Blame Game: 60% of Those With Credit Card Debt Say It Was Unavoidable

Credit card debt isn’t a new problem, but it’s a concerning and pervasive one. According to the latest LendingTree survey of over 2,000 Americans, 47% have credit card debt. Worse, nearly half have carried that debt for at least a year, giving interest ample time to add up.

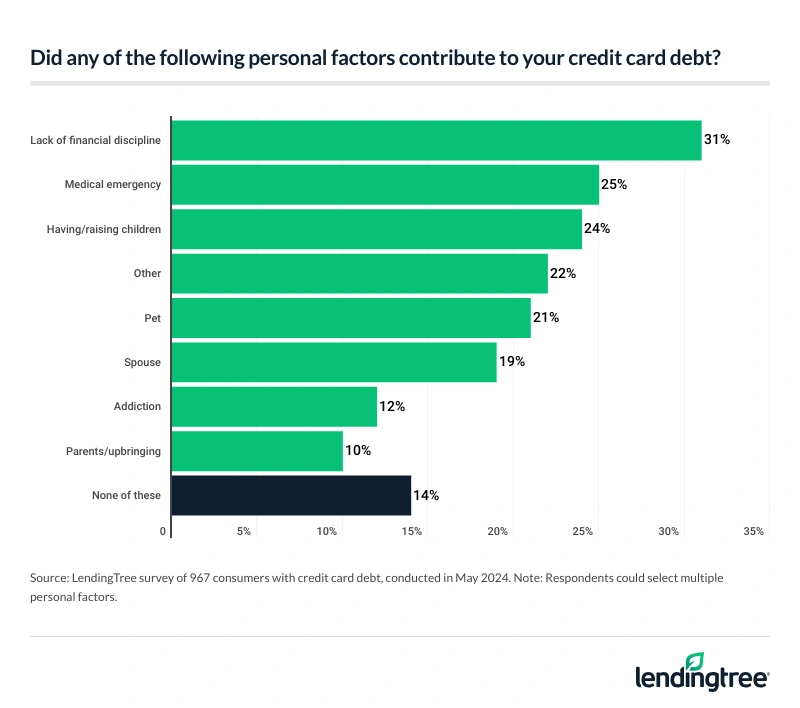

What’s the cause of this unfortunate cycle? From pets to the pandemic, credit card debt-holders have plenty of places to point their fingers — including, in the case of the 31% who acknowledge the problem is at least in part due to a lack of financial discipline, themselves.

Let’s dive into the statistics.

