2026 Credit Card Debt Statistics

Americans have an absolute mountain of credit card debt — $1.277 trillion, to be exact.

This credit card debt statistics page tracks Americans’ credit card use each month. We update this page regularly, examining the amount of debt people have, how often they carry a balance from month to month, how frequently they pay their credit card bills late and more.

How much credit card debt do Americans have?

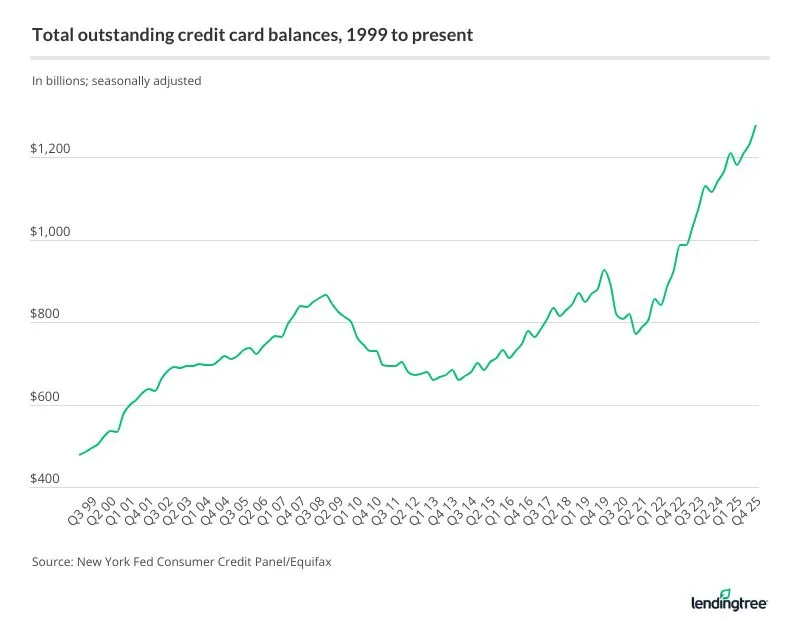

Americans’ total credit card balance is $1.277 trillion as of the fourth quarter of 2025, according to the latest consumer debt data from the Federal Reserve Bank of New York. That’s up from $1.233 trillion in Q3 2025 and is the highest balance since the New York Fed began tracking in 1999.

It isn’t unusual for credit card debt to rise in Q4. The last time we saw card debt decrease in Q4 of a year was 2010, in the wake of the Great Recession.

With this quarter’s increase, credit card balances have risen by $507 billion since Q1 2021, when credit card debt bottomed out at $770 billion during the pandemic. That’s a 66% increase in nearly five years. Americans’ credit card debt is $350 billion higher than the pre-pandemic record set in Q4 2019, when balances stood at $927 billion. (That’s a 38% increase.) However, thanks to still-sky-high interest rates, stubborn inflation and myriad other economic factors, credit card balances are likely only going to climb.

These record balances are light years above the $478 billion seen more than 20 years ago in Q1 1999.

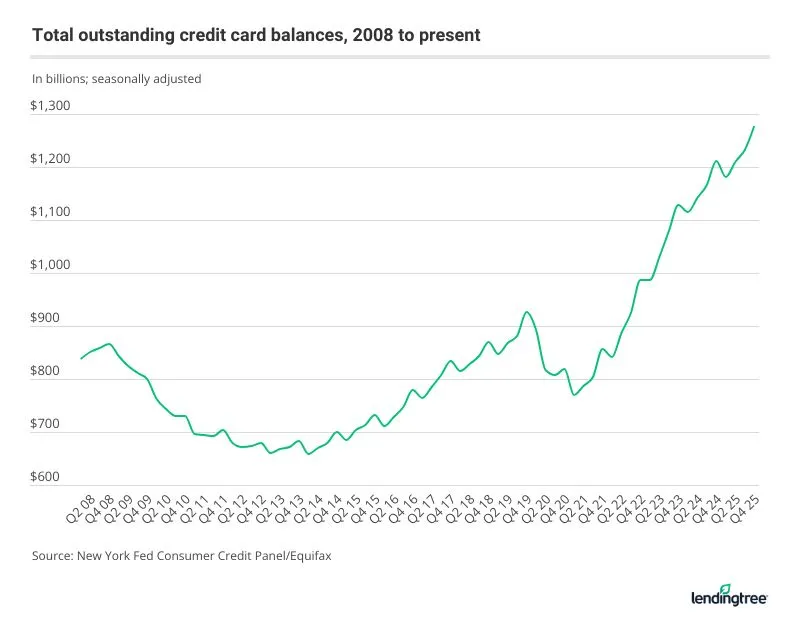

Card debt showed hockey-stick growth until the financial collapse in 2008, when balances fell from $866 billion in Q4 2008 to $660 billion in Q1 2013. But, as you can see in the chart below, the hockey stick returned.

