Cheapest Car Insurance in New York (2026)

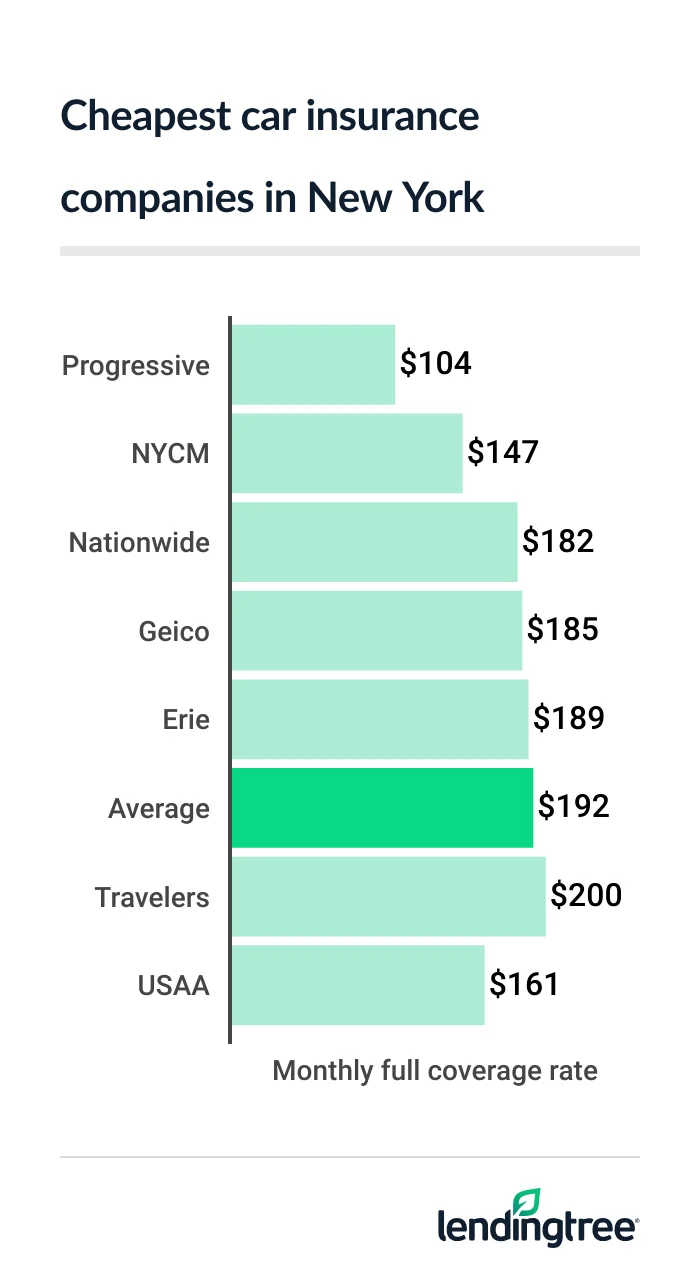

Progressive has the cheapest full coverage car insurance in New York state at $104 a month. This is $88 less than the state average of $192 a month.

Best cheap New York car insurance

Cheap full coverage car insurance in New York: Progressive

Progressive has the cheapest full coverage car insurance in New York state at $104 a month. This is 29% less than the next-cheapest rate of $147 a month from NYCM.

Of the two, NYCM has the better satisfaction rating from J.D. Power

New York drivers pay an average of $192 a month for full coverage. Your actual rate depends on factors like your driving record, location and credit history.

Cheap full coverage car insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Progressive | $104 | |

| NYCM | $147 | |

| Nationwide | $182 | |

| Geico | $185 | |

| Erie | $189 | |

| Travelers | $200 | |

| Chubb | $221 | |

| State Farm | $224 | |

| Allstate | $304 | |

| USAA* | $161 | |

Companies treat these factors differently and offer different car insurance discounts. This makes it worthwhile to compare car insurance quotes to find the cheapest rate.

New York’s cheapest minimum coverage car insurance: NYCM

At $39 a month, NYCM has New York’s cheapest liability insurance, or minimum coverage. NYCM charges 34% less than next-cheapest Progressive.

NYCM also has discounts for taking a defensive driving class and having a commercial driver’s license. Progressive has several other discounts, but not these.

Cheap auto liability insurance

| Company | Monthly rate |

|---|---|

| NYCM | $39 |

| Progressive | $60 |

| Geico | $85 |

| Erie | $88 |

| Nationwide | $89 |

| Chubb | $95 |

| Travelers | $96 |

| State Farm | $126 |

| Allstate | $171 |

| USAA* | $67 |

Minimum coverage in New York includes personal injury protection

Cheap car insurance for New York teens: NYCM and Progressive

NYCM and Progressive have New York’s cheapest car insurance for teens. NYCM has the lowest minimum coverage rates for young drivers at $71 a month. This is 48% less than Progressive’s rate of $136 a month.

Progressive has the state’s cheapest full coverage for teens at $251 a month. However, this is just barely cheaper than NYCM’s rate of $253 a month.

Teen auto insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| NYCM | $71 | $253 |

| Progressive | $136 | $251 |

| Erie | $185 | $368 |

| Chubb | $223 | $460 |

| Nationwide | $262 | $520 |

| Travelers | $263 | $529 |

| Geico | $340 | $674 |

| State Farm | $395 | $706 |

| Allstate | $437 | $859 |

| USAA* | $281 | $617 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why they get such high auto insurance rates. Young drivers usually get cheaper car insurance on a parent’s policy than they do on their own.

Discounts can also help make car insurance more affordable for teens:

- NYCM and Progressive give teens a discount for getting good grades.

- NYCM also has a discount for teens who complete driver training.

- Progressive gives parents a discount for adding a teen under 18 years old to their policy. The parents have to be with Progressive for at least a year to get it.

Other companies have these and additional discounts for young drivers. It’s good to ask about them with your quotes so they don’t get overlooked.

Best NY auto insurance rates after a ticket: Progressive

New York drivers with a speeding ticket can get the best auto insurance rates from Progressive. The company charges $106 a month after a ticket. This is 28% less than NYCM’s rate of $147 a month.

Auto insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Progressive | $106 |

| NYCM | $147 |

| Nationwide | $182 |

| Erie | $189 |

| Travelers | $200 |

| Geico | $237 |

| State Farm | $245 |

| Chubb | $261 |

| Allstate | $377 |

| USAA* | $181 |

You may save more with Progressive by using its Snapshot app. The app monitors your driving and gives you discounts for driving safely. If a ticket has inspired you to now drive more safely, the savings can add up.

Programs like Snapshot are known as usage-based insurance (UBI). NYCM doesn’t offer UBI, but several other companies do.

Cheapest NY car insurance after an accident: Progressive

At $112 a month, Progressive has New York’s cheapest car insurance after an at-fault accident. USAA has the next-cheapest rate at $161 a month, but it’s only available to the military community.

Car insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Progressive | $112 |

| NYCM | $176 |

| Nationwide | $238 |

| Travelers | $252 |

| State Farm | $267 |

| Chubb | $271 |

| Erie | $285 |

| Allstate | $304 |

| Geico | $327 |

| USAA* | $161 |

An at-fault accident raises the cost of car insurance by an average of 25% to $239 a month. However, some companies have smaller rate increases. Shopping around helps you find the cheapest company for a bad driving record.

Best rates for New York teens with a bad driving record: NYCM

New York teens with a bad driving record can get the best car insurance rates from NYCM. It charges young drivers $71 a month for minimum coverage after a ticket. This is 48% less than Progressive’s rate of $136 a month.

NYCM charges teens $106 a month after an accident. This is 22% less than Progressive’s rate.

Teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| NYCM | $71 | $106 |

| Progressive | $136 | $136 |

| Erie | $185 | $295 |

| Nationwide | $262 | $296 |

| Travelers | $263 | $350 |

| Chubb | $265 | $276 |

| Geico | $396 | $441 |

| State Farm | $438 | $482 |

| Allstate | $572 | $437 |

| USAA* | $281 | $281 |

Cheap New York car insurance after a DWI: Progressive

At $108 a month, Progressive has New York’s cheapest car insurance after a DWI (driving while intoxicated). NYCM has the next-cheapest DWI insurance at $213 a month.

A DWI raises car insurance rates in New York by an average of 72% to $329 a month. However, you may find a cheaper rate if you shop around.

Cheapest insurance rates with a DWI

| Company | Monthly rate |

|---|---|

| Progressive | $108 |

| NYCM | $213 |

| Travelers | $249 |

| Chubb | $275 |

| Erie | $288 |

| Nationwide | $295 |

| Allstate | $433 |

| Geico | $578 |

| State Farm | $626 |

| USAA* | $228 |

New York’s cheapest bad credit car insurance: Nationwide

At $182 a month, Nationwide has New York’s cheapest bad credit car insurance. Geico is the next-cheapest company at $262 a month.

Geico has more discounts than Nationwide, which could make it more affordable. Nationwide is a better choice if you need gap coverage

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Nationwide | $182 |

| Geico | $262 |

| Chubb | $275 |

| Erie | $333 |

| NYCM | $345 |

| State Farm | $490 |

| Allstate | $515 |

| Travelers | $573 |

| Progressive | $653 |

| USAA* | $313 |

Your insurance credit score is slightly different from the score lenders use for loan applications. Insurance companies focus on your payment history and borrowing habits, but not your income.

That said, you can improve your credit scores for both insurance and loans by:

- Paying down debts

- Avoiding late payments

Best car insurance in New York

NYCM stands out as the best car insurance company in New York for a few reasons:

- It has the state’s cheapest minimum coverage for adults and teens. It’s also among the price leaders for most other types of drivers.

- NYCM has a better satisfaction rating than most other companies. It makes customers happier over features like price, coverage options and service.

-

It has useful coverage options for new and new-ish cars. NYCM’s new car replacement

program lasts three years. It also offers original equipment manufacturer (OEM)If your car is totaled while it’s relatively new, new car replacement pays for a new one.parts coverage for cars up to 10 years old.Pays to replace damaged parts with factory originals, instead of after-market substitutes.

Progressive may be your best choice if price is your greatest concern. Progressive’s full coverage rates are 46% less than the state average for a typical driver. It also has the state’s cheapest rates after a ticket, accident or DWI.

You can save more by using Progressive’s Snapshot app. However, make sure to monitor the ratings the app gives you. Your rates can go up if the app detects unsafe driving, unless you opt out of the program within the first 45 days.

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Chubb | Not rated | A++ | |

| Erie | 703 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| NYCM | 652 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

New York insurance rates by city

At $471 a month, Brooklyn has the most expensive car insurance among New York’s boroughs, cities and towns. Drivers in Queens’ South Ozone Park neighborhood have the next-highest rate at $424 a month.

