65% of Single Daters Say Inflation Has Impacted Their Dating Life

Single Americans’ hearts and wallets are taking a hit.

According to the latest LendingTree survey of over 2,000 U.S. consumers, 65% of active daters say inflation has impacted their dating life — and debt is particularly common among certain demographics.

Here’s what else we found.

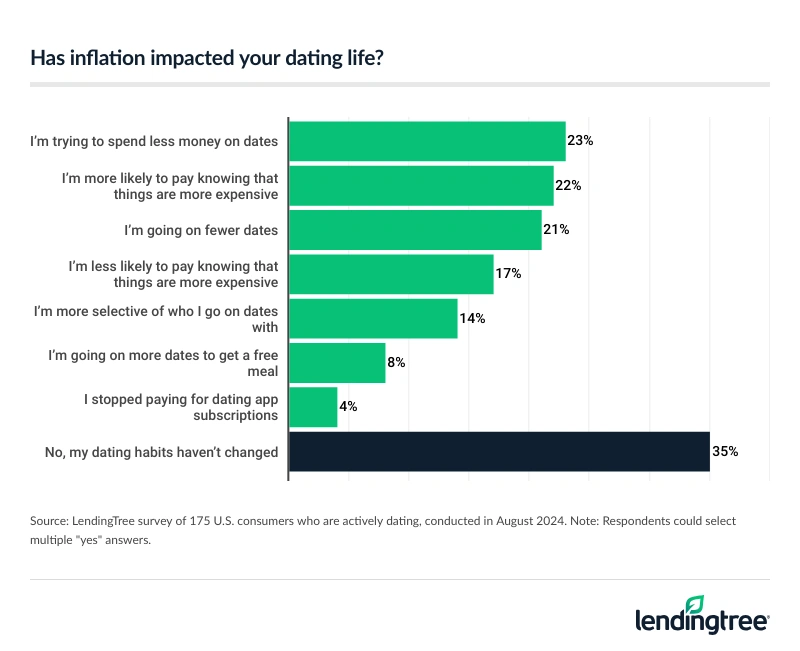

- Dating can be hard, especially when inflation is attracting high prices. Nearly half (49%) of surveyed Americans are single, but only 9% are actively seeking a relationship. Of those dating, 65% say inflation has impacted their dating life, with nearly 1 in 4 (23%) trying to spend less money on dates and 21% going on fewer dates.

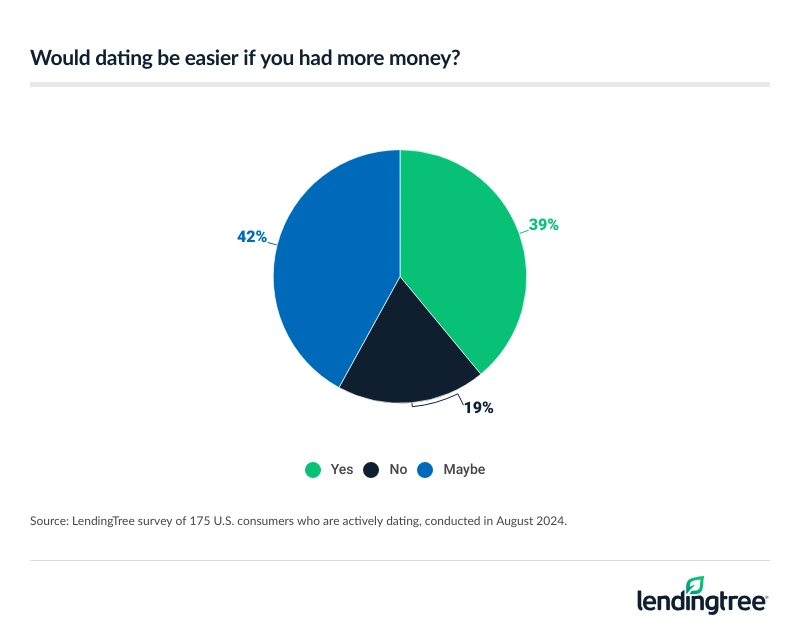

- Many agree more money would help their love life. 81% of Americans actively looking for love agree that dating might be easier if they had more money. Additionally, a third (33%) say they’d turn down a date they couldn’t afford even if they wanted to go. Some young Americans may have been willing to risk it, as over 1 in 4 (26%) Gen Zers have had their card declined on a first date.

