Nearly 3 in 10 Americans Fear They’ve Been Victim of Card Skimming, Though 64% Admit They Don’t Know How to Spot It

About 3 in 10 Americans suspect they’ve been a victim of card skimming, with half of them saying it’s happened in the past year, according to a new LendingTree survey.

Skimming can be hard to detect because it typically involves a physical device being installed on a card reader. When someone swipes their credit or debit card in the reader, the skimming device captures the information on the card’s magnetic stripe and stores it so fraudsters can illegally use it later. A camera or a thin overlay on the keypad is also often used, allowing bad guys to capture the PIN or ZIP codes associated with the cards.

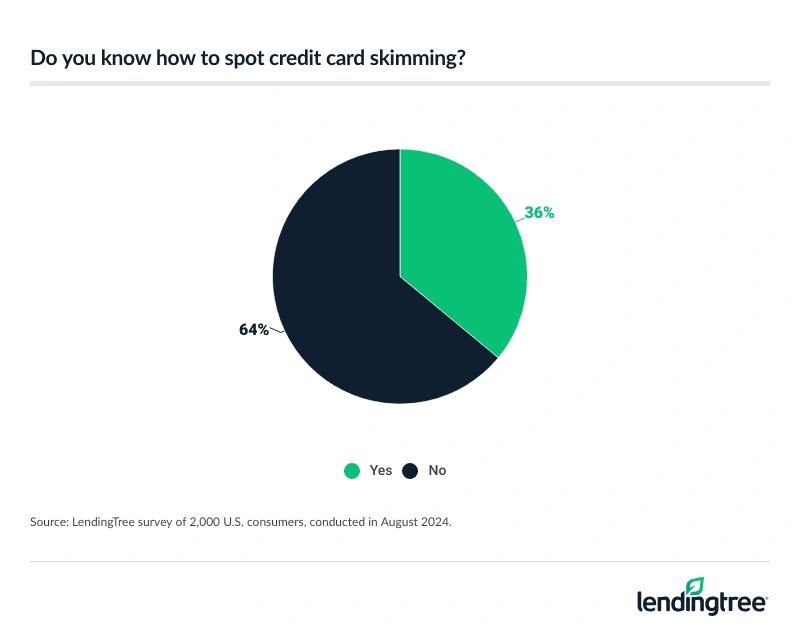

It’s scary and potentially costly, and our survey clearly shows it’s alive and well in 2024. Perhaps the most troubling thing is that nearly two-thirds of Americans say they don’t know how to spot it.

Here’s more of what we found, plus some simple steps you can take to avoid becoming a victim.

- Many Americans feel they’ve been victimized by card skimming, with most blaming gas pumps. 29% of consumers suspect they’ve been victims of card skimming, with 15% saying it happened in the past year. Among victims, 60% say it happened at a gas pump. Additionally, 35% of Americans say they know someone who’s been a victim.

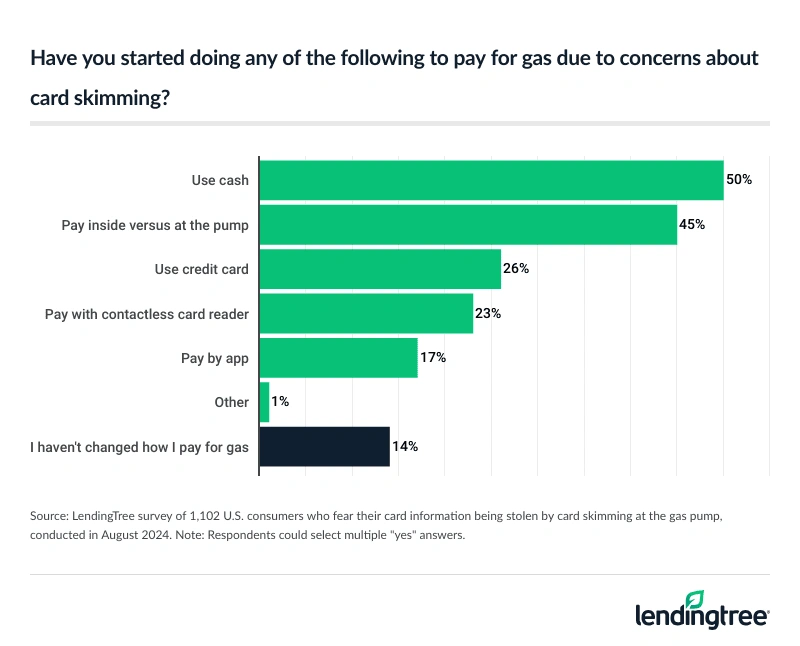

- The threat of skimming has many consumers on guard. Over half of Americans (55%) fear their card information will be stolen at a gas pump, and 56% of them are more worried about it now than a year ago. Many in this group have changed their behavior, as 66% will only get gas at certain stations, 50% have started paying in cash and 45% pay inside.

