Capital One Transfer Partners Guide 2026: Get the Most From Your Miles

Key takeaways

- Capital One partners with more than 15 airline and hotel loyalty programs, allowing you to get more value from your miles.

- The process to transfer Capital One miles is straightforward, and most transfers happen within 24 hours.

- If your preferred airline isn’t a Capital One transfer partner, you may still be able to fly with them by using one of their alliance partners that is a Capital One partner.

- You’ll receive the highest value from your Capital One miles when you transfer them to a Capital One airline or hotel partner that converts on a 1:1 ratio and doesn’t charge fees.

Capital One travel partners

Capital One currently partners with more than 15 airline and hotel loyalty programs. Most partners transfer at a ratio of 1:1, though a few partners have different rates.

Capital One airline partners

| Partner | Airline Alliance | Transfer Ratio |

|---|---|---|

| Aeromexico Club Premier | SkyTeam | 01:01 |

| Air Canada Aeroplan | Star Alliance | 01:01 |

| Asia Miles (Cathay Pacific) | oneworld | 01:01 |

| Avianca LifeMiles | Star Alliance | 01:01 |

| British Airways Executive Club | oneworld | 01:01 |

| Emirates Skywards | N/A | 04:03 |

| Etihad Guest | N/A | 01:01 |

| EVA Air Infinity MileageLands | Star Alliance | 02:01.5 |

| Finnair Plus | oneworld | 01:01 |

| Flying Blue (Air France/KLM) | SkyTeam | 01:01 |

| Japan Airlines | oneworld | 02:01.5 |

| JetBlue TrueBlue | N/A | 05:03 |

| Qantas Frequent Flyer | oneworld | 01:01 |

| Qatar Airways | oneworld | 01:01 |

| Singapore Airlines KrisFlyer | Star Alliance | 01:01 |

| TAP Miles&Go | Star Alliance | 01:01 |

| Turkish Airlines Miles&Smiles | Star Alliance | 01:01 |

| Virgin Red | N/A | 01:01 |

Capital One currently has 17 airline partners that represent the three major airline alliances: Oneworld, SkyTeam and Star Alliance.

Three of its airline partners — Emirates, Etihad and JetBlue — aren’t part of an airline alliance, but you can move your Capital One miles to any of these airlines. They partner with various international airlines, which means you can, for example, transfer miles to Emirates if you want to use them to book with Japan Airlines.

Capital One hotel partners

| Partner | Transfer Ratio |

|---|---|

| ALL - Accor Live Limitless | 2 : 1 |

| Choice Privileges® | 1 : 1 |

| I Prefer Hotel Rewards | 1 : 2 |

| Wyndham Rewards | 1 : 1 |

The best Capital One travel partners

Air Canada

- Home Country: Canada

- Major hubs: Toronto, Montreal, Vancouver

- Airline alliance: Star Alliance

Air Canada’s Aeroplan points are versatile, letting you use them to book air travel as well as car rental, hotel packages and more. You’ll find good value using Aeroplan miles to book Air Canada’s Star Alliance and other partners, with their zone-based award chart. You can find flights from North America to Europe for as few as 35,000 Aeroplan miles in economy or 60,000 miles in business class.

Avianca LifeMiles

- Home Country: Colombia

- Major hubs: Bogota, San Salvador

- Airline alliance: Star Alliance

Avianca LifeMiles has excellent pricing on international flights with Star Alliance partners. A United flight from New York to Paris costs between 36,000 and 40,000 LifeMiles plus around $50 each way in economy. Another perk is that you won’t pay fuel surcharges or taxes when you redeem your miles for international travel.

British Airways

- Home Country: England

- Major hubs: Heathrow Airport, Gatwick Airport and London City Airport

- Airline alliance: oneworld

British Airways uses a distance-based award chart, which offers great value for direct travel, as it will “cost” less than a less direct route. As part of the oneworld alliance, British Airways Avios points can be used to book flights with American Airlines. You can fight great deals by using Avios for domestic airfare, especially since domestic flights don’t have the high fees British Airways charges for overseas flights. For example, we found a one-way economy flight from New York to Chicago for 16,000 Avios points and $5.60 (but that amount can vary based on seasonality and other factors).

The least valuable Capital One transfer partners

Choice Privileges Hotels

You’ll generally lose value on your Capital One miles by transferring them to the Choice Privileges program, where points are typically worth less than 1 cent apiece. Furthermore, while many travelers are seeking to redeem points for aspirational travel, many Choice hotel locations are on the budget end of the spectrum, especially in the United States.

