2024 Halloween Spending Report

With Halloween creeping up, consumers are preparing to enter the season of budget horror — otherwise known as holiday spending — that starts in October and runs through the rest of the year.

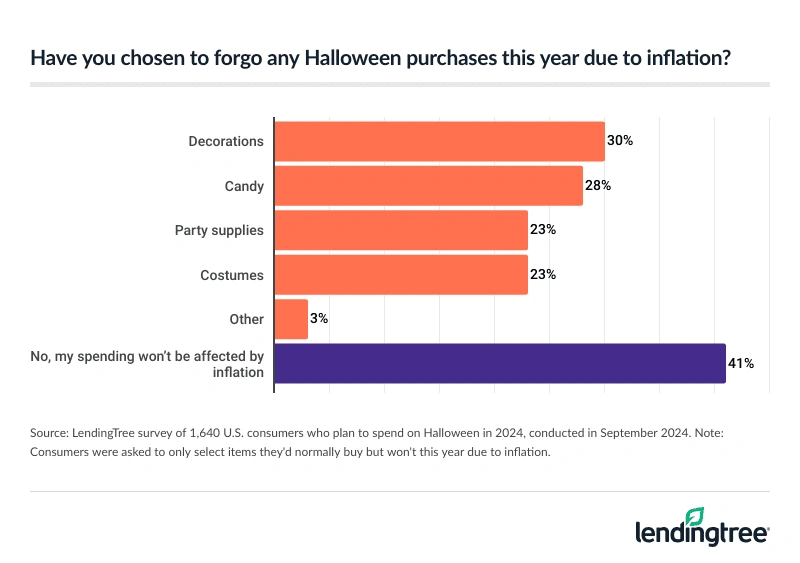

But given inflation’s impact on people’s budgets, Americans may get more tricks than treats this year. In fact, according to our newest survey of more than 2,000 U.S. consumers, 59% of Halloween spenders plan to forgo a spooky purchase this year due to inflation.

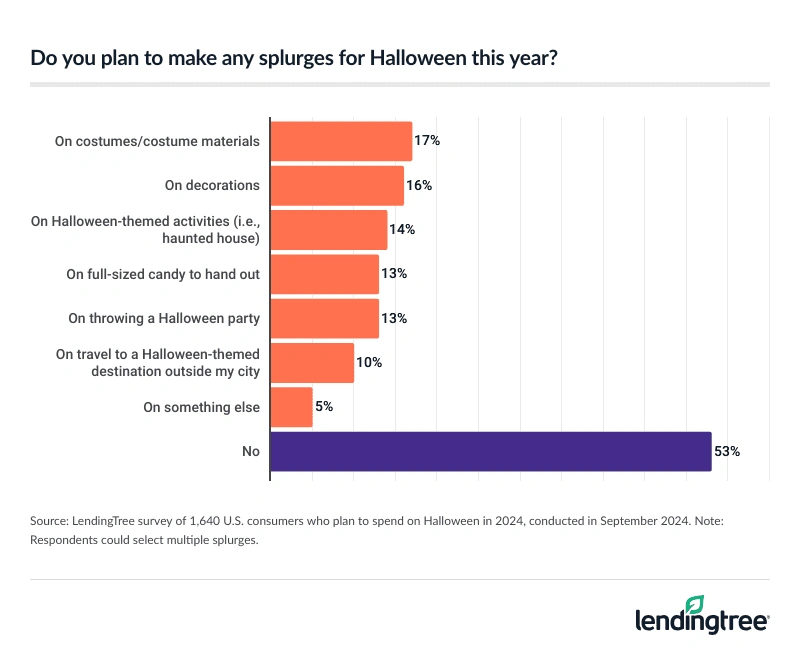

Of course, others say they expect to splurge, even as 49% who’ve overspent admit being haunted by regret. See what other scary findings our survey reveals … if you dare.

- Inflation may dampen the Halloween spirits of Americans who plan to spend. 59% will forgo a Halloween purchase this year due to inflation, including decorations (30%), candy (28%) and party supplies (23%). Across generations, Gen Zers who plan to spend on Halloween are most likely to cut back on holiday purchases, at 74%.