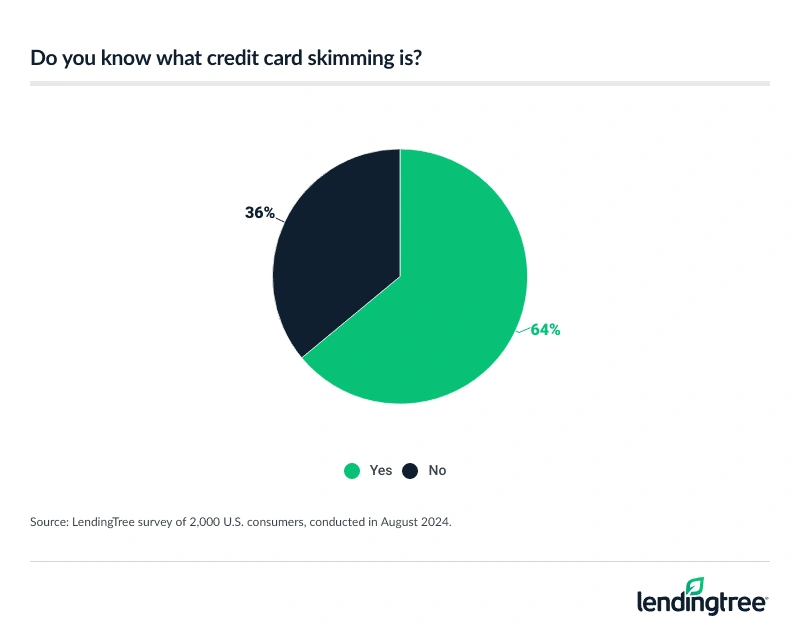

- Not all Americans are aware of skimming risks. 36% of Americans don’t know what credit card skimming is, and 64% don’t know how to spot it. Additionally, 64% don’t know how to spot a security seal on a card reader. These figures are higher among older Americans, as 71% of baby boomers don’t know how to spot skimming and 74% can’t spot a safety seal.

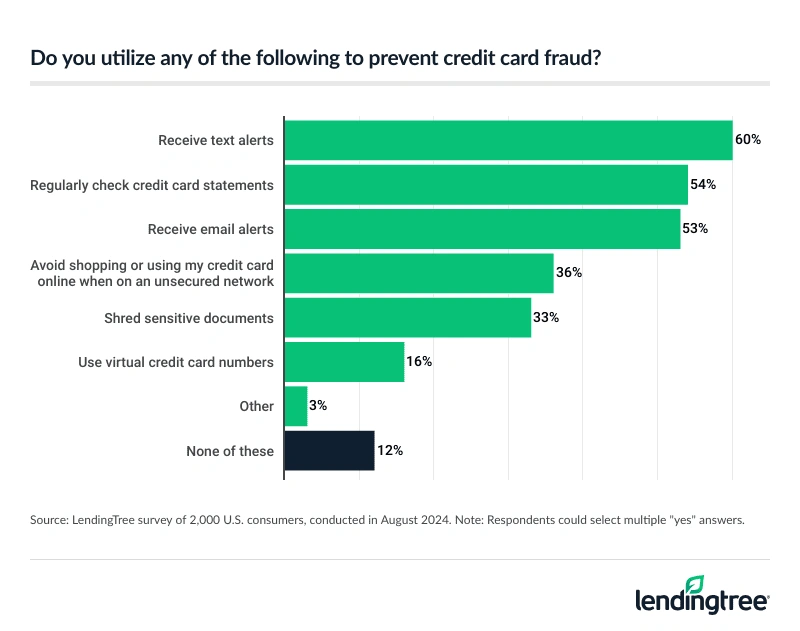

- Staying aware of purchases can help, but some still have more to learn. Nearly all Americans take some measures to fight against credit card fraud, such as receiving text alerts (60%), regularly checking credit card statements (54%) and receiving email alerts (53%). However, 29% don’t know what to do if they become a victim of card fraud.

