More Americans Want to Lose Debt Than Weight in 2025

From financial fitness to physical trimness, lightening the load is a common New Year’s resolution.

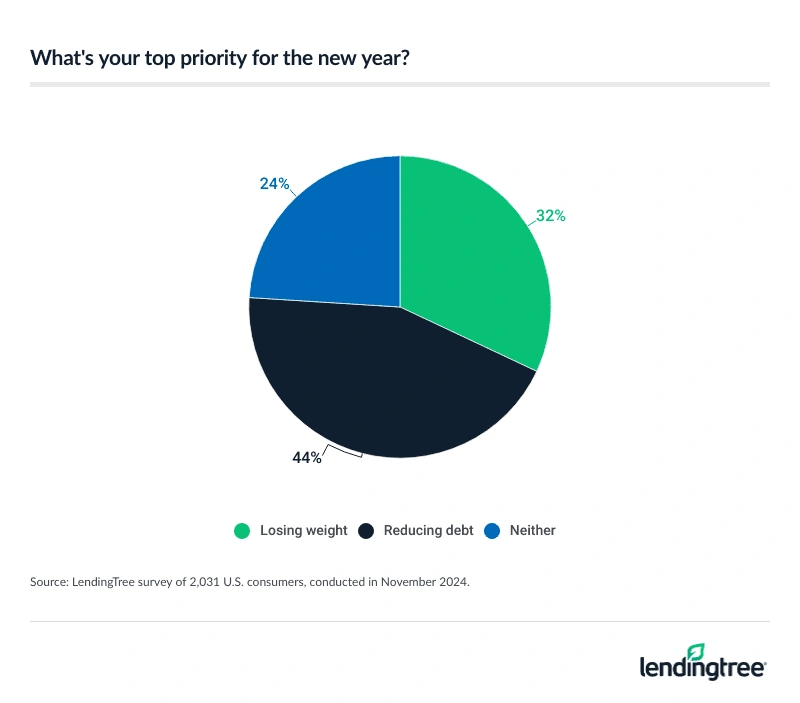

As for what Americans prefer, 44% say their top priority for the new year is reducing debt, according to the latest LendingTree survey of 2,031 consumers.

Here’s what else we found.

- 2025 rang in a new year of goals, and the desire to shed debt is top of mind for many. 44% of Americans say their top priority for the new year is reducing debt. In fact, 84% agree that slashing their debt would make life less stressful. But when asked how long they think it’ll take to hit their debt goal, 40% prioritizing this said over a year.

- Losing weight is hard, but younger Americans are willing to go into debt to make it happen. Almost 1 in 3 (32%) consumers say their top priority for 2025 is to lose weight. Among those prioritizing losing weight, 33% say they would pay for weight-loss drugs like Ozempic or Mounjaro even if it puts them into debt, led generationally by 47% of millennials.

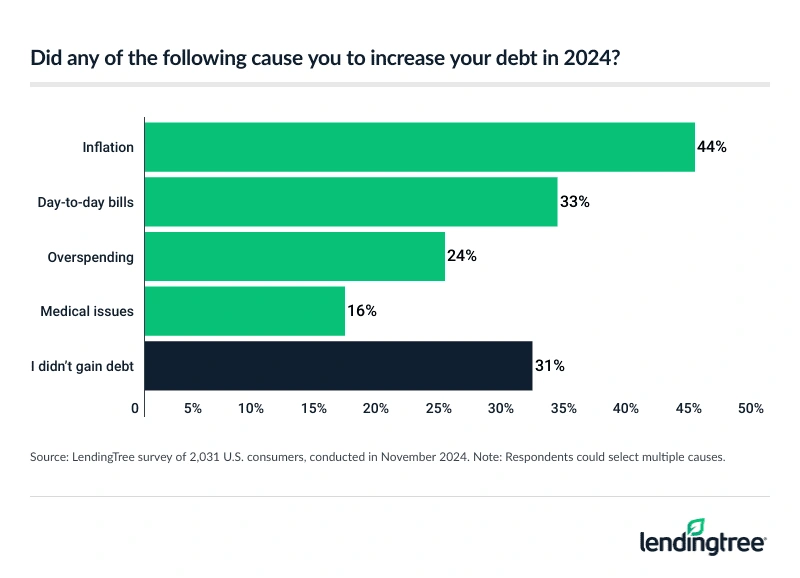

- Life is getting more expensive, and it’s causing more debt. Inflation is to blame for an increase in 2024 debt for 44% of Americans, ahead of day-to-day bills (33%) and overspending (24%). Most Americans agree that losing debt is more stressful and harder than losing weight.