ALL Accor Live Limitless

As the only hotel program whose points transfer at a ratio less than 1:1, Accor offers less value than its counterparts. For 2,000 miles, Accor Live Limitless deducts 40 Euros from your bill. This appears to be a good deal until you remember this requires 4,000 Capital One miles due to the 1: 0.5 transfer ratio. At this rate, you’re better off booking your stay with Capital One’s travel portal and paying with cash or using your miles for a statement credit.

EVA Infinity MileageLands

EVA Air is one of the few Capital One airline partners that transfers miles at a lower ratio. For every 1,000 Capital One miles you transfer, you only get 750 EVA Infinity miles. It also features a more expensive award chart. You’re better off transferring miles to a different Star Alliance program, like Air Canada Aeroplan or Avianca LifeMiles.

How to transfer Capital One miles

Here are the steps after you’ve logged into your CapitalOne.com account.

- Log in to CapitalOne.com.

- Select your eligible Capital One credit card.

- Click on “View Rewards.”

- Choose “Transfer Rewards.”

- Choose the option you want to use.

- Follow the prompts to complete the transfer.

- Receive a confirmation email and save it for your records.

Note that the minimum number of miles you can transfer is 1,000. You must also transfer miles in increments of 1,000. For example, if you need 15,500 miles to book an award flight, you’ll need to transfer 16,000 Capital One miles to the partner airline. The remaining 500 miles won’t go to waste; they can be used on your next trip.

Transfers aren’t always instant, but you can generally expect them to be completed within 24 hours. Remember that transfers are final and cannot be reversed.

Why transfer to Capital One travel partners?

When you use your Capital One miles as a statement credit or via the Capital One travel portal, they are worth 1 cent per mile. While that serves as a useful floor for the value of your miles, it’s possible to get even more miles when you transfer to Capital One’s travel partners. You can find deals that make your miles worth up to 2 cents each — much higher than the 1-cent value you get from redeeming miles through the Capital One travel portal.

Adding your Capital One miles to an existing balance of airline miles or hotel points also helps you earn rewards faster. Transfer bonuses are occasionally offered and can give you even more value.

When you’re considering the value of Capital One transfer partners, you’ll also want to consider what kind of trips you’re planning on taking, what airlines you’d like to fly with, and whether you can easily earn Capital One miles.

“I specifically chose the Capital One Venture Rewards Credit Card due to Capital One’s list of transfer partners for a future trip to Bulgaria, since these include Turkish Airlines and Aeroplan. Aeroplan had the lowest prices for flights to Bulgaria, so I transferred sign-up bonus miles to Aeroplan and then purchased the round-trip ticket that way. It got me a virtually free flight!”

