Cheapest Car Insurance in Ohio (2026)

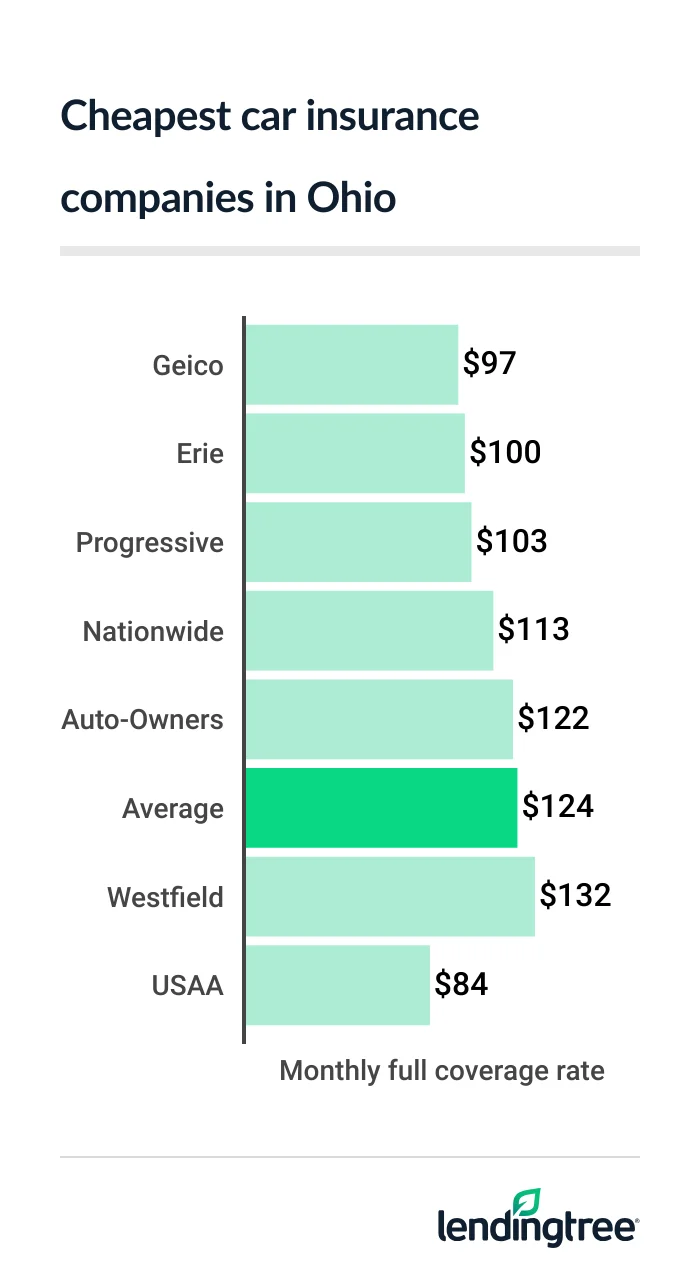

Geico has Ohio’s cheapest full coverage car insurance at $97 a month. Erie is only slightly more expensive at $100 a month and has happier customers.

Best Cheap Ohio Car Insurance

Ohio’s cheapest full coverage car insurance: Geico

Geico has the cheapest full coverage car insurance for most Ohio drivers at $97 a month. Erie is more expensive at $100 a month, but has a better satisfaction rating from J.D. Power

USAA is cheaper than both companies for full coverage

Full coverage costs an average of $124 a month for a typical Ohio driver. Your actual rate depends on things like your driving history, location and credit.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Geico | $97 | |

| Erie | $100 | |

| Progressive | $103 | |

| Nationwide | $113 | |

| Auto-Owners | $122 | |

| Westfield | $132 | |

| Cincinnati Insurance | $136 | |

| Grange | $169 | |

| Allstate | $188 | |

| USAA* | $84 | |

Each company treats these factors differently and offers different car insurance discounts. It’s good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheap Ohio liability car insurance: Westfield and Erie

At $30 a month each, Westfield and Erie have the cheapest liability insurance for most Ohio drivers. Auto-Owners has the next-cheapest liability insurance

Cheapest liability-only rates

| Company | Monthly rate |

|---|---|

| Westfield | $30 |

| Erie | $30 |

| Auto-Owners | $41 |

| Geico | $46 |

| Cincinnati Insurance | $49 |

| Nationwide | $53 |

| Progressive | $56 |

| Grange | $66 |

| Allstate | $78 |

| USAA* | $27 |

Westfield’s MissionSafe app can make its rates cheaper for you if you drive safely. The app monitors your driving and gives you discounts of up to 40% for safe driving.

Erie also has an app-based program for safe drivers. Instead of an insurance discount, Erie’s YourTurn gives you gift cards from various retailers.

Cheapest car insurance for Ohio teens: Erie and Geico

Erie has the cheapest car insurance for teens in Ohio at $68 a month for liability coverage. This is 17% less than Westfield’s teen liability rate of $82 a month.

Young drivers can get the cheapest full coverage from Geico at $204 a month. Erie has the next-cheapest full coverage for most teens at $225 a month.

Teen insurance rates

| Company | Liability only | Full coverage |

|---|---|---|

| Erie | $68 | $225 |

| Westfield | $82 | $269 |

| Geico | $101 | $204 |

| Cincinnati Insurance | $153 | $382 |

| Auto-Owners | $155 | $350 |

| Progressive | $173 | $422 |

| Nationwide | $177 | $425 |

| Allstate | $180 | $361 |

| Grange | $242 | $477 |

| USAA* | $76 | $216 |

Teens tend to get cheaper rates when added to a parent’s policy than they do on their own. Discounts can also help make auto insurance more affordable for young drivers.

- Geico gives teens discounts for getting good grades and completing a driver training course.

- Erie gives teens a discount for living with their parents, regardless of their grades. It also has a driver training discount for teens.

Many other companies also offer these and other discounts to young drivers. It’s good to ask about them when you get your quotes.

Cheap car insurance for Ohio drivers with a speeding ticket: Erie

Most Ohio drivers with a speeding ticket can get the cheapest car insurance quotes from Erie. The company’s rates average $108 a month after a ticket.

Geico has the next-cheapest rate at $120 a month, which is 11% higher than Erie’s rate. However, Geico has a few more discounts than Erie, which may make it cheaper for you.

Auto insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Erie | $108 |

| Geico | $120 |

| Auto-Owners | $122 |

| Progressive | $134 |

| Nationwide | $138 |

| Westfield | $157 |

| Cincinnati Insurance | $160 |

| Allstate | $232 |

| Grange | $241 |

| USAA* | $106 |

A speeding ticket raises the average cost of full coverage by 22% to $152 a month. However, some companies increase their rates by less. Shopping around can help you find cheap car insurance for a bad driving record.

Best Ohio auto insurance rates after an accident: Geico

At $140 a month, Geico has Ohio’s best auto insurance rates after an at-fault accident. Erie’s rate is only 4% higher at $146 a month. It’s good to get quotes from both companies when their rates are this close.

Car insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Geico | $140 |

| Erie | $146 |

| Progressive | $157 |

| Nationwide | $163 |

| Auto-Owners | $169 |

| Westfield | $176 |

| Grange | $206 |

| Cincinnati Insurance | $252 |

| Allstate | $325 |

| USAA* | $122 |

Cheap car insurance for Ohio teens with a bad record: Erie

Ohio teens can get the cheapest car insurance from Erie after a ticket or accident. The company’s liability rates for young drivers with a speeding ticket average $79 a month. Its teen liability rates go up to $96 a month after an at-fault accident.

At $98 a month, Westfield charges teens with a ticket 21% more than Erie does. Westfield is only 4% more expensive than Erie for teens with an accident.

