Chase Pay Yourself Back Program Guide 2026: Boost Rewards on Eligible Categories

- Points are worth between 1 to 1.50 cents when using Chase Pay Yourself Back to get statement credits on certain purchases.

- Some purchases give you higher rewards, depending on which Chase card you have.

- Many of the offers will expire, usually changing each quarter.

- Chase cardholders can find the most up-to-date program details in their online accounts.

Chase cardholders have many ways to spend their reward points, but one that’s often overlooked is the Pay Yourself Back feature.

If you’re unable to travel or don’t like any of the other redemption options, Pay Yourself Back lets you use your points to reduce your balance with statement credits on some of your purchases.

Chase Pay Yourself Back is available on many personal and business rewards credit cards, but the redemption options and rates can vary.

What is Chase Pay Yourself Back?

Chase Pay Yourself Back is another way to spend your Chase Ultimate Rewards® points. You can use points to pay for any eligible purchases made with your card within the past 90 days.

You don’t need to use points to pay for the entire purchase — you can redeem points and use them to cover part of the purchase cost. Chase will then apply the statement credit to your account.

Originally, this benefit was a limited-time offer for select Chase credit cards, but it’s since been extended and is now an ongoing feature.

Chase continues to tweak the program, so certain offers listed below may have expired or will be expiring soon. The point value for Chase Pay Yourself Back redemptions also varies by the specific Chase card. The most accurate info on your card’s Pay Yourself Back offers can be found in “cardholder documents” in your online account or by visiting the Chase Ultimate Rewards® Pay Yourself Back portal.

Chase Pay Yourself Back categories

Chase Pay Yourself Back has a variety of categories for cardholders to use their points. Redemption options vary depending on which Chase credit card you have. Some cards let you use points for any purchase, and some purchases are eligible for a bonus of up to 50%.

To get the most value out of your points, you should use the Pay Yourself Back feature for purchases in the current eligible bonus categories. These categories change over time and can include grocery stores, gas stations, utilities, insurance, travel, Disney purchases, donations to select charities or even your card’s annual fee.

How does Chase Pay Yourself Back work?

Chase Pay Yourself Back is one of your options in the Chase Ultimate Rewards® program. You can log in to your online account and use your available Ultimate Rewards points to get credit back for eligible purchases under the Chase Pay Yourself Back option.

Which purchase categories are available and how much each point is worth will depend on which card you use. Offers with some cards may have different expiration dates than others.

| Chase Card | Redeem Points For | Point Value | End Date |

|---|---|---|---|

| Chase Sapphire Reserve® | Statement credit | 1 to 1.50 cents each | Dec. 31, 2025, for a 25% bonus on annual fees, department stores, gas stations and grocery stores (excluding Target and Walmart). Ongoing for charities and annual fees. |

| Chase Sapphire Preferred® Card | Statement credit | 1 cent each | Ongoing |

| Chase Freedom® Chase Freedom Flex® Chase Freedom Rise® Credit Card Chase Freedom Unlimited® | Statement credit | 1 to 1.25 cents each | Ongoing for select charities. |

| Aeroplan® Card | Annual fee, statement credit | 0.8 to 1.25 cents each | Dec. 31, 2025, for promotions on home improvement, gas stations, utilities, department stores and Amazon.com. Ongoing for travel, dining and grocery store purchases (excluding Target and Walmart). |

| Southwest credit cards (personal and business) | Annual fee | 1 cent each | Ongoing |

| United Airlines credit cards (personal and business) | Annual fee, statement credit | 1 to 1.5 cents each (per mile) | Ongoing for United airfare ticket purchases. |

| Disney® Visa® Credit Card | Statement credit | 1 cent each | Disney+, Disney Parks tickets, dining, Resort stays, airline purchases, and more. Ongoing |

| Ink Business Preferred® Credit Card Ink Business Premier® Credit Card Ink Business Cash® Credit Card Ink Business Unlimited® Credit Card Ink Plus® Business Credit Card | Statement credit | 1 to 1.25 cents each | Ongoing for select charities. |

*Point value is subject to change. Consult your Chase credit card account for the most current details.

Charities for Pay Yourself Back

Chase Pay Yourself Back may also include statement credits for donations to some charities. Currently, the Chase Sapphire Reserve® offers 50% in extra point value when you use them for statement credit toward eligible charitable contributions. This means 100 points is worth $1.50 rather than the standard $1. Other Chase credit cards, like the Chase Freedom® and Ink Business Unlimited® Credit Card, offer 25% more value when redeeming for select charitable donations.