Car insurance tends to cost more in areas where insurance companies spend more on claims. The factors that affect an area’s car insurance costs include:

- Crash rates

- Car theft rates

- Medical costs

- Car repair prices

Cooper Plains and Gang Mills have New York’s cheapest car insurance. Drivers in these neighboring areas pay $135 a month, or 30% less than the state average.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Accord | $195 | 2% |

| Acra | $186 | -3% |

| Adams | $142 | -26% |

| Adams Basin | $146 | -24% |

| Adams Center | $140 | -27% |

| Addison | $153 | -20% |

| Adirondack | $142 | -26% |

| Afton | $158 | -18% |

| Airmont | $243 | 27% |

| Akron | $171 | -11% |

| Albany | $153 | -20% |

| Albertson | $288 | 50% |

| Albion | $159 | -17% |

| Alcove | $159 | -17% |

| Alden | $171 | -11% |

| Alder Creek | $158 | -18% |

| Alexander | $160 | -17% |

| Alexandria Bay | $140 | -27% |

| Alfred | $153 | -20% |

| Alfred Station | $153 | -20% |

| Allegany | $152 | -21% |

| Allentown | $155 | -19% |

| Alma | $154 | -20% |

| Almond | $152 | -21% |

| Alpine | $147 | -23% |

| Alplaus | $148 | -23% |

| Altamont | $153 | -20% |

| Altmar | $153 | -20% |

| Alton | $153 | -20% |

| Altona | $140 | -27% |

| Amagansett | $218 | 14% |

| Amawalk | $214 | 12% |

| Amenia | $202 | 6% |

| Amityville | $272 | 42% |

| Amsterdam | $147 | -23% |

| Ancram | $180 | -6% |

| Ancramdale | $181 | -6% |

| Andes | $175 | -9% |

| Andover | $156 | -19% |

| Angelica | $155 | -19% |

| Angola | $169 | -12% |

| Angola on the Lake | $169 | -12% |

| Annandale On Hudson | $201 | 5% |

| Antwerp | $141 | -27% |

| Apalachin | $145 | -24% |

| Appleton | $164 | -15% |

| Apulia Station | $150 | -22% |

| Aquebogue | $214 | 12% |

| Arcade | $165 | -14% |

| Arden | $230 | 20% |

| Ardsley | $220 | 15% |

| Ardsley On Hudson | $220 | 15% |

| Argyle | $144 | -25% |

| Arkport | $149 | -22% |

| Arkville | $180 | -6% |

| Arlington | $200 | 4% |

| Armonk | $214 | 12% |

| Arverne | $415 | 116% |

| Asharoken | $260 | 36% |

| Ashland | $188 | -2% |

| Ashville | $155 | -19% |

| Astoria | $375 | 96% |

| Athens | $180 | -6% |

| Athol | $147 | -24% |

| Athol Springs | $169 | -12% |

| Atlanta | $153 | -20% |

| Atlantic Beach | $342 | 78% |

| Attica | $162 | -15% |

| Au Sable Forks | $141 | -26% |

| Auburn | $148 | -23% |

| Auriesville | $152 | -21% |

| Aurora | $154 | -20% |

| Austerlitz | $174 | -9% |

| Ava | $158 | -17% |

| Averill Park | $151 | -21% |

| Avoca | $151 | -21% |

| Avon | $154 | -19% |

| Babylon | $271 | 42% |

| Bainbridge | $157 | -18% |

| Baiting Hollow | $238 | 24% |

| Bakers Mills | $149 | -22% |

| Baldwin | $322 | 68% |

| Baldwin Harbor | $322 | 68% |

| Baldwin Place | $218 | 14% |

| Baldwinsville | $146 | -24% |

| Ballston Lake | $142 | -26% |

| Ballston Spa | $143 | -25% |

| Balmville | $217 | 13% |

| Bangall | $204 | 6% |

| Bardonia | $238 | 24% |

| Barker | $164 | -14% |

| Barneveld | $156 | -18% |

| Barnum Island | $318 | 66% |

| Barrytown | $201 | 5% |

| Barryville | $232 | 21% |

| Barton | $145 | -24% |

| Basom | $169 | -12% |

| Batavia | $159 | -17% |

| Bath | $150 | -22% |

| Baxter Estates | $285 | 49% |

| Bay Park | $315 | 64% |

| Bay Shore | $280 | 46% |

| Bayport | $249 | 30% |

| Bayside | $365 | 90% |

| Bayville | $272 | 42% |

| Baywood | $280 | 46% |

| Beacon | $204 | 7% |

| Bear Mountain | $242 | 26% |

| Bearsville | $193 | 1% |

| Beaver Dam Lake | $219 | 14% |

| Beaver Dams | $145 | -24% |

| Beaver Falls | $151 | -21% |

| Bedford | $215 | 12% |

| Bedford Hills | $214 | 12% |

| Belfast | $155 | -19% |

| Belle Terre | $250 | 31% |

| Bellerose | $335 | 75% |

| Bellerose Terrace | $335 | 75% |

| Belleville | $143 | -25% |

| Bellmore | $299 | 56% |

| Bellona | $151 | -21% |

| Bellport | $247 | 29% |

| Bellvale | $231 | 21% |

| Belmont | $155 | -19% |

| Bemus Point | $155 | -19% |

| Bergen | $155 | -19% |

| Berkshire | $147 | -23% |

| Berlin | $154 | -20% |

| Berne | $158 | -17% |

| Bernhards Bay | $153 | -20% |

| Bethel | $229 | 20% |

| Bethpage | $269 | 40% |

| Bible School Park | $146 | -24% |

| Big Flats | $137 | -29% |

| Big Indian | $194 | 1% |

| Billings | $208 | 9% |

| Billington Heights | $167 | -13% |

| Binghamton | $144 | -25% |

| Binghamton University | $143 | -25% |

| Black Creek | $158 | -17% |

| Black River | $139 | -27% |

| Blasdell | $178 | -7% |

| Blauvelt | $235 | 23% |

| Bliss | $166 | -13% |

| Blodgett Mills | $154 | -20% |

| Bloomfield | $150 | -22% |

| Bloomingburg | $227 | 18% |

| Bloomingdale | $145 | -25% |

| Bloomington | $191 | 0% |

| Bloomville | $168 | -13% |

| Blossvale | $157 | -18% |

| Blue Mountain Lake | $150 | -22% |

| Blue Point | $243 | 27% |

| Bohemia | $258 | 35% |

| Boiceville | $196 | 2% |

| Bolivar | $154 | -20% |

| Bolton Landing | $147 | -23% |

| Bombay | $146 | -24% |

| Boonville | $157 | -18% |

| Boston | $170 | -11% |

| Bouckville | $156 | -19% |

| Bovina Center | $174 | -9% |

| Bowmansville | $169 | -12% |

| Bradford | $149 | -22% |

| Brainard | $156 | -18% |

| Brainardsville | $146 | -24% |

| Branchport | $153 | -20% |

| Brant Lake | $146 | -24% |

| Brantingham | $153 | -20% |

| Brasher Falls | $146 | -24% |

| Breesport | $143 | -26% |

| Breezy Point | $407 | 112% |

| Brentwood | $284 | 48% |

| Brewerton | $146 | -24% |

| Brewster | $221 | 15% |

| Brewster Hill | $221 | 15% |

| Briarcliff Manor | $214 | 11% |

| Bridgehampton | $218 | 14% |

| Bridgeport | $150 | -22% |

| Brier Hill | $150 | -22% |

| Brighton | $145 | -24% |

| Brightwaters | $272 | 42% |

| Brinckerhoff | $202 | 5% |

| Broadalbin | $146 | -24% |

| Brockport | $147 | -23% |

| Brocton | $156 | -19% |

| Bronxville | $235 | 23% |

| Brookfield | $156 | -18% |

| Brookhaven | $248 | 29% |

| Brooklyn | $471 | 146% |

| Brooktondale | $152 | -21% |

| Brookville | $282 | 47% |

| Brushton | $147 | -23% |

| Buchanan | $214 | 11% |

| Buffalo | $214 | 12% |

| Bullville | $228 | 19% |

| Burdett | $147 | -23% |

| Burke | $145 | -24% |

| Burlingham | $234 | 22% |

| Burlington Flats | $163 | -15% |

| Burnt Hills | $145 | -24% |

| Burt | $165 | -14% |

| Buskirk | $151 | -21% |

| Busti | $155 | -19% |

| Byron | $155 | -19% |

| Cadyville | $139 | -28% |

| Cairo | $183 | -5% |

| Calcium | $140 | -27% |

| Caledonia | $154 | -20% |

| Callicoon | $224 | 17% |

| Callicoon Center | $225 | 17% |

| Calverton | $233 | 21% |

| Cambria Heights | $414 | 116% |

| Cambridge | $149 | -22% |

| Camden | $157 | -18% |

| Cameron | $154 | -20% |

| Cameron Mills | $155 | -19% |

| Camillus | $148 | -23% |

| Campbell | $140 | -27% |

| Campbell Hall | $226 | 18% |

| Canaan | $172 | -10% |

| Canajoharie | $148 | -23% |

| Canandaigua | $147 | -23% |

| Canaseraga | $153 | -20% |

| Canastota | $152 | -21% |

| Candor | $145 | -24% |

| Caneadea | $159 | -17% |

| Canisteo | $154 | -19% |

| Canton | $149 | -22% |

| Cape Vincent | $142 | -26% |

| Carle Place | $288 | 50% |

| Carlisle | $156 | -18% |

| Carmel | $219 | 14% |

| Carmel Hamlet | $219 | 14% |

| Caroga Lake | $151 | -21% |

| Carthage | $144 | -25% |

| Cassadaga | $156 | -19% |

| Cassville | $157 | -18% |

| Castile | $161 | -16% |

| Castle Creek | $144 | -25% |

| Castle Point | $206 | 8% |

| Castleton-on-Hudson | $152 | -21% |

| Castorland | $152 | -21% |

| Cato | $154 | -19% |

| Catskill | $183 | -5% |

| Cattaraugus | $160 | -16% |

| Cayuga | $146 | -24% |

| Cayuga Heights | $152 | -21% |

| Cayuta | $147 | -24% |

| Cazenovia | $153 | -20% |

| Cedarhurst | $331 | 72% |

| Celoron | $155 | -19% |

| Center Moriches | $230 | 20% |

| Centereach | $251 | 31% |

| Centerport | $265 | 38% |

| Central Bridge | $158 | -18% |

| Central Islip | $283 | 47% |

| Central Square | $151 | -21% |

| Central Valley | $220 | 15% |

| Centre Island | $274 | 43% |

| Ceres | $154 | -19% |

| Chadwicks | $156 | -19% |

| Chaffee | $171 | -11% |

| Champlain | $139 | -27% |

| Chappaqua | $214 | 11% |

| Charlotteville | $160 | -17% |

| Chase Mills | $146 | -24% |

| Chateaugay | $145 | -25% |

| Chatham | $172 | -10% |

| Chaumont | $140 | -27% |

| Chautauqua | $159 | -17% |

| Chazy | $139 | -27% |

| Cheektowaga | $187 | -2% |

| Chelsea | $206 | 8% |

| Chemung | $148 | -23% |

| Chenango Bridge | $143 | -25% |

| Chenango Forks | $146 | -24% |

