Cheapest Car Insurance in Rhode Island (2026)

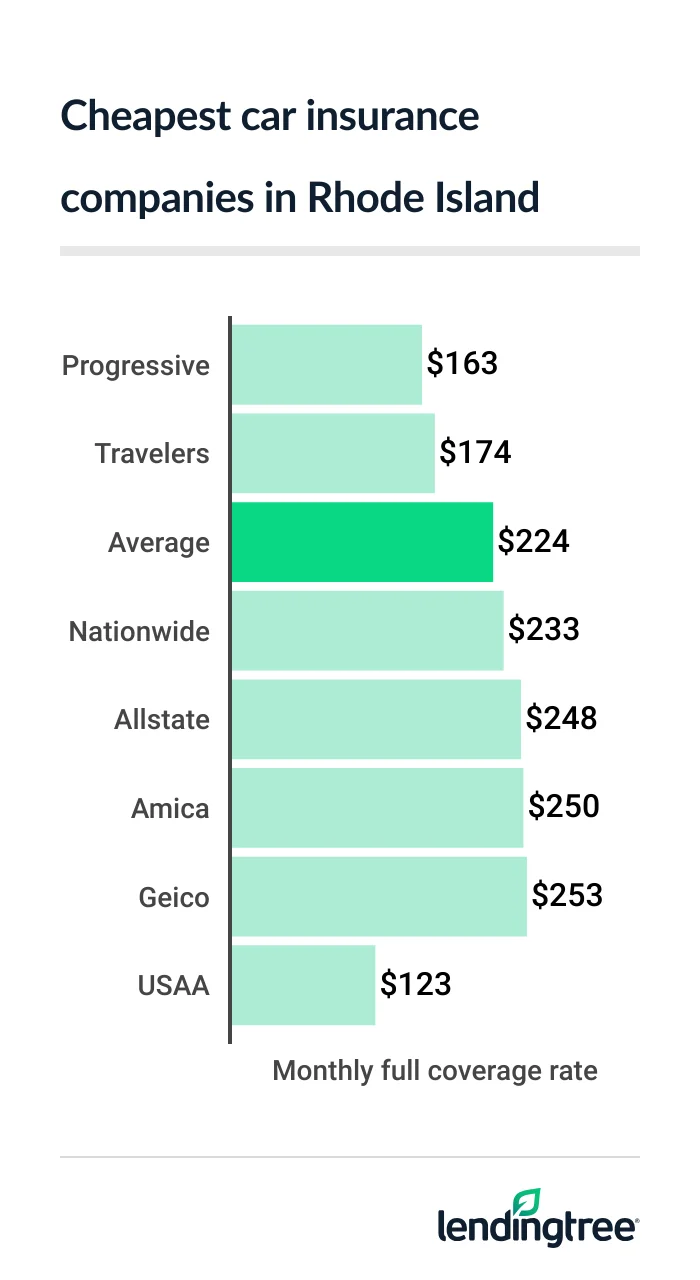

Progressive has the cheapest full coverage car insurance for most Rhode Island drivers, at $163 per month. This is $61 less than the state average.

Best cheap car insurance in Rhode Island

Cheapest full coverage car insurance in Rhode Island: Progressive

Progressive has the cheapest full coverage car insurance for most Rhode Island drivers, at an average rate of $163 per month.

USAA is $40 cheaper than Progressive, at $123 per month for a full coverage

Travelers also offers full coverage car insurance to Rhode Island drivers that is less than the state average of $224 per month.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Progressive | $163 | |

| Travelers | $174 | |

| Nationwide | $233 | |

| Allstate | $248 | |

| Amica | $250 | |

| Geico | $253 | |

| Farmers | $352 | |

| USAA* | $123 | |

Progressive and USAA both score better with customers than Travelers does, based on their J.D. Power satisfaction ratings

Cheap Rhode Island liability insurance: Travelers

With an average rate of $60 per month, Travelers has the cheapest liability insurance for most drivers in Rhode Island.

Progressive is $11 more, at $71 per month. The state average rate for liability

Liability car insurance rates

| Company | Monthly rate |

|---|---|

| Travelers | $60 |

| Progressive | $71 |

| Nationwide | $102 |

| Amica | $104 |

| Geico | $105 |

| Allstate | $120 |

| Farmers | $146 |

| USAA* | $47 |

Both Travelers and Progressive offer several car insurance discounts that can make your premium

Both Progressive and Travelers have discounts for insuring multiple vehicles or buying more than one policy from them. Only Travelers gives discounts for new, hybrid or electric cars, though. And only Progressive offers savings for going paperless or signing documents online.

Best cheap car insurance in Rhode Island for teen drivers: Progressive

Most drivers in Rhode Island get the cheapest teen car insurance from Progressive.

Progressive’s teen liability rates are the state’s lowest (after USAA), at $245 per month. It also has the lowest full coverage rates for most of the state’s teen drivers, at $554 per month.

