Cheapest Car Insurance in South Carolina (2026)

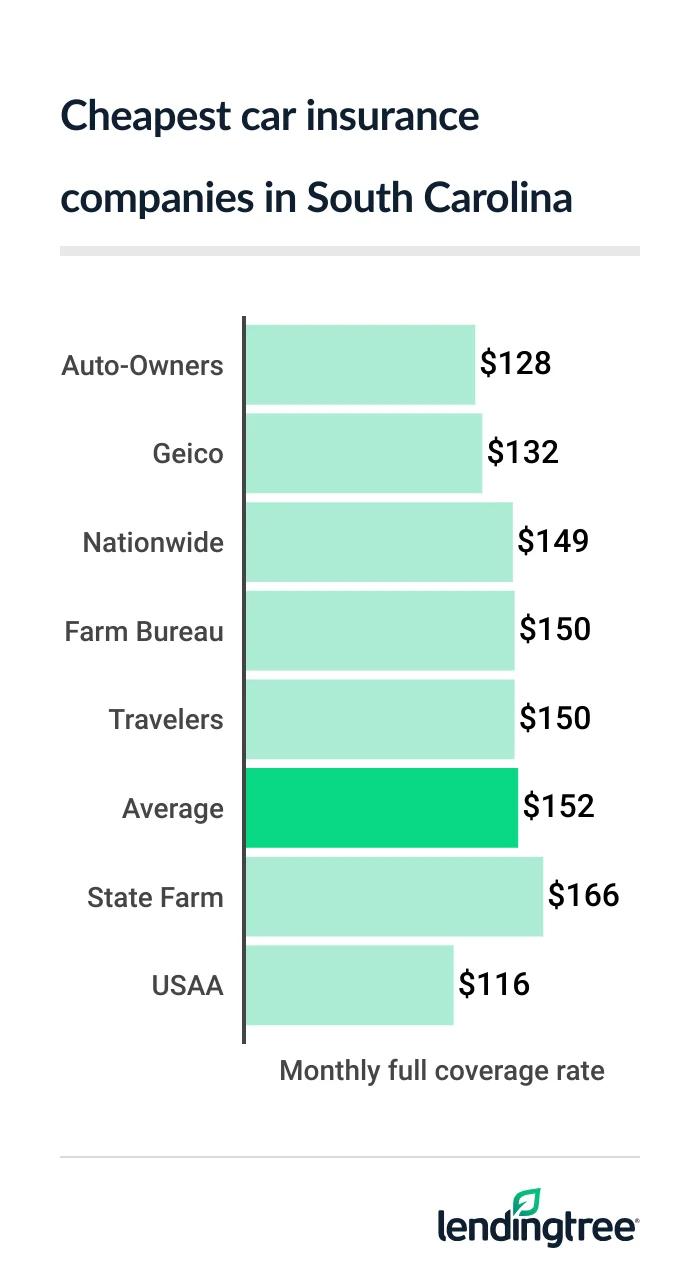

Auto-Owners has South Carolina’s cheapest full coverage car insurance for most drivers at $128 a month. This is $24 cheaper than the state average.

Best cheap South Carolina car insurance

Cheap South Carolina full coverage car insurance: Auto-Owners

Auto-Owners has the cheapest full coverage car insurance for most South Carolina drivers at $128 a month. USAA is cheaper, but it’s only available to the military community. Geico is slightly more expensive than Auto-Owners at $132 a month for full coverage

Full coverage car insurance costs an average of $152 a month in South Carolina. Auto-Owners and Geico both charge about 15% less than the state average.

Cheapest full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Auto-Owners | $128 | |

| Geico | $132 | |

| Nationwide | $149 | |

| Farm Bureau | $150 | |

| Travelers | $150 | |

| State Farm | $166 | |

| Progressive | $169 | |

| Allstate | $212 | |

| USAA* | $116 | |

Geico offers more discounts than Auto-Owners, which could make it your cheapest option. These include affiliation discounts for:

- Federal employees

- Members of participating professional and alumni groups

- Military service members

Auto-Owners is a better choice than Geico if you want gap insurance

South Carolina’s cheapest liability car insurance: Geico

At $55 a month, Geico has South Carolina’s cheapest liability insurance, or minimum coverage, for most drivers. This is 12% less than Auto-Owners rate of $63 a month. Minimum car insurance in South Carolina includes liability coverage

Cheap liability car insurance

| Company | Monthly rate |

|---|---|

| Geico | $55 |

| Auto-Owners | $63 |

| Progressive | $65 |

| State Farm | $70 |

| Nationwide | $70 |

| Farm Bureau | $70 |

| Travelers | $72 |

| Allstate | $94 |

| USAA* | $33 |

Liability auto insurance costs an average of $66 a month in South Carolina. Your actual rate depends on things like your driving record, location and credit history.

