36% of Americans Took on Holiday Debt, Averaging $1,181

Consumers spread more than Christmas cheer this holiday season; they also took on debt. In fact, 36% of Americans took on holiday debt this season, with 42% of them having their highest interest rate at 20.00% or higher.

Now that all the presents have been unwrapped, let’s unpack holiday overspending.

- Santa’s checking his list this holiday season — and consumer debt is at the top. 36% of Americans took on debt this holiday season, only 44% of which had planned to. Parents of young children were the most likely to take on debt, at 48%. Those who went into debt took on an average of $1,181, up from $1,028 in 2023.

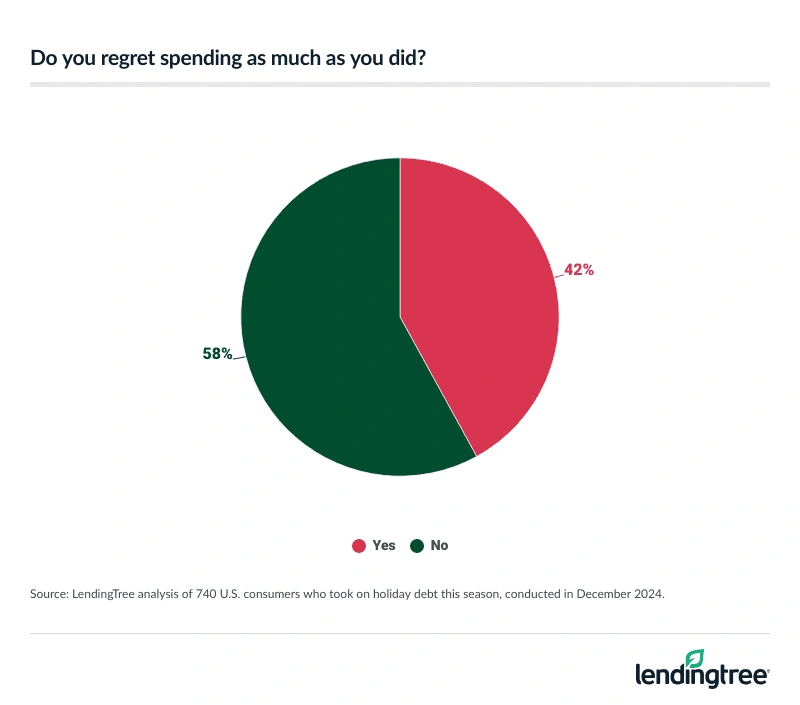

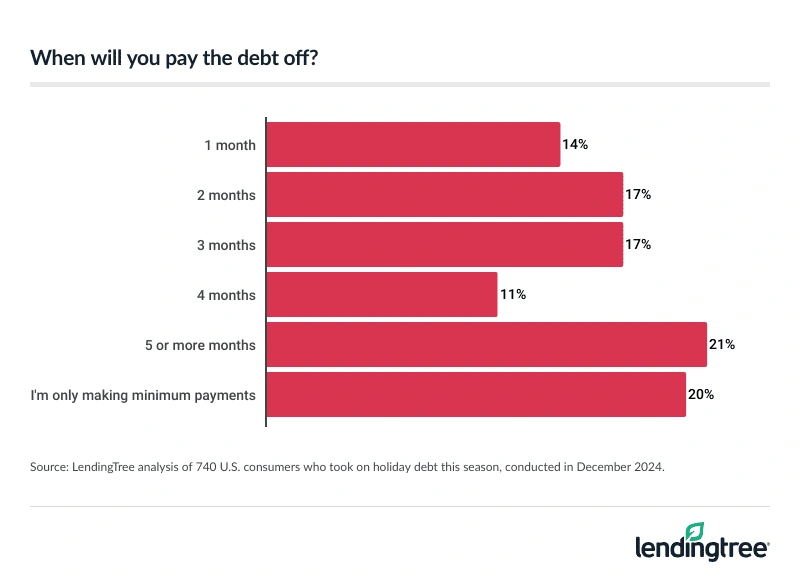

- You’ve heard of Dasher and Dancer, but what about stress and regret? 60% of those who took on debt say they’re stressed about it, with 69% of parents of young children saying so. Additionally, 42% say they regret spending as much as they did, and 21% expect it’ll take five months or longer to pay it off. Another 20% are only making minimum payments.

