23% of People in Relationships Have Ended One Due to Financial Incompatibility

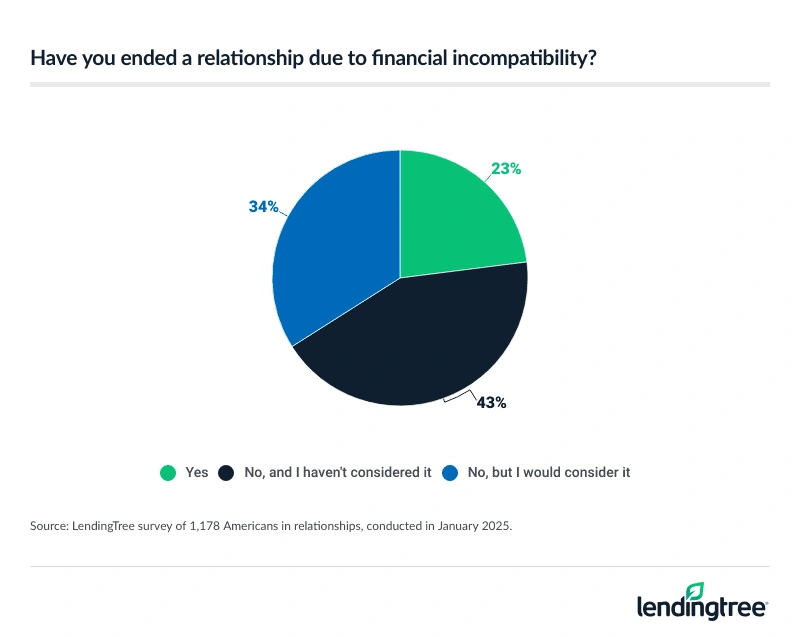

Nearly 1 in 4 people currently in an exclusive romantic relationship say they’ve ended a previous one because they weren’t financially compatible with their partner, according to a new LendingTree report. Another 34% say they’d consider doing so in the future.

It’s no secret money is often the source of great tension in relationships. LendingTree wanted to gauge how important it is for Americans to be on the same page financially with their partner. This report leaves no doubt that it’s a big deal for most Americans — as it should be — even though what it means to be compatible can vary widely.

Here’s what we found.

- Financial compatibility is important to most Americans, and a deal-breaker for some. 83% of coupled Americans consider themselves to be financially compatible with their partners, and 67% say it’s very important in a relationship. In fact, 23% have ended a relationship due to financial incompatibility, and another 34% would consider doing so.