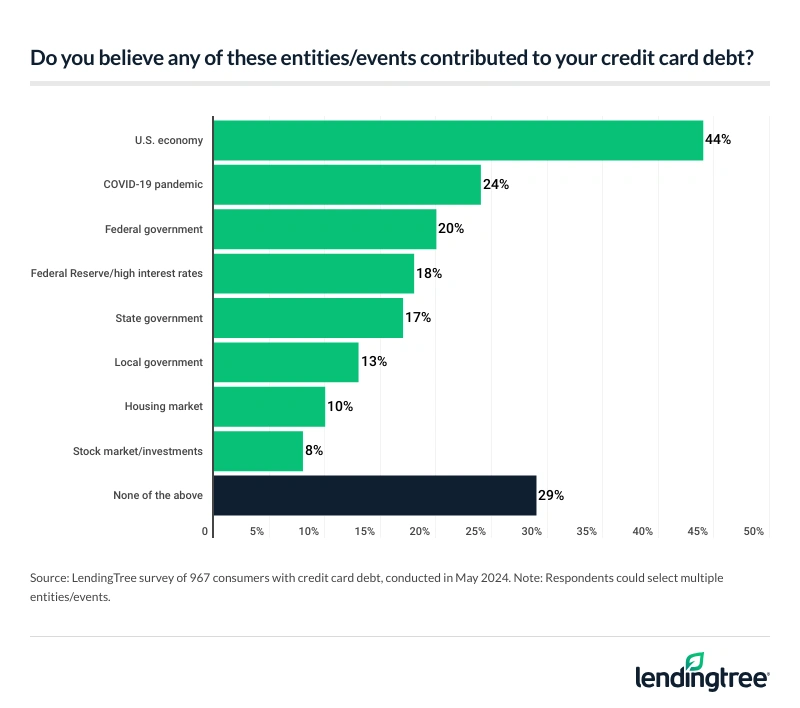

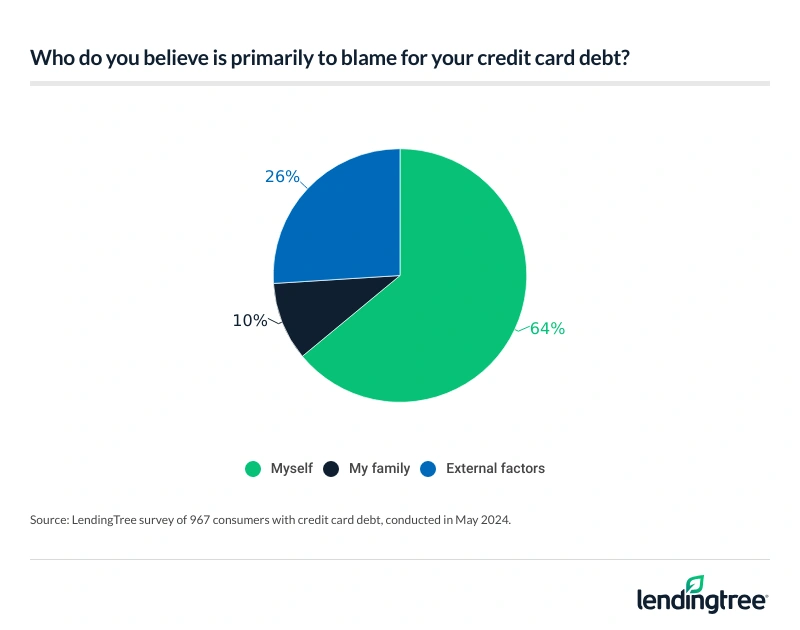

- Most Americans with credit card debt believe it was out of their hands. Of the 47% of consumers with credit card debt, 60% believe factors beyond their control caused it. Additionally, 71% of those in debt say certain entities or events worsened their financial situation, including the U.S. economy (44%), COVID-19 pandemic (24%) and federal government (20%). Drilling deeper on personal factors, 31% blame their lack of financial discipline, 25% point to medical emergencies and 24% cite raising children.

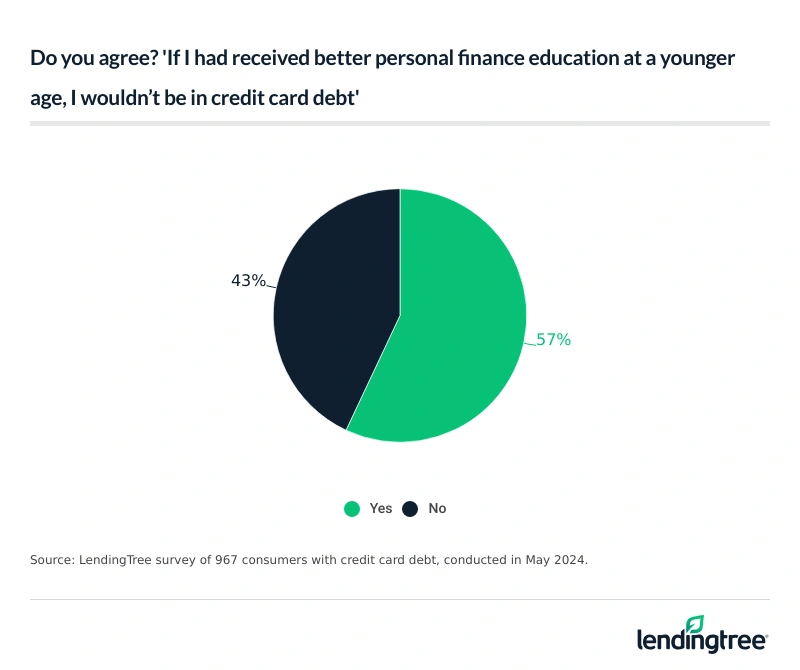

- Financial education could be the key to financial discipline as an adult. 57% of Americans with credit card debt believe they wouldn’t be saddled with it if they received better personal finance education earlier in life.

- While many can admit that credit card debt is ultimately their fault, some also point the finger at their parents. Almost a third (32%) of Americans with credit card debt believe their parents’ financial situation set them up to be in debt. This is especially true for younger generations, as 52% of Gen Zers and 44% of millennials agree.