You can check with Chase to see if this charity promotion is still active. It includes the following charities:

- American Heart Association

- American Red Cross

- Equal Justice Initiative

- Feeding America

- GLSEN

- Habitat for Humanity®

- International Medical Corps*

- International Rescue Committee*

- Leadership Conference Education Fund

- Make-A-Wish® America

- NAACP Legal Defense and Education Fund

- National Urban League

- Out & Equal Workplace Advocates

- SAGE

- Thurgood Marshall College Fund

- United Negro College Fund

- UNICEF USA*

- United Way

- World Central Kitchen*

*Includes support for relief efforts in Ukraine.

Note that donations to local chapters of these charities might not qualify as eligible purchases through the Pay Yourself Back program. You may need to donate to the charity’s parent organization to ensure you’re eligible for statement credits through Pay Yourself Back.

What is the Chase Pay Yourself Back end date?

The Pay Yourself Back program began in 2020 as a temporary promotion to encourage cardholders to redeem points because few people were traveling during the COVID pandemic.

Since then, many Chase Pay Yourself Back promotions have been made permanent. Besides standard redemption options, Chase also has limited-time bonus redemption offers. These tend to expire each quarter, but they could be extended.

How to use Pay Yourself Back

Step 1

Log in to your Chase online account or through the Chase mobile app.

Step 2

Navigate to the Ultimate Rewards program.

Step 3

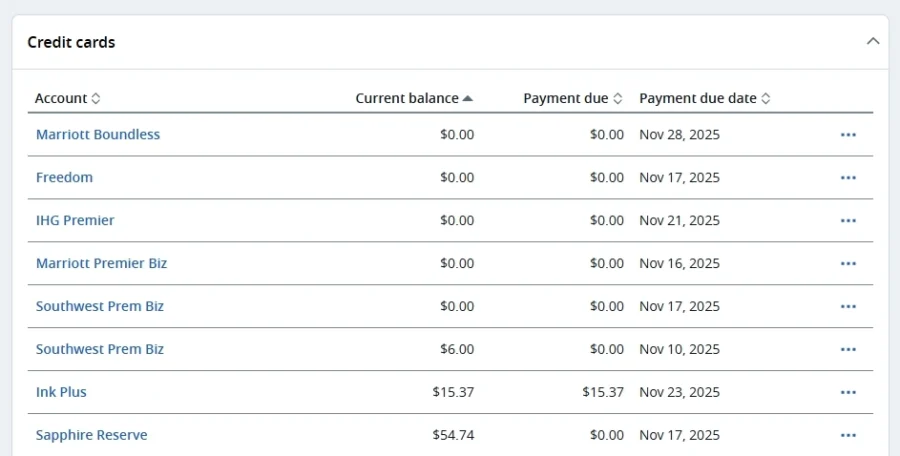

Select your card from your list of card accounts.

Step 4

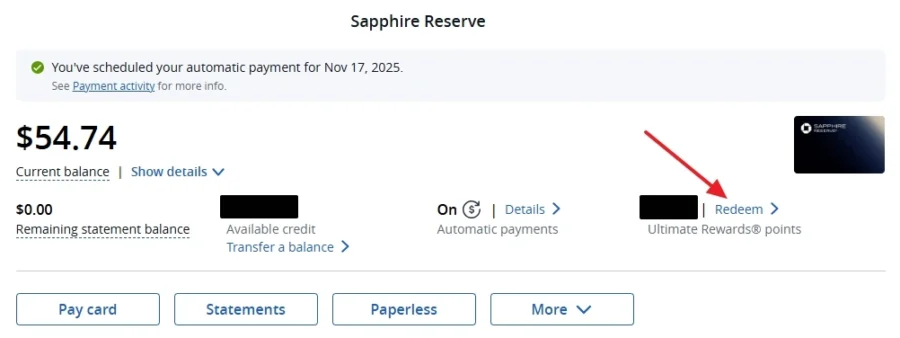

Click “Redeem”.

Step 5

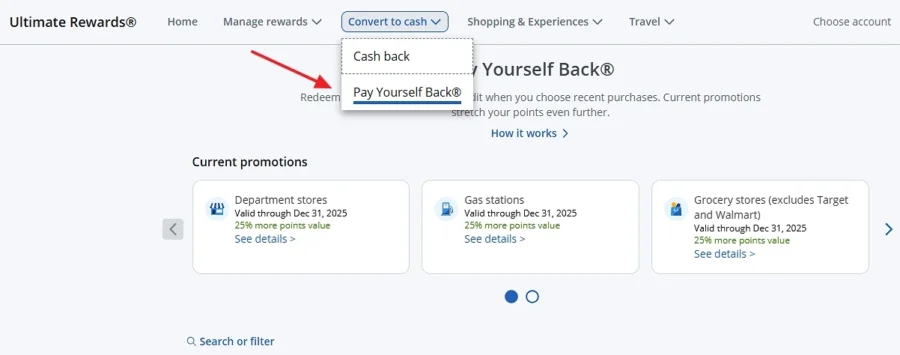

Click “Convert to Cash” at the top of the screen. Select “Pay Yourself Back” from the dropdown menu.