- Love does cost a thing, and many daters are taking the risk. 14% of Americans have gone into debt due to dating, with men more than twice as likely to agree as women (21% versus 9%). However, the end justifies the means for many: 62% of those who went into debt said it was worth it, despite incurring $711 of debt on average.

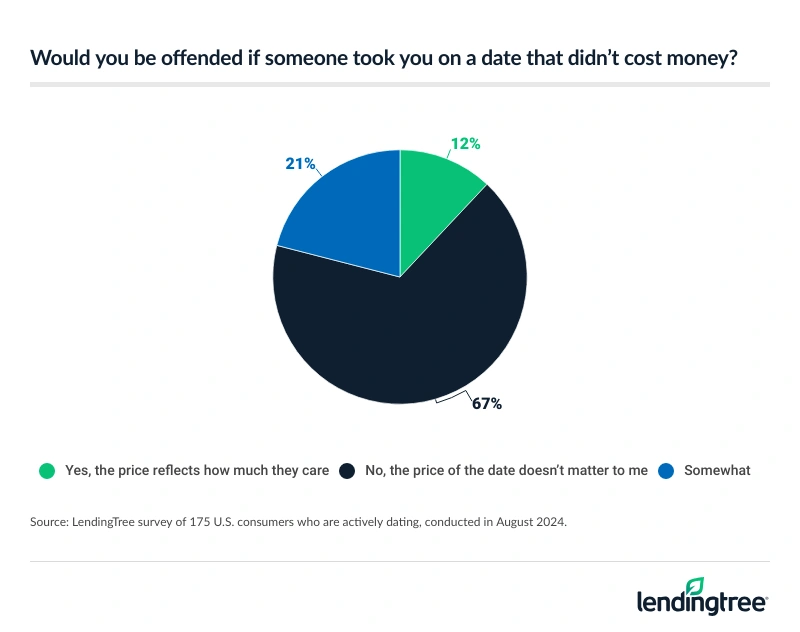

- Regarding the bill, many opt for tradition but don’t rule out free. 44% of Americans agree that the man should pay in a heterosexual relationship, while 25% think the person who asked out the other person should pay. However, 2 in 3 (67%) daters say they wouldn’t be offended if someone took them on a date that didn’t cost money.

Inflation and dating don’t get along

With prices still high, love and wallets are a match made in financial hell.

Despite 49% of surveyed Americans being single, only 9% are actively seeking a relationship. Why might that be? Money may be the root of the problem. Of those actively dating, 65% say inflation has impacted their dating life.

More specifically, 23% are trying to spend less money on dates and 21% are going on fewer dates.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” believes this trend will continue — at least for a while.

“If people are dating less, that has a massive impact on society,” he says. “It affects the economy if people are unwilling to spend. However, it can also lead to increased loneliness, which is already a major issue in our country, and can even lead to more people making bad decisions romantically. After all, you and that person you chose not to go out with because of the cost could have wound up being an amazing match.”

Also of note, 4% of daters have downgraded their apps from paid to free. This comes as 62% of single daters use related apps, with 46% using free versions and 16% utilizing at least one premium membership.

Dating apps may be successful, though, as 63% of those on them say they go on more dates and spend more money because of them.

Daters think money makes it easier

More money doesn’t always equal more problems. In fact, 81% of Americans actively dating agree it might be easier if they had more money, with 39% confidently agreeing.

Meanwhile, 33% of daters would turn down a date they couldn’t afford even if they wanted to go — but 36% admit they’d go even if they couldn’t pay for it. Across all Americans, 14% have had a card declined on a first date. That figure rises to 26% among Gen Zers ages 18 to 27.

According to Schulz, you shouldn’t have to limit yourself due to affordability.

“A date doesn’t have to involve a fancy dinner and a night out on the town,” he says. “Also, if you plan to date a lot, carving out space in your budget for dating costs makes all the sense in the world. That way, you can go into these dates more confident that they won’t send you spiraling into debt. Plus, if one of the dates is way more expensive than you expected, a budget allows you to shuffle around other costs to make up for it.”