Insurance rates for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Erie | $79 | $96 |

| Westfield | $98 | $100 |

| Geico | $115 | $138 |

| Auto-Owners | $155 | $242 |

| Cincinnati Insurance | $181 | $287 |

| Nationwide | $187 | $192 |

| Progressive | $188 | $198 |

| Allstate | $231 | $347 |

| Grange | $351 | $276 |

| USAA* | $126 | $136 |

Ohio’s cheapest car insurance after an OVI: Progressive

Ohio drivers with an OVI can get the cheapest car insurance quotes from Progressive. The company’s rates average $129 a month after a conviction for operating a vehicle under the influence (OVI).

Geico also has cheap OVI insurance at $140 a month. Geico has a better satisfaction rating than Progressive, which usually means better customer service.

Insurance rates with an OVI

| Company | Monthly rate |

|---|---|

| Progressive | $129 |

| Geico | $140 |

| Erie | $183 |

| Nationwide | $205 |

| Auto-Owners | $226 |

| Allstate | $257 |

| Grange | $269 |

| Westfield | $278 |

| Cincinnati Insurance | $331 |

| USAA* | $157 |

An OVI makes Ohio car insurance rates go up by an average of 75% to $218 a month. The high cost of OVI insurance makes it especially important to shop around for a cheaper rate.

Ohio’s cheapest bad credit car insurance: Geico

Geico has Ohio’s cheapest bad credit car insurance at $150 a month. Progressive has the next-cheapest rates for drivers with bad credit at $159 a month. Progressive is a better option if you need gap insurance

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Geico | $150 |

| Progressive | $159 |

| Nationwide | $169 |

| Cincinnati Insurance | $205 |

| Erie | $228 |

| Grange | $228 |

| Westfield | $236 |

| Allstate | $306 |

| Auto-Owners | $340 |

| USAA* | $148 |

Insurance companies review your credit for things like your payment history and borrowing habits. Avoiding late payments and paying down debts often help bring down your car insurance rate.

Ohio’s best car insurance companies

Cheap rates and excellent ratings help make Erie the best car insurance company for most Ohio drivers. USAA is the best choice if you meet its eligibility requirements.

Erie’s full coverage rate is 20% less than the state average. It ranks among the price leaders for most types of drivers. This includes teens and adults with a speeding ticket.

Insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Cincinnati Insurance | 667 | A+ | |

| Erie | 703 | A | |

| Geico | 645 | A++ | |

| Grange | 650 | A | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| USAA* | 735 | A++ | |

| Westfield | 647 | A |

Erie also offers a few extras at no added cost. For example, you get free accident forgiveness after three claim-free years with Erie. It also covers car accident injuries your pet suffers while riding in your vehicle.

An excellent satisfaction rating means customers generally like Erie’s prices, coverage options and service.

No Ohio car insurance company has a higher satisfaction rating than USAA. It also has the state’s cheapest overall rates for full coverage and liability insurance. These are good reasons to get car insurance quotes from USAA if you meet its eligibility requirements.

USAA membership is available to current and former members of the military and their families. The spouses and children of USAA members also qualify.

Ohio car insurance rates by city

Among Ohio’s cities and towns, Bratenahl has the most expensive car insurance at $145 a month. Cleveland is the next-priciest location at $144 a month.

An area’s car insurance rates are largely tied to accident and crime rates. Places with more crashes and car thefts tend to see higher rates. Car insurance can also cost more in areas with expensive medical and car repair costs.

Four Sandusky County locales tie for the state’s cheapest car insurance. Drivers in Ballville, Clyde, Fremont and Stoney Prairie all pay an average of $103 a month. This is 18% less than the state average.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Aberdeen | $126 | 1% |

