Cheapest Car Insurance in Tennessee (2026)

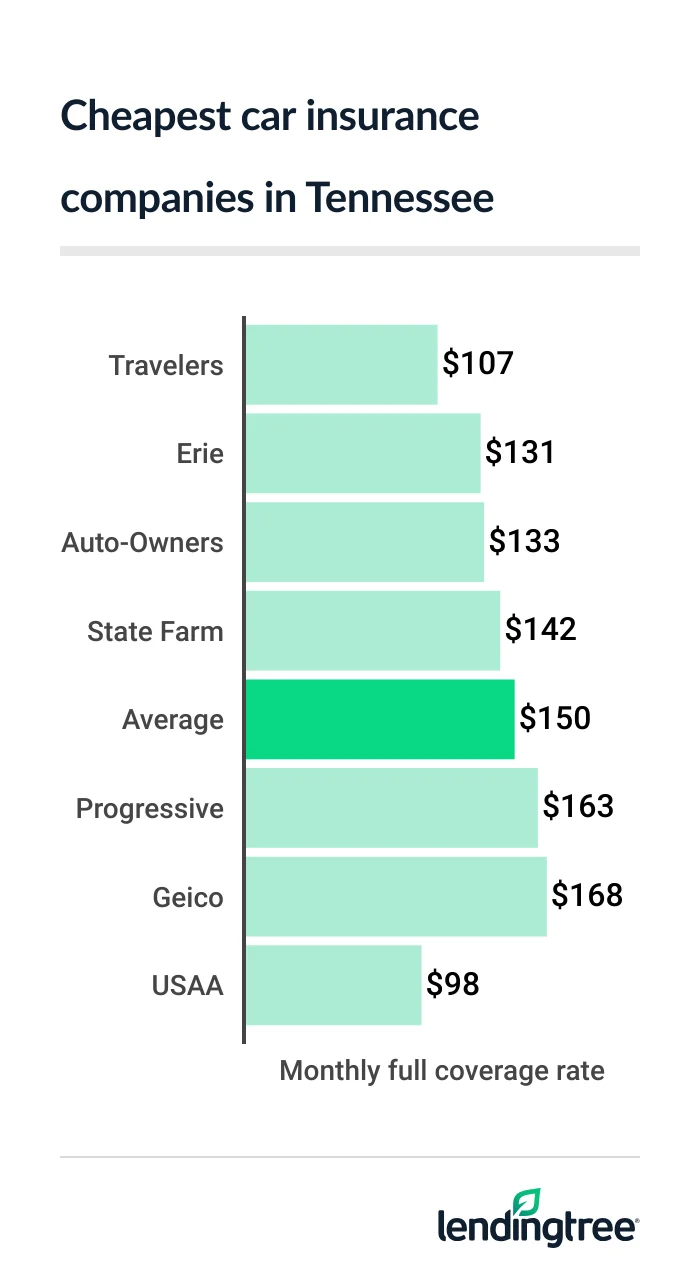

Travelers has the cheapest full coverage car insurance for most Tennessee drivers, at $107 a month. Erie has the cheapest liability-only coverage, at $38 a month.

Beat Cheap TN car insurance

Cheapest full coverage car insurance in Tennessee: Travelers

Travelers has the cheapest full coverage car insurance for most Tennessee drivers, at $107 a month. USAA is even cheaper for full coverage

Full coverage costs an average of $150 a month in Tennessee. The actual price you pay depends on factors like your driving record, vehicle and credit history.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $107 | |

| Erie | $131 | |

| Auto-Owners | $133 | |

| State Farm | $142 | |

| Progressive | $163 | |

| Geico | $168 | |

| Farmers | $180 | |

| Allstate | $229 | |

| USAA* | $98 | |

Companies treat these factors differently and offer different car insurance discounts. It’s good to compare car insurance quotes from a few companies to find the cheapest rate.

Tennessee’s cheapest liability auto insurance: Erie

At $38 a month, Erie has the cheapest liability insurance for most Tennessee drivers. Travelers and State Farm are only slightly more expensive for liability-only

Cheap liability insurance

| Company | Monthly rate |

|---|---|

| Erie | $38 |

| Travelers | $41 |

| State Farm | $41 |

| Auto-Owners | $44 |

| Farmers | $59 |

| Progressive | $71 |

| Geico | $72 |

| Allstate | $86 |

| USAA* | $29 |

The discounts you can get may determine the cheapest company for you.

- Travelers has discounts for new cars, homeowners and hybrid or electric vehicles. These can make it your cheapest option if you qualify.