Companies treat these factors differently and offer different car insurance discounts. Depending on your situation, one company may offer you a much lower rate than the others. This makes it good to compare car insurance quotes from a few companies when you shop.

Best auto insurance rates for South Carolina teens: Farm Bureau

South Carolina Farm Bureau has the state’s cheapest car insurance for most teens. The company charges young drivers $160 a month for minimum coverage. This is 9% less than Geico’s rate of $175 a month.

Farm Bureau’s full coverage rates average $270 a month for teens. This works out to 12% less than Auto-Owners’ rate.

Cheap auto insurance for teens

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Farm Bureau | $160 | $270 |

| Geico | $175 | $351 |

| Auto-Owners | $184 | $306 |

| Nationwide | $189 | $340 |

| Travelers | $206 | $383 |

| State Farm | $227 | $448 |

| Allstate | $243 | $554 |

| Progressive | $310 | $758 |

| USAA* | $146 | $442 |

A lack of driving experience makes teens more likely to get into accidents. This is the main reason why they have such high auto insurance rates. Young drivers usually get cheaper rates when added to a parent’s policy than they do on their own.

Discounts also help make auto insurance more affordable for young drivers. Farm Bureau, Geico and Auto-Owners give teens discounts for getting good grades. Geico and Auto-Owners also give parents a discount if a teen on their policy goes off to college without a car.

Geico has additional discounts for:

- Teens who complete driver training

- Teens and parents who drive safely with its DriveEasy app

Geico’s DriveEasy app monitors your driving. You get discounts for avoiding risky and unsafe driving. The app also provides feedback you can use to improve your driving.

Programs like DriveEasy are also known as usage-based insurance (UBI). They’re available to drivers of any age. The discounts and driving tips may benefit teens the most.

Many other companies also have UBI programs, but not Farm Bureau. Auto-Owners gives teens a discount for using a GPS monitoring system, but it doesn’t have its own UBI app.

Cheap South Carolina auto insurance with a speeding ticket: Auto-Owners

Auto-Owners and Geico have South Carolina’s cheapest car insurance after a speeding ticket. Auto-Owners has the cheapest rate at $128 a month. Geico is only slightly more expensive at $132 a month.

Of the two, Geico has a slightly better satisfaction rating from J.D. Power

Auto insurance with a ticket

| Company | Monthly rate |

|---|---|

| Auto-Owners | $128 |

| Geico | $132 |

| Farm Bureau | $163 |

| State Farm | $177 |

| Nationwide | $178 |

| Travelers | $184 |

| Progressive | $233 |

| Allstate | $272 |

| USAA* | $142 |

Best car insurance in South Carolina after an accident: Auto-Owners

At $182 a month, Auto-Owners has South Carolina’s cheapest car insurance after an at-fault accident, but not by much. Farm Bureau and Geico each charge less than $10 more per month.

Cheapest insurance after an accident

| Company | Monthly rate |

|---|---|

| Auto-Owners | $182 |

| Farm Bureau | $188 |

| Geico | $190 |

| State Farm | $195 |

| Travelers | $200 |

| Nationwide | $208 |

| Progressive | $285 |

| Allstate | $398 |

| USAA* | $166 |

An at-fault accident raises the average price of car insurance by 47% to $223 a month. However, you may find cheaper car insurance with a bad driving record by shopping around.

Cheapest car insurance for South Carolina teens with a bad driving record: Geico

South Carolina teens with a bad driving record can get the cheapest car insurance from Geico. The company’s liability rates for young drivers with a ticket average $175 a month. This is 6% less than the next-cheapest rate of $188 a month from Farm Bureau.

Geico’s rates for teens with an accident average $196 a month. Nationwide only costs 5% more at $206 a month. However, Nationwide doesn’t have as many young driver discounts as Geico. This may make it hard for Nationwide to beat Geico’s rate.

