Cheapest Car Insurance in New Mexico (2026)

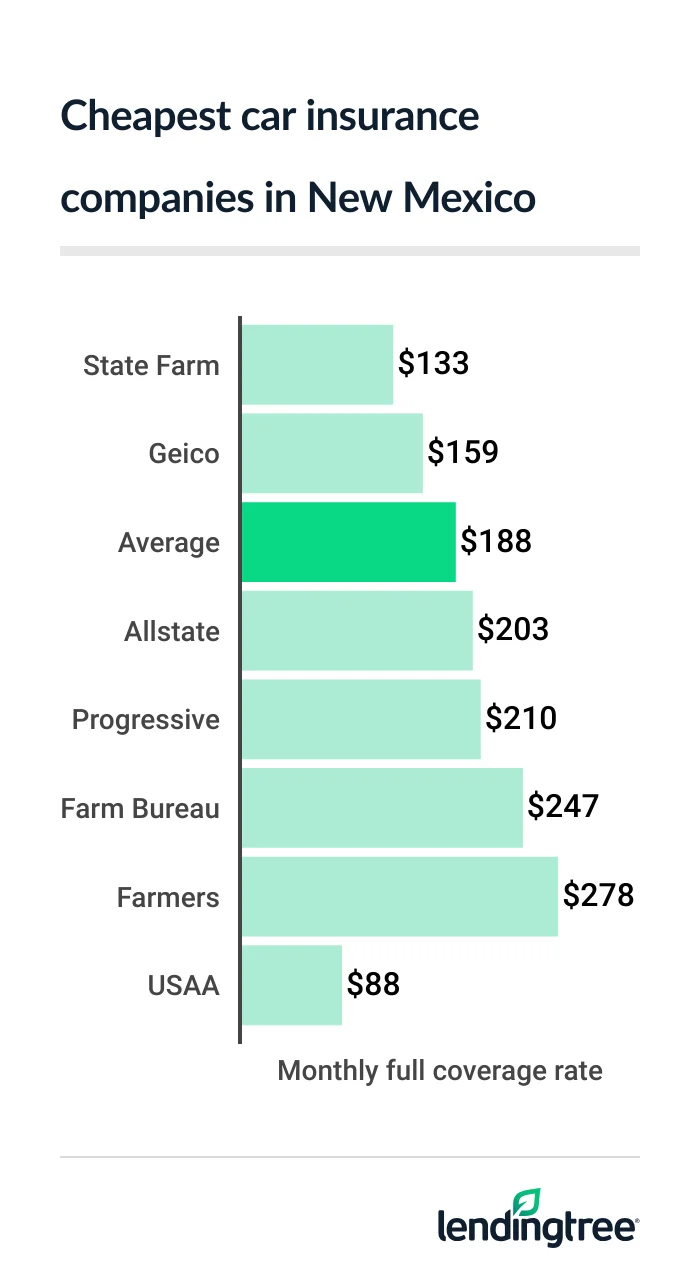

State Farm has the cheapest car insurance in New Mexico for most drivers, at $133 a month for full coverage. That’s $55 less than the state average. USAA is even cheaper for those with military ties.

Best cheap car insurance in New Mexico

Cheapest full coverage car insurance in New Mexico: State Farm

State Farm has the cheapest full coverage car insurance for most drivers in New Mexico, with an average rate of $133 per month. The state average for full coverage

USAA is $45 cheaper than State Farm, at $88 per month for full coverage policies. But only active or retired military and their families can get coverage from USAA.

Cheapest companies for full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $133 | |

| Geico | $159 | |

| Allstate | $203 | |

| Progressive | $210 | |

| Farm Bureau | $247 | |

| Farmers | $278 | |

| USAA* | $88 | |

New Mexico drivers who can’t get a policy from USAA should get quotes from Geico and State Farm. Geico’s average full coverage rate is $159 per month. That’s more than State Farm, but Geico has many car insurance discounts that could make it a lot cheaper.