- Travelers and State Farm give you discounts for using their safe-driving apps. Travelers may raise your rate if its app detects unsafe driving. State Farm won’t.

- Erie has fewer discounts than State Farm and Travelers. Its safe-driving app gives you gift cards for driving safely, but not insurance discounts.

Safe-driving apps are also known as usage-based insurance, or UBI. Several companies have them.

Best cheap auto insurance for TN teens: Erie and Travelers

Erie and Travelers have Tennessee’s cheapest car insurance for teens. Erie has the cheapest liability-only insurance for most young drivers, at $93 a month. This is 17% less than Travelers’ rate of $112 a month.

Travelers has the cheapest full coverage for most teens at $281 a month. Erie’s rate is 12% higher at $315 a month.

Cheapest car insurance for teens

| Company | Liability only | Full coverage |

|---|---|---|

| Erie | $93 | $315 |

| Travelers | $112 | $281 |

| State Farm | $142 | $417 |

| Geico | $159 | $334 |

| Auto-Owners | $194 | $453 |

| Progressive | $223 | $572 |

| Farmers | $247 | $628 |

| Allstate | $326 | $823 |

| USAA* | $85 | $259 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why car insurance costs so much for young drivers. Teens usually get lower rates on a parent’s policy than they do on their own.

Discounts can also make car insurance more affordable for young drivers.

- Erie has a youthful driver discount for unmarried drivers who live with their parents.

- Travelers gives teens a discount for getting good grades.

- Both companies give teens a discount for completing a driver training program.

The discounts available to teens vary by company. You should ask about them with your quotes to make sure they don’t get overlooked.

Cheap Tennessee car insurance after a speeding ticket: Auto-Owners

Most Tennessee drivers with a speeding ticket get the cheapest car insurance from Auto-Owners. The company’s rates average $133 a month after a ticket. Travelers and Erie are the next-cheapest companies, at about $140 a month each.

Of the three, Erie has the best satisfaction rating from J.D. Power

Cheapest car insurance with a ticket

| Company | Monthly rate |

|---|---|

| Auto-Owners | $133 |

| Travelers | $140 |

| Erie | $142 |

| State Farm | $154 |

| Farmers | $220 |

| Geico | $228 |

| Progressive | $242 |

| Allstate | $331 |

| USAA* | $117 |

The average cost of insurance goes up by 26% after a speeding ticket to $190 a month. However, some companies raise their rates by smaller amounts. Shopping around can help you find cheaper car insurance with a bad driving record.

Best TN car insurance rates after an accident: State Farm

State Farm has the cheapest car insurance for most Tennessee drivers with an at-fault accident. Its rates average $142 a month. This is only slightly cheaper than Travelers’ rate of $149 a month after an accident.

State Farm also has a better satisfaction rating than Travelers. This usually means better customer service. However, Travelers is a good choice if you need gap insurance

Cheapest car insurance with an accident

| Company | Monthly rate |

|---|---|

| State Farm | $142 |

| Travelers | $149 |

| Erie | $190 |

| Farmers | $222 |

| Auto-Owners | $223 |

| Progressive | $225 |

| Geico | $250 |

| Allstate | $450 |

| USAA* | $141 |

Best insurance for TN teens with bad driving records: Erie and Travelers

Most teens with bad driving records get the cheapest car insurance quotes from Erie. Erie charges teens with a ticket $109 a month for liability insurance. This is 25% cheaper than Travelers’ rate of $144 a month.

Erie’s rates for teens with an at-fault accident average $130 a month. This is 8% less than State Farm’s rate of $142 a month.

Insurance rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Erie | $109 | $130 |

| Travelers | $144 | $175 |

| State Farm | $157 | $142 |

| Auto-Owners | $194 | $289 |

| Geico | $196 | $220 |

| Progressive | $237 | $242 |

| Farmers | $290 | $297 |

| Allstate | $537 | $628 |

| USAA* | $94 | $103 |

Cheapest Tennessee car insurance after a DUI: Travelers

At $159 a month, Travelers has Tennessee’s cheapest car insurance after a DUI (driving under the influence). Progressive is the next-cheapest company, at $214 a month, which is 34% higher than Travelers’ rate.

Cheapest car insurance with a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $159 |

| Progressive | $214 |

| Erie | $238 |

| Farmers | $260 |

| Geico | $268 |

| State Farm | $299 |

| Allstate | $305 |

| Auto-Owners | $309 |

| USAA* | $187 |

Travelers and Progressive are available from independent insurance agents. Erie and Auto-Owners are, too. Many independent agents can get you quotes from all or most of these companies at the same time. This makes comparison shopping a little easier.

