2025 Balance Transfer Credit Card Report

It’s getting more expensive to shift debt onto a 0% balance transfer credit card, according to a new LendingTree report.

A 0% balance transfer credit card, which allows you to avoid accruing interest on a transferred balance for as many as 21 months, may be the best weapon in the fight against credit card debt. It can save you a small fortune in interest and dramatically reduce the time it takes to pay off the balance, but it also typically comes with a one-time fee.

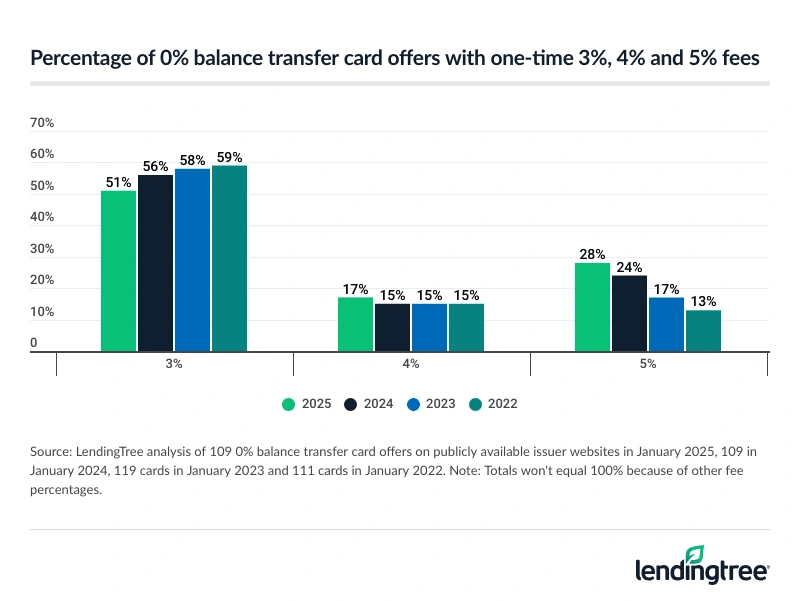

It has long been the industry standard that the fee would be 3% of the balance being transferred. However, for the third straight year, an increasing rate of these cards are charging a one-time transaction fee of 4% or 5%.

To assess the current landscape for 0% balance transfer cards, LendingTree looked at offers for more than 100 of them. Here’s what we found.

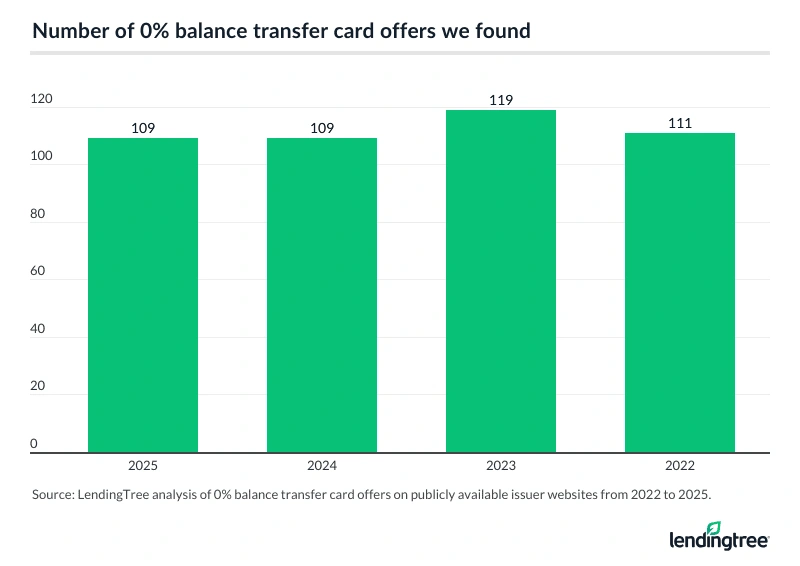

- 0% balance transfer card offers remain widely available. We found 109 cards from 31 issuers. That’s the same number of cards as 2024, but it’s down from 119 in 2023 and 111 in 2022.

- Balance transfer fees continue to rise as 4% and 5% fees become more common. 44% of 0% balance transfer card offers come with a one-time fee of 4% or 5%, up from 39% a year ago and 28% in 2022. The most common fee is 3%, which 51% of 0% balance transfer cards charge. But that figure was 56% in 2024 and 59% in 2022.