Teen rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Geico | $175 | $196 |

| Farm Bureau | $188 | $214 |

| Nationwide | $203 | $206 |

| Auto-Owners | $220 | $287 |

| State Farm | $252 | $289 |

| Travelers | $259 | $295 |

| Allstate | $333 | $548 |

| Progressive | $349 | $372 |

| USAA* | $220 | $246 |

South Carolina’s cheapest car insurance after a DUI: Farm Bureau

At $174 a month, Farm Bureau has South Carolina’s cheapest car insurance after a driving under the influence conviction (DUI). Travelers has the next-cheapest DUI insurance at $212 a month. Although it’s more expensive, Travelers also offers gap insurance, which Farm Bureau does not have.

Cheap car insurance with a DUI

| Company | Monthly rate |

|---|---|

| Farm Bureau | $174 |

| Travelers | $212 |

| Progressive | $220 |

| Nationwide | $273 |

| Auto-Owners | $284 |

| Allstate | $289 |

| Geico | $312 |

| State Farm | $379 |

| USAA* | $214 |

Cheap South Carolina car insurance for bad credit: Nationwide

Drivers with bad credit can get South Carolina’s cheapest car insurance from Nationwide. The company’s bad-credit car insurance rates average $229 a month. This beats the next-cheapest rate of $256 a month from Travelers by 10%.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Nationwide | $229 |

| Travelers | $256 |

| Farm Bureau | $270 |

| Progressive | $274 |

| Geico | $290 |

| Allstate | $330 |

| Auto-Owners | $371 |

| State Farm | $625 |

| USAA* | $180 |

Insurance companies check your credit for things like late payments and the amounts you borrow. They believe your borrowing habits show how likely you are to have an accident or other claim. Avoiding late payments and paying down debts can help you get cheaper car insurance.

Best car insurance in South Carolina

Auto-Owners has the best car insurance for most South Carolina drivers. Along with low rates, Auto-Owners offers more coverage options than Geico and Farm Bureau. These include gap insurance and accident forgiveness.

Geico has more discounts than Auto-Owners and most other companies. Along with its affiliation and teen discounts, Geico also offers discounts for:

- Driving a new car

- Having a clean driving record

- Getting a quote online

- Choosing a paperless policy

- Setting up automatic payments.

- Owning your home

These can help make Geico your cheapest option, if you qualify for enough of them.

USAA is the best choice if you meet its eligibility requirements. It doesn’t have a specific military discount like Geico. However, it does generally have low car insurance rates for current and former service members and their families.

For example, USAA has South Carolina’s cheapest overall full coverage for drivers with a clean record. USAA also has a better customer satisfaction rating than almost every other company. This means customers like its prices, coverage options and customer service.

Car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

South Carolina car insurance rates by city

South Carolina car insurance rates range from $133 a month in Walhalla to $202 a month in Crocketville.

Accident and crime rates are among the factors that impact an area’s car insurance prices. High medical and car repair costs can also drive up insurance rates in your city or town.

Charleston drivers pay an average of $175 a month for car insurance. This is 15% higher than the state average. Car insurance costs $166 a month in Columbia, or 9% more than the average.

