Although Odds Dipped, LendingTree Survey Finds 70% of Requests for Lower Credit Card APRs Are Still Granted

Thinking of asking your credit card issuer to lower your interest rate or waive an annual fee? Your chances of success aren’t at the stratospheric levels seen in previous years, according to a new report from LendingTree, but they’re still high enough to make it well worth making the call.

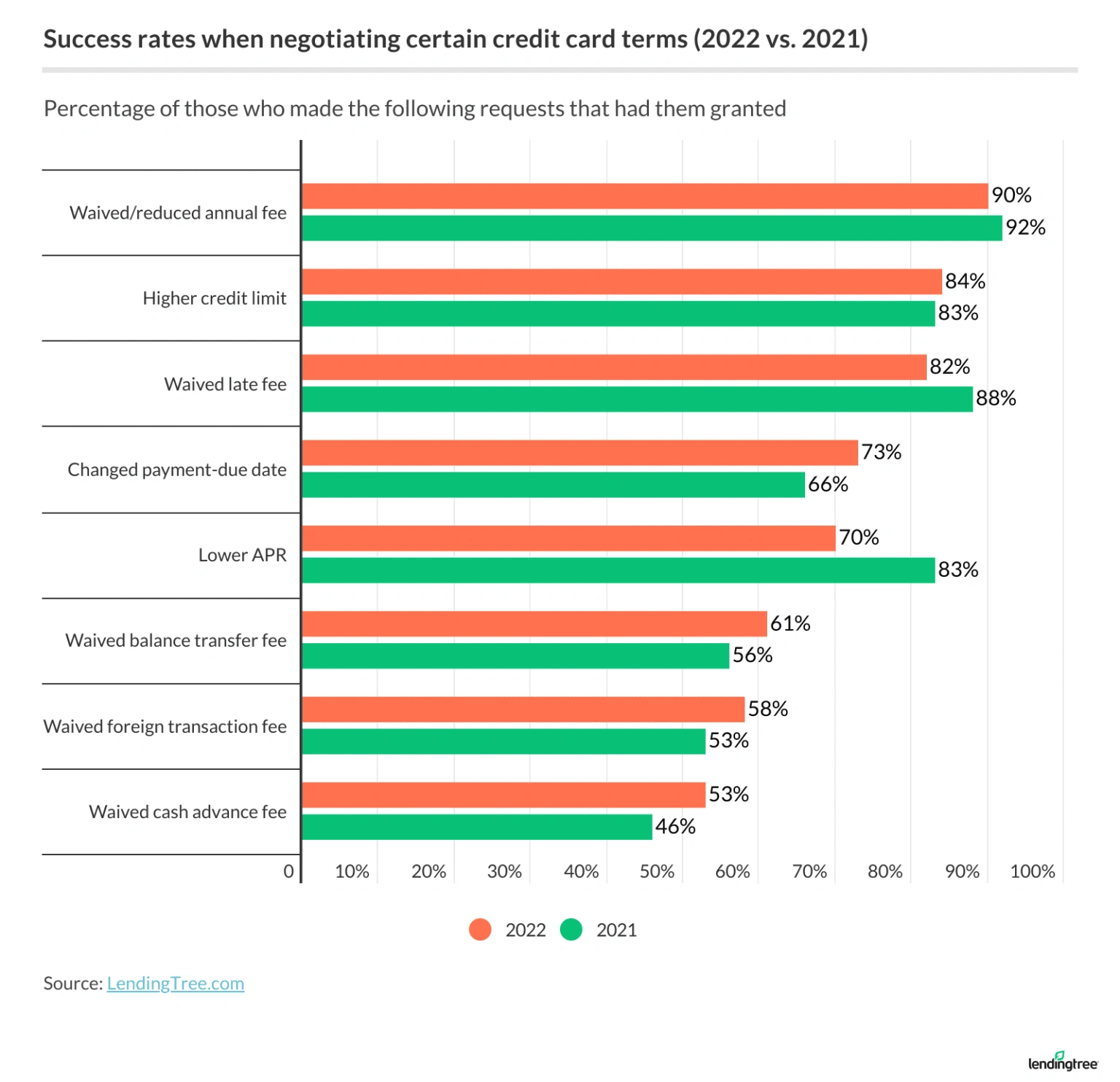

For the fourth straight year, LendingTree asked credit cardholders whether they’d asked their card issuers for certain breaks, including a lower APR, a waived annual fee and a waived late fee. What we found was that while some requests, such as a waived balance transfer fee or a later payment due date, were more likely to be granted, others — such as a lower APR or a waived annual fee — were less likely to be successful than if they asked last year.

So while your chances of getting your credit card’s APR reduced are the lowest they’ve been in four years, it is still very likely to happen if you ask. Seven in 10 cardholders who asked for a reduction got their way. The success rate was even higher for the three other issuer requests, hitting 80% or higher. In a time of skyrocketing inflation, rising interest rates and general economic uncertainty, that is definitely something cardholders should take advantage of.

