Most Back-to-School Shoppers Feel Stressed and Expect to Spend More, While Nearly 1 in 3 Say They Can’t Afford It This Year

Inflation has made back-to-school shopping increasingly expensive over the past few years. Even though inflation has slowed, prices are still higher, and more back-to-school shoppers say they’re unable to afford supplies this year, according to the latest LendingTree survey of 2,000 Americans.

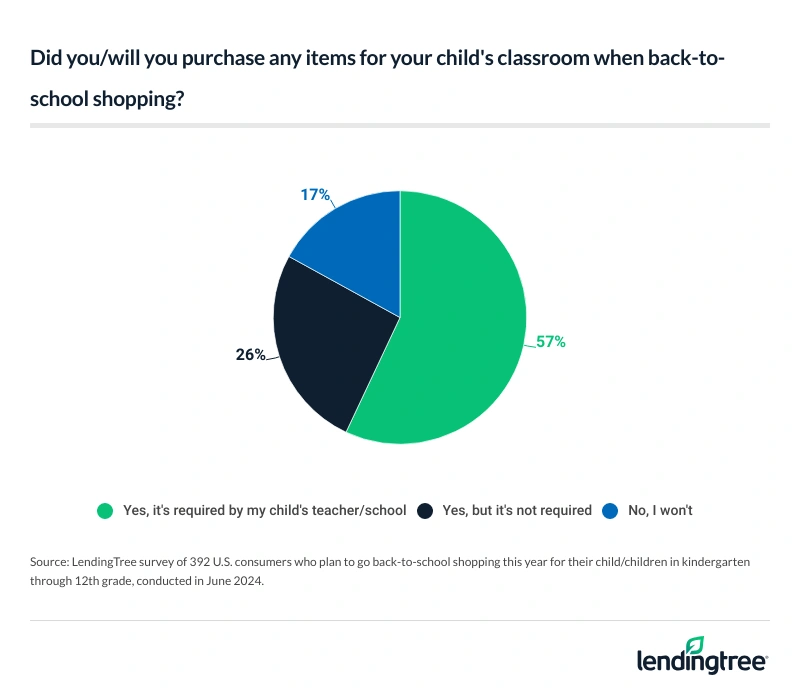

As such, nearly 3 in 4 shoppers say they’re stressed over how they’ll afford school supplies. Despite that, more than 8 in 10 shoppers with kids in kindergarten through 12th grade are taking on the extra expense of helping to stock classrooms with needed supplies.

Find out more insights about the 2024 back-to-school shopping season.

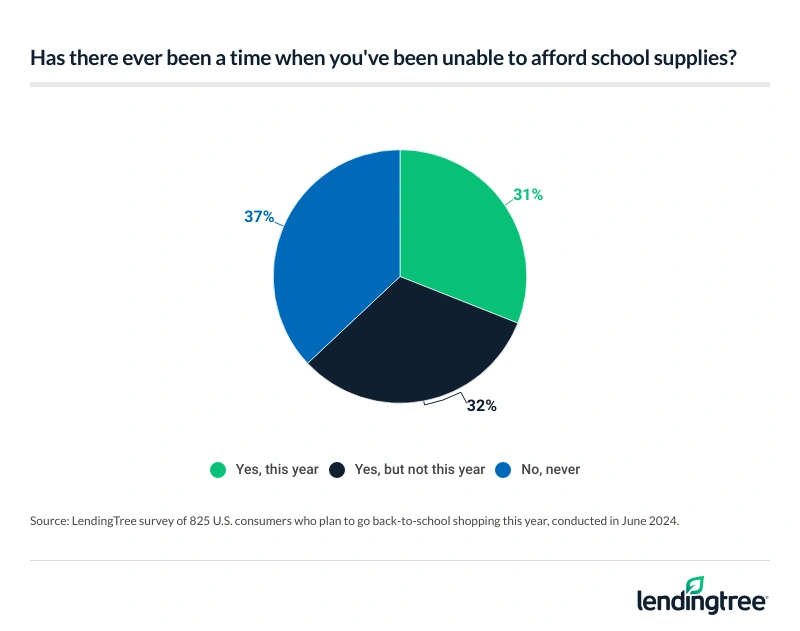

- Back-to-school shopping is more unaffordable for many Americans. 41% of Americans plan to go back-to-school shopping this year, with 68% of shoppers expecting to spend more than last year. Among shoppers, 31% say they’re unable to afford school supplies this year, up from 26% in 2023.

