Editors’ Picks: Best Low-Interest Credit Cards of 2026 for Smart Borrowers

Our top pick for best low-interest card

Our top pick for best low-interest card

BECU Visa Credit Card

We chose the BECU Visa Credit Card as our top pick for low interest since it offers 0% intro APR for 12 months on purchases, plus 0% intro APR for 12 months on balance transfers when completed within 90 days of account opening completed within 90 days of account opening with a $0 balance transfer fee. Both offers are followed by a lower-than-average 12.74% to 23.74% Variable APR.

Key takeaways

- The BECU Visa Credit Card is our top low-interest credit card since it offers a generous intro APR and no balance transfer fees.

- The best low-interest credit cards offer 0% APR on purchases, balance transfers or both for a limited time.

- These cards help consumers save money as they pay down large purchases or debt they consolidate from other cards.

- Some low-interest credit cards also offer cash back rewards.

- Lowest interest rate credit card: BECU Visa Credit Card

- Low-interest credit card for fair credit: Navy Federal Platinum Credit Card

- Longest intro APR credit card: U.S. Bank Shield™ Visa® Card

- Low-interest business credit card: U.S. Bank Business Platinum Card

- Low-interest credit card with no hard credit check: Secured Self Visa® Credit Card

- Low-interest secured credit card: DCU Visa® Platinum Secured Credit Card

- Low-interest cash back credit card: Chase Freedom Unlimited®

- Balance transfer credit card with a low interest rate: BankAmericard® credit card

- Low-interest travel credit card: Capital One VentureOne Rewards Credit Card

- Low-interest gas credit card: Citi Custom Cash® Card

10 top low-interest cards

| Credit Cards | Our Ratings | Intro Purchase APR | Regular APR | Recommended Credit Credit scores ranges may vary. Your individual chance at approval may vary due to factors such as creditors using a particular variation at their discretion | |

|---|---|---|---|---|---|

BECU Visa Credit Card*

|

3.5

Lowest interest rate credit card

|

0% intro APR for 12 months on purchases | 12.74% to 23.74% Variable | N/A | |

Navy Federal Platinum Credit Card*

|

Low-interest credit card for fair credit

|

N/A | 10.49% to 18.00% (variable) | Fair / Good / Excellent | |

U.S. Bank Business Platinum Card*

|

Low-interest business credit card

|

0% intro on purchases for 12 billing cycles | 16.24% - 25.24% Variable | Good / Excellent | |

U.S. Bank Shield™ Visa® Card*

|

Longest intro APR

|

0% intro APR on purchases for the first 24 billing cycles after card opening | 16.99% - 27.99% variable APR | Good / Excellent | |

Secured Self Visa® Credit Card

on Self's secure site Rates & Fees |

Low-interest credit card with no hard credit check

|

N/A | Variable APR of 27.49% as of 1/1/2026 | Poor |

on Self's secure site Rates & Fees |

DCU Visa® Platinum Secured Credit Card*

|

Low-interest secured credit card

|

N/A | 15.25% (variable) | Poor | |

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

Low-interest cash back credit card

|

0% Intro APR on Purchases for 15 months | 18.24% - 27.74% Variable | Good / Excellent |

on Chase's secure site Rates & Fees |

BankAmericard® credit card*

|

Balance transfer credit card with a low interest rate

|

0% Intro APR for 21 billing cycles for purchases | 14.74% - 25.74% Variable APR | Good / Excellent | |

Capital One VentureOne Rewards Credit Card

|

Low-interest travel credit card

|

0% intro on purchases for 15 months | 18.49% - 28.49% (Variable) | Good / Excellent | |

Citi Custom Cash® Card*

|

Low-interest gas credit card

|

N/A | 17.49% - 27.49% (Variable) | Good / Excellent |

Methodology: How we chose the best low-interest credit cards

We take a comprehensive, data-driven approach to identify the best low-interest credit cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals. We use the following criteria to make our picks:

We calculate the amount saved on interest given the length of the card’s introductory period. We assume a purchase of $6,000 and a monthly payment of $300. We subtract the card’s annual fee and interest paid on any amount remaining after the introductory period expires. We also add in the amount earned on rewards for the average cardholder, including the card’s sign-up bonus, minus the card’s annual fee. We look at the average rewards earned over two years to balance out a card’s ongoing value with its first-year value.

