If you’re looking to close your old Capital One card for a card with better benefits and rewards, a card upgrade can be a quick route to a card that’s a better fit for you.

Upgrading from one Capital One credit card to another is a simple process. You can request an upgrade in just a few minutes through the Capital One app or by calling the 1-800 number on the back of your card. The main benefit is that you can get a better card without impacting your credit score. However, you will lose out on any sign-up bonus that the card typically offers, which could be worth hundreds of dollars in rewards.

A credit card upgrade, also known as a “product change” or a “swap,” occurs when a cardholder switches from their current credit card to a different one from the same issuer.

An upgrade may be ideal if your existing credit card no longer suits your lifestyle and spending needs. For example, if you got the Capital One Platinum Credit Card as a starter credit card and have since established your credit profile, you may want to upgrade to a Capital One card that offers a rewards program like the Capital One Savor Cash Rewards Credit Card. Or, if you got the Capital One QuicksilverOne Cash Rewards Credit Card to earn cash back and your credit score has improved, you may want to swap it for a cash back card like the Capital One Quicksilver Cash Rewards Credit Card card with a $0 annual fee (see rates & fees).

There are a few ways to begin the process of upgrading your credit card:

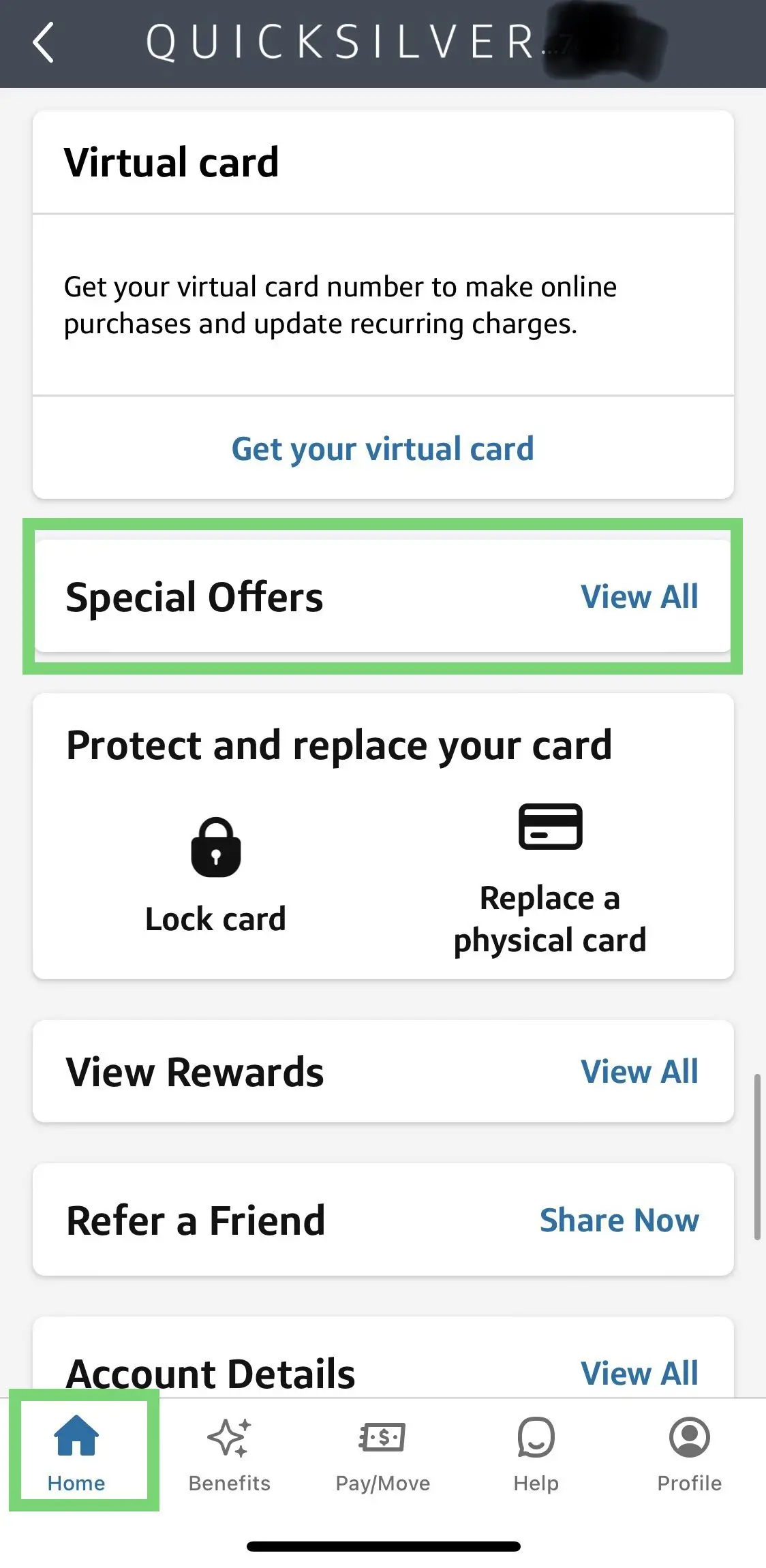

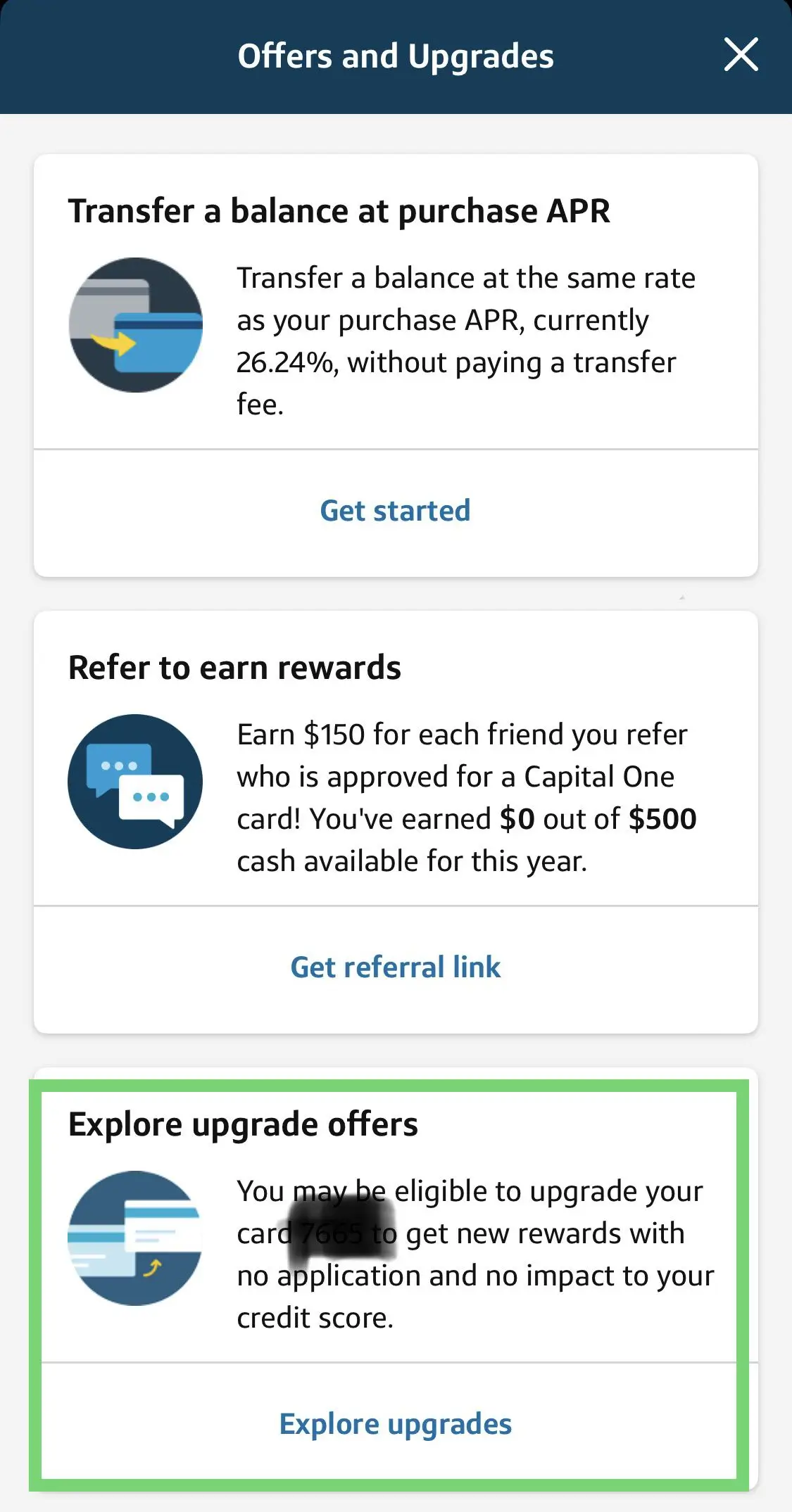

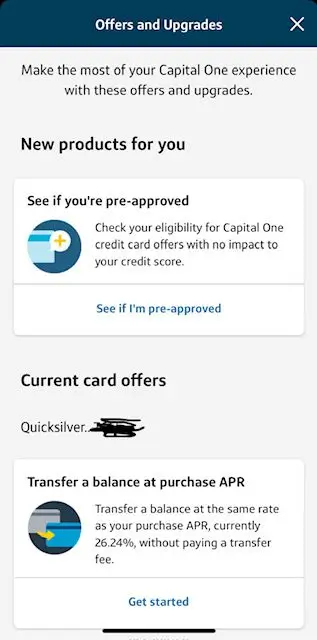

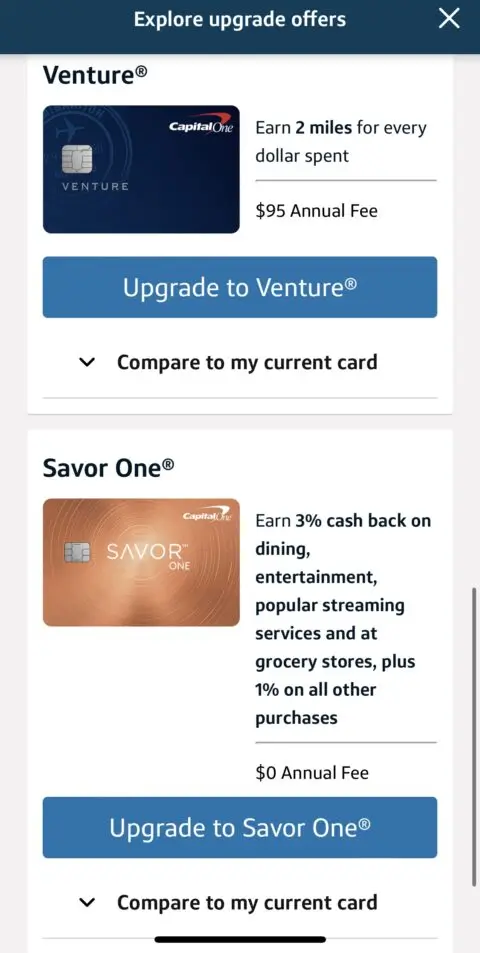

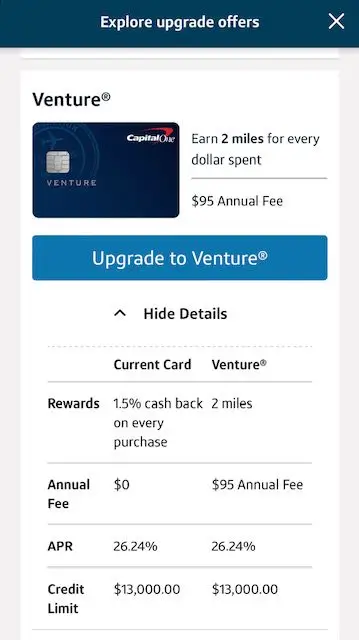

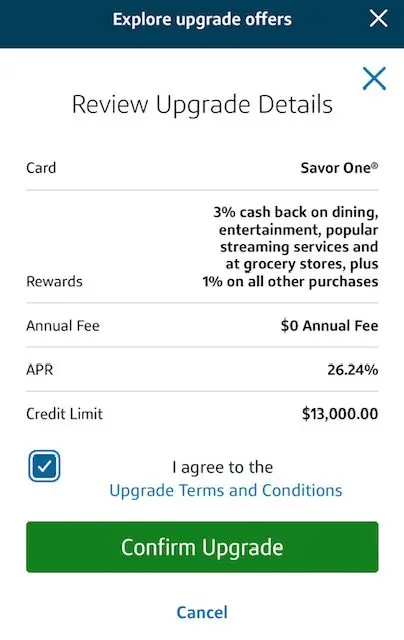

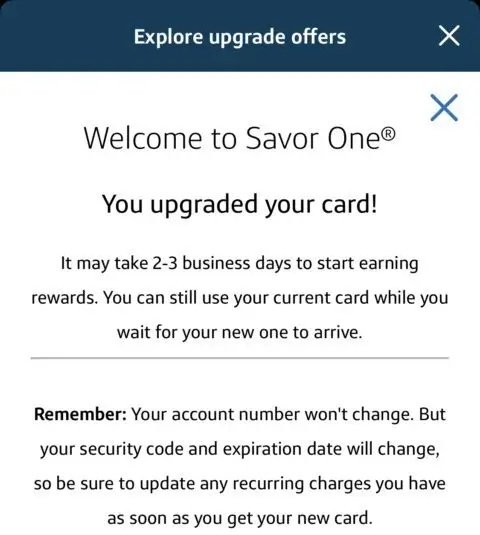

To upgrade your card in the app, follow these quick steps that show how to upgrade your Capital One card:

This process can be completed in under 60 seconds. However, do give yourself time to read about the terms, conditions and credit card fees.

Did you know? You can contact Capital One’s credit card reconsideration line at 800-625-7866 to ask them to review your credit card application.

Not everyone upgrades, or downgrades, their card for the same reason. Here are a few card upgrade possibilities and why you might consider upgrading your card. Remember that your options are limited to what Capital One offers.

| Current card | New card | Why upgrade? |

|---|---|---|

| Capital One Platinum Credit Card | Capital One Quicksilver Cash Rewards Credit Card | Upgrade to a card with a rewards program |

| Capital One QuicksilverOne Cash Rewards Credit Card (see rates & fees) | Capital One Savor Cash Rewards Credit Card (see rates & fees) | Eliminate your annual fee |

| Capital One Quicksilver Cash Rewards Credit Card | Capital One Venture Rewards Credit Card | Elevated cash back rewards in certain categories |

| Capital One Venture Rewards Credit Card | Capital One Venture X Rewards Credit Card | More robust travel rewards and benefits |

| Credit Cards | Our Ratings | Annual Fee | Rewards Rate | Welcome Offer | |

|---|---|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card*

|

$0 | 1.5% - 5% Cash Back

| $200 Cash Bonus

Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

| ||

Capital One Savor Cash Rewards Credit Card*

|

$0 | 1% - 8% cash back

| $200 Cash Back

$200 Cash Back after you spend $500 on purchases within 3 months from account opening

| ||

Capital One Venture Rewards Credit Card*

|

$95 | 2X - 5X Miles

| 75,000 miles

75,000 Miles once you spend $4,000 on purchases within the first 3 months of account opening, plus receive a one-time $250 Capital One Travel credit to use in your first cardholder year – that’s equal to $1,000 in travel

| ||

Capital One Venture X Rewards Credit Card*

|

$395 | 2X - 10X miles

| 75,000 miles

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

|

Product upgrades are seldom talked about, so before you commit to swapping one card for another, be sure you really understand how they work and can impact your overall credit health.

Before you even consider upgrading, know that if you have a pattern of late payments or high balances on your current card, the odds of being approved for another card may be slim. Therefore, it’s important to establish good credit card habits, like the following, in advance:

Always pay your bill on time

Your payment history, which shows whether you’ve made past credit card and loan payments on time, accounts for 35% of your credit score, according to FICO.

Keep your card balance low

Amounts owed and your credit utilization ratio — how much the amount of your available credit you’re using — make up about 30% of your credit score. If your credit utilization ratio is too high, that signals to issuers that you might be struggling to pay back your debt. Try to keep your card balance below 30% of your credit limit or pay off the entire balance every month for best results.

Be patient

You should also examine how long you’ve had your existing card. If you haven’t been solicited for an upgrade offer from Capital One, know that you may have to wait a bit. In fact, it’s a good idea to hold onto your existing card for at least six months and show regular and responsible usage during that time before you request an upgrade.

Check your credit score

Knowing where your credit score stands can help give you some insight as to which card products you may qualify for. You can access your credit score for free and without generating a hard inquiry in a variety of ways, including through LendingTree Spring or through Capital One’s CreditWise.

If you’ve had your Capital One card for at least six months, have used it regularly and have a good history of on-time payments, you can request an upgrade. Remember, however, you’re not guaranteed approval.

When requesting an upgrade, consider what type of rewards you’re looking for and whether or not you spend enough on your card to make any annual fee worthwhile.

That said, if you want to take advantage of a new cardmember sign-up bonus or promotional 0% intro APR on purchases or balance transfers*, you may want to apply for a new card instead. The application will generate a hard inquiry on your credit report, which may temporarily reduce your score. But opening a new card can also improve your credit utilization ratio and help boost your score over time.

To see if you prequalify for a Capital One card without initiating a hard inquiry, you can check out Capital One’s pre approval tool.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.