Then, when the pandemic took hold in 2020, credit card balances plunged again — from $927 billion in Q4 2019 to $770 billion in Q1 2021. But — again — the hockey stick returned, thanks to a massive spike in Q4 2021.

Which states’ residents have the most credit card debt?

Credit cardholders in Connecticut have the highest average credit card debt of any state, according to LendingTree data, while those in Mississippi have the lowest.

| Rank | State | Avg. credit card debt, Q3 2025 | Avg. credit card debt, Q3 2024 | % difference, Q3 24 to Q3 25 |

|---|---|---|---|---|

| 1 | Connecticut | $9,778 | $9,323 | 4.9% |

| 2 | New Jersey | $9,748 | $9,112 | 7.0% |

| 3 | Maryland | $9,630 | $8,830 | 9.1% |

| 4 | Hawaii | $9,448 | $8,798 | 7.4% |

| 5 | District of Columbia | $9,413 | $9,209 | 2.2% |

| 6 | California | $9,396 | $9,191 | 2.2% |

| 7 | Alaska | $9,261 | $9,040 | 2.4% |

| 8 | Massachusetts | $9,244 | $8,685 | 6.4% |

| 9 | Florida | $9,184 | $9,094 | 1.0% |

| 10 | New York | $9,089 | $8,810 | 3.2% |

| 11 | Washington | $9,039 | $8,086 | 11.8% |

| 12 | Colorado | $8,911 | $8,371 | 6.5% |

| 13 | New Hampshire | $8,696 | $8,217 | 5.8% |

| 14 | Virginia | $8,416 | $8,136 | 3.4% |

| 15 | Texas | $8,394 | $8,316 | 0.9% |

| 16 | Nevada | $8,381 | $8,186 | 2.4% |

| 17 | Illinois | $8,328 | $7,846 | 6.1% |

| 18 | Arizona | $8,307 | $7,842 | 5.9% |

| 19 | Georgia | $8,090 | $7,925 | 2.1% |

| 20 | Rhode Island | $8,069 | $8,069 | 0.0% |

| 21 | Delaware | $7,787 | $7,598 | 2.5% |

| 22 | Oregon | $7,745 | $7,204 | 7.5% |

| 23 | Vermont | $7,670 | $7,478 | 2.6% |

| 24 | Utah | $7,613 | $7,290 | 4.4% |

| 25 | Maine | $7,422 | $7,026 | 5.6% |

| 26 | Montana | $7,412 | $7,106 | 4.3% |

| 27 | Minnesota | $7,339 | $6,820 | 7.6% |

| 28 | North Carolina | $7,297 | $6,940 | 5.1% |

| 29 | Idaho | $7,265 | $6,694 | 8.5% |

| 30 | South Dakota | $7,223 | $6,465 | 11.7% |

| 31 | Pennsylvania | $7,199 | $6,992 | 3.0% |

| 32 | Nebraska | $7,075 | $6,355 | 11.3% |

| 33 | Kansas | $6,979 | $6,818 | 2.4% |

| 34 | Wyoming | $6,833 | $6,873 | -0.6% |

| 35 | Michigan | $6,812 | $6,318 | 7.8% |

| 36 | North Dakota | $6,707 | $6,437 | 4.2% |

| 37 | South Carolina | $6,706 | $6,615 | 1.4% |

| 38 | Wisconsin | $6,703 | $6,082 | 10.2% |

| 39 | Ohio | $6,536 | $6,300 | 3.7% |

| 40 | Missouri | $6,421 | $6,069 | 5.8% |

| 41 | Iowa | $6,394 | $6,064 | 5.4% |

| 42 | Indiana | $6,096 | $5,876 | 3.7% |

| 43 | Oklahoma | $5,963 | $6,004 | -0.7% |

| 44 | Alabama | $5,889 | $5,765 | 2.2% |

| 45 | New Mexico | $5,871 | $6,543 | -10.3% |

| 46 | Tennessee | $5,846 | $5,727 | 2.1% |

| 47 | Louisiana | $5,421 | $5,529 | -2.0% |

| 48 | Kentucky | $5,368 | $5,266 | 1.9% |

| 49 | West Virginia | $5,336 | $5,497 | -2.9% |

| 50 | Arkansas | $5,259 | $5,305 | -0.9% |

| 51 | Mississippi | $4,887 | $4,918 | -0.6% |

LendingTree analysts reviewed anonymized credit report data from Q3 2025 for more than 400,000 LendingTree users to calculate these averages and create a list of states with the most debt. We also compared this data to what we found in our Q3 2024 analysis of over 410,000 reports.