We also compare a card’s benefits, such as purchase and travel protections, against benefits from other cards.

Note, that our ratings are a starting point for comparing and choosing the best 0% APR credit cards. However, your needs may be different from the average cardholder. You should consider the amount you’re likely to finance with a 0% offer and which benefits you value to choose the best card for you.

Lowest interest rate credit card

BECU Visa Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: 0% intro APR for 12 months on purchases; after, a 12.74% to 23.74% Variable APR applies

- Low everyday interest rate

- $0 annual fee

- Intro APR offer on both balance transfers and purchases

- $0 balance transfer fee

- $0 foreign transaction fees

- Requires credit union membership to apply

- Shorter intro APR period than some other cards

- No rewards program

- Minimal benefits

The BECU Visa Credit Card is our choice for the lowest interest card because of its powerful combination of features. Not only does it come with one of the lowest ongoing APRs of any credit card (currently 12.74% to 23.74% Variable), it also offers an interest-free offer on both purchases and balance transfers. You’ll get a 0% intro APR for 12 months on purchases followed by a low APR of 12.74% to 23.74% Variable, as well as an intro APR of 0% intro APR for 12 months on balance transfers when completed within 90 days of account opening (after which, a 12.74% to 23.74% Variable APR applies).

The BECU Visa Credit Card also comes with a $0 balance transfer fee, $0 cash advance fee, $0 foreign transaction fees and $0 annual fee.

- No annual fee

- No balance transfer fees

- No cash advance fees

- No foreign transaction fees

- Choose from four card designs

Low-interest credit card for fair credit

Navy Federal Platinum Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro balance transfer APR: 0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening; after, an 10.49% to 18.00% (variable) APR applies

- Low everyday interest rate

- Intro APR on balance transfers

- Limited fees

- Qualify with fair / good / excellent credit

- Requires membership in Navy Federal Credit Union

- No intro APR period on purchases

- No rewards program

- Minimal benefits

The Navy Federal Platinum Credit Card is one of few cards available to people with fair credit that includes an introductory APR. You’ll get a 0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening. After that, you’ll get a relatively low APR of 10.49% to 18.00% (variable). Plus, unlike many other cards with balance transfer offers, it doesn’t have any balance transfer fees.

There are also $0 annual fees and $0 foreign transaction fees with the card. However, you’ll need to be a member of Navy Federal Credit Union to apply for this card. Membership requires you to be a member of the armed forces, Department of Defense, or a veteran, or a family member of one of the above.

- 0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening. Applies to balance transfers requested within 60 days of account opening.

- After the intro period, a 10.49% to 18.00% (variable) APR applies

- No balance transfer fee

- No annual fee

Longest intro APR credit card

U.S. Bank Shield™ Visa® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: 0% intro APR on purchases for the first 24 billing cycles after card opening; after, a 16.99% - 27.99% variable APR applies

- Longest intro APR currently available

- $0 annual fee

- Cellphone protection

- Earns cash back on select travel booked in the Rewards Center

- Chance to earn a statement credit

- No sign-up bonus

- Rewards are limited

- Poor long-term value

The U.S. Bank Shield™ Visa® Card stands out for its longest-in-market intro APR, giving you real breathing room to finance a purchase or pay down debt. There’s no sign-up bonus, and rewards are limited — but you can still earn a $20 annual statement credit for 11 consecutive months of purchases, and the card includes cellphone protection. For most people, though, the headline isn’t the perks — it’s the interest you can save, which is where this card’s value really lies.

- For a limited time, get a special 0% intro APR on purchases and balance transfers for 24 billing cycles. After that the APR is variable, currently 16.99% - 27.99%.

- 4% cash back on prepaid air, hotel and car reservations booked directly in the Rewards Center when you use your card

- $0 annual fee

- Earn a $20 annual statement credit for 11 consecutive months of purchases.

- Get up to $600 reimbursed if your cell phone is stolen or damaged when you pay your monthly cellular bill with your card.

