Best High Limit Credit Cards in 2026: More Spending Power & Perks

Best credit card with a high limit

Best credit card with a high limit

Chase Sapphire Reserve®

The Chase Sapphire Reserve® is the best high-limit credit card, as it offers a high minimum limit of $10,000, along with a stellar earning rate, sign-up bonus and luxury travel benefits.

Key takeaways

- What counts as a high credit limit varies by your credit score.For poor or limited credit, a $2,000 limit is relatively high. With good or excellent credit, limits of $20,000 to $40,000 are more common.

- Our picks for high credit limit cards have a reputation for offering above-average limits, though there’s no guarantee you’ll get a high limit with any card.

- The cards we recommend are known for offering above-average limits, though approval amounts vary.

- LendingTree data shows that American Express, Bank of America and Wells Fargo typically offer the highest starting limits.

- (Winner) Best high-limit credit card overall: Chase Sapphire Reserve®

- Best high-limit card for travel: Capital One Venture X Rewards Credit Card

- Best high-limit card for luxury card users: American Express Platinum Card®

- Best business credit card with high limit: The Blue Business® Plus Credit Card from American Express

- Best balance transfer credit card with a high limit: BankAmericard® credit card

- Best high-limit card for cash back*: Blue Cash Preferred® Card from American Express

- Best high-limit credit card with no annual fee: Chase Freedom Unlimited®

- Best secured credit card with a high limit: U.S. Bank Cash+ Visa Secured Card

- Best easy approval high-limit credit card: Secured Chime Credit Builder Visa® Credit Card

Which bank gives the highest credit limit?

A LendingTree study of credit card limits shows that certain major issuers tend to be much more generous with credit limits than others. American Express offers the highest overall average starting credit limit — $12,177 — followed by Bank of America with an average of $11,436. Wells Fargo is also fairly generous with starting credit limits, with an overall average of $9,498.

Average credit card limits for new cards from major issuers by cardholder credit score

9 best high-credit-limit cards

| Credit Cards | Our Ratings | Credit Limit | Annual Fee | Rewards Rate | |

|---|---|---|---|---|---|

Chase Sapphire Reserve®*

|

Winner

|

Starting at $10,000 | $795 | 1X - 8X points

| |

Capital One Venture X Rewards Credit Card

|

Travel

|

Not officially disclosed, though some cardholders report limits as high as $100,000. | $395 | 2X - 10X miles

| |

American Express Platinum Card®

|

Luxury card users

|

No preset spending limit. The amount you can spend adapts based on factors such as your purchase, payment and credit history. | $895 | 5X points

| |

The Blue Business® Plus Credit Card from American Express

|

Business owners

|

Potential for no preset spending limit. The amount you can spend adapts based on factors such as your purchase, payment and credit history. | No annual fee | 1X - 2X points

| |

BankAmericard® credit card*

|

Balance transfers

|

Not officially disclosed, though some cardholders report a limits as high as $19,000. | $0 | N/A | |

Blue Cash Preferred® Card from American Express

|

Cash back*

|

Not officially disclosed, though some cardholders report limits as high as $31,000. | $0 intro annual fee for the first year, then $95. | 1% - 6% cash back

| |

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

No annual fee

|

Starting at $500 or $5,000 | $0 | 1.5% - 5% cash back

|

on Chase's secure site Rates & Fees |

U.S. Bank Cash+ Visa Secured Card*

|

Secured card

|

$300 to $5,000 | $0 | 1% - 5% cash back

| |

Secured Chime Credit Builder Visa® Credit Card*

|

Easy approval

|

Transfer any amount from your Chime checking account, which will serve as your line of credit. | $0 | N/A |

Methodology: How we chose the best high-credit-limit credit cards

We take a comprehensive, data-driven approach to identify the best high-limit credit cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals.

For high-limit credit cards, we’ve selected cards that offer the possibility of receiving a high credit limit. We considered features like rewards programs, 0% intro APR, regular APR and benefits. Each of the cards on this list excel for certain types of financial needs. Many of the cards on this list charge no annual fee. At the same time, those that do charge an annual fee offer enough value through rewards and benefits to be worth it.