– Isabella Kok, credit cards writer at LendingTree

Capital One's travel portal vs. Capital One transfer partners

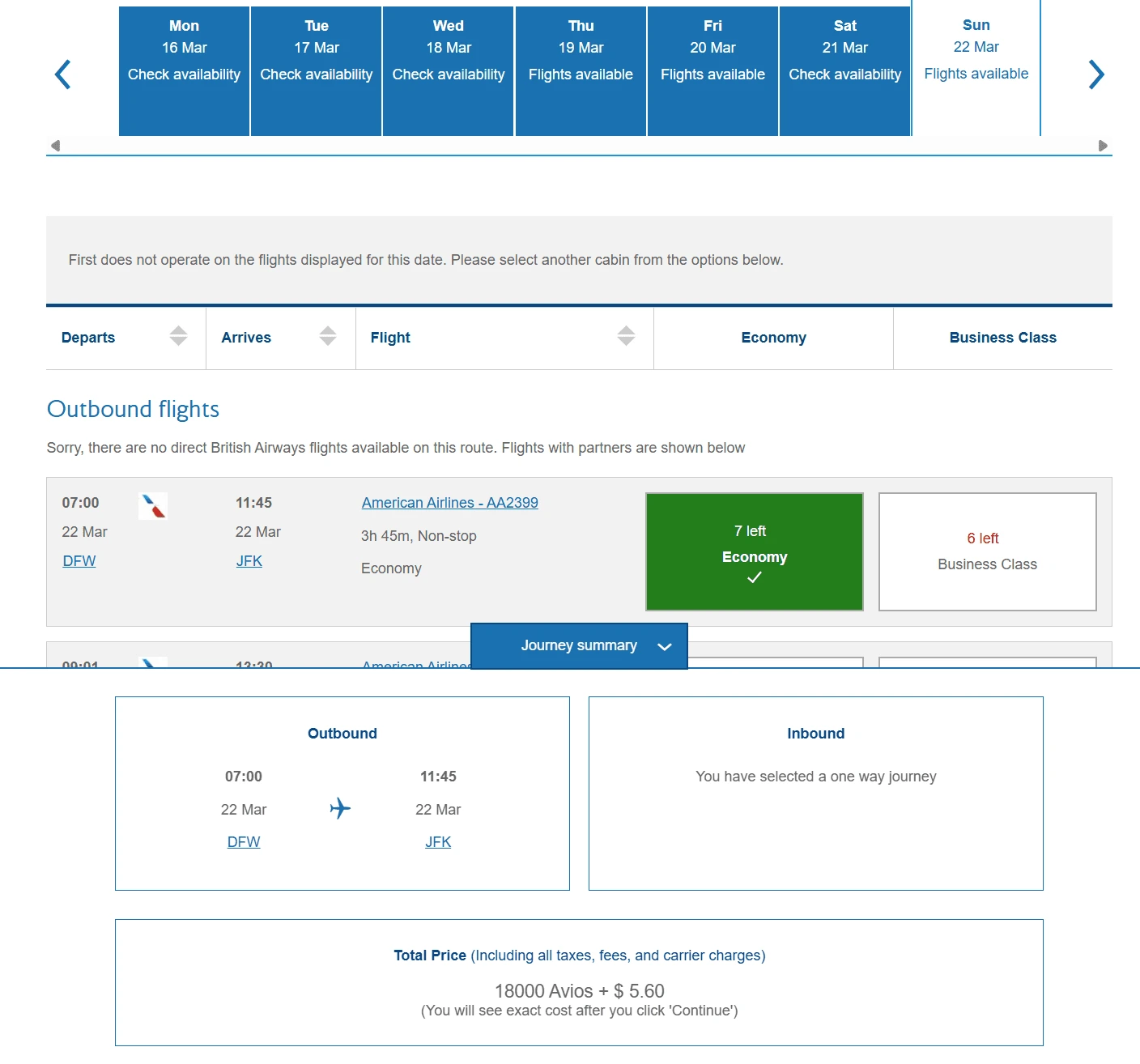

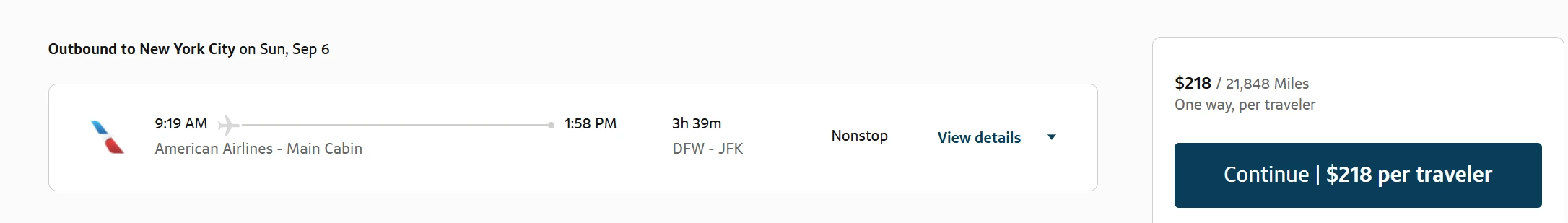

To illustrate the value of booking miles with one of the Capital One airline transfer partners, we’ll compare a flight through Capital One’s travel portal versus transferring your miles to British Airways Avios. We’ve chosen a one-way flight on American Airlines from Dallas (DFW) to New York JFK.

You can transfer Capital One miles to British Airways Avios and book this flight for 18,000 Avios plus $5.60 in fees.

If you tried to book this flight through the Capital One travel portal, it would cost 21,848 Capital One miles.

In this scenario, you save nearly 4,000 Capital One miles by transferring to an airline partner instead of booking through the travel portal.