- Free credit score access

Low-interest business credit card

U.S. Bank Business Platinum Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: 0% intro on purchases for 12 billing cycles; after, a 16.24% - 25.24% Variable Variable APR applies

- Long intro APR for purchases and balance transfers

- $0 annual fee

- Card controls and expense management

- Employee cards for $0 annual fee

- No rewards program

- No intro APR for balance transfers

- Limited benefits

- Foreign transaction fees

The U.S. Bank Business Platinum Card offers one of the longest introductory periods on purchases of any business credit card. If you want to finance a large purchase, you’ll have over a year to pay it down with no interest. The card offers a 0% intro on purchases for 12 billing cycles, then a 16.24% - 25.24% Variable Variable APR applies.

And while it’s light on other benefits, the business credit card comes with some useful tools for your small business, including controls for employee cards and expense management.

- 0% Intro APR on purchase and balance transfers for 12 billing cycles. After that, a variable APR currently 16.24% - 25.24%.

- Save on interest when you transfer balances from higher rate credit cards.

- Take control of your card spend with U.S. Bank Spend Management—a game-changing platform for monitoring and managing business expenses and employee spending.

- No annual fee.

- Terms and conditions apply.

Low-interest credit card with no hard credit check

Secured Self Visa® Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Regular purchase APR: Variable APR of 27.49% as of 1/1/2026

- Deposit as low as $100

- No hard credit check

- Helps build credit by reporting to the major credit bureaus

- Security deposit required

- No rewards program

If you have bad credit or are working on building your credit history, you might consider the Secured Self Visa® Credit Card. It’s a secured credit card designed for people with bad or poor credit. There’s no hard credit check performed when you apply, and the minimum security deposit is just $100. Plus, you can be considered for credit limit increase in just six months.

- Click APPLY NOW to apply online.

- No hard credit check or credit score required

- See if you’re approved in minutes

- Fund the secured Self Visa® Credit Card1 with a minimum security deposit of $100.

- $0 annual fee for the first year only, $25 annual fee thereafter. Variable APR of 27.49% as of 1/1/2026. Offer valid for new customers only.

- Reports to all 3 major credit bureaus to build credit history

- Be automatically considered for a higher credit line in just 6 months—no extra deposit needed

- Monitor your credit progress in the app with free access to your Credit Score.

- Secure your credit line with a refundable security deposit - as low as $100.5

- Use your card anywhere Visa is accepted–in the US.

- Enjoy peace of mind with $0 Fraud Liability Guarantee for Lost/Stolen Cards with Visa’s Zero Liability Policy

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Manage your account online, by phone or in Self mobile app

- If you don’t have the $100 security deposit today, consider a Credit Builder Account2 starting at $25 a month4. Consistent, on-time payments help you build credit and build savings to secure the secured Self Visa® Credit Card.3

- 1Self is not a bank. Secured Self Visa Credit Card issued/held by Lead Bank, Sunrise Banks, N.A., or First Century Bank, N.A. See self.inc/visa-secured-credit-card for details including important rate and fee information.

- 2Self is not a bank. Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., or First Century Bank, N.A., each Member FDIC. See self.inc/credit-builder-loan for details including important rate and fee information.

- 3Qualification for the secured Self Visa® Credit Card is based on meeting eligibility requirements, including income and expense requirements and establishment of security interest. Criteria subject to change

- 4$25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

- 5Deposits are returned upon account closure after settling outstanding balances.

- Rates & Fees

Low-interest secured credit card

DCU Visa® Platinum Secured Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Regular purchase APR: 15.25% (variable)

- Exceptionally low APR for a secured credit card

- Builds credit by reporting to the credit bureaus

- Limited fees

- Possibility of approval with poor credit

- Requires credit union membership

- No rewards program

- Requires a security deposit

The DCU Visa® Platinum Secured Credit Card is another option if your credit is less-than-ideal and you’re looking for a secured card. It features an APR of 15.25% (variable), one of the lowest rates you’ll find among secured credit cards.

While you are required to put down an initial security deposit, that deposit will turn into your initial credit limit. The DCU Visa® Platinum Credit Card also requires credit union membership to apply, but you can be approved even with bad or poor credit. Further, there’s a $0 annual fee, no balance transfer fee, no cash advance fee and $0 foreign transaction fees.