Best credit card with high limit

Chase Sapphire Reserve®*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Starting at $10,000

- Earn 8x points on all purchases through Chase Travel℠, including The Edit℠

- Earn 4x points on flights and hotels booked direct

- Earn 3x points on dining worldwide

- Earn 1x points on all other purchases

- Welcome offer: 125,000 points Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

- Transfer points to 10-plus loyalty programs

- $2,000+ worth of credits, including a $300 travel credit

- Airport lounge access

- Excellent travel insurance

- $795 annual fee

- $195 authorized user fee per year

- Excellent credit recommended

The Chase Sapphire Reserve® is a Visa Infinite card, which means its minimum credit limit is $10,000. This is a very high starting base for a credit limit, which you’re likely to exceed if you have excellent credit.

The card is best for frequent travelers who take advantage of benefits, like a Global Entry, NEXUS or TSA PreCheck fee credit and airport lounge access. That said, you should only get it if you travel enough and use the benefits fully to make up for the $795 annual fee. If you’re looking for a similar card with a high credit limit and a lower annual fee, you should check out the Chase Sapphire Preferred® Card.

What do Reddit users say?

“On Chase Sapphire Reserve®, my limit is $80K.”

- Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

- Get more than $2,700 in annual value with Sapphire Reserve.

- Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years

- Get up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Get complimentary Apple TV+, the exclusive streaming home of Apple Originals. Plus Apple Music — all the music you love, across all your devices. Subscriptions run through 6/22/27 — a value of $250 annually

- Member FDIC

Best high-limit card for travel

Capital One Venture X Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Not officially disclosed, though some cardholders report limits as high as $100,000.

- Earn 2 Miles per dollar on every purchase, every day

- Earn 10 Miles per dollar on hotels and rental cars booked through Capital One Travel

- Earn 5X Miles per dollar on flights booked through Capital One Travel

- Welcome offer: 75,000 miles Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening

- Miles transfer to airlines and hotels

- $300 annual credit for travel through Capital One’s travel website

- Priority PassTM lounge access

- Global Entry or TSA PreCheck® credit

- $395 annual fee

- Excellent credit recommended

- Limited bonus rewards categories

While Capital One has a reputation for offering lower credit limits on its cards, the Capital One Venture X Rewards Credit Card may be an exception. It’s a Visa Infinite credit card — Visa Infinite cards typically have a starting limit of $10,000, and some Capital One Venture X Rewards Credit Card cardholders report limits as high as $100,000. You’ll pay a more reasonable annual fee compared to other premium travel credit cards and get excellent travel perks in return, including Priority Pass lounge access and an annual $300 credit for travel purchased through Capital One’s travel portal.

You’ll also earn miles at a high rate that you can transfer to an array of airline and hotel partners.

What do Reddit users say?

“I have 75k — when I asked for a credit increase, they told me 75k is the highest. I heard people have 100k, but I haven’t verified it.”

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights and vacation rentals booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best high-limit card for luxury card users

American Express Platinum Card®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Potential for no preset spending limit — spending limit is flexible and depends on factors such as your purchase, payment and credit history

- Earn 5X Membership Rewards® points on flights booked directly with airlines or with American Express Travel® on up to $500,000 on these purchases per calendar year

- Earn 5X Membership Rewards® points on prepaid hotels booked with American Express Travel®.

- Terms apply.

- Welcome offer: As high as 175,000 points You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

- Over $2,000 in travel and shopping credits

- Access to the Global Lounge Collection®

- Hotel elite status (enrollment required)

- Transfer points to 20 travel programs

- $895 annual fee

- Low rewards rate on non-travel purchases

- Annual credits can be difficult to use

The American Express Platinum Card® is an excellent option if you’re looking for a card with no preset spending limit and plenty of travel perks. The amount you can spend adapts based on factors such as your purchase, payment and credit history.

It’s best for travelers who take advantage of luxury benefits, like hotel elite status (enrollment required) and airport lounge access for eligible card members. But because of its large $895 annual fee, it’s not the best fit for people who only travel occasionally.