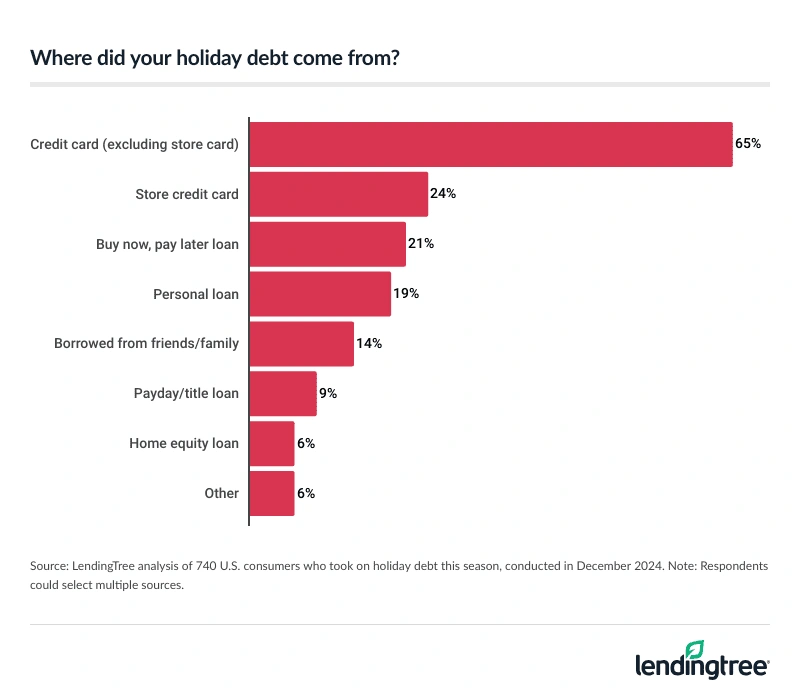

- Many Americans are ending the year with holly jolly high-interest debt. Of those who took on holiday debt, 65% put purchases on a credit card and 24% on a store card. With that in mind, 42% say the highest interest rate they’re paying is 20.00% or higher. Despite that, two-thirds (67%) won’t try to consolidate their debt.

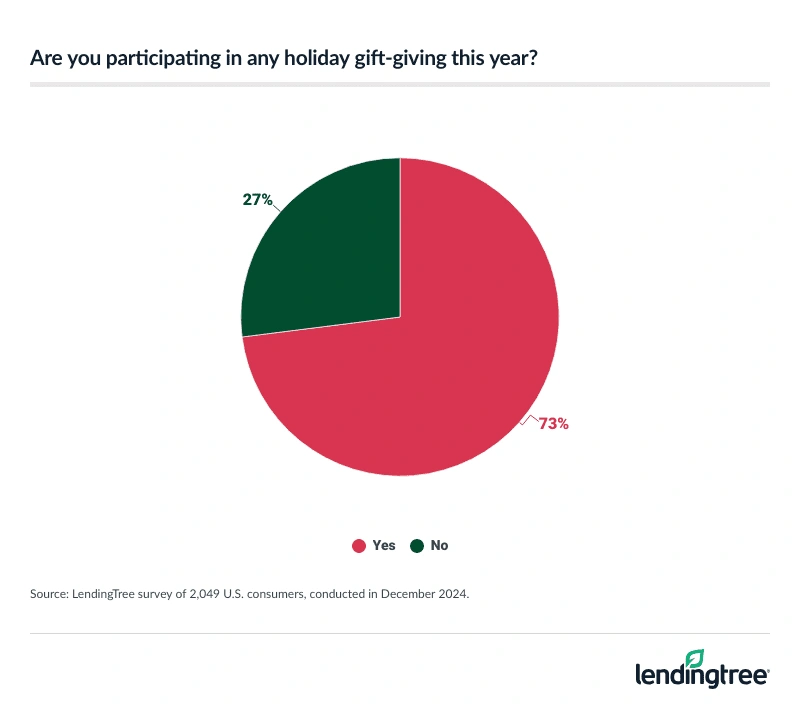

- High prices won’t get in the way of Christmas traditions, as many Americans are still exchanging gifts this year. Among the 73% participating in holiday gift-giving this season, 45% completed their shopping by the time the survey was fielded Dec. 10 to 12. When asked about their most expensive purchase, 36% say they spent $250 or more. 32% gave their most expensive gift to a child, while 31% gave it to a significant other.

Those with holiday debt took on an average of $1,181

Rudolf’s nose isn’t the only thing in the red after this holiday season. In fact, 36% of Americans took on debt for celebrations this season, led by parents of young children (48%), millennials ages 28 to 43 (42%) and those earning $30,000 to $49,999 (39%).

Of this group, only 44% had planned to go into debt. Indebted six-figure earners (55%) and men (49%) were the most prepared to take on holiday debt.