You can get discounts from Geico for having a newer vehicle, driving a car with certain safety features, getting a quote before you buy a policy, going paperless and signing up for autopay.

New Mexico’s cheapest liability insurance: State Farm

At $34 per month, State Farm also has the cheapest liability insurance for most New Mexico drivers.

Farm Bureau is the next-cheapest company for liability coverage

Cheapest companies for liability coverage

| Company | Monthly rate |

|---|---|

| State Farm | $34 |

| Farm Bureau | $48 |

| Farmers | $77 |

| Geico | $77 |

| Allstate | $91 |

| Progressive | $115 |

| USAA* | $22 |

Once again, USAA is the cheapest overall, with an average rate of $22 per month for liability insurance.

In fact, USAA has the most affordable car insurance in New Mexico for every driver and coverage type we researched. So, if you or a close relative have military ties, make sure you compare quotes from USAA before you buy or renew a policy.

Best cheap auto insurance for New Mexico teen drivers: State Farm and Geico

Most drivers in New Mexico get the cheapest teen car insurance from State Farm and Geico.

State Farm’s teen liability rates are New Mexico’s lowest (after USAA), at $118 per month. Geico has the lowest full coverage rates for most of the state’s teen drivers, at $257 per month.

Cheapest insurance companies for teens

| Company | Liability coverage | Full coverage |

|---|---|---|

| State Farm | $118 | $357 |

| Geico | $127 | $257 |

| Farm Bureau | $155 | $408 |

| Allstate | $271 | $630 |

| Progressive | $292 | $738 |

| Farmers | $354 | $1,107 |

| USAA* | $56 | $191 |

Discounts are one of the best and easiest ways to save money on car insurance for teen drivers. Geico, State Farm and many other companies offer discounts for teens and young adults who:

- Get good grades

- Go away to school without a vehicle

- Complete a driver’s education program

Cheap New Mexico auto insurance rates after a speeding ticket: State Farm

State Farm is New Mexico’s cheapest car insurance company for most drivers with a speeding ticket on their records. Its average rate for these drivers is $141 per month.

Cheapest insurance companies after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $141 |

| Geico | $206 |

| Allstate | $241 |

| Progressive | $279 |

| Farm Bureau | $282 |

| Farmers | $379 |

| USAA* | $110 |

The state average cost of car insurance after a speeding ticket is $234 per month in New Mexico. Like State Farm, Geico comes in below that amount, with an average rate of $206 per month.

You can expect your car insurance premium to go up by about $45 per month after getting a speeding ticket in New Mexico. State Farm customers may see a lower increase, however. We found that State Farm only raises its rates by $8 per month after a ticket, on average.

Cheapest car insurance after an accident in New Mexico: State Farm

With an average rate of $133 per month, State Farm has the cheapest car insurance after an accident for most New Mexico drivers.

Geico is the next-cheapest company after an accident, but its average rate is quite a bit higher than State Farm’s, at $219 per month.

Cheapest insurance after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $133 |

| Geico | $219 |

| Progressive | $306 |

| Allstate | $331 |

| Farm Bureau | $350 |

| Farmers | $383 |

| USAA* | $128 |

Most drivers in New Mexico pay $264 per month for car insurance after an at-fault accident. This is around $75 per month more than what the state’s drivers with clean records pay for the same coverage.

Best insurance for New Mexico teens with bad driving records: State Farm

State Farm has the cheapest auto insurance for most New Mexico teens with a ticket or accident on their driving records.

State Farm’s average rate for teens with a speeding ticket is $130 per month in New Mexico. For teens with an accident, the company’s rates average $118 per month.

Cheapest insurance for teens with tickets or accidents

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $130 | $118 |

| Geico | $152 | $166 |

| Farm Bureau | $189 | $255 |

| Progressive | $318 | $326 |

| Allstate | $336 | $477 |

| Farmers | $437 | $437 |

| USAA* | $87 | $98 |

Geico has the second-cheapest car insurance rates for most young drivers with a ticket, at $152 per month. It also comes in second for young drivers after an accident, at $166 per month.