When transferring miles is less valuable

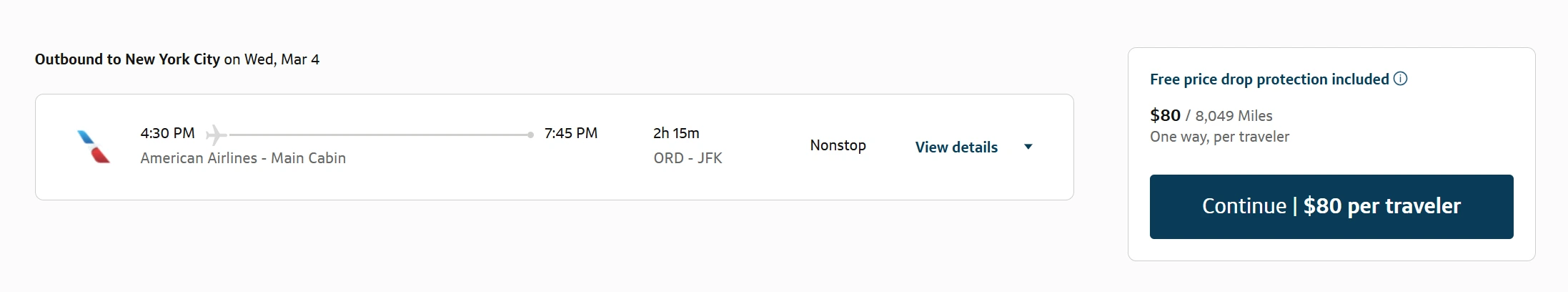

While transferring miles will often give you better value, that is not always the case. Here is another example using British Airways Avios, this time for a flight on American Airlines from Chicago to New York.

You could transfer your Capital One miles to British Airways Avios to book this flight on BA’s oneworld alliance partner, American Airlines. It would take 16,000 Capital One miles (plus $5.60) to book this flight using Avios.

But this same flight is available through the Capital One travel portal for only 8,049 miles.

In this case, it would be a smarter move to not transfer your Capital One miles and instead book through the Capital One travel portal (just know that these values are subject to change).

Cards that earn Capital One miles

Capital One has six travel cards for consumers and business owners. Two cards have no annual fee, while the others have fees and include various travel perks and protections.

Welcome bonuses and earning rates vary among the cards. With the Capital One Venture X Rewards Credit Card, you can earn up to 10x miles on hotels and rental cars booked through Capital One’s travel portal.

| Credit Cards | Our Ratings | Annual Fee | Rewards Rate | Welcome Offer | |

|---|---|---|---|---|---|

Capital One Venture Rewards Credit Card

|

$95 | 2X - 5X Miles

| 1,000 dollars

Earn up to $1,000 towards travel once you spend $4,000 on purchases within the first 3 months of account opening

| ||

Capital One VentureOne Rewards Credit Card

|

$0 | 1.25X - 5X Miles

| 20,000 miles

Earn 20,000 Miles once you spend $500 on purchases within 3 months from account opening

| ||

Capital One Venture X Rewards Credit Card

|

$395 | 2X - 10X miles

| 75,000 miles

Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening

| ||

Capital One Venture X Business

|

$395 | 2X - 10X Miles

| 150,000 miles

Earn 150,000 Miles once you spend $30,000 in the first 3 months from account opening

| ||

Capital One Spark Miles for Business

|

$0 intro for first year; $95 after that | 2X - 5X Miles

| 50,000 miles

Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening.

| ||

Capital One Spark Miles Select for Business*

|

$0 | 1.5X Miles

1.5 Miles per $1 on every purchase

| 50,000 miles

One-time bonus of 50,000 miles once you spend $4,500 on purchases within 3 months from account opening

|

Tips: What to know before transferring Capital One miles

- Sign up for the airline or hotel loyalty program before transferring your miles if you’re not already a member. You won’t be able to transfer your miles without an account in the program where you’re trying to transfer.

- Verify that a flight has plenty of award space before transferring your miles.

- Some airline programs allow you to put an award flight on hold to give you time to transfer miles. This is important because Capital One transfers can take some time to finalize.

- Your name and important contact information must match those in your loyalty program and Capital One account. Addresses and phone numbers are generally easy to update. However, if there’s an error in your birthdate or your ID, you may need additional customer service support.

- All miles transfers are final, so be sure you want to make the transaction, because your miles can’t be transferred back to your Capital One account.

- Transfer ratios vary by partner — so make sure you know how many miles you should expect after the transfer.

- Capital One occasionally has transfer bonuses, so it may make sense to watch out for those before transferring your miles. Taking advantage of a transfer bonus can boost your balance by up to 40% or more.

Frequently asked questions

You can transfer Capital One miles to another person if they also have a Capital One card that earns miles. You can transfer them online through your travel portal.

No, Delta Air Lines is not a transfer partner of Capital One. However, since Delta is part of the SkyTeam Alliance, you can transfer Capital One miles to one of its partners to book a flight on Delta. Aeromexico, Air France and KLM are Capital One’s SkyTeam partners.

When you book flights through the Capital One travel portal, you can book a flight on most domestic airlines and many international airlines. Capital One’s travel portal claims to offer trips from over 200 airlines, so you are likely to find the airline you need.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Capital One Spark Miles Select for Business has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.