Despite Federal Reserve Rate Hikes, 76% of Lower Credit Card APR Requests Were Granted in Past Year

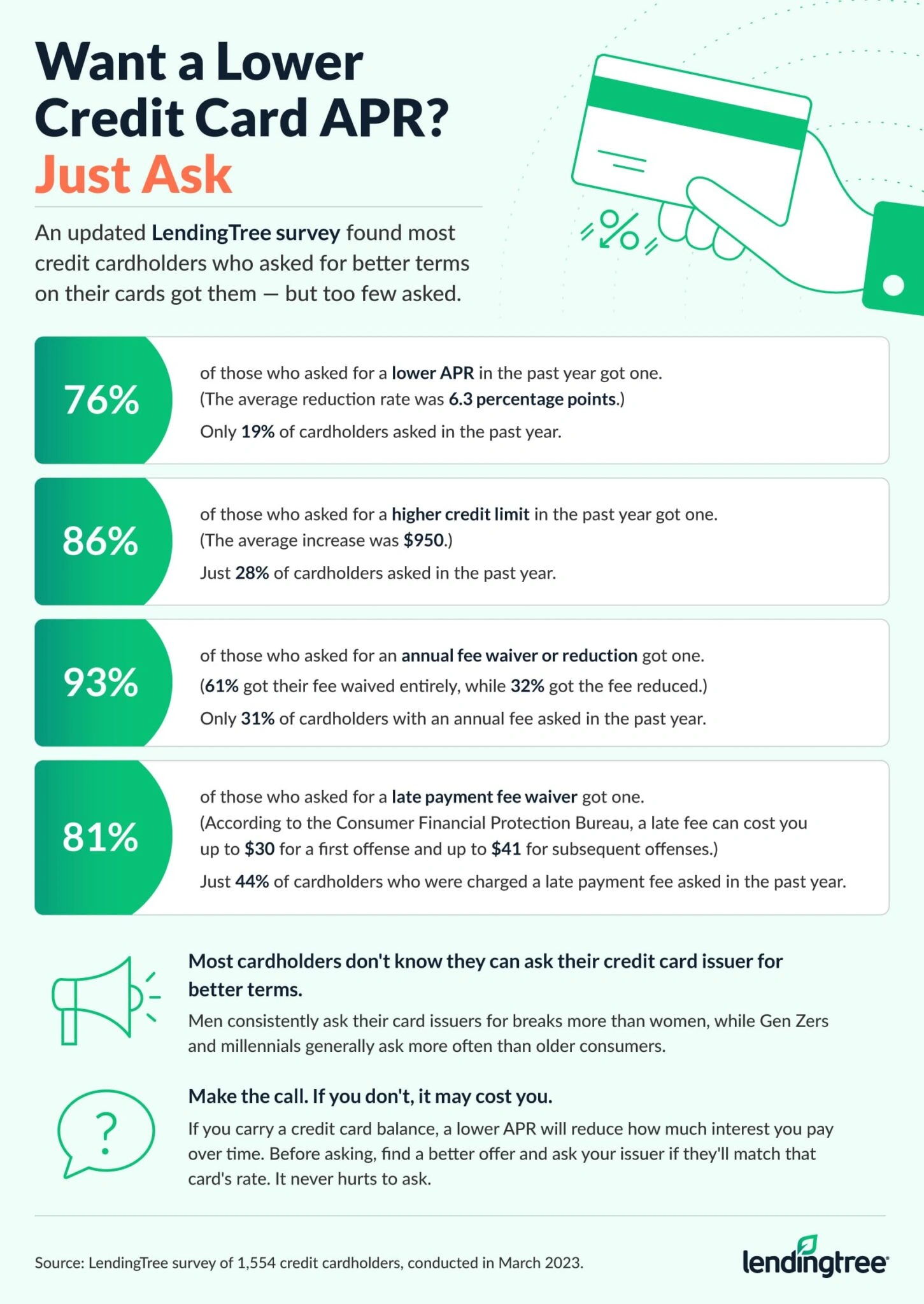

More than 3 in every 4 cardholders who asked for a lower interest rate on one of their credit cards in the past year got one, according to a new LendingTree survey.

That’s welcome news for cardholders struggling to cope with credit card debt in the wake of the nine interest rate increases served up by the Federal Reserve since March 2022. However, it may also come as a bit of a surprise given that those Fed rate hikes made it more expensive for banks to lend and that credit card APRs are at their highest level in decades, perhaps ever. Still, that’s what we found. In fact, cardholders’ success rates when asking for a lower APR increased significantly, up 6 percentage points from 70% a year ago.

