Lovebirds Plan to Spend $179 on Average This Valentine’s Day, While 56% of Americans Would Skip the Holiday if They Could

Love is in the air, but Americans’ wallets are feeling the pressure.

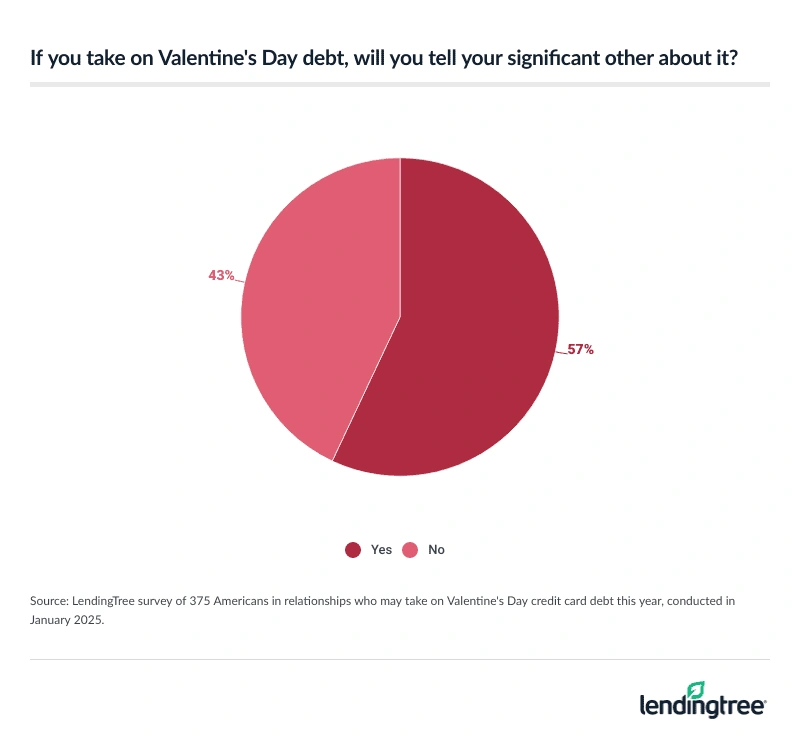

Americans in relationships plan to spend an average of $179 on their significant others for Valentine’s Day, according to the latest LendingTree survey of 2,000-plus consumers. However, 43% of those who may take on credit card debt won’t tell their partners about it.

Here’s what else we found.

- All you need is love this Valentine’s Day — and maybe a wallet full of cash. 82% of coupled Americans will give their significant other a gift this Valentine’s Day, spending an average of $179 — nearly identical to the $180 they planned to spend when we conducted this survey last year. Men expect to spend twice as much as women this holiday ($258 versus $106).

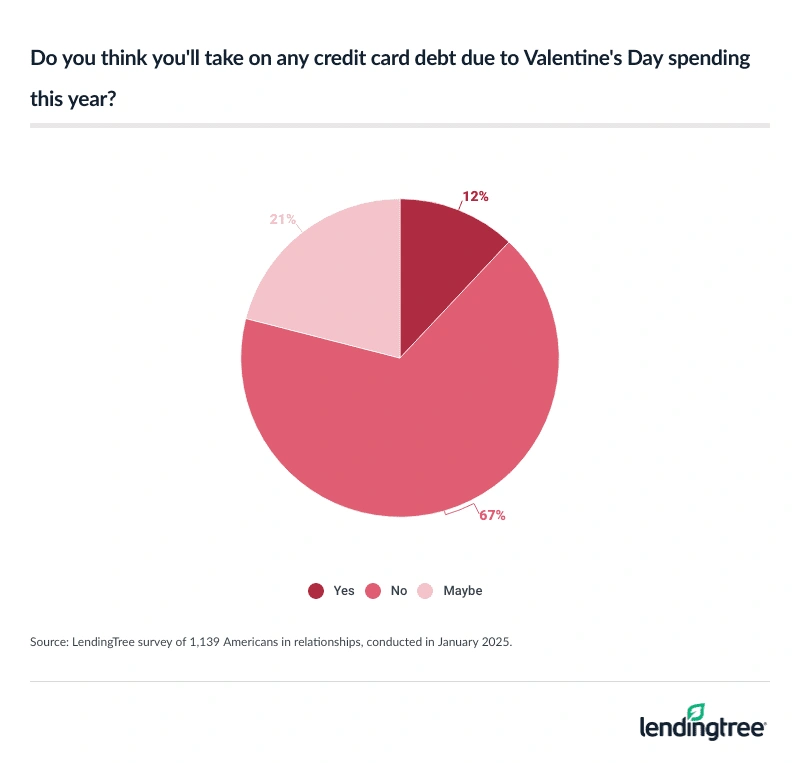

- While some lovebirds say “yes” to the romantic holiday, others swipe left. A third (33%) of Americans in relationships think they may take on Valentine’s Day debt, but 38% think it’s worth it to show their significant other they care — regardless of whether they’re going into debt. Meanwhile, 34% of all Americans say they’ve set a spending limit with their partner in the past, and 56% admit they would skip the holiday if they could.