What do Reddit users say?

“I have a $750k limit, but they’ve let me go up to $1.4 million.”

- Click APPLY NOW to apply online.

- You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings. You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- With over 1,550 airport lounges - more than any other credit card company on the market* - enjoy the benefits of the Global Lounge Collection®, over $850 of annual value, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass Select membership (enrollment required), and other select partner lounges.* As of 07/2025.

- $200 Uber Cash + $120 Uber One Credit: With the Platinum Card® you can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction. Plus, when you use the Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- $300 Digital Entertainment Credit: Experience the latest shows, news and recipes. Get up to $25 in statement credits each month when you use your Platinum Card® for eligible purchases on Disney+, a Disney+ bundle, ESPN streaming services, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. Enrollment required.

- $600 Hotel Credit: Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the Platinum Card®. *The Hotel Collection requires a minimum two-night stay.

- $400 Resy Credit + Platinum Nights by Resy: Get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at U.S. Resy restaurants. Enrollment required. Plus, with Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you.

- $209 CLEAR+ Credit: CLEAR+ helps get you to your gate faster by using your face to verify you are you at 55+ airports nationwide. You can cover the cost of a CLEAR+ Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR+ with your Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- Start your vacation sooner, and keep it going longer. When you book Fine Hotels + Resorts® through American Express Travel®, enjoy noon check-in, when available, and guaranteed 4PM check-out.

- $300 lululemon Credit: Enjoy up to $75 in statement credits each quarter when you use the Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That’s up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit: Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the Platinum Card®.* Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- Whenever you need us, we're here. Our Member Services team will ensure you are taken care of. From lost Card replacement to statement questions, we are available to help 24/7.

- $895 annual fee.

- Terms Apply.

- Rates & Fees

Best business credit card with a high limit

The Blue Business® Plus Credit Card from American Express

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Potential for no preset spending limit — spending limit is flexible and depends on factors such as your purchase, payment and credit history

- Earn 2X points on everyday business purchases such as office supplies or client dinners.

- Earn 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter.

- Terms and limitations apply.

- Welcome offer: 15,000 points Earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership.

- No annual fee

- Earns American Express Membership Rewards points

- 2X points on first $50,000 in purchases annually

- Intro APR offer for purchases

- Earns just 1X points after spending threshold is met

- Low welcome offer

The Blue Business® Plus Credit Card from American Express is the best business credit card with a high limit, thanks to its potential for expanded buying power and the fact that it has no annual fee. New cardholders can also get an intro APR offer for purchases, and they can earn flexible Amex Membership Rewards points for travel.

You’ll earn points at a high rate on every purchase, though business owners with a big budget beware: You’ll only get 1X point after the first $50,000 in purchases in a year.

What do Reddit users say?

“I spend anywhere from $3k to $30k a month, so I’d consider anything under ~$75k a tad low…my highest limit is $75k on The Blue Business® Plus Credit Card from American Express.”

- Click APPLY NOW to apply online.

- Earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership.

- 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 16.74% - 26.74%, based on your creditworthiness and other factors at account opening. APR will not exceed 29.99%

- Earn 2X points on everyday business purchases such as office supplies or client dinners. 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter. Terms and limitations apply.

- You’ve got the power to spend beyond your credit limit* with Expanded Buying Power. *The amount you can spend above your credit limit is flexible, so it adapts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors. Just remember, the amount you can spend with Expanded Buying Power is not unlimited.

- No Annual Fee

- Terms Apply.

- Rates & Fees

Best balance transfer credit card with a high limit

BankAmericard® credit card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Not officially disclosed, though some cardholders report limits as high as $19,000.

- Lengthy intro APR offer for purchases and balance transfers

- $0 annual fee

- Introductory balance transfer fee

- No penalty APR for late payments

- No rewards for spending

- No meaningful cardholder benefits

While Bank of America doesn’t list a minimum credit limit for the BankAmericard® credit card, anecdotal evidence suggests it can be on the high side. This card can also be an excellent option for balance transfers due to its lengthy intro APR offer, $0 annual fee and introductory balance transfer fee.

