$1,000 Annual Fee? Millions of Credit Cardholders — Led by Gen Zers — Would Consider It

Millions of credit cardholders would consider paying an annual fee of $1,000 or more for a card, according to a new report from LendingTree. However, nearly half of cardholders say they wouldn’t pay a penny.

Our report comes amid a time of extremes in the credit card space. There’s more than $1 trillion in card debt. Credit card interest rates are the highest in decades, maybe ever. Credit scores are at or near record highs, while credit card issuers are stingier with their lending than in past years. We might have more cards than ever offering 2% cash back or more.

Consider annual fees. While there have long been exclusive, invitation-only credit cards with annual fees in the thousands of dollars, those have generally been kept separate from the mainstream business. For example, you weren’t going to come to LendingTree or visit a major credit card issuer’s website and find those cards advertised alongside typical offerings.

That’s changing, though. Now a card with a $695 annual fee is advertised prominently on the primary website of one of the biggest card issuers. Other major issuers have prominent cards with annual fees of $500 or more being pitched to the public — not by invitation only. Seeing that, a mass-market credit card with a $1,000 fee hardly seems out of the question.

With that in mind, our survey asked people their views on these and other credit card extremes. Here’s what we found.

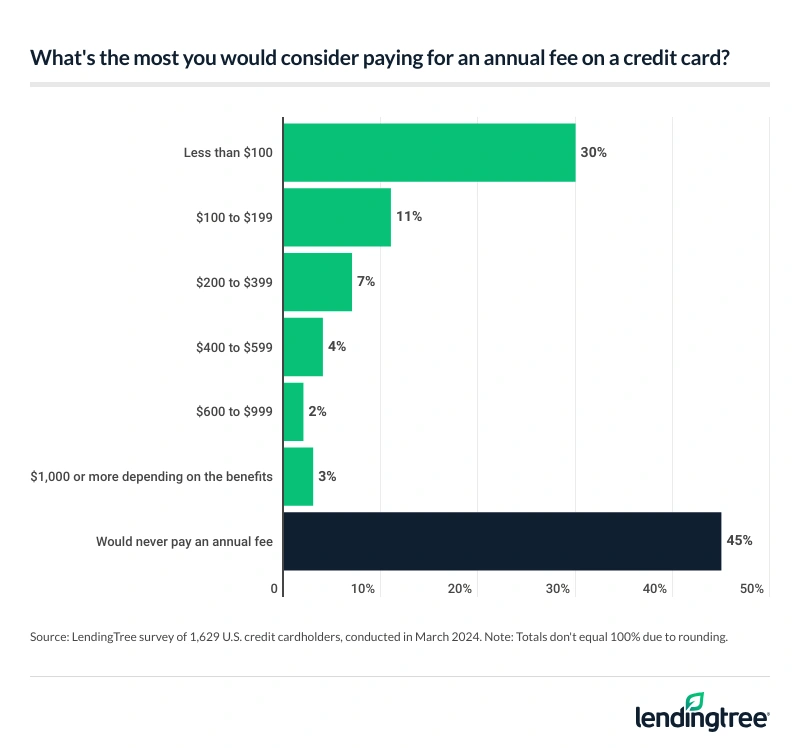

- 6 million U.S. cardholders would consider a $1,000 annual fee credit card, but most would prefer to skip annual fees altogether. 3% of all cardholders — including 6% of Gen Z cardholders — would consider dropping $1,000 or more on an annual fee depending on the card’s benefits. However, nearly half (45%) of all cardholders say they would never pay an annual fee. Another 30% say they would only pay a fee of less than $100.

- More than half of those who’ve had a card with an annual fee say the highest fee they’ve paid was worth it, with Gen Zers and millennials most likely to agree. Among those who’ve had an annual fee card, 56% say the highest annual fee they’ve paid was worth it to receive the perks. Still, 44% say it wasn’t, meaning millions of Americans were left with borrower’s remorse. Gen Zers and millennials are about twice as likely to say their highest fee card was worth it than not, while more Gen Xers and baby boomers say it’s not worth it.