Overall, the national average card debt among cardholders with unpaid balances in Q3 2025 was $7,886, up 2.8% from $7,673 in Q1 2024. That includes debt from bank cards and retail credit cards.

Eleven states spread throughout the nation have average balances of at least $9,000. Connecticut leads at $9,778, ahead of New Jersey ($9,748) and Maryland ($9,630).

The six states with the lowest balances are in the South. Mississippi’s balance is $4,887, lower than Arkansas ($5,259) and West Virginia ($5,336).

Washington has the fastest-growing card debt in the period analyzed. That state’s average card balance grew a troubling 11.8% from Q3 2024 to Q3 2025, rising from $8,086 to $9,039. Three other states saw double-digit increases, including South Dakota (up 11.7%), Nebraska (up 11.3%) and Wisconsin (up 10.2%).

Meanwhile, New Mexico saw the largest year-over-year decrease in debt, with its residents’ debt falling 10.3% from $6,543 to $5,871. In all, seven states saw credit card balances decrease in the past year. West Virginia (down 2.9%) and Louisiana (down 2.0%) joined New Mexico as the only states to see decreases of at least 2.0%.

What percentage of credit cardholders carry a balance?

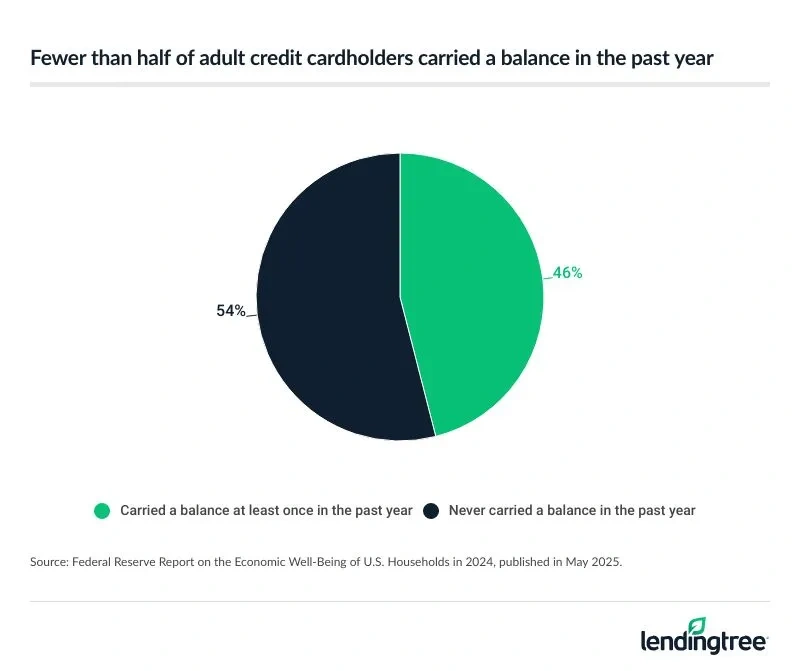

Fewer than half of adult credit cardholders (46%) carried a balance on a credit card for at least one month in the past year, according to a May 2025 Federal Reserve study using 2024 data.

Job No. 1 for anyone with a credit card is to pay off that balance in full at the end of each month. But we all know that life happens, and that means that it’s not always possible to pay off your credit cards each month.

Federal Reserve data showed that fewer than half (47%) of credit cardholders carried a balance at some point in 2023. That’s down a percentage point from 2022 and 2021.

What’s the average interest rate on people’s credit cards? What about those who carry a balance? What about new credit card offers?

For all credit cards, the average APR in Q4 2025 was 20.97%.

For cards accruing interest, the average in Q4 2025 was 22.30%.

For new credit card offers, the average today is 23.79%.

- Average APR, current card accounts: 20.97%

- Average APR, accounts that accrue interest: 22.30%

- Average APR, new credit card offers: 23.79%

The Federal Reserve’s G.19 consumer credit report showed that the average APRs for cards accruing interest fell to 22.30% in Q4 2025, down from 22.83% in Q3 2025. Meanwhile, APRs for all current credit card accounts fell to 20.97% in Q4 2025, down from 21.39% in Q3 2025.

If you plan to get a new credit card, your interest rate will likely be higher than those listed above. The latest LendingTree data on credit card APRs shows that the average APR with a new credit card offer is 23.79%, with the average card offering an APR range of 20.18% to 27.39% (your rate varies based on your creditworthiness).

That 23.79% number is down from December, marking the fourth straight monthly decline and pushing the average to its lowest since 23.65% in March 2023. The decrease wasn’t a surprise, though, coming on the heels of the Federal Reserve’s September, October and December announcements that it would lower its benchmark lending rate. The downward trend is likely to continue, as card issuers slowly implement the Fed’s recent cuts.