Monthly auto insurance rates for teens

| Company | Liability only | Full coverage |

|---|---|---|

| Progressive | $245 | $554 |

| Allstate | $270 | $634 |

| Geico | $351 | $755 |

| Nationwide | $385 | $840 |

| Amica | $532 | $1,131 |

| Farmers | $567 | $1,133 |

| Travelers | $611 | $1,375 |

| USAA* | $207 | $516 |

Like many insurance companies, Progressive offers discounts to teens and young adults who get good grades or go to college without a vehicle.

Teen drivers may also save money on car insurance by signing up for Progressive’s Snapshot program. This usage-based insurance (UBI) program monitors your driving through a mobile app or plug-in device. The safer you drive, the better your discount.

One common car insurance discount Progressive doesn’t offer is for teens who complete a driver’s education program.

Cheap Rhode Island auto insurance after a speeding ticket: Progressive

Progressive is Rhode Island’s cheapest car insurance company for most drivers with a speeding ticket on their records. Its average rate for these drivers is $227 per month.

Car insurance rates with a speeding ticket

| Company | Monthly rate |

|---|---|

| Progressive | $227 |

| Amica | $250 |

| Nationwide | $286 |

| Allstate | $305 |

| Travelers | $324 |

| Farmers | $415 |

| Geico | $449 |

| USAA* | $140 |

Amica and Nationwide also offer rates for drivers with a ticket on their records that are cheaper than the state average of $299 per month.

You can expect your car insurance premium to go up about $75 per month after getting a speeding ticket in Rhode Island.

Rhode Island’s cheapest car insurance after an accident: Progressive

At $170 per month, Progressive has the cheapest car insurance after an accident for most Rhode Island drivers.

Travelers and Allstate are the next-cheapest companies after an accident, but their average rates are quite a bit higher than Progressive’s. Travelers’ average rate is $242 per month, while Allstate’s is $248.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Progressive | $170 |

| Travelers | $242 |

| Allstate | $248 |

| Geico | $327 |

| Nationwide | $362 |

| Amica | $399 |

| Farmers | $459 |

| USAA* | $123 |

A typical driver in Rhode Island pays $291 per month for car insurance after an at-fault accident. This is a little over $65 per month more than what the state’s drivers with clean records pay for the same coverage.

Best car insurance for Rhode Island teens with a bad driving record: Progressive

Teens in Rhode Island with a speeding ticket or accident on their driving records usually get the cheapest auto insurance from Progressive.

Progressive’s average quote for teens with a speeding ticket is $271 per month. For teens with an accident, the company’s quotes average $255 per month.

Monthly teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Progressive | $271 | $255 |

| Allstate | $300 | $270 |

| Nationwide | $416 | $423 |

| Geico | $491 | $409 |

| Amica | $532 | $671 |

| Farmers | $678 | $704 |

| Travelers | $750 | $722 |

| USAA* | $303 | $207 |

Allstate is the next-cheapest company for most of these teens. Its rates average $270 per month for teens after an accident and $300 for teens after a ticket.

Cheapest car insurance in Rhode Island after a DUI: Progressive

Progressive has the cheapest DUI insurance quotes for most Rhode Island drivers, at $208 per month. That’s less than half the state average of $512 per month for drivers with a DUI (driving under the influence) conviction.

Travelers and Allstate also come in well below the state average for DUI insurance. Travelers’ average rate is $343 per month, while Allstate’s is $368.

Auto insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $208 |

| Travelers | $343 |

| Allstate | $368 |

| Nationwide | $481 |

| Farmers | $595 |

| Amica | $898 |

| Geico | $915 |

| USAA* | $287 |

The average driver sees their car insurance costs more than double after getting a DUI in Rhode Island. You may see a smaller increase depending on your insurer, however. For example, Progressive only raises the rates of its customers 28% after a DUI, on average, or about $45 per month.

Best Rhode Island car insurance rates for bad credit: Progressive

With an average quote of $272 per month, Progressive also has the cheapest car insurance for drivers with bad credit for most Rhode Island drivers.

Amica, Geico and Nationwide are cheaper than the state average rate of $409 per month as well.

Auto insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Progressive | $272 |

| Amica | $349 |

| Geico | $362 |

| Nationwide | $400 |

| Travelers | $416 |

| Allstate | $455 |

| Farmers | $768 |

| USAA* | $253 |

In Rhode Island, the average driver with poor credit pays around $185 per month more for car insurance than a driver with good credit pays for the same policy. That’s an 83% increase.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance in Rhode Island

Progressive is the best car insurance company in Rhode Island, based on our data and research.

Most drivers in Rhode Island get the cheapest car insurance rates from Progressive, and its many discounts can make it even more affordable.

Progressive also stands out for offering more coverage options than most other car insurance companies. For an extra cost, you can get accident forgiveness

Rhode Island insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Amica | 735 | A+ | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

USAA should be your first stop if you or a family member are active duty or retired military, however.