| Cherry Creek | $160 | -16% |

| Cherry Plain | $154 | -20% |

| Cherry Valley | $162 | -16% |

| Chester | $222 | 16% |

| Chestertown | $146 | -24% |

| Chestnut Ridge | $242 | 26% |

| Chichester | $195 | 2% |

| Childwold | $150 | -22% |

| Chippewa Bay | $148 | -23% |

| Chittenango | $152 | -21% |

| Churchville | $145 | -24% |

| Churubusco | $142 | -26% |

| Cicero | $146 | -24% |

| Cincinnatus | $157 | -18% |

| Circleville | $218 | 14% |

| Clarence | $170 | -11% |

| Clarence Center | $169 | -12% |

| Clark Mills | $156 | -19% |

| Clarkson | $147 | -23% |

| Clarksville | $152 | -21% |

| Claryville | $216 | 13% |

| Claverack | $176 | -8% |

| Clay | $145 | -24% |

| Clayton | $141 | -27% |

| Clayville | $157 | -18% |

| Clemons | $146 | -24% |

| Cleveland | $153 | -20% |

| Cleverdale | $145 | -24% |

| Clifton Park | $139 | -27% |

| Clifton Springs | $142 | -26% |

| Climax | $182 | -5% |

| Clinton | $154 | -20% |

| Clinton Corners | $201 | 5% |

| Clintondale | $203 | 6% |

| Clockville | $154 | -20% |

| Clyde | $151 | -21% |

| Clymer | $159 | -17% |

| Cobleskill | $157 | -18% |

| Cochecton | $229 | 19% |

| Cochecton Center | $234 | 22% |

| Coeymans Hollow | $160 | -17% |

| Cohocton | $153 | -20% |

| Cohoes | $147 | -23% |

| Cold Brook | $154 | -19% |

| Cold Spring | $221 | 15% |

| Cold Spring Harbor | $268 | 40% |

| Colden | $170 | -11% |

| College Point | $363 | 89% |

| Colliersville | $163 | -15% |

| Collins | $166 | -13% |

| Collins Center | $169 | -12% |

| Colonie | $149 | -22% |

| Colton | $150 | -22% |

| Columbiaville | $170 | -11% |

| Commack | $260 | 36% |

| Comstock | $146 | -24% |

| Conesus | $158 | -18% |

| Conewango Valley | $159 | -17% |

| Congers | $238 | 24% |

| Conklin | $143 | -25% |

| Connelly | $191 | -1% |

| Constable | $147 | -24% |

| Constableville | $153 | -20% |

| Constantia | $152 | -21% |

| Coopers Plains | $135 | -30% |

| Cooperstown | $162 | -16% |

| Copake | $179 | -7% |

| Copake Falls | $178 | -7% |

| Copenhagen | $151 | -21% |

| Copiague | $274 | 43% |

| Coram | $252 | 32% |

| Corbettsville | $145 | -24% |

| Corfu | $165 | -14% |

| Corinth | $141 | -26% |

| Corning | $136 | -29% |

| Cornwall | $219 | 14% |

| Cornwall-on-Hudson | $219 | 14% |

| Cornwallville | $187 | -2% |

| Corona | $389 | 103% |

| Cortland | $152 | -21% |

| Cortland West | $152 | -21% |

| Cortlandt Manor | $214 | 11% |

| Cossayuna | $146 | -24% |

| Cottekill | $192 | 0% |

| Country Knolls | $140 | -27% |

| Cowlesville | $167 | -13% |

| Coxsackie | $179 | -7% |

| Cragsmoor | $205 | 7% |

| Cranberry Lake | $149 | -22% |

| Craryville | $176 | -8% |

| Crittenden | $172 | -11% |

| Croghan | $151 | -21% |

| Crompond | $213 | 11% |

| Cropseyville | $151 | -21% |

| Cross River | $215 | 12% |

| Croton Falls | $218 | 14% |

| Croton-on-Hudson | $216 | 13% |

| Crown Heights | $201 | 5% |

| Crown Point | $143 | -26% |

| Crugers | $214 | 12% |

| Cuba | $156 | -19% |

| Cuddebackville | $224 | 17% |

| Cumberland Head | $138 | -28% |

| Cutchogue | $213 | 11% |

| Dale | $164 | -14% |

| Dalton | $157 | -18% |

| Dannemora | $140 | -27% |

| Dansville | $153 | -20% |

| Darien Center | $168 | -12% |

| Davenport | $168 | -12% |

| Davenport Center | $169 | -12% |

| Dayton | $160 | -17% |

| De Kalb Junction | $149 | -22% |

| De Peyster | $150 | -22% |

| De Ruyter | $157 | -18% |

| Deansboro | $157 | -18% |

| Deer Park | $275 | 44% |

| Deer River | $148 | -23% |

| Deferiet | $143 | -25% |

| Delancey | $173 | -10% |

| Delanson | $150 | -22% |

| Delevan | $161 | -16% |

| Delhi | $166 | -13% |

| Delmar | $152 | -21% |

| Delphi Falls | $150 | -22% |

| Denver | $176 | -8% |

| Depauville | $142 | -26% |

| Depew | $170 | -12% |

| Deposit | $150 | -22% |

| Derby | $171 | -11% |

| Dewittville | $157 | -18% |

| Dexter | $140 | -27% |

| Diamond Point | $145 | -24% |

| Dickinson Center | $147 | -23% |

| Dix Hills | $270 | 41% |

| Dobbs Ferry | $220 | 15% |

| Dolgeville | $148 | -23% |

| Dormansville | $157 | -18% |

| Dover Plains | $209 | 9% |

| Downsville | $175 | -9% |

| Dresden | $152 | -21% |

| Dryden | $151 | -21% |

| Duane Lake | $150 | -22% |

| Duanesburg | $150 | -22% |

| Dundee | $150 | -22% |

| Dunkirk | $156 | -19% |

| Durham | $185 | -4% |

| Durhamville | $155 | -19% |

| Eagle Bay | $153 | -20% |

| Eagle Bridge | $150 | -22% |

| Earlton | $179 | -6% |

| Earlville | $157 | -18% |

| East Amherst | $171 | -11% |

| East Atlantic Beach | $328 | 71% |

| East Aurora | $168 | -12% |

| East Berne | $158 | -18% |

| East Bethany | $157 | -18% |

| East Branch | $173 | -10% |

| East Chatham | $172 | -10% |

| East Concord | $172 | -10% |

| East Durham | $183 | -5% |

| East Elmhurst | $376 | 96% |

| East Farmingdale | $263 | 37% |

| East Garden City | $332 | 73% |

| East Glenville | $146 | -24% |

| East Greenbush | $153 | -20% |

| East Hampton | $212 | 11% |

| East Hampton North | $212 | 11% |

| East Hills | $289 | 51% |

| East Homer | $154 | -20% |

| East Islip | $263 | 37% |

| East Ithaca | $152 | -21% |

| East Jewett | $189 | -1% |

| East Marion | $213 | 11% |

| East Massapequa | $267 | 39% |

| East Meadow | $302 | 57% |

| East Meredith | $167 | -13% |

| East Moriches | $221 | 15% |

| East Nassau | $156 | -19% |

| East Northport | $261 | 36% |

| East Norwich | $274 | 43% |

| East Otto | $162 | -15% |

| East Patchogue | $244 | 27% |

| East Pembroke | $160 | -17% |

| East Pharsalia | $162 | -15% |

| East Quogue | $217 | 13% |

| East Randolph | $157 | -18% |

| East Rochester | $141 | -26% |

| East Rockaway | $315 | 64% |

| East Schodack | $155 | -19% |

| East Setauket | $249 | 30% |

| East Shoreham | $247 | 29% |

| East Springfield | $164 | -14% |

| East Syracuse | $150 | -22% |

| East Williamson | $150 | -22% |

| East Williston | $287 | 50% |

| East Worcester | $164 | -15% |

| Eastchester | $226 | 18% |

| Eastport | $217 | 13% |

| Eaton | $156 | -19% |

| Eatons Neck | $261 | 36% |

| Eden | $170 | -12% |

| Edmeston | $162 | -16% |

| Edwards | $150 | -22% |

| Eggertsville | $177 | -8% |

| Elba | $157 | -18% |

| Elbridge | $148 | -23% |

| Eldred | $231 | 21% |

| Elizabethtown | $142 | -26% |

| Elizaville | $181 | -5% |

| Elka Park | $186 | -3% |

| Ellenburg Center | $142 | -26% |

| Ellenburg Depot | $140 | -27% |

| Ellenville | $202 | 5% |

| Ellicottville | $158 | -18% |

| Ellington | $156 | -18% |

| Ellisburg | $143 | -25% |

| Elma | $166 | -13% |

| Elma Center | $166 | -13% |

| Elmhurst | $382 | 99% |

| Elmira | $138 | -28% |

| Elmira Heights | $137 | -28% |

| Elmont | $323 | 68% |

| Elmsford | $219 | 14% |

| Elwood | $265 | 38% |

| Endicott | $143 | -26% |

| Endwell | $142 | -26% |

| Erieville | $157 | -18% |

| Erin | $146 | -24% |

| Esperance | $156 | -18% |

| Essex | $142 | -26% |

| Etna | $154 | -20% |

| Evans Mills | $141 | -26% |

| Fabius | $150 | -22% |

| Fair Haven | $155 | -19% |

| Fairmount | $148 | -23% |

| Fairport | $141 | -27% |

| Fairview | $213 | 11% |

| Falconer | $155 | -19% |

| Fancher | $155 | -19% |

| Far Rockaway | $413 | 116% |

| Farmersville Station | $160 | -16% |

| Farmingdale | $270 | 41% |

| Farmington | $144 | -25% |

| Farmingville | $250 | 30% |

| Farnham | $171 | -11% |

| Fayetteville | $150 | -22% |

| Felts Mills | $142 | -26% |

| Ferndale | $226 | 18% |

| Feura Bush | $152 | -21% |

| Fillmore | $159 | -17% |

| Findley Lake | $160 | -16% |

| Fine | $149 | -22% |

| Fire Island | $269 | 40% |

| Firthcliffe | $219 | 14% |

| Fishers | $153 | -20% |

| Fishers Island | $226 | 18% |

| Fishers Landing | $140 | -27% |

| Fishkill | $203 | 6% |

| Fishs Eddy | $168 | -13% |

| Flanders | $214 | 12% |

| Fleischmanns | $179 | -7% |

| Floral Park | $325 | 69% |

| Florida | $225 | 18% |

| Flower Hill | $287 | 50% |

| Flushing | $382 | 99% |

| Fly Creek | $163 | -15% |

| Fonda | $149 | -22% |

| Forest Hills | $364 | 90% |

| Forestburgh | $232 | 21% |

| Forestport | $156 | -19% |

| Forestville | $161 | -16% |

| Fort Ann | $145 | -24% |

| Fort Covington Hamlet | $146 | -24% |

| Fort Drum | $141 | -26% |

| Fort Edward | $141 | -27% |

| Fort Hunter | $149 | -22% |

| Fort Johnson | $148 | -23% |

| Fort Montgomery | $221 | 15% |

| Fort Plain | $148 | -23% |

| Fort Salonga | $260 | 36% |

| Frankfort | $147 | -23% |

