Americans More Focused On Losing Debt Than Losing Weight In 2019

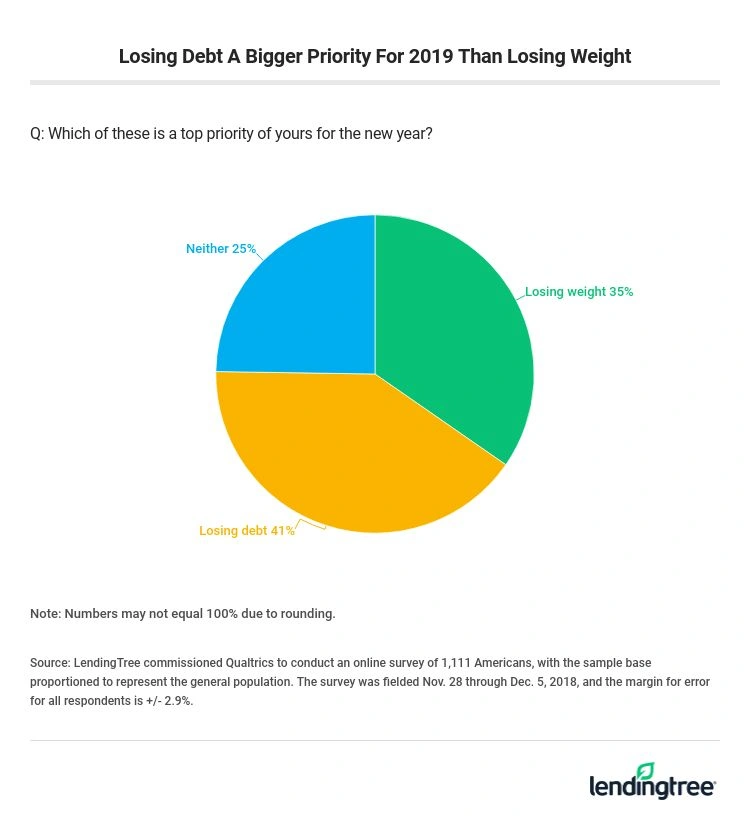

Americans would rather knock down their debt than shed pounds in 2019, according to a survey from LendingTree.

LendingTree asked Americans whether either of these two popular New Year’s resolutions – losing weight or losing debt – was a top priority for them entering 2019. Given that both debt and obesity are significant problems facing millions of Americans today, it’s encouraging that 75% of respondents said one of these issues would be a top priority for them.

- Losing debt is a bigger priority than losing weight: More than 4 in 10 Americans (41%) say losing debt is a top priority in the new year, while 34% said losing weight would be their primary focus and 25% say neither is a priority.

