How To Dispute a Credit Card Charge: Understanding Your Rights

- If you see an unauthorized charge or billing mistake on your credit card statement, or if you didn’t receive satisfactory goods or services from a merchant, you generally have the right to dispute the charge under the Fair Credit Billing Act (FCBA).

- You should review a credit card charge and contact the merchant involved before filing a dispute with your credit card issuer.

- You typically have 60 days from when a charge appears on your credit card statement to dispute it.

How do you dispute a credit card charge?

The process of disputing fraudulent charges on your credit card often depends on the type of transaction. But with any dispute, it’s best to reach out to the merchant as soon as you identify a potential issue (and before contacting the credit card company):

-

Review the charge

Before you contact your credit card company, review the details of the charge in your credit card account or monthly statement. You’ll be able to view the merchant’s name and location, which can help you decide whether this charge is one you authorized or if it should be disputed. -

Contact the merchant involved

In some cases, a merchant may be able to resolve an error more quickly than the credit card company. If you’re able to resolve the issue with the merchant, there’s no need to contact the credit card company. However, if you can’t reach a resolution or the merchant disagrees, you can dispute the charge with your credit card company. If you suspect fraud or have received an unsatisfactory product or service, you should contact your credit card company directly. -

Collect evidence

Document the date you contacted the merchant, who you spoke with and what their resolution was. Save receipts, photos or any communication with the merchant that you can relay to your credit card company. This demonstrates that you made an effort to resolve the issue with the merchant before contacting the credit card company. -

Contact your credit card issuer

You can reach your credit card issuer by calling the number on the back of your card, emailing customer service, using the app to report the issue or submitting a written dispute.

When to dispute a credit card charge

When you dispute a charge, you must have reasonable cause for why it is fraudulent. Not liking the item or service received isn’t enough to warrant a claim. The Federal Trade Commission (FTC) sets guidelines for when consumers can dispute the following credit card charges:

Unauthorized or fraudulent transactions

An unauthorized or fraudulent transaction is a bank or credit card transaction that you didn’t make or approve. This may occur when a card is lost or your credit card information was stolen. Watch your accounts and report any fraudulent charges or a lost or stolen card immediately to the credit card company.

Federal law limits your responsibility for unauthorized charges to $50. But most credit card issuers offer $0 fraud liability, meaning you aren’t liable for unauthorized charges if your card is lost or stolen.

A credit card skimmer is a device installed on a card reader that collects your credit card information. Scammers use this information to make fraudulent charges to your credit card account. According to a LendingTree survey, 29% of consumers suspected they were victims of card skimming and 15% said it happened in the last year.

Learn more about how to spot a credit card skimmer.

Billing errors

A billing error is a mistake that can result in an incorrect charge or amount showing up on your bill. According to the FTC, you can dispute the following billing errors with your credit card company:

- Charges that list the wrong date or amount

- Charges for goods and services you didn’t accept or weren’t delivered as agreed

- Math errors

- Failure to post payments and other credits, like returns

- Failure to send bills to your current address — assuming the creditor has your change of address, in writing, at least 20 days before the billing period ends

- Charges for which you ask for an explanation or written proof of purchase, along with a claimed error or request for clarification

While you can call the issuer as soon as you discover a billing error, it is highly recommended that you submit a dispute letter to your creditor. The FTC provides specific guidelines for filing a dispute.

Issues with quality of goods and services

You can’t dispute a charge if you don’t like the purchase you made, but you can if the quality of the goods or services received is subpar. For example, if you purchased a couch and it’s delivered to your home with a tear in the cushion, you may be able to file a claim if the manufacturer refuses to either fix the damage or replace the cushion or the entire couch.

Only disputes that meet the following criteria qualify for a dispute under the FCBA:

- The transaction must exceed $5

- You “made a good faith attempt to obtain satisfactory resolution” of the issue

- The transaction was made in the same state you reside, or within 100 miles of your home

To learn the process for disputing charges of this nature or taking legal action, check with your state’s consumer protection office.