| Ada | $111 | -11% |

| Adamsville | $124 | 0% |

| Addyston | $129 | 4% |

| Adelphi | $122 | -2% |

| Adena | $126 | 1% |

| Akron | $131 | 6% |

| Albany | $128 | 3% |

| Alexandria | $125 | 0% |

| Alger | $113 | -9% |

| Alledonia | $128 | 3% |

| Alliance | $113 | -9% |

| Alpha | $117 | -6% |

| Alvada | $104 | -16% |

| Alvordton | $113 | -9% |

| Amanda | $123 | -1% |

| Amberley | $132 | 6% |

| Amelia | $121 | -3% |

| Amesville | $131 | 6% |

| Amherst | $110 | -11% |

| Amlin | $126 | 1% |

| Amsterdam | $127 | 2% |

| Andersonville | $121 | -3% |

| Andover | $127 | 2% |

| Anna | $109 | -13% |

| Ansonia | $108 | -13% |

| Antwerp | $109 | -13% |

| Apple Creek | $116 | -7% |

| Apple Valley | $127 | 2% |

| Aquilla | $119 | -5% |

| Arcadia | $106 | -15% |

| Arcanum | $112 | -10% |

| Archbold | $112 | -10% |

| Arlington | $107 | -14% |

| Arlington Heights | $132 | 6% |

| Ashland | $115 | -8% |

| Ashley | $118 | -5% |

| Ashtabula | $116 | -6% |

| Ashville | $125 | 0% |

| Athens | $124 | 0% |

| Attica | $109 | -13% |

| Atwater | $117 | -6% |

| Aurora | $116 | -7% |

| Austinburg | $120 | -4% |

| Austintown | $120 | -3% |

| Ava | $128 | 3% |

| Avon | $111 | -11% |

| Avon Lake | $114 | -9% |

| Bainbridge | $123 | -1% |

| Bakersville | $124 | -1% |

| Ballville | $103 | -18% |

| Baltic | $122 | -2% |

| Baltimore | $123 | -1% |

| Bannock | $125 | 0% |

| Barberton | $117 | -6% |

| Barnesville | $126 | 2% |

| Bartlett | $132 | 6% |

| Barton | $123 | -1% |

| Bascom | $106 | -15% |

| Batavia | $119 | -4% |

| Bay View | $109 | -13% |

| Bay Village | $117 | -6% |

| Beach City | $117 | -6% |

| Beachwood | $134 | 8% |

| Beallsville | $128 | 3% |

| Beaver | $129 | 4% |

| Beavercreek | $116 | -7% |

| Beaverdam | $108 | -13% |

| Beckett Ridge | $122 | -2% |

| Bedford | $126 | 1% |

| Bedford Heights | $125 | 0% |

| Beechwood Trails | $128 | 3% |

| Bellaire | $124 | 0% |

| Bellbrook | $116 | -7% |

| Belle Center | $116 | -7% |

| Belle Valley | $128 | 3% |

| Bellefontaine | $114 | -9% |

| Bellevue | $108 | -13% |

| Bellville | $118 | -5% |

| Belmont | $125 | 0% |

| Belmore | $109 | -13% |

| Beloit | $113 | -9% |

| Belpre | $130 | 5% |

| Bentleyville | $123 | -1% |

| Benton Ridge | $106 | -14% |

| Bentonville | $131 | 6% |

| Berea | $113 | -9% |

| Bergholz | $129 | 3% |

| Berkey | $115 | -8% |

| Berlin Center | $116 | -7% |

| Berlin Heights | $110 | -12% |

| Bethel | $123 | -1% |

| Bethesda | $125 | 1% |

| Bettsville | $105 | -16% |

| Beverly | $128 | 3% |

| Bexley | $140 | 13% |

| Bidwell | $132 | 6% |

| Big Prairie | $124 | -1% |

| Birmingham | $113 | -10% |

| Blacklick | $134 | 7% |

| Blacklick Estates | $141 | 13% |

| Bladensburg | $126 | 1% |

| Blaine | $124 | 0% |

| Blakeslee | $114 | -9% |

| Blanchester | $118 | -5% |

| Blissfield | $131 | 5% |

| Bloomdale | $106 | -15% |

| Bloomingburg | $119 | -4% |

| Bloomingdale | $127 | 2% |

| Bloomville | $109 | -12% |

| Blue Ash | $125 | 1% |

| Blue Creek | $131 | 5% |

| Blue Rock | $127 | 2% |

| Bluffton | $106 | -15% |

| Boardman | $121 | -3% |

| Bolindale | $120 | -3% |

| Bolivar | $118 | -5% |

| Boston Heights | $114 | -8% |

| Botkins | $109 | -13% |

| Bourneville | $123 | -1% |

| Bowerston | $125 | 0% |

| Bowersville | $118 | -6% |

| Bowling Green | $106 | -15% |

| Bradford | $111 | -11% |

| Bradner | $106 | -15% |

| Brady Lake | $116 | -7% |

| Bratenahl | $145 | 16% |

| Brecksville | $116 | -7% |

| Bremen | $125 | 0% |

| Brewster | $114 | -8% |

| Brice | $134 | 7% |

| Bridgeport | $123 | -1% |

| Bridgetown | $136 | 9% |

| Brilliant | $123 | -1% |

| Brimfield | $116 | -7% |

| Brinkhaven | $128 | 3% |

| Bristolville | $121 | -3% |

| Broadview Heights | $116 | -7% |

| Broadway | $116 | -7% |

| Brook Park | $117 | -6% |

| Brookfield | $119 | -4% |

| Brookfield Center | $119 | -5% |

| Brooklyn | $124 | -1% |

| Brooklyn Heights | $119 | -5% |

| Brookpark | $117 | -6% |

| Brookside | $122 | -2% |

| Brookville | $117 | -6% |

| Brownsville | $124 | 0% |

| Brunswick | $107 | -14% |

| Bryan | $111 | -11% |

| Buchtel | $126 | 1% |

| Buckeye Lake | $125 | 0% |

| Buckland | $106 | -15% |

| Bucyrus | $108 | -13% |

| Burbank | $113 | -9% |

| Burghill | $121 | -3% |

| Burgoon | $105 | -16% |

| Burkettsville | $107 | -14% |

| Burlington | $129 | 3% |

| Burton | $125 | 0% |

| Butler | $122 | -2% |

| Byesville | $123 | -1% |

| Cable | $120 | -4% |

| Cadiz | $128 | 3% |

| Cairo | $110 | -12% |

| Calcutta | $120 | -3% |

| Caldwell | $127 | 2% |

| Caledonia | $115 | -7% |

| Cambridge | $123 | -2% |

| Camden | $119 | -5% |

| Cameron | $130 | 4% |

| Camp Dennison | $123 | -2% |

| Campbell | $129 | 4% |

| Canal Fulton | $114 | -8% |

| Canal Winchester | $130 | 5% |

| Candlewood Lake | $118 | -5% |

| Canfield | $118 | -5% |

| Canton | $122 | -2% |

| Carbon Hill | $128 | 3% |

| Carbondale | $127 | 2% |

| Cardington | $118 | -5% |

| Carey | $106 | -15% |

| Carlisle | $116 | -7% |

| Carroll | $126 | 1% |

| Carrollton | $123 | -1% |

| Casstown | $112 | -10% |

| Castalia | $109 | -13% |

| Catawba | $117 | -6% |

| Cecil | $111 | -11% |

| Cedarville | $118 | -6% |

| Celina | $106 | -15% |

| Centerburg | $123 | -1% |

| Centerville | $117 | -6% |

| Chagrin Falls | $123 | -1% |

| Champion Heights | $119 | -4% |

| Chandlersville | $124 | 0% |

| Chardon | $118 | -5% |

| Charm | $123 | -1% |

| Chauncey | $124 | 0% |

| Cherry Fork | $129 | 4% |

| Cherry Grove | $121 | -2% |

| Chesapeake | $130 | 5% |

| Cheshire | $132 | 6% |

| Chesterhill | $134 | 7% |

| Chesterland | $118 | -5% |

| Chesterville | $122 | -2% |

| Cheviot | $139 | 12% |

| Chickasaw | $107 | -14% |

| Chillicothe | $121 | -3% |

| Chilo | $126 | 1% |

| Chippewa Lake | $109 | -13% |

| Chippewa Park | $112 | -10% |

| Choctaw Lake | $118 | -6% |

| Christiansburg | $115 | -7% |

| Churchill | $125 | 0% |

| Cincinnati | $141 | 13% |

| Cinnamon Lake | $115 | -8% |

| Circleville | $120 | -4% |

| Clarington | $129 | 3% |

| Clarksburg | $119 | -4% |

| Clarksville | $118 | -5% |

| Clay Center | $112 | -10% |

| Clayton | $118 | -5% |

| Cleveland | $144 | 16% |

| Cleveland Heights | $139 | 12% |

| Cleves | $128 | 3% |

| Clifton | $116 | -7% |

| Clinton | $117 | -6% |

| Cloverdale | $109 | -13% |

| Clyde | $103 | -17% |

| Coal Grove | $125 | 0% |