| Franklin | $165 | -14% |

| Franklin Springs | $158 | -18% |

| Franklin Square | $321 | 67% |

| Franklinville | $158 | -18% |

| Fredonia | $156 | -19% |

| Freedom | $160 | -16% |

| Freehold | $183 | -5% |

| Freeport | $347 | 81% |

| Freeville | $150 | -22% |

| Fremont Center | $223 | 16% |

| Fresh Meadows | $367 | 92% |

| Frewsburg | $153 | -20% |

| Friendship | $155 | -19% |

| Fulton | $150 | -22% |

| Fultonham | $159 | -17% |

| Fultonville | $149 | -22% |

| Gabriels | $147 | -24% |

| Gainesville | $166 | -13% |

| Galeville | $145 | -24% |

| Gallupville | $158 | -18% |

| Galway | $143 | -25% |

| Gang Mills | $135 | -30% |

| Gansevoort | $140 | -27% |

| Garden City | $305 | 59% |

| Garden City Park | $288 | 50% |

| Garden City South | $314 | 64% |

| Gardiner | $202 | 5% |

| Gardnertown | $217 | 13% |

| Garnerville | $238 | 24% |

| Garrattsville | $163 | -15% |

| Garrison | $220 | 15% |

| Gasport | $165 | -14% |

| Gates | $151 | -21% |

| Geneseo | $154 | -19% |

| Geneva | $144 | -25% |

| Genoa | $156 | -18% |

| Georgetown | $156 | -19% |

| Germantown | $178 | -7% |

| Gerry | $154 | -20% |

| Getzville | $173 | -10% |

| Ghent | $174 | -9% |

| Gilbertsville | $161 | -16% |

| Gilboa | $163 | -15% |

| Glasco | $188 | -2% |

| Glen Aubrey | $143 | -26% |

| Glen Cove | $269 | 41% |

| Glen Head | $275 | 44% |

| Glen Oaks | $345 | 80% |

| Glen Spey | $233 | 22% |

| Glen Wild | $227 | 19% |

| Glenfield | $154 | -20% |

| Glenford | $194 | 1% |

| Glenham | $206 | 8% |

| Glenmont | $152 | -21% |

| Glens Falls | $142 | -26% |

| Glens Falls North | $141 | -26% |

| Glenwood | $175 | -9% |

| Glenwood Landing | $278 | 45% |

| Gloversville | $148 | -23% |

| Golden’s Bridge | $214 | 12% |

| Gordon Heights | $252 | 32% |

| Goshen | $225 | 17% |

| Gouverneur | $146 | -24% |

| Gowanda | $165 | -14% |

| Grahamsville | $224 | 17% |

| Grand Gorge | $168 | -12% |

| Grand Island | $173 | -10% |

| Grandyle Village | $173 | -10% |

| Granite Springs | $214 | 12% |

| Granville | $146 | -24% |

| Great Bend | $143 | -25% |

| Great Neck | $293 | 53% |

| Great Neck Estates | $293 | 53% |

| Great Neck Gardens | $292 | 52% |

| Great Neck Plaza | $293 | 53% |

| Great River | $261 | 36% |

| Great Valley | $153 | -20% |

| Greece | $146 | -24% |

| Green Island | $149 | -22% |

| Greene | $159 | -17% |

| Greenfield Center | $143 | -26% |

| Greenfield Park | $200 | 5% |

| Greenhurst | $158 | -17% |

| Greenlawn | $269 | 40% |

| Greenport | $213 | 11% |

| Greenport West | $213 | 11% |

| Greenvale | $284 | 48% |

| Greenville | $198 | 3% |

| Greenwich | $145 | -24% |

| Greenwood | $157 | -18% |

| Greenwood Lake | $227 | 18% |

| Greig | $154 | -20% |

| Groton | $154 | -20% |

| Groveland | $156 | -19% |

| Guilderland | $151 | -21% |

| Guilderland Center | $153 | -20% |

| Guilford | $158 | -18% |

| Hadley | $144 | -25% |

| Hagaman | $148 | -23% |

| Hague | $146 | -24% |

| Hailesboro | $146 | -24% |

| Haines Falls | $188 | -2% |

| Halcottsville | $174 | -9% |

| Halesite | $268 | 40% |

| Hall | $152 | -21% |

| Hamburg | $169 | -12% |

| Hamden | $169 | -12% |

| Hamilton | $156 | -19% |

| Hamlin | $149 | -22% |

| Hammond | $149 | -22% |

| Hammondsport | $153 | -20% |

| Hampton | $147 | -24% |

| Hampton Bays | $214 | 12% |

| Hampton Manor | $152 | -21% |

| Hancock | $167 | -13% |

| Hankins | $227 | 18% |

| Hannacroix | $179 | -7% |

| Hannawa Falls | $149 | -22% |

| Hannibal | $151 | -21% |

| Harbor Hills | $293 | 53% |

| Harbor Isle | $318 | 66% |

| Harpersfield | $170 | -11% |

| Harpursville | $150 | -22% |

| Harriman | $223 | 17% |

| Harris | $232 | 21% |

| Harris Hill | $172 | -10% |

| Harrison | $219 | 14% |

| Harrisville | $147 | -23% |

| Hartford | $144 | -25% |

| Hartsdale | $220 | 15% |

| Hartwick | $162 | -16% |

| Hastings | $151 | -21% |

| Hastings-on-Hudson | $223 | 17% |

| Hauppauge | $263 | 37% |

| Haverstraw | $238 | 24% |

| Haviland | $200 | 4% |

| Hawthorne | $213 | 11% |

| Head of the Harbor | $257 | 34% |

| Hector | $149 | -23% |

| Helena | $147 | -23% |

| Hemlock | $157 | -18% |

| Hempstead | $353 | 84% |

| Henderson | $143 | -25% |

| Henderson Harbor | $143 | -25% |

| Henrietta | $144 | -25% |

| Hensonville | $187 | -2% |

| Heritage Hills | $214 | 12% |

| Herkimer | $145 | -24% |

| Hermon | $147 | -23% |

| Herricks | $287 | 50% |

| Heuvelton | $150 | -22% |

| Hewlett | $323 | 69% |

| Hewlett Bay Park | $329 | 72% |

| Hewlett Harbor | $330 | 72% |

| Hicksville | $276 | 44% |

| High Falls | $195 | 2% |

| Highland | $197 | 3% |

| Highland Falls | $220 | 15% |

| Highland Lake | $233 | 22% |

| Highland Mills | $220 | 15% |

| Highmount | $192 | 0% |

| Hillburn | $243 | 27% |

| Hillcrest | $244 | 28% |

| Hillsdale | $177 | -8% |

| Hillside | $190 | -1% |

| Hillside Lake | $205 | 7% |

| Hilton | $147 | -24% |

| Himrod | $151 | -21% |

| Hinckley | $159 | -17% |

| Hinsdale | $151 | -21% |

| Hobart | $170 | -11% |

| Hoffmeister | $152 | -21% |

| Hogansburg | $145 | -25% |

| Holbrook | $249 | 30% |

| Holland | $171 | -11% |

| Holland Patent | $157 | -18% |

| Holley | $159 | -17% |

| Hollis | $410 | 114% |

| Hollowville | $177 | -8% |

| Holmes | $207 | 8% |

| Holtsville | $249 | 30% |

| Homer | $153 | -20% |

| Honeoye | $156 | -18% |

| Honeoye Falls | $149 | -22% |

| Hoosick Falls | $154 | -20% |

| Hopewell Junction | $203 | 6% |

| Hornell | $150 | -22% |

| Horseheads | $139 | -27% |

| Horseheads North | $137 | -29% |

| Hortonville | $227 | 18% |

| Houghton | $159 | -17% |

| Howard Beach | $419 | 118% |

| Howells | $229 | 19% |

| Howes Cave | $159 | -17% |

| Hubbardsville | $156 | -19% |

| Hudson | $174 | -9% |

| Hudson Falls | $143 | -26% |

| Hughsonville | $206 | 8% |

| Huguenot | $226 | 18% |

| Huletts Landing | $148 | -23% |

| Hunt | $159 | -17% |

| Hunter | $186 | -3% |

| Huntington | $269 | 40% |

| Huntington Bay | $269 | 40% |

| Huntington Station | $269 | 40% |

| Hurley | $191 | 0% |

| Hurleyville | $230 | 20% |

| Hyde Park | $199 | 4% |

| Ilion | $146 | -24% |

| Indian Lake | $150 | -22% |

| Inlet | $151 | -21% |

| Interlaken | $152 | -21% |

| Inwood | $338 | 76% |

| Ionia | $155 | -19% |

| Irondequoit | $150 | -22% |

| Irving | $170 | -11% |

| Irvington | $219 | 14% |

| Island Park | $318 | 66% |

| Islandia | $275 | 43% |

| Islip | $278 | 45% |

| Islip Terrace | $269 | 41% |

| Ithaca | $152 | -20% |

| Jackson Heights | $378 | 97% |

| Jacksonville | $153 | -20% |

| Jamaica | $419 | 119% |

| Jamesport | $215 | 12% |

| Jamestown | $155 | -19% |

| Jamestown West | $155 | -19% |

| Jamesville | $152 | -20% |

| Jasper | $157 | -18% |

| Java Center | $170 | -11% |

| Java Village | $170 | -11% |

| Jay | $146 | -24% |

| Jefferson | $164 | -15% |

| Jefferson Heights | $183 | -5% |

| Jefferson Valley | $219 | 14% |

| Jefferson Valley-Yorktown | $214 | 11% |

| Jeffersonville | $223 | 16% |

| Jericho | $286 | 49% |

| Jewett | $189 | -1% |

| Johnsburg | $149 | -22% |

| Johnson | $229 | 20% |

| Johnson City | $142 | -26% |

| Johnsonville | $151 | -21% |

| Johnstown | $147 | -23% |

| Jordan | $152 | -21% |

| Jordanville | $158 | -18% |

| Kanona | $152 | -21% |

| Kaser | $243 | 27% |

| Katonah | $214 | 11% |

| Kattskill Bay | $146 | -24% |

| Kauneonga Lake | $232 | 21% |

| Keene | $144 | -25% |

| Keene Valley | $145 | -24% |

| Keeseville | $141 | -27% |

| Kendall | $162 | -16% |

| Kenmore | $179 | -7% |

| Kennedy | $153 | -20% |

| Kenoza Lake | $224 | 17% |

| Kensington | $293 | 53% |

| Kent | $162 | -16% |

| Kerhonkson | $198 | 3% |

| Keuka Park | $153 | -20% |

| Kew Gardens | $397 | 107% |

| Kiamesha Lake | $227 | 19% |

| Kill Buck | $154 | -20% |

| Killawog | $146 | -24% |

| Kinderhook | $170 | -11% |

| King Ferry | $156 | -19% |

| Kings Park | $257 | 34% |

| Kings Point | $292 | 52% |

| Kingston | $190 | -1% |

| Kirkville | $149 | -22% |

| Kirkwood | $143 | -25% |

| Kiryas Joel | $224 | 17% |

| Knowlesville | $159 | -17% |

| Knoxboro | $170 | -11% |

| La Fargeville | $140 | -27% |

| La Fayette | $151 | -21% |

| Lackawanna | $198 | 3% |

| Lacona | $153 | -20% |

| Lagrangeville | $206 | 7% |

| Lake Carmel | $219 | 14% |

| Lake Clear | $146 | -24% |

| Lake Erie Beach | $169 | -12% |

| Lake George | $145 | -24% |