What is less clear is whether these lower success rates are a blip or the start of a trend. Either way, cardholders who could benefit from one of these breaks would be well served to ask for them sooner rather than later.

- Card issuers weren’t as likely as in previous years to grant requests for a lower credit card APR, a waived annual fee or waived late fee. The biggest decrease: 70% of cardholders who asked their issuer for a reduced APR in the past year were successful, a 13-point drop from 2021.

- Despite a small decrease, annual fee waivers or reductions (down from 92% to 90% from last year) were still the most likely request to be granted. A higher credit limit (up from 83% to 84%) was the second-most likely.

- Balance transfer fees and foreign transaction fees becoming more likely to be waived. Success rates for these requests improved by at least 5 points from last year, growing to 61% and 58% respectively.

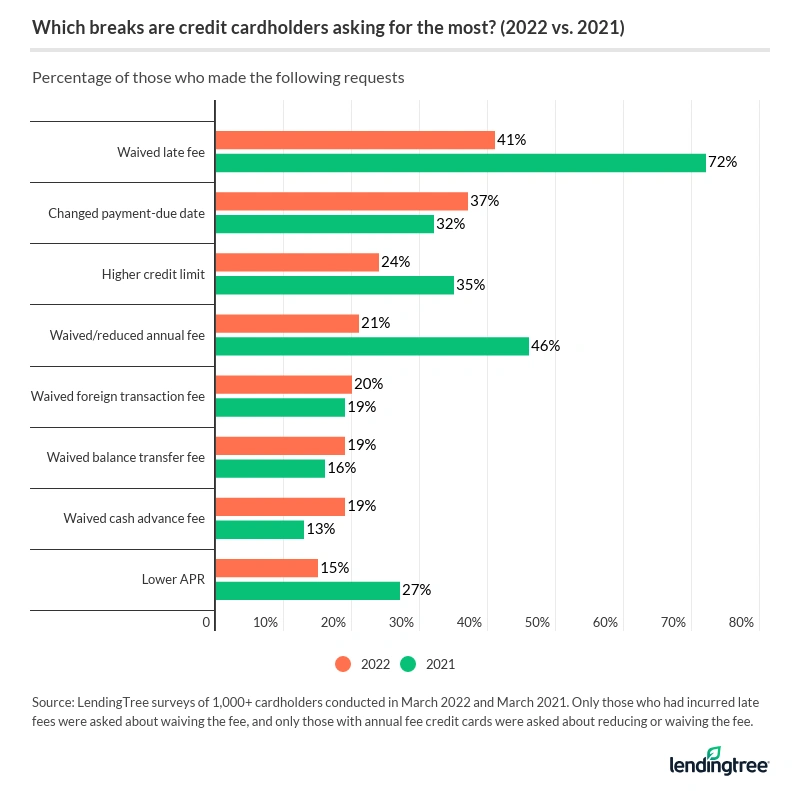

- A record-breaking number of consumers asked their credit card issuers for breaks last year, but this year’s numbers appear to have dropped back to pre-pandemic levels. This year, cardholders were less likely to ask their issuers for late fee removals, annual fee waivers, higher credit limits or lower interest rates.