Many Americans feel they’ve been victimized by card skimming, with most blaming gas pumps

Skimming is a serious problem, and it’s growing. For example, FICO, the credit scoring and data analytics company, reported that the number of debit cards compromised by skimming was up 96% year over year in 2023, totaling more than 315,000 cards.

In addition, the FBI has noted that fraudsters have increasingly targeted electronic benefit transfer (EBT) cards through skimming in recent years. These cards, through which the Supplemental Nutrition Assistance Program (SNAP) and other benefits are paid, are more susceptible than most credit or debit cards because they’re not often chip-enabled.

Our survey is further proof of how widespread the skimming problem is. It shows that 29% of consumers suspect they’ve been skimming victims, and about half of those (15%) say they’ve been victimized in the past year.

Men are slightly more likely than women (31% versus 27%) to say they’ve been victimized, while Gen Zers ages 18 to 27 and millennials ages 28 to 43 (both at 36%) are more likely than their older counterparts to say so. (Just 19% of baby boomers ages 60 to 78 and 24% of Gen Xers ages 44 to 59 say so.) And the higher your household income, the more likely you are to say you’ve been a victim: 33% of those making $100,000 or more a year say so, versus 22% of those making less than $30,000.

Additionally, 35% of consumers say they know someone who has been a victim of card skimming, including 49% of parents with kids younger than 18.

- 2020: Number of drivers claiming to be victims of card skimming grows for second straight year

- 2019: Growing number of drivers claim to be victims of gas pump card skimming

- 2018: Card skimming at the gas pump: How Americans are reacting

Among those who say they’ve been victims themselves, 60% say they’ve had it happen at a gas pump. Gas pumps have long been seen as the fertile spot for skimming, in part because they were among the slowest merchants to implement chip-enabled payment terminals at their stores. That meant that when cardholders went to the pump, they were often forced to swipe their cards rather than insert or tap them, leaving them susceptible to skimmers. Today, most gas stations accept chip cards, but it’s clear skimming is still an issue there.

With chip cards, ‘shimming’ is bigger issue than ‘skimming’

Chip cards are typically less susceptible to skimming because most skimming devices can only read the information on a credit card’s magnetic strip. They can’t read the data on a card’s chip.

As acceptance of chip cards spread, fraudsters began using a more sophisticated technique called “shimming,” in which a super-thin device called a shimmer is installed on a payment terminal or ATM to steal the data from a card’s chip.

This is a significant problem as well, but it’s not something we asked about in this survey. However, some respondents who said they were victims of skimming might have instead been victims of shimming.

Threat of skimming has many consumers on guard

The fear of skimming is real. Our survey shows that more than half of Americans (55%) are afraid their card information will be stolen at the pump, and 56% of them are more worried about it today than a year ago.

There’s some good news, however. Our survey highlights that many of those fearful consumers are changing their behavior as a result. For example, two-thirds of them say they’ll only get gas at certain stations or from certain brands due to fears about card skimming.

These changes aren’t just about the stations they’ll visit. They’re also about what they do when they’re at the pump. For example, 50% have started paying in cash and 45% have begun paying inside due to concerns about card skimming.

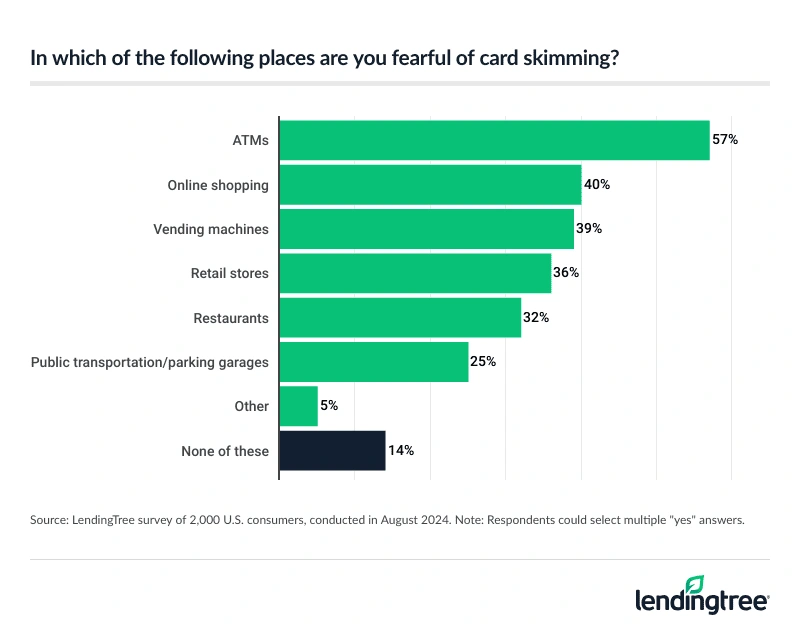

People aren’t only wary of skimming at gas pumps, however. More than half of respondents (57%) say they’re fearful of skimming at the ATM, while 40% say they’re fearful of it when shopping online, 39% at vending machines and 32% at restaurants.