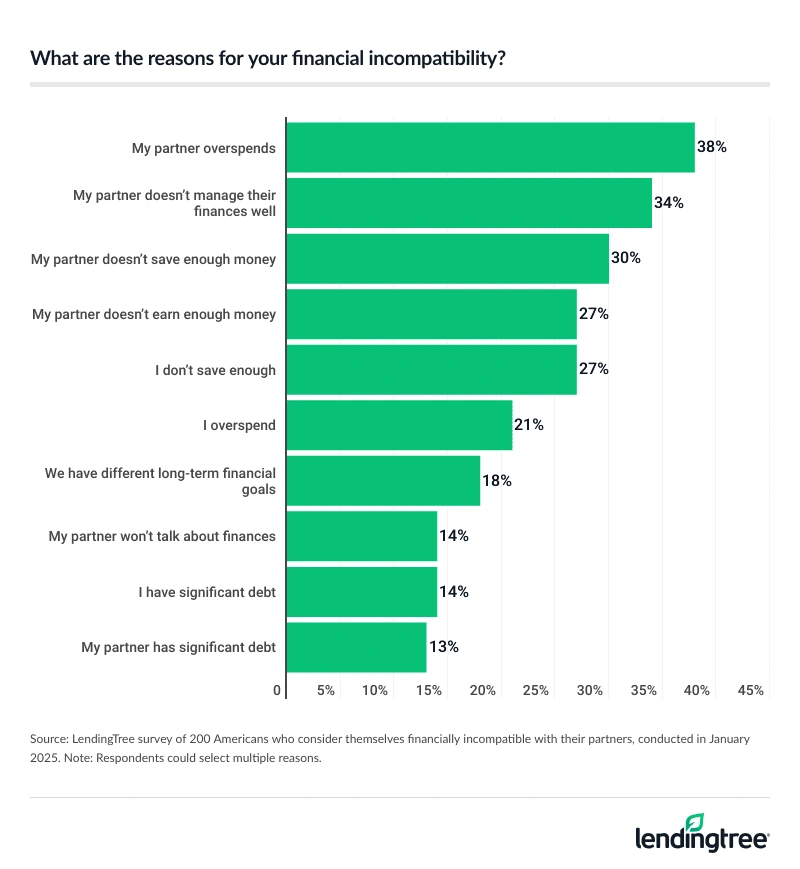

- Incompatible partners blame their significant others. Among those who aren’t financially compatible, 38% say their partner overspends, 34% say their partner doesn’t manage their finances well and 30% say their partner doesn’t save enough.

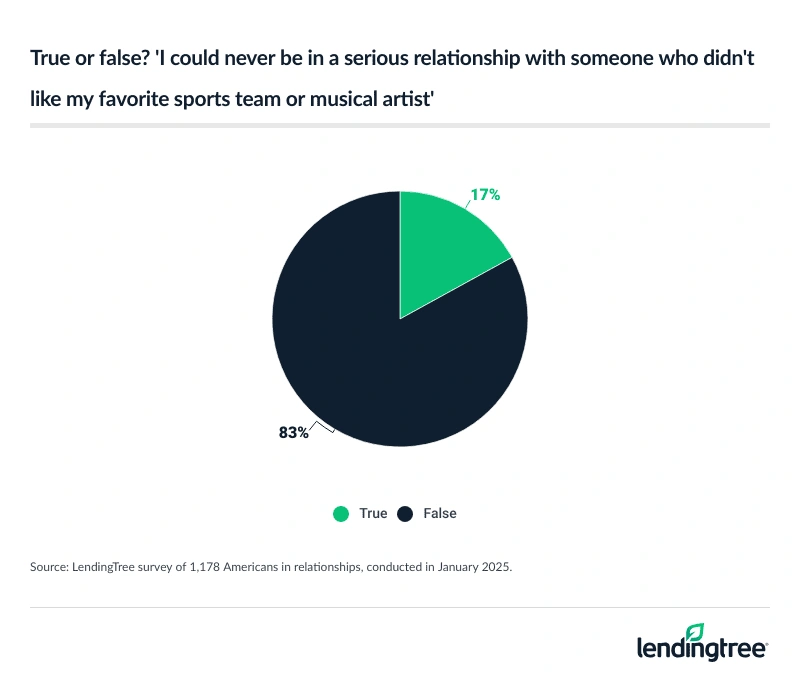

- Sports and musical tastes can be a deal-breaker, too. Nearly 1 in 3 Gen Zers (30%) say they could never be in a serious relationship with someone who doesn’t like their favorite sports team or musical artist, along with 28% of millennials, 24% of men and 23% of those making $100,000 or more a year. Overall, 17% of coupled Americans say so.

- Younger Americans are more likely to quarrel over money. While most Americans in relationships say they’re financially compatible with their partner, 19% still frequently fight about money. This is highly common among millennials (27%) and Gen Zers (25%).