The card doesn’t come with many other benefits, but members do get free FICO score access on their credit card statement.

What do Reddit users say?

“My wife and I just applied separately for the Citi Simplicity® Card to take advantage of the balance transfer offer too. We have 800+ scores and a combined income of $152,000. We both got a $7,000 limit. We then each applied for the BankAmericard® credit card. Same balance transfer offer. We both got a $19,000 limit.”

- New! 0% Intro APR for 21 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 14.74% - 25.74% will apply. A 5% fee applies to all balance transfers. Balance transfers may not be used to pay any account provided by Bank of America.

- No annual fee.

- No penalty APR. Paying late won't automatically raise your interest rate (APR). Other account pricing and terms apply.

- This offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

Best high-limit card for cash back*

Blue Cash Preferred® Card from American Express

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Not officially disclosed, though some cardholders report limits as high as $31,000.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%)

- Earn 6% cash back on select U.S. streaming subscriptions

- Earn 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases

- Earn 1% cash back on other purchases

- Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout

- Welcome offer: $250 statement credit Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

- One of the highest rewards rates on U.S. supermarket purchases

- Intro APR offer for purchases

- Monthly streaming subscription credit (enrollment required)

- Annual fee

- Limited redemption options

The Blue Cash Preferred® Card from American Express is an excellent cash back* rewards card that’s reported to offer high credit limits to some cardholders. You’ll earn some of the highest rewards rates around on categories like U.S. supermarkets and U.S. gas stations. You’ll also get up to a $10 monthly statement credit after using your enrolled Blue Cash Preferred® Card from American Express for a subscription purchase, including a bundle subscription purchase, at disneyplus.com, Hulu.com or Plus.espn.com U.S. websites. Subject to auto-renewal. These benefits can easily outmatch the annual fee.

What do Reddit users say?

“I got a Blue Cash Preferred® Card from American Express a couple years ago with…a $31k limit. I don’t recall what my income was at the time, somewhere around $150k/yr. Credit score ~800 at the time. IME, Amex writes higher limits than other card brands.”

- Click APPLY NOW to apply online.

- Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

- $0 intro annual fee for the first year, then $95.

- Low Intro APR: 0% intro APR on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR of 19.49% - 28.49%.

- Plan It®: Buy now, pay later with Plan It. Split purchases of $100 or more into equal monthly installments with a fixed fee so you don’t have the pressure of paying all at once. Simply select the purchase in your online account or the American Express® App to see your plan options. Plus, you’ll still earn rewards on purchases the way you usually do.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases and 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- Get up to a $10 monthly statement credit after using your enrolled Blue Cash Preferred® Card for a subscription purchase, including a bundle subscription purchase, at disneyplus.com, Hulu.com, or Plus.espn.com U.S. websites. Subject to auto-renewal.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Rates & Fees

Best high-limit credit card with no annual fee

Chase Freedom Unlimited®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Starting at $500 or $5,000

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- Earn 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service

- Earn 1.5% on all other purchases

- Welcome offer: $200 cash back Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- $0 annual fee

- Long intro APR on purchases and balance transfers

- High cash back earning rate

- Transfer points to premium Chase Ultimate Rewards® cards

- Points are flexible and easy to redeem

- Foreign transaction fees

- Good / Excellent credit recommended

The Chase Freedom Unlimited® offers a solid minimum credit limit of $5,000, if your credit is good enough to qualify for the Visa Signature version of the card. (If you’re approved for a Visa Platinum, your minimum credit limit is $500.)

It’s one of the highest-earning cash back credit cards and comes with a $0 annual fee. Points are flexible and easy to redeem. Plus, if you have multiple Chase Ultimate Rewards® credit cards, you can potentially get more value by transferring points between them and using them to book travel through Chase TravelSM.

What do Reddit users say?

“Just applied for the Chase Freedom Unlimited® with a 750 credit score, 2nd credit card. Was approved immediately online and went on to make an account, with a credit limit of $5,000.”