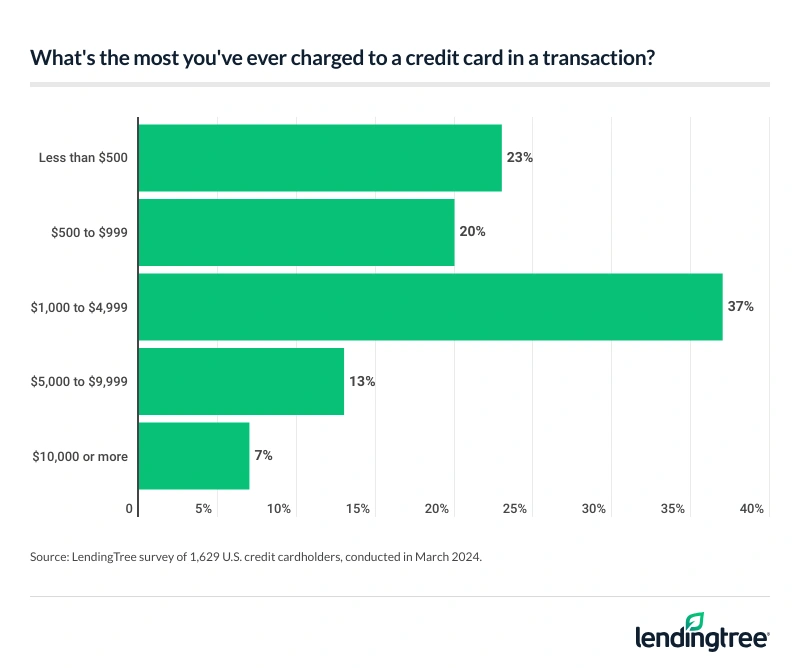

- $10,000 or more on a single credit card purchase? 7% of cardholders say yes. While 43% of credit cardholders have never charged $1,000 or more in a single transaction, 7% have made a purchase of $10,000 or more using a credit card. That includes 17% of those making $100,000 or more a year and 11% of baby boomers.

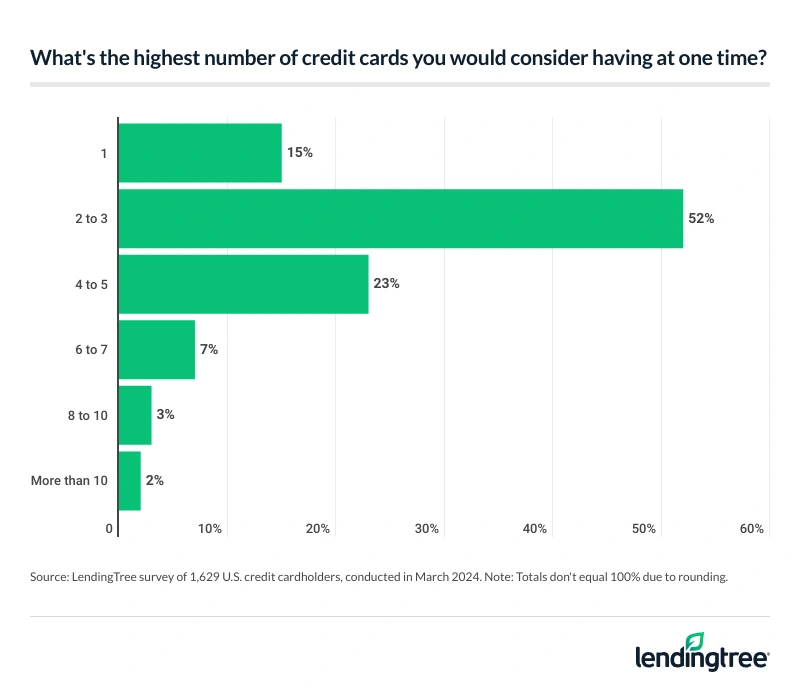

- Millions of cardholders would consider having eight or more credit cards at once, but two-thirds would consider no more than three. 4% of cardholders say they’d consider having eight or more cards. The most likely: Those making $100,000 or more a year (7%).

- Certain credit cards are perceived as a marker of success, especially among men and Gen Zers. 38% of cardholders consider certain types or brands of credit cards a status symbol, with 58% of Gen Zers agreeing. Additionally, 31% of men say they’ve applied for a certain credit card to impress other people — more than twice the percentage of women (13%). Among cardholders who’ve applied for a card to impress, 27% had their application rejected.

High annual fees OK for some, but nearly half avoid fees altogether

Annual fees are a constant source of debate in the credit card space. Some are dead set against them in all cases, while some don’t mind them as long as the card delivers good value. However, there are limits on how high they’d be willing to go. For 3 in 4 cardholders, the limit is less than $100.

One in 12 cardholders (8%) say they’d be willing to pay $400 or more in annual fees, including 3% who would consider paying $1,000 or more. While no demographic reaches the double digits for being willing to pay $1,000 or more, some groups are more open to the idea: Gen Zers ages 18 to 27 (6%), those earning $100,000 or more a year in household income (5%), and men and parents of children younger than 18 (both at 4%).

On the flip side, baby boomers ages 60 to 78 (69%), parents with older children (63%), those making less than $30,000 a year (56%) and women (52%) are the most likely to say they’d never pay an annual fee.

More than half say their highest annual fee card’s perks were worth it

There’s no one-size-fits-all answer for whether a card delivers enough value to be worth the expense. Depending on your goals, spending habits and other factors, the answer can be an emphatic yes, a resounding no or something in between.

Our survey leaves no doubt that borrower regret is a real and common thing. While 56% of those who’ve had an annual fee card say the benefits of their highest annual fee credit card were worth the cost, 44% say they weren’t. That leaves a whole lot of unhappy cardholders.

A distinct generation gap exists here. Most Gen Zers (69%) and millennials ages 28 to 43 (66%) who’ve had annual fee cards say their perks have been worth it. That compares with 48% of Gen Xers ages 44 to 59 and 43% of baby boomers.

