How To Request a Credit Limit Increase With Bank of America

Ways to increase a credit limit with Bank of America

Increasing your credit card’s credit limit provides additional purchasing power, and has the potential to improve your credit score. If you’re a Bank of America cardholder, asking for a credit limit increase is easy. In some cases, the bank will increase your limit automatically. Otherwise, you can submit a request over the phone, online or in a branch. But remember — if you’ve just opened your card or haven’t treated it responsibly, your request may not be granted.

Here’s what you need to know about how to ask for a credit limit increase on your Bank of America credit card.

How to increase your credit limit with Bank of America

There are three ways to request a credit limit increase with Bank of America — through online banking, the Bank of America app or over the phone. Bank of America will typically ask for some personal information and the amount you’d like to request. The maximum increase you can request at once depends on your account.

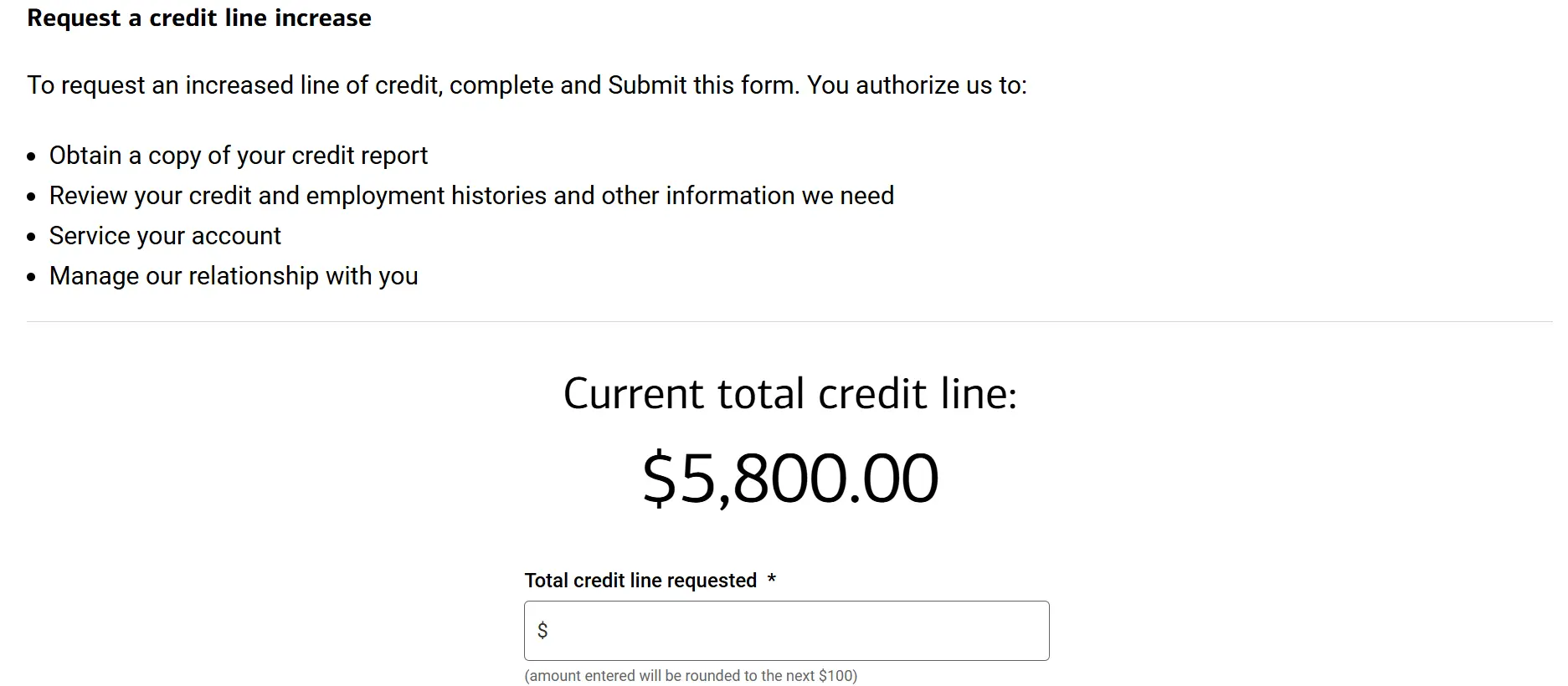

Request a credit limit increase online

If you’re eligible for a credit limit increase, here are the steps to take:

- Log in to your online banking account.

- Select your credit card account.

- Click on “Request a Credit Line Increase,” which can be found under “Card Details” in the “Account Summary” section.

- Fill in the form with your target credit limit, your income information and your housing payment.

Tip

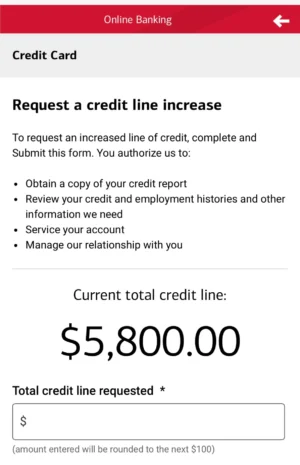

Use the Bank of America app

You can also request a credit line increase using your Bank of America app.