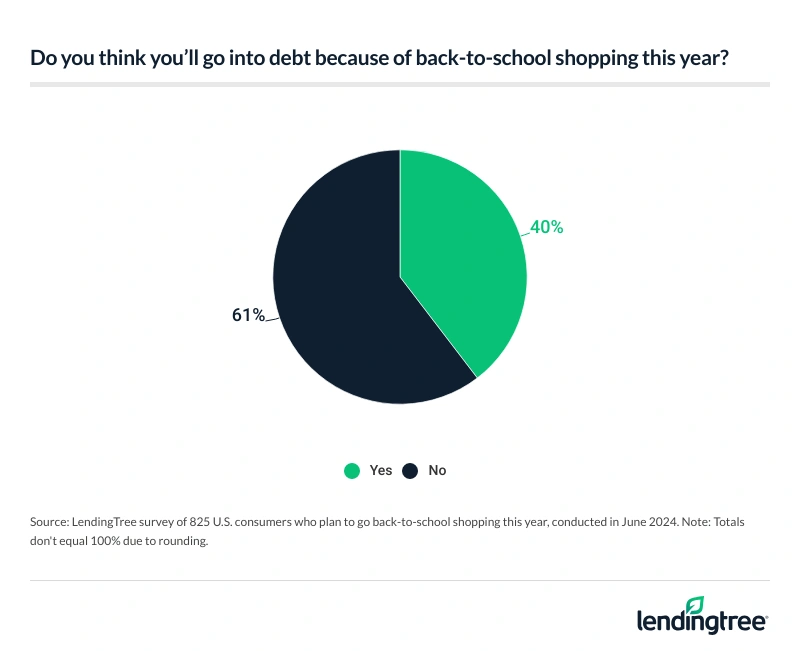

- Shopping for the school year is causing stress — and debt. Nearly 3 in 4 (73%) back-to-school shoppers say they’re stressed about paying for it this year. Even worse, 2 in 5 (40%) shoppers expect to go into debt over it, at an average of $793.

- Most parents are being asked to pitch in for classroom supplies. 86% of parents who plan to shop for their children in kindergarten through 12th grade believe that school systems should provide more supplies for students and teachers. While 57% say their child’s teacher or school requires classroom contributions, 83% have plans to help stock their child’s classroom with supplies whether it’s required or not.

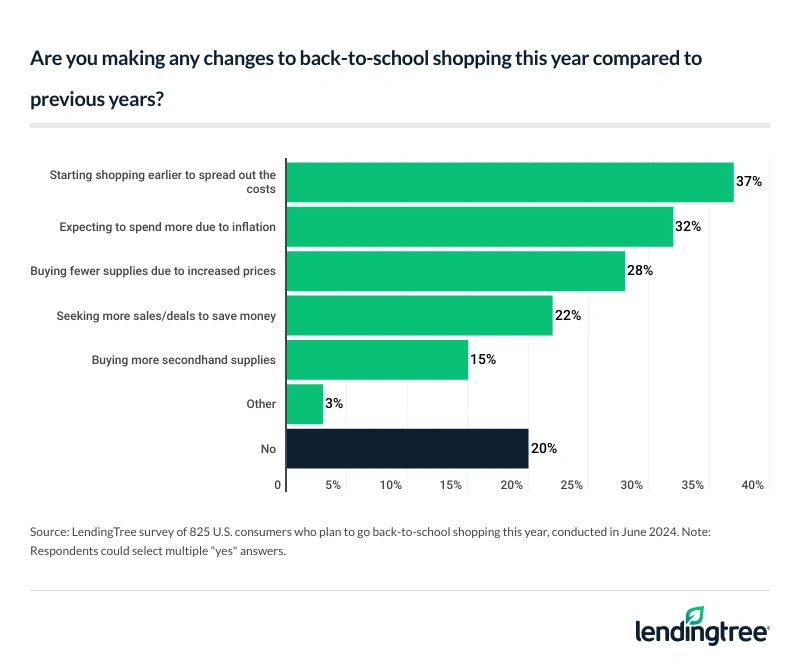

- Shoppers strategize to save money. Finding the best deal by shopping around helps 84% of shoppers save money, while 37% shop early to spread out costs and 28% will buy fewer supplies. Additionally, 62% plan to take advantage of tax-free holidays.