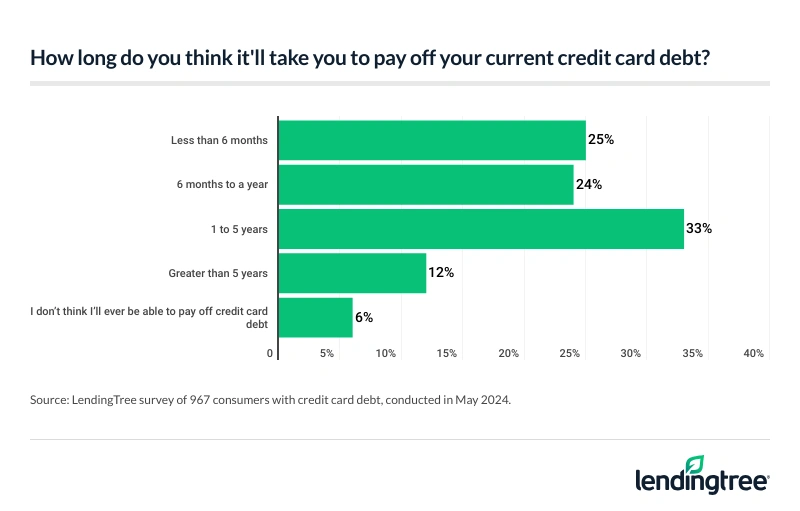

- Regardless, the majority are stressed about their debt, and some don’t know when they can pay it off. As for addressing their credit card debt, 72% feel stressed about it, and 61% regret going into debt in the first place. Looking at timelines, 49% expect it to take a year or less, while 18% say it’ll take more than five years to pay off.

Most Americans with credit card debt believe it was out of their hands

Of the 2,043 respondents, 47% say they have some amount of credit card debt. The largest portion of those holding credit card debt (31%) have had it for one to five years.

Fortunately, 27% of those with credit card debt say they’ve had it for less than six months, though 19% have been in debt for more than five years. Baby boomers ages 60 to 78 and women are significantly more likely than younger generations and men to have credit card debt for at least half a decade.

Intriguingly, 6 in 10 with credit card debt (60%) believe it was caused by factors or events beyond their personal control.

Some of the most common entities and events that credit card debt-holders point at to explain the problem include the U.S. economy (44%), the COVID-19 pandemic (24%) and the federal government (20%). According to Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” debt-holders may be at least partially right in their finger-pointing.

“There are as many reasons for credit card debt as dollars of debt in this country,” Schulz says. “For most Americans, there’s not just one reason they’re in credit card debt.”

“The economy, and specifically stubborn inflation, obviously plays a role because it makes it harder for Americans to pay their bills, leading many into debt and deepening the debt hole for others,” Schulz says. He affirms those pointing toward the pandemic as well, saying that its effects “continue to ripple through Americans’ finances,” especially those who face ongoing medical issues or whose livelihoods were impacted by lockdowns.

Nearly 1 in 3 with credit card debt cite lack of financial discipline

Along with government entities and historical events, those in credit card debt also point to more personal factors that affected their debt status. Prominent among these are medical emergencies (25%), having/raising children (24%) and costs related to pets (21%). (Gen Zers ages 18 to 27 are the most likely of the four generations to say pampering their pets is racking up credit card debt, at 27%.)

But nearly a third of credit card debt-holders — 31% — point to their lack of financial discipline as a cause.

Further, of those in credit card debt who pointed to one of these personal factors, almost a quarter say their lack of financial discipline was the strongest contributor.

The next-highest main contributor was medical emergencies, which are unfortunately no surprise. According to a 2022 LendingTree survey, nearly 1 in 4 Americans have medical debt. Also unsurprisingly, parents with children younger than 18 are far more likely (25%) than those with adult children (9%) or no children (2%) to say children were the strongest contributor to their credit card debt.

More than half of those with credit card debt (57%) agree that if they’d received better personal finance education at a younger age, they wouldn’t be in such debt in the first place. Younger generations are especially likely to say they’d have benefited from better personal finance education: 69% of millennials ages 28 to 43 agree, followed by 68% of Gen Zers.

While Schulz believes that “the best and most impactful place to learn about money is in the home” — an assertion borne out by respondents, as we’ll see in the next section — he also points to the need for personal finance basics to be built into our educational system.