State Farm and Allstate are among the companies with exclusive agents. You have to contact exclusive-agent companies separately to get their quotes.

Best bad credit car insurance rates in Tennessee: Travelers

Most Tennessee drivers with bad credit get the cheapest car insurance quotes from Travelers. The company’s bad-credit car insurance rates average $184 a month. This is 28% less than the next-cheapest rate of $255 a month from Farmers.

Cheap car insurance for bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $184 |

| Farmers | $255 |

| Progressive | $258 |

| Geico | $270 |

| Erie | $301 |

| Auto-Owners | $352 |

| Allstate | $398 |

| State Farm | $600 |

| USAA* | $177 |

Drivers with bad credit pay an average of $310 a month for car insurance. This is more than twice as much as drivers with good credit pay.

Insurance companies check your credit for things like your payment history and the amounts you borrow. Avoiding late payments and paying down debts can help lower your car insurance rate.

Best car insurance in Tennessee

Erie’s low rates and excellent satisfaction rating help make it Tennessee’s best car insurance company. It has the state’s cheapest liability insurance. Its full coverage rate is 13% less than the state average.

A high satisfaction rating means customers love Erie for its prices, coverage options and service. One perk of getting a policy from Erie is that it will cover your pet if it’s injured while riding in your car. The company also gives you free accident forgiveness

USAA is the only Tennessee company with a better satisfaction score than Erie. USAA also has the cheapest rates for most types of drivers. These factors help make USAA your best car insurance choice if you meet its eligibility requirements

Car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Erie | 703 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Tennessee car insurance rates by city

Memphis has the most expensive car insurance among Tennessee’s cities and towns, at $222 a month. This is 48% higher than the state average.

Nashville drivers pay an average of $162 a month, or 8% more than the state average.

Car insurance tends to cost more in areas with high accident and crime rates. High medical and car repair costs can also drive up an area’s car insurance costs.

Johnson City is one of five cities with the state’s cheapest rate of $129 a month. The others are Central, Pine Crest, Bristol and Walnut Hill.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Adams | $157 | 5% |