Back-to-school shopping more unaffordable for many

Overall, about 4 in 10 (41%) consumers will go back-to-school shopping this year. Shoppers are most commonly buying for K-through-12 students (20% of consumers), followed by those shopping for themselves (16%), preschoolers (10%) and children in college (5%).

Regardless of the recipient of the back-to-school gear, 68% of the shoppers expect this year’s haul to cost more than last year’s — and they’re probably correct. Using the Bureau of Labor Statistics (BLS) consumer price index (CPI) inflation calculator, $300 spent in May 2023 would cost $309.81 in May 2024.

That said, prices have stabilized or even decreased since 2023 in some categories like footwear, which may help balance increases on other items.

Either way, 31% of shoppers don’t think they’ll be able to afford school supplies this year. Among Gen Z shoppers ages 18 to 27, the percentage is even higher (38%). The overall percentage is up from our 2023 back-to-school survey, when 26% said the same.

Nearly 1 in 3 back-to-school shoppers are already done

Perhaps surprisingly, 31% of back-to-school shoppers have already checked off the items on their lists. There does seem to be a generational gap among the early birds, however, with Gen Zers leading the way (38%), versus just 20% of Gen Xers ages 44 to 59 who say they’re finished.

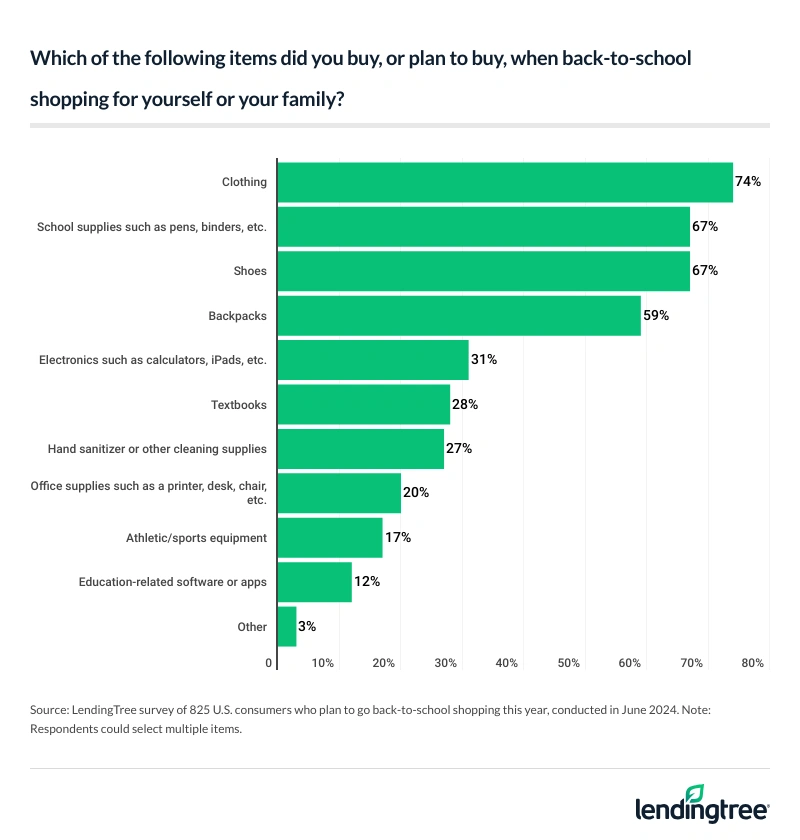

As for what people are buying this year, clothing, school supplies (notebooks, pens, etc.) and shoes top the list, while just about 1 in 3 plan to buy electronics such as calculators or iPads. Gear for extracurriculars is on the list as well, as 17% expect to buy athletic and sports equipment.

Millennials ages 28 to 43 seem to have the longest shopping lists, leading the way in nearly all major shopping categories (except textbooks, for which Gen Z edges them out). It makes sense considering that millennials are most likely to have younger, grade school-age kids with specific school supply lists, and who outgrow their clothes and shoes each year.

While online purchases are the preference for 23% of shoppers, more (39%) favor the “old-school” method of in-store shopping for their back-to-school needs. The remaining (38%) will use a mix of online and in-person shopping.

Men have a higher preference to shop online than women (29% versus 18%), while more women than men plan to hit store aisles in person (44% versus 34%).