Car insurance rates near you

| City | Monthly rate | City rate vs. state average |

|---|---|---|

| Abbeville | $146 | -4% |

| Adams Run | $185 | 22% |

| Aiken | $142 | -7% |

| Alcolu | $164 | 8% |

| Allendale | $191 | 25% |

| Anderson | $148 | -3% |

| Andrews | $172 | 13% |

| Arcadia | $156 | 3% |

| Arcadia Lakes | $162 | 6% |

| Arial | $143 | -6% |

| Awendaw | $165 | 8% |

| Aynor | $168 | 11% |

| Ballentine | $168 | 10% |

| Bamberg | $166 | 9% |

| Barnwell | $166 | 9% |

| Batesburg | $152 | 0% |

| Batesburg-leesville | $148 | -3% |

| Bath | $147 | -3% |

| Beaufort | $153 | 0% |

| Beech Island | $150 | -2% |

| Belton | $151 | -1% |

| Belvedere | $146 | -4% |

| Bennettsville | $162 | 7% |

| Berea | $158 | 4% |

| Bethera | $188 | 23% |

| Bethune | $159 | 4% |

| Bishopville | $169 | 11% |

| Blacksburg | $152 | 0% |

| Blackstock | $168 | 10% |

| Blackville | $166 | 9% |

| Blair | $168 | 10% |

| Blenheim | $169 | 11% |

| Bluffton | $150 | -1% |

| Blythewood | $161 | 5% |

| Boiling Springs | $146 | -4% |

| Bonneau Beach | $172 | 13% |

| Bowling Green | $159 | 5% |

| Bowman | $172 | 13% |

| Bradley | $150 | -2% |

| Branchville | $174 | 14% |

| Briarcliffe Acres | $149 | -2% |

| Brookdale | $173 | 14% |

| Brunson | $191 | 25% |

| Buffalo | $158 | 4% |

| Burnettown | $142 | -7% |

| Burton | $154 | 1% |

| Cades | $172 | 13% |

| Calhoun Falls | $147 | -4% |

| Camden | $161 | 6% |

| Cameron | $173 | 13% |

| Campobello | $145 | -5% |

| Canadys | $197 | 29% |

| Carlisle | $157 | 3% |

| Cassatt | $159 | 4% |

| Catawba | $153 | 0% |

| Cayce | $158 | 4% |

| Centerville | $145 | -5% |

| Central | $136 | -11% |

| Central Pacolet | $151 | -1% |

| Chapin | $160 | 5% |

| Chappells | $149 | -2% |

| Charleston | $175 | 15% |

| Charleston AFB | $177 | 16% |

| Cheraw | $155 | 2% |

| Cherryvale | $164 | 7% |

| Chesnee | $146 | -4% |

| Chester | $158 | 4% |

| Chesterfield | $154 | 1% |

| City View | $161 | 6% |

| Clarks Hill | $152 | 0% |

| Clearwater | $147 | -3% |

| Clemson | $138 | -10% |

| Cleveland | $145 | -5% |

| Clifton | $158 | 4% |

| Clinton | $147 | -3% |

| Clio | $167 | 9% |

| Clover | $153 | 0% |

| Columbia | $166 | 9% |

| Conestee | $159 | 5% |

| Converse | $158 | 3% |

| Conway | $168 | 10% |

| Coosawhatchie | $181 | 19% |

| Cope | $167 | 10% |

| Cordesville | $177 | 16% |

| Cordova | $169 | 11% |

| Cottageville | $182 | 20% |

| Coward | $175 | 15% |

| Cowpens | $154 | 1% |

| Crocketville | $202 | 33% |

| Cross | $181 | 19% |

| Cross Anchor | $156 | 2% |

| Cross Hill | $147 | -4% |

| Dale | $177 | 16% |

| Dalzell | $165 | 9% |

| Darlington | $167 | 10% |

| Daufuskie Island | $152 | 0% |

| Davis Station | $175 | 15% |

| Denmark | $169 | 11% |

| Dentsville | $169 | 11% |

| Dillon | $172 | 13% |

| Donalds | $148 | -3% |

| Dorchester | $176 | 15% |

| Drayton | $151 | -1% |

| Due West | $149 | -2% |

| Duncan | $151 | -1% |

| Dunean | $158 | 4% |

| Early Branch | $187 | 23% |

| Easley | $145 | -5% |

| East Gaffney | $152 | 0% |

| East Sumter | $169 | 11% |

| Eastover | $170 | 12% |

| Edgefield | $149 | -2% |

| Edgemoor | $159 | 4% |

| Edisto | $170 | 12% |

| Edisto Island | $186 | 22% |

| Effingham | $172 | 13% |

| Ehrhardt | $179 | 17% |