| Adamsville | $167 | 11% |

| Afton | $138 | -8% |

| Alamo | $164 | 9% |

| Alcoa | $143 | -5% |

| Alexandria | $159 | 6% |

| Algood | $140 | -7% |

| Allardt | $157 | 5% |

| Allons | $155 | 3% |

| Allred | $157 | 5% |

| Alpine | $157 | 4% |

| Altamont | $157 | 4% |

| Andersonville | $150 | 0% |

| Antioch | $173 | 15% |

| Apison | $148 | -1% |

| Ardmore | $162 | 7% |

| Arlington | $182 | 21% |

| Arnold AFB | $149 | -1% |

| Arrington | $146 | -3% |

| Arthur | $154 | 2% |

| Ashland City | $160 | 6% |

| Athens | $145 | -3% |

| Atoka | $179 | 19% |

| Atwood | $164 | 9% |

| Auburntown | $154 | 2% |

| Bakewell | $151 | 0% |

| Banner Hill | $131 | -13% |

| Bartlett | $192 | 28% |

| Bath Springs | $162 | 8% |

| Baxter | $142 | -5% |

| Bean Station | $145 | -4% |

| Beech Bluff | $162 | 7% |

| Beechgrove | $150 | 0% |

| Beersheba Springs | $157 | 5% |

| Belfast | $159 | 6% |

| Bell Buckle | $151 | 1% |

| Belle Meade | $153 | 2% |

| Bells | $164 | 9% |

| Belvidere | $149 | -1% |

| Benton | $148 | -1% |

| Berry Hill | $162 | 8% |

| Bethel Springs | $168 | 12% |

| Bethpage | $150 | 0% |

| Big Rock | $159 | 6% |

| Big Sandy | $171 | 14% |

| Birchwood | $152 | 1% |

| Blaine | $148 | -1% |

| Bloomingdale | $133 | -11% |

| Bloomington Springs | $154 | 2% |

| Blountville | $133 | -12% |

| Bluff City | $132 | -12% |

| Bogota | $169 | 12% |

| Bolivar | $184 | 22% |

| Bon Aqua | $161 | 7% |

| Bon Aqua Junction | $162 | 8% |

| Braden | $186 | 24% |

| Bradford | $160 | 6% |

| Bradyville | $154 | 3% |

| Brentwood | $147 | -2% |

| Briceville | $152 | 1% |

| Brighton | $183 | 21% |

| Bristol | $129 | -14% |

| Brownsville | $164 | 9% |

| Bruceton | $168 | 12% |

| Brunswick | $189 | 25% |

| Brush Creek | $155 | 3% |

| Buchanan | $173 | 15% |

| Buena Vista | $170 | 13% |

| Buffalo Valley | $144 | -4% |

| Bulls Gap | $137 | -9% |

| Bumpus Mills | $167 | 11% |

| Burlison | $183 | 21% |

| Burns | $160 | 6% |

| Butler | $133 | -11% |

| Bybee | $157 | 5% |

| Byrdstown | $158 | 5% |

| Calhoun | $148 | -2% |

| Camden | $167 | 11% |

| Campaign | $159 | 6% |

| Carthage | $158 | 5% |

| Caryville | $152 | 1% |

| Castalian Springs | $153 | 2% |

| Cedar Grove | $165 | 10% |

| Cedar Hill | $157 | 4% |

| Celina | $160 | 6% |

| Centerville | $166 | 10% |

| Central | $129 | -14% |

| Chapel Hill | $157 | 4% |

| Chapmansboro | $162 | 8% |

| Charleston | $146 | -3% |

| Charlotte | $162 | 8% |

| Chattanooga | $152 | 1% |

| Chestnut Mound | $154 | 3% |

| Chewalla | $169 | 13% |

| Christiana | $155 | 3% |

| Chuckey | $135 | -10% |

| Church Hill | $134 | -11% |

| Clairfield | $151 | 1% |

| Clarkrange | $157 | 4% |

| Clarksburg | $166 | 10% |

| Clarksville | $156 | 4% |

| Cleveland | $145 | -3% |

| Clifton | $164 | 9% |

| Clinton | $149 | -1% |

| Coalfield | $153 | 2% |

| Coalmont | $158 | 5% |

| Coker Creek | $155 | 3% |

| College Grove | $145 | -3% |

| Collegedale | $148 | -1% |

| Collierville | $176 | 17% |

| Collinwood | $164 | 9% |

| Colonial Heights | $131 | -13% |

| Columbia | $154 | 2% |

| Como | $168 | 12% |

| Conasauga | $150 | 0% |

| Cookeville | $142 | -6% |

| Coopertown | $154 | 2% |

| Copperhill | $149 | -1% |

| Cordova | $190 | 26% |

| Cornersville | $162 | 8% |

| Corryton | $146 | -3% |

| Cosby | $157 | 4% |

| Cottage Grove | $166 | 10% |

| Cottontown | $151 | 0% |

| Counce | $167 | 11% |

| Covington | $180 | 19% |

| Cowan | $148 | -2% |

| Crab Orchard | $143 | -5% |

| Crawford | $154 | 2% |

| Crockett Mills | $168 | 12% |

| Cross Plains | $155 | 3% |

| Crossville | $142 | -5% |

| Crump | $166 | 10% |

| Culleoka | $159 | 6% |

