You Miss 100% of the Shots You Don’t Take — Here Are Topics You Should Talk to Your Credit Card Issuers About

Some good news for credit cardholders who could use it in the wake of years of stubborn inflation, record debt and sky-high interest rates: You’re still likely to get a break from your credit card issuer if you ask for it in 2024.

In fact, according to a new LendingTree survey, your chances of getting late, balance transfer or foreign transaction fees waived or reduced are the highest in years.

Even interest rates — at record highs after years of Federal Reserve increases — are being reduced upon request for more than three-fourths of those who ask.

If you’re willing to wield it, you have more power over your money than you realize. But you have to seek opportunities, as banks generally won’t come to you with these types of offers.

Here’s what we found.

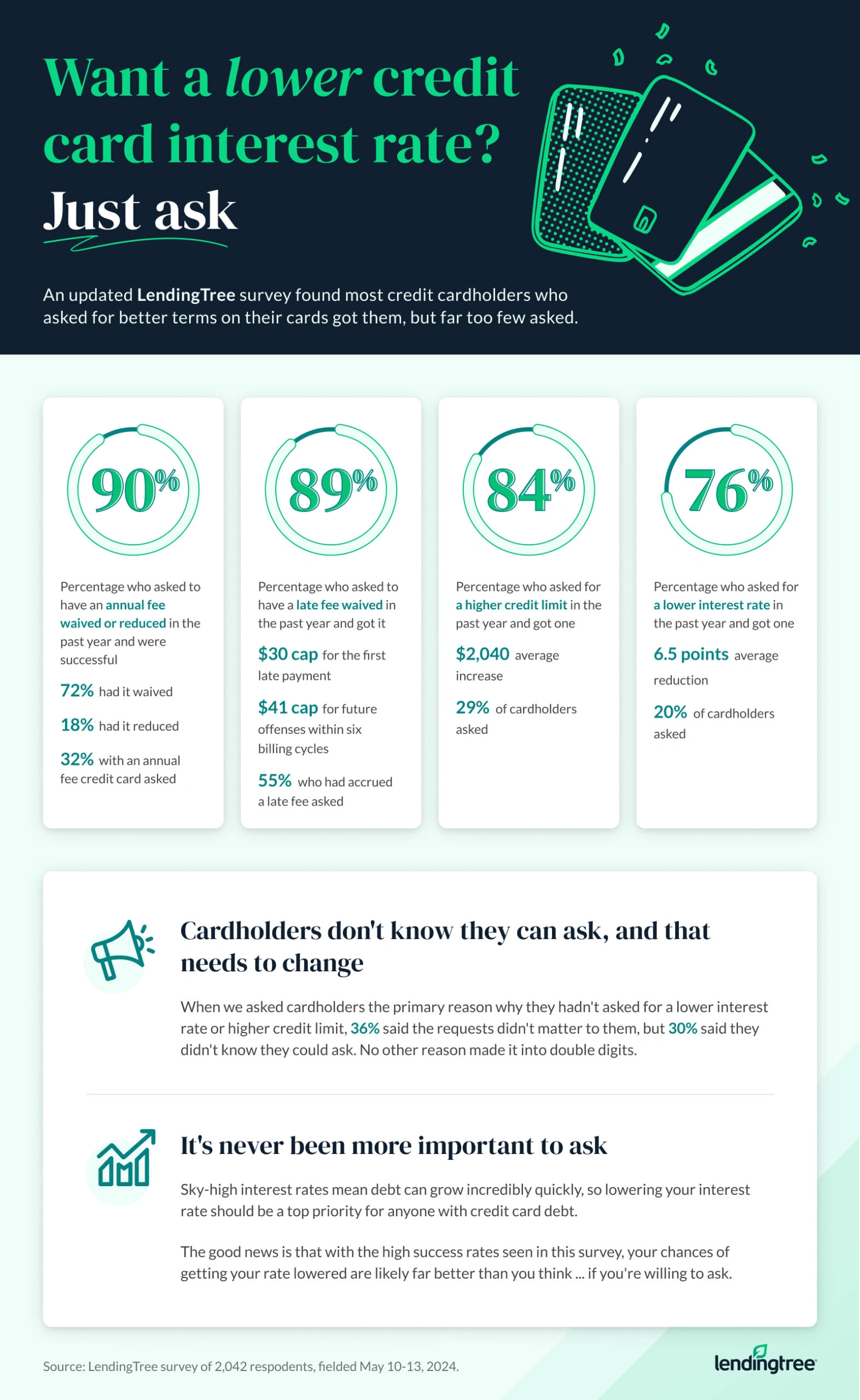

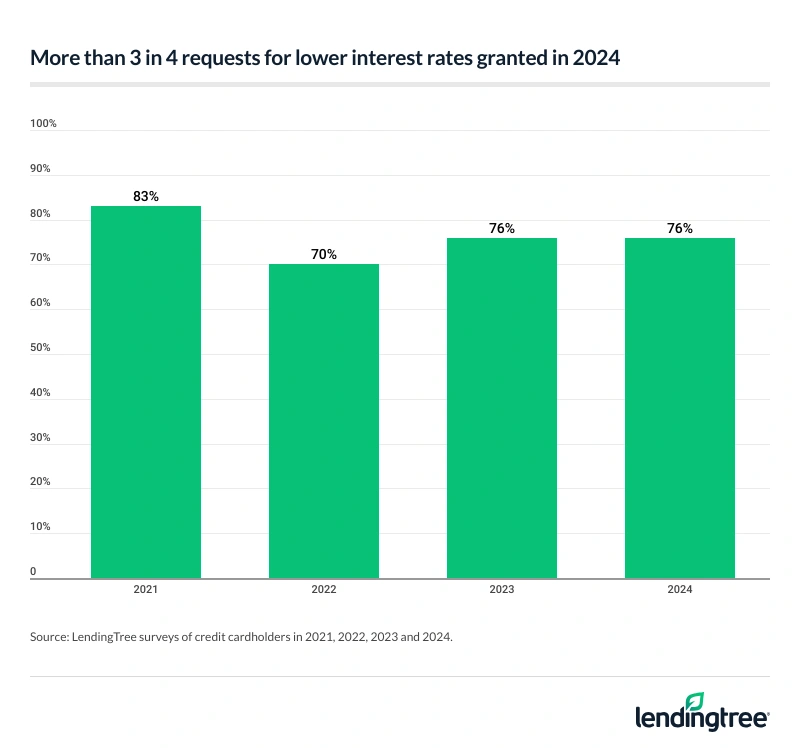

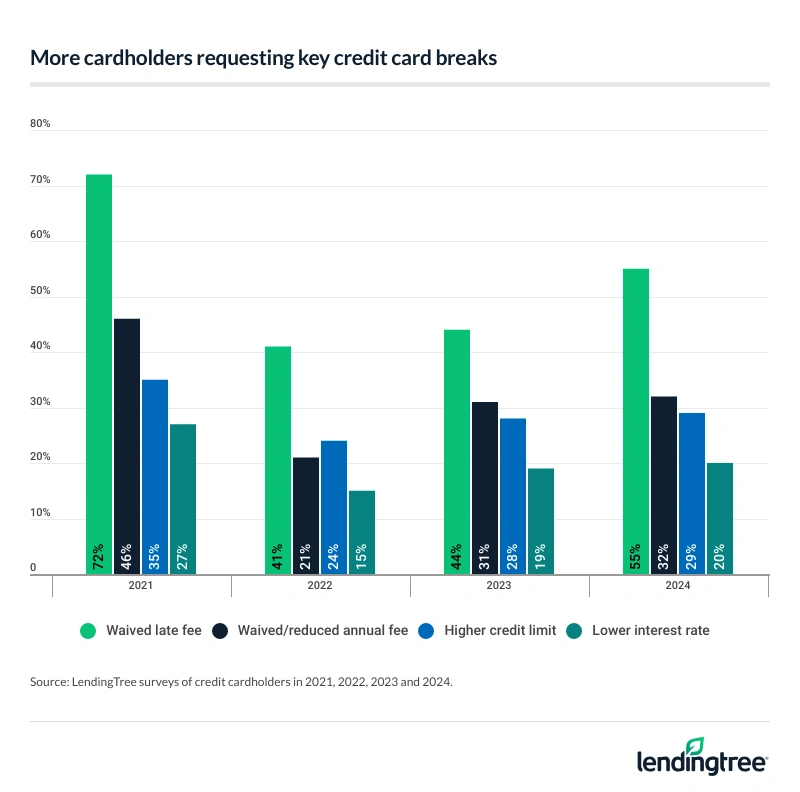

- 76% of those who asked for a lower interest rate on one of their credit cards in the past year were successful, with the average reduction being 6.5 points. Overall, 20% of cardholders asked for a lower interest rate in the past year. Last year’s success rate was also 76% — six points higher than 70% in 2022.