- Others, however, will splurge on the spooky season. Almost half (47%) of Halloween spenders plan to splurge this year, mainly on costumes (17%), decorations (16%) or themed activities (14%). Overall, they’ll spend $172 on average (up from $162 in 2023), and 33% expect to spend more this year than last.

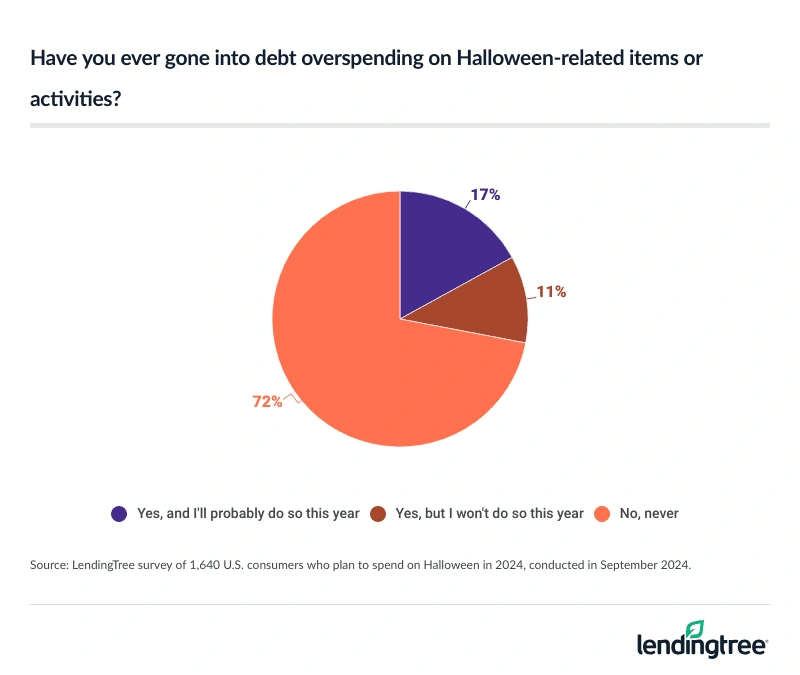

- Some have overdone their Halloween spending in the past. 28% of Halloween spenders have gone into debt over holiday items or activities, with 17% saying they likely will again this year. When asked what contributed to their decision to overspend, 40% admitted they wanted to impress neighbors with their decorations. Overall, 49% of those who’ve overspent on Halloween regret it.