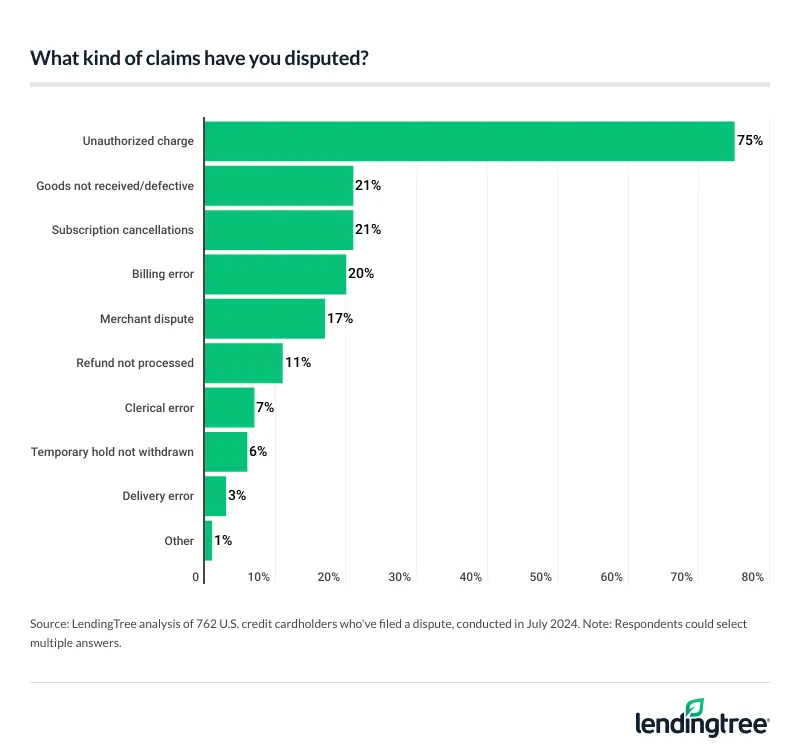

Disputing a credit card charge has a 96% success rate

According to a LendingTree survey, 50% of cardholders said they’ve disputed a claim. and 96% were successful in getting a resolution. Of those who disputed a claim, 75% had an authorized charge, 21% claimed they didn’t receive the goods they paid for or they were defective and 21% said they canceled a subscription and were still charged.

How do credit card disputes work?

After you dispute a charge, your credit card company has 30 days to confirm they received your dispute. Then, they have two billing cycles (no more than 90 days) to resolve the dispute. According to our findings, 91% of cardholders who disputed a charge had a resolution within a month.

If you haven’t paid your bill yet, the credit card company may apply a provisional credit to your account. This is a temporary credit equal to the disputed charge. If the credit card company determines that you were in the right, the temporary credit will become permanent. A credit card company also may remove the disputed amount from your bill.

Even if you’ve already paid your bill, you can still dispute the charge. However, you may not receive a refund unless the credit card company determines that you were correct.

You typically have 60 days from when a charge appears on your credit card statement to dispute it, but if there’s fraud involved, there’s no time limit. Some card issuers allow up to 120 days for disputes related to billing errors and issues with the quality of goods and services from a merchant.

How to contact major credit card issuers

If you need to dispute a credit card charge, it’s best to call your credit card issuer as you see an error on your account. If your credit card was lost or stolen, you should also follow up with a written notice of the reported loss. Here’s how to contact major credit card issuers about a credit card dispute:

| Issuer | Mailing address | Phone number |

|---|---|---|

American Express | American Express Customer Service P.O. Box 981535 El Paso, TX 79998 | (800) 528-4800 |

Bank of America | Bank of America P.O. Box 982234 El Paso, TX 79998-2234 | (866) 266-0212 |

Capital One | Capital One Attn: Disputes P.O. Box 30279 Salt Lake City, UT 84130-0279 | (800) 227-4825 |

Chase | Card Services Attn: Billing Inquiries P.O. Box 15299 Wilmington, DE 19850-5299 | (800) 955-9060 |

Citi | Citibank Customer Service Attn: Billing Inquiries P.O. Box 6500 Sioux Falls, SD 57117 | (800) 950-5114 |

Discover | Discover Bank P.O. Box 30945 Salt Lake City, UT 84130-0945 | (866) 240-7938 |

Navy Federal Credit Union | Navy Federal Credit Union Attn: Card Fraud Prevention Recovery P.O. Box 3503 Merrifield, VA 22119-3503 | (888) 842-6328 |

U.S. Bank | U.S. Bank/Bank by Mail P.O. Box 1950 St. Paul, MN 55101-0950 | (800) 285-8585 |

Wells Fargo | Wells Fargo Card Services P.O. Box 51193 Los Angeles, CA 90051-5493 | (800) 390-0533 |

What happens if a credit card dispute is denied?

If your dispute is denied, the charge will go back to your credit card. You should receive an explanation from the credit card issuer detailing the reason the dispute was denied. If you refuse to pay, they can put your account in collections or seek legal action.

There are several possible reasons a credit card company may deny a dispute claim:

- You provided inaccurate information.

- There’s insufficient evidence of an error or unauthorized charge.

- The charge was too old.

- The charge occurred outside of the U.S.

- There’s no proof of returned merchandise.

- You didn’t attempt to resolve the issue with the merchant.

If you disagree with the outcome, you can appeal the decision in writing, which gives you another chance to provide evidence to support your claim. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB).

Frequently asked questions

The following are valid reasons to dispute a charge on your credit card: unauthorized or fraudulent charges, billing errors by the card issuer and poor quality of goods or services from a merchant.

Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

A chargeback is an action taken by a bank or financial institution to reverse electronic payments. Chargebacks typically occur when a cardholder successfully disputes a charge.

If you’ve already reviewed the details of the charge and contacted the merchant, you can dispute a credit card charge with Chase by logging in to your online account. Navigate to the specific charge in question and follow the on-screen instructions to start a dispute.