85% of Americans Say Inflation/Economy Makes Charitable Donations Harder

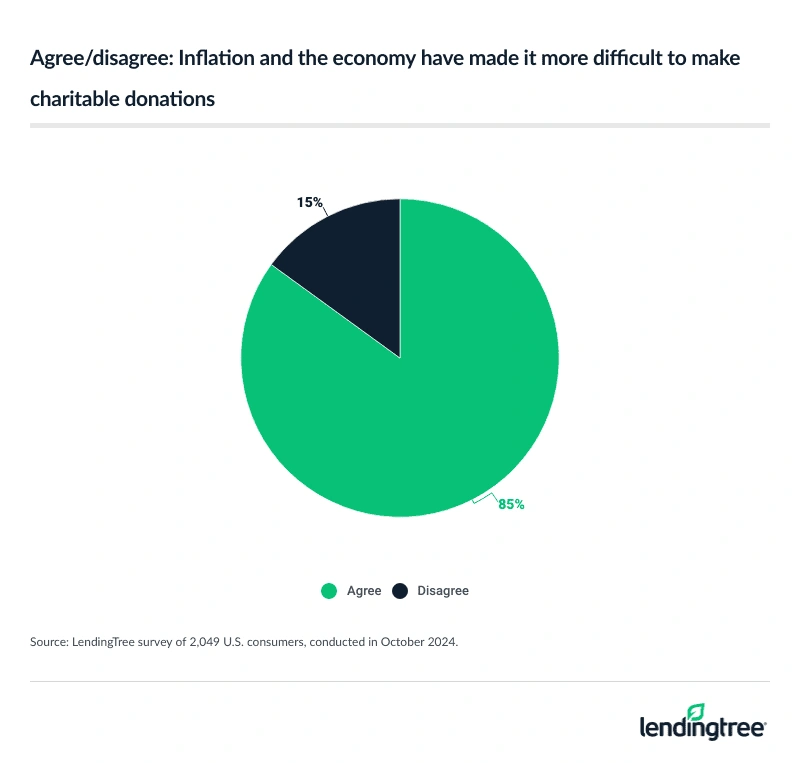

The season of giving is approaching, but Americans are struggling to be charitable this year. According to the latest LendingTree survey of nearly 2,050 U.S. consumers, 85% agree that inflation and the economy have made it more difficult to make charitable contributions.

After spotlighting our survey findings, we’ll highlight — using IRS data — which states have the most charitable residents. We’ll also provide tips on using your credit card to donate.

- Inflation and the economy are putting the pinch on Americans’ charitable donations. 85% of Americans agree that inflation and the economy have made it more difficult to make charitable contributions, led by 88% of Gen Zers, 87% of women and 87% of those who make $50,000 to $99,999 annually.

- Despite economic headwinds, most Americans are charitable. Nearly 3 in 4 (72%) have donated money to charity. Higher-income Americans making $100,000 or more a year are far more likely to have done so than lower-income Americans making less than $30,000 a year — 86% versus 57%. Charitable Americans mainly say they donate to help others.