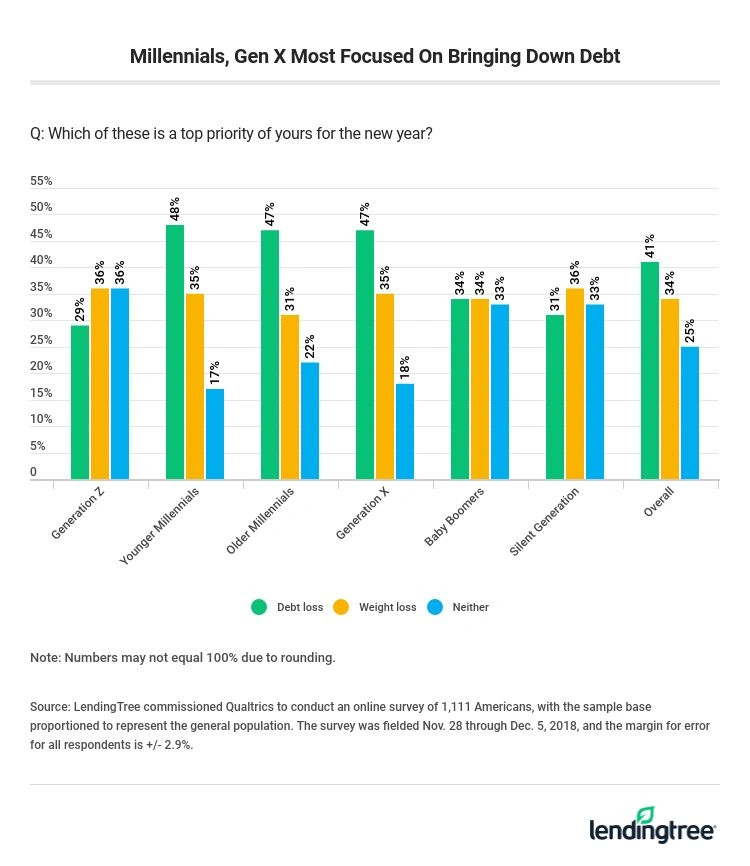

- Millennials and Generation X are most focused on bringing down debt: Nearly half of Millennials and Gen Xers (both at 47%) said debt was their top priority. Just 34% of Boomers, 31% of the Silent Generation and 29% of Generation Z said the same.

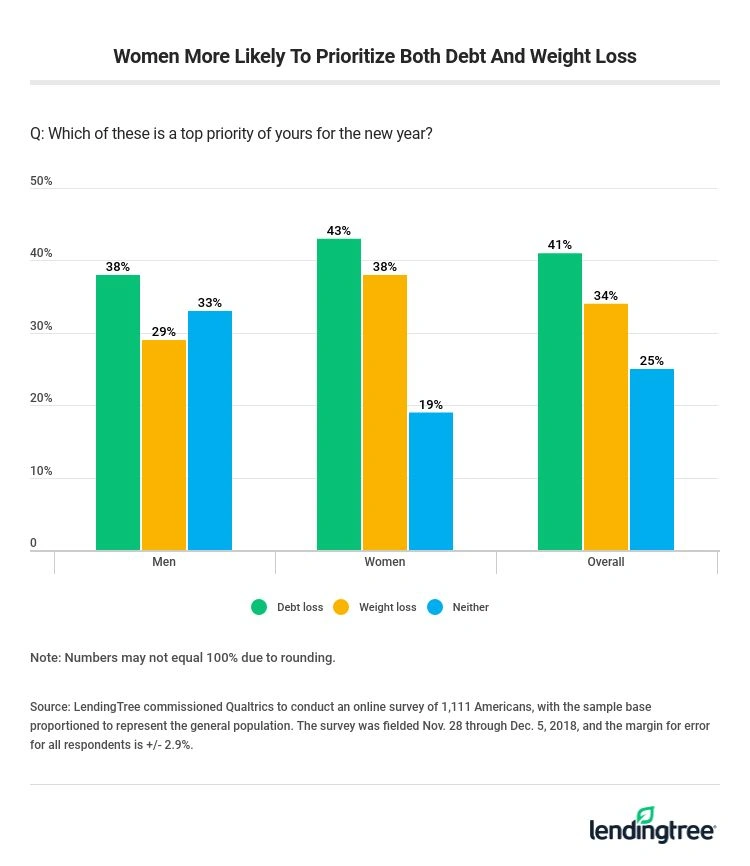

- Men are less likely to make either weight loss or debt reduction a priority: A third of men (33%) said neither losing weight or losing debt would be a top priority of theirs in 2019. That compares to just 19% of women. However, the most common response for both men (38%) and women (43%) was that losing debt would be their main priority.