- APR as low as 15.75% variable

- No annual fee

- No balance transfer fee

- No cash advance fee

- No foreign transaction fee

Low-interest cash back credit card

Chase Freedom Unlimited®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: 0% Intro APR on Purchases for 15 months; after that, a 18.24% - 27.74% Variable APR applies

- Long intro APR on purchases and balance transfers

- $0 annual fee

- Earn rewards with every purchase

- Purchase protection and extended warranties

- Requires good / excellent credit

- Relatively high regular APR

- Foreign transaction fee

The Chase Freedom Unlimited® is one of the best cash back cards you can find with an introductory APR on both purchases and balance transfers. It gives you a longer-than-average intro period to pay down a balance, plus a great cash rewards program that makes it worth keeping in the long run.

You can enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

The card requires a better credit score than other cards, however, so you should consider alternatives if your credit still needs some work.

- Click APPLY NOW to apply online.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% - 27.74%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- Rates & Fees

Balance transfer credit card with a low interest rate

BankAmericard® credit card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: 0% Intro APR for 21 billing cycles for purchases; after, a 14.74% - 25.74% Variable APR applies

- One of the longest intro periods for balance transfers and purchases

- Intro balance transfer fee

- $0 annual fee

- No penalty APR

- Requires good / excellent credit

- No rewards program

- Foreign transaction fees

The BankAmericard® credit card comes with one of the longest intro periods for purchases and balance transfers around. The card also has an intro balance transfer fee of 5% of the amount of each transaction

While this low-interest credit card doesn’t have a rewards program or many other perks, its long intro APR on purchases and balance transfers plus its potentially low regular APR can score you savings in the long run.

- New! 0% Intro APR for 21 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 14.74% - 25.74% will apply. A 5% fee applies to all balance transfers. Balance transfers may not be used to pay any account provided by Bank of America.

- No annual fee.

- No penalty APR. Paying late won't automatically raise your interest rate (APR). Other account pricing and terms apply.

- This offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

Low-interest travel credit card

Capital One VentureOne Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: 0% intro on purchases for 15 months; after, a 18.49% - 28.49% (Variable) APR applies

- Long intro APR for balance transfers and purchases

- $0 annual fee

- Foreign transaction fees: None

- Earn rewards with each purchase

- Ability to earn a solid welcome offer

- Recommended for consumers with good / excellent credit

- Lower rewards rate than some other cards

- Potentially high regular APR

- A balance transfer fee applies

If you’re looking to finance an upcoming trip or transfer an existing balance to a travel credit card, the Capital One VentureOne Rewards Credit Card may be your best bet. This rewarding card from Capital One features a longer-than-average intro APR on both purchases and balance transfers (balance transfer fee applies). It also offers a simple, yet solid, rewards program.

You’ll earn 1.25 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. The card also lets you earn a solid initial welcome offer that can boost your rewards balance. It doesn’t have a ton of travel perks as a no-annual-fee card. However, when it comes to foreign transaction fees, there are none.

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- $0 annual fee and no foreign transaction fees

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 18.49% - 28.49% variable APR after that; balance transfer fee applies

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Low-interest gas credit card

Citi Custom Cash® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro purchase APR: N/A; after, a 17.49% - 27.49% (Variable) APR applies

- Long intro APR on purchases and balance transfers

- $0 annual fee

- Valuable cash back rewards

- Solid initial welcome offer

- Earning cap on bonus rewards rate

- Balance transfer fee

- Foreign transaction fee

The Citi Custom Cash® Card isn’t just a really rewarding card for gas purchases. It also gives you more than a year to finance a new purchase or pay down an existing balance, interest-free.

This card lets users earn cash back quickly with a unique structure so you can use the card for more than its intro APR: Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. The 5% category includes gas purchases, making a great option for a dedicated gas card.

Its welcome offer and the ongoing rewards are paid out in ThankYou® Points, which you can redeem as cash or use for travel expenses. The Citi Custom Cash® Card has a $0 annual fee, but watch out for foreign transaction fees.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 17.99% - 27.99%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2026.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

What is a low-interest-rate credit card?