New Mexico’s cheapest car insurance rates after a DWI: Geico

At $231 per month, Geico has the cheapest DUI insurance in New Mexico.

The second-cheapest option for most drivers with a DUI

Cheapest insurance companies after a DWI

| Company | Monthly rate |

|---|---|

| Geico | $231 |

| Progressive | $262 |

| Allstate | $276 |

| State Farm | $283 |

| Farmers | $369 |

| Farm Bureau | $466 |

| USAA* | $174 |

Although Progressive is a bit more expensive than Geico, you can customize your policy more with Progressive. It offers accident forgiveness

The average driver in New Mexico pays $294 per month for auto insurance after a DWI. This is just over $100 per month more than what drivers with clean records pay.

Cheapest car insurance for bad credit in New Mexico: Geico

Geico also has the cheapest car insurance for drivers with bad credit in New Mexico, with an average rate of $254 per month.

Allstate and Progressive are the next-cheapest companies for drivers with poor credit. Allstate’s average rate is $290 per month, while Progressive’s is $320 per month.

Cheapest insurance for drivers with poor credit

| Company | Monthly rate |

|---|---|

| Geico | $254 |

| Allstate | $290 |

| Progressive | $320 |

| Farm Bureau | $376 |

| Farmers | $458 |

| State Farm | $510 |

| USAA* | $155 |

The state average rate for car insurance with poor credit is $338 per month. This is $150 per month more than what New Mexico drivers with good credit pay for the same policies.

Best car insurance in New Mexico

State Farm and USAA are the best car insurance companies in New Mexico.

State Farm has the cheapest car insurance rates in the state for most drivers, and its many discounts could make it even more affordable. It also has a great J.D. Power

USAA should be your first stop if you or a family member is active-duty or retired military, however. USAA’s rates are the cheapest overall for all driver and coverage types we surveyed in New Mexico. Also, its reputation for customer service is unmatched by other insurance companies.

New Mexico car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Farm Bureau | 645 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

New Mexico insurance rates by city

The cheapest city for car insurance in New Mexico is Deming, where rates average $158 per month.

Drivers in South Valley, which is part of the Albuquerque metro area, pay the state’s highest car insurance rates of $231 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abiquiu | $193 | 2% |