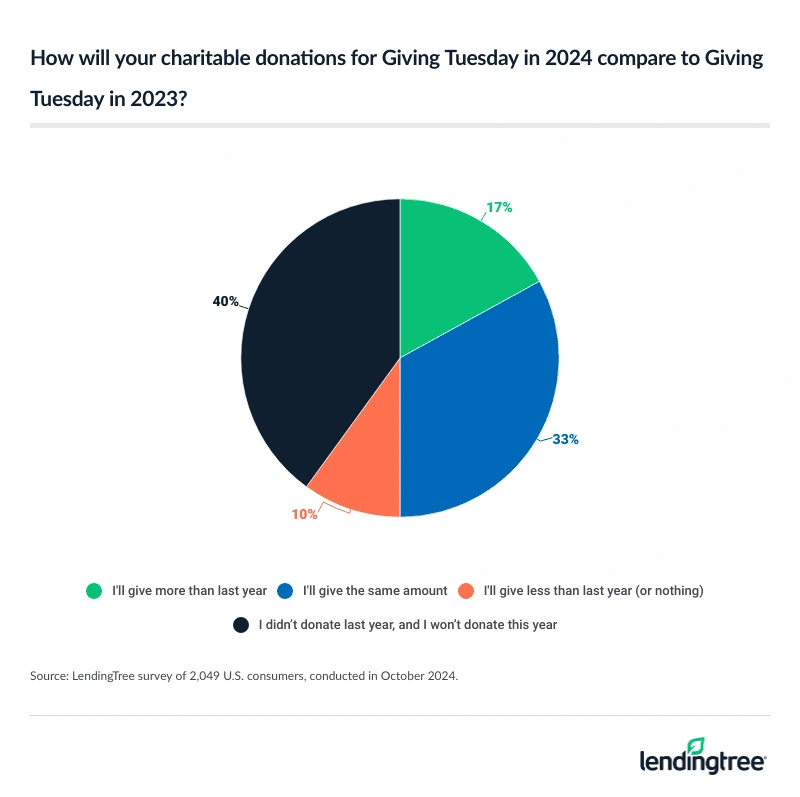

- The percentage of Americans planning to donate on Giving Tuesday has grown. 42% of Americans plan to donate to a charitable organization for Giving Tuesday (Dec. 3 in 2024) this year, up from 35% in 2021. A third (33%) plan to give the same amount as last year, while 10% will give less.

- Analyzing IRS data, a significant chunk of Americans report charitable contributions on their tax filings. 37.7% of American filers reported charitable contributions in the latest available tax year, at an average of $4,654.

- Wyoming residents make the highest average charitable contributions. The average in Wyoming among residents who filed returns with charitable contributions is $14,627, ahead of Arkansas ($12,934) and Utah ($8,080).

- New Jersey tax filers are the most likely to report charitable contributions. Nearly half (46.8%) did so in New Jersey, ahead of Connecticut (44.5%) and Maryland and the District of Columbia (tied at 44.3%).

Americans find it more difficult to donate

Charity may be integral to many Americans, but recent economic difficulties have made donating harder. In fact, 85% of Americans agree that inflation and the economy have made it more difficult to do so.

Gen Zers ages 18 to 27 are the most likely to agree at 88%. That’s followed by women (87%) and those who make $50,000 to $99,999 annually (87%). Meanwhile, six-figure earners (80.0%), Gen Xers ages 44 to 59 (83%) and men (83%) are the least likely to feel the pinch.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says Americans are understandably dealing with tighter budgets.

“High prices have shrunk people’s financial margin for error, forcing them to make difficult decisions around their spending,” he says. “Unfortunately, in many of those types of cases, charitable donations end up being one of the things that gets dropped first. It’s understandable, but it means that a lot of charities are going to fall well short of the donations they so desperately need this year.”

The majority of Americans have donated

Most Americans have donated at least once before. In fact, 72% have donated money to charity. That’s particularly true among high earners: While 86% of six-figure earners have donated, just 57% of those making less than $30,000 say similarly.

Baby boomers ages 60 to 78 (85%) and parents with children 18 or older (82%) are also among the most likely to have donated.

What drives charity? Of those who’ve donated, 67% say their main motivation was to help others. That’s followed by social or religious duties (17%) and because it makes donors feel good about themselves (9%). Notably, Gen Z donors are equally likely to say social or religious duties and because it makes them feel good, at 15% for both.

Schulz agrees that helping people is the biggest benefit for Americans, but there are also tax benefits.

“Whether you’re giving to disaster relief, medical research, a religious organization or any other group, your money can make a huge difference,” he says. “There can also be tax benefits. Generally, however, charitable donations can only be written off if you itemize deductions on your tax return. That was more common before the Tax Cuts and Jobs Act of 2017 dramatically increased the size of the standard deduction. Now, most Americans simply take the standard deduction on their tax return, leaving them less financial incentive to give to charity.”