| Lake Grove | $250 | 30% |

| Lake Hill | $192 | 0% |

| Lake Huntington | $230 | 20% |

| Lake Katrine | $193 | 1% |

| Lake Luzerne | $143 | -25% |

| Lake Mohegan | $213 | 11% |

| Lake Peekskill | $219 | 14% |

| Lake Placid | $144 | -25% |

| Lake Pleasant | $150 | -22% |

| Lake Ronkonkoma | $252 | 32% |

| Lake Success | $293 | 53% |

| Lake View | $172 | -11% |

| Lakeland | $146 | -24% |

| Lakemont | $153 | -20% |

| Lakeview | $318 | 66% |

| Lakeville | $153 | -20% |

| Lakewood | $154 | -20% |

| Lancaster | $167 | -13% |

| Lanesville | $193 | 1% |

| Lansing | $153 | -20% |

| Larchmont | $222 | 16% |

| Latham | $148 | -23% |

| Lattingtown | $273 | 42% |

| Laurel | $213 | 11% |

| Laurel Hollow | $276 | 44% |

| Laurens | $161 | -16% |

| Lawrence | $337 | 76% |

| Lawrenceville | $149 | -22% |

| Lawtons | $167 | -13% |

| Le Roy | $156 | -19% |

| Lee Center | $156 | -19% |

| Leeds | $180 | -6% |

| Leicester | $155 | -19% |

| Leonardsville | $177 | -7% |

| Levittown | $272 | 42% |

| Lewis | $142 | -26% |

| Lewiston | $167 | -13% |

| Liberty | $225 | 17% |

| Lido Beach | $326 | 70% |

| Lily Dale | $157 | -18% |

| Lima | $154 | -20% |

| Lime Lake | $159 | -17% |

| Limerick | $141 | -27% |

| Limestone | $154 | -20% |

| Lincoln Park | $190 | -1% |

| Lincolndale | $215 | 12% |

| Lindenhurst | $272 | 42% |

| Lindley | $153 | -20% |

| Linwood | $155 | -19% |

| Lisbon | $150 | -22% |

| Lisle | $145 | -24% |

| Little Falls | $147 | -23% |

| Little Genesee | $153 | -20% |

| Little Neck | $349 | 82% |

| Little Valley | $157 | -18% |

| Little York | $151 | -21% |

| Liverpool | $145 | -24% |

| Livingston Manor | $217 | 13% |

| Livonia | $154 | -19% |

| Livonia Center | $156 | -19% |

| Lloyd Harbor | $268 | 40% |

| Loch Sheldrake | $229 | 19% |

| Locke | $156 | -19% |

| Lockport | $166 | -14% |

| Lockwood | $146 | -24% |

| Locust Valley | $273 | 42% |

| Lodi | $152 | -21% |

| Long Beach | $325 | 70% |

| Long Eddy | $181 | -5% |

| Long Island City | $376 | 96% |

| Long Lake | $152 | -21% |

| Lorenz Park | $174 | -9% |

| Lorraine | $144 | -25% |

| Lowman | $143 | -25% |

| Lowville | $151 | -21% |

| Lycoming | $152 | -21% |

| Lynbrook | $315 | 64% |

| Lyncourt | $166 | -13% |

| Lyndonville | $162 | -15% |

| Lyon Mountain | $142 | -26% |

| Lyons | $144 | -25% |

| Lyons Falls | $154 | -20% |

| Macedon | $142 | -26% |

| Machias | $159 | -17% |

| Madison | $156 | -19% |

| Madrid | $149 | -22% |

| Mahopac | $222 | 16% |

| Mahopac Falls | $226 | 18% |

| Maine | $144 | -25% |

| Malden Bridge | $172 | -10% |

| Malden On Hudson | $193 | 0% |

| Mallory | $151 | -21% |

| Malone | $145 | -25% |

| Malverne | $313 | 64% |

| Malverne Park Oaks | $314 | 64% |

| Mamaroneck | $221 | 15% |

| Manchester | $143 | -25% |

| Manhasset | $291 | 52% |

| Manhasset Hills | $288 | 50% |

| Manlius | $149 | -22% |

| Mannsville | $143 | -25% |

| Manorhaven | $286 | 49% |

| Manorville | $226 | 18% |

| Maple Springs | $159 | -17% |

| Maple View | $151 | -21% |

| Maplecrest | $187 | -2% |

| Marathon | $152 | -21% |

| Marcellus | $148 | -23% |

| Marcy | $156 | -19% |

| Margaretville | $176 | -8% |

| Mariaville Lake | $149 | -22% |

| Marietta | $150 | -22% |

| Marilla | $169 | -12% |

| Marion | $144 | -25% |

| Marlboro | $204 | 7% |

| Martville | $155 | -19% |

| Maryknoll | $217 | 13% |

| Maryland | $162 | -16% |

| Masonville | $160 | -16% |

| Maspeth | $359 | 87% |

| Massapequa | $265 | 38% |

| Massapequa Park | $265 | 38% |

| Massena | $145 | -24% |

| Mastic | $247 | 29% |

| Mastic Beach | $250 | 30% |

| Matinecock | $273 | 43% |

| Mattituck | $213 | 11% |

| Mattydale | $152 | -21% |

| Maybrook | $224 | 17% |

| Mayfield | $148 | -23% |

| Mayville | $158 | -18% |

| Mc Connellsville | $158 | -18% |

| Mc Donough | $158 | -18% |

| Mc Graw | $152 | -21% |

| Mc Lean | $151 | -21% |

| Mechanicstown | $226 | 18% |

| Mechanicville | $143 | -25% |

| Mecklenburg | $150 | -22% |

| Medford | $250 | 30% |

| Medina | $162 | -16% |

| Medusa | $159 | -17% |

| Mellenville | $178 | -7% |

| Melrose | $150 | -22% |

| Melrose Park | $148 | -23% |

| Melville | $270 | 41% |

| Memphis | $150 | -22% |

| Menands | $153 | -20% |

| Mendon | $146 | -24% |

| Meridale | $167 | -13% |

| Meridian | $156 | -18% |

| Merrick | $301 | 57% |

| Merritt Park | $203 | 6% |

| Mexico | $152 | -21% |

| Middle Falls | $147 | -23% |

| Middle Granville | $148 | -23% |

| Middle Grove | $144 | -25% |

| Middle Island | $252 | 31% |

| Middle Village | $363 | 89% |

| Middleburgh | $162 | -16% |

| Middleport | $165 | -14% |

| Middlesex | $153 | -20% |

| Middletown | $226 | 18% |

| Middleville | $153 | -20% |

| Milford | $161 | -16% |

| Mill Neck | $272 | 42% |

| Millbrook | $203 | 6% |

| Miller Place | $252 | 32% |

| Millerton | $200 | 4% |

| Millport | $144 | -25% |

| Millwood | $216 | 13% |

| Milton | $174 | -9% |

| Mineola | $288 | 50% |

| Minerva | $150 | -22% |

| Minetto | $150 | -22% |

| Mineville | $143 | -26% |

| Minoa | $147 | -23% |

| Model City | $167 | -13% |

| Modena | $201 | 5% |

| Mohawk | $146 | -24% |

| Mohegan Lake | $213 | 11% |

| Moira | $147 | -23% |

| Mongaup Valley | $232 | 21% |

| Monroe | $225 | 17% |

| Monsey | $243 | 27% |

| Montauk | $213 | 11% |

| Montebello | $243 | 27% |

| Montgomery | $224 | 17% |

| Monticello | $227 | 18% |

| Montour Falls | $146 | -24% |

| Montrose | $214 | 12% |

| Mooers | $140 | -27% |

| Mooers Forks | $140 | -27% |

| Moravia | $157 | -18% |

| Moriah | $143 | -25% |

| Moriah Center | $143 | -25% |

| Moriches | $233 | 21% |

| Morris | $162 | -15% |

| Morrisonville | $138 | -28% |

| Morristown | $149 | -22% |

| Morrisville | $155 | -19% |

| Morton | $150 | -22% |

| Mottville | $149 | -22% |

| Mount Ivy | $240 | 25% |

| Mount Kisco | $214 | 12% |

| Mount Marion | $187 | -3% |

| Mount Morris | $155 | -19% |

| Mount Sinai | $253 | 32% |

| Mount Tremper | $195 | 2% |

| Mount Upton | $158 | -18% |

| Mount Vernon | $312 | 62% |

| Mount Vision | $162 | -15% |

| Mountain Dale | $226 | 18% |

| Mountain Lodge Park | $224 | 17% |

| Mountainville | $229 | 20% |

| Mumford | $148 | -23% |

| Munnsville | $154 | -20% |

| Munsey Park | $288 | 50% |

| Munsons Corners | $152 | -21% |

| Muttontown | $276 | 44% |

| Myers Corner | $201 | 5% |

| Nanuet | $239 | 25% |

| Napanoch | $198 | 3% |

| Napeague | $218 | 14% |

| Naples | $155 | -19% |

| Narrowsburg | $230 | 20% |

| Nassau | $155 | -19% |

| Natural Bridge | $141 | -27% |

| Nedrow | $162 | -16% |

| Nelliston | $150 | -22% |

| Nelsonville | $221 | 15% |

| Nesconset | $257 | 34% |

| Neversink | $223 | 16% |

| New Berlin | $161 | -16% |

| New Cassel | $292 | 52% |

| New City | $240 | 25% |

| New Hampton | $226 | 18% |

| New Hartford | $154 | -19% |

| New Hempstead | $245 | 28% |

| New Hyde Park | $291 | 52% |

| New Kingston | $177 | -8% |

| New Lebanon | $173 | -10% |

| New Lisbon | $162 | -15% |

| New Milford | $227 | 18% |

| New Paltz | $197 | 3% |

| New Rochelle | $230 | 20% |

| New Russia | $146 | -24% |

| New Square | $245 | 28% |

| New Suffolk | $221 | 15% |

| New Windsor | $220 | 15% |

| New Woodstock | $153 | -20% |

| New York | $348 | 82% |

| New York Mills | $154 | -20% |

| Newark | $143 | -25% |

| Newark Valley | $145 | -24% |

| Newburgh | $217 | 13% |

| Newcomb | $151 | -21% |

| Newfane | $165 | -14% |

| Newfield | $153 | -20% |

| Newport | $155 | -19% |

| Newton Falls | $149 | -22% |

| Newtonville | $152 | -21% |

| Niagara Falls | $174 | -9% |

| Niagara University | $168 | -13% |

| Nichols | $145 | -25% |

| Nicholville | $149 | -23% |

| Nineveh | $146 | -24% |

| Niobe | $162 | -15% |

| Niskayuna | $149 | -22% |

| Nissequogue | $256 | 33% |

| Niverville | $171 | -11% |

| Norfolk | $145 | -24% |

| North Amityville | $275 | 43% |

| North Babylon | $275 | 43% |

| North Ballston Spa | $144 | -25% |

| North Bangor | $147 | -23% |

| North Bay | $156 | -19% |

| North Bay Shore | $281 | 46% |

| North Bellmore | $300 | 56% |

| North Bellport | $247 | 29% |

| North Blenheim | $160 | -16% |

| North Boston | $166 | -13% |

| North Branch | $225 | 17% |

| North Brookfield | $156 | -18% |

| North Chatham | $169 | -12% |

| North Chili | $144 | -25% |

| North Collins | $168 | -12% |

| North Creek | $143 | -25% |