| Coal Run | $129 | 4% |

| Coalton | $131 | 6% |

| Coldstream | $123 | -1% |

| Coldwater | $105 | -15% |

| College Corner | $120 | -4% |

| Collins | $111 | -11% |

| Collinsville | $124 | 0% |

| Colton | $113 | -9% |

| Columbia Station | $109 | -12% |

| Columbiana | $113 | -9% |

| Columbus | $138 | 11% |

| Columbus Grove | $107 | -14% |

| Commercial Point | $122 | -2% |

| Conesville | $127 | 2% |

| Conneaut | $117 | -6% |

| Conover | $111 | -11% |

| Continental | $111 | -11% |

| Convoy | $106 | -15% |

| Coolville | $132 | 6% |

| Corning | $131 | 5% |

| Cortland | $119 | -5% |

| Coshocton | $127 | 2% |

| Covedale | $137 | 10% |

| Covington | $110 | -11% |

| Craig Beach | $117 | -6% |

| Creola | $126 | 2% |

| Crestline | $110 | -12% |

| Creston | $112 | -10% |

| Cridersville | $108 | -13% |

| Crooksville | $128 | 3% |

| Croton | $130 | 4% |

| Crown City | $132 | 6% |

| Crystal Lakes | $113 | -9% |

| Cuba | $119 | -4% |

| Cumberland | $126 | 1% |

| Curtice | $113 | -9% |

| Custar | $109 | -13% |

| Cutler | $133 | 7% |

| Cuyahoga Falls | $118 | -5% |

| Cuyahoga Heights | $130 | 5% |

| Cygnet | $105 | -15% |

| Cynthiana | $128 | 3% |

| Dalton | $115 | -8% |

| Danville | $126 | 1% |

| Darbydale | $123 | -1% |

| Day Heights | $119 | -5% |

| Dayton | $128 | 3% |

| De Graff | $117 | -6% |

| Deer Park | $129 | 3% |

| Deerfield | $117 | -6% |

| Deersville | $127 | 2% |

| Defiance | $112 | -10% |

| Delaware | $118 | -5% |

| Delhi Hills | $140 | 12% |

| Dellroy | $125 | 0% |

| Delphos | $106 | -15% |

| Delshire | $141 | 13% |

| Delta | $117 | -6% |

| Dennison | $119 | -5% |

| Dent | $130 | 5% |

| Derby | $121 | -3% |

| Derwent | $126 | 1% |

| Deshler | $109 | -12% |

| Devola | $125 | 1% |

| Dexter City | $127 | 2% |

| Diamond | $119 | -4% |

| Dillonvale | $128 | 2% |

| Dola | $111 | -11% |

| Donnelsville | $116 | -7% |

| Dorset | $124 | -1% |

| Dover | $115 | -8% |

| Doylestown | $115 | -8% |

| Dresden | $125 | 1% |

| Drexel | $126 | 2% |

| Dry Ridge | $127 | 2% |

| Dry Run | $124 | 0% |

| Dublin | $120 | -3% |

| Dunbridge | $107 | -14% |

| Duncan Falls | $122 | -2% |

| Dundee | $119 | -4% |

| Dunkirk | $111 | -11% |

| Dunlap | $127 | 2% |

| Dupont | $110 | -11% |

| East Canton | $119 | -4% |

| East Claridon | $119 | -4% |

| East Cleveland | $143 | 15% |

| East Fultonham | $125 | 1% |

| East Liberty | $115 | -8% |

| East Liverpool | $120 | -3% |

| East Palestine | $115 | -7% |

| East Rochester | $116 | -7% |

| East Sparta | $118 | -5% |

| East Springfield | $125 | 0% |

| Eastlake | $114 | -8% |

| Eaton | $115 | -7% |

| Eaton Estates | $111 | -11% |

| Edgerton | $113 | -9% |

| Edgewood | $117 | -6% |

| Edison | $117 | -6% |

| Edon | $117 | -6% |

| Eldorado | $115 | -8% |

| Elgin | $109 | -13% |

| Elida | $110 | -12% |

| Elkton | $117 | -6% |

| Elmore | $105 | -15% |

| Elmwood Place | $138 | 11% |

| Elyria | $111 | -11% |

| Empire | $123 | -1% |

| Englewood | $116 | -7% |

| Enon | $114 | -9% |

| Euclid | $133 | 7% |

| Evansport | $113 | -9% |

| Evendale | $124 | 0% |

| Fairborn | $113 | -9% |

| Fairfax | $131 | 5% |

| Fairfield | $126 | 1% |

| Fairfield Beach | $124 | 0% |

| Fairlawn | $117 | -6% |

| Fairpoint | $125 | 0% |

| Fairport Harbor | $112 | -10% |

| Fairview | $128 | 3% |

| Fairview Park | $118 | -5% |

| Farmdale | $122 | -2% |

| Farmersville | $119 | -5% |

| Fayette | $116 | -7% |

| Fayetteville | $123 | -1% |

| Feesburg | $129 | 3% |

| Felicity | $127 | 2% |

| Findlay | $104 | -16% |

| Finneytown | $136 | 9% |

| Five Points | $114 | -8% |

| Flat Rock | $107 | -14% |

| Fleming | $129 | 4% |

| Fletcher | $111 | -10% |

| Flushing | $126 | 1% |

| Forest | $111 | -11% |

| Forest Park | $129 | 4% |

| Forestville | $123 | -1% |

| Fort Jennings | $106 | -15% |

| Fort Loramie | $109 | -12% |

| Fort Recovery | $107 | -14% |

| Fort Shawnee | $111 | -11% |

| Fostoria | $106 | -15% |

| Four Bridges | $120 | -3% |

| Fowler | $120 | -3% |

| Frankfort | $120 | -3% |

| Franklin | $116 | -7% |

| Franklin Furnace | $128 | 3% |

| Frazeysburg | $126 | 1% |

| Fredericksburg | $117 | -6% |

| Fredericktown | $123 | -1% |

| Freeport | $128 | 3% |

| Fremont | $103 | -18% |

| Fresno | $126 | 1% |

| Friendship | $129 | 3% |

| Fruit Hill | $127 | 2% |

| Fulton | $120 | -4% |

| Fultonham | $124 | 0% |

| Gahanna | $132 | 6% |

| Galena | $124 | -1% |

| Galion | $112 | -10% |

| Gallipolis | $132 | 6% |

| Galloway | $124 | 0% |

| Gambier | $128 | 2% |

| Garfield Heights | $133 | 7% |

| Garrettsville | $117 | -6% |

| Gates Mills | $125 | 0% |

| Geneva | $116 | -7% |

| Geneva-on-the-Lake | $116 | -7% |

| Genoa | $108 | -13% |

| Georgetown | $128 | 3% |

| Germantown | $117 | -6% |

| Gettysburg | $110 | -11% |

| Gibsonburg | $106 | -15% |

| Girard | $123 | -1% |

| Glandorf | $106 | -15% |

| Glencoe | $123 | -1% |

| Glendale | $128 | 3% |

| Glenford | $126 | 2% |

| Glenmont | $126 | 1% |

| Glenmoor | $120 | -3% |

| Glenwillow | $122 | -2% |

| Gloria Glens Park | $109 | -12% |

| Glouster | $128 | 3% |

| Gnadenhutten | $119 | -5% |

| Golf Manor | $138 | 11% |

| Gomer | $109 | -13% |

| Goshen | $119 | -4% |

| Grafton | $111 | -11% |

| Grand Rapids | $111 | -11% |

| Grand River | $112 | -10% |

| Grandview | $128 | 3% |

| Grandview Heights | $132 | 6% |

| Granville | $124 | 0% |

| Granville South | $124 | 0% |

| Gratiot | $124 | 0% |

| Graysville | $130 | 4% |

| Graytown | $107 | -14% |

| Green | $119 | -4% |

| Green Meadows | $113 | -9% |

| Green Springs | $105 | -16% |

| Greenfield | $120 | -4% |

| Greenford | $119 | -4% |

| Greenhills | $129 | 4% |

| Greentown | $116 | -7% |

| Greenville | $110 | -12% |

| Greenwich | $114 | -9% |

| Grelton | $112 | -10% |

| Groesbeck | $133 | 6% |

| Grove City | $124 | 0% |

| Groveport | $131 | 5% |

| Grover Hill | $108 | -14% |

| Guysville | $129 | 4% |

| Gypsum | $107 | -14% |

| Hallsville | $121 | -2% |

| Hamden | $130 | 4% |

| Hamersville | $128 | 2% |

| Hamilton | $126 | 2% |

| Hamler | $112 | -10% |

| Hammondsville | $125 | 0% |

| Hannibal | $129 | 4% |

| Hanover | $124 | 0% |

| Hanoverton | $119 | -4% |

| Harbor Hills | $124 | 0% |

| Harbor View | $118 | -5% |

| Harpster | $111 | -11% |

| Harrisburg | $124 | 0% |

| Harrison | $124 | 0% |

| Harrod | $112 | -10% |

| Hartville | $116 | -7% |