Low-interest-rate credit cards offer low ongoing variable rates that help consumers save money on interest as they pay off their credit card balances. Cards with this perk help consumers save considerable sums of money, since the average credit card interest rate is well over 24.19%, according to a LendingTree analysis.

Low-interest credit cards can be secured or unsecured credit cards, although cards with the lowest rates and best benefits tend to be unsecured.

-

Low-interest card vs. 0% APR credit card

Credit cards that offer 0% APR introductory rates can last anywhere from 12 to 24 months. Introductory rates can apply to new purchases made with a card, balance transfers from other credit cards or both. In these scenarios, individuals get the chance to avoid interest completely as they pay off balances on their cards.

While getting 0% APR for a year is longer can be huge when it comes to interest savings, it’s important to remember that these offers don’t last forever. Once the introductory period ends, remaining balances are charged with the card’s regular variable APR, so it’s important to pay off whatever you can of your balance before your intro APR finishes.

-

Balance transfer cards

Some 0% APR credit cards are also called balance transfer credit cards since they extend 0% APR to balances transferred from other credit cards and loans. These cards typically give consumers 0% APR on balance transfers for 12 to 24 months, which can help them save on interest and pay down debt faster.

In the case of balance transfer cards, the vast majority charge balance transfer fees. While paying these fees is a downside, the added cost can be worth it to get 0% APR for a limited time.

Tip: Most cards with 0% balance transfer offers charge a 3% to 5% fee to transfer your balance. You could pay more than $100 in fees to transfer a large balance. You can save significantly by applying for a credit card with no balance transfer fee, although they are typically offered by credit unions and have stricter requirements to qualify.

How does credit card interest work?

Credit card interest is the price you pay to borrow money with a credit card, and how much you’ll pay is represented with a credit card’s annual percentage rate (APR). The better your credit score is, the lower your regular APR will likely be.

-

How is credit card interest calculated?

Even though how much credit card interest you’re charged is based on your credit card’s annual percentage rate (APR), most credit cards calculate the interest you owe on a daily basis. They do this based on your average daily balance using a calculation called the daily periodic rate. If you don’t have a grace period, which is the time in between the end of your card’s billing cycle and your payment due date, you can reduce your interest charges by paying off all or part of your credit card balance as soon as you can.

Also remember that credit cards can charge different interest rates for different types of balances, including new purchases, balance transfers and cash accessed through a cash advance.

-

When do credit cards charge interest?

If you have a credit card with a 0% intro APR period, you won’t be charged interest on your balances until that period ends. Once it does end, any remaining balances you have — including the balance transfer fee — are charged interest based on the card’s variable APR.

Outside of that, credit cards come with grace periods that let users avoid interest charges on new purchases. Grace periods are the time between the end of a billing cycle and the date the payment is due, and they typically last for 21 days.

-

How to avoid paying credit card interest

If you have a credit card with 0% APR, you can avoid paying interest by paying off all amounts you owe before the introductory period ends.

Outside of introductory APR periods, you can avoid credit card interest by paying off your balance in full every billing period. This means paying the full statement balance on your card each month when you receive your credit card bill.

What is a good interest rate on a credit card?

The average credit card interest rate currently stands at 24.19% across all credit cards in circulation today, according to a LendingTree review. However, a “good” interest rate for you will depend on your credit score and financial history. Lower APRs are usually given to applicants with higher credit scores and stronger financials.

Cards with good interest rates should fall below these averages:

| Category | Min. APR | Max. APR | Avg. | Prior month |

|---|---|---|---|---|

| Avg. APR for all new card offers | 20.45% | 27.63% | 24.04% | 24.19% |

| 0% balance transfer cards | 17.94% | 26.98% | 22.46% | 22.65% |

| No-annual-fee cards | 19.91% | 27.17% | 23.54% | 23.71% |

| Rewards cards | 20.11% | 27.78% | 23.94% | 24.10% |

| Cash back cards | 20.66% | 27.70% | 24.18% | 24.37% |

| Travel rewards cards | 19.64% | 28.30% | 23.97% | 24.11% |

| Airline credit cards | 19.76% | 28.92% | 24.34% | 24.45% |

| Hotel credit cards | 19.74% | 28.67% | 24.21% | 24.32% |

| Low-interest credit cards | 13.41% | 22.47% | 17.94% | 19.11% |

| Grocery rewards cards | 19.95% | 27.94% | 23.95% | 24.11% |

| Gas rewards cards | 20.39% | 27.63% | 24.01% | 24.31% |

| Dining rewards cards | 19.57% | 27.95% | 23.76% | 23.92% |

| Student credit cards | 17.84% | 27.44% | 22.64% | 22.79% |

| Secured credit cards | 26.32% | 26.32% | 26.32% | 26.52% |

How to get a low-interest credit card

If you want a low-interest credit card, you’ll need to think about your goals. Do you want to pay down debt at 0% APR? Or, do you prefer having a low interest rate that lasts as long as you have the card? Consider the following steps to find and apply for the right card for your needs.

- Understand your credit score and what cards you’re likely to be approved for

- Decide which low-interest credit card you want to apply for

- Gather your financial and demographic information

- Apply for the card, either over the phone, in a bank branch or online

- If you’re approved, then start using the card

- If you applied for a card with an intro 0% APR on balance transfers, make sure to do any such transfers during the initial window (usually 60 to 90 days)

Can you get a low-interest credit card with a fixed interest rate?

Fixed-rate credit cards are much less common than they were before the Credit CARD Act of 2009. Since the act requires issuers to notify consumers 45 days before an APR increase, issuers have shifted toward variable APR cards to give themselves more flexibility. That said, a few fixed-rate cards still exist in some credit unions.

Can you ask your credit card issuer for lower rates and fees?

Maximizing your rewards becomes even simpler when you’re not burdened by high interest rates and fees. But how can you achieve that with inflation, record-level debt, and sky-high interest rates?