What’s the most expensive relationship status? Overall, 45% believe being married would be the most expensive relationship status, followed by being single but going on dates (35%). Another 20% believe being in a relationship would be the most expensive relationship status.

Ultimately, it depends. Regarding first dates, 59% of actively dating Americans typically spend $50 to $199. Across actively dating Americans, those in relationships and married Americans, 45% spend a similar amount per month on dates.

In total, 49% of actively dating Americans, those in relationships and married Americans go on one to two dates a month.

Dating in debt is common

Given how Americans feel about the cost of dating, it may not be surprising that 14% of Americans have gone into debt due to dating. Notably, men (21%) are more than twice as likely to agree as women (9%). Meanwhile, those with children younger than 18 (25%), Gen Zers (23%) and millennials ages 28 to 43 (21%) are also among the most likely to agree.

Still, 62% of those who went into debt said it was worth it, despite landing themselves with $711 of debt on average. Men ($786) end up with the most debt on average.

“I think these numbers actually show remarkable restraint on the part of single Americans,” Schulz says. “Life is expensive in 2024. It would be relatively easy to take on a ton of debt in pursuit of your perfect match. The fact more people aren’t doing that bodes well for them financially, even if it may not be the best thing for their romantic lives.”

Who’s got the bill? Americans prefer tradition

The bill can be a delicate subject at the end of a first date, but many Americans believe in tradition. Across all Americans, 44% agree that the man should pay in a heterosexual relationship. That’s particularly true among six-figure earners (51%) and men (50%).

Still, a quarter (25%) think the person who asked out the other person should pay, with baby boomers ages 60 to 78 (33%) and women (30%) most likely to agree with this sentiment.

A bill doesn’t have to be involved, though, as 67% of active daters say they wouldn’t be offended if someone took them on a date that didn’t cost money.

Still, 12% of daters would take offense if someone took them on a date that didn’t cost money, and 21% would be somewhat offended.

Is that a red flag? It could be one to consider. In general, Schulz says to keep an eye on how a potential partner spends or views money.

“Great dates and great relationships are about compatibility, and one’s views and perspectives on money are part of that,” he says. “For example, if a man refuses to let a woman pay for anything, it may be a sign that he’s controlling. Also, if one partner is never OK with a date unless it involves spending a ton of money, it can be a sign that their money priorities are off. Of course, these actions don’t happen in a vacuum and should be viewed in the context of other interactions with the person. But if someone consistently does things you’re not comfortable with or shares basic financial views out of alignment with your own, that shouldn’t be overlooked.”

Love and other expenses: Top tips to avoid dating debt

When love is in the air, your credit card debt doesn’t have to soar alongside it. To help keep the spark alive without shouldering too many costs, Schulz recommends the following:

- Get your interest rates under control. “If you’re concerned about taking on credit card debt, perhaps the best thing you can do is make sure your interest rate is as low as possible,” he says. “Get a new credit card with a 0% introductory offer on new purchases. You can do that by shopping around at sites like LendingTree for the card with the lowest possible interest rate available to someone with your credit profile. You can even call your credit card issuer and ask it to lower the interest rate on your card. It works more often than you’d imagine.”

- Be planful. “Spontaneity is amazing and can often be when the magic happens on a date,” he says. “However, there’s a place for planning and thoughtfulness. If you think through what you’re going to do on a date, it can help keep costs down. For example, it can lead you to find cheaper parking than you might at the last minute or help you find an amazing restaurant with a happy hour menu you would’ve otherwise missed. These types of savings consistently over time can make a significant difference.”

- Communicate. “This doesn’t mean that you open your financial books on the first date or let financial issues dominate your conversation off the bat,” he says. “However, it does mean that if one person wants you to take them to the fanciest restaurant in town and you’re not comfortable with the price, you should feel free to say so. It can be tough to be that vulnerable with someone you like and want to impress, but if you push back and are given a hard time about it, you should be grateful. It’s better to know this about that person early and deal with it than to ignore it.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 78 from Aug. 1 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78