| Adelino | $206 | 9% |

| Agua Fria | $189 | 0% |

| Alamo | $174 | -7% |

| Alamogordo | $160 | -15% |

| Albuquerque | $223 | 19% |

| Alcalde | $192 | 2% |

| Algodones | $197 | 4% |

| Alto | $186 | -2% |

| Amalia | $193 | 3% |

| Amistad | $190 | 1% |

| Angel Fire | $197 | 4% |

| Animas | $161 | -15% |

| Anthony | $181 | -4% |

| Anton Chico | $189 | 0% |

| Aragon | $166 | -12% |

| Arenas Valley | $162 | -14% |

| Arrey | $166 | -12% |

| Arroyo Seco | $194 | 3% |

| Artesia | $187 | -1% |

| Atoka | $187 | 0% |

| Aztec | $170 | -10% |

| Bard | $184 | -2% |

| Bayard | $161 | -15% |

| Belen | $211 | 12% |

| Bent | $169 | -10% |

| Berino | $180 | -5% |

| Bernalillo | $198 | 5% |

| Black Rock | $167 | -12% |

| Blanco | $166 | -12% |

| Bloomfield | $169 | -10% |

| Bluewater Village | $169 | -10% |

| Bosque | $195 | 3% |

| Bosque Farms | $206 | 9% |

| Brimhall | $170 | -10% |

| Broadview | $195 | 4% |

| Buckhorn | $159 | -15% |

| Buena Vista | $192 | 2% |

| Caballo | $162 | -14% |

| Canjilon | $198 | 5% |

| Cannon AFB | $192 | 2% |

| Canones | $196 | 4% |

| Capitan | $188 | 0% |

| Caprock | $190 | 1% |

| Capulin | $188 | 0% |

| Carlsbad | $197 | 5% |

| Carnuel | $219 | 16% |

| Carrizozo | $177 | -6% |

| Carson | $194 | 3% |

| Casa Blanca | $185 | -2% |

| Causey | $187 | -1% |

| Cebolla | $198 | 5% |

| Cedar Crest | $208 | 11% |

| Cedar Grove | $194 | 3% |

| Cedarvale | $192 | 2% |

| Cedro | $208 | 10% |

| Cerrillos | $185 | -2% |

| Cerro | $191 | 1% |

| Chacon | $193 | 2% |

| Chama | $199 | 6% |

| Chamberino | $177 | -6% |

| Chamisal | $189 | 0% |

| Chamita | $191 | 1% |

| Chaparral | $184 | -2% |

| Chimayo | $193 | 2% |

| Church Rock | $174 | -8% |

| Cimarron | $197 | 4% |

| Claunch | $176 | -6% |

| Clayton | $191 | 1% |

| Cleveland | $191 | 1% |

| Cliff | $166 | -12% |

| Clines Corners | $189 | 0% |

| Cloudcroft | $176 | -6% |

| Clovis | $192 | 2% |

| Cochiti Lake | $191 | 1% |

| Cochiti Pueblo | $196 | 4% |

| Columbus | $164 | -13% |

| Conchas Dam | $189 | 1% |

| Continental Divide | $170 | -10% |

| Cordova | $193 | 2% |

| Corona | $193 | 2% |

| Corrales | $209 | 11% |

| Costilla | $191 | 2% |

| Counselor | $182 | -3% |

| Coyote | $193 | 3% |

| Crossroads | $192 | 2% |

| Crownpoint | $173 | -8% |

| Cuartelez | $184 | -2% |

| Cuba | $181 | -4% |

| Cubero | $176 | -7% |

| Cuervo | $184 | -2% |

| Datil | $171 | -9% |

| Deming | $158 | -16% |

| Derry | $169 | -10% |

| Des Moines | $193 | 2% |

| Dexter | $190 | 1% |

| Dixon | $190 | 1% |

| Dona Ana | $177 | -6% |

| Dulce | $195 | 3% |

| Eagle Nest | $188 | 0% |

| Edgewood | $194 | 3% |

| El Cerro | $205 | 9% |

| El Cerro Mission | $207 | 10% |

| El Prado | $193 | 3% |

| El Rancho | $188 | 0% |

| El Rito | $191 | 1% |

| Eldorado at Santa Fe | $191 | 2% |

| Elephant Butte | $160 | -15% |

| Elida | $185 | -2% |

| Embudo | $193 | 3% |

| Encino | $183 | -3% |

| Espanola | $190 | 1% |

| Estancia | $199 | 6% |

| Eunice | $194 | 3% |

| Fairacres | $181 | -4% |

| Farmington | $166 | -12% |

| Faywood | $164 | -13% |

| Fence Lake | $168 | -11% |

| Flora Vista | $168 | -11% |