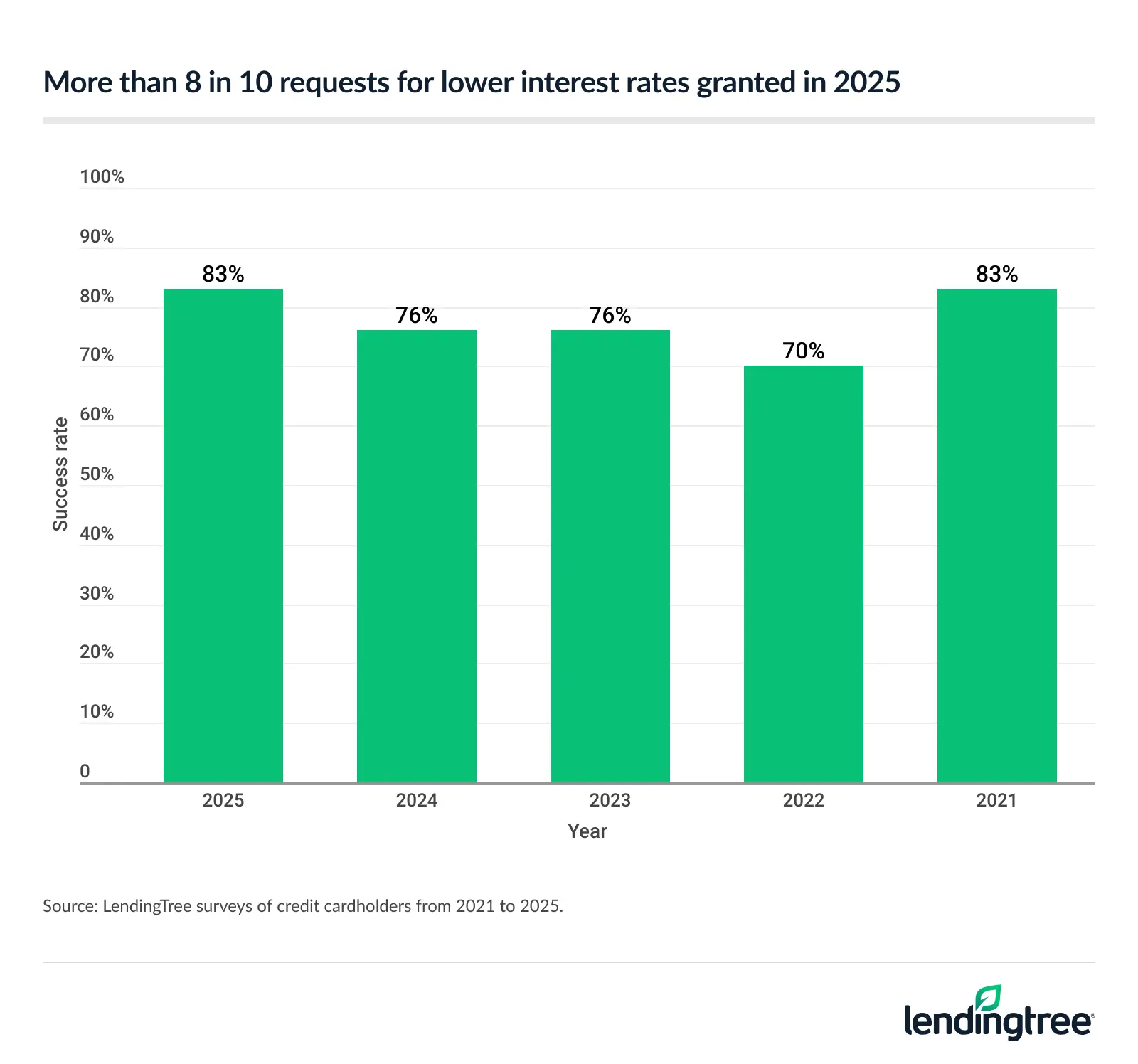

If you just ask your credit card issuer for a break on your rates and fees, there’s a good chance you’ll get it. According to a LendingTree survey, your chances of getting late, balance transfer or foreign transaction fees waived or reduced is higher than it’s been in years.

For example, 83% of those who asked for a lower interest rate on one of their credit cards in the past year were successful; that’s up from 76% in 2024. The average interest rate reduction was 6.7 points, and could save you hundreds of dollars in interest over the life of your balance.