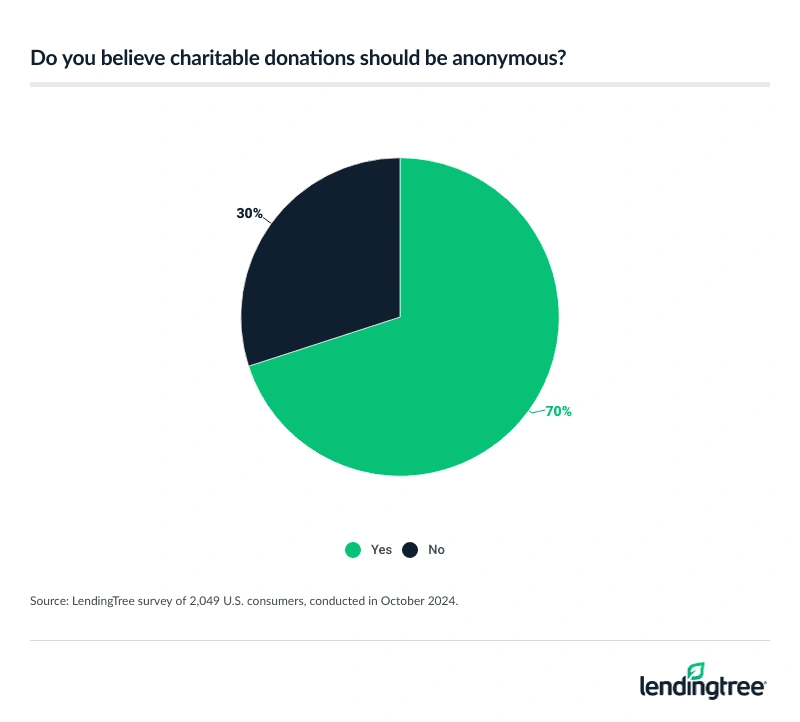

Whether that good feeling or the tax break is the main motivator, Americans aren’t inclined to brag about donating. Across all Americans, 70% say charitable donations should be anonymous, while 77% say they’ve never used social media to promote their charitable donation.

Still, those with children younger than 18 (37%) and six-figure earners (37%) are the most likely to have posted about donating on social media. By age group, millennials ages 28 to 43 (34%) and Gen Zers (32%) are more likely to have done so than Gen Xers (18%) and baby boomers (6%).

Over 2 in 5 plan to donate on Giving Tuesday

The economy may mean money’s tight, but the percentage of Americans planning to donate on Giving Tuesday has grown. This year, 42% of Americans plan to donate to a charitable organization for Dec. 3’s Giving Tuesday. That’s up from 35% in 2021.

As far as how much Americans are giving, 33% plan to give the same amount as last year. On the other hand, 17% will give more and 10% will give less.

Tax filers report donating an average of over $4,600

Turning to IRS data, we found that 37.7% of American filers reported charitable contributions in the latest available tax year — 2021. On average, those donating gave $4,654.

Average donations by reported income in tax year 2021

| Reported income | # of returns | # of returns with charitable donations | % of returns with charitable donations | Total amount donated | Avg. donation |

|---|---|---|---|---|---|

| All returns | 159.5 million | 60.1 million | 37.7% | $279.5 billion | $4,654 |

| Under $1 | 3.6 million | 550,910 | 15.3% | $187.5 million | $340 |

| $1 to $9,999 | 17.0 million | 2.4 million | 14.4% | $753.2 million | $308 |

| $10,000 to $24,999 | 28.5 million | 5.9 million | 20.7% | $2.5 billion | $430 |

| $25,000 to $49,999 | 37.5 million | 10.9 million | 29.0% | $7.8 billion | $717 |

| $50,000 to $74,999 | 22.7 million | 9.2 million | 40.5% | $10.5 billion | $1,138 |

| $75,000 to $99,999 | 14.6 million | 7.3 million | 50.0% | $11.3 billion | $1,540 |

| $100,000 to $199,999 | 24.0 million | 14.9 million | 62.0% | $37.3 billion | $2,500 |

| $200,000 to $499,999 | 9.0 million | 6.8 million | 75.1% | $39.1 billion | $5,776 |

| $500,000 to $999,999 | 1.6 million | 1.3 million | 82.2% | $21.0 billion | $15,740 |

| $1 million or more | 873,670 | 764,500 | 87.5% | $149.1 billion | $195,041 |

Notably, rich Americans do a lot of the heavy lifting when it comes to charitable contributions — both in the amount donated and the likelihood of donating. Americans with incomes of $1 million or more report an average of $195,041 in charitable contributions, with 87.5% of filers making contributions.