To pay for those collective purchases, a debit card (42%) is the most popular payment choice among shoppers, followed by a credit card (29%) and cash (22%). Gen Z is the most likely group to rely on buy now, pay later options (6%).

Shopping for school year causing stress — and debt

Although summertime is supposed to be a laid-back season, nearly three-quarters (73%) of back-to-school shoppers are stressing over shopping for the next school year. Millennials are the most-stressed shoppers (77%), and women feel the strain more than men (76% versus 70%).

While money no doubt plays a big role in back-to-school shopping stress, there could be other contributing factors. Trying to find items that meet the specifications of the supply list can send parents running to multiple stores, for example. The pressure to keep up with the proverbial Joneses in terms of trendy clothing, sneakers and backpacks could also be tough for parents trying to juggle pleasing their kids with sticking to their budgets.

Whether because of higher prices or spending beyond their means, 2 in 5 (40%) shoppers expect to go into debt to pay for back-to-school items. The percentage is higher for Gen Z (44%) and millennial (43%) shoppers, while just 29% of Gen Xers expect to have debt.

Respondents also expect the debt load to be significant, at an average of $793.

One thing to consider if you’re among those expected to rely on credit to get through back-to-school season is applying for a new credit card with an introductory 0% APR offer. This can give you several months, and in some cases close to two years, to pay off the purchases interest-free.

Most parents are being asked to pitch in for supplies

On top of their families’ back-to-school needs, parents are picking up a few classroom staples. Although an overwhelming 86% of K-through-12 parents feel that school systems need to step up and provide more needed supplies for classrooms, 57% say their child’s teacher or school requires them to contribute. Regardless of whether it’s a requirement, 83% say they will do their part to stock the classroom with high-need items.

The majority of this group say there’s no guesswork as to what they need to buy for their kids (and, if applicable, their classrooms) since 78% receive a supply list from their schools or teachers.

Shoppers strategize to save money

To try to offset the expense of back-to-school purchases, most shoppers are leaning on tried-and-true bargain-hunting techniques. For starters, 84% take the time to comparison shop to find the best deals.

Other strategies include starting shopping early to spread out costs (a tactic used by 37% of shoppers, and 42% of millennials). A good portion of shoppers (28%) will buy fewer supplies.

For those fortunate enough to live in a state that offers a tax-free shopping holiday (the Federation of Tax Administrators website has a running list), 62% of shoppers plan to take advantage of those periods. Tax-free windows and spending categories and limits vary by state.

For example, Florida shoppers can enjoy tax-free shopping from July 29 through Aug. 11 this year, while New Jersey has an extensive list of tax-free items from Aug. 24 to Sept. 2, including computers up to $3,000 and sports equipment. Other states like Arkansas and Texas may only have a couple of days to shop tax-free.

4 things to know before going back-to-school shopping

If you’re among the high percentage of Americans who get stressed about back-to-school shopping, you can do a few things to alleviate some of your worries — and save money. First, you should snap a photo of those school supply lists as soon as they become available. That way as you’re out and about, you’ll know what you need should you come across any great deals.

Here are some other things that can help.

- You probably don’t need everything on the list. Take an inventory of what you already have on hand. If backpacks, sneakers, lunch bags and other gear are still in good condition, there’s no reason you have to buy new ones each year. A good wash can do wonders for a backpack. And for little ones, adding a fun zipper pull or sewing on a patch or two can make it feel like new. Also, see what other items survived the school year unscathed that you can reuse or pass on to a younger sibling, like protractors, calculators and staplers. You can also rip out the written-on pages in notebooks that were barely used and start fresh.

- Think outside the office supply store. The dollar store or discount stores like Five Below can be a gold mine for school supplies like folders, pencil boxes and art supplies. You can also head to warehouse stores for bulk buys on things like cleaning supplies, tissues and copy paper — especially helpful if you have multiple kids in grade school and can split up those multipacks for each teacher.

- Check the weekly flyers. Superstores like Target and Walmart, office supply chains like Staples, and supermarkets and pharmacies may put different items on sale throughout the summer. That’s when you’ll find those 50-cent crayon boxes or $1 marble notebooks. It might require some detective work and a few extra trips, but you can save by picking up pieces here and there.

- Cash in credit card points for gift cards. If you have a rewards credit card that allows gift card redemption, consider cashing in to shop at your favorite department stores, office supply stores and other retailers.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from June 4 to 6, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59