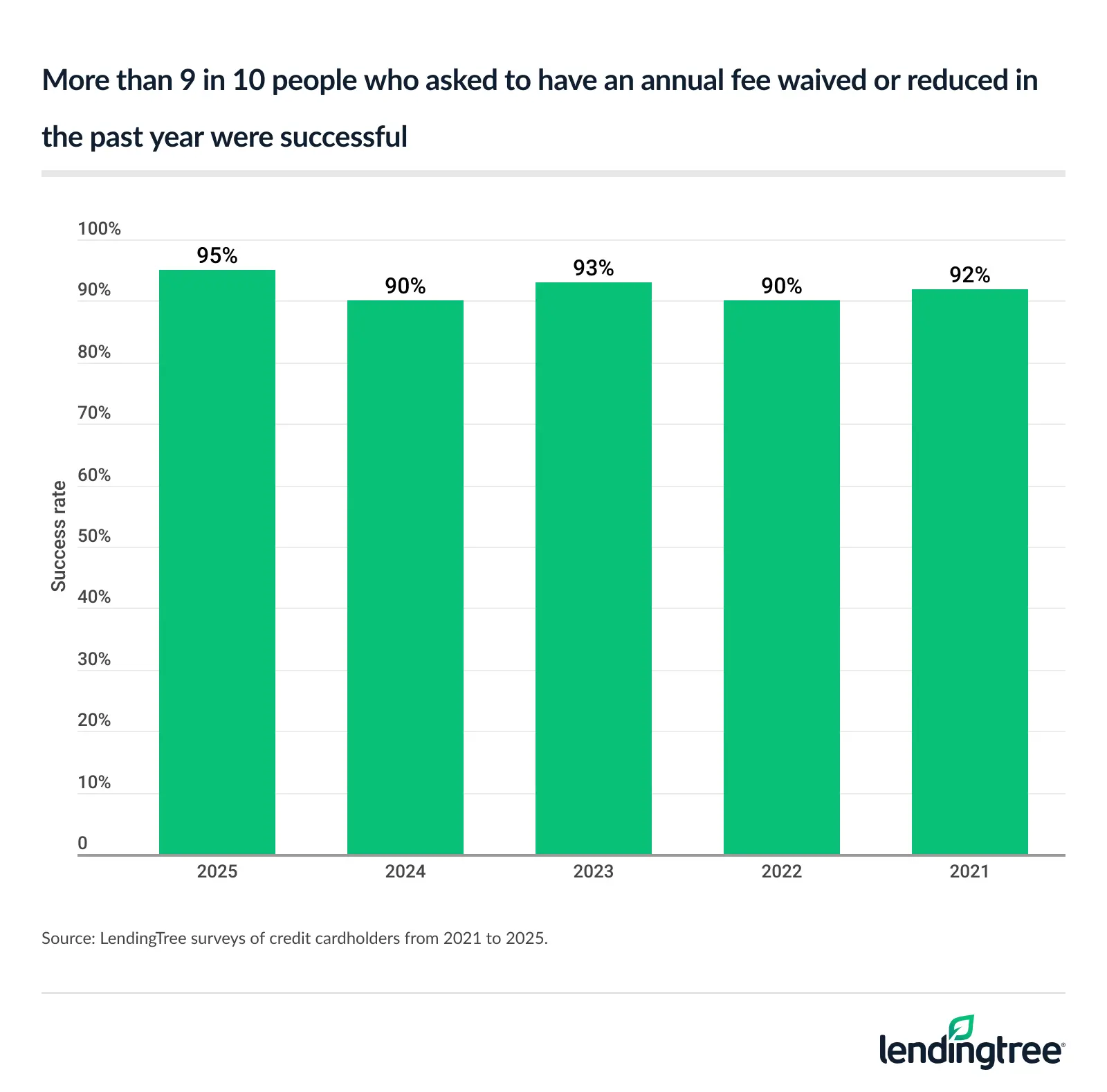

Nearly 90% of people who asked to have an annual fee waived or reduced were successful.

32% of people with an annual fee credit card asked this past year. 72% of people had the fee waived and 18% had it reduced.

Why don’t more people ask for lower rates and fees?

During our survey, when we asked why consumers haven’t asked for a lower interest rate or a higher credit limit, the most common response was that they didn’t know they could ask. As debt continues to rise, reducing your rates and fees can significantly help you avoid or eliminate credit card debt. Plus, your chances of success when requesting a reduction from your credit card issuer may be higher than you expect.

Before talking to your credit card issuer, check your credit.

Understanding your credit score can give you an idea of the lowest rate you may be able to secure. Many issuers also let you request a higher credit limit directly through their mobile app, without needing to speak with anyone.

Frequently asked questions

In the case of many other types of loans, your interest rate is the rate at which interest is charged on any outstanding balances. The annual percentage rate (APR), meanwhile, reflects the total cost of borrowing including fees. For credit cards, your APR is synonymous with your interest rate — and not two separate values like other loans.

It is possible for credit card companies to lower your interest rate. In many cases, all you need to do is call up the customer service department and ask if your interest rate can be lowered. The more valuable you are as a customer (by being a long-time customer and/or regularly paying your bills on time), the more likely the bank is to grant your request.

If you don’t have any luck with your current card when you ask your card issuer, consider transferring your high-interest debt to a balance transfer credit card instead.

There’s no one bank that offers lower rates across the board. Credit card interest rates are typically variable, which means they not only change over time but also depend on each borrower’s specific financial situation. Because of this, some banks may offer lower interest rates for some borrowers and higher rates for others.

Some of the best low-interest credit cards are geared to individuals with good to excellent credit, whereas others can work for people with poor credit or fair credit. If you have limited credit history or poor credit, you may want to look into secured credit cards with lower-than-average interest rates first.

Unfortunately, cards with 0% intro APR offers are usually never geared to individuals with poor credit. If you have bad credit but you want to save money on interest, your best bet is paying down any credit card balances you have as quickly as you can. Also make on-time payments on your card(s) each month, and you can slowly work toward building your credit score over time.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the BECU Visa Credit Card, Navy Federal Platinum Credit Card, U.S. Bank Shield™ Visa® Card, U.S. Bank Business Platinum Card, DCU Visa® Platinum Secured Credit Card, BankAmericard® credit card, Citi Custom Cash® Card, DCU Visa® Platinum Credit Card, Wings Visa Platinum Credit Card and Lake Michigan Credit Union Prime Platinum has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.