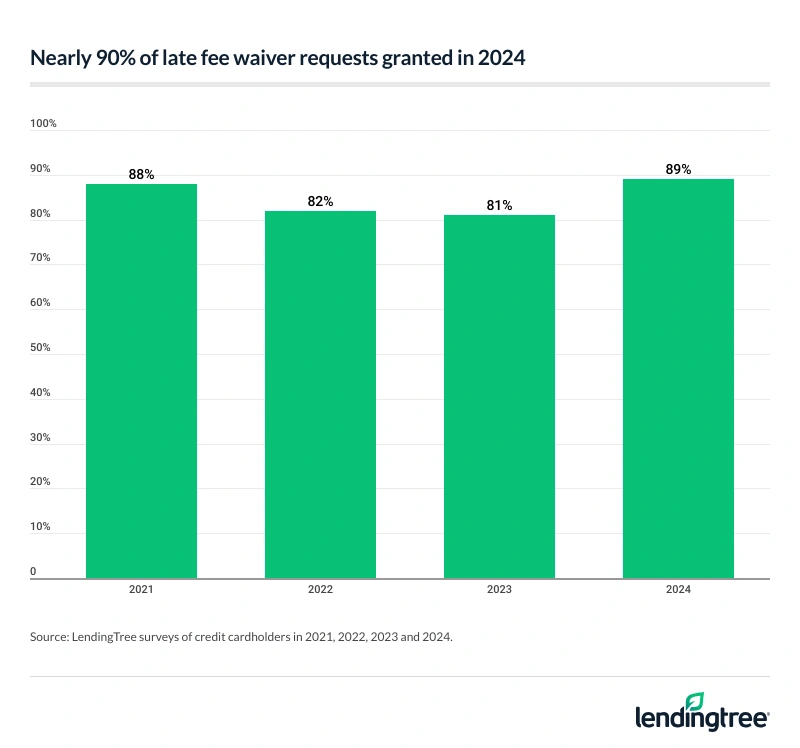

- Late fees are being waived far more often, as 89% of those who’ve asked in the past year were successful. That’s a four-year high. In total, 55% of those who incurred a late fee in the past year asked. Last year, 81% were successful.