- Log in to the app.

- Select the credit card you’d like to request a credit line increase for.

- Scroll down to the “Credit line” section and select “Credit line increase.”

- Fill in the form with your target credit limit, your income information and your housing payment.

Request an increase over the phone

Call the number on the back of your credit card to request a higher credit limit over the phone. You’ll need to prepare the same information that you’d provide to make the request online.

Tip: You may be able to get an automatic credit limit increase.

When to ask for a credit limit increase with Bank of America

There are no specific guidelines for when to request a credit limit increase, but certain scenarios can increase your odds of approval:

- You’ve had the card for six months or more. Bank of America will set your credit limit when you apply for a credit card based on factors like your credit score. It’s best to wait at least six months to give yourself time to establish a good history of credit card use before requesting a credit limit increase. If you’ve just requested a credit limit increase, it also might be a good idea to wait at least six months before requesting another one.

- Your account is in good standing. Bank of America states that your eligibility for a credit line increase is based on your relationship with the issuer. This means that a good history of on-time payments and paying down balances can help your approval odds.

- Your income increased. Bank of America needs to confirm that you have enough income to support a higher credit limit. If your income recently increased, it may be a good time to submit a request.

- Your credit score has increased. Your credit score can have an impact on whether or not you’ll be approved for a higher credit limit. It’s best to request a higher credit limit after your score has improved.

Tip

How much of a credit limit increase should you request?

When submitting a request to Bank of America to increase your credit limit, you’ll need to say how much additional credit you want. Here are a few factors to consider when submitting your request:

- Upcoming purchases. Is your credit limit prohibiting you from making a purchase? If you have a purchase in mind, ask for a large enough increase to make that purchase possible.

- Be reasonable with your request. Banks provide credit limits based on your ability to repay your balance. When deciding, they look at your credit history, income, debt obligations and other factors. Unless something has changed dramatically, limit your request to 10% to 25% of your current credit limit.

- Prevent overspending. Some people have a hard time controlling their spending. A larger credit limit can lead to the temptation to buy more than you can realistically repay. You should request a limit that you can easily manage.

Will requesting a credit limit increase with Bank of America hurt your score?

No, a credit line increase with Bank of America won’t lower your credit score. When applying for new credit, most lenders perform a “hard inquiry” on your credit report that can temporarily lower your credit score. However, Bank of America does a “soft pull” before increasing your credit limit — this doesn’t affect your credit score, and other lenders can’t see the inquiry.

Tip

For example, assume that you were carrying a $400 balance on a credit card with a $1,000 limit (40% utilization). If you have increased your limit to $1,500, you would lower your utilization to just under 27%, below the 30% ratio recommended by personal finance experts.

But, don’t allow a higher credit limit to tempt you into overspending. Only make purchases you know you can pay off when your bill is due. Otherwise, you could dig yourself into debt that you can’t pay off and harm your credit score.

What to do if your credit limit increase is denied by Bank of America

Unfortunately, Bank of America doesn’t approve every credit limit increase request. If your request was declined, here are a few options:

- Continue to improve your credit score. Boosting your credit score increases your odds of an automatic credit limit increase or approval when you request one. Check your credit report to identify areas for improvement and to monitor for any potential errors.

Check your credit score for free using LendingTree Spring. - Continue to make on-time payments on your card. Showing that you can be responsible with your card by using it and paying it off each month illustrates good credit behavior. The bank may approve future requests based on your positive usage. Set up automatic payments to ensure you never miss a due date.

- Make sure your income is up-to-date. Your income may have changed significantly from when your credit card was opened. Updating your income may lead to future increases in your credit limit.

- Ask for a credit limit increase on a card from a different bank. Some card issuers are stricter than others when it comes to offering credit limit increases. If you’re denied a credit limit increase with Bank of America but have cards with other banks, consider requesting a limit increase on one of those cards instead. For example, here’s how to request a credit limit increase with Wells Fargo.

- Apply for a new credit card. Applying for a new credit card is a good way to increase your available credit without asking for a credit limit increase. If you continue to use your cards responsibly, applying for another card can also help boost your credit utilization ratio and credit score. You can also find high-limit credit cards from numerous banks.

Tip

If you’re trying to get a credit limit increase due to difficulty paying down debt and concerns about exceeding your limit, you might consider a balance transfer credit card. Choosing a card with a 0% balance transfer APR can be an excellent way to reduce debt and save potentially hundreds of dollars in interest. For example, the BankAmericard® credit card offers a 0% Intro APR for 18 billing cycles for any balance transfers made in the first 60 days, then a 15.24% - 25.24% Variable APR on balance transfers. - Wait at least six months to ask Bank of America again. Waiting six months between credit limit requests allows time for positive behaviors to build your credit score. This also puts negative credit events in the rearview mirror, making them less likely to impact the bank’s decision.

The information related to the BankAmericard® credit card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.