| Floyd | $190 | 1% |

| Folsom | $191 | 1% |

| Fort Bayard | $165 | -13% |

| Fort Stanton | $181 | -4% |

| Fort Sumner | $195 | 3% |

| Fort Wingate | $174 | -8% |

| Fruitland | $168 | -11% |

| Gallina | $199 | 6% |

| Gallup | $169 | -10% |

| Gamerco | $174 | -8% |

| Garfield | $167 | -11% |

| Garita | $191 | 1% |

| Gila | $167 | -12% |

| Gladstone | $190 | 1% |

| Glencoe | $186 | -1% |

| Glenwood | $165 | -12% |

| Glorieta | $189 | 1% |

| Grady | $196 | 4% |

| Grants | $166 | -12% |

| Grenville | $190 | 1% |

| Guadalupita | $188 | 0% |

| Hachita | $161 | -15% |

| Hagerman | $188 | 0% |

| Hanover | $161 | -14% |

| Hatch | $171 | -9% |

| Hernandez | $190 | 1% |

| High Rolls Mountain Park | $178 | -6% |

| Hillsboro | $163 | -13% |

| Hobbs | $195 | 3% |

| Holloman AFB | $162 | -14% |

| Holman | $195 | 3% |

| Hondo | $186 | -1% |

| Hope | $193 | 2% |

| House | $186 | -1% |

| Hurley | $160 | -15% |

| Ilfeld | $194 | 3% |

| Isleta | $210 | 12% |

| Jal | $191 | 2% |

| Jamestown | $175 | -7% |

| Jarales | $208 | 11% |

| Jemez Pueblo | $186 | -1% |

| Jemez Springs | $186 | -1% |

| Kenna | $191 | 1% |

| Kirtland | $167 | -11% |

| Kirtland Air Force Base | $220 | 17% |

| La Cienega | $188 | 0% |

| La Huerta | $196 | 4% |

| La Jara | $188 | 0% |

| La Joya | $181 | -4% |

| La Loma | $188 | 0% |

| La Luz | $168 | -11% |

| La Madera | $190 | 1% |

| La Mesa | $176 | -6% |

| La Mesilla | $193 | 2% |

| La Plata | $167 | -11% |

| La Puebla | $190 | 1% |

| La Union | $181 | -4% |

| La Villita | $192 | 2% |

| Laguna | $192 | 2% |

| Lake Arthur | $189 | 0% |

| Lakewood | $191 | 1% |

| Lamy | $184 | -2% |

| Las Cruces | $179 | -5% |

| Las Maravillas | $206 | 10% |

| Las Vegas | $193 | 3% |

| Lee Acres | $166 | -12% |

| Lemitar | $180 | -4% |

| Lincoln | $187 | -1% |

| Lindrith | $189 | 0% |

| Lingo | $191 | 2% |

| Livingston Wheeler | $197 | 5% |

| Llano | $193 | 2% |

| Loco Hills | $190 | 1% |

| Logan | $189 | 0% |

| Lordsburg | $162 | -14% |

| Los Alamos | $172 | -9% |

| Los Chaves | $208 | 10% |

| Los Lunas | $205 | 9% |

| Los Ojos | $204 | 8% |

| Los Ranchos de Albuquerque | $218 | 16% |

| Loving | $196 | 4% |

| Lovington | $195 | 3% |

| Luna | $166 | -12% |

| Magdalena | $173 | -8% |

| Malaga | $193 | 2% |

| Maljamar | $193 | 3% |

| Maxwell | $191 | 1% |

| Mayhill | $184 | -2% |

| McIntosh | $199 | 6% |

| Mcalister | $185 | -2% |

| Mcdonald | $194 | 3% |

| Meadow Lake | $206 | 10% |

| Medanales | $193 | 3% |

| Melrose | $197 | 5% |

| Mentmore | $174 | -8% |

| Mescalero | $174 | -8% |

| Mesilla | $178 | -5% |

| Mesilla Park | $179 | -5% |

| Mesquite | $178 | -6% |

| Mexican Springs | $169 | -10% |

| Miami | $194 | 3% |

| Milan | $168 | -11% |

| Mills | $190 | 1% |

| Milnesand | $188 | 0% |

| Mimbres | $162 | -14% |

| Monterey Park | $206 | 9% |

| Montezuma | $191 | 1% |

| Monticello | $163 | -13% |

| Monument | $198 | 5% |

| Mora | $194 | 3% |

| Moriarty | $196 | 4% |

| Mosquero | $197 | 5% |

| Mountainair | $197 | 5% |

| Mule Creek | $166 | -12% |

| Nageezi | $175 | -7% |

| Nambe | $189 | 0% |

| Napi Headquarters | $166 | -12% |