ATMs are the most common choice among all age groups, genders, parental statuses and income levels. (Note: This question didn’t include gas pumps.)

Not all Americans aware of skimming risks

While many Americans are nervous about skimming and making moves to protect themselves, plenty are unaware there’s an issue. For example, more than 1 in 3 Americans (36%) don’t know what card skimming is.

Men are more likely than women to say they know what it is (69% of men versus 59% of women). Higher-income Americans are far more likely than others to say they know about it (73% of those making $100,000 or more a year versus 53% of those making less than $30,000 a year).

That last percentage is particularly troubling because we’ve seen fraudsters set their sights on SNAP benefit cards and other EBT cards held by low-income Americans in recent years. While a few fraudulent charges may be inconvenient for many Americans, the consequences of card fraud can be far more severe for those struggling to keep the lights on or food on the table.

Given that nearly two-thirds of Americans (64%) know what skimming is, it might be surprising that most (64%) don’t know how to spot it, and the same rate (64%) don’t know how to spot a security seal on a card reader.

What does a security seal on a gas pump look like, and where would it be on the pump? It’ll likely be a brightly colored label or piece of tape near the card reader, often over the cabinet panel. (See below.) If that seal is broken or missing, it could be a sign that the payment terminal has been tampered with and that you should notify the merchant of the issue and then take your business elsewhere.

Nearly 7 in 10 women (69%) say they don’t know how to recognize a security seal, compared with 59% of men. The lack of awareness is more pronounced among older Americans, with 71% of baby boomers saying they don’t know how to spot skimming and 74% saying they can’t spot a safety seal. Those are troubling percentages and reasons to believe that card skimming is likely to continue to be a problem for the foreseeable future.

Staying aware of purchases can help, but some still have more to learn

The need for diligence doesn’t end when you drive away from the pump or ATM. Credit fraud is a 24/7/365 operation, and that’s not changing anytime soon. That means that even if you do all the right things and are as cautious as possible, sometimes trouble still finds you. That’s why building credit card fraud prevention into your regular financial routine is so important.

The good news is that people are taking action. Nearly 9 in 10 Americans are taking steps to fight card fraud. The most common moves are receiving text alerts (60%), regularly checking credit card statements (54%) and receiving email alerts (53%).

All these moves can boost awareness significantly. However, many Americans (29%) say they wouldn’t know what to do if they were a victim of card fraud. That rate grows to 43% among Gen Zers and 39% among those making less than $30,000 a year.

So what do you do if you’re a victim of card fraud? Here are some helpful tips:

- Contact the card issuer. Whether it was your debit or credit card that was compromised, contact the financial institution immediately. With a credit card, it may be as simple as getting the charge waived. With a debit card, however, real money might have been taken from your account, so time may be of the essence. Ask the issuer to undo the transaction and put the money in question back into your account. In both cases, a new card will likely be issued to you.

- Review other accounts regularly. If one of your accounts has been compromised, others may have. Frequently check online statements for your credit cards and checking and savings accounts to make sure no suspicious activity is present. If you find anything unusual, don’t hesitate to report it.

- Consider freezing your credit. Better safe than sorry, right? A credit freeze is the nuclear option for protecting your credit. It means no one can access your credit file. Since no one can access your file, no one can open a new account in your name while the freeze is in effect. If you’re planning to apply for a new credit card, mortgage or some other type of loan in the near future, it may not make sense to put the freeze on your credit since you’d have to undo it shortly after that. However, even if you choose not to freeze your credit, be sure to take the time to review your credit report from all three major bureaus to make sure there are no signs of fraudulent activity.

- Report the incident to the authorities. IdentityTheft.gov bills itself as “the federal government’s one-stop resource for identity theft victims.” Operated by the Federal Trade Commission, the site can guide you through the process of dealing with identity theft and offers a “personal recovery plan” based on the details of the particular fraud. It all starts with reporting what happened.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from Aug. 12 to 14, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78