USAA’s rates are even cheaper than Progressive’s for most of the driver and coverage types we surveyed in Rhode Island. And its reputation for customer service is unmatched by any other insurance company.

Rhode Island insurance rates by city

The cheapest city for car insurance in Rhode Island is Newport East, where rates average $174 per month.

Providence is the state’s most expensive city for car insurance. Rates there average $302 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Adamsville | $214 | -5% |

| Albion | $222 | -1% |

| Ashaway | $191 | -15% |

| Barrington | $212 | -6% |

| Block Island | $187 | -17% |

| Bradford | $191 | -15% |

| Bristol | $201 | -11% |

| Carolina | $198 | -12% |

| Central Falls | $277 | 24% |

| Charlestown | $197 | -12% |

| Chepachet | $222 | -1% |

| Clayville | $234 | 4% |

| Coventry | $210 | -6% |

| Cranston | $275 | 22% |

| Cumberland | $224 | 0% |

| Cumberland Hill | $224 | 0% |

| East Greenwich | $218 | -3% |

| East Providence | $242 | 8% |

| Exeter | $201 | -10% |

| Fiskeville | $241 | 7% |

| Forestdale | $225 | 0% |

| Foster | $232 | 4% |

| Glendale | $229 | 2% |

| Greene | $211 | -6% |

| Greenville | $235 | 5% |

| Harmony | $226 | 1% |

| Harrisville | $218 | -3% |

| Hope | $235 | 5% |

| Hope Valley | $193 | -14% |

| Hopkinton | $192 | -14% |

| Jamestown | $176 | -21% |

| Johnston | $285 | 27% |

| Kenyon | $198 | -12% |

| Kingston | $201 | -11% |

| Lincoln | $241 | 8% |

| Little Compton | $180 | -20% |

| Manville | $224 | 0% |

| Mapleville | $220 | -2% |

| Melville | $177 | -21% |

| Middletown | $174 | -22% |

| Misquamicut | $180 | -20% |

| Narragansett | $199 | -11% |

| Narragansett Pier | $199 | -11% |

| Newport | $181 | -19% |

| Newport East | $174 | -23% |

| North Kingstown | $202 | -10% |

| North Providence | $298 | 33% |

| North Scituate | $226 | 1% |

| North Smithfield | $216 | -4% |

| Oakland | $218 | -3% |

| Pascoag | $217 | -3% |

| Pawtucket | $266 | 19% |

| Peace Dale | $227 | 1% |

| Portsmouth | $180 | -20% |

| Providence | $302 | 35% |

| Prudence Island | $183 | -19% |

| Riverside | $252 | 12% |

| Rockville | $197 | -12% |

| Rumford | $260 | 16% |

| Saunderstown | $203 | -10% |

| Shannock | $200 | -11% |

| Slatersville | $219 | -3% |

| Slocum | $206 | -8% |

| Smithfield | $231 | 3% |

| Tiverton | $191 | -15% |

| Valley Falls | $223 | -1% |

| Wakefield | $200 | -11% |

| Wakefield-Peacedale | $200 | -11% |

| Warren | $212 | -6% |

| Warwick | $223 | -1% |

| West Greenwich | $216 | -4% |

| West Kingston | $203 | -9% |

| West Warwick | $225 | 0% |

| Westerly | $180 | -20% |

| Wood River Junction | $197 | -12% |

| Woonsocket | $223 | -1% |

| Wyoming | $195 | -13% |

The average cost of car insurance in Rhode Island’s other large cities:

- Cranston, $275 per month

- Pawtucket, $266 per month

- Warwick, $223 per month

Minimum coverage for car insurance in Rhode Island

You must have valid car insurance to register your vehicle and drive it legally in Rhode Island. To meet the state’s minimum auto insurance requirements, you need at least:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000 per accident

You can also meet the state’s requirements by getting a policy with a combined bodily injury and property damage liability limit of $75,000 per accident.

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you cause to someone else’s property, including their vehicles.

Rhode Island law doesn’t require full coverage, which usually includes collision

The Division of Motor Vehicles (DMV) uses an online system to verify the insurance status of registered vehicles. If the system detects a lapse in your car insurance coverage, it sends you an insurance verification letter.

Your registration can be revoked if you don’t get car insurance by the date specified in the letter.

Frequently asked questions

Car insurance in Rhode Island costs $94 a month, on average, if you only buy liability coverage. If you buy a full coverage policy, the state average cost is $224 a month.

No, Rhode Island isn’t a no-fault state. If you cause an accident, you have to pay for the other party’s medical treatment and car repairs. The liability coverage in your car insurance covers these expenses, up to your policy’s limits.

Rhode Island no longer requires SR-22 insurance. However, you still need to comply with an SR-22 requirement from another state if it’s still in effect when you move to Rhode Island.

In this situation, you need to let your new Rhode Island car insurance company know about your out-of-state SR-22 requirement. This lets your new company send the proper forms to your old state’s DMV.

How we selected the cheapest car insurance companies in Rhode Island

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Rhode Island

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.