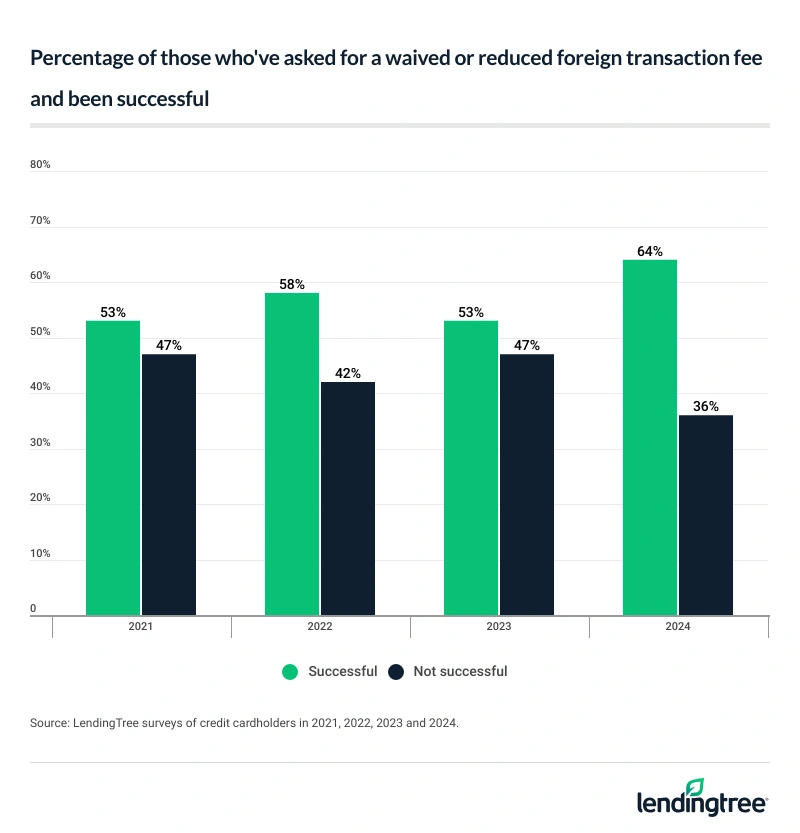

- Great news for travelers: 64% of those who’ve asked to have a foreign transaction fee waived or reduced got it. That’s 11 points higher than last year and the highest since we began tracking in 2021.

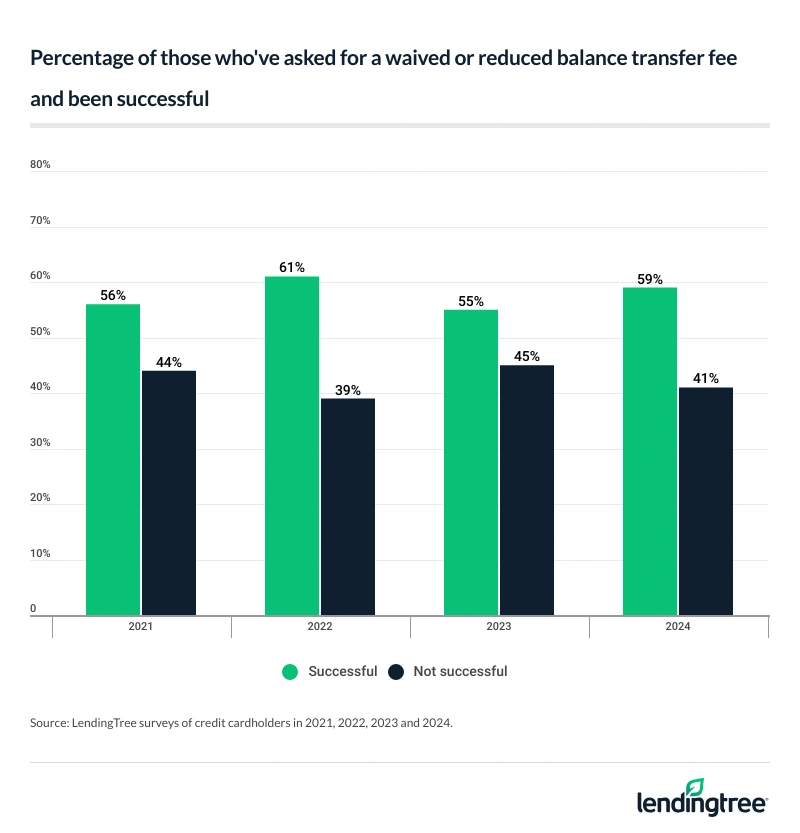

- More balance transfer fees are being waived or reduced: 59% of those who’ve asked got their way. That’s up four points from last year and the second-highest percentage since 2021. (It was 61% in 2022.)

-

You’re still highly likely to get an annual fee waived or reduced or a credit limit increased if you ask, but not as probable as in recent years…