| Cumberland City | $175 | 16% |

| Cumberland Furnace | $167 | 11% |

| Cumberland Gap | $147 | -2% |

| Cunningham | $159 | 6% |

| Cypress Inn | $165 | 10% |

| Dandridge | $148 | -2% |

| Darden | $167 | 11% |

| Dayton | $146 | -3% |

| Decatur | $152 | 1% |

| Decaturville | $165 | 10% |

| Decherd | $148 | -2% |

| Deer Lodge | $155 | 3% |

| Del Rio | $156 | 4% |

| Delano | $147 | -2% |

| Dellrose | $154 | 3% |

| Denmark | $163 | 8% |

| Dickson | $160 | 7% |

| Dixon Springs | $160 | 6% |

| Dover | $171 | 14% |

| Dowelltown | $155 | 3% |

| Doyle | $140 | -7% |

| Dresden | $161 | 7% |

| Drummonds | $182 | 21% |

| Duck River | $162 | 7% |

| Ducktown | $151 | 0% |

| Duff | $155 | 3% |

| Dukedom | $160 | 6% |

| Dunlap | $152 | 1% |

| Dyer | $160 | 6% |

| Dyersburg | $161 | 7% |

| Eads | $184 | 22% |

| Eagan | $153 | 2% |

| Eagleton Village | $143 | -5% |

| Eagleville | $157 | 4% |

| East Cleveland | $146 | -3% |

| East Ridge | $153 | 2% |

| Eastview | $167 | 11% |

| Eaton | $162 | 8% |

| Eidson | $140 | -7% |

| Elgin | $159 | 6% |

| Elizabethton | $131 | -13% |

| Elkton | $162 | 8% |

| Ellendale | $195 | 30% |

| Elmwood | $153 | 2% |

| Elora | $153 | 2% |

| Englewood | $146 | -3% |

| Enville | $162 | 8% |

| Erin | $181 | 20% |

| Erwin | $131 | -13% |

| Estill Springs | $146 | -3% |

| Ethridge | $161 | 7% |

| Etowah | $147 | -2% |

| Eva | $165 | 10% |

| Evensville | $147 | -2% |

| Fairfield Glade | $141 | -6% |

| Fairmount | $149 | -1% |

| Fairview | $149 | -1% |

| Fall Branch | $134 | -11% |

| Falling Water | $149 | -1% |

| Farner | $150 | 0% |

| Farragut | $147 | -2% |

| Fayetteville | $156 | 4% |

| Fincastle | $153 | 2% |

| Finger | $167 | 11% |

| Finley | $163 | 8% |

| Five Points | $160 | 7% |

| Flag Pond | $133 | -12% |

| Flat Top Mountain | $147 | -2% |

| Flintville | $158 | 5% |

| Forest Hills | $157 | 4% |

| Fosterville | $157 | 4% |

| Frankewing | $159 | 6% |

| Franklin | $144 | -4% |

| Friendship | $163 | 9% |

| Friendsville | $145 | -4% |

| Fruitvale | $167 | 11% |

| Gadsden | $163 | 8% |

| Gainesboro | $155 | 3% |

| Gallatin | $148 | -1% |

| Gallaway | $185 | 23% |

| Gates | $165 | 10% |

| Gatlinburg | $151 | 0% |

| Georgetown | $152 | 1% |

| Germantown | $183 | 22% |

| Gibson | $164 | 9% |

| Gladeville | $160 | 6% |

| Gleason | $161 | 7% |

| Goodlettsville | $164 | 9% |

| Goodspring | $161 | 7% |

| Gordonsville | $156 | 4% |

| Grand Junction | $188 | 25% |

| Grandview | $146 | -3% |

| Granville | $154 | 3% |

| Gray | $130 | -13% |

| Graysville | $149 | -1% |

| Green Hill | $160 | 7% |

| Greenback | $146 | -3% |

| Greenbrier | $154 | 2% |

| Greeneville | $138 | -8% |

| Greenfield | $163 | 9% |

| Grimsley | $157 | 5% |

| Gruetli-Laager | $158 | 5% |

| Guild | $158 | 5% |

| Guys | $164 | 9% |

| Halls | $166 | 10% |

| Hampshire | $160 | 6% |

| Hampton | $132 | -12% |

| Harriman | $154 | 2% |

| Harrison | $150 | 0% |

| Harrogate | $146 | -3% |

| Hartford | $159 | 6% |

| Hartsville | $157 | 5% |

| Heiskell | $149 | -1% |

| Helenwood | $156 | 4% |

| Henderson | $164 | 9% |

| Hendersonville | $150 | 0% |

| Henning | $172 | 15% |

| Henry | $165 | 9% |

| Hermitage | $166 | 10% |

| Hickman | $155 | 3% |

| Hickory Valley | $187 | 24% |

| Hilham | $155 | 3% |

| Hillsboro | $149 | -1% |

| Hixson | $149 | -1% |

| Hohenwald | $161 | 7% |

| Holladay | $169 | 12% |

| Hollow Rock | $165 | 10% |

| Hopewell | $146 | -3% |

| Hornbeak | $161 | 7% |

| Hornsby | $169 | 12% |

| Humboldt | $158 | 5% |

| Hunter | $131 | -13% |

| Huntingdon | $167 | 11% |

| Huntland | $149 | -1% |

| Huntsville | $156 | 4% |

| Huron | $168 | 12% |