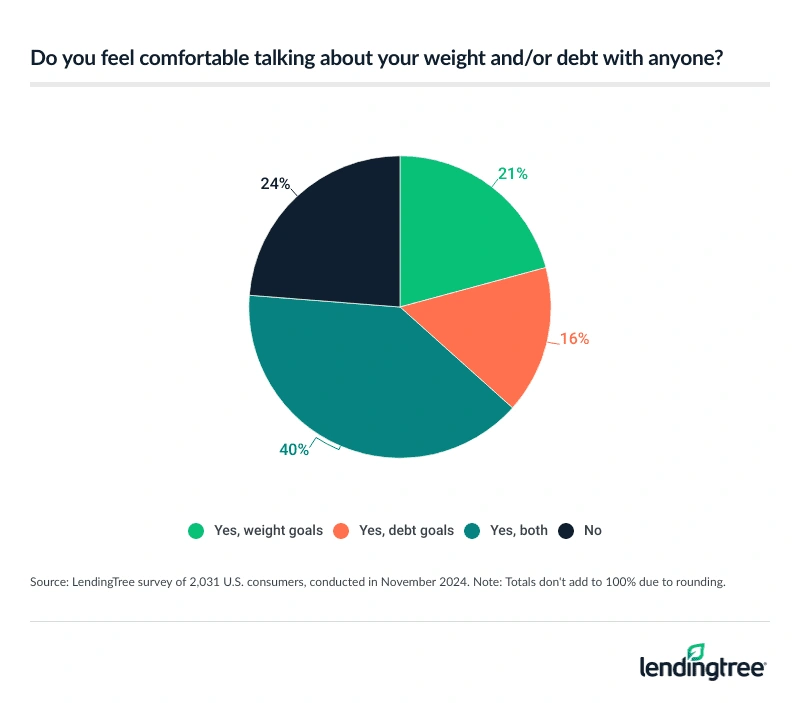

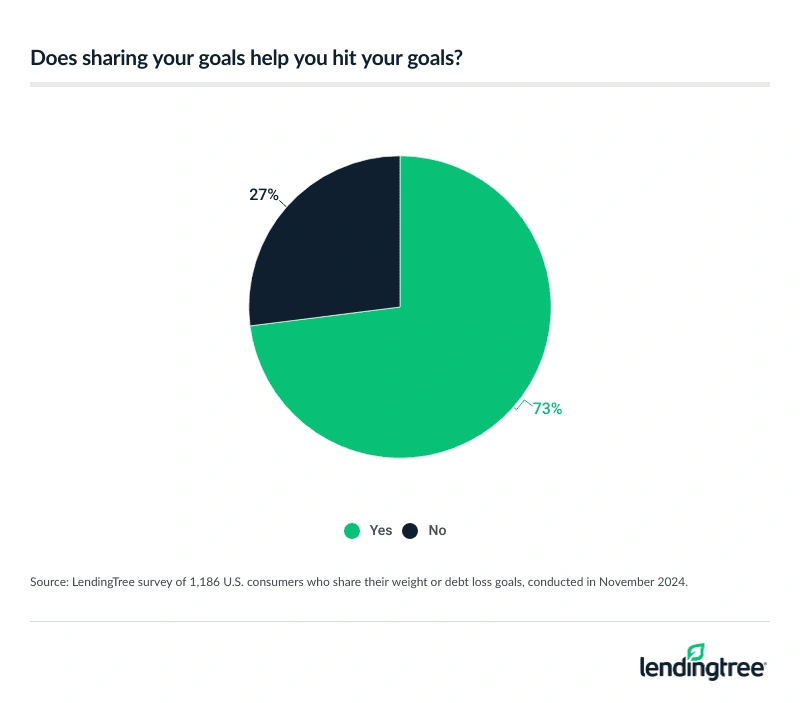

- Not everyone feels comfortable sharing their self-improvement goals. Almost a quarter (24%) of Americans say they don’t feel comfortable sharing their weight or debt with anyone. Additionally, 42% say shame about their weight and/or debt has prevented them from seeking help to reduce their burden. However, 73% who share their goals say it helps them hit them.

Scaling back or scaling down? Consumers prefer cutting debt

The new year brought new goals. For the majority, slashing debt is the top priority. When asked if their top priority in 2025 is losing weight, losing debt or neither, 44% of Americans said losing debt. That’s led by those with children younger than 18 (50%) and those earning $50,000 to $99,999 a year (49%).

By age group, millennials ages 28 to 43 and Gen Xers ages 44 to 59 are the most likely to prioritize debt, at 46% for both.

Across all Americans, 84% agree that slashing their debt would make life less stressful. However, those prioritizing debt have a long way to go. Among these Americans, 40% think reaching their goal will take over a year. Another 29% believe reaching their goal will take six months to a year.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says those can be reasonable time frames.

“It largely depends on your particular financial situation,” he says. “However, it’s important for people to understand that sometimes paying down debt is a marathon rather than a sprint and that setting goals that are too high and unreachable can be demotivating. That doesn’t mean you shouldn’t take big swings, of course. It’s like that old cliche: If you shoot for the stars and land on the moon, you’ve still accomplished a lot.”

Millennials and six-figure earners hoping to slash debt are the most ambitious, with 33% of millennials and 32% of six-figure earners believing they can reach their goal in one to six months. That compares with 27% of all Americans prioritizing debt reduction.

When asked whether debt loss or weight loss will bring them more value in 2025, 54% of Americans cited losing debt.