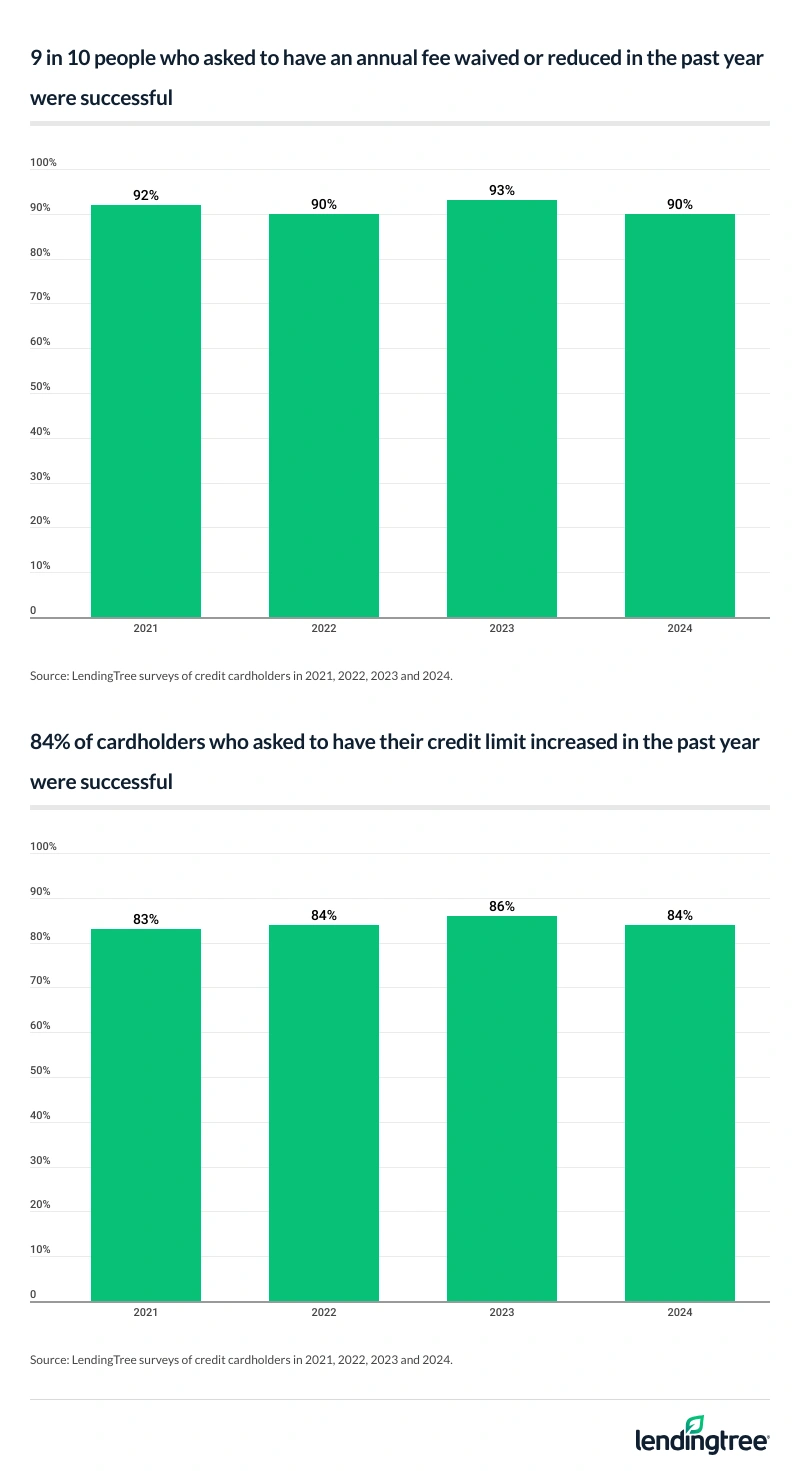

- 90% of those who asked to have an annual fee waived or reduced in the past year were successful. 72% got it waived, while 18% got it reduced. Overall, 32% asked in the past year. The success rate is down three points from last year’s 93% and ties 2022’s figure.

- 84% of those who asked for a higher credit limit in the past year got one, with the average increase being $2,040. 29% of cardholders asked in the past year. The success rate is down two points from 86% last year and ties 2022.

More than 3 in 4 interest rate reduction requests granted

For years, LendingTree has annually checked in with cardholders about whether they’ve asked their cards’ issuers for breaks, such as a lower interest rate, a reduced or waived annual fee, a higher credit limit or a waived late fee. We started asking in 2019, but we only compare since 2021 because of methodology changes.

During that period, we’ve seen the nation emerge from the depths of the COVID-19 pandemic only to be thrown headfirst into a perfect storm of massive debt, rampant inflation and skyrocketing interest rates. We’re still wrestling with these issues today.