| Hurricane Mills | $173 | 15% |

| Idlewild | $166 | 10% |

| Indian Mound | $165 | 10% |

| Iron City | $163 | 8% |

| Jacks Creek | $161 | 7% |

| Jacksboro | $152 | 1% |

| Jackson | $160 | 6% |

| Jamestown | $157 | 5% |

| Jasper | $155 | 3% |

| Jefferson City | $147 | -2% |

| Jellico | $157 | 4% |

| Joelton | $160 | 7% |

| Johnson City | $129 | -14% |

| Jonesborough | $130 | -13% |

| Kelso | $156 | 4% |

| Kenton | $157 | 5% |

| Kimball | $155 | 3% |

| Kingsport | $132 | -12% |

| Kingston | $153 | 2% |

| Kingston Springs | $160 | 6% |

| Knoxville | $150 | 0% |

| Kodak | $152 | 1% |

| Kyles Ford | $148 | -1% |

| La Follette | $153 | 2% |

| La Grange | $183 | 21% |

| La Vergne | $159 | 6% |

| Laconia | $186 | 24% |

| Lafayette | $156 | 4% |

| Lake City | $149 | -1% |

| Lake Tansi | $142 | -6% |

| Lakeland | $184 | 23% |

| Lakesite | $147 | -2% |

| Lakewood | $166 | 10% |

| Lakewood Park | $150 | 0% |

| Lancaster | $156 | 4% |

| Lancing | $156 | 4% |

| Lascassas | $154 | 3% |

| Laurel Bloomery | $133 | -11% |

| Lavinia | $163 | 9% |

| Lawrenceburg | $160 | 6% |

| Lebanon | $152 | 1% |

| Lenoir City | $148 | -2% |

| Lenox | $162 | 8% |

| Leoma | $160 | 6% |

| Lewisburg | $156 | 4% |

| Lexington | $165 | 10% |

| Liberty | $156 | 4% |

| Limestone | $134 | -11% |

| Linden | $169 | 12% |

| Livingston | $155 | 3% |

| Lobelville | $170 | 13% |

| Lone Mountain | $153 | 2% |

| Lone Oak | $152 | 1% |

| Lookout Mountain | $152 | 1% |

| Loretto | $159 | 6% |

| Loudon | $146 | -3% |

| Louisville | $145 | -4% |

| Lowland | $152 | 1% |

| Lupton City | $150 | -1% |

| Luray | $163 | 8% |

| Luttrell | $149 | -1% |

| Lutts | $160 | 6% |

| Lyles | $163 | 8% |

| Lynchburg | $148 | -2% |

| Lynnville | $161 | 7% |

| Macon | $186 | 23% |

| Madison | $171 | 14% |

| Madisonville | $146 | -3% |

| Manchester | $148 | -1% |

| Mansfield | $168 | 11% |

| Martin | $161 | 7% |

| Maryville | $143 | -5% |

| Mascot | $146 | -3% |

| Mason | $182 | 21% |

| Maury City | $162 | 8% |

| Maynardville | $148 | -1% |

| McDonald | $146 | -3% |

| McEwen | $172 | 14% |

| McLemoresville | $165 | 9% |

| McKenzie | $163 | 9% |

| McMinnville | $154 | 2% |

| Medina | $159 | 6% |

| Medon | $168 | 11% |

| Memphis | $222 | 48% |

| Mercer | $165 | 10% |

| Michie | $166 | 10% |

| Middle Valley | $149 | -1% |

| Middleton | $183 | 21% |

| Midtown | $154 | 2% |

| Midway | $139 | -8% |

| Milan | $157 | 5% |

| Milledgeville | $163 | 9% |

| Millersville | $163 | 8% |

| Milligan College | $139 | -8% |

| Millington | $193 | 28% |

| Milton | $156 | 4% |

| Minor Hill | $160 | 6% |

| Mitchellville | $156 | 3% |

| Mohawk | $138 | -8% |

| Monroe | $156 | 4% |

| Monteagle | $156 | 4% |

| Monterey | $144 | -4% |

| Mooresburg | $136 | -9% |

| Morris Chapel | $168 | 12% |

| Morrison | $153 | 2% |

| Morristown | $142 | -6% |

| Moscow | $184 | 22% |

| Mosheim | $139 | -7% |

| Moss | $157 | 5% |

| Mount Carmel | $135 | -10% |

| Mount Juliet | $156 | 4% |

| Mount Pleasant | $160 | 6% |

| Mountain City | $136 | -10% |

| Mountain Home | $131 | -13% |

| Mowbray Mountain | $147 | -2% |

| Mulberry | $155 | 3% |

| Munford | $180 | 20% |

| Murfreesboro | $154 | 2% |

| Nashville | $162 | 8% |

| New Hope | $156 | 4% |

| New Johnsonville | $170 | 13% |

| New Market | $147 | -2% |

| New Tazewell | $147 | -3% |

| Newbern | $162 | 8% |

| Newcomb | $158 | 5% |

| Newport | $155 | 3% |

| Niota | $145 | -4% |

| Nolensville | $149 | -1% |

| Norene | $159 | 6% |

| Normandy | $148 | -1% |

| Norris | $148 | -2% |

| Nunnelly | $163 | 8% |

| Oak Grove | $130 | -13% |

| Oak Hill | $155 | 3% |

| Oak Ridge | $148 | -1% |