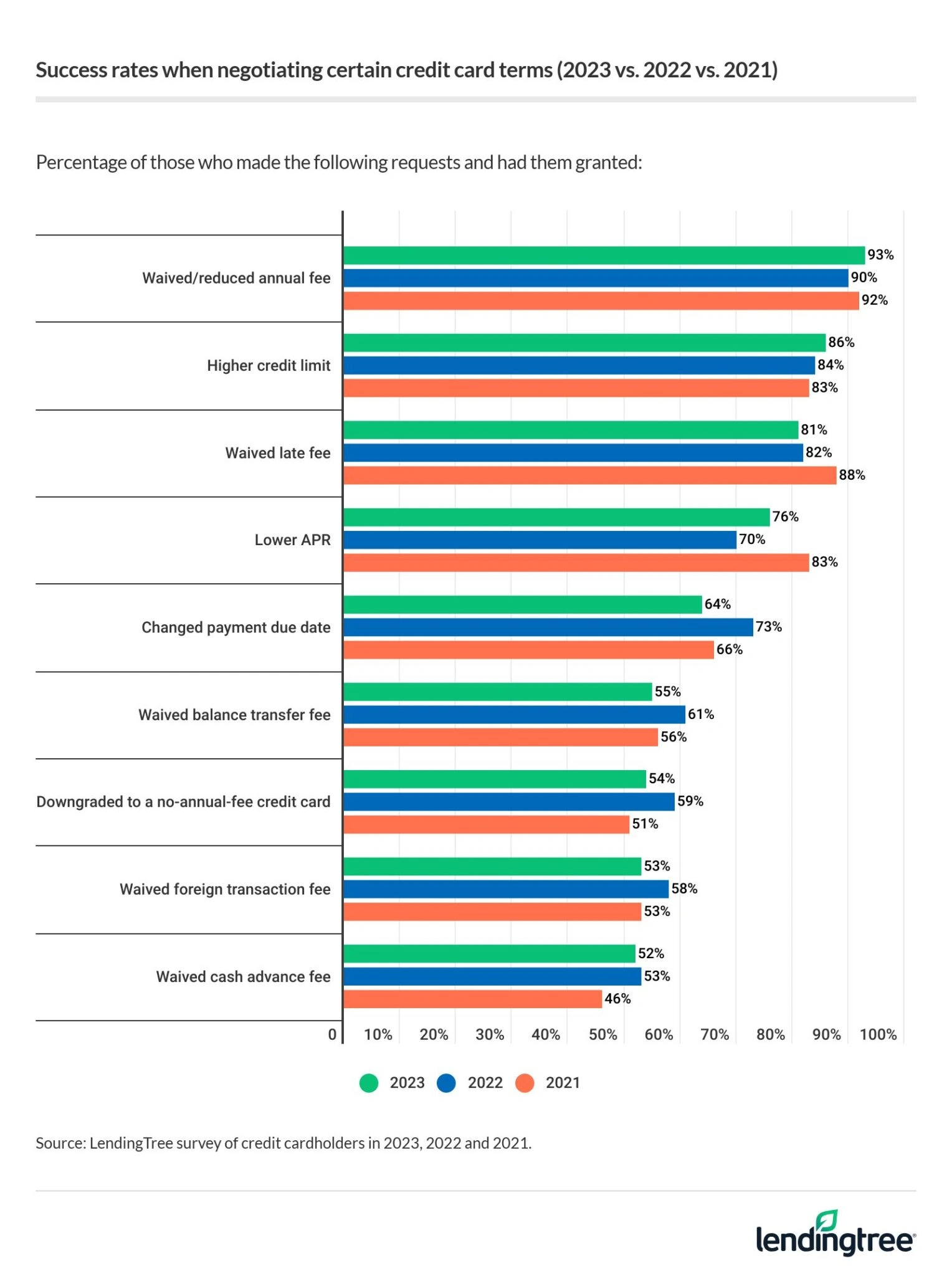

Not all the news from the survey is positive. For example, people are less likely to get balance transfer and foreign transaction fees waived than a year ago. However, the key takeaway is simple: It’s absolutely, positively worth your time to call your credit card issuer and ask them for help. Whether you’re asking for a lower interest rate, a waived late fee, annual fee or balance transfer fee, a higher credit limit or any other improvements on your credit card terms, your chances of success are likely better than you think.

