Half of Credit Cardholders Have Disputed a Claim — 96% of Whom Were Successful

Finding an unfamiliar charge on your credit card can be stressful, but disputes are often easy and simple.

In fact, 96% of credit cardholders who’ve filed a dispute had a successful resolution the most recent time, according to the latest LendingTree survey of nearly 2,000 U.S. consumers.

Here’s a look at the types of disputes consumers file, resolution timelines and more.

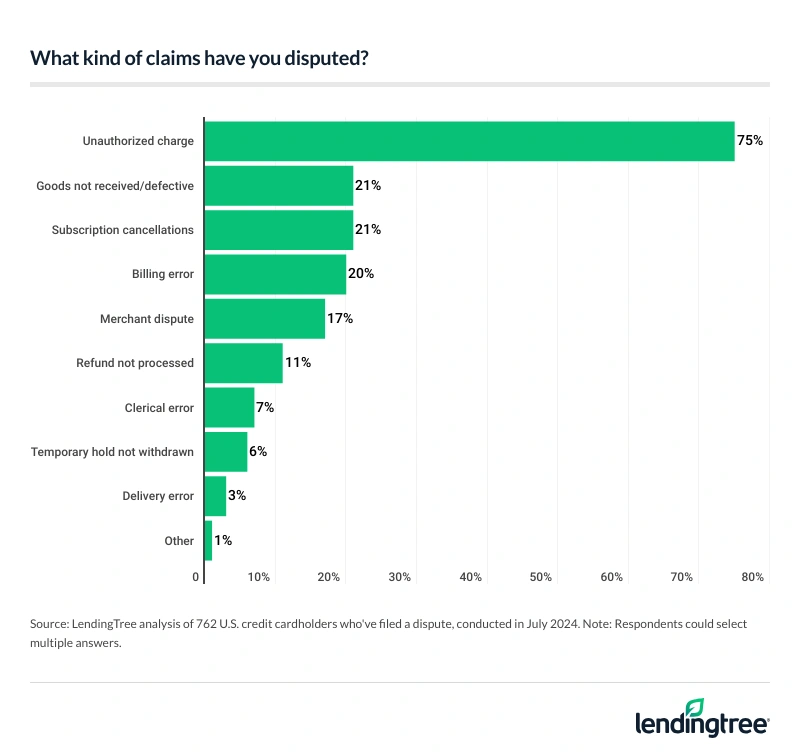

- It pays to speak up on credit card disputes. Half (50%) of American credit cardholders say they’ve disputed a claim — 96% of whom were successful in getting a resolution the most recent time. The top reasons for claims are unauthorized charges (75%), goods not received or defective (21%) and subscription cancellations (21%).

- However, some disputers are committing fraud. 17% of cardholders who’ve disputed a transaction admit they put in a fraudulent claim for a legitimate charge. Men are four times more likely to do this than women — 28% versus 7%. Younger generations are also more likely to admit doing so, with 29% of millennials committing fraud via disputes, versus 7% of Gen Xers and 2% of baby boomers.

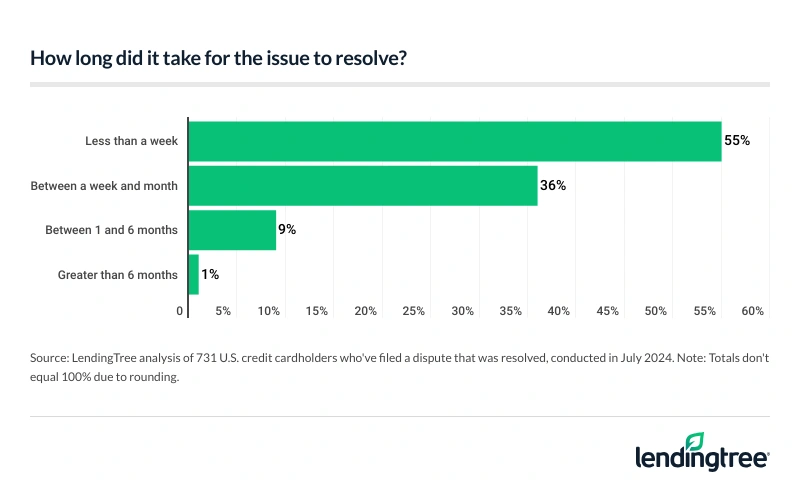

- Filing claims might be extra work, but the majority think it’s worth it. Among those who’ve successfully disputed a claim, 91% say it was resolved within a month and 98% feel filing was worth it. Across all disputers (regardless of outcome), 62% initiated their claim over the phone, while 36% filed online and 2% filed in person.