A gender gap is at play here, too. Women are fairly evenly split on whether the high annual fee was worth it (53% say yes, while 47% say no). Among men, 59% say the fee was worth it, versus 41% who say it wasn’t.

$10,000 on a single credit card purchase? Some say yes

Big annual fees aren’t the only extreme numbers associated with credit cards. We also asked cardholders to tell us the most they’ve ever charged to a credit card in one transaction. About a quarter of cardholders (23%) say they’ve never spent $500 or more on a single credit card purchase, while another 20% say they’ve spent $5,000 or more in a single transaction. That includes 7% who say they’ve reached $10,000 (or more) at one time.

Older and higher-income Americans, not surprisingly, are the most likely to have dropped $10,000 on one credit card transaction. One in 6 (17%) of those making $100,000 or more a year have done so, as have 1 in 9 (11%) baby boomers.

We also saw a significant gender gap in big purchases. Almost 1 in 4 men (23%) say they’ve spent at least $5,000 on a single credit card transaction, including 9% who say they’ve spent $10,000 or more. Just 18% of women say they’ve spent $5,000 or more, with only 6% saying they’ve spent $10,000 or more.

Most cardholders say 3 or fewer cards is just right

We also asked people what they thought was too extreme when it came to the number of cards they held at one time. As with everything else in this report, we saw many opinions.

Just over half of cardholders (52%) say two to three cards is the most they’d consider at one time. Another 15% say one is the most they’d consider. However, 4% of cardholders say they’d consider having eight or more credit cards at one time, including 2% who would consider having more than 10.

A deeper dive into the numbers shows very little difference among various demographics when it comes to being willing to consider eight or more cards. By age, gender, household income and parenting status, the numbers are very similar. The one exception: 7% of those making $100,000 or more a year say they’d consider having that many cards.

On the other end of the spectrum, younger and lower-income cardholders are the most likely to say they wouldn’t consider more than one card at a time. A quarter of Gen Z cardholders (25%) and 27% of those making less than $30,000 a year say so.

Many see cards as status symbols

Different people can view credit cards quite differently. For some, they’re just a financial tool, a means to an end. For others, they’re the key to unlocking a dream vacation. For some, they’re a necessary evil they wish they didn’t need to lean on as much as they do. For many others, however, they’re something more — a status symbol.

That’s especially true among Gen Zers and men. Nearly 6 in 10 Gen Z cardholders (58%) and 45% of men say they consider certain brands or types of credit cards to be a status symbol. Nearly 4 in 10 cardholders overall (38%) say so.

We even found that many cardholders have applied for a specific brand or type of card to impress someone. More than 1 in 5 cardholders (21%) say so. Men are more than twice as likely as women to say they’ve done it (31% of men versus 13% of women), and 39% of parents with young kids have done so.

However, as we all know, sometimes the best-laid plans go astray. More than a quarter (27%) of those who say they applied for a card to impress had their application rejected.

(Note: We didn’t ask which specific brands or types of cards were considered status symbols.)

The big takeaway: Know thyself

If there’s one thing that’s clear from this report, it’s this: What is extreme to one person when it comes to credit cards might not be to someone else. What matters most is figuring out where your comfort zone lies and how willing you are to push those boundaries — and then managing yourself accordingly.

Here are a few tips for doing that.

- Think about your why: Why do you want that $700 annual fee credit card? Why do you need to spend $5,000 on this one credit card purchase? Why do you need that eighth credit card? If your best answer is “to impress the person in the cubicle next to me” or “to keep up with the Joneses,” it probably makes sense to reconsider.

- Follow the 24-hour rule: We’ve all been impulse shoppers. One of the best ways to fight those urges is with this rule. The idea is that if you think you want something, walk away and give yourself 24 hours. If you still want it in 24 hours — and it fits your budget and isn’t problematic in other ways — it’s probably OK to buy. But if you’re no longer thrilled about it in 24 hours, let it go. It takes discipline, but it can be effective to manage your impulses whether the object of your affection is a car, a credit card or something else.

- Be realistic with yourself: Boy, we can be good about lying to ourselves. That’s never great, but it can be damaging when managing our finances. Before you apply for that new credit card, ask yourself if you’ll be able to handle it without missing any payments. Before you make that $10,000 credit card purchase — or even that $1,000 buy — think through how quickly you’ll be able to pay it off. Before you apply for that high annual fee credit card, review your spending habits and consider whether you’ll be able to get real value from those perks. If you’re real with yourself, you might not like all the answers you hear, but they’ll serve you well in the long run.

- Keep your goals in mind: Going to extremes isn’t always bad, especially if it’s in service of your goals. If that new credit card will help improve your credit score, for example, go for it. If you travel a lot and that high annual fee card’s perks will make that easier for you, it could be worthwhile. If that big purchase will allow you to expand your small business, bond more with your family or bring you closer to accomplishing some other big goal, consider it. But, again, make sure you’re being honest with yourself.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,026 U.S. consumers ages 18 to 78 from March 1 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78