| Oakdale | $154 | 3% |

| Oakfield | $160 | 6% |

| Oakland | $182 | 21% |

| Obion | $160 | 6% |

| Ocoee | $148 | -2% |

| Old Fort | $148 | -2% |

| Old Hickory | $163 | 8% |

| Olivehill | $167 | 11% |

| Oliver Springs | $152 | 1% |

| Oneida | $157 | 4% |

| Only | $168 | 12% |

| Ooltewah | $148 | -1% |

| Orlinda | $154 | 3% |

| Pall Mall | $156 | 4% |

| Palmer | $159 | 6% |

| Palmersville | $164 | 9% |

| Palmyra | $160 | 6% |

| Paris | $165 | 10% |

| Park City | $156 | 4% |

| Parrottsville | $156 | 4% |

| Parsons | $166 | 11% |

| Pegram | $161 | 7% |

| Pelham | $158 | 5% |

| Petersburg | $158 | 5% |

| Petros | $155 | 3% |

| Philadelphia | $149 | -1% |

| Pickwick Dam | $169 | 13% |

| Pigeon Forge | $151 | 1% |

| Pikeville | $150 | 0% |

| Pine Crest | $129 | -14% |

| Piney Flats | $131 | -13% |

| Pinson | $162 | 8% |

| Pioneer | $155 | 3% |

| Piperton | $172 | 14% |

| Plainview | $149 | -1% |

| Pleasant Hill | $146 | -3% |

| Pleasant Shade | $158 | 5% |

| Pleasant View | $161 | 7% |

| Pocahontas | $168 | 12% |

| Portland | $149 | -1% |

| Powder Springs | $149 | -1% |

| Powell | $147 | -2% |

| Powells Crossroads | $156 | 4% |

| Primm Springs | $153 | 1% |

| Prospect | $161 | 7% |

| Pruden | $158 | 5% |

| Pulaski | $160 | 7% |

| Puryear | $168 | 12% |

| Quebeck | $139 | -8% |

| Ramer | $168 | 12% |

| Readyville | $156 | 4% |

| Reagan | $165 | 10% |

| Red Bank | $150 | 0% |

| Red Boiling Springs | $156 | 4% |

| Reliance | $148 | -1% |

| Riceville | $146 | -3% |

| Rickman | $153 | 2% |

| Riddleton | $159 | 6% |

| Ridgely | $166 | 10% |

| Ridgeside | $155 | 3% |

| Ridgetop | $153 | 2% |

| Ripley | $170 | 13% |

| Rives | $159 | 6% |

| Roan Mountain | $133 | -11% |

| Robbins | $157 | 5% |

| Rock Island | $150 | 0% |

| Rockford | $146 | -3% |

| Rockvale | $154 | 3% |

| Rockwood | $150 | 0% |

| Rocky Top | $149 | -1% |

| Rogersville | $137 | -9% |

| Rossville | $176 | 17% |

| Rugby | $163 | 9% |

| Rural Hill | $158 | 5% |

| Russellville | $141 | -6% |

| Rutherford | $160 | 7% |

| Rutledge | $147 | -2% |

| Sale Creek | $148 | -1% |

| Saltillo | $168 | 12% |

| Samburg | $159 | 6% |

| Santa Fe | $155 | 3% |

| Sardis | $167 | 11% |

| Saulsbury | $190 | 26% |

| Savannah | $167 | 11% |

| Scotts Hill | $166 | 11% |

| Selmer | $167 | 11% |

| Sequatchie | $158 | 5% |

| Sevierville | $150 | 0% |

| Sewanee | $150 | 0% |

| Seymour | $143 | -5% |

| Shady Valley | $134 | -11% |

| Sharon | $161 | 7% |

| Sharps Chapel | $147 | -2% |

| Shawanee | $154 | 2% |

| Shelbyville | $148 | -2% |

| Sherwood | $148 | -2% |

| Shiloh | $164 | 9% |

| Signal Mountain | $149 | -1% |

| Silerton | $171 | 14% |

| Silver Point | $144 | -4% |

| Slayden | $166 | 10% |

| Smartt | $157 | 5% |

| Smithville | $153 | 2% |

| Smyrna | $152 | 1% |

| Sneedville | $146 | -3% |

| Soddy-Daisy | $148 | -2% |

| Somerville | $185 | 23% |

| South Cleveland | $144 | -4% |

| South Fulton | $156 | 3% |

| South Pittsburg | $156 | 4% |

| Southside | $159 | 6% |

| Sparta | $140 | -7% |

| Speedwell | $149 | -1% |

| Spencer | $151 | 1% |

| Spring City | $147 | -3% |

| Spring Creek | $159 | 6% |

| Spring Hill | $142 | -5% |

| Springfield | $154 | 2% |

| Springville | $169 | 13% |

| Spurgeon | $130 | -13% |

| St. Joseph | $155 | 3% |

| Stanton | $172 | 15% |

| Stantonville | $168 | 12% |

| Stewart | $178 | 18% |

| Strawberry Plains | $150 | 0% |

| Sugar Tree | $166 | 11% |

| Summertown | $160 | 7% |

| Summitville | $148 | -1% |

| Sunbright | $155 | 3% |

| Surgoinsville | $136 | -10% |

| Sweetwater | $144 | -4% |

| Taft | $159 | 6% |

| Talbott | $142 | -5% |

| Tallassee | $142 | -6% |