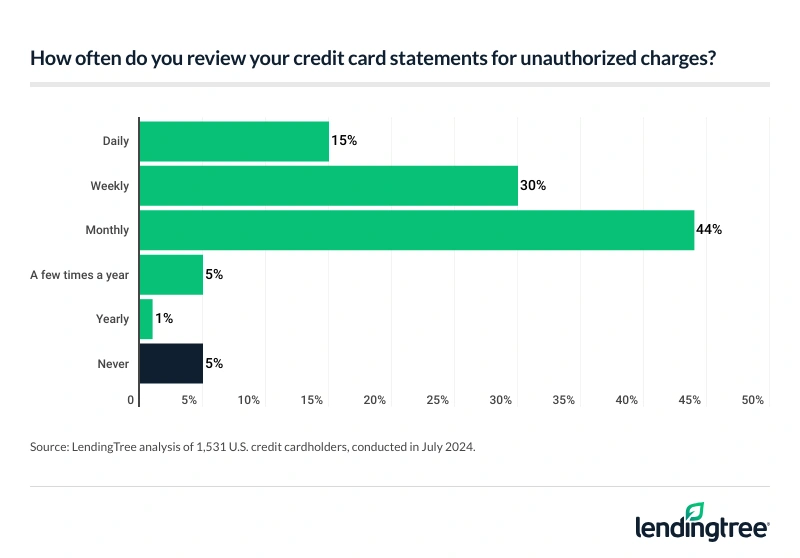

- Ignorance isn’t always bliss. 44% of cardholders say they review their credit card statements for unauthorized charges monthly, while 30% check weekly and 15% check daily. Additionally, 4 in 5 (80%) signed up for notifications for credit card transactions.

Americans successfully dispute credit card charges

In an era of data leaks, card skimmers and more, it’s not abnormal for a bad actor to find and use your credit card information. In fact, 50% of American credit cardholders have disputed a claim.

It may not be surprising that the younger generations are the least likely to have done so due to their ages, with just 38% of Gen Zers ages 18 to 27 having filed a claim. That compares with:

- 46% of millennials ages 28 to 43

- 50% of Gen Xers ages 44 to 59

- 60% of baby boomers ages 60 to 78

High earners are also more likely to dispute claims than low earners, at 61% among six-figure earners, versus 43% among those earning less than $30,000.

Of those who’ve disputed a claim, 96% were given a successful resolution the last time they tried. As for why they disputed a claim, 75% had an unauthorized charge, 21% didn’t receive the goods they paid for or they were defective, and 21% challenged a subscription charge.

Separately, 18% of those who’ve filed a claim have done so for a subscription service because it was otherwise difficult to cancel. That figure rises to 29% among men, versus 8% of women.

According to Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” it’s gotten easier to file a card dispute over the years.

“Credit card issuers have gotten a lot smarter at determining what’s legitimate and what isn’t,” he says. “In many cases, they have so much data on people and businesses that they can spot fraudulent activity before we know it happened. That knowledge has likely also made it easier for card issuers to see which dispute claims are legitimate and which aren’t. That doesn’t mean they’re perfect, but the process has streamlined.”

If filing a credit card dispute is so easy, why can’t the same be said for debit card disputes? “The big difference between disputing a claim on a credit card is that your money hasn’t moved yet,” Schulz says. “With a debit card dispute, you’re dealing with real money that has left your checking or savings account. With a credit card, it’s a charge that can be waived.”

Of the cardholders who’ve never filed a dispute, 91% say they’ve never had an instance to do it, followed by 7% deeming it not worth it. Meanwhile, a whopping 26% of those who’ve never disputed a claim say they don’t know how.