- Going into debt may break some hearts. 43% of those who may take on Valentine’s Day debt don’t plan to tell their significant others — possibly because 67% of coupled Americans say they would be upset to learn their partner went into debt for their gift. Many blame inflation, as 61% say that has made it harder for them to afford Valentine’s gifts.

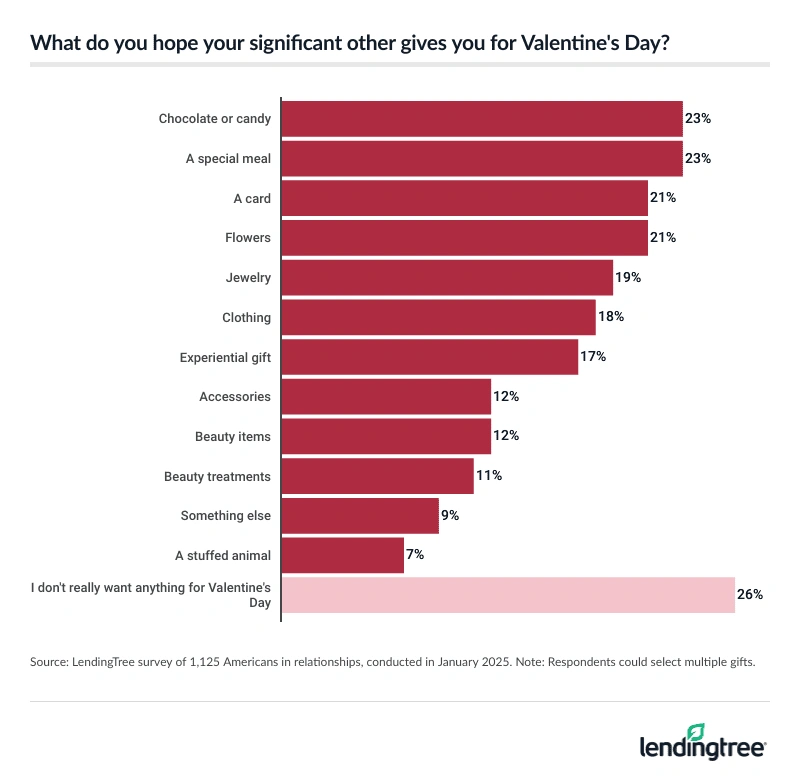

- Some choose to cut back, but wish list items won’t break the bank. 28% of Americans say they’ll spend less on Valentine’s Day this year than last. Among those hoping for gifts, chocolate or candy and a special meal are most desired. Separately, 40% will skip the holiday this year to save money.

Love is an investment this Valentine’s Day

Of the 56% of respondents in relationships, 82% will give their significant other a gift this Valentine’s Day. Men (89%) are much more likely to do so than women (76%). Additionally, Gen Zers ages 18 to 28 (91%) are the most likely age group to buy their significant other a gift, while Gen Xers ages 45 to 60 (74%) are the least likely.

Overall, coupled Americans plan to spend an average of $179 on their significant others. That’s similar to the $180 they planned to spend when we conducted this survey last year.

Men expect to spend twice as much as women this holiday — $258 versus $106. Meanwhile, six-figure earners in relationships plan to spend the most of any demographic, at $311. Conversely, those earning less than $30,000 plan to spend the least by income group, at $131.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” says that average is about what he expects. Still, he advises caution for groups with high spending.

“Those numbers get pretty big, especially when you consider it’s being spent so soon after the holiday shopping season,” he says. “That means there are a lot of men and six-figure earners spending big on Valentine’s Day while they’re still digging out from under holiday debt. That’s certainly not ideal, but it speaks to the power of Valentine’s Day.”

Those with young children may be particularly appreciative of their partner, with those with kids younger than 18 spending $277 on average. Comparatively, those without children plan to spend $152, and those with children 18 or older plan to spend $82.

By age group, Gen Zers ($257) and millennials ages 29 to 44 ($247) plan to spend much more than Gen Xers ($139) and baby boomers ages 61 to 79 ($89).

Meanwhile, coupled Americans expect their partner to spend an average of $162 on them, with women ($124) having much lower expectations than men ($202). Notably, women are one of the only demographics that expect their partners to spend more than they plan to spend on them.

Those who’ve never been married share this discrepancy, expecting their partners to spend $173 while spending $148 on them. That’s followed by those who are married, expecting their partners to spend $181 while spending $162 on them.