- Men consistently ask their card issuers for breaks more than women do. The gap was largest when it came to late fee waivers (21-percentage-point difference), even though women were slightly more likely to be charged a late fee (24% versus 23%).

Requests for a lower APR, waived annual fee or late fee less likely to be granted

No one should ever pay their credit card issuer a penny more than they have to. That’s true in the best of economic times, and it is certainly true today as consumers wrestle with inflation and rising interest rates.

For years, one of the best ways to avoid paying the bank more than is necessary has been to simply call and ask for a break. That is still the case today, though the latest data from LendingTree reveals that banks are becoming less generous with some of those breaks, including some of the most impactful ones.

The biggest decrease was with the request for a lower APR. Last year, 83% of those who asked for one received one. This year, that number fell to 70%, a significant drop. The good news is that a success rate of 70% is still really high, and the average APR decrease that issuers granted was about 7 percentage points. However, it is troubling that the break that can have the most impact took the biggest hit.

Why is it so impactful? Consider this:

- If you have $5,000 in card debt on a card with a 20% APR and pay $250 each month, you’ll pay $1,133 in interest and take 25 months to pay it off.

- Lower that APR by 7 points to 13% and leave everything else equal, and you’ll pay $666 in interest and pay it off in 23 months.

- That’s a $467 decrease in interest — a lot more money than you’d save with a waived annual fee or late fee.

Unfortunately, banks were also less likely to waive or reduce annual fees and late fees this year, too, though only slightly. 90% of those who asked for a lower annual fee got one (down from 92%) and 82% of those who asked to have a late fee waived were successful (down from 88%). Still, even with the decrease, those chances for success are high, hinting that even those with imperfect credit may be able to get their way if they just ask.

Balance transfer and foreign transaction fee waivers among requests with rising success rates

A balance transfer fee is charged every time a balance is transferred to a card and is usually 3% to 5% of the transferred balance. That means that if you transfer $5,000 to a card, your fee will likely be $150 to $250.Meanwhile, a foreign transaction fee is typically assessed when making a purchase with your card overseas, but can also apply to purchases made from home with a foreign merchant. This fee is typically about 3% of each purchase, meaning that if you spend $5,000 on your vacation in Italy, you’ll end up paying about $150 in foreign transaction fees. However, know that not all credit cards charge a foreign transaction fee.

The good news is that card issuers are becoming more willing to waive these fees. 61% of those who asked to waive a balance transfer fee got their way (up from 53% last year) and 58% of those who asked to waive a foreign transaction fee were successful (up from 53% last year).

We’ve seen fewer cards charge foreign transaction fees in the past decade as cards tried to attract frequent travelers, especially prior to the pandemic, but these fees are still out there, so being able to get them waived is a big deal. Better yet, before traveling, get a credit card that charges no foreign transaction fees.

Getting a balance transfer fee waived may be an even bigger deal, though. As inflation hits Americans’ wallets and the Federal Reserve pushes credit card interest rates higher, it is likely that we’ll see increased demand for balance transfer cards in coming months and years. The name of the game with a balance transfer card is saving money, and being able to get the transaction fee waived on these cards would help cardholders do more of that.

Other requests that were more likely to be granted this year than last:

- Higher credit limit: 84% this year, 83% last year

- Changed payment due date: 73% this year, 66% last year

- Waive a cash advance fee: 53% this year, 46% last year

Fewer cardholders asking for most common requests; men still most likely to ask

Far too few people ask their credit card issuer for breaks.