| North Evans | $172 | -10% |

| North Gates | $152 | -21% |

| North Granville | $147 | -23% |

| North Great River | $270 | 41% |

| North Greece | $146 | -24% |

| North Haven | $213 | 11% |

| North Hills | $288 | 50% |

| North Hoosick | $155 | -19% |

| North Hudson | $146 | -24% |

| North Java | $169 | -12% |

| North Lawrence | $149 | -22% |

| North Lindenhurst | $271 | 41% |

| North Lynbrook | $315 | 64% |

| North Massapequa | $266 | 39% |

| North Merrick | $300 | 56% |

| North New Hyde Park | $289 | 51% |

| North Patchogue | $243 | 27% |

| North Pitcher | $162 | -16% |

| North River | $149 | -22% |

| North Rose | $150 | -22% |

| North Salem | $216 | 13% |

| North Sea | $214 | 11% |

| North Syracuse | $147 | -23% |

| North Tonawanda | $169 | -12% |

| North Valley Stream | $328 | 71% |

| North Wantagh | $273 | 42% |

| Northampton | $215 | 12% |

| Northeast Ithaca | $152 | -21% |

| Northport | $260 | 36% |

| Northville | $173 | -10% |

| Northwest Harbor | $213 | 11% |

| Northwest Ithaca | $153 | -20% |

| Norwich | $157 | -18% |

| Norwood | $148 | -23% |

| Noyack | $213 | 11% |

| Nunda | $157 | -18% |

| Nyack | $235 | 23% |

| Oak Hill | $182 | -5% |

| Oakdale | $257 | 34% |

| Oakfield | $162 | -16% |

| Oakland Gardens | $366 | 91% |

| Oaks Corners | $151 | -21% |

| Obernburg | $228 | 19% |

| Ocean Beach | $265 | 38% |

| Oceanside | $320 | 67% |

| Odessa | $147 | -24% |

| Ogdensburg | $149 | -22% |

| Olcott | $165 | -14% |

| Old Bethpage | $274 | 43% |

| Old Brookville | $278 | 45% |

| Old Chatham | $172 | -10% |

| Old Field | $249 | 30% |

| Old Forge | $153 | -20% |

| Old Westbury | $289 | 51% |

| Olean | $152 | -21% |

| Olivebridge | $192 | 0% |

| Olmstedville | $149 | -22% |

| Oneida | $155 | -19% |

| Oneonta | $162 | -16% |

| Ontario | $143 | -26% |

| Ontario Center | $150 | -22% |

| Orange Lake | $218 | 14% |

| Orangeburg | $235 | 23% |

| Orchard Park | $172 | -10% |

| Orient | $213 | 11% |

| Oriskany | $156 | -19% |

| Oriskany Falls | $159 | -17% |

| Ossining | $215 | 12% |

| Oswegatchie | $150 | -22% |

| Oswego | $150 | -22% |

| Otego | $161 | -16% |

| Otisville | $222 | 16% |

| Ouaquaga | $146 | -24% |

| Ovid | $152 | -21% |

| Owego | $145 | -25% |

| Owls Head | $144 | -25% |

| Oxbow | $142 | -26% |

| Oxford | $157 | -18% |

| Oyster Bay | $270 | 41% |

| Oyster Bay Cove | $275 | 43% |

| Ozone Park | $418 | 118% |

| Painted Post | $138 | -28% |

| Palatine Bridge | $147 | -23% |

| Palenville | $185 | -4% |

| Palisades | $236 | 23% |

| Palmyra | $143 | -25% |

| Panama | $158 | -18% |

| Paradox | $146 | -24% |

| Parish | $154 | -20% |

| Parishville | $150 | -22% |

| Parksville | $224 | 17% |

| Patchogue | $243 | 27% |

| Patterson | $221 | 15% |

| Pattersonville | $149 | -22% |

| Paul Smiths | $145 | -24% |

| Pavilion | $157 | -18% |

| Pawling | $209 | 9% |

| Peach Lake | $220 | 15% |

| Pearl River | $235 | 23% |

| Peconic | $213 | 11% |

| Peekskill | $213 | 11% |

| Pelham | $241 | 26% |

| Pelham Manor | $232 | 21% |

| Penfield | $141 | -27% |

| Penn Yan | $150 | -22% |

| Pennellville | $150 | -22% |

| Perkinsville | $154 | -20% |

| Perry | $159 | -17% |

| Perrysburg | $160 | -16% |

| Peru | $139 | -28% |

| Peterboro | $153 | -20% |

| Petersburg | $154 | -20% |

| Phelps | $142 | -26% |

| Philadelphia | $141 | -26% |

| Phillipsport | $234 | 22% |

| Philmont | $174 | -9% |

| Phoenicia | $195 | 2% |

| Phoenix | $151 | -21% |

| Piercefield | $149 | -22% |

| Piermont | $234 | 22% |

| Pierrepont Manor | $144 | -25% |

| Piffard | $154 | -20% |

| Pine Bush | $221 | 15% |

| Pine City | $137 | -29% |

| Pine Hill | $190 | -1% |

| Pine Island | $228 | 19% |

| Pine Plains | $192 | 0% |

| Pine Valley | $147 | -23% |

| Piseco | $151 | -21% |

| Pitcher | $163 | -15% |

| Pittsford | $142 | -26% |

| Plainedge | $267 | 39% |

| Plainview | $276 | 44% |

| Plainville | $150 | -22% |

| Plandome | $289 | 51% |

| Plandome Heights | $290 | 51% |

| Plandome Manor | $289 | 51% |

| Plattekill | $211 | 10% |

| Plattsburgh | $138 | -28% |

| Plattsburgh West | $138 | -28% |

| Pleasant Valley | $200 | 5% |

| Pleasantville | $213 | 11% |

| Plessis | $142 | -26% |

| Plymouth | $159 | -17% |

| Poestenkill | $152 | -21% |

| Point Lookout | $316 | 65% |

| Poland | $156 | -19% |

| Pomona | $241 | 25% |

| Pond Eddy | $235 | 22% |

| Poplar Ridge | $155 | -19% |

| Poquott | $249 | 30% |

| Port Byron | $152 | -21% |

| Port Chester | $219 | 14% |

| Port Crane | $146 | -24% |

| Port Dickinson | $143 | -25% |

| Port Ewen | $190 | -1% |

| Port Gibson | $154 | -20% |

| Port Henry | $142 | -26% |

| Port Jefferson | $251 | 31% |

| Port Jefferson Station | $249 | 30% |

| Port Jervis | $225 | 17% |

| Port Kent | $144 | -25% |

| Port Leyden | $154 | -20% |

| Port Washington | $285 | 48% |

| Port Washington North | $285 | 49% |

| Portageville | $163 | -15% |

| Porter Corners | $143 | -25% |

| Portlandville | $163 | -15% |

| Portville | $153 | -20% |

| Potsdam | $149 | -22% |

| Pottersville | $143 | -26% |

| Poughkeepsie | $200 | 4% |

| Poughquag | $209 | 9% |

| Pound Ridge | $216 | 13% |

| Prattsburgh | $152 | -21% |

| Prattsville | $189 | -2% |

| Preble | $151 | -21% |

| Preston Hollow | $160 | -17% |

| Prospect | $159 | -17% |

| Pulaski | $153 | -20% |

| Pulteney | $152 | -21% |

| Pultneyville | $151 | -21% |

| Purchase | $219 | 14% |

| Purdys | $217 | 13% |

| Purling | $186 | -3% |

| Putnam Lake | $221 | 15% |

| Putnam Station | $143 | -25% |

| Putnam Valley | $221 | 15% |

| Pyrites | $149 | -22% |

| Quaker Street | $149 | -22% |

| Queens Village | $388 | 103% |

| Queensbury | $141 | -26% |

| Quiogue | $217 | 13% |

| Quogue | $221 | 15% |

| Rainbow Lake | $146 | -24% |

| Randolph | $155 | -19% |

| Ransomville | $164 | -14% |

| Rapids | $167 | -13% |

| Raquette Lake | $151 | -21% |

| Ravena | $159 | -17% |

| Ray Brook | $143 | -25% |

| Raymondville | $146 | -24% |

| Reading Center | $148 | -23% |

| Red Creek | $152 | -20% |

| Red Hook | $194 | 1% |

| Red Oaks Mill | $200 | 4% |

| Redfield | $153 | -20% |

| Redford | $140 | -27% |

| Redwood | $142 | -26% |

| Rego Park | $378 | 97% |

| Remsen | $158 | -17% |

| Remsenburg | $224 | 17% |

| Rensselaer | $153 | -20% |

| Rensselaer Falls | $150 | -22% |

| Rensselaerville | $159 | -17% |

| Retsof | $156 | -19% |

| Rexford | $139 | -27% |

| Rexville | $156 | -19% |

| Rhinebeck | $198 | 3% |

| Rhinecliff | $203 | 6% |

| Richburg | $154 | -19% |

| Richfield Springs | $161 | -16% |

| Richford | $147 | -23% |

| Richland | $153 | -20% |

| Richmond Hill | $417 | 117% |

| Richmondville | $157 | -18% |

| Richville | $150 | -22% |

| Ridge | $247 | 29% |

| Ridgewood | $385 | 101% |

| Rifton | $192 | 0% |

| Riparius | $147 | -24% |

| Ripley | $157 | -18% |

| Riverhead | $215 | 12% |

| Riverside | $215 | 12% |

| Rochester | $155 | -19% |

| Rock City Falls | $145 | -24% |

| Rock Hill | $222 | 16% |

| Rock Stream | $148 | -23% |

| Rock Tavern | $219 | 14% |

| Rockaway Park | $409 | 113% |

| Rockville Centre | $313 | 63% |

| Rocky Point | $252 | 32% |

| Rodman | $143 | -25% |

| Rome | $155 | -19% |

| Romulus | $150 | -22% |

| Ronkonkoma | $255 | 33% |

| Roosevelt | $353 | 84% |

| Rooseveltown | $147 | -23% |

| Roscoe | $206 | 8% |

| Roseboom | $164 | -14% |

| Rosedale | $420 | 119% |

| Rosendale | $193 | 1% |

| Rosendale Hamlet | $191 | 0% |

| Roslyn | $287 | 50% |

| Roslyn Estates | $287 | 50% |

| Roslyn Harbor | $287 | 49% |

| Roslyn Heights | $290 | 51% |

| Rotterdam | $150 | -22% |

| Rotterdam Junction | $148 | -23% |

| Round Lake | $144 | -25% |

| Round Top | $185 | -3% |

| Rouses Point | $139 | -27% |

| Roxbury | $168 | -13% |

| Ruby | $191 | -1% |

| Rush | $147 | -24% |

| Rushford | $160 | -16% |

| Rushville | $150 | -22% |

| Russell | $150 | -22% |

| Russell Gardens | $293 | 53% |

| Rye | $219 | 14% |

| Rye Brook | $220 | 15% |

| SUNY Oswego | $150 | -22% |

| Sabael | $148 | -23% |

| Sackets Harbor | $140 | -27% |

| Saddle Rock | $293 | 53% |

| Sag Harbor | $213 | 11% |

| Sagaponack | $219 | 14% |

| Salamanca | $153 | -20% |

| Salem | $145 | -24% |

| Salisbury | $295 | 54% |

| Salisbury Center | $152 | -20% |

| Salisbury Mills | $223 | 16% |

| Salt Point | $198 | 3% |

| Saltaire | $277 | 44% |