33% may take on Valentine’s debt

Love is priceless, but chocolate isn’t. Of those in relationships, 33% think they may take on Valentine’s Day credit card debt, particularly millennials (51%) and those with children younger than 18 (50%). Men (40%) are much more likely to think they’ll take on debt than women (26%).

Those planning to take on debt will pay it off quickly, with 34% reporting they’ll do so within two months. Another 38% believe it’ll take two to four months to pay off their Valentine’s debt. Just 8% believe it’ll take six months to more than a year.

Regardless of whether they think they’ll go into debt this Valentine’s Day, 38% in relationships think doing so is worth it to show their significant other they care. Gen Zers (58%), millennials (55%) and those with children younger than 18 (55%) are the most likely to agree.

Meanwhile, 34% of all Americans say they’ve set a Valentine’s Day spending limit with their partner in the past, with 11% saying they’ve done so every year. On the other hand, 34% haven’t considered it and wouldn’t.

Schulz says more couples should implement spending limits, even though it can be scary.“ No one wants to look like a cheapskate to their partner, especially in the early days of the relationship,” he says. “But here’s the thing: Your partner probably doesn’t want you to go into debt over Valentine’s Day. With that in mind, it’s OK to approach your partner about a spending limit. Of course, it should be a two-way conversation. That way, you can discuss what works best and come to an agreement both sides are happy with. That’s what relationships are all about, right?”

Overall, 56% would skip the holiday if they could. Widowed Americans (73%), divorced Americans (69%) and those earning less than $30,000 (64%) most commonly agree.

Many of those going into debt won’t tell their partners

Cupid’s credit comes at a cost, and many Americans wouldn’t be happy to know their partners owe. Of those who may take on Valentine’s Day debt, 43% don’t plan to tell their significant others.

That makes it even more important to know that 67% of coupled Americans would be upset to learn their partner went into debt for the holiday. Baby boomers (73%) and those with children 18 or older (71%) are particularly likely to be upset.

Schulz says taking on debt without telling your partner can be OK if it’s within reason.

“Almost no one’s going to get upset about their partner taking on a little debt to buy an engagement ring or a special anniversary gift,” he says. “However, if there are too many secrets too often about too much debt, it can become an issue. Open, honest communication is essential to any healthy relationship. If your partner isn’t giving that to you, it should be a bright red flag.”

Debt may be hard to avoid, with 61% of those in relationships saying inflation has made it harder for them to afford Valentine’s gifts. That’s especially true among those earning less than $30,000 (71%) and millennials (71%).

28% cutting back on Valentine’s spending

With inflation in mind, the budget for love may be tighter than in the past. In fact, 28% of Americans say they’ll spend less on Valentine’s Day this year than last. Meanwhile, 52% say their Valentine’s Day spending this year will be about the same as last year and 20% plan to spend more.

That’s not surprising, according to Schulz. “Inflation has slowed, but high prices are still a major issue for people throughout this country, and they’re forcing people to make sacrifices,” he says. “It’s unfortunate that a Valentine’s Day gift for a loved one may have to be one of those sacrifices, but that’s the reality for many today.”

Among those in relationships, 23% want to receive chocolate or candy — tying with a special meal as the most commonly desired gift.

Many will get what they want, as 28% plan to gift their partner chocolate or candy and 27% plan to give them a special meal. Regardless of who’s paying for the meal, 46% of coupled Americans say they plan to celebrate Valentine’s Day by going out to a special dinner. That’s followed by eating at home (36%) and going out for drinks (18%).

Separately, 40% of all Americans plan to skip the holiday this year to save money, with 29% also having done so in the past. Meanwhile, 14% have skipped Valentine’s Day to save money before but don’t plan to do so this year.

All’s fair in love and finance: Celebrating Valentine’s Day without breaking the bank

If you’re looking to create a special Valentine’s Day without going all out, you should keep a few things in mind. Particularly, Schulz offers the following advice:

- The right credit card, used the right way, can extend your budget. “It may sound counterintuitive, but a credit card can help save you money,” he says. “A simple cash back card can give you 1.5% or 2% back on every purchase or give you valuable miles and points. Sign-up bonuses can be useful as well. For example, rather than using cash to buy that gift, use a new credit card to do it and then use that cash to pay off the card when the bill comes. Many cards come with bonuses of $100 or more if you hit certain minimum spending levels. Obviously, you need to make sure you don’t overspend to get those rewards, but that card can help if you can manage it.”

- Get creative. “The best holiday gifts aren’t always the most expensive,” he says. “A creative, thoughtful and inexpensive gift can be every bit as impactful and appreciative.”

- Share your story. “It can be hard to make yourself vulnerable, even with people you love,” he says. “However, if you’re in the early days of a relationship and your partner doesn’t know you’re struggling financially or are cutting back to meet certain financial goals, tell them. Chances are they’ll be supportive and want to help.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,039 U.S. consumers ages 18 to 79 from Jan. 2 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Recommended Articles