Through it all, we’ve seen a consistent theme: When people ask for help from credit card issuers, they’re far more likely to get it than not. Today, many requests have at least a coin flip’s chance of success. Most, however, have far better odds than that, often 80% or higher.

Among these requests, perhaps none are more impactful than a lower interest rate. Depending on your amount of debt, a lower rate can save you hundreds of dollars or more over the life of the balance. For the second straight year (and third in four), more than three-quarters of those who requested a lower rate in the past year got one. In all, 76% of those who asked in the past year were successful, the same as last year. That’s well below the peak number (83%) in 2021 but higher than 2022’s 70%.

Still, even in 2022 at the low watermark of the last four years, the chances of success were sky-high. There’s little reason to believe that the odds will significantly worsen anytime soon.

Nearly 9 in 10 late fee waiver requests granted

Those seeking to get a late fee waived are even more likely to be successful.

These fees, capped at $30 for a first offense and $41 for subsequent ones, aren’t as costly as a high interest rate, but they’re still significant. They’re an extra expense no one wants to pay.

The good news, however, is you likely won’t have to pay it if you ask. Almost nine in every 10 people (89%) who asked to have a late fee waived in the past year got their way. That’s a huge rate that hints that it isn’t just people with 800 credit scores and long track records getting their way. It’s also the highest percentage since we started tracking in 2021, besting that year’s 88%.

Because of massive changes potentially coming to late fees, it’s unclear whether these numbers will remain high. The Consumer Financial Protection Bureau (CFPB) — the federal government’s consumer watchdog agency — ruled that credit card late fees were to be slashed to $8 for offenses in most cases. That change was due to take effect in May 2024. However, after uproar from the banking industry, a federal judge issued a preliminary injunction to temporarily prevent the law from taking effect, leaving the ruling in limbo and the current maximums in place.

Should the CFPB’s ruling take effect, it remains to be seen whether banks would continue to be willing to waive these fees. On one hand, banks could view the lower fees as less significant and easier to waive. On the other hand, they could become less willing to waive them, having already lost a ton of revenue when the cap was implemented, wary of losing any more.

Either way, it’ll still be worth asking.

More cardholders getting foreign transaction fees waived

If you’ve traveled overseas, you’re probably familiar with foreign transaction fees. These are the fees, typically ranging from 1% to 3%, tacked on to anything you buy in a foreign country with your American credit card. (You don’t have to leave the country to have these fees kick in, though. Any transaction in a foreign currency, like buying an English soccer jersey or a French bottle of wine online from a foreign-based retailer, can trigger these charges.)

Travelers hate these charges because foreign travel is expensive as it is. The last thing they want is to pay an extra 1% to 3% for, to be frank, no good reason. Many travel credit cards no longer charge these fees because issuers know how distasteful people find them. However, they’re still present on cards not primarily travel-focused. Folks who travel less frequently may have an unpleasant surprise waiting for them on their credit card bill when they return home.

However, these fees are commonly waived, too. Nearly two-thirds (64%) of those who’ve requested to have them waived or reduced have been successful. That’s a big deal because these fees could add up to an extra $30 for every $1,000 spent on the trip. That adds up.

That’s up 11 points from last year and is the highest rate since we started tracking in 2021.

With foreign transaction fees and balance transfer fees, we asked if people had ever been successful with these requests. With other requests in this report — late fees, credit limits, annual fees and lower APRs — we asked if requestors had been successful in the past year.

Balance transfer fee waivers becoming more common

While foreign transaction fees have generally become less common over the years, that’s certainly not the case for balance transfer fees. These are the one-time fees you usually pay when you transfer a balance from one card to another. They’re typically 3% to 5% of the transferred balance, so $30 to $50 for every $1,000 transferred. That’s a lot of money on top of that debt you’re already struggling to pay off.

Fortunately, these fees are frequently being waived or reduced, too. Our survey showed that about 6 in every 10 people (59%) who’ve asked to have a balance transfer fee waived or reduced got their way. That’s the second-highest percentage we’ve seen since 2021. (Only 2022 was higher, at 61%.)

You’ll likely need good credit — 670 or higher — to get a 0% balance transfer card. If you can get one, though, it might be the best tool in your arsenal in the fight against credit card debt.