- Click APPLY NOW to apply online.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% - 27.74%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- Rates & Fees

Best secured credit card with a high limit

U.S. Bank Cash+ Visa Secured Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: $300 to $5,000

- Earn 5% cash back on up to $2,000 in purchases per quarter in the two categories of your choosing

- Earn 2% cash back on purchases in one everyday category of your choice

- Earn 1% back on other purchases

- $0 annual fee

- Earns cash back rewards

- Choose your payment due date

- Security deposit required

- No sign-up bonus

The U.S. Bank Cash+ Visa Secured Card is best for people with limited / poor credit, particularly ones who have a larger number of expenses and need a more flexible credit card to accommodate them. It has a maximum credit limit of $5,000 (based on the amount that you deposit) — higher than many other secured credit cards.

On top of its high credit limit for a secured credit card, it also offers cash back on a wide range of everyday expenses, including fast food, home utilities, department stores and streaming services.

- 5% cash back on the first $2,000 of purchases each quarter in two categories of your choosing.

- 2% cash back on purchases in the category of your choice.

- 1% back on other purchases.

- No annual fee.

Best easy approval high-limit credit card

Secured Chime Credit Builder Visa® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Credit limit: Transfer any amount from your Chime checking account, which will serve as your line of credit.

- No credit check

- $0 annual fee

- Reports to the three major credit bureaus

- No preset credit limit

- No interest

- Chime account required

- No rewards

- No path to upgrade to an unsecured card

- Doesn’t operate like a regular credit card

The Secured Chime Credit Builder Visa® Credit Card doesn’t have a preset credit limit. Instead, you can deposit any amount from an existing Chime checking account to your Chime credit builder account to give yourself a high credit limit.

This card is easy to get approved for, since there’s no credit check. All you need is a Chime checking account and a qualifying direct deposit of $200 or more. It’s a great option for building or repairing credit.

What do Reddit users say?

“With the Secured Chime Credit Builder Visa® Credit Card, you add money to the credit builder account. Add as much as you can and maybe put some requiring monthly charges on there.”

- No annual fees or interest,* no credit check to apply, and no minimum security deposit required3

- Help increase credit score by an average of 30 points1

- View and track your FICO® Score right in the Chime app. FICO Scores are used by 90% of top lenders

- Use everywhere VISA is accepted on everyday purchases, such as gas and groceries, and have these purchases count towards building credit via on-time payments

- Build credit history with your own money - your direct deposit sets how much you could spend, spend up to that amount, and have your monthly balance automatically paid with your direct deposit.

- Instant disable card in-app and real-time transaction alerts to prevent fraudulent activities, 24/7 support to assist you around the clock.

- Interest and fee-free˜ cash withdrawals at 60K+ ATMs at retailers like Walgreens, CVS, and more.

- Apply for a Secured Chime Credit Builder Visa® Credit Card once you sign up for a Chime Checking Account2. See www.chime.com to learn more.

- Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A. The secured Credit Builder Visa® Credit Card is issued by The Bancorp Bank, N.A. or Stride Bank, N.A., pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your card for its issuing bank.

- *No interest: Out of network ATM withdrawal fees may apply. See here for details.1 Based on a representative study conducted by Experian®, members who made their first purchase with Credit Builder between June 2020 and October 2020 observed an average FICO® Score 8 increase of 30 points after approximately 8 months. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.2 To apply for Credit Builder, you must have an active Chime® Checking Account.3 Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month.ATM Disclosure: Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

What is a high credit limit?

The definition of a high credit card limit can depend on how much credit history you have, and on where your credit score and income fall at the moment. Those with higher incomes and credit scores tend to qualify for more generous credit limits, whereas individuals just starting to build credit qualify for credit limits on the lower end.