| Sanborn | $167 | -13% |

| Sand Lake | $154 | -20% |

| Sand Ridge | $150 | -22% |

| Sands Point | $285 | 48% |

| Sandusky | $161 | -16% |

| Sandy Creek | $153 | -20% |

| Saranac | $140 | -27% |

| Saranac Lake | $145 | -24% |

| Saratoga Springs | $143 | -26% |

| Sardinia | $172 | -10% |

| Saugerties | $188 | -2% |

| Saugerties South | $188 | -2% |

| Sauquoit | $156 | -19% |

| Savannah | $152 | -21% |

| Savona | $150 | -22% |

| Sayville | $251 | 31% |

| Scarsdale | $221 | 15% |

| Schaghticoke | $148 | -23% |

| Schenectady | $150 | -22% |

| Schenevus | $161 | -16% |

| Schodack Landing | $155 | -19% |

| Schoharie | $160 | -17% |

| Schroon Lake | $145 | -24% |

| Schuyler Falls | $139 | -28% |

| Schuyler Lake | $162 | -15% |

| Schuylerville | $143 | -25% |

| Scio | $153 | -20% |

| Scipio Center | $153 | -20% |

| Scotchtown | $223 | 17% |

| Scotia | $146 | -24% |

| Scotts Corners | $217 | 13% |

| Scottsburg | $156 | -18% |

| Scottsville | $145 | -24% |

| Sea Cliff | $272 | 42% |

| Seaford | $270 | 41% |

| Searingtown | $286 | 49% |

| Selden | $251 | 31% |

| Selkirk | $153 | -20% |

| Seneca Castle | $153 | -20% |

| Seneca Falls | $149 | -22% |

| Seneca Knolls | $147 | -23% |

| Setauket-East Setauket | $249 | 30% |

| Severance | $145 | -24% |

| Shandaken | $192 | 0% |

| Sharon Springs | $157 | -18% |

| Shelter Island | $213 | 11% |

| Shelter Island Heights | $217 | 13% |

| Shenorock | $214 | 11% |

| Sherburne | $159 | -17% |

| Sherman | $159 | -17% |

| Sherrill | $156 | -19% |

| Shinnecock Hills | $214 | 11% |

| Shirley | $250 | 31% |

| Shokan | $191 | 0% |

| Shoreham | $247 | 29% |

| Shortsville | $143 | -25% |

| Shrub Oak | $214 | 12% |

| Shushan | $147 | -24% |

| Sidney | $162 | -16% |

| Sidney Center | $160 | -16% |

| Silver Bay | $146 | -24% |

| Silver Creek | $163 | -15% |

| Silver Lake | $160 | -16% |

| Silver Springs | $163 | -15% |

| Sinclairville | $156 | -19% |

| Skaneateles | $151 | -21% |

| Skaneateles Falls | $147 | -23% |

| Slate Hill | $227 | 18% |

| Slaterville Springs | $154 | -20% |

| Sleepy Hollow | $216 | 12% |

| Slingerlands | $152 | -21% |

| Sloan | $196 | 2% |

| Sloansville | $158 | -17% |

| Sloatsburg | $243 | 27% |

| Smallwood | $230 | 20% |

| Smithboro | $147 | -23% |

| Smithtown | $258 | 34% |

| Smithville Flats | $159 | -17% |

| Smyrna | $159 | -17% |

| Sodus | $148 | -23% |

| Sodus Point | $150 | -22% |

| Solsville | $156 | -19% |

| Solvay | $147 | -23% |

| Somers | $214 | 11% |

| Sonyea | $155 | -19% |

| Sound Beach | $253 | 32% |

| South Bethlehem | $155 | -19% |

| South Blooming Grove | $224 | 17% |

| South Butler | $153 | -20% |

| South Byron | $153 | -20% |

| South Cairo | $185 | -3% |

| South Colton | $150 | -22% |

| South Dayton | $161 | -16% |

| South Fallsburg | $228 | 19% |

| South Farmingdale | $267 | 39% |

| South Floral Park | $317 | 66% |

| South Glens Falls | $139 | -27% |

| South Hempstead | $343 | 79% |

| South Hill | $152 | -21% |

| South Huntington | $271 | 41% |

| South Jamesport | $218 | 14% |

| South Kortright | $169 | -12% |

| South Lima | $154 | -20% |

| South Lockport | $166 | -13% |

| South New Berlin | $159 | -17% |

| South Nyack | $235 | 23% |

| South Otselic | $162 | -16% |

| South Ozone Park | $424 | 121% |

| South Plymouth | $160 | -17% |

| South Richmond Hill | $422 | 120% |

| South Salem | $216 | 13% |

| South Valley Stream | $345 | 80% |

| South Wales | $168 | -12% |

| Southampton | $213 | 11% |

| Southfields | $224 | 17% |

| Southold | $213 | 11% |

| Southport | $138 | -28% |

| Spackenkill | $200 | 4% |

| Sparkill | $235 | 22% |

| Sparrow Bush | $223 | 16% |

| Speculator | $153 | -20% |

| Spencer | $146 | -24% |

| Spencerport | $145 | -25% |

| Spencertown | $176 | -8% |

| Speonk | $224 | 17% |

| Sprakers | $148 | -23% |

| Spring Brook | $167 | -13% |

| Spring Glen | $201 | 5% |

| Spring Valley | $244 | 27% |

| Springfield Center | $162 | -16% |

| Springfield Gardens | $419 | 118% |

| Springs | $213 | 11% |

| Springville | $167 | -13% |

| Springwater | $158 | -17% |

| St. Albans | $421 | 120% |

| St. Bonaventure | $152 | -21% |

| St. James | $257 | 34% |

| St. Johnsville | $148 | -23% |

| St. Regis Falls | $149 | -22% |

| Staatsburg | $197 | 3% |

| Stafford | $155 | -19% |

| Stamford | $165 | -14% |

| Stanfordville | $202 | 5% |

| Stanley | $146 | -24% |

| Star Lake | $149 | -22% |

| Staten Island | $300 | 56% |

| Steamburg | $157 | -18% |

| Stella Niagara | $162 | -16% |

| Stephentown | $155 | -19% |

| Sterling | $154 | -20% |

| Sterling Forest | $230 | 20% |

| Stewart Manor | $303 | 58% |

| Stillwater | $144 | -25% |

| Stittville | $159 | -17% |

| Stockton | $157 | -18% |

| Stone Ridge | $192 | 0% |

| Stony Brook | $249 | 30% |

| Stony Brook University | $249 | 30% |

| Stony Creek | $149 | -22% |

| Stony Point | $239 | 25% |

| Stormville | $207 | 8% |

| Stottville | $174 | -9% |

| Stow | $159 | -17% |

| Stratford | $152 | -21% |

| Strykersville | $168 | -12% |

| Stuyvesant | $172 | -10% |

| Stuyvesant Falls | $170 | -11% |

| Suffern | $242 | 26% |

| Sugar Loaf | $226 | 18% |

| Summit | $161 | -16% |

| Summitville | $233 | 21% |

| Sunnyside | $377 | 97% |

| Sunset Bay | $165 | -14% |

| Surprise | $182 | -5% |

| Swain | $155 | -19% |

| Swan Lake | $226 | 18% |

| Sylvan Beach | $156 | -19% |

| Syosset | $275 | 44% |

| Syracuse | $158 | -17% |

| Taberg | $157 | -18% |

| Tallman | $239 | 25% |

| Tannersville | $185 | -4% |

| Tappan | $235 | 22% |

| Tarrytown | $217 | 13% |

| Terryville | $250 | 30% |

| Thendara | $153 | -20% |

| Theresa | $142 | -26% |

| Thiells | $239 | 24% |

| Thomaston | $293 | 53% |

| Thompson Ridge | $219 | 14% |

| Thompsonville | $222 | 16% |

| Thornwood | $213 | 11% |

| Thousand Island Park | $141 | -27% |

| Three Mile Bay | $141 | -26% |

| Ticonderoga | $143 | -26% |

| Tillson | $193 | 0% |

| Tioga Center | $146 | -24% |

| Titusville | $200 | 4% |

| Tivoli | $198 | 3% |

| Tomkins Cove | $238 | 24% |

| Tonawanda | $180 | -6% |

| Town Line | $172 | -10% |

| Treadwell | $168 | -12% |

| Tribes Hill | $150 | -22% |

| Troupsburg | $156 | -19% |

| Trout Creek | $164 | -14% |

| Troy | $151 | -21% |

| Trumansburg | $153 | -20% |

| Truxton | $155 | -19% |

| Tuckahoe | $220 | 15% |

| Tully | $151 | -21% |

| Tunnel | $151 | -21% |

| Tupper Lake | $146 | -24% |

| Turin | $153 | -20% |

| Tuxedo Park | $223 | 16% |

| Ulster Park | $191 | -1% |

| Unadilla | $163 | -15% |

| Union Hill | $150 | -22% |

| Union Springs | $147 | -23% |

| Uniondale | $340 | 77% |

| Unionville | $229 | 19% |

| University Gardens | $296 | 55% |

| University at Buffalo | $179 | -7% |

| Upper Brookville | $273 | 42% |

| Upper Jay | $145 | -24% |

| Upper Nyack | $236 | 23% |

| Upton | $247 | 29% |

| Utica | $155 | -19% |

| Vails Gate | $220 | 15% |

| Valatie | $170 | -11% |

| Valhalla | $216 | 13% |

| Valley Cottage | $237 | 23% |

| Valley Falls | $149 | -22% |

| Valley Stream | $329 | 72% |

| Van Buren Point | $156 | -18% |

| Van Etten | $148 | -23% |

| Van Hornesville | $158 | -18% |

| Varysburg | $167 | -13% |

| Verbank | $205 | 7% |

| Vermontville | $145 | -24% |

| Vernon | $156 | -19% |

| Vernon Center | $155 | -19% |

| Verona | $156 | -19% |

| Verona Beach | $156 | -19% |

| Verplanck | $216 | 12% |

| Versailles | $162 | -15% |

| Vestal | $142 | -26% |

| Victor | $143 | -25% |

| Victory | $143 | -25% |

| Victory Mills | $145 | -24% |

| Village Green | $146 | -24% |

| Village of the Branch | $257 | 34% |

| Viola | $243 | 27% |

| Voorheesville | $150 | -22% |

| Waccabuc | $217 | 13% |

| Waddington | $147 | -24% |

| Wading River | $243 | 27% |

| Wainscott | $218 | 14% |

| Walden | $222 | 16% |

| Wales Center | $170 | -11% |

| Walker Valley | $207 | 8% |

| Wallkill | $211 | 10% |

| Walton | $165 | -14% |

| Walton Park | $224 | 17% |

| Walworth | $143 | -25% |

| Wampsville | $154 | -20% |

| Wanakah | $170 | -11% |

| Wanakena | $149 | -22% |

| Wantagh | $274 | 43% |

| Wappingers Falls | $203 | 6% |

| Warners | $147 | -23% |

| Warnerville | $159 | -17% |

| Warrensburg | $145 | -24% |

| Warsaw | $165 | -14% |

| Warwick | $226 | 18% |

| Washington Heights | $227 | 18% |

| Washington Mills | $155 | -19% |

| Washingtonville | $223 | 16% |

| Wassaic | $203 | 6% |