Men (63%) are far more likely than women (50%) to have these fees waived or reduced, while Gen Xers ages 44 to 59 (64%) and millennials ages 28 to 43 (58%) are more likely than Gen Zers ages 18 to 27 (56%) to have them waived or reduced.

Annual fee, credit limit requests still frequently granted, but not quite as often

The news isn’t perfect for these requests. If you’re looking to get a credit limit increase or have an annual fee waived or reduced, your chances aren’t quite as good as last year. They’re still good — you might even call them sky-high — but not as high as a year ago.

Take credit limit increases, for example. Of those who asked for one in the past year, 84% got one, with the average increase being $2,040. Last year, however, 86% were successful.

The numbers were even better with annual fees. Nine of every 10 people (90%) who asked to have an annual waived or reduced in the past year were successful, with the vast majority of them succeeding in getting the fee waived entirely (72%, versus 18% who had it reduced). However, as good as those numbers sound, they fall three points shy of last year’s 93%.

You have more power over your money than you realize

Here’s the problem: Even though the odds of success are this high — and the savings with some of these requests are so significant — most cardholders still don’t ask.

We’ve seen requests rise steadily since 2022. In fact, more than half of those assessed a late fee in 2024 asked to have it waived. That’s the highest since 2021, in which 72% did so as the nation wrestled with high unemployment amid the pandemic. Still, there’s a long way to go.

Why don’t people ask?

We asked that of people who said they didn’t ask for a higher credit limit or lower interest rate in the past year. (We didn’t ask about late fees and annual fees because not every card comes with an annual fee, and not everyone pays a late fee every year. Most cards, however, have interest rates and credit limits.)

The most commonly offered reason (36%) was that neither of the requests mattered to them. That’s understandable. If you’re happy with your credit limit, why bump it up? Or if you never carry a balance, why fiddle with your interest rate?

By far the second-most common reason: “I didn’t know I could.” Thirty percent of respondents said that. No other reason was in the double digits. (Nine percent said, “I didn’t think I would be successful.”) Men are more likely than women to ask for any of these requests, and are usually more likely — and in some cases far more likely — than women to be successful with them.

Ever since I started at LendingTree, I’ve been on a mission to get more people to take action, doing hundreds of interviews and telling countless people that you can ask for things from banks and that it works. And it isn’t just about credit card issuers. It’s also true with mortgage lenders, car dealerships, gyms, cellphone providers and more.

I even wrote a book about it — “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” was inspired by these numbers — in which I lay out loads of data, success stories and even word-for-word scripts on how to do these things. It’s all with the goal of showing people they have way more power over their money than they realize.

Here are a few tips for leveraging that power:

- Check your credit first. If you have terrible credit and ask your card issuer for the lowest rate available on a credit card, you’re setting yourself up for failure. Knowing your credit score can help you avoid that and help you set expectations for what is possible.

- Practice, practice, practice. Steph Curry is the best three-point shooter ever and still makes 500 shots a day in the offseason. This stuff matters, whether you’re the greatest ever or a newbie. One of the best ways to practice these negotiations is to roleplay with a trusted friend or relative, walking through a few possible scenarios. It can help you feel more comfortable when it is time for the real thing.

- Leverage apps. Many issuers will allow you to request a higher credit limit in their mobile app without speaking with anyone. The app might even indicate if you’re preapproved for one. Just remember that a higher credit limit can be a double-edged sword. Handled wisely, it can boost your credit score and give you extra cushion in case of an emergency. Handled poorly, it can lead to you digging your debt hole deeper.

- Keep trying. Sometimes you get connected with a customer service representative who has had it, beaten down after being yelled at by 10 different people and unwilling to give the benefit of the doubt. That doesn’t mean that everyone will treat you that way. If you get rejected for any of these requests, consider reaching out at least a time or two more to see if your luck might change. And remember, be nice. No one wants to help a jerk.

- Don’t be afraid to be vulnerable. Our stories connect us with others, and those connections are what make people want to help. To build those connections, you don’t have to give all the gory details or craft a sob story. Just share what you’re going through or trying to accomplish with the person on the other end. If you’re genuine and open, you might find that people are more willing to help you than expected.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,042 U.S. consumers ages 18 to 78 from May 10 to 13, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Recommended Articles