| Harveysburg | $118 | -5% |

| Haskins | $107 | -14% |

| Haverhill | $128 | 3% |

| Haviland | $108 | -14% |

| Haydenville | $127 | 2% |

| Hayesville | $116 | -7% |

| Heath | $123 | -1% |

| Hebron | $123 | -1% |

| Helena | $104 | -16% |

| Hicksville | $111 | -11% |

| Higginsport | $128 | 3% |

| Highland Heights | $127 | 2% |

| Highland Hills | $137 | 10% |

| Highpoint | $123 | -1% |

| Hilliard | $123 | -1% |

| Hillsboro | $123 | -1% |

| Hinckley | $108 | -13% |

| Hiram | $118 | -5% |

| Hockingport | $132 | 6% |

| Holgate | $112 | -10% |

| Holiday Valley | $114 | -9% |

| Holland | $122 | -2% |

| Hollansburg | $109 | -12% |

| Holloway | $126 | 1% |

| Holmesville | $121 | -3% |

| Homerville | $111 | -11% |

| Homeworth | $115 | -7% |

| Hooven | $128 | 3% |

| Hopedale | $126 | 1% |

| Hopewell | $125 | 0% |

| Houston | $112 | -10% |

| Howard | $127 | 2% |

| Howland Center | $119 | -4% |

| Hoytville | $109 | -12% |

| Hubbard | $120 | -3% |

| Huber Heights | $118 | -5% |

| Huber Ridge | $129 | 3% |

| Hudson | $115 | -7% |

| Hunter | $116 | -6% |

| Hunting Valley | $124 | 0% |

| Huntsburg | $121 | -3% |

| Huntsville | $114 | -9% |

| Huron | $108 | -13% |

| Iberia | $118 | -5% |

| Independence | $117 | -6% |

| Irondale | $126 | 1% |

| Ironton | $125 | 0% |

| Irwin | $114 | -8% |

| Isle St. George | $108 | -13% |

| Jackson | $127 | 2% |

| Jackson Center | $111 | -11% |

| Jacksontown | $126 | 1% |

| Jacksonville | $129 | 4% |

| Jacobsburg | $125 | 0% |

| Jamestown | $116 | -7% |

| Jefferson | $122 | -2% |

| Jeffersonville | $117 | -6% |

| Jenera | $107 | -14% |

| Jeromesville | $118 | -5% |

| Jerry City | $108 | -14% |

| Jerusalem | $128 | 3% |

| Jewell | $113 | -9% |

| Jewett | $128 | 3% |

| Johnstown | $129 | 3% |

| Junction City | $127 | 2% |

| Kalida | $107 | -14% |

| Kansas | $105 | -15% |

| Keene | $128 | 3% |

| Kelleys Island | $108 | -13% |

| Kensington | $119 | -4% |

| Kent | $116 | -6% |

| Kenton | $113 | -10% |

| Kenwood | $126 | 1% |

| Kerr | $134 | 8% |

| Kettering | $118 | -5% |

| Kettlersville | $110 | -12% |

| Kidron | $115 | -7% |

| Kilbourne | $120 | -3% |

| Killbuck | $128 | 3% |

| Kimbolton | $126 | 1% |

| Kings Mills | $119 | -5% |

| Kingston | $120 | -3% |

| Kingsville | $120 | -4% |

| Kinsman | $125 | 0% |

| Kinsman Center | $125 | 0% |

| Kipling | $124 | 0% |

| Kipton | $114 | -8% |

| Kirby | $110 | -12% |

| Kirkersville | $126 | 2% |

| Kirtland | $113 | -9% |

| Kirtland Hills | $112 | -10% |

| Kitts Hill | $129 | 4% |

| Kunkle | $114 | -8% |

| La Croft | $120 | -3% |

| La Rue | $115 | -8% |

| LaGrange | $112 | -10% |

| Lacarne | $107 | -14% |

| Lafferty | $125 | 0% |

| Laings | $130 | 4% |

| Lake Darby | $126 | 1% |

| Lake Lakengren | $116 | -7% |

| Lake Lorelei | $123 | -1% |

| Lake Milton | $117 | -6% |

| Lake Mohawk | $122 | -2% |

| Lake Waynoka | $125 | 0% |

| Lakemore | $121 | -2% |

| Lakeside | $107 | -14% |

| Lakeside Marblehead | $107 | -14% |

| Lakeview | $112 | -10% |

| Lakeville | $124 | -1% |

| Lakewood | $125 | 0% |

| Lancaster | $120 | -4% |

| Landen | $120 | -4% |

| Langsville | $130 | 5% |

| Lansing | $123 | -2% |

| Latham | $127 | 2% |

| Laura | $111 | -11% |

| Laurelville | $124 | 0% |

| Leavittsburg | $119 | -4% |

| Lebanon | $117 | -6% |

| Leesburg | $118 | -5% |

| Leesville | $125 | 0% |

| Leetonia | $114 | -9% |

| Leipsic | $107 | -14% |

| Lemoyne | $109 | -13% |

| Lewis Center | $123 | -2% |

| Lewisburg | $118 | -5% |

| Lewistown | $113 | -9% |

| Lewisville | $132 | 6% |

| Lexington | $116 | -7% |

| Liberty Center | $113 | -9% |

| Lima | $113 | -9% |

| Limaville | $116 | -7% |

| Lincoln Heights | $131 | 6% |

| Lincoln Village | $131 | 5% |

| Lindsey | $104 | -16% |

| Lisbon | $116 | -7% |

| Litchfield | $108 | -13% |

| Lithopolis | $127 | 2% |

| Little Hocking | $130 | 4% |

| Lockbourne | $128 | 3% |

| Lockland | $132 | 6% |

| Lodi | $110 | -11% |

| Logan | $126 | 1% |

| London | $118 | -5% |

| Londonderry | $126 | 1% |

| Long Bottom | $132 | 6% |

| Lorain | $114 | -8% |

| Lordstown | $118 | -5% |

| Lore City | $125 | 0% |

| Loudonville | $122 | -2% |

| Louisville | $115 | -7% |

| Loveland | $119 | -4% |

| Loveland Park | $119 | -4% |

| Lowell | $127 | 2% |

| Lowellville | $119 | -4% |

| Lower Salem | $128 | 3% |

| Lucas | $120 | -4% |

| Lucasville | $128 | 3% |

| Luckey | $108 | -13% |

| Ludlow Falls | $112 | -10% |

| Lynchburg | $120 | -4% |

| Lyndhurst | $129 | 3% |

| Lynx | $129 | 4% |

| Lyons | $117 | -6% |

| Macedonia | $115 | -8% |

| Mack | $131 | 5% |

| Macksburg | $129 | 3% |

| Madeira | $126 | 1% |

| Madison | $115 | -8% |

| Magnetic Springs | $115 | -8% |

| Magnolia | $121 | -3% |

| Maineville | $119 | -4% |

| Malinta | $111 | -11% |

| Malta | $130 | 5% |

| Malvern | $122 | -2% |

| Manchester | $130 | 5% |

| Mansfield | $117 | -6% |

| Mantua | $117 | -6% |

| Maple Heights | $136 | 9% |

| Maple Ridge | $113 | -9% |

| Maplewood | $111 | -11% |

| Marble Cliff | $130 | 5% |

| Marblehead | $107 | -14% |

| Marengo | $123 | -1% |

| Maria Stein | $106 | -15% |

| Mariemont | $130 | 5% |

| Marietta | $125 | 1% |

| Marion | $115 | -7% |

| Mark Center | $112 | -10% |

| Marne | $125 | 0% |

| Marshallville | $114 | -9% |

| Martel | $116 | -7% |

| Martin | $110 | -11% |

| Martins Ferry | $124 | -1% |

| Martinsburg | $125 | 1% |

| Martinsville | $119 | -5% |

| Marysville | $112 | -10% |

| Mason | $119 | -4% |

| Massillon | $116 | -6% |

| Masury | $120 | -4% |

| Maumee | $116 | -7% |

| Maximo | $116 | -7% |

| Mayfield | $126 | 1% |

| Mayfield Heights | $128 | 2% |

| Maynard | $125 | 0% |

| Mc Comb | $105 | -15% |

| Mc Cutchenville | $109 | -13% |

| Mc Dermott | $129 | 3% |

| Mc Guffey | $114 | -9% |

| McArthur | $129 | 4% |

| McClure | $111 | -11% |

| McDonald | $120 | -3% |

| Mcconnelsville | $130 | 4% |

| Mechanicsburg | $118 | -5% |

| Mechanicstown | $123 | -1% |

| Medina | $107 | -14% |

| Medway | $113 | -9% |

| Melmore | $107 | -14% |

| Melrose | $111 | -11% |

| Mendon | $107 | -14% |

| Mentor | $112 | -10% |

| Mentor-on-the-Lake | $113 | -10% |

| Metamora | $116 | -7% |

| Meyers Lake | $120 | -3% |

| Miami Heights | $128 | 3% |

| Miamisburg | $115 | -7% |

| Miamitown | $125 | 0% |

| Miamiville | $120 | -3% |

| Middle Bass | $110 | -12% |

| Middle Point | $106 | -15% |