- Cardholders with lower credit scores:

Individuals with poor or fair credit may qualify for starting credit limits as low as $200 to $300 at first. LendingTree finds that the average starting limit for cardholders with poor credit (scores below 600) falls below $2,000 — anything above this is relatively high. One user on Reddit recently said the following: “For your first credit card, it’s quite unlikely that you’d get 5K right away. Credit isn’t something you can rush, so the limit you get is the limit you get.” - Cardholders with good or excellent credit:

Credit cards geared to consumers with good or excellent credit tend to come with starting limits of around $500 to $10,000, although some users report having limits as high as $20,000 to $40,000. - High-income cardholders and business owners:

Big spenders and small business owners who use credit can be granted even more generous credit limits that could be as high as $100,000 or even $1 million. One consumer on Reddit recently said: “I have a Capital One Venture X Rewards Credit Card with a 119k limit. So definitely possible.”

→ Check your credit score for free with LendingTree Spring.

What is the average credit card limit?

LendingTree found $6,123 to be the average starting limit for a credit card in a recent study. However, the average limit varies a lot across credit ranges. The average starting limit for someone with a score under 520 was $1,274, while the average for cardholders with scores of 760 and up was $13,866.

| Credit score | Average starting limit |

|---|---|

| 760 and Up | $13,866 |

| 720 - 749 | $9,260 |

| 680 -719 | $6,014 |

| 640 - 679 | $4,410 |

| 600 - 639 | $2,796 |

| 560 - 599 | $1,734 |

| 520 - 559 | $1,311 |

| Under 520 | $1,274 |

| All Scores | $6,123 |

→ See the average credit limit for your metro area

Is it good to have a high credit limit?

While having a high credit limit can be good for your credit score and give you more purchasing power overall, there are potential pitfalls. For example, having more available credit makes it easy to overspend.

Pros

- Easier to maintain a lower credit utilization ratio, which can increase your credit score

- More spending power

- Increased available credit for emergencies

Cons

- Makes it easier to overspend and rack up long-term debt

- May impact your ability to qualify for other credit cards

How do credit card companies determine your credit limit?

Credit card issuers all have their own processes for determining credit limits. They may consider the following criteria:

- Your credit profile

Card issuers consider your current and past credit history when assigning credit limits. This includes how long you have been using credit and your history of making on-time payments. - Your income

If you have a high income, your card issuer may be willing to give you more credit. - Your debt-to-income ratio

If your current monthly debts exceed 36% of your monthly income, card issuers may be inclined to assign you a lower credit limit. - Your relationship with the issuer

You have the potential to qualify for a higher credit limit on a card if you have a long and positive relationship with the card issuer. - Annual fee on a card

Credit cards with the highest annual fees tend to come with higher starting credit limits. - The current economic environment

Card issuers may offer higher credit limits if the economy is going well, whereas they may be more stingy during tough economic times.

High credit limit vs. no preset limit

How to get a high-limit credit card

While getting a high-limit credit card may not happen overnight, there are steps you can take to position yourself for more available credit over time:

- Check your credit history and clean up any errors.

You can check your credit reports for free at AnnualCreditReport.com. If you find false information on your reports, take steps to dispute it and have it removed. - Pay down your balances.

Paying down revolving debt can help reduce your credit utilization ratio and give a big boost to your credit score, since it makes up 30% of your FICO credit score. - Choose a card that fits your credit profile. Make sure to apply for credit cards that fit your current credit rating.

- Look for options with your current bank.

You may get a higher credit limit from an issuer that has an existing relationship with you. - See if you’re preapproved.

Some credit cards let you gauge your approval odds and get an idea of your future credit limit before you apply. - Don’t apply for too many cards at once.

Each new card you apply for results in a hard inquiry on your credit reports. Applying for too many in a short amount of time can damage your credit and make it harder to qualify for a card with a good limit.

→ Read How to Apply for a Credit Card in 7 Steps

Application tip

To qualify for a good credit limit, be sure to include all your income sources on your application. Potential income streams include:

- Income from full-time and part-time jobs

- Alimony or child support

- Gifts or trust fund payments

- Investment income

- Social Security payments

- Retirement fund payments

- Your spouse or partner’s income

Note, if you’re under the age of 21, you can only provide personal income, such as income earned through employment.