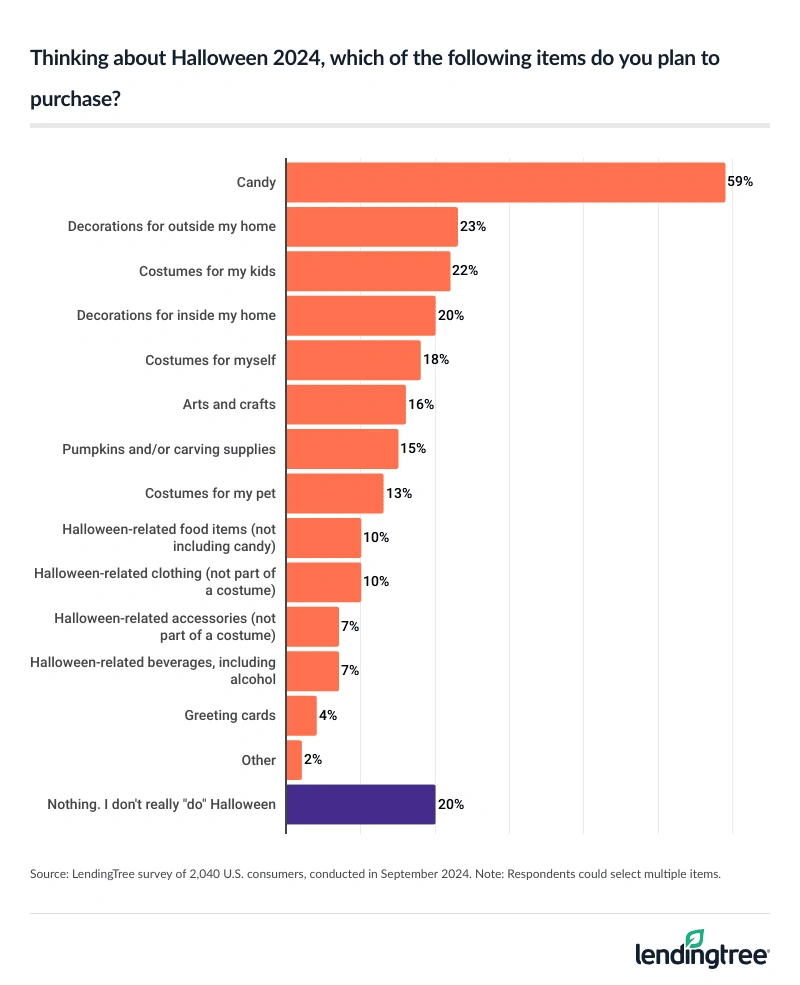

- Most stay traditional with their Halloween purchases. Among all Americans, the top items to purchase are candy (59%), outside decorations (23%) and kids’ costumes (22%). Some Halloween spenders plan to celebrate with spooky movies, as 52% say they may subscribe to a new streaming service this year for holiday content.

Inflation may dampen Halloween spirits

Tighter budgets may mean less room for Halloween extras this year, according to the 59% of Americans participating in ghoulish fun who are forgoing purchases because of inflation. The generation doing the most slashing (don’t worry, not the Michael Myers kind) is Gen Z, with 74% of those ages 18 to 27 scaling back.

“It never surprises me to hear people cutting back on anything because of inflation,” says Matt Schulz, LendingTree chief consumer finance analyst. “Life is so much more expensive than just a few years ago, and it has left many Americans squeezed to the breaking point. When that happens, sacrifices have to be made, and sometimes that means dialing back on things you love, like Halloween spending.”

Some will splurge on spooky season

Not everyone is willing to give up on their frightful fun, however. In fact, among those who plan to spend on Halloween this year, nearly half (47%) expect to splurge, whether it’s on costumes (17%), decorations (16%) or Halloween-themed outings (14%). Kids (and perhaps their dentists) will also be happy to note that 13% will splurge on full-sized candy bars.

Among generations, 22% of millennials ages 28 to 43 are likely to go all out on spooky decorations, while a good portion of Gen Zers is spending on travel to a Halloween-themed attraction outside their city (18%, versus 10% overall).

As for which group is most likely to splurge on costumes, perhaps it’s no surprise that it’s parents of young children, 28% of whom will splurge on dressing up their little pumpkins, compared with 17% overall.

For those who plan to spend on Halloween, the average amount is expected to be $172, up from $162 in 2023. However, there’s a wide range depending on gender, age, parental status and income. Some of the groups expected to spend the most are men ($225, versus $115 for women), millennials ($233), parents with kids under 18 ($260) and those earning more than $100,000 a year ($299).

Just one-third of Halloween spenders expect to dole out more than last year, though, another sign that budgets may be a bit tighter this year.

More than 1 in 4 Halloween spenders have gone into holiday debt

Among those who plan to spend on Halloween, the good news is that nearly three-quarters (72%) have never gone into debt to fuel their frightful festivities. But 17% say they have overspent their way into debt before and will probably do so again this year. That percentage is high among Gen Zers and millennials (25% each) and parents of young children (28%). Another 11% who’ve gone into debt for Halloween in the past don’t expect to do so this year.

“People definitely love Halloween, but overspending on the holiday can lead to something far scarier than anything you’ll run across while trick-or-treating, namely debt,” says Schulz, author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” That’s the last thing you need, especially with the holiday shopping season coming behind it, he warns. “Overspending on Halloween can make an already pricey time much harder to manage.”

For the Halloween spenders who’ve gone into debt, trying to out-spookify their neighbors with elaborate home decorations was the most popular reason (cited by 40% of the group). Something related to that was another popular choice: the desire to have an Insta-worthy or TikTok-viral display (33%). Other ghastly excuses for summoning the debt demons include:

- Ghost spending: In other words, all those small purchases add up without realizing it (34%)

- FOMO fright: The fear of missing out on things family/friends are doing (27%)

- Being under a spell: Being consumed by the pressure to spend (19%)

Despite their encounters with debt, just over half of respondents say they don’t regret their Halloween overspending.