Wyoming residents make the highest donations, while New Jersey residents are most likely to donate

By state, Wyoming residents make the highest average charitable contributions. Here, the average charitable contribution among taxpayers who make one is $14,627.

Arkansas follows at $12,934 — the only other state with a five-digit average contribution. Utah ($8,080) rounds out the top three.

States with the highest average charitable contributions

| Rank | State | Amount of charitable contributions | Returns with charitable contributions | Avg. charitable contribution |

|---|---|---|---|---|

| 1 | Wyoming | $1.3 billion | 90,110 | $14,627 |

| 2 | Arkansas | $5.4 billion | 420,560 | $12,934 |

| 3 | Utah | $5.2 billion | 648,530 | $8,080 |

Conversely, residents in West Virginia ($2,029) report the smallest average contributions, followed by residents in Rhode Island ($2,191) and Hawaii ($2,367).

When it comes to the likelihood of donating, New Jersey tax filers are the most likely to report charitable contributions. In fact, 46.8% of New Jersey taxpayers donated. That’s followed by Connecticut (44.5%) and Maryland and the District of Columbia (tied at 44.3%).

States with the highest percentages of returns with charitable contributions

| Rank | State | Returns | Returns with charitable contributions | % of returns with charitable contributions |

|---|---|---|---|---|

| 1 | New Jersey | 4.6 million | 2.1 million | 46.8% |

| 2 | Connecticut | 1.8 million | 810,920 | 44.5% |

| 3 | Maryland | 3.1 million | 1.4 million | 44.3% |

| 3 | District of Columbia | 3,46,130 | 153,390 | 44.3% |

West Virginia again ranks last, with just 25.5% of tax filers here reporting a charitable contribution. That’s ahead of Alaska (30.5%) and New Mexico (31.2%).

Full rankings: States with the highest/lowest average charitable contributions

| Rank | State | Amount of charitable contributions | Returns with charitable contributions | Avg. charitable contribution |