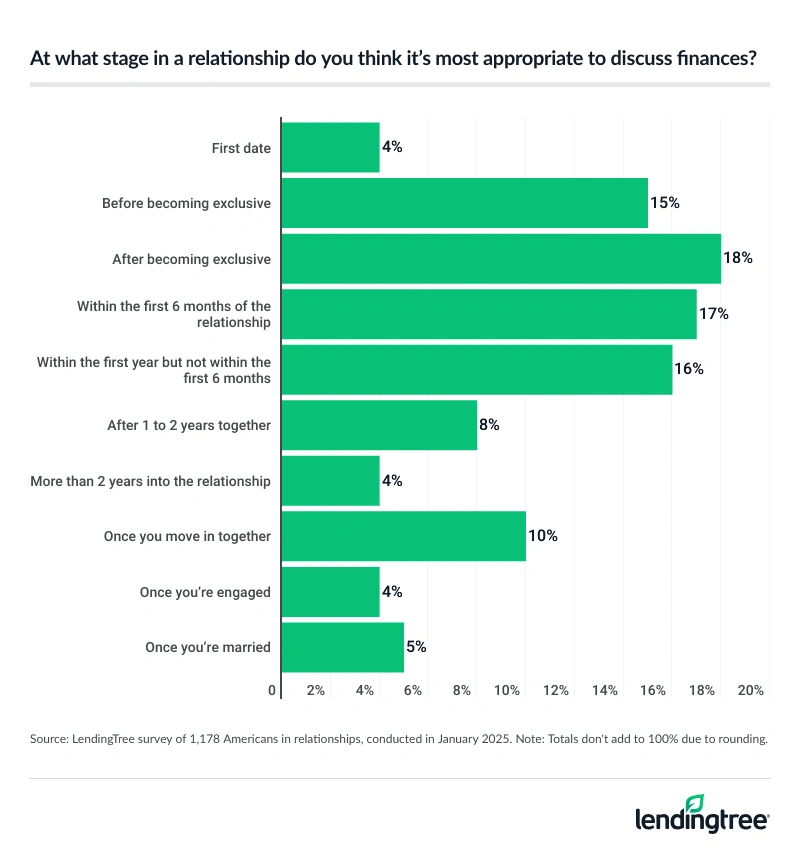

- Not all couples have the same view on discussing money. About two-thirds (66%) of coupled Americans say they frequently discuss finances with their partner, but 29% say they rarely do. When asked what stage they think is most appropriate to discuss finances, 18% said after becoming exclusive, 17% said within the first six months and 16% said after the first six months but within the first year.

Financial compatibility is a deal-breaker for some

A million things go into a successful relationship, but what elements are the most important can wildly differ from one couple to another.

However, there’s very little disagreement about one thing: Financial compatibility is important. Our survey found that 98% of people currently in an exclusive relationship say financial compatibility is important in a relationship, including 67% who say it’s very important.

So it shouldn’t be surprising that 83% of coupled Americans say they’re financially compatible with their partner. The higher your income, the more likely you are to agree with that. Also, the younger you are, the more likely you are to agree, with one exception. Gen Xers (ages 45 to 60) are far more likely than any other age group to say they’re not compatible with their partner — 24% say so, versus 16% of baby boomers (ages 61 to 79), 15% of millennials (ages 29 to 44) and 11% of Gen Zers (ages 18 to 28).

For many Americans, financial compatibility is important enough to be a deal-breaker. Nearly 1 in 4 (23%) say they’ve ended a relationship because of a lack of financial compatibility, and another 34% say they’d consider doing so.

More than 1 in 3 millennials (34%) say they’ve broken off a relationship due to financial incompatibility, as did 33% of parents with young kids, 28% of men and 27% of those making $100,000 or more a year. Meanwhile, just 18% of women and 9% of baby boomers say they’ve done that.

Incompatible partners blame their significant others

Because financial compatibility can mean different things to different people, we chose not to define the term in our survey. We wanted to let people tell us what it meant to them.

The survey showed that when it comes to financially incompatible relationships, those currently in one tend to blame their significant other.

Among respondents in those relationships, 38% say they’re incompatible because their partner overspends, while 34% say their partner doesn’t manage their finances well, 30% say their partner doesn’t save enough and 27% say their partner doesn’t earn enough. Not all respondents are pushing away blame: 27% say they don’t save enough and 21% say they overspend.