Traditional purchases top Halloween spending list

The 2024 Halloween shopping list should look pretty familiar, as Americans mostly plan to spend on traditional holiday categories. At the top of the list is candy, with 59% of Americans planning to stock up on some bite-sized sugary treats to pass out (and maybe a Reese’s pumpkin or two for themselves).

Just be warned: Your candy budget may not get you as far as it did for past Halloweens. One reason could be that 2024 saw the price of cocoa soar globally, impacting what it costs to produce some of your favorite bite-sized chocolate treats. Candy prices are also up a bit this year, even though inflation has calmed down from the drastic increases in 2022 and 2023.

Beyond candy, other Halloween spending is being allocated for:

- Costumes for themselves, kids and/or pets (18%, 22% and 13%, respectively)

- Decorations for inside and outside the home (20% and 23%, respectively)

- Halloween-related food and beverages — not including candy (10% and 7%, respectively)

- Arts and crafts (16%)

Demographic-wise, some higher-than-average Halloween purchasing habits include the 21% of Gen Zers buying costumes for their pets, and the 21% of parents with small kids purchasing pumpkins and carving supplies.

As for more modern Halloween expenses, more than half (52%) of Halloween spenders are subscribing or thinking about subscribing to a new streaming service solely to watch Halloween-related movies and TV shows.

In fact, as far as Halloween plans go for those spending on Halloween, the most common planned activity is watching scary movies, cited by 48%. Among generations, millennials will do the most trick-or-treating (38%, most likely with their kids, versus 27% overall). For 47%, buying Halloween treats is part of their tradition, while 35% say they enjoy decorating their homes.

Of course, dressing up is one of the more popular activities for Halloween spenders, whether it involves costumes for themselves, their child(ren) and/or their pets. But nearly half (48%) of the people doing so are going the DIY route this year by making their own costumes to save money. The percentage rises to 54% among Gen Zers.

2 in 3 parents with young kids thoroughly check candy

All those urban legends about razor blades in apples and poisoned candy have stuck with today’s parents, with 67% of them saying they thoroughly check their children’s Halloween candy, removing all homemade or unwrapped items. Another 23% say they perform a quick-glance inspection.

When asked what type of candy they plan to pass out, most Halloween spenders are going with chocolate bars (57%). Other popular options were gummies or chewy candies (43%) and lollipops (37%). Meanwhile, 8% plan to give out noncandy items, which might appeal to kids with food allergies. But 17% say they won’t participate in trick-or-treating.

4 tips to curb Halloween overspending

Don’t let Halloween debt possess your finances. Use these strategies to tame the terror.

- Lean on credit card rewards if you have them. “That extra 1.5% or 2% cash back may not seem like much,” Schulz says. “But if you’re a big Halloween spender, it can help you stretch your budget a little farther than you might be able to otherwise.” Bonus tip: If food is one of your biggest Halloween splurges, consider applying for a grocery card that gives you a little extra back. Also, if you have accumulated rewards, you might consider cashing in for a gift card you can use for decorations, party supplies or candy.

- Shop dollar stores for DIY decor and costumes. Shopping around is a great idea, regardless of the holiday, and can usually save you real money, Schulz says. He encourages consumers to get creative and crafty with costumes, too, as about half in the survey say they plan to do. For inspiration, there are tons of ideas on social media platforms like TikTok and Instagram.

- Give yourself a candy budget. “You don’t win any points for giving out the most expensive candy on the block,” says Schulz, though you don’t necessarily want to be giving out the cheap stuff that no one likes (i.e., circus peanuts), either. Watch the sales flyers and pick up a couple of bags here and there. “If you can spread out purchases over a longer period, it can make the hit not feel quite as hard,” Schulz says.

- Do a costume swap with other parents or in your local social media group. “Hand-me-downs and costume swaps can be a great way to save on Halloween,” says Schulz, noting that elaborate costumes can get expensive quickly, especially for bigger families. Especially if your kids are in a princess or superhero phase, there’s likely to be a friend or family member who has a once-worn costume taking up closet space. “Most of us can still have an amazing Halloween without letting our costume break the bank.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,040 U.S. consumers ages 18 to 78 from Sept. 3 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78