| Elgin | $166 | 9% |

| Elko | $164 | 8% |

| Elliott | $172 | 13% |

| Elloree | $169 | 11% |

| Enoree | $147 | -3% |

| Estill | $195 | 28% |

| Eureka Mill | $157 | 3% |

| Eutawville | $174 | 14% |

| Fair Play | $138 | -10% |

| Fairfax | $194 | 27% |

| Fairforest | $154 | 1% |

| Five Forks | $146 | -4% |

| Florence | $170 | 12% |

| Folly Beach | $168 | 10% |

| Forest Acres | $165 | 8% |

| Forestbrook | $158 | 4% |

| Fork | $169 | 11% |

| Fort Lawn | $163 | 7% |

| Fort Mill | $151 | -1% |

| Fountain Inn | $144 | -5% |

| Furman | $193 | 27% |

| Gable | $172 | 13% |

| Gadsden | $173 | 14% |

| Gaffney | $152 | 0% |

| Galivants Ferry | $169 | 11% |

| Gantt | $154 | 1% |

| Garden City | $154 | 1% |

| Garnett | $189 | 24% |

| Gaston | $168 | 10% |

| Gayle Mill | $158 | 4% |

| Georgetown | $167 | 9% |

| Gifford | $188 | 23% |

| Gilbert | $156 | 2% |

| Glendale | $157 | 3% |

| Gloverville | $143 | -6% |

| Golden Grove | $148 | -3% |

| Goose Creek | $176 | 15% |

| Gramling | $146 | -4% |

| Graniteville | $143 | -6% |

| Gray Court | $144 | -5% |

| Great Falls | $174 | 14% |

| Greeleyville | $168 | 10% |

| Green Pond | $185 | 22% |

| Green Sea | $169 | 11% |

| Greenville | $153 | 1% |

| Greenwood | $145 | -5% |

| Greer | $149 | -2% |

| Gresham | $175 | 15% |

| Grover | $184 | 21% |

| Hamer | $174 | 14% |

| Hampton | $191 | 26% |

| Hanahan | $173 | 14% |

| Hardeeville | $165 | 8% |

| Harleyville | $173 | 13% |

| Hartsville | $164 | 8% |

| Heath Springs | $168 | 10% |

| Hemingway | $170 | 12% |

| Hickory Grove | $151 | -1% |

| Hilda | $166 | 9% |

| Hilton Head Island | $146 | -4% |

| Hodges | $145 | -5% |

| Holly Hill | $171 | 12% |

| Hollywood | $189 | 24% |

| Homeland Park | $150 | -2% |

| Honea Path | $153 | 0% |

| Hopkins | $170 | 12% |

| Horatio | $167 | 10% |

| Huger | $180 | 18% |

| India Hook | $148 | -3% |

| Inman | $145 | -5% |

| Inman Mills | $143 | -6% |

| Irmo | $158 | 3% |

| Irwin | $170 | 12% |

| Islandton | $187 | 23% |

| Isle Of Palms | $159 | 4% |

| Iva | $153 | 0% |

| Jackson | $149 | -2% |

| Jacksonboro | $192 | 26% |

| Jamestown | $177 | 16% |

| Jefferson | $154 | 1% |

| Jenkinsville | $164 | 8% |

| Joanna | $147 | -4% |

| Johns Island | $175 | 15% |

| Johnsonville | $173 | 13% |

| Johnston | $152 | 0% |

| Jonesville | $156 | 2% |

| Judson | $161 | 6% |

| Kershaw | $161 | 5% |

| Kiawah Island | $173 | 14% |

| Kinards | $147 | -4% |

| Kingstree | $169 | 11% |

| La France | $142 | -7% |

| Ladson | $180 | 18% |

| Lake City | $173 | 14% |

| Lake Murray of Richland | $159 | 5% |

| Lake Secession | $150 | -2% |

| Lake View | $169 | 11% |

| Lake Wylie | $153 | 1% |

| Lakewood | $168 | 10% |

| Lamar | $165 | 8% |

| Lancaster | $170 | 12% |

| Lando | $174 | 15% |

| Landrum | $143 | -6% |

| Lane | $170 | 11% |

| Langley | $142 | -7% |

| Latta | $172 | 13% |

| Laurel Bay | $155 | 2% |

| Laurens | $145 | -5% |

| Leesville | $151 | -1% |

| Lesslie | $154 | 1% |

| Lexington | $157 | 3% |

| Liberty | $141 | -7% |

| Liberty Hill | $162 | 7% |

| Little Mountain | $154 | 1% |

| Little River | $158 | 4% |

| Little Rock | $173 | 14% |

| Livingston | $173 | 13% |

| Lobeco | $161 | 5% |

| Lodge | $184 | 21% |

| Long Creek | $136 | -10% |