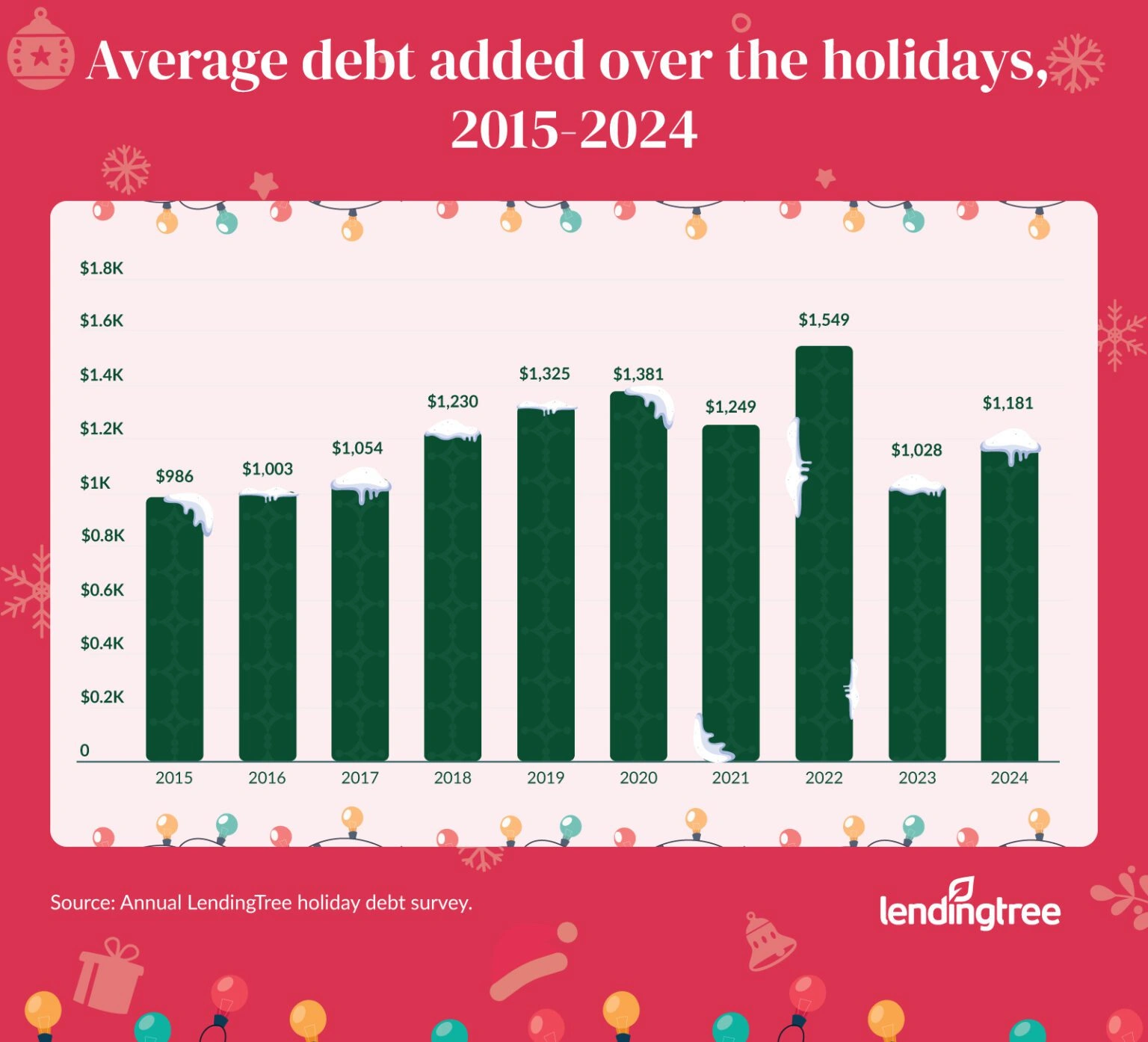

On average, those who took on debt spent $1,181, up from $1,028 in 2023. Across all years of our holiday survey, this debt figure was lowest at $986 in 2015.

Six-figure earners took out the most debt, spending an average of $1,429 on the holidays. Meanwhile, those earning $30,000 to $49,999 ($909) took out the least on average.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says it’s fair to expect holiday debt figures to increase over the years.

“Inflation is still a big deal in this country, and it’s having a huge impact on people’s finances, including their holiday spending,” he says. “If you were to only buy the same things you bought last Christmas, you’d likely have to spend more this year thanks to inflation. For many Americans, that means you either have to cut back on gifts or take on more debt. While people make lots of sacrifices to deal with higher prices, many may not want to sacrifice at the holidays, so debts continue to rise.”