|---|---|---|---|---|

| 1 | Wyoming | $1.3 billion | 90,110 | $14,627 |

| 2 | Arkansas | $5.4 billion | 420,560 | $12,934 |

| 3 | Utah | $5.2 billion | 648,530 | $8,080 |

| 4 | New York | $26.3 billion | 3.9 million | $6,690 |

| 5 | District of Columbia | $1.0 billion | 153,390 | $6,612 |

| 6 | Washington | $8.4 billion | 1.4 million | $6,078 |

| 7 | South Dakota | $949.9 million | 156,780 | $6,059 |

| 8 | California | $45.4 billion | 7.6 million | $5,992 |

| 9 | North Dakota | $712.1 million | 123,630 | $5,760 |

| 10 | Massachusetts | $8.9 billion | 1.6 million | $5,637 |

| 11 | Texas | $23.4 billion | 4.4 million | $5,284 |

| 12 | Maryland | $7.0 billion | 1.4 million | $5,213 |

| 13 | Georgia | $9.4 billion | 1.9 million | $4,991 |

| 14 | Nevada | $2.6 billion | 524,570 | $4,955 |

| 15 | Colorado | $5.5 billion | 1.1 million | $4,943 |

| 16 | Oregon | $3.6 billion | 735,350 | $4,892 |

| 17 | Florida | $18.8 billion | 3.8 million | $4,886 |

| 18 | Nebraska | $1.7 billion | 357,870 | $4,681 |

| 19 | Idaho | $1.5 billion | 334,100 | $4,520 |

| 20 | Virginia | $7.5 billion | 1.7 million | $4,510 |

| 21 | Connecticut | $3.5 billion | 810,920 | $4,343 |

| 22 | Illinois | $10.4 billion | 2.4 million | $4,325 |

| 23 | Kansas | $2.1 billion | 483,560 | $4,315 |

| 24 | Oklahoma | $2.4 billion | 567,880 | $4,275 |

| 25 | Tennessee | $4.8 billion | 1.1 million | $4,233 |

| 26 | Alabama | $3.6 billion | 873,870 | $4,072 |

| 27 | Montana | $809.1 million | 206,940 | $3,910 |

| 28 | South Carolina | $3.5 billion | 916,240 | $3,806 |

| 29 | Missouri | $3.8 billion | 1.0 million | $3,765 |

| 30 | Arizona | $4.5 billion | 1.2 million | $3,706 |

| 31 | North Carolina | $6.7 billion | 1.9 million | $3,573 |

| 32 | New Hampshire | $996.6 million | 279,390 | $3,567 |

| 33 | Indiana | $3.9 billion | 1.1 million | $3,533 |

| 34 | Vermont | $390.0 million | 114,450 | $3,408 |

| 35 | Minnesota | $3.9 billion | 1.2 million | $3,401 |

| 36 | New Jersey | $7.0 billion | 2.1 million | $3,284 |

| 37 | Mississippi | $1.4 billion | 439,710 | $3,137 |

| 38 | Louisiana | $2.1 billion | 689,430 | $3,011 |

| 39 | Pennsylvania | $7.2 billion | 2.5 million | $2,870 |

| 40 | Michigan | $5.1 billion | 1.8 million | $2,852 |

| 41 | Delaware | $555.8 million | 195,370 | $2,845 |

| 42 | Wisconsin | $3.1 billion | 1.1 million | $2,783 |

| 43 | Alaska | $291.4 million | 106,780 | $2,729 |

| 44 | Ohio | $5.4 billion | 2.0 million | $2,710 |

| 45 | New Mexico | $804.2 million | 306,350 | $2,625 |

| 46 | Iowa | $1.5 billion | 564,180 | $2,587 |

| 47 | Maine | $606.7 million | 239,290 | $2,535 |

| 48 | Kentucky | $1.8 billion | 713,540 | $2,505 |

| 49 | Hawaii | $664.4 million | 280,650 | $2,367 |

| 50 | Rhode Island | $500.5 million | 228,430 | $2,191 |

| 51 | West Virginia | $407.8 million | 201,010 | $2,029 |

Full rankings: States with the highest/lowest percentages of returns with charitable contributions

| Rank | State | Returns | Returns with charitable contributions | % of returns with charitable contributions |