| Longs | $161 | 6% |

| Loris | $169 | 11% |

| Lowndesville | $148 | -3% |

| Lugoff | $160 | 5% |

| Luray | $190 | 25% |

| Lydia | $164 | 8% |

| Lyman | $151 | -1% |

| Lynchburg | $173 | 14% |

| Manning | $165 | 9% |

| Marietta | $147 | -4% |

| Marion | $169 | 11% |

| Martin | $177 | 16% |

| Mauldin | $146 | -4% |

| Mayesville | $172 | 13% |

| Mayo | $152 | 0% |

| Mc Bee | $157 | 3% |

| Mc Clellanville | $165 | 8% |

| Mc Coll | $168 | 10% |

| McConnells | $152 | 0% |

| McCormick | $151 | -1% |

| Meggett | $189 | 24% |

| Miley | $201 | 32% |

| Modoc | $151 | -1% |

| Monarch Mill | $158 | 4% |

| Moncks Corner | $179 | 18% |

| Monetta | $148 | -3% |

| Montmorenci | $151 | -1% |

| Moore | $151 | -1% |

| Mount Carmel | $148 | -3% |

| Mount Croghan | $156 | 2% |

| Mount Pleasant | $158 | 4% |

| Mountain Rest | $136 | -11% |

| Mountville | $147 | -3% |

| Mullins | $167 | 10% |

| Murphys Estates | $150 | -1% |

| Murrells Inlet | $152 | 0% |

| Myrtle Beach | $155 | 2% |

| Neeses | $172 | 13% |

| Nesmith | $175 | 15% |

| New Ellenton | $140 | -8% |

| New Zion | $169 | 11% |

| Newberry | $146 | -4% |

| Newport | $149 | -2% |

| Newry | $134 | -12% |

| Nichols | $170 | 11% |

| Ninety Six | $148 | -3% |

| Norris | $141 | -8% |

| North | $171 | 12% |

| North Augusta | $148 | -3% |

| North Charleston | $181 | 19% |

| North Hartsville | $164 | 8% |

| North Myrtle Beach | $148 | -3% |

| Northlake | $143 | -6% |

| Norway | $171 | 12% |

| Oak Grove | $158 | 4% |

| Oakland | $166 | 9% |

| Okatie | $153 | 1% |

| Olanta | $173 | 13% |

| Olar | $167 | 9% |

| Orangeburg | $172 | 13% |

| Pacolet | $152 | 0% |

| Pacolet Mills | $164 | 8% |

| Pageland | $158 | 4% |

| Pamplico | $178 | 17% |

| Parker | $159 | 5% |

| Parris Island | $175 | 15% |

| Patrick | $159 | 4% |

| Pauline | $149 | -2% |

| Pawleys Island | $151 | -1% |

| Peak | $167 | 10% |

| Pelion | $164 | 8% |

| Pelzer | $149 | -2% |

| Pendleton | $140 | -8% |

| Pickens | $140 | -8% |

| Piedmont | $150 | -2% |

| Pine Ridge | $163 | 7% |

| Pineland | $188 | 23% |

| Pineville | $181 | 19% |

| Pinewood | $170 | 12% |

| Pinopolis | $174 | 14% |

| Plum Branch | $151 | -1% |

| Pomaria | $154 | 1% |

| Port Royal | $152 | 0% |

| Powdersville | $148 | -3% |

| Privateer | $166 | 9% |

| Prosperity | $147 | -3% |

| Rains | $168 | 10% |

| Ravenel | $188 | 24% |

| Red Bank | $158 | 4% |

| Red Hill | $164 | 8% |

| Reevesville | $172 | 13% |

| Rembert | $168 | 10% |

| Richburg | $162 | 7% |

| Richland | $142 | -7% |

| Ridge Spring | $149 | -2% |

| Ridgeland | $181 | 19% |

| Ridgeville | $178 | 17% |

| Ridgeway | $165 | 8% |

| Rion | $177 | 16% |

| Rock Hill | $158 | 4% |

| Roebuck | $151 | -1% |

| Round O | $185 | 21% |

| Rowesville | $172 | 13% |

| Ruby | $155 | 2% |

| Ruffin | $181 | 19% |

| Russellville | $185 | 22% |

| Salem | $134 | -12% |

| Salley | $159 | 4% |

| Salters | $166 | 9% |

| Saluda | $150 | -2% |

| Sandy Springs | $142 | -7% |

| Sangaree | $175 | 15% |

| Sans Souci | $153 | 1% |

| Santee | $169 | 11% |

| Saxon | $157 | 3% |

| Scotia | $187 | 23% |

| Scranton | $174 | 14% |

| Seabrook | $158 | 4% |

| Seabrook Island | $175 | 15% |

| Sellers | $170 | 12% |

| Seneca | $134 | -12% |