- More than 3 in 4 credit cardholders (76%) who asked for a lower card APR in the past year got their request granted. That’s a 6-percentage-point increase over the previous year, which is eye-opening given the historic run of credit card rate increases during that time. The average decrease given was 6.3 percentage points, which could save you $500 or more depending on how much you owe.

- The most likely requests to be granted are waived or reduced annual fees (93%) and increased credit limits (86%). The success rates for both requests are the highest since we began asking in 2019. However, when it comes to annual fees, issuers are more likely than in previous years to only reduce the fee than waive it.

- The least successful request was still pretty darn successful. Slightly more than half (52%) of those who asked to have a cash advance fee waived got their request granted. Those fees are typically 3% to 5% of the total amount withdrawn.

- Waivers of balance transfer and foreign transaction fees were granted less often than in previous years. 55% of those asking for a waived balance transfer fee got their way (down from 61% the year before), while 53% of foreign-transaction-fee waiver requests were granted (down from 58%).

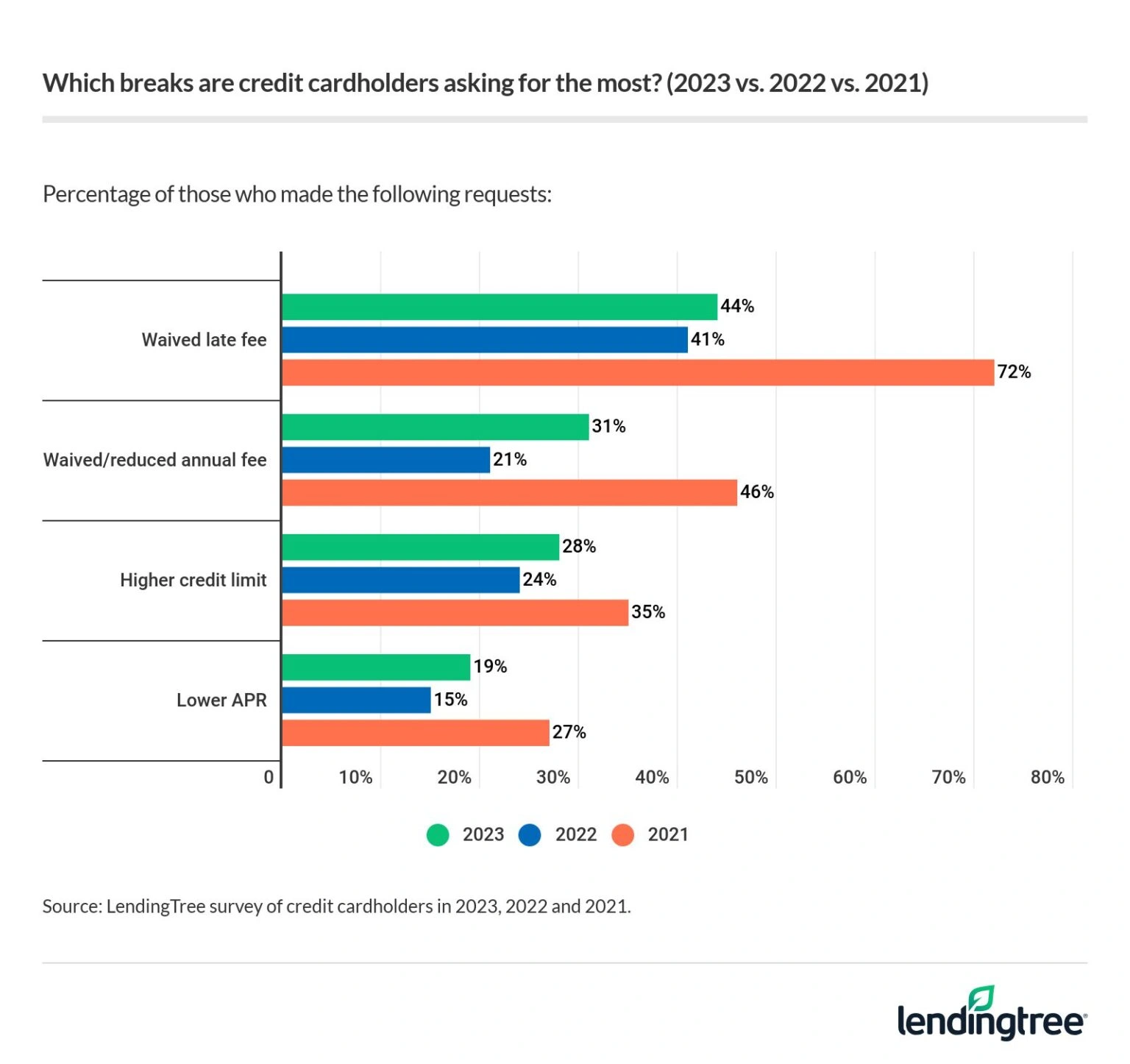

- More people asked for key breaks than in the previous year, but requests were still well down from the height of the pandemic. Cardholders asked for lower APRs, higher credit limits and waived annual fees and late fees more frequently in the past year. However, for each request, the percentage of cardholders who asked was down at least 7 percentage points from 2021’s record highs.