(Note: Q4 2025 interest rates for all cards and cards accruing interest date to November 2025, before the Fed announced its rate cut in December. Expect to see these averages continue to fall in coming quarters.)

Future Fed rate cuts are far from guaranteed, however, especially given all the uncertainty in the economy today. Regardless, credit cardholders should expect rates to stay high for the foreseeable future. After all, even if the Fed were to continue to step on the gas with cuts, rates wouldn’t go from awful to awesome overnight.

And as the chart below shows, the rate you’re offered can also vary widely based on the type of card for which you apply.

Average APRs by category

| Category | Min. APR | Max. APR | Avg. | Prior month |

|---|---|---|---|---|

| Avg. APR for all new card offers | 20.18% | 27.39% | 23.79% | 23.96% |

| 0% balance transfer cards | 17.65% | 26.81% | 22.23% | 22.40% |

| No-annual-fee cards | 19.64% | 26.93% | 23.28% | 23.46% |

| Rewards cards | 19.84% | 27.54% | 23.69% | 23.86% |

| Cash back cards | 20.41% | 27.51% | 23.96% | 24.11% |

| Travel rewards cards | 19.33% | 28.01% | 23.67% | 23.88% |

| Airline credit cards | 19.43% | 28.59% | 24.01% | 24.26% |

| Hotel credit cards | 19.39% | 28.32% | 23.86% | 24.11% |

| Low-interest credit cards | 13.26% | 22.06% | 17.66% | 17.68% |

| Grocery rewards cards | 19.69% | 22.73% | 23.71% | 23.87% |

| Gas rewards cards | 20.32% | 27.52% | 23.92% | 24.06% |

| Dining rewards cards | 19.24% | 27.68% | 23.46% | 23.67% |

| Student credit cards | 17.49% | 27.09% | 22.29% | 22.64% |

| Secured credit cards | 26.10% | 26.10% | 26.10% | 26.27% |

Of course, your best move is to make those interest rates a moot point by paying your card debt in full, but that’s often easier said than done.

How many Americans are currently delinquent with their credit card payments?

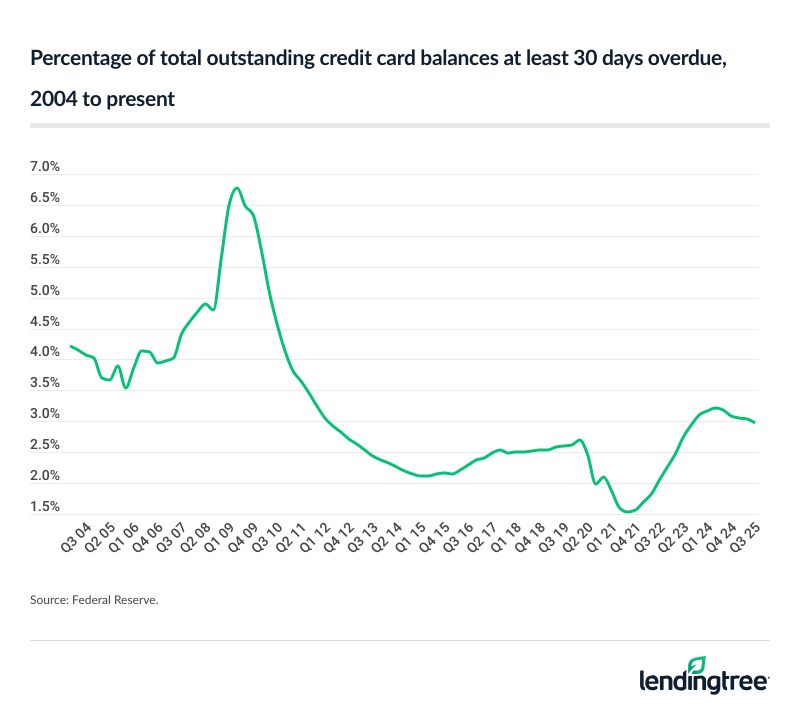

Just 2.98% of Americans’ total outstanding credit card balances are currently at least 30 days delinquent.

According to the most recent delinquency data from the Fed, the 30-day delinquency rate (or the percentage of total outstanding credit card balances currently at least 30 days overdue) dipped to 2.98% in the third quarter of 2025, the fifth straight quarterly decrease.

The recent run of decreases follows 11 consecutive quarters of increases. During that period, delinquency rates rose to the highest levels seen since Q4 2011, when rates hit 3.25%. However, delinquency rates are still near historic lows. The average delinquency rate since the Fed began tracking in 1991 is 3.70%, while the average since 2000 is 3.44%.

Today’s numbers are also vastly different from those seen during the Great Recession, when delinquencies peaked at nearly 7% in 2009 and remained above 5% for nearly two years.