| Tazewell | $146 | -3% |

| Telford | $131 | -13% |

| Tellico Plains | $146 | -3% |

| Tellico Village | $146 | -3% |

| Ten Mile | $153 | 2% |

| Tennessee Ridge | $181 | 20% |

| Thompson’s Station | $141 | -6% |

| Thorn Hill | $147 | -2% |

| Tigrett | $166 | 10% |

| Tipton | $185 | 23% |

| Tiptonville | $162 | 8% |

| Toone | $174 | 16% |

| Townsend | $142 | -6% |

| Tracy City | $158 | 5% |

| Trade | $137 | -9% |

| Trenton | $157 | 4% |

| Trezevant | $164 | 9% |

| Trimble | $156 | 4% |

| Troy | $159 | 6% |

| Tullahoma | $147 | -2% |

| Turtletown | $150 | 0% |

| Tusculum | $137 | -9% |

| Unicoi | $131 | -13% |

| Union City | $157 | 4% |

| Unionville | $154 | 3% |

| Vanleer | $170 | 13% |

| Viola | $155 | 3% |

| Vonore | $142 | -6% |

| Walden | $149 | -1% |

| Walland | $143 | -5% |

| Walling | $141 | -7% |

| Walnut Hill | $129 | -14% |

| Wartburg | $153 | 2% |

| Wartrace | $150 | 0% |

| Washburn | $147 | -2% |

| Watauga | $131 | -13% |

| Watertown | $155 | 3% |

| Waverly | $173 | 15% |

| Waynesboro | $162 | 8% |

| Westmoreland | $152 | 1% |

| Westpoint | $161 | 7% |

| Westport | $169 | 12% |

| White Bluff | $159 | 6% |

| White House | $154 | 3% |

| White Pine | $148 | -2% |

| Whites Creek | $167 | 11% |

| Whitesburg | $143 | -5% |

| Whiteside | $159 | 5% |

| Whiteville | $182 | 21% |

| Whitleyville | $158 | 5% |

| Whitwell | $156 | 4% |

| Wilder | $158 | 5% |

| Wildersville | $166 | 10% |

| Wildwood | $143 | -5% |

| Wildwood Lake | $144 | -4% |

| Williamsport | $156 | 4% |

| Williston | $184 | 22% |

| Winchester | $148 | -2% |

| Winfield | $156 | 4% |

| Woodbury | $153 | 2% |

| Woodland Mills | $157 | 4% |

| Woodlawn | $155 | 3% |

| Wynnburg | $167 | 11% |

| Yorkville | $165 | 10% |

| Yuma | $166 | 10% |

Tennessee car insurance requirements

Car insurance is required by law in Tennessee. The minimum amounts you need to drive legally include:

- Bodily injury liability: $25,000 per accident, $50,000 per accident

- Property damage liability: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Collision

Car insurance laws in Tennessee

Tennessee uses an electronic verification system to enforce state car insurance laws. Insurance companies report new policies and cancellations to the state.

If the system detects a lapse in your insurance coverage, it’ll send you an alert. Your registration can be suspended if you don’t reply in time.

When you switch companies, your new and former company notify the state for you. Make sure the details about you and your vehicle are accurate in your new insurance documents.

How to get SR-22 insurance in Tennessee

You may need SR-22 car insurance to reinstate your driver’s license after certain offenses. These include DUI, reckless driving and insurance or registration violations. An SR-22 is a form that certifies you have valid car insurance. Your insurance company sends it to the state after you buy your policy.

Some companies don’t offer SR-22 insurance. Those that do may add a small filing fee to your rate. The actual cost of SR-22 insurance depends on your driving record.

SR-22 insurance costs about $250 a month on average after a major offense like DUI. The average rate is closer to $190 a month after an insurance or registration violation. You can often find cheaper prices by shopping around.

It’s good to be upfront about your SR-22 insurance when you ask for quotes. This allows you to get the most accurate estimates of each company’s rates.

How we selected the cheapest car insurance companies in Tennessee

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Tennessee

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.