Young Americans want to lose weight — even at a cost

Young consumers wouldn’t mind a slimmer wallet if it meant a slimmer waist, too. Across all Americans, 32% are prioritizing losing weight in 2025.

Those prioritizing weight loss will go to great financial lengths to do so. In fact, 33% of those prioritizing weight loss would pay for weight-loss drugs like Ozempic or Mounjaro — even if it puts them into debt. That’s particularly true for those with children younger than 18 (54%). By generation, millennials (47%) are the most likely to share this sentiment.

Notably, men prioritizing weight loss (41%) are significantly more likely to be willing to go into debt for weight-loss drugs than women (26%).

Drugs like Ozempic and Mounjaro are GLP-1s — and they’re not cheap. According to the KFF Health System Tracker, prices for these types of drugs range between $936 and $1,349 a month before insurance. That cost is certainly a burden. According to a KFF survey, 54% of those who’ve taken a GLP-1 before say it was at least somewhat difficult to afford these medications.

While those costs may be prohibitive, Schulz says it’s not unreasonable to go into debt for weight loss, so long as you know you can pay it back.

“I’m a believer in good debt, which is debt that brings a positive return on investment,” he says. “Given the massive positive impact that weight loss can have on various aspects of your life, there’s an argument to be made that going into debt in pursuit of weight loss could be good debt. The big caveat to that, of course, is that it has to be done in moderation. Taking on a little bit of debt for a few months in your weight-loss journey is one thing. Taking on potentially debilitating levels of debt over the long term is something else entirely. That type of debt can put you behind in the pursuit of other important goals, such as building an emergency fund or saving for retirement or a mortgage down payment.”

Regardless of whether they prioritize it, 64% of Americans agree that losing weight would make their life less stressful in the new year, led by those with children younger than 18 (72%) and Gen Zers ages 18 to 27 (72%).

As far as how long it would take, weight loss is generally more quickly attainable than debt loss. Of those prioritizing losing weight, 43% think it’ll take between one and six months, while 35% think it’ll take between six months and a year.

Overall, 27% of Americans think losing weight will bring them more value than losing debt in 2025. This comes as 38% of consumers say stress caused them to gain weight in 2024, followed by a lack of exercise (37%) and overeating (28%). Meanwhile, 34% say they didn’t gain any weight.

Inflation was the leading cause of debt in 2024

One reason Americans may prioritize debt over weight loss is that life is more expensive. Across all Americans, 44% say inflation led to increased debt in 2024, followed by day-to-day bills (33%) and overspending (24%).

Just 31% say their debt didn’t increase.

Schulz says it’s understandable that inflation has had an oversized impact on people’s finances.

“Even though price growth has slowed, prices are still crazy-high, and I don’t think there’s much reason to believe that things will change significantly for the better in 2025,” he says. “With all the potential factors to influence the economy in 2025, it would be foolish or deceptive to say we know what the coming year will look like. However, the wise financial move for Americans would be to plan for the worst when it comes to inflation and interest rates, while hoping for the best.”

Debt is particularly tough to shake. In fact, 68% think it’s more stressful and 53% think it’s harder than losing weight. To add insult to injury, 43% of Americans think debt is the more out-of-control stressor in their life.

Americans who share their weight or debt goals are more likely to reach them

While talking about debt and weight may be a source of shame for some, sharing their goals motivates many. Across all Americans, 24% don’t feel comfortable sharing their weight or debt with anyone. On the other hand, 40% feel comfortable sharing both. Between the two, Americans feel slightly more comfortable talking about weight (21%) than debt (16%).

Meanwhile, 42% say shame about their weight and/or debt has prevented them from seeking help to reduce their burden. That’s especially true among Gen Zers (61%). That being said, sharing these goals has benefits. In fact, 73% who share their goals say it’s helped them to hit them.

That’s especially true among those with children younger than 18 (81%). By generation, that figure is highest among Gen Zers (80%).

New year, new you: Top tips for meeting finance goals

If you’re trying to shed some weight or debt this new year, Schulz recommends the following:

- Don’t beat yourself up. “Whether you’re trying to lose weight or debt, the road is going to be bumpy,” he says. “You’ll make mistakes. You’ll spend too much one day or eat too much on another, but it’s important to understand that those setbacks are temporary. What matters most is that you’re continuing to make progress toward your goal and you don’t let a slipup or two derail your plans.”

- Debt consolidation can be a superpower. “A 0% balance transfer credit card or a low-interest personal loan can be rocket fuel for your debt paydown efforts,” Schulz says. “They can dramatically reduce the amount of interest you pay over the life of debt and the time it takes to pay off the debt. You’ll likely need good credit to get a 0% card, but either of these options can work for you. What won’t work is simply burying your head in the sand and trying to wish your problem away.”

- Maximize your rewards. When utilized well, credit card rewards can stretch a budget. For example, credit cards with grocery store rewards can help stretch food budgets for both debt-shedders and pound-shedders, particularly if you’re looking to incorporate more health-conscious (and often more expensive) food.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,031 U.S. consumers ages 18 to 78 from Nov. 19 to 21, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78