| Middlebranch | $117 | -6% |

| Middleburg | $115 | -7% |

| Middleburg Heights | $115 | -8% |

| Middlefield | $122 | -2% |

| Middleport | $131 | 5% |

| Middletown | $120 | -4% |

| Midland | $118 | -5% |

| Midvale | $119 | -5% |

| Milan | $107 | -14% |

| Milford | $119 | -4% |

| Milford Center | $113 | -9% |

| Millbury | $113 | -9% |

| Milledgeville | $117 | -6% |

| Miller City | $110 | -12% |

| Millersburg | $125 | 0% |

| Millersport | $125 | 1% |

| Millfield | $125 | 0% |

| Milton Center | $108 | -13% |

| Mineral City | $120 | -4% |

| Mineral Ridge | $120 | -4% |

| Minerva | $118 | -5% |

| Minerva Park | $139 | 12% |

| Minford | $130 | 4% |

| Mingo | $121 | -3% |

| Mingo Junction | $124 | 0% |

| Minster | $108 | -14% |

| Mogadore | $118 | -6% |

| Monclova | $114 | -8% |

| Monfort Heights | $135 | 9% |

| Monroe | $120 | -4% |

| Monroeville | $108 | -13% |

| Montezuma | $107 | -14% |

| Montgomery | $125 | 0% |

| Montpelier | $113 | -9% |

| Montrose-Ghent | $117 | -6% |

| Montville | $122 | -2% |

| Moraine | $120 | -4% |

| Moreland Hills | $124 | 0% |

| Morgandale | $120 | -4% |

| Morral | $114 | -8% |

| Morristown | $124 | 0% |

| Morrow | $119 | -5% |

| Moscow | $126 | 1% |

| Mount Blanchard | $107 | -14% |

| Mount Carmel | $122 | -2% |

| Mount Cory | $106 | -15% |

| Mount Eaton | $118 | -5% |

| Mount Gilead | $118 | -5% |

| Mount Healthy | $132 | 6% |

| Mount Healthy Heights | $131 | 5% |

| Mount Hope | $122 | -2% |

| Mount Liberty | $124 | 0% |

| Mount Orab | $123 | -1% |

| Mount Perry | $126 | 1% |

| Mount Repose | $119 | -5% |

| Mount St. Joseph | $133 | 7% |

| Mount Sterling | $120 | -4% |

| Mount Vernon | $124 | -1% |

| Mount Victory | $114 | -8% |

| Mowrystown | $125 | 0% |

| Moxahala | $129 | 4% |

| Mulberry | $119 | -4% |

| Munroe Falls | $116 | -7% |

| Murray City | $128 | 2% |

| Nankin | $118 | -5% |

| Napoleon | $111 | -11% |

| Nashport | $125 | 1% |

| Nashville | $123 | -1% |

| Navarre | $115 | -7% |

| Neapolis | $114 | -9% |

| Neffs | $123 | -1% |

| Negley | $119 | -5% |

| Nelsonville | $125 | 0% |

| Nevada | $111 | -11% |

| Neville | $124 | 0% |

| New Albany | $125 | 1% |

| New Athens | $128 | 3% |

| New Baltimore | $124 | 0% |

| New Bavaria | $111 | -11% |

| New Bloomington | $115 | -7% |

| New Boston | $126 | 1% |

| New Bremen | $106 | -15% |

| New Burlington | $131 | 5% |

| New Carlisle | $113 | -10% |

| New Concord | $125 | 0% |

| New Franklin | $118 | -5% |

| New Hampshire | $108 | -13% |

| New Haven | $124 | 0% |

| New Holland | $119 | -5% |

| New Knoxville | $106 | -15% |

| New Lebanon | $119 | -4% |

| New Lexington | $128 | 3% |

| New London | $113 | -9% |

| New Madison | $110 | -11% |

| New Marshfield | $127 | 2% |

| New Matamoras | $129 | 4% |

| New Miami | $125 | 0% |

| New Middletown | $116 | -7% |

| New Paris | $113 | -9% |

| New Philadelphia | $116 | -7% |

| New Plymouth | $126 | 2% |

| New Richmond | $122 | -2% |

| New Riegel | $105 | -16% |

| New Rumley | $127 | 2% |

| New Springfield | $116 | -7% |

| New Straitsville | $126 | 2% |

| New Vienna | $117 | -6% |

| New Washington | $110 | -11% |

| New Waterford | $116 | -6% |

| New Weston | $108 | -13% |

| Newark | $125 | 0% |

| Newburgh Heights | $141 | 13% |

| Newbury | $124 | 0% |

| Newcomerstown | $122 | -2% |

| Newport | $127 | 2% |

| Newton Falls | $118 | -5% |

| Newtonsville | $120 | -3% |

| Newtown | $124 | 0% |

| Ney | $113 | -9% |

| Niles | $120 | -3% |

| North Baltimore | $106 | -15% |

| North Bend | $128 | 3% |

| North Benton | $115 | -8% |

| North Bloomfield | $122 | -2% |

| North Canton | $116 | -7% |

| North College Hill | $137 | 10% |

| North Fairfield | $113 | -9% |

| North Georgetown | $117 | -6% |

| North Hampton | $114 | -8% |

| North Jackson | $119 | -5% |

| North Kingsville | $117 | -6% |

| North Lawrence | $115 | -8% |

| North Lewisburg | $119 | -5% |

| North Lima | $117 | -6% |

| North Madison | $115 | -8% |

| North Olmsted | $115 | -8% |

| North Perry | $113 | -9% |

| North Randall | $139 | 12% |

| North Ridgeville | $111 | -11% |

| North Robinson | $111 | -11% |

| North Royalton | $113 | -9% |

| North Star | $108 | -13% |

| North Zanesville | $122 | -2% |

| Northbrook | $131 | 5% |

| Northfield | $113 | -9% |

| Northgate | $129 | 4% |

| Northridge | $118 | -5% |

| Northwood | $115 | -7% |

| Norton | $117 | -6% |

| Norwalk | $110 | -12% |

| Norwich | $123 | -1% |

| Norwood | $137 | 10% |

| Nova | $115 | -7% |

| Novelty | $123 | -1% |

| Oak Harbor | $106 | -15% |

| Oak Hill | $130 | 4% |

| Oakwood | $117 | -6% |

| Oberlin | $113 | -9% |

| Obetz | $137 | 10% |

| Oceola | $111 | -11% |

| Ohio City | $107 | -14% |

| Okeana | $124 | 0% |

| Okolona | $112 | -10% |

| Old Fort | $106 | -15% |

| Old Washington | $125 | 1% |

| Olde West Chester | $122 | -2% |

| Olmsted Falls | $112 | -10% |

| Ontario | $114 | -8% |

| Orange | $128 | 3% |

| Orangeville | $122 | -2% |

| Oregon | $118 | -6% |

| Oregonia | $118 | -5% |

| Orient | $124 | 0% |

| Orrville | $112 | -10% |

| Orwell | $126 | 2% |

| Osgood | $109 | -13% |

| Ostrander | $116 | -7% |

| Ottawa | $106 | -15% |

| Ottawa Hills | $132 | 6% |

| Ottoville | $108 | -13% |

| Otway | $132 | 6% |

| Overpeck | $125 | 0% |

| Owensville | $120 | -4% |

| Oxford | $123 | -1% |

| Painesville | $112 | -10% |

| Palestine | $111 | -11% |

| Pandora | $106 | -15% |

| Paris | $117 | -6% |

| Park Layne | $112 | -10% |

| Parma | $118 | -5% |

| Parma Heights | $117 | -6% |

| Pataskala | $128 | 3% |

| Patriot | $133 | 7% |

| Paulding | $109 | -12% |

| Payne | $108 | -13% |

| Pedro | $129 | 3% |

| Peebles | $129 | 4% |

| Pemberton | $112 | -10% |

| Pemberville | $106 | -15% |

| Peninsula | $114 | -8% |

| Pepper Pike | $126 | 1% |

| Perry | $113 | -9% |

| Perry Heights | $116 | -7% |

| Perrysburg | $110 | -11% |

| Perrysville | $120 | -3% |

| Petersburg | $116 | -7% |

| Pettisville | $115 | -7% |

| Phillipsburg | $117 | -6% |

| Philo | $123 | -1% |

| Pickerington | $126 | 2% |

| Piedmont | $126 | 2% |

| Pierpont | $120 | -3% |

| Pigeon Creek | $118 | -5% |

| Piketon | $127 | 2% |

| Piney Fork | $126 | 2% |

| Pioneer | $114 | -8% |

| Piqua | $108 | -13% |

| Pitsburg | $112 | -10% |

| Plain City | $115 | -7% |

| Plainfield | $126 | 1% |

| Pleasant City | $126 | 1% |

