Credit Card Confidence Sees 1st Decrease Since December

Credit card confidence dipped in March for the first time in 2025, according to the latest LendingTree Credit Card Confidence Index.

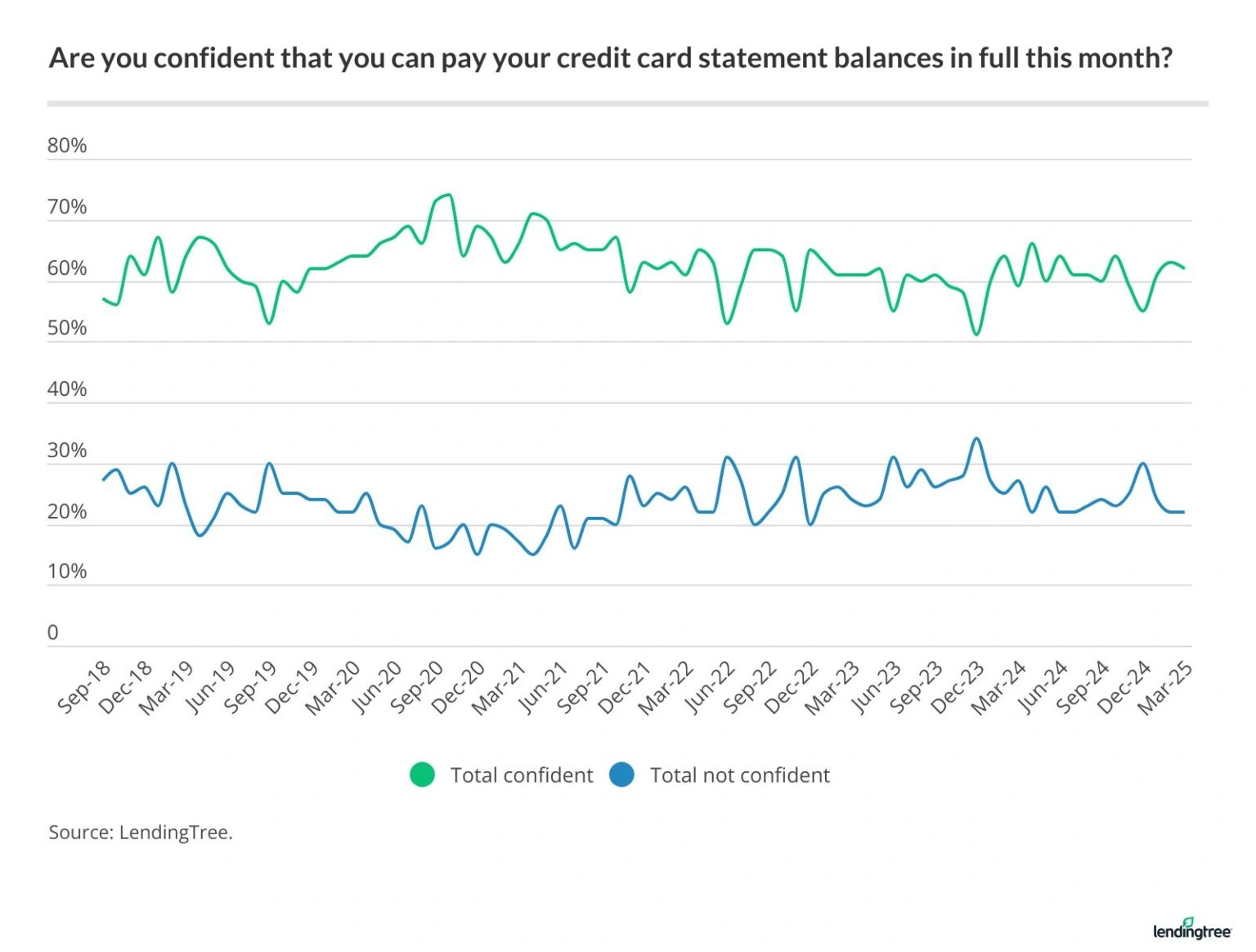

Every month since September 2018, LendingTree has asked a nationally representative sample of credit cardholders the following: “Think about all of your credit cards. On a scale of 1 to 5 (5 being very confident, 1 being not at all confident), how confident are you that you can pay the entire monthly statement balance on all of those cards in full this month?” Those who responded with 4s and 5s were called confident, while those who responded with 1s or 2s were deemed not confident.

