry, $134 per month

- Dover, $119 per month

- Rochester, $117 per month

Car insurance laws in New Hampshire

Car insurance is not required by law in New Hampshire. However, you are financially responsible for injuries and damage you cause to others in a car accident.

Because these costs can get extremely expensive, car insurance is recommended.

Minimum coverage for car insurance in New Hampshire

When you buy car insurance in New Hampshire, the minimum coverages and limits you can get include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

- Uninsured motorist: $25,000 per person, $50,000 per accident

- Medical payments: $1,000

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident.

Property damage liability pays for damage you cause to property like fences, toll booths and light posts.

Uninsured motorist covers you and your passengers for injuries and damage caused by a driver with no insurance.

Medical payments covers injuries to you and your passengers, no matter who caused the accident.

Collision

SR-22 insurance in New Hampshire

If you have a DUI, you may have to get SR-22 insurance to reinstate your driving privileges. SR-22s are also required for reckless driving and certain other major offenses.

An SR-22 is a document that proves you have car insurance. Your insurance company files the SR-22 for you with the DMV.

It’s good to let the companies you contact for quotes know about your SR-22 requirement. Since some companies don’t offer SR-22 filings, it may take a little longer to shop.

Frequently asked questions

Car insurance in New Hampshire costs $50 a month, on average, if you buy minimum coverage. If you buy a full coverage policy, the state average cost is $113 a month.

You can get the cheapest car insurance in New Hampshire from Safety. It has the state’s lowest average rate for minimum coverage, at $37 a month, and full coverage, at $86 a month.

How we selected the cheapest car insurance companies in New Hampshire

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Medical payments: $1,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in New Hampshire

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.