How to increase your credit card limit

You don’t have to open a new card to increase your credit limit. It’s possible to qualify for a higher credit limit on a card you already have. Take the following steps to boost your odds of an increase:

-

1. Pay your full statement balance on time each month

Paying your credit card bill on time shows issuers you are responsible with credit. This move also helps you avoid late fees and penalty interest rates.

-

2. Make sure the rest of your finances are in good shape

Have some savings in the bank for emergencies, and do your best to avoid overborrowing through other loans like auto loans and personal loans. Living below your means is the best way to ensure you can maintain excellent credit for your lifetime.

-

3. See if your card offers an automatic credit limit review

Sometimes paying your credit card statement balance on time each month is all it takes to qualify for a credit limit increase. There are also credit cards — like the Discover it® Secured Credit Card — that promise automatic reviews after a certain amount of time.

If you’re unsure whether your card issuer offers automatic credit limit increases, you can check the card information online or call the card issuer directly to inquire.

-

4. Gather your financial information

Make sure you have the right information handy when you request a credit limit increase. This includes your total annual income, current employment status and monthly mortgage or rent payment.

You will also want to have a general idea of how much more credit you plan to request. While there are no hard-and-fast rules here, Reddit users recommend asking for anywhere from 50% more available credit to double or triple your current limit if it’s on the low side.

-

5. Contact your credit card company

Some issuers — Capital One and Citi, for example — make it easy to request a credit limit increase online. With others, such as Wells Fargo, you’ll need to call in by phone to make the request. You should also be aware that you should typically wait at least six to 12 months before requesting a credit limit increase on a recently opened card.

- Online: You can find the option to increase your credit limit with Chase, for example, by logging in to your account. If you search through your account services, you’ll find the credit limit increase option. To be considered, you’ll likely have to update your income on your account. Bank of America also has the option to request a credit limit increase online.

- By phone: If you don’t see the option to request a credit limit increase online, try calling the number on the back of your card. You aren’t guaranteed to receive a credit limit increase, but it’s always worth a shot. You may be asked for information, such as your income. Wells Fargo specifies that cardholders need to call their customer service line to request a credit line increase.

→ Learn more about how to increase your credit limit.

Call this number to request a credit limit increase with your bank:

- American Express: 800-528-4800

- Bank of America 800-732-9194

- Capital One (personal): 800-227-4825

- Capital One (business): 800-867-0904

- Chase: 800-432-3117

- Citi: 800-950-5114

- Discover: 800-347-2683

- U.S. Bank: 800-285-8585

- Wells Fargo: 800-642-4720

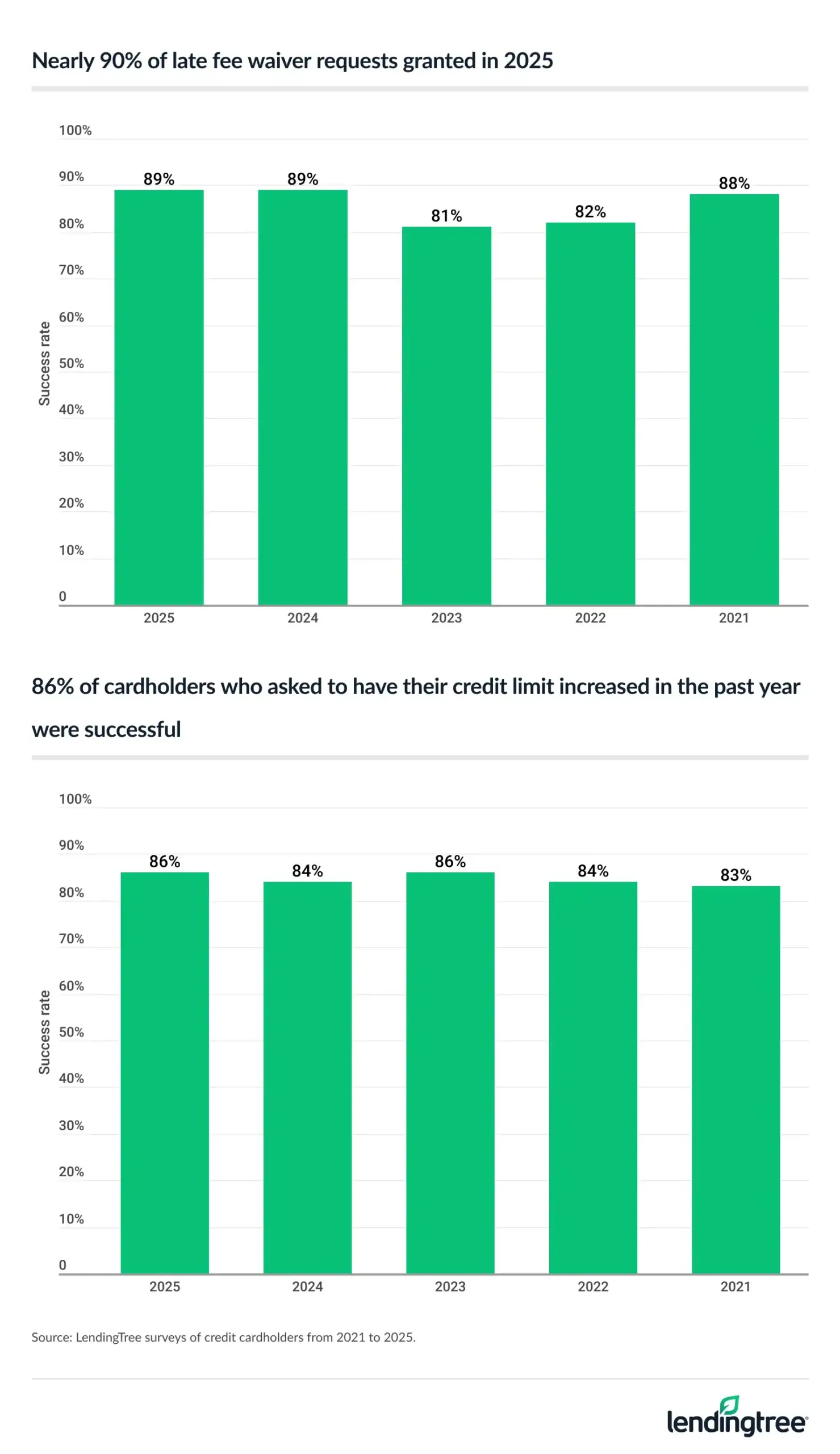

LendingTree data: Ask and you shall receive

You have a great chance of getting approved for a credit limit just by asking your issuer. A survey from LendingTree showed that credit limit increases were one of the most commonly granted requests. 86% of cardholders reported success in our most recent survey:

Frequently asked questions

If you try to make a purchase that exceeds your available credit, your card may be declined at checkout. In some cases, the transaction may still go through, but your issuer could charge an over-the-limit fee.

It can. Increasing your credit limit may help your credit score by lowering your credit utilization ratio, the percentage of credit you’re using.

For example, if you have $2,000 in balances on a card with a $5,000 limit, your utilization is 40%. Increasing the limit to $10,000 would lower it to 20%, which is generally better for your score.

→ Learn more about how increasing your credit limit affects your credit score.

Aim for a credit limit high enough to keep your utilization below 30% of your available credit. Experts generally view this threshold as helpful for maintaining a strong credit score.

→ Learn more about if you can have too much available credit.

There’s no officially published maximum credit limit. However, some consumers report limits of $100,000, $200,000, or more on forums like Reddit.

If you have poor credit, your best chance at a higher limit is typically a secured credit card. Your credit limit will usually match your deposit, so a larger deposit can mean a higher limit. For example, the U.S. Bank Cash+ Visa Secured Card offers a credit limit up to $5,000.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- American Express Platinum Card®

- The Blue Business® Plus Credit Card from American Express

- Blue Cash Preferred® Card from American Express

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Chase Sapphire Reserve®, BankAmericard® credit card, U.S. Bank Cash+ Visa Secured Card, Secured Chime Credit Builder Visa® Credit Card and Chase Slate Edge℠ has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.