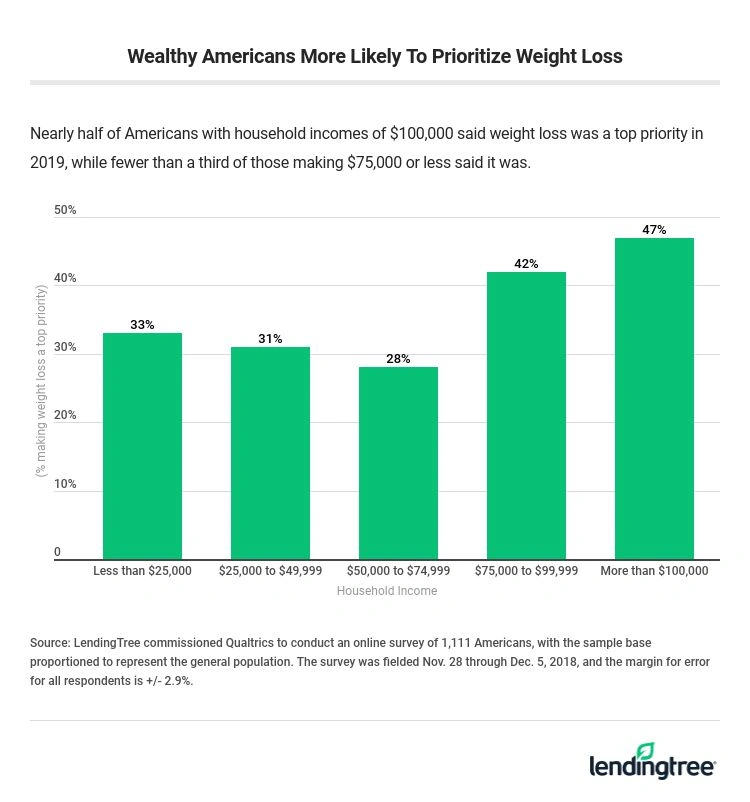

- Wealthy Americans are most likely to prioritize weight loss: Nearly half (47%) of people with $100,000 or more in income said losing weight is a top priority, versus 27% who plan to prioritize losing debt. Among those with incomes of $75K and up, more said weight loss was a top priority. Among those with incomes of $75K or less, more said debt loss was a top priority.

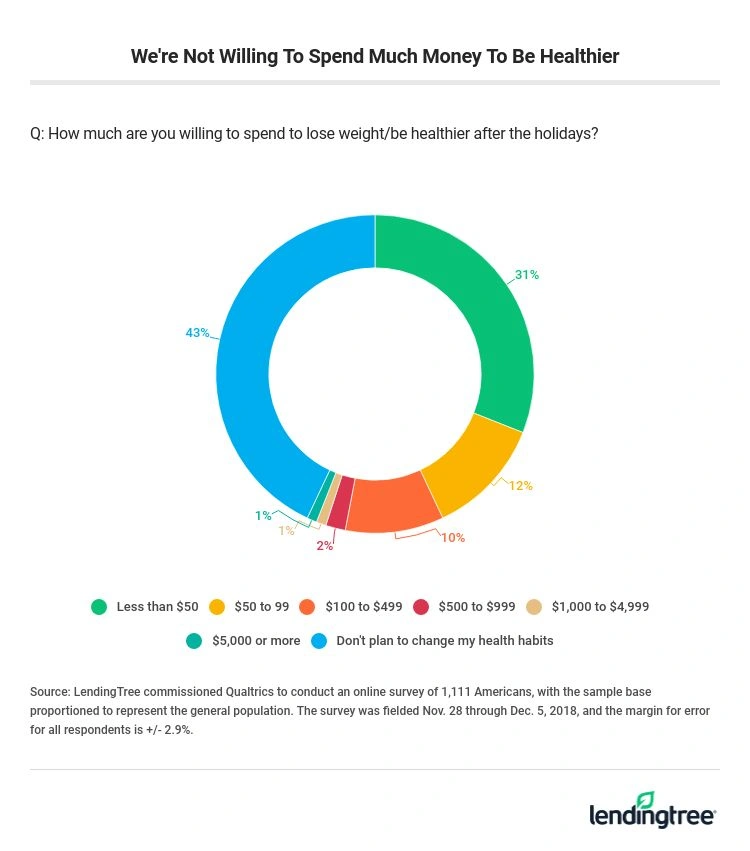

- We’re not willing to spend much money to be healthier: When com asked “How much are you willing to spend to lose weight/be healthier after the holidays?” just 15% said they’d be open to spending more than $100, while 43% said they don’t plan to change their health habits at all after the holidays.

The bottom line: Figure out your priority and take action

Given that Americans’ credit card balances are at record levels, it shouldn’t be surprising that debt will be such a big focus this year.

If you are carrying a lot of debt, it’s especially important to make 2019 the year you commit to finally knocking it down for good. With interest rates rising, that debt is only going to get more expensive and take longer to pay off, so don’t wait.

Whether you’re trying to lose weight or debt, the worst thing you can do is nothing. Take some action today — even if it’s small — to get the ball rolling. Consider an intro 0% balance transfer credit card to help reduce any high-interest card debt you’re carrying. Add an extra few dollars to those monthly credit card payments. Sell something of value to raise some extra income. It may not seem like much, but if you keep taking those small steps, they’ll eventually lead to real change, and that’s what it’s all about.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,111 Americans, with the sample base proportioned to represent the general population. The survey was fielded Nov. 28 through Dec. 5, 2018, and the margin for error for all respondents is +/- 2.9%.