- 2024: 65% of single daters say inflation has impacted their dating life

- 2022: 77% of daters say dating could be easier if they had more money, with some going on fewer dates due to inflation

- 2022: Americans’ biggest financial turnoffs: Relying on parents for money, unemployment and debt

- 2021: 41% of Americans have moved for love, with women more likely to regret it

Sports, musical fandom can be a deal-breaker, too

Our survey found that many people say they couldn’t be in a serious relationship with someone who doesn’t like their favorite sports team or musical artist.

While just 17% of coupled Americans say so, that rate rises to 30% among Gen Zers, 28% among millennials, 24% among men and 23% among those making $100,000 or more a year.

What does this have to do with financial compatibility? Plenty. Money touches all aspects of our lives, and what we spend it on tends to be a direct reflection of what we consider to be important.

For many, their favorite sports teams and musical artists are among their biggest passions. That often means spending a significant amount of money on them, in the form of tickets, merchandise, travel to and from shows and so on. If your partner is a fan of the same artist or team — or at least doesn’t actively dislike them — they may be more likely to support you spending money on them.

Younger Americans more likely to fight about money

Strong relationships are all about successful communication. Our survey showed that 89% of people in couples say they’ve discussed finances with their partner. About two-thirds (66%) of coupled Americans say they talk about money frequently, but that leaves another third who discuss it rarely at best. That’s troubling.

There’s also disagreement on when it’s best to discuss finances. The most common answer, by 18% of coupled people, is after becoming exclusive, while another 17% say sometime in the first six months and another 16% say after the first six months but before the end of the first year.

Of course, regardless of when they happen, not all money conversations go well. About 1 in 5 coupled people (19%) say they frequently fight about money with their partner, with another 47% saying they have money fights only rarely. (Meanwhile, 35% say they never fight about money.)

Interestingly, men are far more likely than women (24% to 14%) to say they fight about money frequently with their partners. Millennials (27%) and Gen Zers (25%) are more likely than their older counterparts to say they have frequent money fights, and the highest-income Americans are more likely than those with lower incomes to say they have them.

Silence isn’t an option

Every couple has their differences. That’s part of the beauty of finding someone with whom you want to be in a relationship.

They can help open you up to new ideas, perspectives and experiences. For example, our survey found that 63% of people in relationships say they’re a saver, while 37% say they’re a spender. Among married couples, 64% say their finances are completely combined with their spouse, while 26% only partially combine them and 11% don’t combine them at all.

Vive la difference!

Generally, there isn’t one right answer to questions about how to handle money in relationships. There’s one big exception, though. Talking about money is nonnegotiable, period. If your partner won’t talk about money, consider that a bright red flag. No relationship can thrive and benefit both partners in the long run if one partner refuses to talk about money.

Here are some tips for talking about money with your partner for the first time.

- Remember that reluctance isn’t the same as refusal. It’s understandable to be nervous talking about money for the first time with a partner. It’s not easy. It’s even normal to push back on someone when the discussions begin. What isn’t normal or acceptable is when a partner closes the door on these conversations immediately and permanently. If that happens, it should raise serious doubts about the long-term viability of the relationship.

- No ambushes allowed. Forcing your partner into a financial discussion with no warning is only going to make awkward, uncomfortable talk even worse. Plan it.

- Make it a conversation, not an interrogation (and maybe even a little fun). No one should feel they’re on trial. These first conversations work best when you keep it kind of light. You’re not asking for balances, passwords and credit scores. You’re just looking for insight into how your partner thinks about money. Starting with a party-game question — like “If you won $1 million today, what’s the first thing you’d do with it?” or “If you could retire today and live anywhere in the world, where would you go?” — can help take the edge off.

- There will be disagreements, and that’s good. When you’re discovering things about your partner’s financial views, there will almost certainly be things you don’t agree on. That’s good. In fact, that’s the point. It‘s part of discovering your partner and determining how compatible you are. Having those discussions early and awkwardly is far better than waiting too long and investing months or years into a relationship doomed from the start.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers — including 1,178 in exclusive romantic relationships — ages 18 to 79 from Jan. 16 to 21, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79