| Pleasant Grove | $121 | -2% |

| Pleasant Hill | $110 | -11% |

| Pleasant Hills | $131 | 5% |

| Pleasant Plain | $121 | -3% |

| Pleasant Run | $130 | 5% |

| Pleasant Run Farm | $129 | 3% |

| Pleasantville | $124 | -1% |

| Plymouth | $111 | -11% |

| Poland | $120 | -4% |

| Polk | $117 | -6% |

| Pomeroy | $131 | 5% |

| Port Clinton | $105 | -15% |

| Port Jefferson | $112 | -10% |

| Port Washington | $120 | -3% |

| Port William | $116 | -7% |

| Portage | $106 | -14% |

| Portage Lakes | $120 | -4% |

| Portland | $131 | 5% |

| Portsmouth | $126 | 2% |

| Potsdam | $113 | -10% |

| Powell | $118 | -5% |

| Powhatan Point | $126 | 1% |

| Proctorville | $129 | 4% |

| Prospect | $118 | -5% |

| Put In Bay | $108 | -13% |

| Quaker City | $130 | 4% |

| Quincy | $115 | -8% |

| Racine | $132 | 6% |

| Radnor | $117 | -6% |

| Rarden | $130 | 4% |

| Ravenna | $116 | -6% |

| Rawson | $106 | -15% |

| Ray | $126 | 1% |

| Rayland | $124 | 0% |

| Raymond | $114 | -9% |

| Reading | $132 | 6% |

| Reedsville | $132 | 6% |

| Reesville | $117 | -6% |

| Reminderville | $114 | -8% |

| Reno | $126 | 1% |

| Republic | $108 | -13% |

| Reynoldsburg | $131 | 5% |

| Richfield | $115 | -8% |

| Richmond | $124 | 0% |

| Richmond Dale | $121 | -3% |

| Richmond Heights | $129 | 3% |

| Richville | $117 | -6% |

| Richwood | $115 | -7% |

| Ridgeville Corners | $112 | -10% |

| Ridgeway | $114 | -8% |

| Rio Grande | $133 | 7% |

| Ripley | $128 | 3% |

| Risingsun | $106 | -15% |

| Rittman | $114 | -8% |

| Riverlea | $126 | 1% |

| Riverside | $119 | -4% |

| Roaming Shores | $121 | -3% |

| Robertsville | $117 | -6% |

| Rock Camp | $131 | 5% |

| Rock Creek | $121 | -3% |

| Rockbridge | $127 | 2% |

| Rockford | $107 | -14% |

| Rocky Ridge | $107 | -14% |

| Rocky River | $118 | -5% |

| Rogers | $120 | -4% |

| Rome | $122 | -2% |

| Rootstown | $117 | -6% |

| Rosemount | $126 | 2% |

| Roseville | $126 | 1% |

| Rosewood | $118 | -5% |

| Ross | $126 | 1% |

| Rossburg | $108 | -13% |

| Rossford | $115 | -8% |

| Rossmoyne | $127 | 2% |

| Rudolph | $107 | -14% |

| Rushsylvania | $116 | -7% |

| Rushville | $125 | 0% |

| Russells Point | $114 | -9% |

| Russellville | $126 | 2% |

| Russia | $111 | -11% |

| Rutland | $133 | 7% |

| Sabina | $114 | -9% |

| Salem | $113 | -9% |

| Salem Heights | $127 | 2% |

| Salesville | $126 | 2% |

| Salineville | $120 | -4% |

| Sandusky | $109 | -13% |

| Sandyville | $121 | -3% |

| Sarahsville | $128 | 3% |

| Sardinia | $125 | 0% |

| Sardis | $128 | 3% |

| Savannah | $117 | -6% |

| Sawyerwood | $122 | -2% |

| Scio | $128 | 3% |

| Scioto Furnace | $130 | 4% |

| Sciotodale | $126 | 1% |

| Scott | $106 | -15% |

| Scottown | $132 | 6% |

| Seaman | $127 | 2% |

| Sebring | $113 | -9% |

| Sedalia | $118 | -5% |

| Senecaville | $127 | 2% |

| Seven Hills | $117 | -6% |

| Seven Mile | $123 | -1% |

| Seville | $108 | -13% |

| Shade | $130 | 5% |

| Shadyside | $124 | 0% |

| Shaker Heights | $140 | 12% |

| Shandon | $125 | 0% |

| Sharon Center | $109 | -12% |

| Sharonville | $124 | 0% |

| Sharpsburg | $130 | 4% |

| Shauck | $119 | -4% |

| Shawnee | $128 | 3% |

| Shawnee Hills | $116 | -7% |

| Sheffield | $111 | -11% |

| Sheffield Lake | $113 | -9% |

| Shelby | $113 | -9% |

| Sherrodsville | $125 | 0% |

| Sherwood | $122 | -2% |

| Shiloh | $115 | -8% |

| Shreve | $119 | -4% |

| Sidney | $111 | -10% |

| Silver Lake | $116 | -7% |

| Silverton | $129 | 4% |

| Sinking Spring | $125 | 0% |

| Sixteen Mile Stand | $123 | -1% |

| Skyline Acres | $132 | 6% |

| Smithville | $113 | -9% |

| Solon | $123 | -1% |

| Somerdale | $118 | -5% |

| Somerset | $126 | 1% |

| Somerville | $122 | -2% |

| South Amherst | $110 | -11% |

| South Bloomfield | $125 | 0% |

| South Bloomingville | $129 | 4% |

| South Canal | $118 | -5% |

| South Charleston | $116 | -7% |

| South Euclid | $136 | 9% |

| South Lebanon | $119 | -4% |

| South Point | $128 | 3% |

| South Russell | $124 | -1% |

| South Salem | $121 | -3% |

| South Solon | $118 | -5% |

| South Vienna | $117 | -6% |

| South Webster | $131 | 5% |

| South Zanesville | $122 | -2% |

| Southington | $119 | -4% |

| Sparta | $122 | -2% |

| Spencer | $111 | -11% |

| Spencerville | $108 | -13% |

| Spring Valley | $118 | -6% |

| Springboro | $115 | -8% |

| Springdale | $128 | 3% |

| Springfield | $117 | -6% |

| St. Bernard | $141 | 13% |

| St. Clairsville | $123 | -1% |

| St. Henry | $107 | -14% |

| St. Johns | $108 | -13% |

| St. Louisville | $126 | 1% |

| St. Marys | $105 | -16% |

| St. Paris | $117 | -6% |

| Stafford | $129 | 4% |

| Sterling | $112 | -10% |

| Steubenville | $125 | 1% |

| Stewart | $132 | 6% |

| Stillwater | $119 | -5% |

| Stockdale | $128 | 3% |

| Stockport | $133 | 7% |

| Stone Creek | $121 | -2% |

| Stony Prairie | $103 | -18% |

| Stony Ridge | $109 | -12% |

| Stout | $133 | 7% |

| Stoutsville | $123 | -1% |

| Stow | $115 | -8% |

| Strasburg | $116 | -7% |

| Stratton | $123 | -1% |

| Streetsboro | $115 | -7% |

| Strongsville | $113 | -9% |

| Struthers | $123 | -1% |

| Stryker | $112 | -10% |

| Sugar Grove | $122 | -2% |

| Sugarcreek | $119 | -4% |

| Sullivan | $116 | -7% |

| Sulphur Springs | $110 | -11% |

| Summerfield | $130 | 5% |

| Summerside | $122 | -2% |

| Summit Station | $128 | 3% |

| Summitville | $118 | -5% |

| Sunbury | $122 | -2% |

| Swanton | $116 | -7% |

| Sycamore | $109 | -12% |

| Sylvania | $120 | -4% |

| Syracuse | $133 | 7% |

| Tallmadge | $116 | -7% |

| Tarlton | $124 | -1% |

| Taylor Creek | $129 | 3% |

| Terrace Park | $121 | -3% |

| The Plains | $123 | -1% |

| The Village of Indian Hill | $125 | 1% |

| Thompson | $119 | -4% |

| Thornport | $125 | 1% |

| Thornville | $125 | 0% |

| Thurman | $131 | 6% |

| Thurston | $123 | -1% |

| Tiffin | $105 | -16% |

| Tiltonsville | $124 | 0% |

| Timberlake | $114 | -8% |

| Tipp City | $112 | -10% |

| Tippecanoe | $126 | 1% |

| Tiro | $111 | -11% |

| Toledo | $138 | 11% |

| Tontogany | $107 | -14% |

| Toronto | $122 | -2% |

| Tremont City | $117 | -6% |

| Trenton | $121 | -3% |

| Trinway | $126 | 1% |

| Trotwood | $126 | 1% |

| Troy | $107 | -14% |

| Tuppers Plains | $134 | 7% |

| Turpin Hills | $125 | 0% |

| Tuscarawas | $119 | -5% |

| Twinsburg | $114 | -9% |

| Twinsburg Heights | $114 | -9% |

| Uhrichsville | $118 | -5% |

| Union | $116 | -7% |