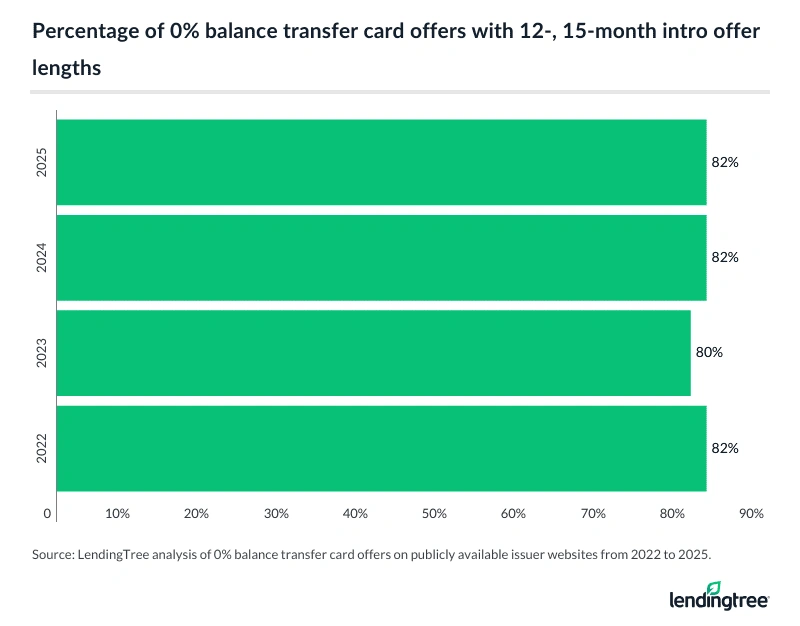

- The most common duration of a 0% offer is 15 months. 82% of 0% balance transfer credit cards come with introductory-offer durations of either 12 or 15 months. Of the 109 cards reviewed, 49 offered 15 months interest-free, while 40 offered 12 months. That 82% is unchanged from a year ago but up slightly from 2023.

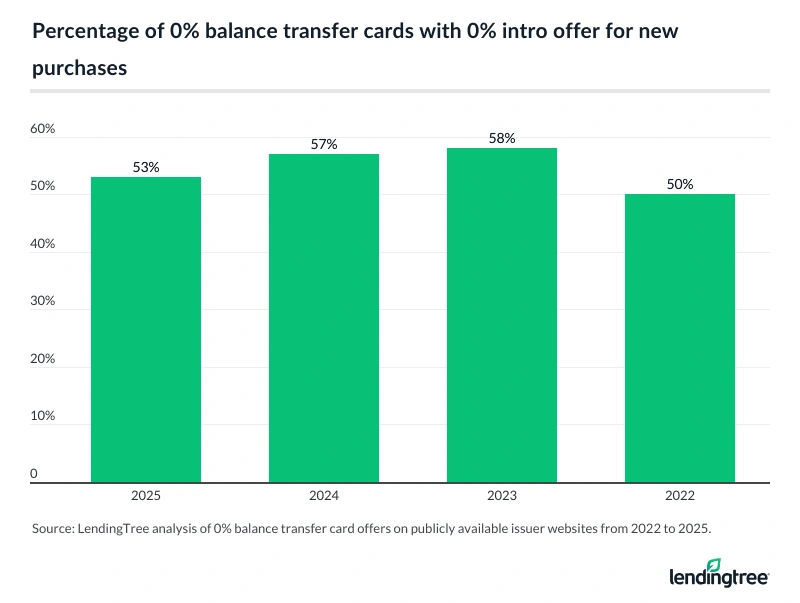

- 0% purchase offers are becoming less common. Just 53% of 0% balance transfer credit cards also come with a 0% introductory offer for new purchases. That’s down from 57% a year ago and 58% the year before.

0% balance transfer offers remain widely available

With credit card balances at an all-time high and credit card APRs just below record levels, it’s a tough time for people with card debt. However, there’s some good news: 0% balance transfer credit cards are still available from card issuers throughout the nation.

In compiling this report, we found 0% balance transfer offers on 109 cards from 31 issuers, including banks and credit unions. That’s the same number of cards we found in 2024, though fewer than in 2023 (119) and 2022 (111).

It’s important to understand, however, that availability doesn’t necessarily mean the cards are easy to get. Generally speaking, banks have made it tougher for those with less-than-perfect credit to get a card in the past few years, and balance transfer credit cards are no exception. You may need good credit to get one — perhaps 680 to 700 or higher — but it can make a huge difference in your financial life if you can.

Balance transfer fees continue to rise

Zero-interest balance transfer credit cards can save you a ton of money. However, they don’t come cheap.

Most 0% balance transfer credit cards charge a one-time transaction fee every time you transfer a balance to the card. These fees are typically a percentage of the transaction, usually from 2% to 5%. Depending on how much you’re transferring, that can be a significant cost. For example, if you transfer $5,000 to a card that charges a 3% fee, you’ll shell out an extra $150 (3% of $5,000) to make the move.