Card issuers increasingly likely to grant requests for lower APRs

The past year or two have been brutal for people with credit card debt. The one-two punch of rampant inflation and seemingly nonstop interest rate hikes have made the always-difficult job of paying down debt that much harder.

Given that, we have frequently reminded consumers that LendingTree surveys in the recent past have shown that 70% or more of cardholders who’ve asked for a lower APR on their credit card have gotten one. Making that phone call is an important option for people battling credit card debt. Those high success rates — along with the continued widespread availability of 0% balance transfer credit cards and low-interest personal loans — are proof that cardholders have more power than they might realize when fighting high interest rates, especially if they have good credit.

Still, the last time we conducted this survey was in March 2022. Since then, a whole lot has changed. The Fed raised interest rates a staggering nine times, pushing credit card interest rates to the highest in decades. Consumer credit card debt neared $1 trillion for the first time, and delinquencies slowly rose. The collapse of Silicon Valley Bank sent shockwaves through the banking industry, causing some lenders to be less willing to lend. Inflation continued to grow. With that in mind, it was reasonable to wonder if banks were still as willing to give breaks such as lower APRs to those who asked.

Well, we’re not wondering anymore. This survey shows the answer is unquestionably yes. More than 3 in 4 (76%) cardholders who asked for a lower APR in the past year got one. That’s up 6 percentage points from a year ago. It’s down from the pandemic peak of 83% that we saw in 2021, but it’s still a high number.

The average reduction that people receive is 6.3 percentage points. That’s a big deal. Depending on your circumstances, that type of decrease could save you $500 or more in interest.

| Example |

|---|

Imagine you have a $5,000 credit card balance and pay $250 per month. A 6.3-percentage point reduction from 23.84% to 17.54% saves $478 and 2 months

A 6.3-percentage-point reduction from 27.00% to 20.70% saves $532 and 2 months

|

Men (80%) are more likely than women (72%) to be successful when asking for a lower APR, though women are still quite likely. Perhaps surprisingly, younger cardholders are more likely to be successful, with 81% of millennials ages 27 to 42 and 79% of Gen Zers ages 18 to 26 getting their way, compared with 63% of Gen Xers ages 43 to 58 and 54% of baby boomers ages 59 to 77. The most successful group was those making $100,000 or more a year at 88%.

Annual fees and late fees also frequently reduced

While a lower APR may be the most impactful request you can make of your credit card issuers, it’s hardly the only, nor is it even the one that is most likely to be successful.

In the past year, more than 9 in 10 cardholders (93%) who asked for a reduced or waived annual fee got one, and 81% of those who asked to have a late fee removed were successful. The typical credit card annual fee is $89 to $99, while a late fee can cost up to $30 for a first offense and up to $41 for subsequent offenses. Getting those costs reduced or even eliminated won’t be as impactful as lowering an APR, but it can still be significant for a family on a tight budget. So can an increased credit limit, which 86% of cardholders who asked for received.

But as this chart shows, the potential breaks — and the high success rates — don’t stop there.

Even the least successful request we asked about — the waiving of a cash advance fee — was granted more than half the time (52%). A typical cash advance fee can be 3% to 5% of the amount withdrawn, meaning that a $200 cash withdrawal would come with a fee of $6 to $10. Again, that’s not a huge amount of money, but if you’re living paycheck to paycheck as you might expect many who regularly take out cash advances would be, every dollar matters.

Balance transfer fees, foreign transaction fees less likely to be waived this year

In several cases, cardholders’ chances for success when making one of these requests improved from last year — at least slightly. (The success rate for lower APR requests improved to 76% from 70%, higher credit limit requests improved to 86% from 84% and waived or reduced annual fee requests improved to 93% from 90%.)

However, the success rates for most of the requests we asked about declined from a single point to as many as 9 points. The most extreme example: 64% of cardholders who asked to change their credit card’s due date got their way, down 9 points from 73% a year ago.