| Water Mill | $213 | 11% |

| Waterford | $139 | -27% |

| Waterloo | $148 | -23% |

| Waterport | $162 | -15% |

| Watertown | $140 | -27% |

| Waterville | $158 | -18% |

| Watervliet | $150 | -22% |

| Watkins Glen | $146 | -24% |

| Waverly | $146 | -24% |

| Wawarsing | $197 | 3% |

| Wayland | $154 | -20% |

| Webster | $142 | -26% |

| Weedsport | $154 | -20% |

| Wellesley Island | $140 | -27% |

| Wells | $153 | -20% |

| Wells Bridge | $165 | -14% |

| Wellsburg | $138 | -28% |

| Wellsville | $152 | -21% |

| Wesley Hills | $245 | 28% |

| West Babylon | $272 | 42% |

| West Bay Shore | $277 | 45% |

| West Bloomfield | $148 | -23% |

| West Burlington | $163 | -15% |

| West Camp | $194 | 1% |

| West Carthage | $142 | -26% |

| West Chazy | $139 | -28% |

| West Clarksville | $155 | -19% |

| West Coxsackie | $180 | -6% |

| West Davenport | $163 | -15% |

| West Eaton | $157 | -18% |

| West Edmeston | $158 | -18% |

| West Elmira | $138 | -28% |

| West End | $162 | -16% |

| West Falls | $168 | -13% |

| West Fulton | $158 | -17% |

| West Glens Falls | $141 | -26% |

| West Harrison | $220 | 15% |

| West Haverstraw | $238 | 24% |

| West Hempstead | $323 | 68% |

| West Henrietta | $145 | -24% |

| West Hills | $270 | 41% |

| West Hurley | $193 | 1% |

| West Islip | $274 | 43% |

| West Kill | $191 | -1% |

| West Lebanon | $170 | -11% |

| West Leyden | $154 | -20% |

| West Monroe | $152 | -21% |

| West Nyack | $236 | 23% |

| West Oneonta | $163 | -15% |

| West Park | $193 | 1% |

| West Point | $218 | 13% |

| West Sand Lake | $150 | -22% |

| West Sayville | $255 | 33% |

| West Seneca | $189 | -1% |

| West Shokan | $193 | 1% |

| West Stockholm | $149 | -22% |

| West Valley | $163 | -15% |

| West Winfield | $160 | -17% |

| Westbrookville | $229 | 20% |

| Westbury | $293 | 53% |

| Westdale | $158 | -18% |

| Westerlo | $159 | -17% |

| Westernville | $157 | -18% |

| Westfield | $155 | -19% |

| Westford | $163 | -15% |

| Westhampton | $217 | 13% |

| Westhampton Beach | $217 | 13% |

| Westmere | $151 | -21% |

| Westmoreland | $154 | -20% |

| Weston Mills | $152 | -21% |

| Westport | $143 | -26% |

| Westtown | $227 | 18% |

| Westvale | $150 | -22% |

| Wevertown | $143 | -25% |

| Wheatley Heights | $278 | 45% |

| Whippleville | $147 | -23% |

| White Lake | $234 | 22% |

| White Plains | $221 | 15% |

| White Sulphur Springs | $230 | 20% |

| Whitehall | $146 | -24% |

| Whitesboro | $155 | -19% |

| Whitestone | $363 | 89% |

| Whitesville | $154 | -19% |

| Whitney Point | $145 | -24% |

| Willard | $154 | -20% |

| Willet | $152 | -21% |

| Williamson | $146 | -24% |

| Williamstown | $153 | -20% |

| Williamsville | $176 | -8% |

| Williston Park | $287 | 49% |

| Willow | $194 | 1% |

| Willsboro | $142 | -26% |

| Willseyville | $146 | -24% |

| Wilmington | $144 | -25% |

| Wilson | $165 | -14% |

| Windham | $187 | -3% |

| Windsor | $144 | -25% |

| Wingdale | $208 | 9% |

| Winthrop | $148 | -23% |

| Witherbee | $145 | -24% |

| Wolcott | $151 | -21% |

| Woodbourne | $225 | 17% |

| Woodbury | $277 | 44% |

| Woodgate | $158 | -17% |

| Woodhaven | $414 | 116% |

| Woodhull | $156 | -19% |

| Woodmere | $342 | 79% |

| Woodridge | $231 | 20% |

| Woodsburgh | $337 | 76% |

| Woodside | $350 | 83% |

| Woodstock | $192 | 0% |

| Worcester | $161 | -16% |

| Wurtsboro | $229 | 20% |

| Wyandanch | $280 | 46% |

| Wynantskill | $152 | -20% |

| Wyoming | $162 | -15% |

| Yaphank | $252 | 31% |

| Yonkers | $270 | 41% |

| Yorktown Heights | $214 | 11% |

| Yorkville | $156 | -19% |

| Youngstown | $164 | -14% |

| Youngsville | $223 | 17% |

| Yulan | $233 | 22% |

| Zena | $192 | 0% |

New York City rates by borough

The average car insurance rate among New York City’s five boroughs is $348 a month. After Brooklyn, the Bronx has the next-highest rate at $398 a month. Progressive has the cheapest car insurance in each of the five boroughs.

Insurance rates by borough

| Borough | Monthly rate | Cheapest company | Cheapest rate |

|---|---|---|---|

| Bronx | $398 | Progressive | $180 |

| Brooklyn | $471 | Progressive | $193 |

| Manhattan | $294 | Progressive | $153 |

| Queens | $365 | Progressive | $185 |

| Staten Island | $300 | Progressive | $169 |

Best and worst drivers in New York

Rome drivers have the state’s lowest incident rate, which makes them New York’s best drivers. Schenectady, on the other hand, has the state’s highest incident rate, or worst drivers. Incidents include speeding tickets, at-fault accidents, DUIs and other violations.

Best New York drivers by city

Drivers in Rome have 2.9 incidents per 1,000 drivers, which is New York’s best rate. Freeport and New Rochelle are tied for second-best, with 3.6 incidents per 1,000 drivers each.

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Rome | 2.9 |

| Freeport | 3.6 |

| New Rochelle | 3.6 |

| Spring Valley | 3.7 |

| Rochester | 4.0 |

Worst New York drivers by city

With 10.6 incidents per 1,000 drivers, Schenectady has New York’s worst drivers. Binghamton has the second-worst rate at nine incidents per 1,000 drivers.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Schenectady | 10.6 |

| Binghamton | 9.0 |

| White Plains | 7.3 |

| Albany | 6.5 |

| Ithaca | 6.1 |

Best and worst NYC drivers by borough

The Bronx has the best drivers among New York City’s five boroughs, with four incidents per 1,000 drivers. Manhattan drivers have the boroughs’ highest incident rate at 7.8 per 1,000 drivers. This makes them the city’s worst drivers.

Best drivers by borough

| Borough | Incidents per 1,000 drivers |

|---|---|

| The Bronx | 4.0 |

| Staten Island | 4.1 |

| Brooklyn | 5.3 |

| Queens | 5.5 |

| Manhattan | 7.8 |

Best and worst New York drivers by age group

Older drivers have the lowest, or best, incident rates among New York state’s drivers. The Silent Generation has the best drivers with only 15.38 incidents per 1,000 drivers. Baby boomers are next with a slightly higher rate of 18.74.

Gen Z has the worst drivers by age group with nearly 40 incidents per 1,000 drivers. This is more than twice as high as the baby boomer rate.

Driving incidents by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 39.90 |

| Millennial | 23.58 |

| Gen X | 20.93 |

| Baby boomer | 18.74 |

| Silent Generation | 15.38 |

Best New York drivers by car make

Mercury drivers have the best incident rate by car make at 10.2 incidents per 1,000 drivers. This gives them a wide margin over Lincoln drivers, at 16.2. Cadillac, Mercedes-Benz and Chrysler round out the top-five makes with the best incident rates in New York.

Best NY drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Mercury | 10.2 |

| Lincoln | 16.2 |

| Cadillac | 16.9 |

| Mercedes-Benz | 17.8 |

| Chrysler | 18.0 |

Worst New York drivers by car make

With 28.2 incidents per 1,000, Ram drivers have New York’s worst incident rates. Jeep vehicles have the state’s second-worst drivers, with 26.2 incidents.

Mazdas, Subarus and Buicks also have high incident rates.

Worst NY drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Ram | 28.2 |

| Jeep | 26.4 |

| Mazda | 26.0 |

| Subaru | 25.2 |

| Buick | 24.7 |

Minimum coverage for car insurance in New York

You need car insurance to drive legally in New York. The state’s minimum car insurance requirements include:

- Personal injury protection (PIP): $50,000

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $10,000

- Uninsured motorist: $25,000 per person, $50,000 per accident

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Collision

New York car insurance laws

New York has no-fault car insurance laws. Your own PIP covers injuries to you and your passengers, whether you or the other driver is at fault.

If you are at fault, you still may have to cover a victim’s costs if their injuries are severe. You can also be sued for causing pain and suffering. Your policy’s bodily injury liability protects you from expenses like these.

The state’s no-fault laws do not apply to property damage. If you cause an accident, you’re responsible for damage to other people’s cars. This is what property damage liability coverage is for.

Frequently asked questions

Car insurance costs an average of $192 a month for full coverage in New York state. The average cost of liability insurance, or minimum coverage, is $92 a month.