How to Request a Credit Limit Increase With Capital One

- While some Capital One credit cards offer automatic credit line increases, others may allow you to request an increase online, in the mobile app or over the phone.

- A credit line increase gives you more purchasing flexibility and can help improve your credit score by lowering your credit utilization ratio.

- Having a history of responsible credit card use with your Capital One card or an income increase can improve your chances of getting a credit line increase.

A credit line increase, or credit limit increase, occurs when a credit card issuer increases the amount you’re able to charge on your credit card. This can be useful if you have a large purchase coming up that exceeds your current available credit limit. It can also help keep your credit utilization ratio low if your regular spending puts you close to maxing out your credit card.

In the long run, having more available credit can help improve your credit score. But remember to use your credit card wisely — since having too much available credit can be tempting and lead to unnecessary credit card debt

A study by LendingTree analysts found that 84% of credit limit increase requests were granted in 2024. The data on credit card issuer requests goes back four years and shows that credit card issuers consistently grant 8 out of 10 requests for credit limit increases.

How to request a Capital One Credit line increase

The simplest and fastest way to initiate an increase in your credit limit is to make the request on the Capital One website or via the Capital One mobile app. But you can also request an increase over the phone.

How to request a Capital One Credit line increase online

- Visit CapitalOne.com and log in to your account.

- Select the card you want to request an increase for (if you have multiple cards).

- Click the “I want to” icon. Then, under “Offers and upgrades,” select “Request credit limit increase.”

- Answer the questions about income, housing expenses, employment and your current credit use.

- Submit your request and wait for the decision.

How to request a Capital One credit line increase in the mobile app

Step 1

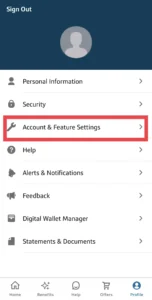

After logging in to your account, select “Profile” at the bottom of your screen.

Step 2

Click on “Account & Feature Settings.”

Step 3

Then select “Request Credit Line Increase.”

Step 4

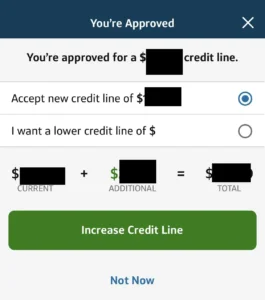

On the next screen, choose which card you want a credit line increase for, and submit the requested information, including your income and the maximum line of credit you’d like.

Step 5

If approved, you have the option to accept the new line of credit or request a lower amount. After making your selection, click on the “increase credit line” button.

Step 6

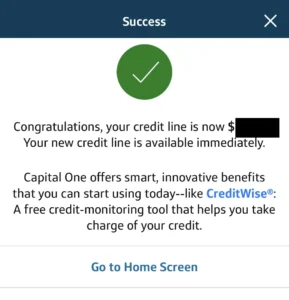

After accepting your new credit line, a confirmation message appears and you can return to the home page.

How to request a Capital One Credit line increase over the phone

To request a higher line of credit over the phone, you can call 1-877-383-4802 or the number on the back of your Capital One credit card.

Before calling, have your credit card info ready for identity verification. Also be prepared to answer questions about your income, employment and monthly housing costs.

How long does a Capital One credit line increase take?

Requesting a credit line increase through the Capital One mobile app or website can take less than five minutes. Calling the customer service number will likely take longer since you’ll have to go through an automated process, wait until a representative is available and provide your information in order for them to process the request.

Your request for a higher credit limit may be approved or denied within minutes of submitting your request. If approved, you generally receive access to the higher limit immediately.

Some requests may need further processing — which could take up to 30 days. When this happens, Capital One sends a letter by mail outlining the details of its decision.

Am I eligible for a Capital One credit limit increase?

Capital One doesn’t disclose its process for credit limit increases, and some accounts may not be eligible for increased credit limits — even upon request.

When deciding whether or not to grant your request, Capital One will consider the following:

- If you make on-time payments with all creditors

- If you pay down your balance by making large monthly payments

- Changes in your employment status

- Changes in your income

- You current credit line usage

- The age of your account and date of your last credit line change

Capital One lists a variety of factors that may contribute to your request being denied, including, but not limited to:

- Your Capital One account is too new

- There were recent changes to your existing credit line

- Your Capital One account was recently past due

- Your average monthly payment was too low

- Your recent usage of the account’s existing credit line was too low

- A recent credit delinquency was reported by the credit reporting agency

- Your credit score is currently too low

Does Capital One automatically increase credit lines?

Capital One offers automatic credit line reviews in as little as six months to see if you can qualify for a higher credit line for the following credit-building cards:

How much of a credit limit increase can I get from Capital One?

When you ask for a credit limit increase, keep in mind that asking for a large increase is a red flag. We recommend keeping your request to 10% to 25% of your current credit limit.

For example, if you currently have a $500 credit limit, you should ask for an increase of $50 to $125. If your credit limit is $1,000, you should ask for $100 to $250.

Will a credit limit increase affect my credit score?

Your credit score will not be negatively affected when you request or are approved for a credit limit increase. That’s because Capital One will conduct a soft credit pull to determine whether or not they approve your request.

Check your credit score with LendingTree Spring.

What can I do if Capital One doesn’t increase my credit limit?

If Capital One doesn’t increase your credit limit, your next step depends on how soon you need access to a higher line of credit. Do you need more credit now to make a purchase or handle a financial hardship? Or are you being proactive in building your credit and don’t need more credit now?

If you need a higher credit limit immediately, you may want to consider the following alternatives:

-

Apply for a new credit card.

Many credit cards offer interest-free periods of a year or more on new purchases or balance transfer offers. This is often the fastest and cheapest way to finance a large purchase. -

Apply for a personal loan.

Personal loans typically offer interest rates that are lower than credit cards. Generally, you can access the funds within a few days. As a bonus, a personal loan may help raise your credit score as it adds diversity to your credit mix. -

Request a credit line increase on a card from a different bank.

While there are a variety of reasons why Capital One may deny your request, another bank may grant a credit limit increase. For example, if Capital One recently increased your credit limit and won’t do another increase so soon, you may be able to get one from another card issuer.

Learn how to ask for an increase to your credit limit from Wells Fargo and Bank of America.

If you don’t need access to a higher line of credit right now, improve your credit by doing one or more of the following actions.

- Check your credit report to see where you can improve your credit score. See your credit score for free with LendingTree Spring.

- Bring your bills current. Missed payments affect your credit score more than you may realize.

- Set up automatic payments so you don’t miss any payments and incur late fees.

- Try to keep your credit utilization below 30%. If you have a $1,000 credit limit, your statement ending balance should be at most $300. You can make payments more frequently to keep your balance low.

- If you have credit card debt, consider the debt snowball method to reduce your credit card balances.

- Become an authorized user on another person’s credit card. You can piggyback off of another person’s credit as a way to boost your credit score.