“We need to support the trend of teaching about personal finance in schools,” he says. Fortunately, the number of states that require personal finance programming as part of their high school curricula is on the rise — though half of the U.S. has yet to impose such a requirement, and improvements need to be made among those that have.

Some point the finger at their parents for their credit card debt

While most of those with credit card debt don’t point to their parents’ financial situations to explain it, nearly a third — 32% — say they essentially inherited credit card debt. (That’s the percentage that responded “yes” to, “My parents’ financial situation set me up to be in credit card debt.”)

The assertion dovetails with Schulz’s beliefs about where the best personal finance education comes from — parents. When families are open about their finances, he says, “it helps lift much of the fear and many of the taboos around money.” While it may not make sense to try to teach your 6-year-old day-trading basics, there are plenty of teachable financial moments that come up in day-to-day life, he says — along with opportunities to set a good financial example.

“Keep it simple, relatable and fun — and if you can model good behavior when it comes to money, your kids will notice,” he says.

And while, again, the lion’s share of those with credit card debt — 64% — say they have primarily themselves to blame, 10% point their finger at their family, while 26% say external factors are the primary reason they carry credit card debt. Gen Zers in particular are willing to take accountability for their debt status: 66% of them blame themselves, the most among all generations.

Majority are stressed about their debt, and some don’t know when they can pay it off

While a (somewhat puzzling) 28% of those with credit card debt say they’re not at all stressed about it, the vast majority are. In fact, 31% admit they’re “very stressed” about their credit card debt, and 61% say they regret taking on the credit card debt they have.

While about half of those who hold credit card debt believe they’ll be able to pay it off in a year or less, 33% believe it’ll take them between one and five years to chip away at their revolving balance, and 6% don’t think they’ll ever be able to pay it off.

One of the most powerful tools if you’re struggling with maxed-out credit cards? Debt consolidation. Specifically, says Schulz, “a 0% balance transfer credit card is probably the best weapon you can have in the fight against credit card debt.”

If you have the good credit you’ll likely need to successfully apply for one, a balance transfer credit card can give you a major leg up. For the duration of its promotional period, which is usually a year or longer, your transferred balance won’t accrue interest. (It’s important to make sure you can feasibly pay it off in that time frame. Once the promo is up, the regular APR kicks in, often at double-digit rates.)

If you can’t qualify, says Schulz, “a low-interest personal loan can be a great option.” While your rate likely won’t be 0%, a debt consolidation loan could still have a substantially lower rate than your existing debts — and can also simplify your life when you make one monthly debt payment instead of five or six.

4 tips to reduce credit card debt

With credit cards so readily available — and plenty of tempting goods and services to spend on — it’s no wonder that almost half of Americans carry some amount of credit card debt. The good news is, getting out of debt is possible, though it may take some hard work and determination. Here are Schulz’s best tips.

- Don’t give up on saving — even while you’re tackling debt. “Yes,” Schulz admits, “it means that it’ll take you longer and cost more to pay down the debt, but that’s OK. When your debt is down to $0, that cash in your savings account will keep you from being forced back into debt if there’s an unexpected expense.” In other words, prioritize your emergency fund, even if it means you spend more on interest in the short term. In the long term, it’ll likely be well worth it.

- Just do it. People in debt can get caught up worrying about the right way to pay it back, Schulz warns — but the longer you dawdle, the more money you hemorrhage in interest. “Paying down debt is a marathon rather than a sprint — but you can’t finish the race if you never start,” Schulz advises. So: “Don’t worry about which method you choose. Don’t worry if you can only pay a little bit off to start. Don’t worry if your interest rates are too high. Just do something to get the ball rolling.” Even seemingly small steps, like putting a few dollars per paycheck toward your credit card, can help you make progress.

- Negotiate with your card issuers. Since they come on such official-looking documents, many people think APRs are written in granite — but you can call the card issuer and ask for a lower one. “Really, you can,” Schulz says. “Your chances of success are better than you realize, and the impact can be significant.”

- Finally, talk about it. Money matters can be a major source of shame — and shame can lead to isolation, which cuts you off from support when you need it the most. “Don’t suffer in silence,” Schulz says. “People want to help, but they can’t if they don’t know you need it. Even if your friends and family are little more than a cheering section for you, it can make a big difference.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,043 U.S. consumers ages 18 to 78 from May 10 to 13, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78