Step 6

Any purchases eligible for Pay Yourself Back from the last 90 days are listed on this page, along with the purchase cost and the amount of points required to cover the full purchase.

Step 7

Choose up to 12 eligible purchases per transaction, depending on your points balance.

Step 8

Verify your redemption to complete the transaction.

The process is similar for Pay Yourself Back redemptions with the Disney® Visa® Credit Card, Aeroplan® Card, Southwest and United credit cards. Statement credits should appear on your account within three business days.

If you don’t have enough points, you can redeem credit card points to partially cover eligible purchases. Keep in mind that you can only use Pay Yourself Back once per purchase, so you won’t be able to redeem points to cover the rest of the purchase cost later.

Chase Pay Yourself Back vs. cash back: Which is best?

Chase credit card points are worth 1 cent each if you redeem them for cash back. But if you have a Chase card that earns Ultimate Rewards points, you could get more value per point with Pay Yourself Back.

Getting more than 1 cent per point will depend on the card you have and what the current Pay Yourself Back options are. Be aware that this doesn’t include Chase’s co-branded airline credit cards, which earn a different type of rewards currency.

Still, if you’re able to redeem your points at a higher rate than 1 cent, then Pay Yourself Back will be more valuable than receiving cash back.

The following cards offer Pay Yourself Back redemptions above 1 cent per point on some purchases.

| Chase Card | Pay Yourself Back Point Value |

|---|---|

| Chase Sapphire Reserve® | 1 – 1.50 cents each |

| Chase Sapphire Preferred® Card | 1 – 1.25 cents each |

| Chase Freedom® Chase Freedom Flex® Chase Freedom Rise® Credit Card Chase Freedom Unlimited® | 1 to 1.25 cents each |

| Ink Business Preferred® Credit Card Ink Business Premier® Credit Card Ink Business Cash® Credit Card Ink Business Unlimited® Credit Card Ink Plus® Business Credit Card | 1 to 1.25 cents each |

*Point value is subject to change. Consult your Chase credit card account for the most current details.

One thing to keep in mind is that not all purchases are eligible for Pay Yourself Back. Some cards are more restrictive than others. If you have purchases outside of the eligible Pay Yourself Back categories, you’re limited to other redemption choices, like cash back.

Find the best cash back credit card.

Is Chase Pay Yourself Back worth it?

Deciding if Chase’s Pay Yourself Back is worth it will depend on how you spend your Chase Ultimate Rewards® points.

Points used with Pay Yourself Back range in value from 0.8 cents to 1.50 cents, based on which card you have. If your purchases are eligible for a high redemption rate, then Pay Yourself Back is worth considering, as you could save more than getting cash back.

Be aware, though, that sometimes you may get more value by redeeming points for travel via the Chase TravelSM portal.

For example, cardholders can get up to 2 cents per point on travel booked through Chase TravelSM with the Chase Sapphire Reserve®. This beats the highest Chase Sapphire Reserve® Pay Yourself Back rate, which is 1.50 cents per point.

Eligible Chase cards also allow you to transfer points to travel partner programs, which can result in even higher redemption values. Credit card travel point redemptions usually give you more value than statement credits through Pay Yourself Back.

But at the same time, some cardholders may prefer to get statement credits that can reduce what they already owe, instead of taking discounts on new travel purchases.

Frequently asked questions

Yes, combining points between eligible Chase cards is a smart strategy to get maximum value. By transferring points among eligible cards, you can unlock transfers to airline and hotel partners. You can also take advantage of Pay Yourself Back categories and bonus promotions that might not be available on all of your cards.

You may also transfer points to a household member or another company owner if they have an eligible card.

Eligible categories for Pay Yourself Back change over time, although categories with redemption values of 1 cent per point typically stay the same. Pay Yourself Back bonus redemption options are available for a limited time, and Chase may rotate bonus categories to encourage certain types of spending throughout the year.

The Chase Pay Yourself Back bonus categories vary by card. However, “select charities” is a common bonus category among many different personal and business Ultimate Rewards cards. Other bonus categories available (depending on your cards) include department stores, gas, travel, grocery stores (excluding Target and Walmart) and annual fees.