| Seven Oaks | $161 | 5% |

| Sharon | $152 | 0% |

| Shaw AFB | $164 | 7% |

| Sheldon | $157 | 3% |

| Shell Point | $154 | 1% |

| Silverstreet | $148 | -3% |

| Simpsonville | $142 | -7% |

| Six Mile | $138 | -10% |

| Slater | $148 | -3% |

| Slater-Marietta | $147 | -3% |

| Smoaks | $186 | 22% |

| Smyrna | $151 | -1% |

| Socastee | $159 | 4% |

| Society Hill | $165 | 8% |

| South Congaree | $160 | 5% |

| South Sumter | $170 | 11% |

| Southern Shops | $152 | 0% |

| Spartanburg | $153 | 0% |

| Springdale | $164 | 8% |

| Springfield | $172 | 13% |

| St. Andrews | $163 | 7% |

| St. George | $175 | 15% |

| St. Helena Island | $156 | 3% |

| St. Matthews | $169 | 11% |

| St. Stephen | $176 | 15% |

| Starr | $152 | 0% |

| Startex | $152 | 0% |

| State Park | $175 | 15% |

| Sullivan’s Island | $160 | 5% |

| Summerton | $161 | 6% |

| Summerville | $177 | 16% |

| Sumter | $167 | 10% |

| Sunset | $138 | -10% |

| Surfside Beach | $155 | 2% |

| Swansea | $164 | 7% |

| Tamassee | $136 | -11% |

| Tatum | $167 | 9% |

| Taylors | $150 | -1% |

| Tega Cay | $150 | -2% |

| Tillman | $177 | 16% |

| Timmonsville | $172 | 13% |

| Townville | $139 | -9% |

| Travelers Rest | $148 | -3% |

| Trenton | $149 | -2% |

| Troy | $146 | -4% |

| Turbeville | $170 | 12% |

| Ulmer | $181 | 19% |

| Una | $161 | 6% |

| Union | $157 | 3% |

| Utica | $135 | -11% |

| Valley Falls | $149 | -2% |

| Vance | $170 | 12% |

| Varnville | $187 | 23% |

| Vaucluse | $143 | -6% |

| Wade Hampton | $149 | -2% |

| Wadmalaw Island | $182 | 20% |

| Wagener | $150 | -1% |

| Walhalla | $133 | -13% |

| Wallace | $160 | 5% |

| Walterboro | $181 | 19% |

| Ward | $152 | 0% |

| Ware Shoals | $148 | -3% |

| Warrenville | $142 | -7% |

| Waterloo | $145 | -5% |

| Watts Mills | $145 | -5% |

| Wedgefield | $166 | 9% |

| Welcome | $161 | 6% |

| Wellford | $151 | -1% |

| West Columbia | $159 | 4% |

| West Pelzer | $148 | -3% |

| West Union | $134 | -12% |

| Westminster | $134 | -12% |

| Westville | $159 | 4% |

| White Rock | $159 | 4% |

| White Stone | $156 | 3% |

| Whitmire | $153 | 0% |

| Wilkinson Heights | $174 | 14% |

| Williams | $181 | 19% |

| Williamston | $148 | -3% |

| Williston | $162 | 6% |

| Windsor | $148 | -3% |

| Winnsboro | $170 | 12% |

| Winnsboro Mills | $170 | 11% |

| Woodfield | $167 | 10% |

| Woodruff | $146 | -4% |

| Yemassee | $180 | 18% |

| York | $149 | -2% |

Minimum coverage for car insurance in South Carolina

You need car insurance to drive legally in South Carolina. The state’s minimum car insurance requirements include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

- Uninsured motorist bodily injury: $25,000 per person, $50,000 per accident

- Uninsured motorist property damage: $25,000

Bodily injury liability helps cover the medical bills of other people you injure in a car accident.

Physical damage liability covers damage you cause to other people’s vehicles or property.

Uninsured motorist covers you and your passengers for injuries and damage caused by a driver with no car insurance.

Collision

How we selected the cheapest car insurance companies in South Carolina

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in South Carolina

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.