Some intentionally file false claims

Like everything, the dispute system can be abused. Nearly 1 in 5 (17%) cardholders who’ve disputed a transaction admit they’ve purposefully lied about a claim they initiated. Men (28%) are four times more likely to do this than women (7%).

Meanwhile, a whopping 29% of millennial disputers admit to committing fraud via disputes, while just 7% of Gen Xers and 2% of baby boomers say similarly. Additionally, six-figure earners (20%) are the most likely income group to commit this fraud, while those earning between $50,000 and $99,999 (15%) are the least likely.

Schulz says the consequences of committing dispute fraud can be significant. “Intentionally filing a false dispute is a big deal,” he says. “It can lead to you being blacklisted by a merchant, having your card account closed or worse. You could even potentially have legal action taken against you, leading to fines and imprisonment. It goes without saying that it’s something you shouldn’t do.”

Majority of claims resolved quickly

Filing may take some time and effort, but doing so is worth it. Of those who’ve successfully disputed a claim, just over 9 in 10 (91%) had a resolution within a month.

According to the Consumer Financial Protection Bureau (CFPB), a credit card issuer must acknowledge your dispute within 30 days and then complete its investigation within two complete billing cycles. That adds up to about 90 days.

A lot goes into that investigation. “During that time, the issuer is investigating the dispute to determine its legitimacy,” Schulz says. “They may review any documentation you’ve provided, as well as any evidence from the merchant and anything else germane to the case. That way, they can determine the proper course of action.”

Overall, 98% of successful disputers say filing was worth it.

Regardless of whether their resolution was successful, 62% of disputers initiated their claim over the phone — the most common response. Meanwhile, 36% filed online and 2% filed in person.

Cardholders regularly review charges

With disputes in mind, the majority of cardholders regularly review their billing statements for accuracy. In fact, 44% review their credit card statements for unauthorized charges monthly, while 30% check weekly and 15% check daily.

Ideally, you should check credit card statements online at least weekly, Schulz says.

“Through issuer apps and websites, it’s never been easier to keep an eye on what’s going on with your account, so there’s no excuse for not checking on these things regularly,” he says. “It may seem like a lot of work, but the more often you check, the easier it gets. If you only do it once a month, for example, you’ll need to review many more charges than if you did it weekly, making it more likely that you might miss something.”

As an additional security measure, 80% have signed up for notifications for credit card transactions.

Freezing a card altogether is another method, and 20% of cardholders currently have at least one card frozen or locked. That rises to 38% among Gen Z cardholders. Meanwhile, 33% of cardholders have previously frozen or locked a card.

Fighting fraudulent charges: Top expert tips

It may feel intimidating to fight a charge, but there are a few ways to make the process a little easier. Particularly, Schulz recommends:

- Document everything. “When disputing a charge, make sure to have as much documentation as you can,” he says. “Receipts, account numbers and other financial information are important, but so is making notes of who you speak to with the card issuer or merchant, when you spoke with them and what was said. It doesn’t mean you need to write down every word like a court reporter, but keeping good notes of your interactions with all parties involved can help you when questions arise.”

- Speak to the merchant first. “In many cases, disputing a charge with your card issuer shouldn’t be the first step,” Schulz says. “Your first move should be to address the issue with the merchant. Often, these issues can be resolved without a ton of difficulty, and without needing to drag the card issuer into it. However, if you’ve attempted to resolve the issue with the merchant and keep running into brick walls, going to the card issuer can help.”

- To protect yourself from fraudulent charges, one of the best things you can do is to trust your gut. “If something about a brick-and-mortar store or a website seems a little off to you, take your business elsewhere,” he says. “If the card slot at the gas pump or the ATM moves when you wiggle it, walk away. If you see a very small charge on your card account that you’re certain you didn’t make, report it. People have pretty strong danger detectors, but we often don’t trust them enough, and they can get us in trouble.”

- Protect your card information like it’s gold. “That’s what it is to bad guys,” Schulz says. “Don’t give your card information to just anyone, and enter your card data every time you shop online rather than having a website save it. These little moves can help.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,991 U.S. consumers ages 18 to 78 from July 1 to 8, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78