That 3% fee has been the most common found with 0% balance transfer offers for years — and still is today. However, since we began tracking these fees in 2022, we’ve seen an unmistakable trend toward higher fees, and that trend is accelerating in 2025.

To start 2025, 44% of 0% balance transfer card offers come with a one-time fee of either 4% or 5%, while 51% charge a 3% fee. That’s a significant change from just a year ago, when the numbers were 39% and 56%, respectively. Look back a few years further and the difference is even more pronounced. In 2022, just 28% of 0% balance transfer cards charged a 4% or 5% fee, while 59% charged 3%.

A one percentage point change is a big deal. As mentioned, a 3% fee on a $5,000 transfer is $150. Bump that up one point to 4%, and the fee becomes $200. Move it to 5%, and the fee is $250. That’s real money, especially when you’re already struggling to pay off debt.

12-, 15-month introductory periods are typical

While 4% and 5% balance transfer fees continue to become more common, there’s better news about the length of 0% introductory periods on balance transfer credit cards.

Today, more than 8 in 10 (82%) 0% balance transfer card offers come with introductory periods of either 12 or 15 months. That’s the same percentage as a year ago, and slightly higher than the 80% in 2023.

That’s cause for celebration among those with card debt, and something that wouldn’t necessarily have been expected given the torrent of interest rate increases from the Federal Reserve in recent years. That’s because it costs banks more to lend when the Fed raises rates. And when it costs banks more to lend, they may be less inclined to offer 0% rates to those who borrow from them. Given that, many observers speculated we’d see fewer 0% balance transfer offers once the Fed raised rates or, at a minimum, we’d see the length of those 0% introductory periods get shorter. Fortunately for consumers, neither has happened.

0% intro purchase offers becoming less common

The goal with a 0% balance transfer credit card, generally speaking, is to knock down your credit card debt. If you’re carrying debt and viewing one of these cards as a vehicle for more spending, you’re missing the point. Still, many of these cards come with introductory rates that incentivize buying more.

Our research found that just over half (53%) of 0% balance transfer credit card offers also include a 0% introductory offer for new purchases. That’s down slightly from 57% in 2024 and 58% in 2023.

While that may mean less temptation for those trying to lower their debt, it also means less opportunity for those without debt who, for example, may be looking to finance a big-ticket purchase. These 0% offers, when used wisely, can be a great option, especially in this time of stubborn inflation and sky-high interest rates.

For those 0% offers that are available, the longest duration you’ll find is 21 months — as with balance transfers — and the typical duration is 12 or 15 months.

2025 Balance Transfer Credit Card Report recap

Fees charged on 0% balance transfer cards, 2022 to 2025

| Balance transfer fee | 2025 | 2024 | 2023 | 2022 |

|---|---|---|---|---|

| 0% | 4 | 5 | 9 | 13 |

| 2% | 1 | 1 | 3 | 1 |

| 3% | 56 | 61 | 69 | 66 |

| 4% | 18 | 16 | 18 | 17 |

| 5% | 30 | 26 | 20 | 14 |

| Total cards | 109 | 109 | 119 | 111 |

| Percentage of cards charging 3% fee | 51% | 56% | 58% | 59% |

| Percentage of cards charging 4% fee | 17% | 15% | 15% | 15% |

| Percentage of cards charging 5% fee | 28% | 24% | 17% | 13% |

| Combined percentage of cards charging 4% or 5% fees | 44% | 39% | 35% | 28% |

Offers are everywhere; shopping around matters

We found more than 100 different 0% balance transfer options on the market. They’re everywhere, from the biggest bank to your local credit union. While they all have some key similarities, there are very real differences. Just a few examples of details that can vary widely from one issuer to the next are:

- Interest rates

- Introductory period lengths

- Balance transfer fees

- Credit limits

- How soon you have to do the transfer to take advantage of the 0% rate

- 0% purchase offers

- And many more

Simply put, if you don’t take the time to shop around when looking for a 0% balance transfer credit card, you could pay more than you need to. With life as expensive as it is today, that’s the last thing anyone needs.

Methodology

LendingTree reviewed offers for 109 credit cards with 0% introductory APR periods on balance transfers. Cards from 31 issuers — including banks and credit unions — were included.

We reviewed basic terms and conditions, including APRs and annual fees, and evaluated the cards’ balance transfer programs. All offers were reviewed online on financial institutions’ public websites. Credit card offer data is accurate as of Dec. 17, 2024.