In our 2021 report, we saw a record number of cardholders asking for help. Nearly 3 in 4 people (72%) who had accrued a credit card late fee asked to have it waived. Nearly half (46%) of those with an annual-fee card asked to have it waived or reduced. More than 1 in 4 cardholders (27%) asked for a lower APR. Even then, though, there was plenty of room for improvement.

Our latest report, however, shows a reversal of that trend.

The percentage who asked for a waived late fee fell by 31 points, those who asked for a waived or reduced annual fee fell 25 points, for a lower APR fell 12 points and for a higher credit limit fell 11 points. The decreases themselves weren’t a surprise — even with higher inflation, many people find themselves in better financial situations than they did a year ago as COVID-19 cases wane and life climbs more toward normalcy — but the magnitude of the decreases were eye-opening.

Not all the trends were bad, however. More cardholders asked for balance transfer fees, foreign transaction fees and cash advance fees to be waived or reduced, as well as for a later payment due date.

Men were most likely to make these requests, as were millennials and Gen Z. For example, 18% of men asked for a lower APR on their credit card versus 11% of women; and 27% of Gen Zers and 22% of millennials made that request, compared to just 8% of Gen Xers and 6% of baby boomers.

The bottom line: It is worth your time to ask, especially if your credit is good

You may have more power over your credit card issuer than you realize. The sky-high success rates revealed in this report — though some are a bit lower than in previous years — are proof of that. From a lower interest rate to a waived cash advance fee, you have a better than 50% chance of getting your way with every request, and often that chance is 70% or higher. (If you have good credit, those chances are likely even greater.)

When you combine those strong odds with the amount of money you can save, especially when your card’s APR is lowered, there’s no doubt that it can be well worth your time to ask.

Still, not enough people do. The two biggest reasons for not asking? People didn’t know they could, and they didn’t think they’d be successful. This report aims to end those misconceptions once and for all.

These findings should also serve notice that people should make these requests sooner rather than later. For example, we don’t know whether issuers will continue to be stingier about reducing cardholders’ APRs. However, given that the Federal Reserve is likely to raise interest rates several more times this year, making it more expensive for banks to lend money, it is a distinct possibility that issuers will continue to become less receptive to those who ask for lower rates.

Here are some tips for asking for certain breaks from your credit card issuer:

- Lower APR: The best thing you can do is find other offers that you qualify for, either through sites like LendingTree or perhaps in your snail mail, and use them to guide the negotiations. “I’ve used your card for years and have never missed a payment, but my rate is really high. I’ve gotten an offer in the mail for a card with a 17% APR. Could you match it?” You can also look at your issuers’ website and see the current APRs being offered on your card. If you have good credit and you’re not getting the best possible rate, ask them to change that.

- Annual fee: Know that you may not get a yes or no answer when you ask if they’ll waive your annual fee. They may just offer to reduce it. They may offer you extra points or other perks. They may even suggest that you downgrade to a no-annual-fee version of your current card instead. Think through what you’ll accept before you ask. That way, you’re able to make a more informed decision when the time comes.

- Late fee: You probably don’t have to do much more than just ask nicely. If you’re a first-time offender, it is pretty likely they’ll waive the fee. They may even do it a time or two after that. However, cardholders who are habitually late with payments probably won’t have as much luck. Also, consider setting up autopay on the account to ensure that you won’t miss more payments in the future, and then tell your issuer. That will help show that you’re serious about avoiding paying late in the future.

- Higher credit limit: If your income has recently increased substantially, getting a higher credit limit might be as simple as telling your issuer your new income. And remember, you can often include a spouse or live-in partner’s income as your own on a credit card application. (Ask your card issuer if they will accept that.) It can also be wise to tell your issuer that you’re asking for a higher limit in order to boost your credit utilization — how much debt you have compared to your available credit — and help your credit score. Just don’t get too greedy. For example, asking for a $2,500 credit limit increase might be fine if your card currently has a $5,000 limit, but not if the limit is just $500.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,224 credit cardholders, conducted March 10-15, 2022. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (defined as those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.