| Union City | $109 | -12% |

| Union Furnace | $128 | 3% |

| Uniontown | $116 | -7% |

| Unionville | $121 | -3% |

| Unionville Center | $115 | -8% |

| Uniopolis | $108 | -13% |

| University Heights | $137 | 10% |

| Upper Arlington | $127 | 2% |

| Upper Sandusky | $108 | -13% |

| Urbana | $118 | -5% |

| Urbancrest | $124 | 0% |

| Utica | $126 | 1% |

| Valley City | $108 | -14% |

| Valley View | $127 | 2% |

| Valleyview | $138 | 11% |

| Van Buren | $106 | -15% |

| Van Wert | $104 | -16% |

| Vandalia | $116 | -7% |

| Vanlue | $107 | -14% |

| Vaughnsville | $108 | -13% |

| Venedocia | $107 | -14% |

| Vermilion | $108 | -13% |

| Verona | $116 | -7% |

| Versailles | $107 | -14% |

| Vickery | $106 | -15% |

| Vienna | $119 | -5% |

| Vincent | $128 | 3% |

| Vinton | $132 | 6% |

| Wadsworth | $108 | -13% |

| Waite Hill | $113 | -9% |

| Wakefield | $128 | 3% |

| Wakeman | $112 | -10% |

| Walbridge | $115 | -8% |

| Waldo | $117 | -6% |

| Walhonding | $129 | 4% |

| Walton Hills | $123 | -1% |

| Wapakoneta | $106 | -15% |

| Warnock | $126 | 1% |

| Warren | $121 | -3% |

| Warrensville Heights | $139 | 11% |

| Warsaw | $133 | 7% |

| Washington Court House | $114 | -8% |

| Washingtonville | $113 | -9% |

| Waterford | $129 | 4% |

| Waterloo | $132 | 6% |

| Waterville | $111 | -11% |

| Wauseon | $115 | -8% |

| Waverly | $124 | -1% |

| Waverly City | $124 | 0% |

| Wayland | $118 | -5% |

| Wayne | $107 | -14% |

| Waynesburg | $118 | -5% |

| Waynesfield | $109 | -12% |

| Waynesville | $118 | -5% |

| Wellington | $115 | -8% |

| Wellston | $128 | 3% |

| Wellsville | $122 | -2% |

| West Alexandria | $119 | -4% |

| West Carrollton | $116 | -7% |

| West Chester | $122 | -2% |

| West Elkton | $121 | -3% |

| West Farmington | $120 | -4% |

| West Hill | $120 | -4% |

| West Jefferson | $119 | -4% |

| West Lafayette | $124 | 0% |

| West Liberty | $116 | -7% |

| West Manchester | $116 | -7% |

| West Mansfield | $117 | -6% |

| West Millgrove | $108 | -13% |

| West Milton | $111 | -10% |

| West Point | $117 | -6% |

| West Portsmouth | $127 | 2% |

| West Salem | $115 | -8% |

| West Union | $131 | 5% |

| West Unity | $114 | -8% |

| Westerville | $124 | 0% |

| Westfield Center | $109 | -12% |

| Westlake | $116 | -6% |

| Weston | $110 | -12% |

| Westville | $119 | -4% |

| Wetherington | $122 | -2% |

| Wharton | $109 | -13% |

| Wheelersburg | $126 | 1% |

| Whipple | $126 | 1% |

| White Cottage | $125 | 0% |

| White Oak | $134 | 8% |

| Whitehall | $141 | 13% |

| Whitehouse | $113 | -9% |

| Wickliffe | $122 | -2% |

| Wilberforce | $118 | -5% |

| Wilkesville | $128 | 3% |

| Willard | $111 | -11% |

| Williamsburg | $122 | -2% |

| Williamsfield | $125 | 1% |

| Williamsport | $121 | -3% |

| Williamstown | $108 | -13% |

| Williston | $112 | -10% |

| Willoughby | $112 | -10% |

| Willoughby Hills | $116 | -6% |

| Willow Wood | $130 | 5% |

| Willowick | $115 | -8% |

| Willshire | $107 | -14% |

| Wilmington | $117 | -6% |

| Wilmot | $116 | -7% |

| Winchester | $127 | 2% |

| Windham | $117 | -6% |

| Windsor | $124 | 0% |

| Winesburg | $121 | -3% |

| Wingett Run | $128 | 2% |

| Winona | $117 | -6% |

| Wintersville | $124 | 0% |

| Withamsville | $120 | -4% |

| Wolf Run | $128 | 3% |

| Wolfhurst | $122 | -2% |

| Woodlawn | $130 | 4% |

| Woodmere | $133 | 7% |

| Woodsfield | $131 | 5% |

| Woodstock | $118 | -5% |

| Woodville | $106 | -15% |

| Wooster | $112 | -10% |

| Worthington | $125 | 1% |

| Wren | $108 | -13% |

| Wright-Patterson AFB | $114 | -8% |

| Wyoming | $130 | 5% |

| Xenia | $118 | -5% |

| Yellow Springs | $115 | -8% |

| Yorkshire | $109 | -13% |

| Yorkville | $125 | 0% |

| Youngstown | $133 | 7% |

| Zaleski | $131 | 5% |

| Zanesfield | $118 | -5% |

| Zanesville | $122 | -2% |

| Zoar | $118 | -5% |

Minimum coverage for car insurance in Ohio

You need car insurance to drive legally in Ohio. The state’s minimum car insurance requirements include:

-

Bodily injury liability

: $25,000 per person $50,000 per accidentBodily injury liability helps cover the medical bills of anyone you injure in a car accident.

-

Property damage liability

: $25,000Property damage liability covers damage you cause to other people’s vehicles and property like fences and light posts.

Collision

Most car insurance companies offer higher limits and additional coverages for extra protection. Of these, uninsured motorist

Uninsured motorist coverage is usually cheap. It can protect you from large expenses if you’re injured by a driver without insurance. Nearly 20% of Ohio drivers don’t have car insurance, according to the Insurance Research Council.

How does SR-22 insurance work in Ohio?

You usually need an SR-22/bond to reinstate your driver’s license after certain offenses in Ohio. These violations include OVI, reckless driving and driving without insurance.

An SR-22 is a form that shows you have car insurance. Your insurance company files it with the state when you buy your policy.

Most Ohio car insurance companies offer SR-22, but some don’t. It’s good to be upfront about your SR-22 requirement when you request a quote. This helps you get the most accurate quotes.

Geico has the cheapest SR-22 insurance in Ohio after a major violation like OVI. Westfield has the cheapest rates after lesser offenses like insurance violations.

Frequently asked questions

Car insurance costs an average of $124 a month in Ohio for full coverage. Liability-only insurance costs $48 a month. The price you pay depends on factors like your driving record and credit. Your location and the type of vehicle you drive can also affect your rate.

Yes, with some exceptions. Car insurance satisfies your financial responsibility requirements for driving legally in Ohio. You can post a bond with the state as an alternative to car insurance. However, getting car insurance is usually a more convenient option.

Ohio requires drivers to have car insurance with liability coverage. The minimum limits required for bodily injury liability are $25,000 per person and $50,000 per accident. The minimum for property damage limit is $25,000. You usually also need collision and comprehensive for a car loan or lease.

How we selected the cheapest car insurance companies in Ohio

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Ohio

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.