Here’s what you need to know about this month’s data.

- Credit card confidence dips slightly in March. 62% of cardholders say they’re confident in their ability to pay their credit cards’ monthly statement balances in full this month. That’s down one point from February, marking the first decrease in 2025. Meanwhile, just 22% say they aren’t confident, unchanged from last month.

- Gen Z confidence falls as baby boomer confidence jumps. 70% of Gen Z cardholders express confidence, down eight points in March after rising 11 in February. Boomers are the only age group with a confidence increase in March, rising four points to the highest since October.

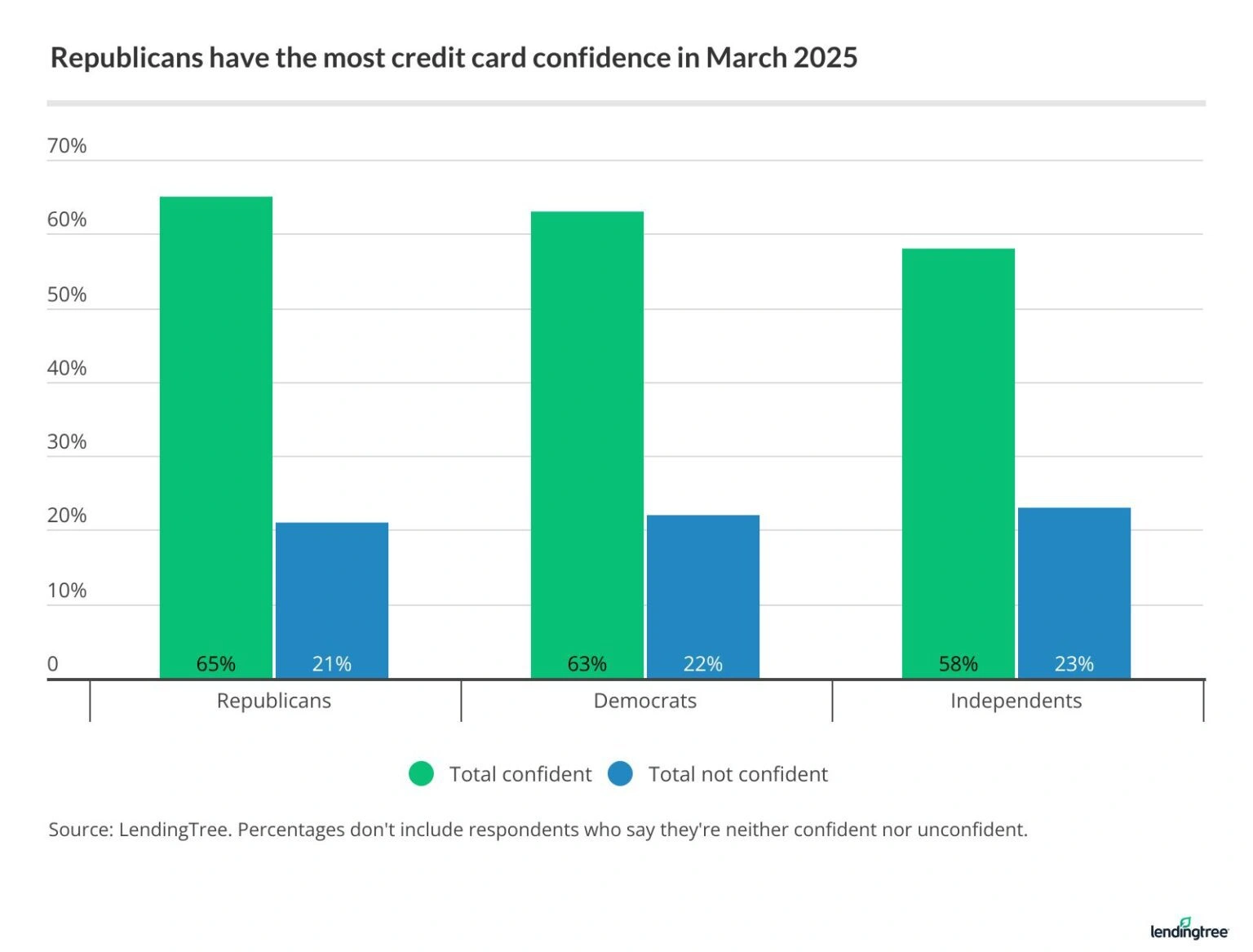

- The partisan gap shrinks. 65% of Republicans express confidence, down four points from February. Meanwhile, 63% of Democrats (unchanged from a month ago) and 58% of independents (down from 59%) say they’re confident.