|---|---|---|---|---|

| 1 | New Jersey | 4.6 million | 2.1 million | 46.8% |

| 2 | Connecticut | 1.8 million | 810,920 | 44.5% |

| 3 | Maryland | 3.1 million | 1.4 million | 44.3% |

| 3 | District of Columbia | 346,130 | 153,390 | 44.3% |

| 5 | Massachusetts | 3.6 million | 1.6 million | 44.2% |

| 6 | Utah | 1.5 million | 648,530 | 43.6% |

| 7 | Rhode Island | 561,060 | 228,430 | 40.7% |

| 7 | Minnesota | 2.8 million | 1.1 million | 40.7% |

| 9 | Hawaii | 693,580 | 280,650 | 40.5% |

| 10 | Alabama | 2.2 million | 873,870 | 40.4% |

| 11 | California | 18.8 million | 7.6 million | 40.3% |

| 12 | Virginia | 4.1 million | 1.7 million | 40.2% |

| 13 | New York | 9.8 million | 3.9 million | 40.0% |

| 14 | Pennsylvania | 6.4 million | 2.5 million | 39.4% |

| 15 | Illinois | 6.1 million | 2.4 million | 39.3% |

| 16 | Delaware | 498,460 | 195,370 | 39.2% |

| 17 | Idaho | 866,360 | 334,100 | 38.6% |

| 18 | New Hampshire | 729,290 | 279,390 | 38.3% |

| 18 | North Carolina | 4.9 million | 1.9 million | 38.3% |

| 18 | Wisconsin | 2.9 million | 1.1 million | 38.3% |

| 21 | Georgia | 4.9 million | 1.9 million | 38.2% |

| 21 | Nebraska | 937,380 | 357,870 | 38.2% |

| 23 | Iowa | 1.5 million | 564,180 | 37.9% |

| 24 | Montana | 547,070 | 206,940 | 37.8% |

| 25 | Colorado | 3.0 million | 1.1 million | 37.5% |

| 26 | South Carolina | 2.4 million | 916,240 | 37.4% |

| 27 | Michigan | 4.9 million | 1.8 million | 36.7% |

| 28 | Washington | 3.8 million | 1. 3 million | 36.6% |

| 29 | Oregon | 2.0 million | 735,350 | 35.9% |

| 29 | Arizona | 3.4 million | 1.2 million | 35.9% |

| 31 | Kentucky | 2.0 million | 713,540 | 35.7% |

| 32 | South Dakota | 442,300 | 156,780 | 35.4% |

| 32 | Florida | 10.8 million | 3.9 million | 35.4% |

| 34 | Kansas | 1.4 million | 483,560 | 35.3% |

| 35 | Tennessee | 3.2 million | 1.1 million | 35.1% |

| 36 | Missouri | 2.9 million | 1.0 million | 34.8% |

| 37 | Mississippi | 1.3 million | 439,710 | 34.6% |

| 38 | Louisiana | 2.0 million | 689,430 | 34.2% |

| 38 | Ohio | 5.8 million | 2.0 million | 34.2% |

| 40 | Vermont | 336,280 | 114,450 | 34.0% |

| 41 | Indiana | 3.3 million | 1.1 million | 33.9% |

| 42 | North Dakota | 367,690 | 123,630 | 33.6% |

| 42 | Nevada | 1.6 million | 524,570 | 33.6% |

| 44 | Maine | 717,300 | 239,290 | 33.4% |

| 45 | Oklahoma | 1.7 million | 567,880 | 33.0% |

| 46 | Texas | 13.5 million | 4.4 million | 32.8% |

| 47 | Arkansas | 1.3 million | 420,560 | 32.2% |

| 48 | Wyoming | 282,070 | 90,110 | 31.9% |

| 49 | New Mexico | 982,580 | 306,350 | 31.2% |

| 50 | Alaska | 349,810 | 106,780 | 30.5% |

| 51 | West Virginia | 788,160 | 201,010 | 25.5% |

Navigating Giving Tuesday amid the current economy: Top expert tips

If you’re feeling the giving spirit this year, but the economy is holding you back, you can do a few things to stretch your dollar. Particularly, Schulz recommends the following:

- When donating with a credit card, help cover the charity’s processing costs. “Credit cards certainly make it easier for people to give to their favorite charity, but it comes at a cost that can sometimes be 2% to 3% of the donated amount,” he says. “When soliciting donations online, many charities ask if you’d like to chip in a little extra to help cover that fee. When asked, you should say yes. It’s likely only a few dollars to you, but it can be huge to that charity.”

- Ask if your company matches charitable donations. “An estimated $4 billion to $7 billion in possible charitable donation matching funds go unclaimed every year,” Schulz says. “That’s a staggeringly huge number that could do an immense amount of good. One of the biggest reasons these funds go unused is that people don’t know they’re available. The next time you plan to donate, take the time to make a call or email your supervisor or your HR team and ask them if your company matches charitable donations. If they do, take advantage of it. If they don’t, ask why and make the case for starting a match.”

- Budget for it. “If you’re passionate about it and you spend a significant amount of money on it, you should budget for it,” he says. “Charitable donations are no exception. After all, as important as these donations are, you shouldn’t be donating yourself into debt. A thorough budget can help you avoid that.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from Oct. 1 to 3, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Additionally, LendingTree researchers analyzed IRS Statistics of Income (SOI) data to calculate the percentage of tax returns with charitable contributions and the average charitable contribution in tax year 2021 — the latest available.

Recommended Articles