These declines shouldn’t give anyone pause about making these requests, but they’re noteworthy. Two of the most notable examples are balance transfer fees (55% got them waived in the past year, versus 61% a year ago) and foreign transaction fees (53% got them waived in the past year, versus 58% a year ago). Here’s why:

- The typical balance transfer fee is 3% of the transferred balance, though it can go as high as 5%. If you transfer $5,000, you can end up with a fee of $150 to $250.

- Foreign transaction fees aren’t as common as they used to be, but they’re typically about 3% when present. That means that if you spend $5,000 on an international vacation for a family, you can expect to be hit with $150 in fees for using a card that charges these fees.

In both cases, that’s real money that’ll have a real impact on a household budget. The good news is that despite this year’s smaller success rates, the odds are still in your favor in both cases. That means it’s still worth making the ask.

More people asked for breaks this year, though still fewer than at the peak of the pandemic

More cardholders asked for waived late fees, lower interest rates, waived annual fees and higher credit limits in the past year than the year before. Waived annual fee requests, in particular, spiked, rising from 21% in 2022 to 31% now. However, in all these cases, the percentage asking was significantly lower than in 2021 as the pandemic wreaked havoc on the American economy.

It shouldn’t be surprising that more people asked for breaks during that time. Sky-high unemployment and general economic volatility meant that millions of Americans were in a pretty dicey financial situation, so many of them called their credit card issuers to ask for help. In many cases, issuers were willing to give assistance. Banks have so-called hardship programs that can be used to help borrowers through short-term financial difficulties, and many of those programs came into play in 2020 and 2021.

Men generally are more likely than women to ask for these types of breaks, and parents with young children are more likely than others to do so. Also, Gen Zers in many cases are the most likely age group to ask for these types of breaks.

The bottom line: It’s absolutely worth your time to ask

Asking for help can be scary. That’s true whether you’re speaking with a close friend or family member or negotiating with a giant megabank. Making the requests that we talk about in this report requires a level of vulnerability that many of us aren’t comfortable with. After all, no one likes getting rejected.

Here’s the thing, though: Your chances of success are far better than you realize. This report is concrete proof of that. It doesn’t mean you’re guaranteed to get your way. Life doesn’t work that way. However, it does mean you’re more likely to have your request approved than shot down. That’s empowering, and that’s important because there’s real money at stake if you don’t act.

The truth is that if you don’t ask for these things, you’re probably paying your credit card issuer more than you should. That’s probably the last thing anyone should do when inflation is rampant and interest rates are sky-high, but it’s what millions of Americans are doing today. They’re costing themselves hundreds of dollars or more by not contacting their credit card issuer and asking them for help.

Here are some tips for how to successfully ask for one of these breaks:

- Roleplay: If you’re nervous about what to say when you call, enlist a trusted friend or relative to help you practice. Have a pretend conversation in which your friend acts as the bank’s customer service representative. It may seem silly at first, but going through the motions can make the real conversation feel a little less foreign. Consider running through a few different scenarios, including one in which everything goes perfectly and one in which the customer service representative isn’t so friendly.

- Leverage other offers: It can be hard to know what to ask for in these types of conversations, but coming in with other offers that you’ve seen at LendingTree, on card issuer websites or in your snail mail can help you frame the negotiation. For example, tell them, “I’ve had a card with you for many years and never missed a payment. However, my interest rate is 25% and I’ve just gotten an offer from this other bank for a card with a 19% rate. Would you be willing to match it?” Chances are they’ll be willing to work with you.

- Don’t be afraid to tell your story: If you’ve been through a really difficult time recently, let your bank know. There’s no need to feel embarrassed or ashamed. People go through difficult times and banks’ hardship programs are created to help people in these situations. If you’re a good customer, it’s in the bank’s best interest to help you when you’re struggling. Your lifetime value to the bank is enough to where they’ll often be willing to waive a fee or lower an APR for a while to keep you happy. However, they can’t help if they don’t know there’s a problem.

- Above all, be kind: That customer service rep on the other end of the phone is just a person. Chances are that they’ve already been yelled at or talked down to at least once today, so if you differentiate yourself by being friendly and respectful, it can make a difference. Of course, that doesn’t mean you should let them walk all over you. You should be firm and clear in what you’re asking, and you shouldn’t easily accept no for an answer. However, you should treat them with respect in the process. After all, no one likes to deal with a jerk.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,044 U.S. consumers — including 1,554 credit cardholders — ages 18 to 77 from March 7 to 8, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77