| Nara Visa | $188 | 0% |

| Navajo | $174 | -8% |

| Navajo Dam | $169 | -10% |

| New Laguna | $189 | 0% |

| Newcomb | $180 | -5% |

| Newkirk | $189 | 0% |

| Nogal | $183 | -3% |

| North Hobbs | $194 | 3% |

| North Valley | $218 | 16% |

| Ocate | $190 | 1% |

| Ohkay Owingeh | $191 | 1% |

| Ojo Caliente | $190 | 1% |

| Ojo Feliz | $191 | 1% |

| Organ | $180 | -5% |

| Orogrande | $177 | -6% |

| Paguate | $183 | -3% |

| Paradise Hills | $215 | 14% |

| Pecos | $193 | 3% |

| Pena Blanca | $186 | -1% |

| Penasco | $187 | -1% |

| Pep | $189 | 0% |

| Peralta | $209 | 11% |

| Petaca | $195 | 4% |

| Picacho | $191 | 1% |

| Pie Town | $170 | -10% |

| Pinehill | $171 | -9% |

| Pinon | $176 | -7% |

| Placitas | $200 | 6% |

| Playas | $169 | -10% |

| Pojoaque | $188 | 0% |

| Polvadera | $180 | -4% |

| Ponderosa | $190 | 1% |

| Ponderosa Pine | $210 | 11% |

| Portales | $188 | 0% |

| Prewitt | $171 | -9% |

| Pueblo Of Acoma | $178 | -6% |

| Quay | $187 | -1% |

| Quemado | $171 | -9% |

| Questa | $193 | 2% |

| Radium Springs | $179 | -5% |

| Rainsville | $194 | 3% |

| Ramah | $171 | -9% |

| Ranchos De Taos | $192 | 2% |

| Raton | $190 | 1% |

| Red River | $190 | 1% |

| Redrock | $165 | -12% |

| Regina | $187 | 0% |

| Rehoboth | $175 | -7% |

| Reserve | $165 | -12% |

| Ribera | $190 | 1% |

| Rincon | $175 | -7% |

| Rio Communities | $211 | 12% |

| Rio Rancho | $203 | 8% |

| Rociada | $193 | 2% |

| Rodeo | $166 | -12% |

| Rogers | $187 | -1% |

| Roswell | $190 | 1% |

| Rowe | $194 | 3% |

| Roy | $188 | 0% |

| Ruidoso | $183 | -3% |

| Ruidoso Downs | $190 | 1% |

| Sacramento | $174 | -8% |

| Salem | $166 | -12% |

| San Acacia | $180 | -4% |

| San Antonio | $173 | -8% |

| San Cristobal | $190 | 1% |

| San Felipe Pueblo | $195 | 4% |

| San Fidel | $171 | -9% |

| San Ildefonso Pueblo | $188 | 0% |

| San Jon | $185 | -2% |

| San Jose | $191 | 2% |

| San Miguel | $176 | -6% |

| San Patricio | $183 | -3% |

| San Rafael | $172 | -9% |

| San Ysidro | $185 | -2% |

| Sandia Heights | $213 | 13% |

| Sandia Knolls | $204 | 8% |

| Sandia Park | $209 | 11% |

| Sanostee | $179 | -5% |

| Santa Clara | $160 | -15% |

| Santa Clara Pueblo | $193 | 2% |

| Santa Cruz | $189 | 0% |

| Santa Fe | $188 | 0% |

| Santa Rosa | $186 | -1% |

| Santa Teresa | $184 | -2% |

| Santo Domingo Pueblo | $188 | 0% |

| Sapello | $191 | 1% |

| Sausal | $211 | 12% |

| Sedan | $191 | 1% |

| Sedillo | $209 | 11% |

| Serafina | $193 | 2% |

| Sheep Springs | $177 | -6% |

| Shiprock | $169 | -10% |

| Silver City | $160 | -15% |

| Skyline-Ganipa | $177 | -6% |

| Smith Lake | $176 | -7% |

| Socorro | $179 | -5% |

| Solano | $189 | 1% |

| South Valley | $231 | 23% |

| Spencerville | $169 | -10% |

| Springer | $191 | 1% |

| St. Vrain | $195 | 3% |

| Stanley | $193 | 2% |

| Sunland Park | $187 | -1% |

| Sunspot | $178 | -5% |

| Taiban | $193 | 3% |

| Taos | $192 | 2% |

| Taos Pueblo | $193 | 3% |

| Taos Ski Valley | $195 | 3% |

| Tatum | $189 | 0% |

| Tererro | $192 | 2% |

| Tesuque | $189 | 0% |

| Texico | $194 | 3% |

| Thoreau | $172 | -9% |

| Tierra Amarilla | $192 | 2% |