Confidence dips for 1st time in 2025

Credit cardholder confidence fell slightly in March, the first decrease after back-to-back increases to begin 2025. It dipped by one point to 62%, the highest mark since 64% in October. There hasn’t been a monthly increase in March since 2021, when confidence rose from 63% to 66%.

Just 22% of cardholders say they aren’t confident. That’s unchanged from the previous month, which was the lowest rate since July’s 22%.

Both men and women saw their confidence dip by a single point, to 69% and 55%, respectively.

Gen Z confidence falls as boomers’ confidence climbs

Seven in 10 cardholding Gen Zers ages 18 to 28 (70%) expressed confidence, while just 9% weren’t confident. That 70% is down eight points from February, which followed an 11-point jump in January. Despite the dip, Gen Z is still the most confident age group for 11 months running. The last time they weren’t the most confident was April 2024, when 69% of Gen Zers and 71% of millennials were confident.

In March, cardholding millennials ages 29 to 44 were the second most confident age group, slightly ahead of boomers ages 61 to 79 (64% versus 63%) and well ahead of Gen Xers ages 45 to 60 (53%). However, boomers were the only group whose confidence grew from February, up four points in March. Meanwhile, Gen Z confidence fell from 78% to 70%, millennial confidence fell from 66% to 64% and Gen X confidence fell from 56% to 53%. Boomers’ confidence level was the highest October’s 65%.

Partisan confidence gap shrinks

We typically see differences between the political parties as well. For example, in September and October 2020, just before the previous presidential election, Republicans were 13 points and 16 points more likely, respectively, to express confidence than Democrats. Then, in November 2020, that gap dropped to three points before it flipped. By January 2021, Democrats were 11 points more likely than Republicans to express confidence.

Perhaps surprisingly, those massive gaps have shrunk significantly in recent years. In 2024, it was never more than six points (65% of Democrats versus 59% of Republicans in May 2024). That has been the peak so far in 2025 as well, with Republicans being six points more confident than Democrats in February (69% versus 63%).

In March, the gap shrunk. Republicans were just two points more likely than Democrats, at 65% and 63%, respectively. Notably, independents were less confident than either party. Just 58% of independent-identifying cardholders expressed confidence in March. That’s seven points fewer than Republicans and five fewer than Democrats.

Expect an April increase, followed by uncertainty over new president, Fed cuts

Since the index began in 2018, cardholder confidence has never fallen in April. It’s been unchanged twice — most recently in 2023 — but has never fallen. I expect that trend to hold. Tax refund checks will play a big role, giving millions of Americans a little extra cash in hand to put toward high-interest debts.

That said, it wouldn’t shock me if confidence dipped slightly. There’s simply so much uncertainty surrounding the economy. The biggest question continues to be how changes initiated by President Donald Trump will impact the economy, including inflation growth. There are other questions as well, such as how the Federal Reserve will handle interest rates cuts. There’s no way to know the road ahead, and that can be unnerving for consumers.

One of the best things cardholders can do — whether they feel good or wobbly about their finances — is knock down their credit card debt. If you don’t, sky-high APRs mean it’ll only continue to grow. The good news is you have options. A 0% balance transfer card might be your best weapon against high interest rates, though a personal loan can help, too.

And don’t forget that you might be able to lower your interest rate with a phone call. A June 2024 LendingTree survey found that 76% of cardholders who asked for a lower interest rate on their credit card in the past year got one, with an average rate reduction of 6.5 points. That can turn a 30.00% card into a 23.50% card or a 24.00% card into a 17.50% card. It’s absolutely worth the call.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 Americans ages 18 to 79 from March 4 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Media inquiries about the Credit Card Confidence Index

Want to talk to Matt — author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — about the latest Confidence Index numbers? Email him at [email protected]. You can also reach out via X at @bymattschulz or Instagram at @bymattschulz.

Recommended Articles