42% regret overspending for the holidays

While the holidays offer a cheerful reprieve, post-spend regret is still rampant. In fact, 60% of those who took on debt say they’re stressed about it, leading with parents of young children (69%), women (65%), millennials (65%) and those who earn less than $30,000 (65%).

Separately, 42% say they regret spending as much as they did.

Most indebted Americans plan to pay well into the new year, with 21% expecting it’ll take five months or longer to pay it off — the most common response.

Meanwhile, 20% are only making minimum payments. That’s especially true among those earning less than $30,000 (28%) and women (24%).

Schulz says only making minimum payments is a recipe for trouble.

“Taking forever to pay off holiday debt means that you’re unable to put as much toward other financial goals such as building an emergency fund or saving for retirement or a mortgage down payment,” he says. “In more extreme cases, it may mean you’re less able to pay essential bills or keep food on the table. In either case, it’s a big deal. It’s a sure way to pay much more and take much longer to pay off that debt, and it should be avoided when possible. Of course, that can certainly be easier said than done.”

Majority put their debt on credit or store cards

Those with debt are most likely to put it on a credit card, with 65% having put purchases on a credit card and 24% on a store card. Meanwhile, 21% used a buy now, pay later (BNPL) loan and 19% used a personal loan.

Many Americans may have been trying to capitalize on store card rewards this holiday season. In fact, 31% of all Americans applied for a store card this holiday season, including 7% of Americans who applied but were unsuccessful.

With the majority using cards, many indebted Americans are facing high-interest debt. Of those with holiday debt, 42% say the highest interest rate they’re paying is 20.00% or higher. Meanwhile, 30% say their highest rate is between 10.00% and 19.99%.

Despite these high rates, 67% won’t try to consolidate their debt. This includes 22% who say they won’t because they don’t want to deal with another financial institution or credit card issuer. Meanwhile, 17% believe consolidating is unnecessary.

Schulz believes more Americans should consider debt consolidation. “If you have debt and don’t at least consider consolidation, you’re doing yourself a disservice,” he says. “Whether you’re talking about a 0% balance transfer card or a low-interest personal loan, consolidation can save you a ton of money in interest, shorten your payoff period in a major way and trim your to-do list because you’ll only have to worry about one bill instead of several.”

Holiday cheer trumps debt fears

Across all Americans, 73% say they’ll participate in holiday gift-giving this year. That figure’s lowest among those earning less than $30,000 (59%), those without children (67%) and Gen Zers ages 18 to 27 (69%).

Of this group, 45% had completed their shopping by the time the survey was fielded Dec. 10 to 12, with Gen Zers (54%) and those earning $30,000 to $49,999 (53%) the most likely to finish their holiday shopping early.

When it comes to their most expensive purchase, 28% spent less than $100, 36% spent $100 to $249, and 36% spent $250 or more. Who are the recipients? A child (32%) was the most common response, followed by a significant other (31%) and a parent (10%).

When asked what kind of gifts they plan to buy, 60% said clothing. That’s followed by:

- Electronics or gadgets (46%)

- Gift cards (42%)

- Toys or games (42%)

- Jewelry (29%)

- Beauty or personal care (26%)

- Food or drink (24%)

- Books or educational material (20%)

- Home goods (17%)

- Household appliances (14%)

- Experiences (10%)

- Travel-related gifts (10%)

Worth noting, 31% participating in holiday gift-giving used buy now, pay later for at least one gift.

Recovering from holiday splurges: Top expert tips

Holiday debt may feel worth it on Christmas Day, but it’s not always worth making payments well into the summer. For those looking to pay off their debt quicker, Schulz recommends the following advice:

- Consolidate, consolidate, consolidate. As mentioned, consolidation can make a massive difference when it comes to how much you’re paying in interest.

- Don’t sweat the how; just get started. “Being in debt can be overwhelming,” Schulz says. “Don’t overthink your debt payoff method. The snowball and the avalanche can be great, but what matters most is that you get started.”

- Keep saving while you pay down the debt. “If possible, keep building your emergency fund while you pay off your debt,” he says. “Yes, it means that it might take a little bit longer and cost a little more to pay it down. However, that emergency savings means that when your card balance finally gets to $0, the next unexpected thing, like a trip to the vet or a flat tire, won’t automatically have to go on your card. That’s how people can break the cycle of debt they often find themselves in. It can be easier said than done and requires discipline, but it’s a worthy goal.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from Dec. 10 to 12, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Recommended Articles