| Tijeras | $210 | 11% |

| Timberon | $181 | -4% |

| Tinnie | $191 | 1% |

| Tohatchi | $174 | -8% |

| Tome | $205 | 9% |

| Torreon | $192 | 2% |

| Trampas | $193 | 3% |

| Trementina | $194 | 3% |

| Tres Piedras | $193 | 3% |

| Truchas | $193 | 3% |

| Truth or Consequences | $160 | -15% |

| Tucumcari | $183 | -3% |

| Tularosa | $167 | -12% |

| Twin Lakes | $174 | -7% |

| University Park | $183 | -3% |

| Upper Fruitland | $168 | -11% |

| Ute Park | $195 | 3% |

| Vadito | $190 | 1% |

| Vado | $177 | -6% |

| Valdez | $188 | 0% |

| Valencia | $206 | 9% |

| Vallecitos | $193 | 2% |

| Valmora | $193 | 2% |

| Vanderwagen | $174 | -7% |

| Veguita | $186 | -1% |

| Velarde | $192 | 2% |

| Wagon Mound | $187 | -1% |

| Waterflow | $167 | -11% |

| Watrous | $191 | 1% |

| Weed | $174 | -8% |

| West Hammond | $169 | -10% |

| White Rock | $176 | -7% |

| White Sands | $176 | -6% |

| White Sands Missile Range | $179 | -5% |

| Whites City | $192 | 2% |

| Willard | $188 | 0% |

| Williamsburg | $161 | -14% |

| Winston | $166 | -12% |

| Yah-ta-hey | $175 | -7% |

| Yeso | $196 | 4% |

| Youngsville | $197 | 4% |

| Zia Pueblo | $189 | 0% |

| Zuni Pueblo | $166 | -12% |

The average cost of car insurance in New Mexico’s largest cities:

- Albuquerque, $223 per month

- Las Cruces, $179 per month

- Rio Rancho, $203 per month

- Roswell, $190 per month

- Santa Fe, $188 per month

Minimum coverage for car insurance in New Mexico

New Mexico drivers are required to buy at least a minimum amount of liability car insurance. This minimum amount is usually written as 25/50/10, which means:

- $25,000 bodily injury coverage per person

- $50,000 bodily injury coverage per accident

- $10,000 property damage coverage

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you cause to property like fences, toll booths and light posts.

New Mexico state law doesn’t require full coverage car insurance, which usually includes collision

SR-22 insurance in New Mexico

If your driver’s license is suspended in New Mexico, you must file an SR-22 to get it reinstated.

An SR-22 proves you have at least the minimum amount of car insurance New Mexico law requires. Your insurance company should file the SR-22 with the Motor Vehicle Division (MVD) on your behalf.

If you do not maintain the SR-22 for its full duration, your insurance company will notify the MVD and your license will be suspended again.

Frequently asked questions

Auto insurance in New Mexico costs $188 a month, on average, if you buy a full coverage policy. If you only buy liability coverage, the state average cost is $66 a month.

Most drivers in New Mexico get the cheapest car insurance from State Farm. State Farm’s average rate for liability coverage is $34 a month. For full coverage, its average rate is $133 a month.

New Mexico is an at-fault state for auto insurance, meaning the driver responsible for the accident pays for resulting injuries and damage.

How we selected the cheapest car insurance companies in New Mexico

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in New Mexico

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.